Global Truck Platooning Market Based on Type(Driver-assistive Tuck Platooning (DATP), Autonomous Truck Platooning), Based on the System Type(Lane Keep Assist, Blind spot Warning, Adaptive Cruise Control, Human Machine Interface, Forward Collision Warning, Automatic Emergency Braking, Other Types), Based on Component Type(Sensors, Radar, LIDAR, Camera, GPS), Based on Infrastructure Type(Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Global Positioning System (GPS)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 101254

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Type Analysis

- Based on the System Type Analysis

- Based on Component Type Analysis

- Based on Infrastructure Type Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

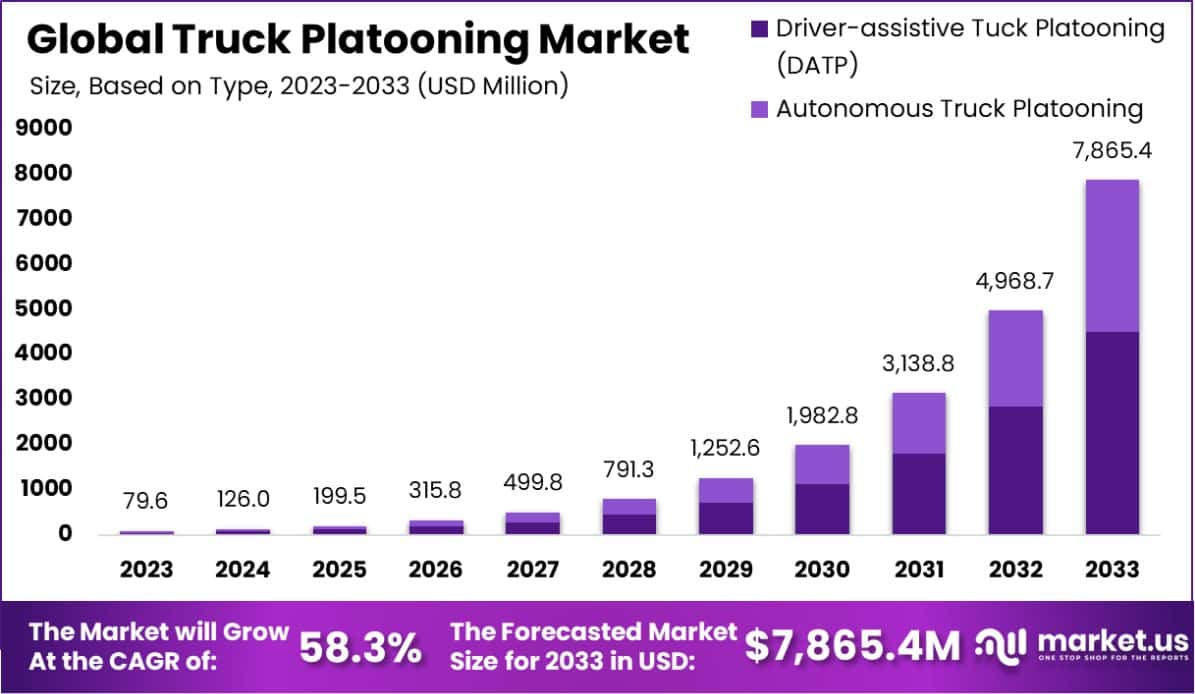

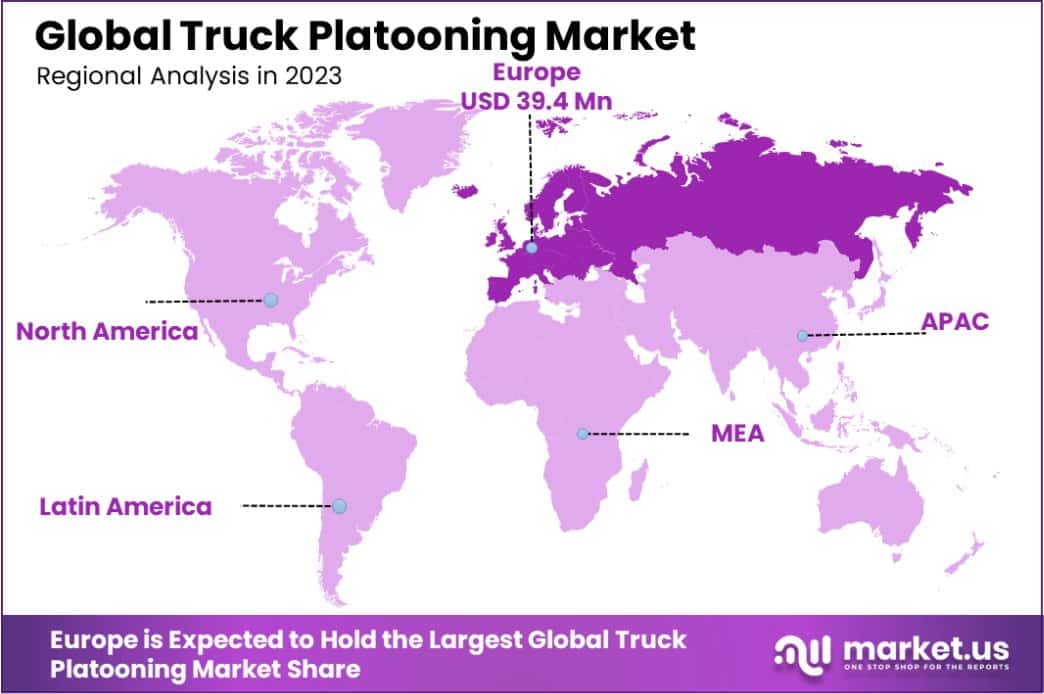

The Global Truck Platooning Market size is expected to be worth around USD 7,865.4 Million by 2033, from USD 79.6 Million in 2023, growing at a CAGR of 58.3% during the forecast period from 2024 to 2033. Europe dominated a 49.5% market share in 2023 and held USD 39.4 Million in revenue from the Truck Platooning Market.

Truck platooning refers to grouping several trucks using technology to maintain a consistent and close distance between them during travel. This method leverages advanced driver-assistance systems and vehicle-to-vehicle communication to improve fuel efficiency, reduce emissions, and enhance road safety.

The truck platooning market encompasses developing, selling, and integrating technologies that enable this coordinated vehicle operation. Growing interest in reducing transportation costs and minimizing environmental impact are primary growth drivers for this market. Additionally, increased government support for autonomous vehicles and smart transportation systems further stimulates market expansion.

Key growth factors include advancements in autonomous driving technologies and supportive regulatory frameworks encouraging the adoption of platooning systems. Demand is driven by logistics companies seeking cost reductions and efficiency improvements.

The market opportunity lies in expanding into emerging economies where logistics operations are growing rapidly and modernizing. The truck platooning market is poised for significant expansion, driven by technological advancements and increasing regulatory support for automated transportation solutions.

This market leverages cutting-edge vehicle-to-vehicle communications and automated driving technologies to enable trucks to travel in close formation, reducing aerodynamic drag and thus improving fuel efficiency and decreasing emissions. This method not only enhances road safety but also optimizes logistical operations by increasing the efficiency of freight transport.

Recent field operational tests, such as the demonstration on the I-66 Corridor in Virginia in September 2017, underline the practical viability of automated speed and spacing controls in truck platooning.

These tests, conducted under the Exploratory Advanced Research (EAR) program, showcase significant strides toward integrating these technologies into real-world transportation networks.

Moreover, studies facilitated by itskrs.its.dot.gov have revealed that approximately 55.7% of all miles driven by trucks are platoonable, suggesting a robust framework for the adoption of platooning technologies across substantial segments of highway travel.

The Federal Highway Administration (FHWA) has also shown a strong commitment to advancing truck platooning technologies. Notably, federal funding allocated for truck platooning research programs, including the Partial Automation for Truck Platooning (PATP) and the Deployment of Automated Truck Platooning (DATP), has exceeded $3.4 million, with an additional $340,000 contributed by project partners.

This financial backing further accelerates the development and deployment of platooning systems, highlighting a substantial market opportunity for growth and innovation in this sector.

This convergence of regulatory support, technological maturity, and demonstrated operational feasibility positions the truck platooning market for substantial growth, offering significant opportunities for stakeholders across the automotive and logistics industries.

Key Takeaways

- The Global Truck Platooning Market size is expected to be worth around USD 7,865.4 Million by 2033, from USD 79.6 Million in 2023, growing at a CAGR of 58.3% during the forecast period from 2024 to 2033.

- In 2023, Driver-assistive Tuck Platooning (DATP) held a dominant market position in the Based on Type segment of the Truck Platooning Market, with a 57.4% share.

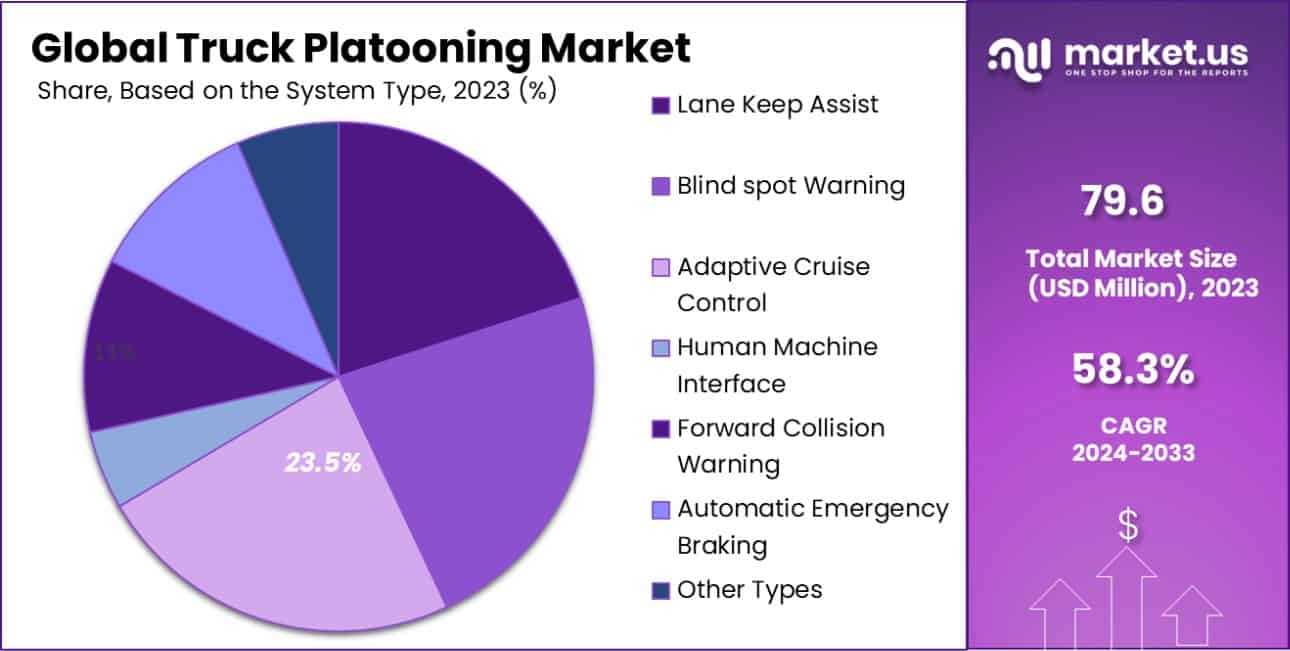

- In 2023, Adaptive Cruise Control held a dominant market position Based on the System Type segment of the Truck Platooning Market, with a 23.5% share.

- In 2023, Sensors held a dominant market position in the Based on Component Type segment of Truck Platooning Market.

- In 2023, Vehicle-to-Vehicle (V2V) held a dominant market position in the Based on Infrastructure Type segment of the Truck Platooning Market, with a 62.3% share.

- Europe dominated a 49.5% market share in 2023 and held USD 39.4 Million in revenue from the Truck Platooning Market.

Based on Type Analysis

In 2023, Driver-assistive Truck Platooning (DATP) held a dominant market position in the “Based on Type” segment of the Truck Platooning Market, commanding a 57.4% share.

DATP systems, which enhance truck convoys using technology that supports drivers with automation of acceleration, braking, and steering, have gained substantial traction due to their ability to improve safety and reduce driver fatigue, thus providing immediate benefits to logistics companies.

The integration of DATP systems aligns with current regulatory frameworks, which tend to favor technologies that assist rather than replace human drivers, thereby facilitating quicker adoption rates compared to fully autonomous solutions.

On the other hand, Autonomous Truck Platooning, although in a nascent stage, is gradually gaining market presence. As technological advancements continue and regulatory bodies evolve to accommodate higher levels of vehicular automation, this segment is expected to grow significantly.

The development of fully autonomous platooning is seen as the next step in optimizing freight transport by maximizing efficiencies and minimizing human intervention, which could potentially revolutionize the trucking industry.

Currently, stakeholders are keenly observing regulatory developments and technological breakthroughs that may shift market dynamics and enable broader deployment of autonomous platooning systems.

Based on the System Type Analysis

In 2023, Adaptive Cruise Control held a dominant market position in the “Based on System Type” segment of the Truck Platooning Market, with a 23.5% share. This technology, pivotal for maintaining safe distances between vehicles and facilitating smooth traffic flow, has become a cornerstone in the deployment of truck platooning systems.

Adaptive Cruise Control’s ability to automatically adjust truck speeds in response to changing traffic conditions has made it integral for enhancing road safety and optimizing fuel consumption, thereby driving its adoption among fleet operators.

Other notable technologies within this segment include Lane Keep Assist and Blind Spot Warning, which also contribute to the safety and efficiency of truck platooning. Lane Keep Assist helps maintain the vehicle’s position within its lane, reducing the risk of accidents due to unintentional lane departures, while Blind Spot Warning systems alert drivers to objects in their blind spots, further enhancing safety.

The Human Machine Interface (HMI), Forward Collision Warning, and Automatic Emergency Braking systems also play critical roles by improving driver awareness and reaction times to potential hazards.

Collectively, these technologies support the broader integration of truck platooning, each adding layers of safety and efficiency that are vital for the acceptance and growth of platooning solutions in the logistics and transportation industry.

Based on Component Type Analysis

In 2023, Sensors held a dominant market position in the “Based on Component Type” segment of the Truck Platooning Market.

Sensors are fundamental components that facilitate the core functionalities required for effective truck platooning, such as proximity detection, speed synchronization, and environmental awareness. Their critical role in ensuring real-time data acquisition and processing has cemented their status as indispensable tools within the platooning ecosystem.

Among the various types of smart sensors, Radar and LIDAR are particularly noteworthy for their ability to offer precise measurements of distances between trucks and their surroundings, enhancing safety and operational reliability.

Cameras also play a pivotal role by providing visual data crucial for lane detection and obstacle recognition, further supporting the autonomous capabilities of platooning systems. Additionally, GPS components are essential for navigation and route planning, enabling trucks to maintain optimal routes and enhance logistical efficiency.

The integration of these sensors into platooning systems underscores a growing trend toward increased automation in the transportation sector. As technologies evolve and their costs decrease, the proliferation of advanced sensors is expected to continue, driving further advancements in truck platooning capabilities and fostering greater market penetration.

Based on Infrastructure Type Analysis

In 2023, Vehicle-to-Vehicle (V2V) communication held a dominant market position in the “Based on Infrastructure Type” segment of the Truck Platooning Market, with a 62.3% share. V2V is pivotal for enabling direct communication between trucks, which is essential for the synchronous operation of platoons.

This technology allows vehicles to share information about their speed, direction, and position, significantly reducing the likelihood of accidents and improving traffic flow efficiency.

Vehicle-to-infrastructure (V2I) communication also plays a crucial role by facilitating the interaction between vehicles and road infrastructure, such as traffic signals and road signs, to enhance road safety and improve traffic management.

Meanwhile, the Global Positioning System (GPS) remains an integral component, providing precise geolocation services that are critical for route navigation and fleet management.

The strong adoption rate of V2V technology underscores its importance in advancing the capabilities of truck platooning systems. As these technologies continue to develop and integrate, they collectively enhance the operational efficiency and safety of transportation networks, supporting the broader adoption of platooning systems across the logistics and transportation sectors. This, in turn, drives continuous growth and innovation within the truck platooning market.

Key Market Segments

Based on Type

- Driver-assistive Tuck Platooning (DATP)

- Autonomous Truck Platooning

Based on the System Type

- Lane Keep Assist

- Blind spot Warning

- Adaptive Cruise Control

- Human Machine Interface

- Forward Collision Warning

- Automatic Emergency Braking

- Other Types

Based on Component Type

- Sensors

- Radar

- LIDAR

- Camera

- GPS

Based on Infrastructure Type

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Global Positioning System (GPS)

Drivers

Truck Platooning Market Drivers

The truck platooning market is driven by several key factors that contribute to its growing adoption and development. Firstly, the increasing focus on fuel efficiency and the reduction of greenhouse gas emissions in the logistics sector is a significant driver.

Truck platooning has been shown to reduce fuel consumption by enabling trucks to drive closely together, thereby lowering air drag. Additionally, advancements in technology such as improved communication systems between vehicles and enhanced automated driving technology make platooning more viable and attractive.

There is also a growing emphasis on safety, as platooning can lead to fewer accidents due to the synchronized movements of the convoyed trucks.

Regulatory support and initiatives by governments worldwide to promote safer and more efficient transportation methods further propel the market forward. These elements collectively underscore the potential of truck platooning to revolutionize freight transportation by making it safer, more efficient, and environmentally friendly.

Restraint

Challenges in Truck Platooning Adoption

Despite the promising advantages, the truck platooning market faces notable restraints that hinder its widespread adoption. A primary challenge is the high initial investment required for the necessary infrastructure and technology, making it a costly endeavor for many companies.

Additionally, there are significant regulatory and legal hurdles that need to be addressed to ensure safety and liability in the operation of autonomous and semi-autonomous vehicles. The interoperability of platooning technology across different brands and models of trucks also poses a technical challenge, complicating the universal application of platooning systems.

Moreover, there is a degree of skepticism and resistance among stakeholders regarding the reliability and benefits of truck platooning, which can slow market growth. These factors collectively create barriers that the industry must overcome to fully capitalize on the potential benefits of truck platooning.

Opportunities

Expanding Opportunities in Truck Platooning

The truck platooning market presents several compelling opportunities for growth and innovation. As technology continues to advance, particularly in the areas of autonomous driving and vehicle communication, platooning can become more efficient and accessible.

Emerging markets are also showing increasing interest in adopting modern transportation technologies, providing a new frontier for platooning expansion. Furthermore, the ongoing push towards sustainability in global supply chains encourages the adoption of fuel-efficient technologies like truck platooning, which can significantly reduce carbon emissions.

Partnerships between technology developers and logistics companies can further facilitate the integration of platooning systems, enhancing their practical application in real-world settings.

This creates a fertile ground for businesses to innovate and scale up platooning solutions, tapping into the growing demand for safer, more efficient, and sustainable transportation methods.

Challenges

Key Challenges Facing Truck Platooning

The truck platooning market faces several significant challenges that could impede its progress. Technological integration across different brands and systems remains complex, requiring substantial standardization to ensure seamless operation among diverse fleets.

Safety concerns also play a crucial role, as the reliance on technology increases the need for robust cybersecurity measures to prevent potential hacking and system failures.

Additionally, the legal and regulatory landscapes have not yet fully evolved to address the unique scenarios presented by autonomous and semi-autonomous vehicles, leading to potential delays and hesitancy among transport operators.

Market acceptance is another hurdle, with some stakeholders still skeptical about the reliability and overall benefits of platooning technology. Overcoming these challenges is essential for the market to thrive and fully realize the potential of truck platooning in transforming the transportation industry.

Growth Factors

Growth Drivers for Truck Platooning Market

The truck platooning market is supported by several growth factors that are driving its expansion. Key among these is the significant improvement in fuel efficiency that platooning offers, which is a major attraction for logistics companies looking to reduce operational costs.

Technological advancements in connectivity and autonomous driving are also pivotal, as they enhance the safety and reliability of platooning systems. Increasing governmental support through regulations that favor automation in transport and initiatives that aim to reduce traffic congestion and emissions are further stimulating the market.

Additionally, as urbanization continues and the global demand for efficient logistics rises, truck platooning is seen as a solution that can greatly optimize freight transportation. These factors together create a favorable environment for the growth and wider adoption of truck platooning technologies across the industry.

Emerging Trends

Emerging Trends in Truck Platooning

Emerging trends in the truck platooning market are reshaping the landscape of transportation logistics. One significant trend is the integration of advanced telematics and artificial intelligence, which enhances communication and data analysis, improving the overall efficiency and safety of platooning operations.

There’s also a noticeable shift towards electric and hybrid trucks within platoons, driven by the global push for sustainability and emission reduction. Additionally, cross-industry collaborations between technology providers and vehicle manufacturers are fostering innovation and speeding up the development of more sophisticated platooning systems.

These partnerships are crucial for overcoming technical challenges and standardizing protocols across different platforms. As these trends continue to develop, they are setting the stage for broader adoption and more effective implementation of truck platooning in mainstream freight transport, signaling a transformative phase in the industry.

Regional Analysis

The Truck Platooning Market exhibits significant variation across regions, reflecting divergent technological adoption rates and regulatory environments. Europe emerges as the dominant player, commanding a substantial 49.5% market share with a valuation of USD 39.4 million.

This region’s leadership is bolstered by robust regulatory frameworks and extensive investment in connected and automated vehicle technologies. North America follows, driven by ongoing collaborations between key industry players and governmental bodies aiming to enhance fuel efficiency and reduce carbon emissions.

In Asia Pacific, the market is gaining momentum due to increasing focus on reducing transportation costs and improving road safety. Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth, fueled by rising awareness and incremental technological advancements.

Overall, Europe’s preeminence in the market is underpinned by its proactive regulatory initiatives and substantial technological integrations within the trucking sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, AB Volvo, Continental AG, and Mercedes-Benz Group AG (formerly Daimler AG) are pivotal players in the global truck platooning market, each contributing uniquely to its evolution and expansion.

AB Volvo has demonstrated robust leadership through its commitment to innovation in automated and connected vehicle technologies. The company’s extensive research and development efforts have not only advanced its platooning capabilities but have also significantly influenced industry standards, emphasizing safety and efficiency.

Continental AG, known for its cutting-edge automotive solutions, plays a crucial role in the platooning sector through the development of high-precision sensors and connectivity solutions.

These components are essential for the operational efficiency of platooning systems, allowing vehicles to communicate and operate seamlessly in real time. Continental’s focus on integrating complex electronic and safety technologies positions it as a critical enabler of sophisticated platooning systems.

Mercedes-Benz Group AG has leveraged its extensive expertise in luxury and commercial vehicle manufacturing to pioneer some of the most advanced platooning technologies. The company’s focus on sustainability and safety, combined with its premium engineering, aligns with the broader industry’s shift towards reducing carbon emissions and enhancing road safety through automation.

Their proactive approach in testing and implementing truck platooning systems underscores their commitment to leading the charge toward fully autonomous commercial transportation.

Together, these companies not only drive technological advancements within the truck platooning market but also shape regulatory and commercial landscapes, setting the pace for global market growth and the adoption of next-generation transportation solutions.

Top Key Players in the Market

- AB Volvo

- Continental AG

- Mercedes-Benz Group AG (former Daimler AG)

- Peloton Technology LLC

- Robert Bosch GmbH

- Scania AB

- TOYOTA MOTOR CORPORATION

- Bendix Corporation

- DAF Trucks N.V

- IVECO S.P.A.

Recent Developments

- In March 2023, Scania AB secured additional funding of $50 million specifically aimed at expanding its truck platooning operations across Europe and Asia. This funding is directed towards research and development to refine Scania’s platooning technologies and infrastructure.

- In August 2022, Robert Bosch GmbH launched a new suite of truck platooning equipment. The suite includes upgraded sensors and software that improve vehicle communication and safety features, marking a significant step forward in Bosch’s product offerings.

- In June 2021, Peloton Technology announced a strategic partnership with a major truck manufacturer to enhance its platooning technology. This collaboration aims to integrate Peloton’s platooning software with the manufacturer’s vehicle systems, significantly advancing Peloton’s market presence.

Report Scope

Report Features Description Market Value (2023) USD 79.6 Million Forecast Revenue (2033) USD 7,865.4 Million CAGR (2024-2033) 58.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type(Driver-assistive Tuck Platooning (DATP), Autonomous Truck Platooning), Based on the System Type(Lane Keep Assist, Blind spot Warning, Adaptive Cruise Control, Human Machine Interface, Forward Collision Warning, Automatic Emergency Braking, Other Types), Based on Component Type(Sensors, Radar, LIDAR, Camera, GPS), Based on Infrastructure Type(Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Global Positioning System (GPS)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AB Volvo, Continental AG, Mercedes-Benz Group AG (former Daimler AG), Peloton Technology LLC, Robert Bosch GmbH, Scania AB, TOYOTA MOTOR CORPORATION, Bendix Corporation, DAF Trucks N.V, IVECO S.P.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Truck Platooning MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Truck Platooning MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Volvo

- Continental AG

- Mercedes-Benz Group AG (former Daimler AG)

- Peloton Technology LLC

- Robert Bosch GmbH

- Scania AB

- TOYOTA MOTOR CORPORATION

- Bendix Corporation

- DAF Trucks N.V

- IVECO S.P.A.