Global Truffle Market Size, Share Analysis Report By Product (Black Truffles, White Truffles, Others), By Nature (Organic, Conventional), By Form (Fresh, Processed), By Distribution Channel (B2B, B2C), By End-use (Food and Beverages, Cosmetics and Personal Care Products, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152762

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

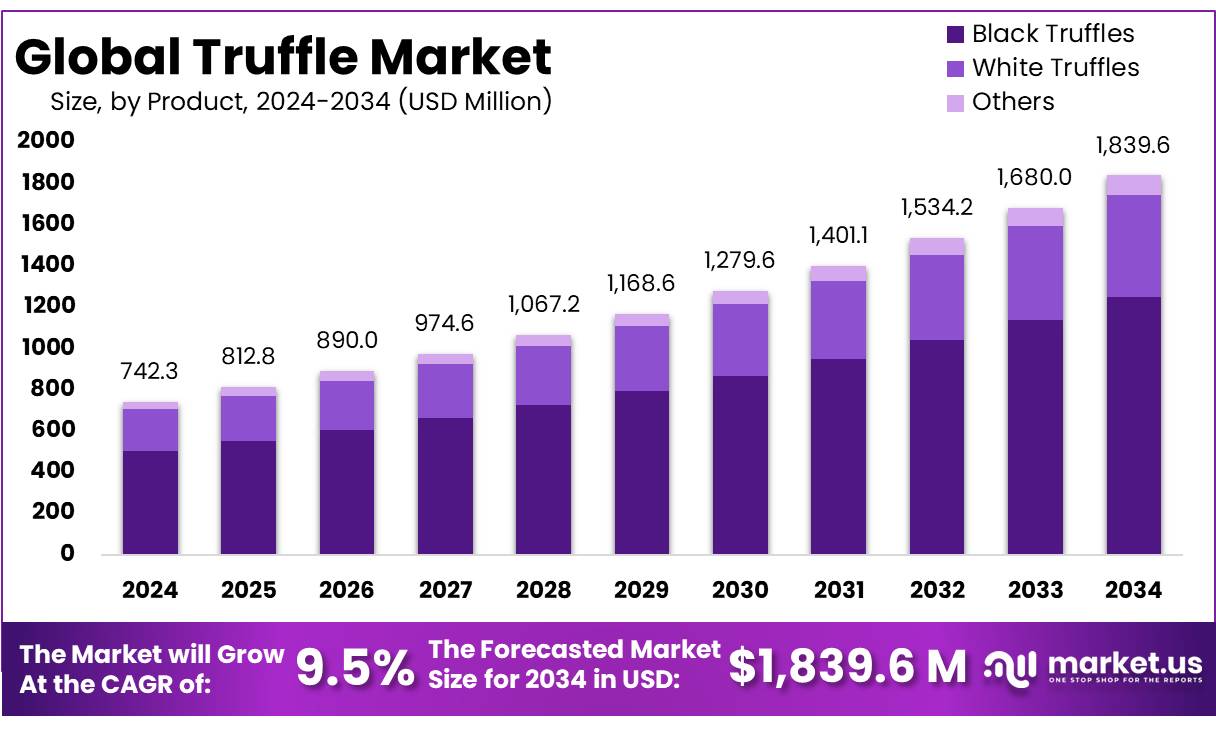

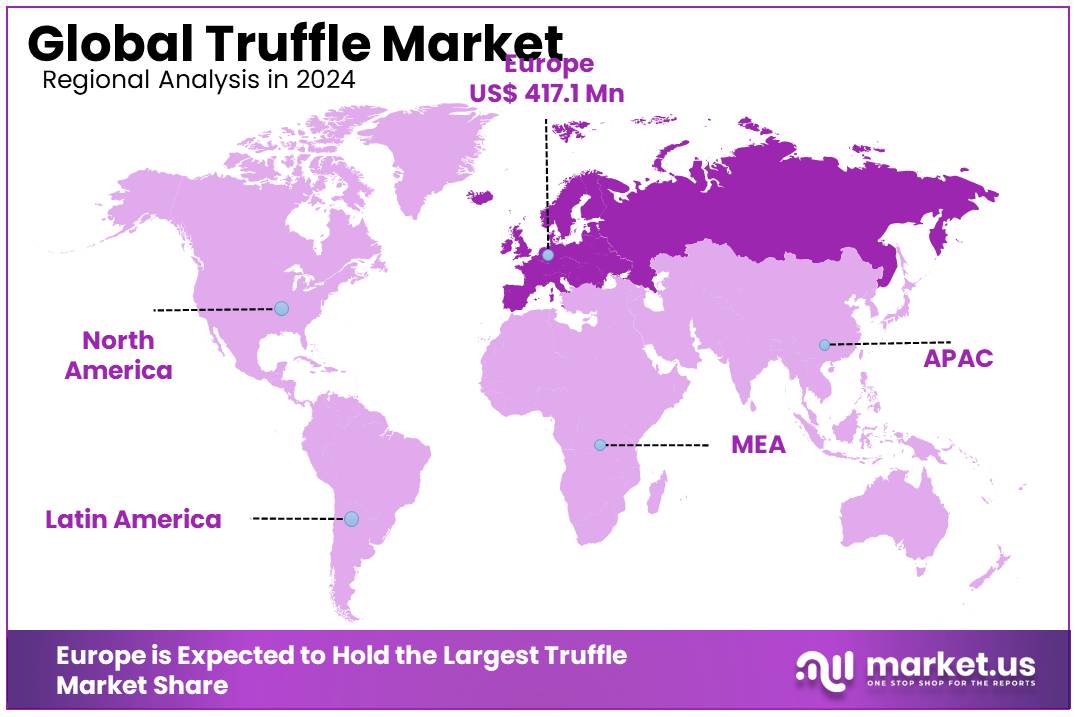

The Global Truffle Market size is expected to be worth around USD 1839.6 Million by 2034, from USD 742.3 Million in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 56.2% share, holding USD 417.1 Million revenue.

Truffle concentrates—such as oils, pastes, powders, and salts—are specialty food ingredients derived from the essence of gourmet truffles (primarily Tuber species: black melanosporum, white magnatum, and others). This segment is a value-added vertical in the broader truffle ecosystem, connecting primary truffle production with luxury culinary markets. It caters to food manufacturers, fine-dining establishments, and retail consumers seeking the distinctive aroma and taste of truffles without the challenge of sourcing fresh produce. As such, truffle concentrates contribute to extended shelf life, standardized flavors, and improved scalability in truffle usage.

The driving factors behind this growth include expanding demand in premium culinary sectors, adaptation by foodservice and retail, and heightened consumer preference for gourmet at-home cooking. Processed truffle products are gaining traction, particularly among foodservice and retail channels that saw processed forms account for approximately 45% of the 2024 market. Truffle concentrates provide an accessible alternative to fresh truffles, offering prolonged shelf life and broader usage in mainstream products. Moreover, rising awareness of truffles’ antioxidant and bioactive properties contributes to their appeal for both culinary and health-oriented applications

Government-funded rural development schemes have underpinned truffle orchard expansion across Europe. For example, the EU’s Rural Development Programme (2000–2006) provided targeted subsidies for truffle plantation establishment, boosting participation across regions such as Aragón in Spain. Similarly, agricultural export agencies, including India’s APEDA, are exploring trade facilitation frameworks to support exotic product export potential—though no direct truffle data is yet reported.

National forestry and agriculture ministries increasingly recognize truffle cultivation as a diversification tool, boosting rural incomes and reversing depopulation trends via financial incentives and extension services, as demonstrated in Teruel’s €17 million turnover and restored school enrollment from 72 to 153 children over 15 years.

Key Takeaways

- Truffle Market size is expected to be worth around USD 1839.6 Million by 2034, from USD 742.3 Million in 2024, growing at a CAGR of 9.5%.

- Black Truffles held a dominant market position, capturing more than a 67.9% share of the overall truffle market.

- Conventional held a dominant market position, capturing more than a 79.4% share of the global truffle market.

- Fresh held a dominant market position, capturing more than a 59.6% share of the overall truffle market.

- B2B held a dominant market position, capturing more than a 69.4% share of the global truffle market.

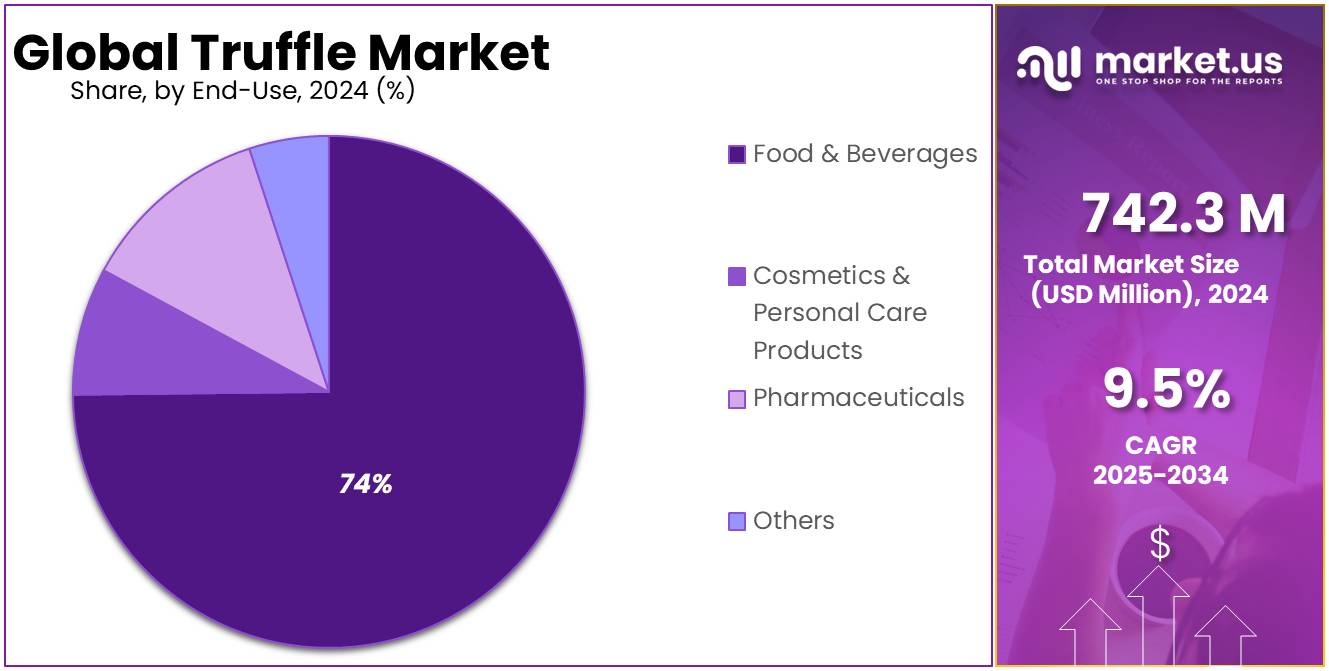

- Food & Beverages held a dominant market position, capturing more than a 74.3% share of the global truffle market.

- Europe stands as the dominant region in the global truffle market, accounting for 56.2% of total market share, with a valuation reaching approximately USD 417.1 million in 2024.

By Product Analysis

Black Truffles dominate with 67.9% share due to strong culinary demand and high market value

In 2024, Black Truffles held a dominant market position, capturing more than a 67.9% share of the overall truffle market. This significant lead is largely due to their strong presence in fine dining and premium food products, especially in Europe and North America, where black truffles are highly prized for their intense aroma and culinary versatility. The consistent cultivation of Tuber melanosporum across France, Spain, and Italy, supported by favorable climate conditions and established harvesting techniques, has further solidified their supply. Additionally, the rising trend of processed truffle products such as oils, sauces, and concentrates has largely relied on black truffles as the preferred raw material.

By Nature Analysis

Conventional Truffles lead with 79.4% share due to wider accessibility and lower production costs

In 2024, Conventional held a dominant market position, capturing more than a 79.4% share of the global truffle market. This strong dominance is mainly driven by the broad availability of conventionally grown truffles, which are more accessible and cost-effective compared to their organic counterparts. Cultivation methods for conventional truffles are well-established, allowing for higher yield volumes and efficient supply chains, particularly in countries like France, Spain, and China. These truffles are widely used across both food service and packaged product segments, making them the preferred choice for manufacturers and chefs alike.

By Form Analysis

Fresh Truffles dominate with 59.6% share due to strong demand in fine dining and gourmet kitchens

In 2024, Fresh held a dominant market position, capturing more than a 59.6% share of the overall truffle market. This dominance is largely attributed to the high demand for fresh truffles in luxury restaurants, hotels, and gourmet food establishments where aroma, texture, and flavor are prioritized. Fresh truffles are seen as a premium ingredient, especially in European and North American cuisines, and are often sold at high prices during peak seasons. Their limited availability and short shelf life enhance their exclusivity, making them highly sought-after by chefs and food connoisseurs.

By Distribution Channel Analysis

B2B channel leads with 69.4% share due to strong demand from restaurants and food manufacturers

In 2024, B2B held a dominant market position, capturing more than a 69.4% share of the global truffle market. This leadership is driven by the steady demand from restaurants, hotels, catering services, and food processing companies that rely on bulk sourcing of truffles, especially for consistent supply and quality control. High-end dining establishments and gourmet food producers prefer direct procurement channels to ensure freshness, traceability, and volume discounts. B2B transactions also support long-term contracts and seasonal sourcing agreements, which are vital in the truffle trade due to its limited harvest period.

By End-use Analysis

Food & Beverages dominate with 74.3% share due to growing use in gourmet and packaged foods

In 2024, Food & Beverages held a dominant market position, capturing more than a 74.3% share of the global truffle market. This segment leads primarily because truffles are widely used to enhance flavor in fine dining, specialty dishes, and a growing range of premium packaged products. From truffle-infused oils, cheeses, and pasta to ready-made sauces and snacks, the demand for truffle flavoring has grown significantly across retail and foodservice. The rising trend of gourmet ingredients in everyday meals and the popularity of natural flavor enhancers have further boosted their usage in food and beverage products.

Key Market Segments

By Product

- Black Truffles

- White Truffles

- Others

By Nature

- Organic

- Conventional

By Form

- Fresh

- Processed

By Distribution Channel

- B2B

- B2C

By End-use

- Food & Beverages

- Cosmetics & Personal Care Products

- Pharmaceuticals

- Others

Emerging Trends

Rising Popularity of Truffle-Infused Products in Mainstream Food Culture

In recent years, a key trend reshaping the truffle market is the rapid rise in demand for truffle-infused food products across mainstream restaurants, grocery stores, and home kitchens. What was once considered a rare delicacy reserved for gourmet chefs is now becoming a popular ingredient in everyday meals. From truffle oils and truffle salts to snacks like truffle popcorn and truffle chips, these specialty items are now widely available in retail chains across the U.S., Europe, and Asia.

According to data from the Specialty Food Association, the truffle-based product category saw a 21% year-over-year increase in retail sales in the U.S. between 2022 and 2023, driven largely by millennials and Gen Z consumers looking for bold, premium flavors in everyday foods. This shift is also being supported by major grocery chains introducing private-label truffle products, making them more affordable and accessible to wider audiences.

Restaurants, too, are embracing the trend. The National Restaurant Association’s 2024 Culinary Forecast placed “truffle-infused condiments” among the top 10 trending ingredients, highlighting its growing appeal in casual dining, burger chains, and even fast food menus. Truffle aioli, truffle mac & cheese, and truffle fries are just a few examples that are now considered menu staples across the U.S. and European cities.

Government-backed agricultural initiatives have also played a role in supporting this shift. For example, Italy’s Ministry of Agriculture is actively promoting sustainable truffle cultivation through funding programs under the EU Rural Development Policy, helping local farmers increase yield and meet export demands. In 2023 alone, over €9 million was allocated to support truffle growers in regions like Umbria and Tuscany.

Drivers

Rising Culinary Demand from Gourmet and Luxury Food Sectors

One of the major forces pushing the growth of the truffle market is the rising demand from gourmet restaurants, fine dining experiences, and high-end culinary establishments. Truffles, prized for their earthy aroma and rich flavor, are no longer limited to European kitchens. Today, chefs in North America, Asia, and the Middle East increasingly include truffles in pasta, meat dishes, infused oils, and even desserts—making them a sought-after luxury ingredient across continents.

As global food culture becomes more adventurous, consumer preferences have evolved. Dishes once considered elite, such as truffle risotto or truffle-laced foie gras, are now becoming part of mainstream fine dining. According to data from the Food and Agriculture Organization (FAO), global mushroom production, which includes truffles under non-cultivated categories, grew from 8.9 million tonnes in 2010 to over 13.5 million tonnes in 2022, highlighting an upward trend in edible fungi consumption. Truffles are riding that wave as the demand for rare and high-quality natural foods grows.

Further driving this trend is the rise in tourism and food-based experiences. Countries such as Italy, France, and even Australia now promote truffle hunting as part of culinary tourism. Italian regions like Piedmont and Umbria host annual truffle festivals supported by local governments to boost rural economies and preserve cultural heritage. For instance, the Alba White Truffle Fair, sponsored by the Italian National Tourist Board, draws tens of thousands of visitors each year and helps generate millions in revenue.

Restraints

Climate Change Threatening Truffle Yield and Ecosystems

One of the biggest hurdles holding back the truffle market is the growing impact of climate change, which is directly affecting truffle production and ecosystem health. Truffles are extremely sensitive to environmental conditions—they need specific soil types, moisture levels, and a steady symbiotic relationship with host trees like oaks and hazelnuts. When climate patterns become unpredictable, these ideal growing conditions are disturbed, reducing truffle yields dramatically.

Over the last two decades, several European countries—especially France, Spain, and Italy—have reported a steep decline in wild truffle production. According to a study published by the European Geosciences Union, black truffle yields in France dropped from over 1,000 tonnes annually in the early 1900s to just around 30 tonnes in recent years. Warmer winters and longer periods of drought are primarily to blame. This not only drives prices higher but also makes the market less stable for farmers and consumers alike.

Furthermore, increased soil erosion, wildfires, and reduced biodiversity are shrinking the natural habitats where truffles grow. In Spain, government-backed research from the Spanish National Research Council (CSIC) has confirmed that soil moisture levels in key truffle-producing areas have dropped by 20–30% over the last two decades, making natural truffle cultivation increasingly difficult.

Opportunity

Emerging Truffle Cultivation in Non-Traditional Regions

One exciting growth opportunity in the truffle market lies in the rapid expansion of truffle cultivation beyond its traditional heartlands, especially into regions like Australia, New Zealand, Spain, and parts of North America. This shift isn’t just about novelty—it’s backed by strong numbers, government and research support, and a wave of entrepreneurial enthusiasm.

For instance, France, Spain, and Italy still dominate black truffle production, accounting for 45%, 35%, and 20% of global output, respectively. But new players are gaining momentum: central Spain has dedicated several thousand hectares to black truffle plantations, powered in part by EU-funded “Rural Development Programmes” that support inoculated tree planting. Expansion into Australia is particularly promising—by 2014, Tasmania, Victoria, New South Wales, and Western Australia had produced over 5000 kg of truffles in a season, including a massive 1.1 kg truffle fetching about USD 2000/kg.

Government and research-driven initiatives further catalyze this trend. AgriFutures Australia launched a major five-year research program, collaborating with universities and growers to develop cultivation methods, biosecurity, and market outreach. In Spain and across Europe, public funding helps farmers inoculate orchards, often converting marginal farmland into productive truffle grounds—boosting both rural incomes and biodiversity.

This geographical diversification also brings economic resilience. Instead of relying only on fragile wild harvests, cultivated truffles offer more predictable yields. As production methods improve—from tree inoculation to irrigation and soil management—the truffle crop becomes more accessible and cost-effective.

Regional Insights

Europe stands as the dominant region in the global truffle market, accounting for 56.2% of total market share, with a valuation reaching approximately USD 417.1 million in 2024. The region’s longstanding culinary tradition, favorable climatic conditions, and advanced cultivation techniques contribute significantly to its leadership position. Countries such as France, Italy, and Spain serve as the core truffle-producing nations, with France alone historically contributing the largest volume of black truffles (Tuber melanosporum), often referred to as “black diamonds.” These countries have well-established supply chains, including cultivation, harvesting, processing, and global export networks.

France hosts major truffle events such as the Sarlat and Richerenches markets, which draw both domestic buyers and international chefs. Italy’s regions like Umbria and Piedmont are renowned for white truffles, notably the prized Alba variety, which can command auction prices upwards of US$3,000 per kilogram. Meanwhile, Spain is increasingly investing in truffle farming, with over 10,000 hectares dedicated to plantations, supported by EU agricultural subsidies and local reforestation programs aimed at rural revitalization.

Government and regional initiatives across Europe further boost the market. The EU’s Common Agricultural Policy (CAP) includes funding for truffle cultivation, encouraging sustainable agroforestry and boosting farmer incomes. Moreover, growing demand for gourmet and specialty foods within Europe drives domestic consumption, while favorable trade agreements help fuel exports to North America and Asia-Pacific.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in Spain, Arotz, SA is one of the world’s leading producers and exporters of black truffles, white truffles, and truffle-based products. The company specializes in both fresh and preserved truffles, with a presence in over 40 countries. Arotz has invested heavily in truffle plantation expansion and advanced preservation technologies, enabling consistent year-round supply. Their partnerships with gourmet retailers and premium restaurants across Europe and Asia enhance their global distribution and brand recognition.

Based in Italy, Gazzarrini Tartufi is a prominent supplier of fresh truffles, particularly known for high-quality Alba white truffles. The company also offers a range of truffle-infused products such as oils, creams, and sauces. It collaborates closely with local truffle hunters and maintains traceability standards to ensure product authenticity. With increasing exports to North America and Asia, Gazzarrini is positioning itself as a heritage brand rooted in Italian tradition while expanding its international footprint.

Headquartered in the United Kingdom, TruffleHunter, Inc. is a major player in the premium truffle product segment. It specializes in truffle oils, mayonnaise, salt, and gourmet gift sets available through major retailers and online platforms. The company emphasizes sustainable sourcing, working with farmers across Europe and focusing on traceability. TruffleHunter has seen strong growth in e-commerce sales, particularly in the U.S. and Asia, supported by a focus on brand storytelling, eco-friendly packaging, and digital marketing.

Top Key Players Outlook

- Arotz, SA

- Gazzarrini Tartufi

- TruffleHunter, Inc.

- Urbani Truffles

- SABATINO NA LLC

- LES FRÈRES JAUMARD

- The Welsh Truffle Co.

- PLANTIN Truffles

- Truffle Hill

- Tartufi Morra

- Angellozzi Tartuficoltura

- Great Southern Truffles

- BLACK BOAR TRUFFLE

- Trufo

- OLD WORLD TRUFFLES

Recent Industry Developments

In 2024, Urbani Truffles held its position as a cornerstone in the global truffle market, operating with 9 subsidiaries worldwide, a workforce of 300 professionals, and commanding an impressive 70 % global market share across fresh and processed truffle products.

In 2024, Arotz, S.A. from Spain continued to impress in the truffle market, operating the largest truffle orchard in the world with over 600 hectares near Navaleno and managing more than 60 years of experience in wild truffles, mushrooms, fruit purees, and frozen goods.

Report Scope

Report Features Description Market Value (2024) USD 742.3 Mn Forecast Revenue (2034) USD 1839.6 Mn CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Black Truffles, White Truffles, Others), By Nature (Organic, Conventional), By Form (Fresh, Processed), By Distribution Channel (B2B, B2C), By End-use (Food and Beverages, Cosmetics and Personal Care Products, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arotz, SA, Gazzarrini Tartufi, TruffleHunter, Inc., Urbani Truffles, SABATINO NA LLC, LES FRÈRES JAUMARD, The Welsh Truffle Co., PLANTIN Truffles, Truffle Hill, Tartufi Morra, Angellozzi Tartuficoltura, Great Southern Truffles, BLACK BOAR TRUFFLE, Trufo, OLD WORLD TRUFFLES Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arotz, SA

- Gazzarrini Tartufi

- TruffleHunter, Inc.

- Urbani Truffles

- SABATINO NA LLC

- LES FRÈRES JAUMARD

- The Welsh Truffle Co.

- PLANTIN Truffles

- Truffle Hill

- Tartufi Morra

- Angellozzi Tartuficoltura

- Great Southern Truffles

- BLACK BOAR TRUFFLE

- Trufo

- OLD WORLD TRUFFLES