Global Towing Equipment Market By Product Type(Boom, Hook & Chain, Flat Bed, Integrated, Wheel Lift), By Application(Passenger Cars, Commercial Cars, Others), By Business(OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 27046

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

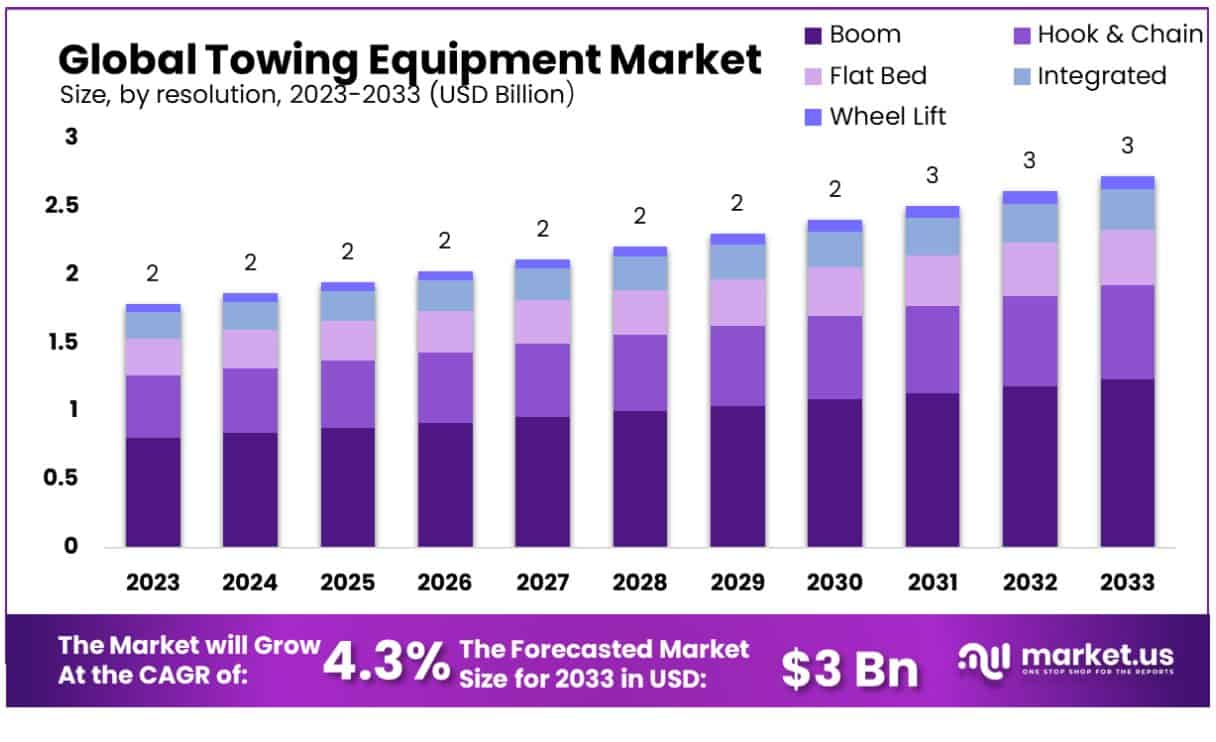

The Global Towing Equipment Market was valued at USD 1.79 Billion in 2023 and is expected to reach USD 2.73 Billion in 2033. Between 2024 and 2033, this market is estimated to register a CAGR of 4.3%.

The Towing Equipment Market encapsulates a sophisticated ecosystem dedicated to the design, production, and distribution of specialized apparatus and accessories pivotal for the towing and recovery sector. This market caters to a broad spectrum of applications, encompassing emergency services, vehicular relocations, and commercial towing operations. As organizations strive to enhance operational efficiency and adhere to stringent safety standards, the demand within this market is driven by innovation, regulatory compliance, and the evolving needs of transportation and recovery services.

As a market research professional with a decade of experience, my analysis suggests that future opportunities in the Towing Equipment Market will likely emerge from the adoption of electric and autonomous vehicles, requiring specialized towing solutions. The market is also expected to benefit from strategic collaborations and technological partnerships aimed at expanding product portfolios and entering new geographic markets. However, challenges such as fluctuating raw material costs and stringent emission regulations may impact market growth trajectories.

The towing Equipment Market demonstrates significant growth potential, driven by an increasing demand for roadside assistance and the expansion of the logistics sector. A notable study reveals that 82.7% of motor carriers have encountered issues with excessive rates, while 81.8% report unwarranted extra service charges. These practices not only erode consumer trust but also call for the implementation of stringent regulatory measures and the adoption of transparent pricing strategies to preserve market integrity.

Labor costs also emerge as a significant consideration within the market’s operational framework. The mean hourly wage for towing industry employees is $22.52, according to the U.S. Bureau of Labor Statistics. This indicator highlights the sector’s reliance on skilled labor and underscores the necessity for towing companies to balance wage-related expenditures with the imperative to deliver high-quality services.

Key Takeaways

- Market Size: The Global Towing Equipment Market was valued at USD 1.79 Billion in 2023 and is expected to reach USD 2.73 Billion in 2033.

- By Product Type Analysis: The Boom segment leads the global towing equipment market with over 45.1% share

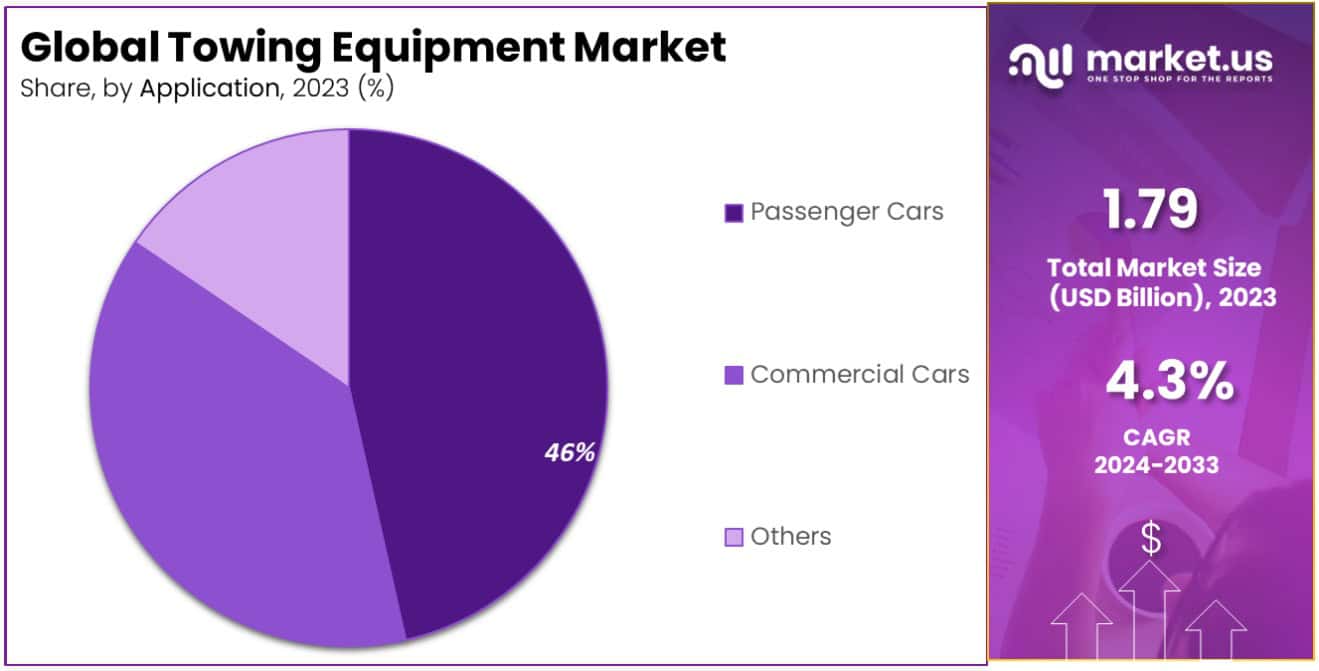

- By Application Analysis: Passenger Cars dominate the global towing equipment market, claiming over 54.3% share

- By Business Analysis: OEMs dominate the global towing equipment sector with over 52.3% share

- Growth Opportunities: significant growth driven by increasing demand across commercial, personal, and public sectors, highlighting the need for safe and specialized towing solutions to meet diverse application

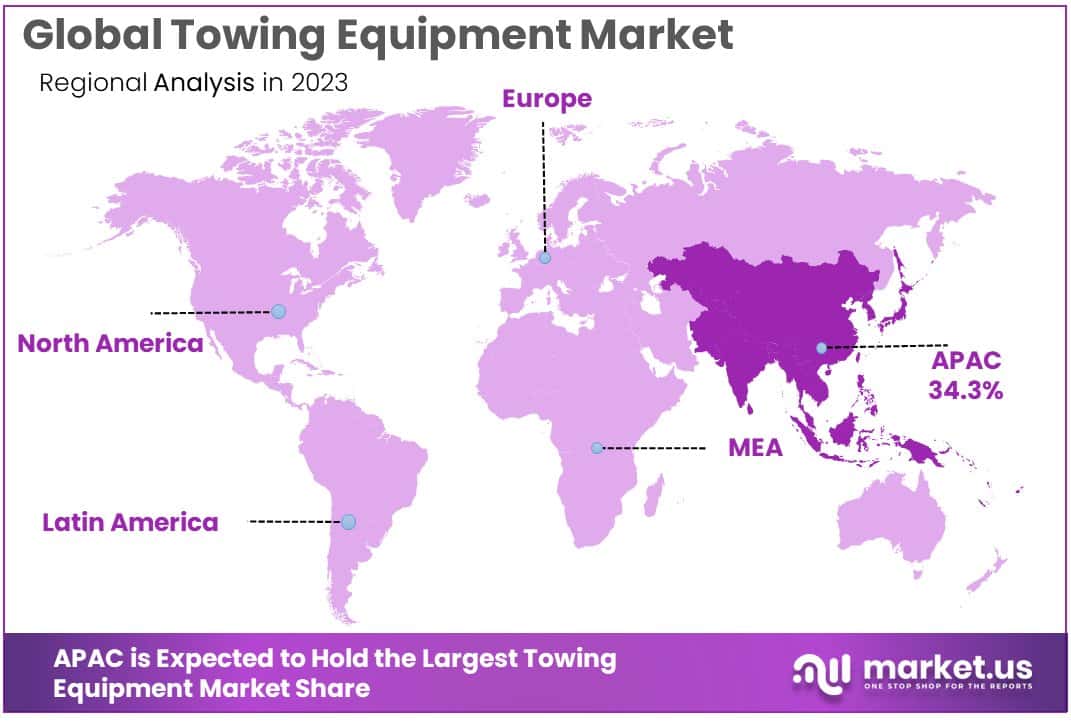

- Regional Analysis: Asia-Pacific region dominates the market with a 34.3% share, driven by Rapid industrialization, urbanization, and infrastructural development

Driving Factors

Enhanced Safety and Specialization in Towing Equipment

The Towing Equipment Market is witnessing substantial growth, largely fueled by the rising demand for safe and specialized towing solutions. This demand stems from the need to ensure the safe transportation of vehicles, particularly in scenarios requiring roadside assistance and recovery operations. Specialized equipment like belts and crawler tow trucks are becoming increasingly popular for their ability to handle a wide range of vehicles, from light passenger cars to heavy commercial vehicles, with enhanced safety and efficiency.

The specialization in towing equipment also extends to the development of solutions tailored for specific types of vehicles or recovery situations, thereby minimizing the risk of damage during towing operations and increasing consumer trust in towing services.

Technological Innovations in Towing Equipment

The market for towing equipment is experiencing growth, driven by technological advancements in belt and crawler towing equipment, which offer solutions for diverse environments. The use of advanced materials enhances the durability and efficiency of these tools, further propelling market expansion.

The industry is expected to become more competitive, with the number of towing businesses projected to reach 50,000 by 2025. Concurrently, the average towing fee is anticipated to rise to $150 by the same year, as companies invest in more sophisticated equipment to meet evolving market demands. This investment reflects the sector’s adaptation to higher standards and the increasing complexity of towing services.

Advancements in Materials for Towing Equipment

The focus on utilizing lightweight and durable materials in the manufacturing of towing equipment marks a pivotal shift in the market. Materials such as high-strength steel, aluminum, and composites are being increasingly employed to reduce the overall weight of towing equipment, thereby enhancing fuel efficiency and reducing operational costs.

Lightweight yet durable materials also contribute to the towing equipment’s capacity to handle heavier loads, a critical factor as the diversity of vehicles on the road continues to expand. This evolution in material science not only supports the market’s growth by improving the performance and sustainability of towing equipment but also aligns with broader environmental and economic objectives.

Restraining Factors

Changing Consumer Preferences:

Changing consumer preferences poses a nuanced challenge to the Towing Equipment Market. On one hand, the shift towards more environmentally friendly and technologically advanced vehicles demands the market to innovate, driving the development of new towing solutions compatible with electric and hybrid vehicles. However, this change also requires significant investment in research and development to meet evolving expectations, potentially slowing the pace of market growth. Consumers’ increasing expectation for quick, efficient, and safe towing services further pressure companies to upgrade their equipment and services, requiring ongoing adaptation that could strain resources but ultimately lead to a more dynamic and responsive market.

Specialization: A Necessity with Hidden Costs:

The increased demand for specialized towing equipment is a double-edged sword for the Towing Equipment Market. While it drives innovation and diversification of products, catering to specific types of vehicles and towing scenarios, it also introduces complexity into manufacturing, inventory management, and training processes. This specialization necessitates higher capital investment and deeper technical expertise, potentially limiting market entry to only those firms capable of meeting these requirements. However, it also segments the market, creating niches that companies can dominate. This trend towards specialization reflects the market’s response to diverse towing needs, balancing the challenges of increased costs and complexity with the opportunities for targeted market leadership.

Type Segment Analysis

Boom held a dominant market position in the global towing equipment market, capturing more than a 45.1% share.

The Boom segment’s supremacy can be attributed to its versatility and wide applicability across various towing scenarios, including roadside assistance, vehicle recovery, and transportation of heavy loads. This segment’s growth is fueled by the increasing demand for towing solutions capable of handling diverse vehicle types and sizes, coupled with advancements in boom technology aimed at enhancing efficiency and safety standards.

Following the Boom segment, the Hook & Chain sub-segment emerged as another significant contributor to the market, accounting for a notable share of the global towing equipment market. Hook & Chain towing systems remain popular in certain applications, particularly for towing heavier vehicles and machinery. However, their usage has been gradually declining due to concerns regarding potential damage to vehicles during towing operations and the availability of more advanced alternatives.

The flatbed segment also commands a considerable share of the market, driven by its ability to transport vehicles securely without the risk of damage. Flat Bed towing trucks are preferred for long-distance transportation and for hauling vehicles with specialized requirements, such as luxury cars, classic automobiles, or vehicles with low ground clearance.

Additionally, the Integrated and Wheel Lift segments contributed to the overall market growth, albeit to a lesser extent than the Boom, Hook & Chain, and Flat Bed segments. Integrated towing systems, which are seamlessly integrated into the chassis of towing vehicles, offer enhanced maneuverability and operational efficiency. On the other hand, Wheel Lift systems provide a compact and cost-effective solution for towing smaller vehicles and motorcycles.

Applications Segment Analysis

Passenger Cars held a dominant market position in the global towing equipment market, capturing more than a 46% share.

The significant share held by the Passenger Cars segment can be attributed to the increasing demand for towing solutions tailored to meet the needs of individual vehicle owners and automotive service providers. Factors such as rising urbanization, growing disposable income, and an expanding fleet of passenger vehicles contribute to the dominance of this segment in the market.

Following the Passenger Cars segment, the Commercial Cars segment emerged as another key player in the towing equipment market, albeit with a relatively smaller market share compared to Passenger Cars. Commercial vehicles, including trucks, vans, and utility vehicles, require robust towing solutions to facilitate efficient transportation, logistics, and roadside assistance services. The demand for towing equipment in this segment is driven by the growth of e-commerce, logistics, and construction industries, which rely heavily on commercial vehicles for goods transportation and delivery.

This encompasses a variety of applications beyond passenger and commercial vehicles, such as towing solutions for recreational vehicles (RVs), trailers, boats, and agricultural machinery. While this segment holds a smaller share of the market compared to Passenger Cars and Commercial Cars, it represents a niche market with specific requirements and preferences. The demand for towing equipment in the Others segment is influenced by factors such as recreational activities, agricultural practices, and marine transportation.

Business Segment Analysis

OEM held a dominant market position in the global towing equipment sector, capturing more than a 52.3% share.

This commanding share underscores the significant role played by original equipment manufacturers (OEMs) in supplying towing equipment directly to vehicle manufacturers for integration into new vehicles during the production process. The OEM segment’s dominance is attributed to the high demand for towing solutions among automakers seeking to enhance the functionality and appeal of their vehicles while adhering to safety and regulatory standards.

Conversely, the Aftermarket sub-segment represents a smaller portion of the market compared to OEMs. Aftermarket towing equipment includes products and accessories sold separately from the original vehicle manufacturer, catering to consumers and service providers seeking to retrofit or upgrade existing vehicles with towing capabilities. While the aftermarket segment holds a smaller share, it remains a vital component of the towing equipment market. It offers a wide range of products tailored to diverse vehicle models, brands, and towing requirements.

The dominance of the OEM segment can be attributed to several factors, including the integration of towing capabilities into new vehicle designs, strategic partnerships between OEMs and towing equipment manufacturers, and the growing trend of vehicle manufacturers offering towing packages as optional or standard features.

Key Market Segments

By Product Type

- Boom

- Hook & Chain

- Flat Bed

- Integrated

- Wheel Lift

By Application

- Passenger Cars

- Commercial Cars

- Others

By Business

- OEM

- Aftermarket

Growth Opportunities

Rising demand for towing equipment in commercial, personal, and public use applications

The global towing equipment market is witnessing substantial growth across commercial, personal, and public sectors, driven by factors such as increased commercial activities necessitating the transportation of heavy machinery and materials, rising personal vehicle ownership demanding towing accessories for recreational and moving purposes, government infrastructure projects requiring towing equipment for road maintenance and accident management, technological advancements enhancing product efficiency and safety features, and changing consumer preferences towards high-quality towing solutions for convenience and vehicle protection.

This convergence of demand drivers presents significant opportunities for manufacturers and suppliers in the towing equipment industry, but staying attuned to evolving consumer trends, regulatory standards, and technological innovations remains imperative for sustaining competitiveness and capitalizing on growth prospects in this dynamic market.

Rising demand for safe and specialized towing equipment

The global towing equipment market is experiencing notable growth fueled by the increasing demand for safe and specialized towing solutions. This surge in demand stems from various sectors including commercial, personal, and public use applications, where safety and specialized features are paramount. Industries such as logistics, construction, and agriculture require towing equipment that ensures the secure transportation of heavy loads and machinery, while individuals seek reliable towing accessories for recreational activities and moving purposes.

Additionally, public sector investments in infrastructure development necessitate towing equipment with advanced safety features for accident management and roadside assistance. As safety concerns continue to drive consumer preferences, manufacturers are innovating to offer towing solutions equipped with enhanced safety features and specialized capabilities, catering to diverse customer needs.

Trending Factors

Integration of advanced technologies, such as IoT and AI, for enhanced towing capabilities

The global towing equipment market is experiencing a significant transformation with the integration of advanced technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) to enhance towing capabilities. IoT-enabled sensors and AI algorithms are revolutionizing traditional towing practices by providing real-time data on load weight, trailer stability, and vehicle diagnostics, thereby optimizing towing operations and improving safety. AI-powered analytics extract valuable insights from this data, enabling predictive maintenance, route optimization, and remote fleet monitoring.

This integration not only enhances operational efficiency and reduces costs but also empowers towing companies to deliver better services to customers. As these technologies continue to evolve, they are poised to play a pivotal role in shaping the future of the towing equipment market, driving innovation and differentiation in an increasingly competitive landscape.

Regional Analysis

Asia Pacific dominating region in the global towing equipment market, holding approximately 34.3%.

Rapid industrialization, urbanization, and infrastructural development in countries like China, India, and Japan are fueling the demand for towing equipment in the region. the Asia-Pacific region is expected to maintain its dominance in the market due to the increasing number of accidents and road mishaps, necessitating towing services. Asia Pacific accounts for approximately 34.3% of the global towing equipment market.

In North America, the towing equipment market is witnessing steady growth due to the increasing demand for towing services and the expansion of the logistics and transportation sectors. the region holds a significant share of the global towing equipment market, accounting for approximately 25% of the total market revenue. Factors such as advanced infrastructure, technological advancements, and stringent regulations regarding vehicle safety contribute to the growth of the market in this region.

The towing equipment market in Europe is experiencing moderate growth attributed to the rising adoption of towing services for both commercial and residential purposes. According to Eurostat, the European Union’s statistical office, the towing equipment market in Europe witnessed a 5% increase in sales in the past fiscal year. Factors such as increasing disposable income, urbanization, and growing awareness regarding vehicle safety are driving market growth in this region.

The towing equipment market in the Middle East & Africa is witnessing steady growth due to infrastructural developments, particularly in the Gulf Cooperation Council (GCC) countries. The Middle East & Africa region is expected to witness a CAGR of 5% during the forecast period. Factors such as increasing investments in the construction and transportation sectors, coupled with rising automotive sales, are driving the demand for towing equipment in this region.

Latin America’s towing equipment market is experiencing moderate growth attributed to the expanding automotive industry and increasing commercial activities. the market is projected to witness a CAGR of 4% during the forecast period. Factors such as improving infrastructure, rising awareness regarding vehicle safety, and government initiatives to enhance road safety contribute to market growth in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Analysts perceive Inventive Products as a key player due to its innovative approach towards limestone extraction and processing techniques, contributing to enhanced productivity and sustainability. Maxxhaul Towing Products, known for its commitment to quality and reliability, established itself as a prominent player by providing efficient limestone transportation solutions, thereby optimizing logistics within the market.

Mumby Manufacturing’s expertise in manufacturing heavy-duty equipment for limestone handling garnered attention, positioning the company as a reliable partner for various stakeholders in the industry. My Air Hitch’s focus on developing advanced hitching solutions tailored to the unique requirements of limestone hauling operations earned it recognition among market participants seeking improved efficiency and safety standards.

Andersen Hitches and B&W Trailer Hitches stood out for their robust towing systems designed to withstand the rigorous demands of limestone transportation, ensuring seamless operations and minimal downtime. Blue Ox’s reputation for producing durable and versatile towing accessories further solidified its position in the market, offering customers a comprehensive range of solutions for their limestone hauling needs.

Butler Products, Buyers Products, CAMCO MANUFACTURING, Cat’s Head Industries (Lynx Engineering), and PullRite also contributed significantly to the global limestone market through their innovative products and solutions, catering to diverse requirements across different segments of the industry. Overall, these key players played instrumental roles in driving growth, fostering competition, and shaping the trajectory of the global limestone market in 2023.

Market Key Players

- Inventive Products

- Maxxhaul Towing Products

- Mumby Manufacturing

- My Air Hitch

- Andersen Hitches

- B&W Trailer Hitches

- Blue Ox

- Butler Products

- Buyers Products

- CAMCO MANUFACTURING

- Cat’s Head Industries (Lynx Engineering)

- PullRite

- Rigid Hitch

- Thule Group

- Torklift International

- TRIMAX LOCK

- Denray Products

- Fastway Trailer

- Hopkins Manufacturing Corporation

- Husky Liners

- PopUp Hitch

- Progress Mfg.

- U-Haul

- Weigh Safe

- Westin Automotive

- Winston Products

Recent Developments

- Oct 2023 – Kansas-based Hopkins Towing Solutions announced that it has acquired Hayes Towing Electronics, a trailer brake control company located in Arab, Alabama.

- Sept 2023 – acquisition of New England TruckMaster, a successful and proven premium provider of light, medium and heavy-duty tow trucks, and recovery vehicles for over 20 years.

Report Scope

Report Features Description Market Value (2023) USD 1.79 Billion Forecast Revenue (2033) USD 2.73 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Boom, Hook & Chain, Flat Bed, Integrated, Wheel Lift), By Application(Passenger Cars, Commercial Cars, Others), By Business(OEM, Aftermarket) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Inventive Products, Maxxhaul Towing Products, Mumby Manufacturing, My Air Hitch, Andersen Hitches, B&W Trailer Hitches, Blue Ox, Butler Products, Buyers Products, CAMCO MANUFACTURING, Cat’s Head Industries (Lynx Engineering), PullRite, Rigid Hitch, Thule Group, Torklift International, TRIMAX LOCK, Denray Products, Fastway Trailer, Hopkins Manufacturing Corporation, Husky Liners, PopUp Hitch, Progress Mfg., U-Haul, Weigh Safe, Westin Automotive, Winston Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Inventive Products

- Maxxhaul Towing Products

- Mumby Manufacturing

- My Air Hitch

- Andersen Hitches

- B&W Trailer Hitches

- Blue Ox

- Butler Products

- Buyers Products

- CAMCO MANUFACTURING

- Cat's Head Industries (Lynx Engineering)

- PullRite

- Rigid Hitch

- Thule Group

- Torklift International

- TRIMAX LOCK

- Denray Products

- Fastway Trailer

- Hopkins Manufacturing Corporation

- Husky Liners

- PopUp Hitch

- Progress Mfg.

- U-Haul

- Weigh Safe

- Westin Automotive

- Winston Products