Global Travel Accessories Market Size, Share, Growth Analysis By Product Type (Travel Bags, Travel Outfits, Business Cases, Electronic Accessories, Personal Leather Goods, Toiletries, Food box, Travel Pillow and Blanket, Others), By Price Range (Premium, Medium Range, Low Range), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Factory Outlets, Online Channels, Multi-brand Outlets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 152044

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

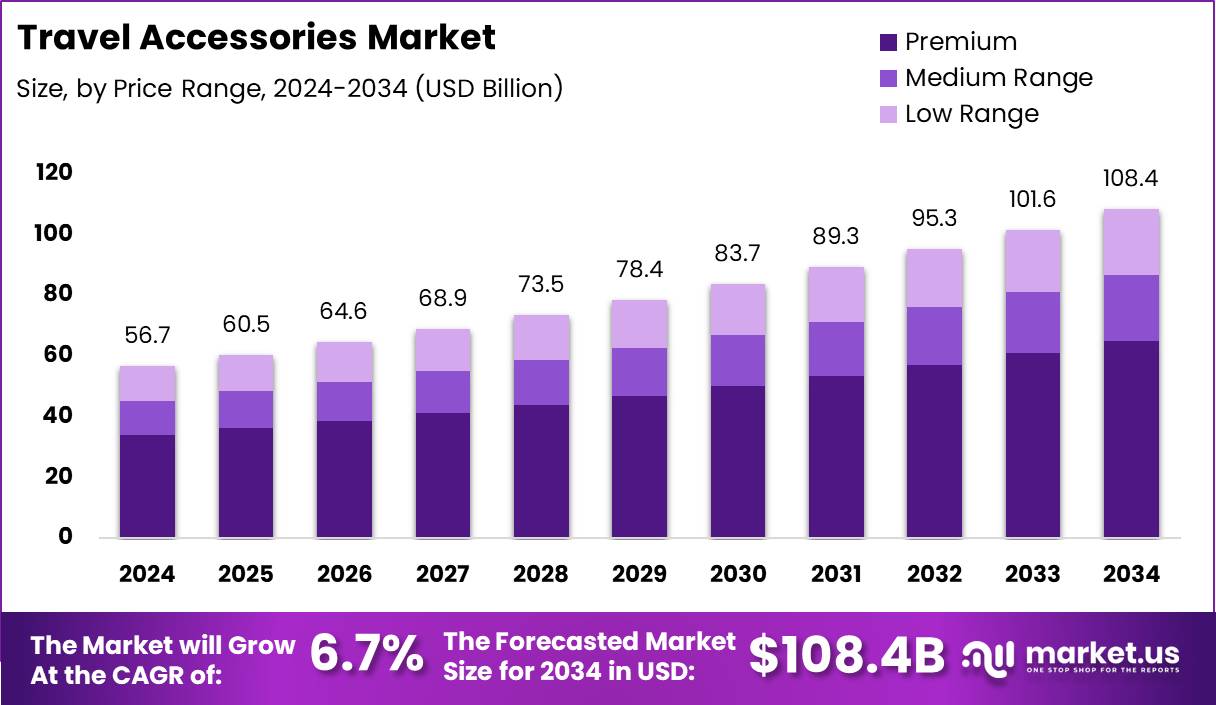

The Global Travel Accessories Market size is expected to be worth around USD 108.4 Billion by 2034, from USD 56.7 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

The travel accessories market is a dynamic segment within the global consumer goods landscape, catering to the evolving needs of modern travelers. From portable tech gadgets to ergonomic luggage, travel accessories enhance convenience, comfort, and organization during trips. This market supports a wide range of products, including travel pillows, toiletry bags, RFID wallets, and packing cubes, offering practical solutions for frequent flyers, business travelers, and leisure tourists alike.

Rising travel frequency, growing disposable income, and increasing digital nomadism have fueled demand for functional travel gear. For example, 80.4% of travelers ensure they carry a portable charger during city trips, according to RadicalStorage. This points to the surge in demand for tech-integrated accessories that support mobile lifestyles.

As travel duration varies, so does luggage size. According to Tatonka, travel bags of 60 liters suit week-long trips, while bags of 100 liters or more cater to longer adventures. This fuels market segmentation opportunities for brands targeting short-haul or long-haul travelers with customized solutions.

Meanwhile, fashion-conscious consumers drive accessory purchases. According to Business of Fashion, 80% of consumers across the US, UK, and China expect to shop for fashion while traveling in 2024. This trend boosts demand for travel-friendly fashion items, compact garment bags, and wrinkle-resistant accessories.

Governments worldwide are investing in tourism infrastructure, indirectly benefitting the travel accessories market. Enhanced connectivity and visa reforms encourage outbound travel, pushing brands to innovate lightweight, compliant, and security-approved products. This creates room for smart luggage, TSA-approved locks, and international travel adaptors.

In addition, regulatory frameworks now emphasize sustainable travel. Policies promoting eco-conscious tourism stimulate demand for biodegradable toiletry kits, reusable bottles, and ethically sourced travel wear. Brands adopting green practices can capture environmentally aware travelers seeking guilt-free mobility.

The rise of solo and wellness travel has further diversified market needs. As individuals pursue personalized, restorative experiences, demand spikes for noise-canceling headphones, eye masks, and compact fitness gear. This niche offers strong potential for wellness-focused accessory brands.

Furthermore, online retail and D2C (Direct-to-Consumer) models empower small and emerging travel accessory brands to access a global customer base with minimal barriers. Digital storefronts with personalized recommendation engines and travel bundles are driving higher conversion and average order values.

Key Takeaways

- The Global Travel Accessories Market is projected to reach USD 108.4 Billion by 2034, up from USD 56.7 Billion in 2024, growing at a CAGR of 6.7% from 2025 to 2034.

- In 2024, Travel Bags led the By Product Type segment with a 18.9% share, driven by their versatility and necessity.

- Premium products dominated the By Price Range segment in 2024, accounting for a 19.2% share, reflecting demand for quality and long-lasting value.

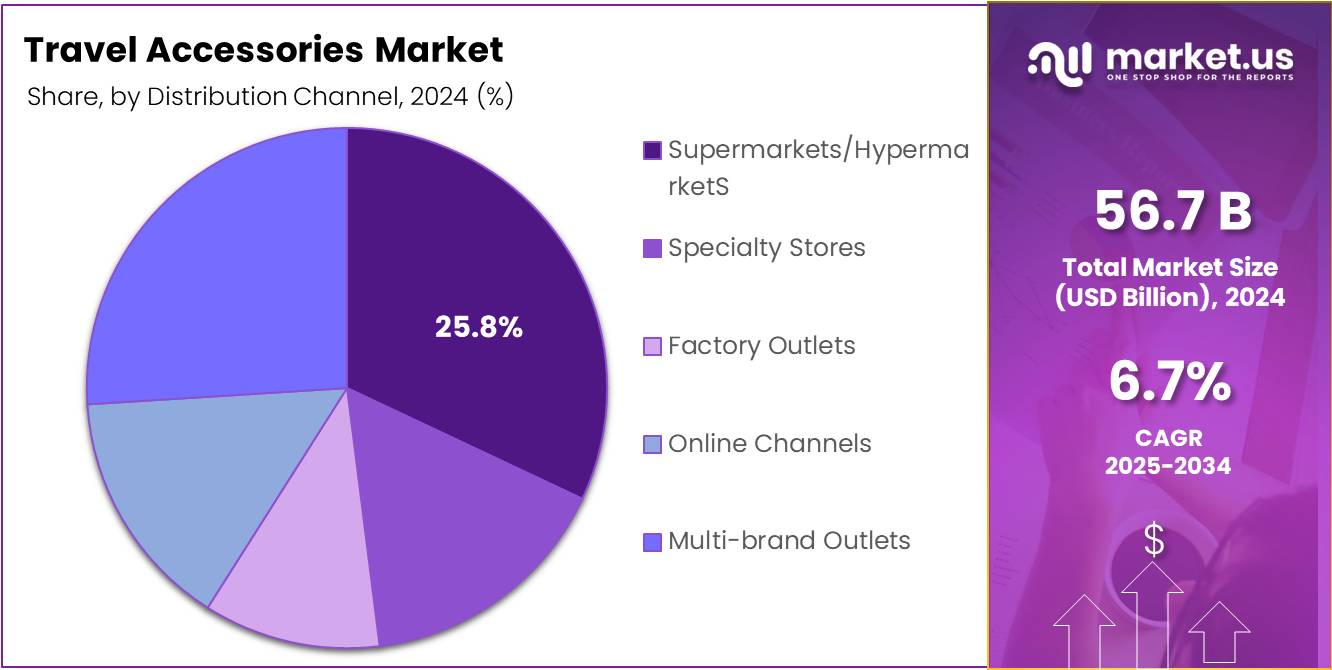

- Supermarkets/Hypermarkets were the leading distribution channel in 2024, with a 25.8% share, due to their broad reach and product variety.

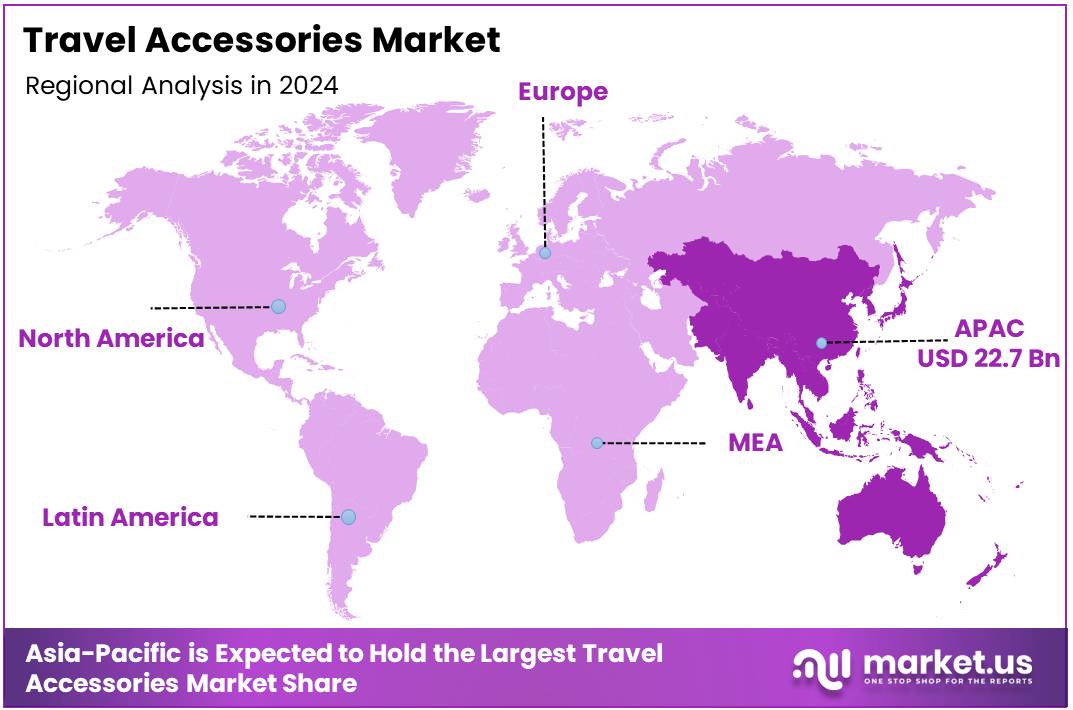

- Asia Pacific was the top regional market in 2024, holding a 40.1% share valued at USD 22.7 Billion, driven by rising tourism and tech-savvy consumers.

Product Type Analysis

Travel Bags lead with 18.9% owing to high utility and rising traveler demand.

In 2024, Travel Bags held a dominant market position in the By Product Type Analysisy segment of the Travel Accessories Market, with a 18.9% share. Their versatility, durability, and necessity for both short and long-distance travel drove consumer preference.

Travel Outfits followed as a favored option, especially among fashion-conscious and comfort-seeking travelers. These outfits gained traction due to their blend of style and travel-specific functionality.

Business Cases also performed steadily, particularly among frequent business travelers who prioritize organization and professional appearance. Electronic Accessories captured notable interest, driven by the increasing dependency on tech gadgets during travel.

Personal Leather Goods maintained relevance through their aesthetic appeal and perceived value, while Toiletries remained essential for hygiene-conscious travelers, particularly on long trips.

Food Boxes saw moderate growth due to the trend of personalized meal prep and dietary preferences while traveling. Travel Pillows and Blankets were consistently purchased for comfort on flights and road trips.

The Others category, comprising miscellaneous travel aids, saw steady demand due to niche travel needs and impulse buying trends at travel hubs.

Price Range Analysis

Premium segment tops the chart with 19.2% thanks to high-end demand for durable and stylish travel accessories.

In 2024, Premium held a dominant market position in the By Price Range Analysis segment of the Travel Accessories Market, with a 19.2% share. Consumers increasingly sought quality and long-lasting value, especially for frequent travel.

Medium Range products followed closely behind, appealing to budget-conscious consumers who desired a balance between cost and performance. These items remained the go-to option for mainstream buyers.

Low Range offerings captured a segment of first-time travelers or occasional users. While affordability was the key attraction, limitations in durability and features restricted wider appeal.

The market reflected a clear shift toward value-based purchasing, with premium buyers focusing on both function and fashion. As travel resumes globally, higher-end options are seeing renewed investment from consumers looking for better performance, warranty, and brand prestige.

Distribution Channel Analysis

Supermarkets/Hypermarkets rule the space with 25.8% by offering convenient access and wide product availability.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Travel Accessories Market, with a 25.8% share. Their extensive reach, in-store visibility, and variety of offerings played a crucial role in this lead.

Specialty Stores came next, offering curated travel gear and personalized shopping experiences. These outlets attracted discerning buyers seeking expert advice and premium products.

Factory Outlets provided cost-effective solutions and exclusive discounts, making them attractive to value-seeking customers. They especially performed well in tourist-heavy locations.

Online Channels gained momentum, especially among tech-savvy and convenience-oriented consumers. The ease of comparison, wide assortment, and doorstep delivery made this channel popular.

Multi-brand Outlets offered competitive advantages by providing a mix of well-known labels under one roof. These stores catered to travelers looking for diverse options at one location.

The dominance of Supermarkets/Hypermarkets underscores the importance of physical retail spaces where customers can inspect and instantly purchase travel accessories.

Key Market Segments

By Product Type

- Travel Bags

- Travel Outfits

- Business Cases

- Electronic Accessories

- Personal Leather Goods

- Toiletries

- Food box

- Travel Pillow and Blanket

- Others

By Price Range

- Premium

- Medium Range

- Low Range

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Factory Outlets

- Online Channels

- Multi-brand Outlets

Drivers

Increasing Demand for Lightweight and Compact Luggage Solutions Drives Market Growth

The travel accessories market is witnessing strong growth due to the rising demand for lightweight and compact luggage. Travelers today prefer gear that is easy to carry and doesn’t take up too much space. This shift is influencing manufacturers to design sleeker, more efficient products that support mobility and convenience, especially during air travel.

Business travel is also expanding across emerging markets like Southeast Asia, Africa, and Latin America. As more professionals travel for work, the demand for high-quality, functional accessories—such as laptop backpacks, packing cubes, and toiletry kits—is growing. This trend is boosting market sales, particularly in regions with growing corporate sectors.

Additionally, adventure and sports tourism is gaining popularity worldwide. Activities like hiking, biking, and water sports require specialized accessories like waterproof bags, hydration packs, and durable backpacks. This type of tourism encourages purchases of practical and high-performance travel gear, pushing market growth further.

Restraints

Volatility in Raw Material Prices Affecting Product Cost Limits Market Expansion

One of the major challenges in the travel accessories market is the fluctuating cost of raw materials like plastics, metals, and fabrics. These price changes increase production costs, making it difficult for manufacturers to offer competitive prices without affecting profit margins.

Another key issue is the spread of counterfeit products in the market. Fake travel accessories often look similar to branded items but are lower in quality. These products hurt the image of established brands and result in lost sales for original manufacturers.

Seasonal travel patterns also affect market stability. Sales often spike during holiday and vacation seasons but drop during off-peak times. This high dependency on travel seasons can lead to inconsistent revenue flows, making it harder for businesses to plan long-term strategies.

Growth Factors

Customization and Personalization of Travel Accessories Offer Lucrative Growth Opportunities

Customization is becoming a major growth driver in the travel accessories market. Consumers now look for personalized products, like bags with initials, custom colors, or unique designs. Brands offering these services are gaining customer loyalty and creating niche demand in a competitive space.

Smart features are another growing opportunity. Travel accessories with built-in GPS tracking, biometric locks, and USB charging ports are attracting tech-savvy travelers. These innovations not only enhance security but also add convenience, making them highly appealing in today’s digital world.

Eco-friendly products are also opening new market segments. Travelers concerned about sustainability prefer accessories made from recycled or biodegradable materials. Brands aligning with eco-conscious values are attracting a new generation of environmentally aware consumers and building long-term customer trust.

Emerging Trends

Surge in Demand for Anti-Theft and RFID Blocking Accessories Shapes Market Trends

Security is becoming a top concern for modern travelers, driving up the demand for anti-theft and RFID-blocking travel accessories. Products like secure backpacks and wallets that block unauthorized scanning are gaining popularity, especially among international tourists.

Subscription-based travel gear services are also emerging as a trending factor. These services allow travelers to rent or receive curated accessories based on their needs, saving space and money. The flexibility of subscriptions appeals to frequent travelers and digital nomads alike.

Finally, modular and multi-functional gear is on the rise. Consumers now prefer items that can be used in various ways—such as convertible backpacks or luggage that expands. These smart, space-saving solutions match today’s lifestyle and are influencing buying decisions across travel accessory segments.

Regional Analysis

Asia Pacific Dominates the Travel Accessories Market with a Market Share of 40.1%, Valued at USD 22.7 Billion

Asia Pacific holds the leading position in the global travel accessories market, accounting for a substantial 40.1% market share, valued at USD 22.7 billion. The region’s dominance is driven by a rising middle-class population, increasing international tourism, and growing travel frequency across countries such as China, India, and Southeast Asian nations. Technological adoption and evolving consumer preferences for compact, durable, and smart travel gear further fuel the market’s expansion in this region.

North America Travel Accessories Market Trends

North America follows closely, propelled by a strong culture of leisure and business travel, high consumer spending power, and innovation in travel convenience products. Increased demand for premium and multifunctional accessories, along with a high awareness of travel safety and comfort, supports steady growth in the region. The U.S. remains a key contributor due to frequent domestic and international travel habits.

Europe Travel Accessories Market Trends

Europe maintains a significant share of the travel accessories market, driven by the region’s well-established tourism sector and extensive cross-border travel. Consumer demand is shaped by preferences for sustainable and ergonomic products, with countries like Germany, France, and the UK witnessing steady sales. The region also benefits from a growing number of business travelers and vacationers.

Middle East and Africa Travel Accessories Market Trends

The Middle East and Africa are experiencing gradual growth in the travel accessories sector, supported by expanding air travel infrastructure and tourism investments, particularly in Gulf Cooperation Council (GCC) countries. The increasing influx of international visitors and rising disposable income levels in certain markets contribute to market momentum.

Latin America Travel Accessories Market Trends

Latin America presents emerging opportunities in the travel accessories market, with growth being fueled by improving travel infrastructure and a recovering tourism industry. Countries like Brazil and Mexico are seeing a rise in domestic and regional travel, encouraging demand for essential and cost-effective travel accessories. The market, though nascent, is gaining pace with increasing consumer mobility.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Travel Accessories Company Insights

In 2024, the global travel accessories market continues to be shaped by innovation, durability, and evolving consumer preferences. Samsonite International S.A. remains a dominant force with its wide product range and strong global presence, leveraging its reputation for quality and innovation to maintain leadership across segments. Targus Group International, Inc. continues to strengthen its foothold in tech-centric travel accessories, particularly with laptop backpacks and smart luggage, targeting business travelers with functionality and style.

Osprey Packs, Inc. sustains its momentum through a loyal consumer base that values ergonomic design and rugged durability, especially within the adventure travel segment. Its strategic focus on sustainability further enhances brand appeal among eco-conscious consumers. Travelpro Products, Inc. leverages its strong association with airline professionals and business travelers, offering practical, lightweight luggage solutions known for reliability, which helps it compete in both the mid- and premium-tier markets.

These leading players underscore the market’s ongoing shift towards lightweight materials, multi-functionality, and tech integration. They are also responding to post-pandemic travel trends with antimicrobial linings, built-in charging ports, and modular packing systems. As consumer demand leans more towards efficiency and convenience, these companies are expected to maintain strong positions through continued product innovation and targeted marketing.

Top Key Players in the Market

- Samsonite International S.A.

- Targus Group International, Inc.

- Osprey Packs, Inc.

- Travelpro Products, Inc.

- American Tourister

- Briggs & Riley Travelware

- Eagle Creek, Inc.

- Victorinox AG

- The North Face, Inc.

- REI Co-op

- Pacsafe

- Lipault

- Kipling

- Thule Group AB

Recent Developments

- In June 2025, travel accessories brand EUME raised Rs 25 Cr in a Series A funding round. The funds will support brand expansion, product innovation, and strengthening its distribution network.

- In May 2024, ICON, a luggage and travel accessories startup, secured $1.2 million in funding led by DSG Consumer Partners. The investment aims to accelerate product development and boost marketing efforts.

- In August 2024, Juniper Travel Technology announced the acquisition of Lleego, a travel and flight booking software firm. This strategic move enhances Juniper’s technological capabilities and expands its global travel solutions portfolio.

Report Scope

Report Features Description Market Value (2024) USD 56.7 Billion Forecast Revenue (2034) USD 108.4 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Travel Bags, Travel Outfits, Business Cases, Electronic Accessories, Personal Leather Goods, Toiletries, Food box, Travel Pillow and Blanket, Others),

By Price Range (Premium, Medium Range, Low Range),

By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Factory Outlets, Online Channels, Multi-brand Outlets)Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Samsonite International S.A., Targus Group International, Inc., Osprey Packs, Inc., Travelpro Products, Inc., American Tourister, Briggs & Riley Travelware, Eagle Creek, Inc., Victorinox AG, The North Face, Inc., REI Co-op, Pacsafe, Lipault, Kipling, Thule Group AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samsonite International S.A.

- Targus Group International, Inc.

- Osprey Packs, Inc.

- Travelpro Products, Inc.

- American Tourister

- Briggs & Riley Travelware

- Eagle Creek, Inc.

- Victorinox AG

- The North Face, Inc.

- REI Co-op

- Pacsafe

- Lipault

- Kipling

- Thule Group AB