Global Tool Storage Products Market Market Size, Share, Growth Analysis By Product Type (Portable Tool Boxes, Tool Cabinets & Chests, Tool Push Carts, Tool Bags & Pouches, Others), By Material (Metal, Plastic, Wood), By End Use (Residential, Commercial, Industrial), By Distribution Channel (Direct, Indirect), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168011

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

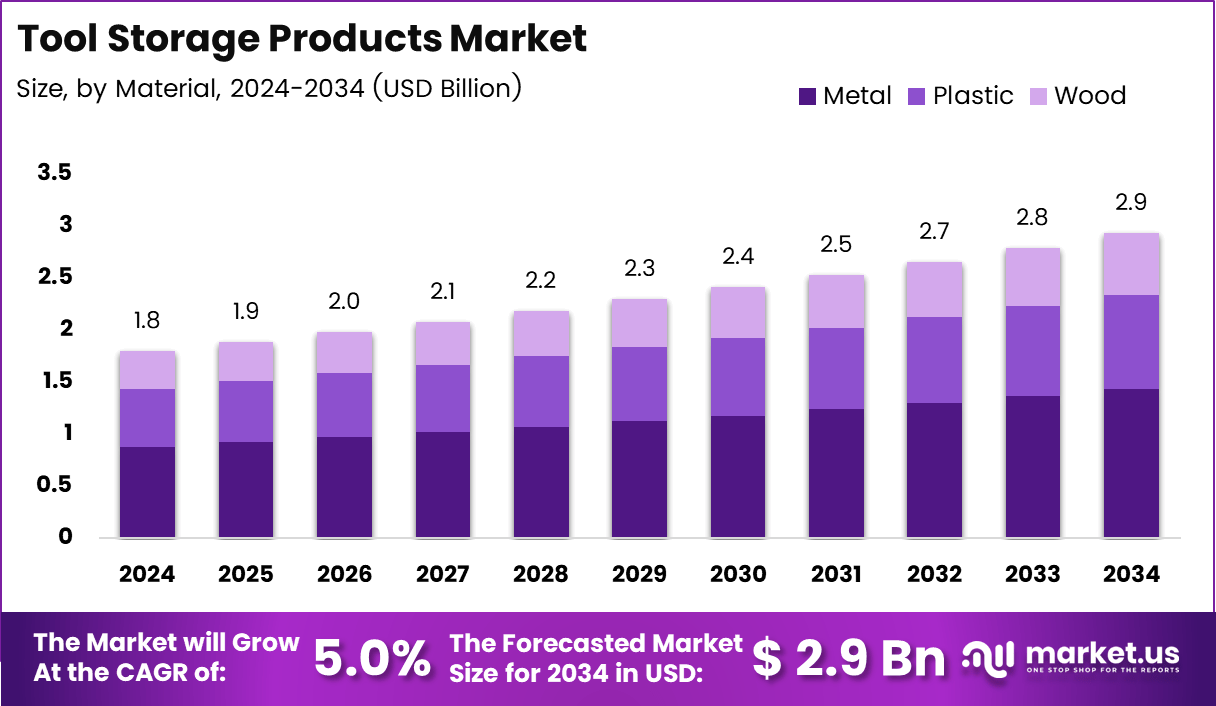

The Global Tool Storage Products Market size is expected to be worth around USD 2.9 billion by 2034, from USD 1.8 billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

The Tool Storage Products Market represents a steadily expanding category driven by rising home-improvement interest and growing adoption of organized tool-management systems. The market continues gaining relevance as professionals and hobbyists seek durable, space-efficient, and modular storage solutions that improve workflow efficiency and protect high-value equipment across residential and commercial environments.

Moreover, increasing construction activity and rapid digitization of workshops enhance product demand across small contractors and maintenance teams. The shift toward mobility-focused tool carriers also strengthens market prospects, as users prefer compact, ergonomic designs that simplify transport and reduce downtime during multi-location tasks. This transition encourages manufacturers to innovate stronger, lighter, and weather-resistant materials.

Additionally, governments promote skill-development programs, vocational training, and MSME capacity building, indirectly driving demand for structured tool-storage essentials. Regulatory emphasis on workplace safety further accelerates adoption, as organized storage minimizes hazards and ensures compliance with equipment-handling standards. These actions support long-term market stability and encourage wider product modernization.

Furthermore, rising opportunities emerge from growing DIY communities and expanding e-commerce accessibility, enabling users to compare features, materials, and configurations more efficiently. The adoption of modular tool-storage kits, stackable systems, and anti-impact housings enhances consumer interest across urban and semi-urban sectors. These elements collectively create a diverse demand environment for tool-storage innovation.

In addition, the market benefits from expanding interest in lightweight polymers, improved locking mechanisms, and impact-resistant housings relevant to both mobile tool cases and workshop cabinets. Technological improvements, such as click-fit modules and accessory integration, support greater product differentiation, strengthening purchasing motivation among diverse consumer groups.

According to survey findings, premium offerings such as the DeWalt TStak Shallow Box are priced around 3157–3624 INR, use high-impact polypropylene, offer a 30 kg weight capacity and 23 L volume, and measure 440 × 162 × 333 mm. Mid-range models such as the Stanley Essential Tool Box cost 849–890 INR and measure 205 × 406 × 406 mm with unspecified capacities.

Similarly, compact units such as the Bosch L-Boxx Mini are priced at 1014–1041 INR, built from PP, support 1.5 kg, offer 7.8 L capacity, and measure 153 × 62 × 155 mm. These survey-based statistics indicate clear segmentation across price, durability, and load-handling expectations, reinforcing structured demand patterns within the Tool Storage Products Market.

Key Takeaways

- The Global Tool Storage Products Market is expected to reach USD 2.9 billion by 2034, rising from USD 1.8 billion in 2024.

- The market grows at a steady CAGR of 5% during the forecast period from 2025 to 2034.

- Portable Tool Boxes lead the By Product Type segment with a dominant share of 34.6% in 2024.

- Metal dominates the By Material segment with a strong market share of 48.9% in 2024.

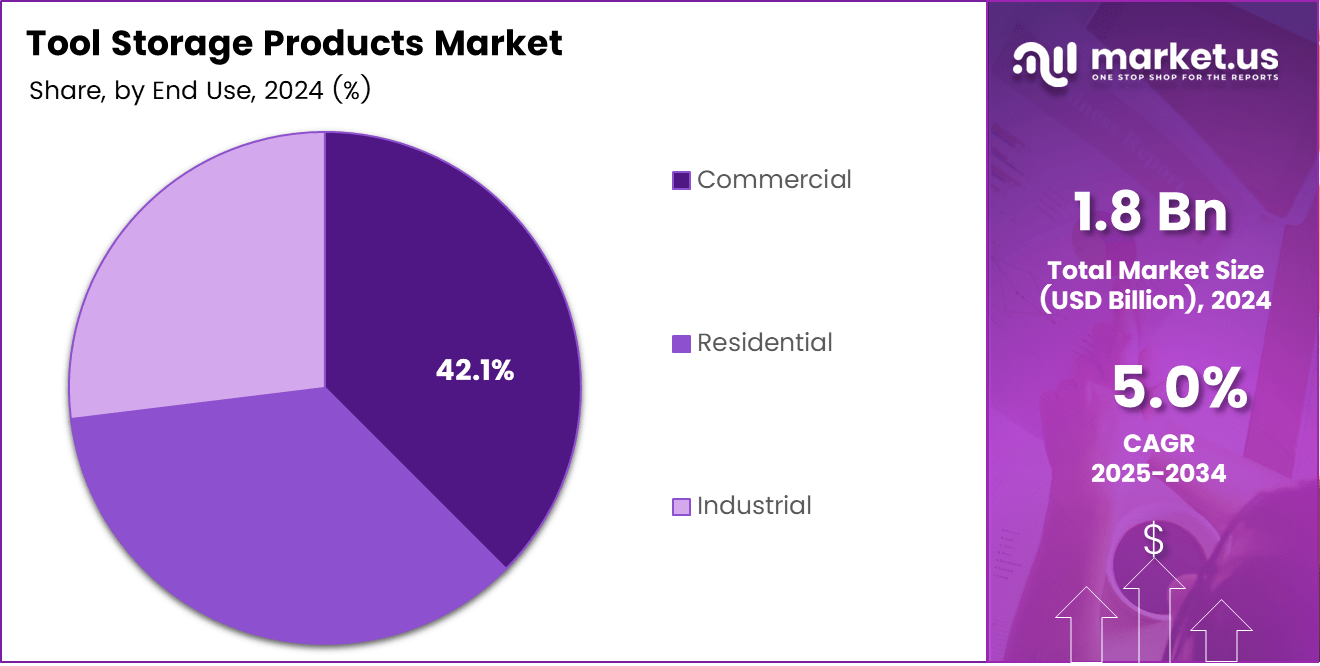

- Commercial applications hold the largest share of 34.8% in the By End Use segment in 2024.

- Indirect distribution channels account for the majority share of 67.2% in 2024.

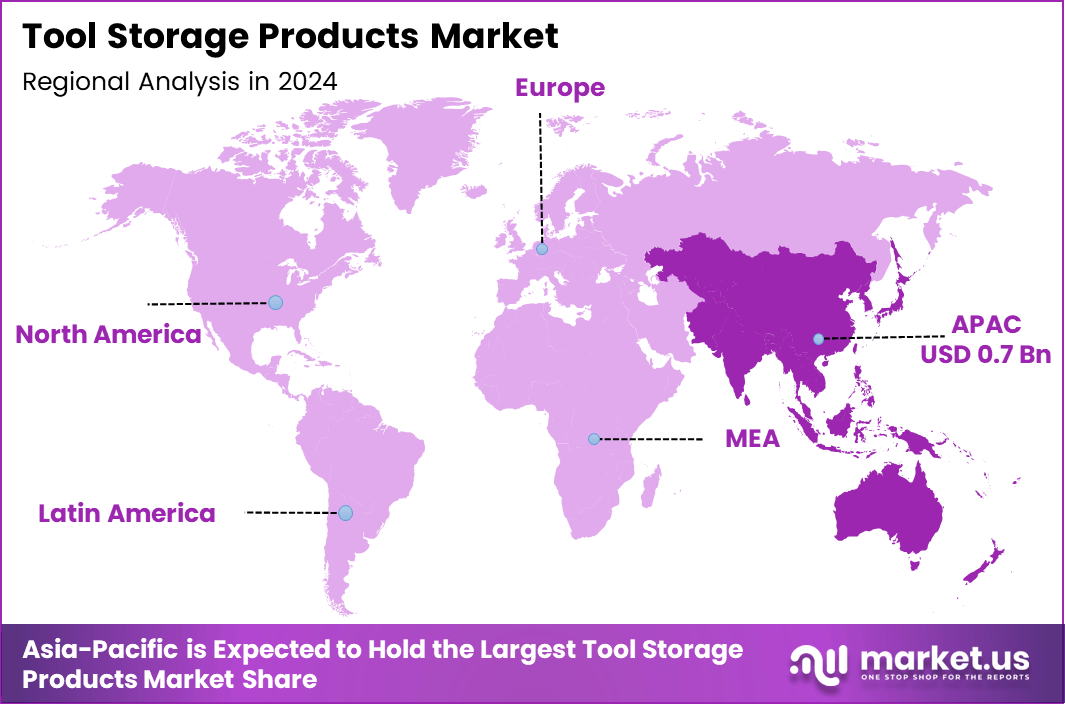

- APAC dominates the global market with a regional share of 43.9%, valued at USD 0.7 billion.

By Product Type Analysis

Portable Tool Boxes dominate with 34.6% due to high mobility and wide consumer adoption.

In 2024, Portable Tool Boxes held a dominant market position in the By Product Type segment of the Tool Storage Products Market, with a 34.6% share. These boxes gained traction due to easy handling, compact designs, and rising DIY usage. Their lightweight formats further enhanced portability across household and field applications.

Tool Cabinets & Chests continued expanding as users sought larger storage for heavy-duty environments. These structures provided multi-drawer systems supporting organized workflows in workshops. Additionally, their lockable designs improved security in commercial and industrial spaces, encouraging upgrades among technicians and maintenance teams.

Tool Push Carts improved mobility inside workshops by enabling the smooth movement of tools between workstations. Their wheeled platforms supported efficient handling of mid-to-heavy loads. Adoption grew in automotive garages, assembly lines, and machine maintenance facilities where mobility and accessibility remained essential for workflow continuity.

Tool Bags & Pouches attracted professionals needing flexible, on-the-go storage. Their lightweight fabrics, numerous pockets, and ergonomic handling helped technicians carry essential tools securely. Growing demand from electricians, plumbers, and field repair workers further strengthened adoption across everyday service operations.

Others included niche storage solutions tailored to specialized tools. These offerings served technical users in fields where standard toolboxes were insufficient. Manufacturers continued refining these designs to meet emerging requirements across precision engineering, lightweight tools, and specialized repair tasks.

By Material Analysis

Metal dominates with 48.9% owing to durability and long service life.

In 2024, Metal held a dominant market position in the By Material segment of the Tool Storage Products Market, with a 48.9% share. Its robustness, corrosion resistance, and structural strength supported heavy-load applications. Industrial users preferred metal structures for long-term reliability and enhanced tool protection across demanding environments.

Plastic solutions expanded steadily due to lightweight designs and cost advantages. These products served residential and light-commercial users seeking easy mobility and affordability. Their molded construction allowed diverse shapes, improving convenience for individuals managing occasional repairs or small-scale tool organization needs.

Wood storage products maintained relevance among users who value aesthetics and traditional craftsmanship. Although limited in industrial environments, they found steady demand in workshops, craftsman studios, and hobby setups. Their natural finish and customizable formats encouraged adoption among users seeking visually appealing storage options.

By End Use Analysis

Commercial dominates with 34.8% due to rising adoption in service and repair businesses.

In 2024, Commercial held a dominant market position in the By End Use segment of the Tool Storage Products Market, with a 34.8% share. Service centers, contractor firms, and repair workshops increasingly adopted structured storage to improve productivity. Rising equipment maintenance activities further supported commercial segment growth.

Residential users contributed significantly to market expansion as DIY activities increased. Homeowners invested in compact tool boxes and pouches to manage routine repairs. Easy availability of affordable options enabled wider adoption, especially among beginners needing essential storage without industrial-grade requirements.

Industrial applications demanded heavy-duty cabinets, chests, and carts to support organized tool handling in factories. Manufacturing lines, assembly units, and maintenance divisions relied on durable storage to reduce downtime. Structured workstations and rising lean manufacturing practices strengthened industrial purchases.

By Distribution Channel Analysis

Indirect dominates with 67.2% because multi-brand retail networks drive wider accessibility.

In 2024, Indirect channels held a dominant market position in the By Distribution Channel segment of the Tool Storage Products Market, with a 67.2% share. Hardware stores, online platforms, and distributors strengthened market access. Their broad assortments and competitive pricing attracted both professionals and residential buyers.

Direct channels served institutional and industrial buyers needing bulk procurement. Manufacturers offered customized solutions, faster delivery, and integrated after-sales support. These channels gained relevance in projects requiring specialized tool storage aligned with operational workflows and technical requirements.

Key Market Segments

By Product Type

- Portable Tool Boxes

- Tool Cabinets & Chests

- Tool Push Carts

- Tool Bags & Pouches

- Others

By Material

- Metal

- Plastic

- Wood

By End Use

- Residential

- Commercial

- Industrial

By Distribution Channel

- Direct

- Indirect

Drivers

Rising Demand for Advanced Garage Organization Systems Fuels Market Growth

The growing demand for advanced garage organization systems among residential users continues to strengthen the Tool Storage Products Market. Homeowners increasingly focus on structured storage to manage expanding DIY tool collections. This shift encourages manufacturers to develop modular, easy-to-install solutions that improve space usage and overall organizational efficiency.

At the same time, the expansion of automotive aftermarket service centers creates consistent demand for professional-grade tool storage systems. These facilities require modular cabinets, heavy-duty racks, and structured workstations to manage tools efficiently during high-volume servicing. As service networks grow, the market benefits from accelerated procurement of durable, workshop-ready storage units.

Additionally, the rising adoption of portable toolboxes among field technicians and contractors supports steady market expansion. Professionals prefer lightweight, impact-resistant toolboxes that improve mobility during on-site operations. This preference encourages continuous innovation in compact, portable formats that offer better capacity and convenience for fieldwork applications.

Restraints

High Upfront Investment Limits Growth in Professional Workshops

High upfront investment for premium tool cabinets and workstation systems remains a major restraint in the Tool Storage Products Market. Many small workshops hesitate to adopt high-end units due to cost barriers, slowing the wider acceptance of advanced storage formats. This limits market penetration across price-sensitive segments.

Moreover, limited awareness among small and unorganized workshops regarding ergonomic storage benefits affects adoption rates. Many operators continue relying on basic shelves or improvised storage, reducing the demand for structured tool management systems. This hesitation results in slower modernization of workshop infrastructure and affects market expansion in developing economies.

Growth Factors

Development of Smart Storage Technologies Unlocks New Opportunities

The development of smart tool storage units integrated with IoT tracking presents strong opportunities for future growth. These systems help technicians locate, track, and secure tools efficiently, reducing losses and improving workflow productivity. This technological shift encourages industrial buyers to upgrade from traditional to connected storage systems.

Expansion into compact and foldable storage formats is also creating new opportunities, especially among urban consumers. Limited home space pushes users toward collapsible or stackable tool storage designs that offer convenience without compromising capacity. This trend strengthens demand for multi-functional, space-saving products in metropolitan markets.

Emerging Trends

Growing Preference for Durable Tool Chests Shapes Market Trends

A rising preference for durable, powder-coated stainless steel tool chests is shaping product trends in the market. Consumers and professionals choose heavy-duty metal units for long-term reliability, corrosion resistance, and improved load-bearing capacity, boosting demand for premium materials.

The increasing popularity of mobile tool carts further influences market trends as workshops prioritize flexibility. These carts allow technicians to move tools across work areas quickly, improving workflow and reducing downtime. This shift reinforces the demand for versatile, mobility-focused storage solutions.

A growing trend toward hybrid storage solutions that combine cabinets, drawers, and portable kits also strengthens product innovation. Users seek integrated setups that support both stationary organization and on-the-go utility, encouraging manufacturers to design modular, multi-purpose tool storage systems.

Regional Analysis

APAC Dominates the Tool Storage Products Market with a Market Share of 43.9%, Valued at USD 0.7 Billion

The Asia Pacific region maintains the leading position in the Tool Storage Products Market due to rapid industrial expansion, strong growth of automotive servicing networks, and rising residential demand for organized storage. APAC’s dominant share of 43.9%, valued at approximately USD 0.7 billion, reflects increasing consumer spending on durable storage units and the fast adoption of modular tool systems across manufacturing hubs.

North America Tool Storage Products Market Trends

North America exhibits steady growth driven by high DIY culture, widespread adoption of advanced garage storage systems, and robust investments in automotive aftermarket infrastructure. Strong purchasing power and preference for premium tool cabinets strengthen market demand across the US and Canada. Additionally, rising home improvement activities continue supporting long-term market expansion.

Europe Tool Storage Products Market Trends

Europe experiences sustained demand supported by well-developed industrial machinery sectors and a strong focus on technician safety and workplace ergonomics. The region benefits from increasing modernization of service workshops and compliance with organized storage standards. Growth also comes from the rising adoption of portable tool solutions among mobile maintenance teams.

Middle East & Africa Tool Storage Products Market Trends

The Middle East & Africa region showcases increasing uptake of tool storage systems due to expanding construction activities and the development of large industrial zones. Growing investments in automotive repair facilities and heavy equipment servicing further enhance product usage. Rising urbanization contributes to a gradual shift toward structured tool organization.

Latin America Tool Storage Products Market Trends

Latin America records moderate growth supported by ongoing improvements in manufacturing clusters and rising demand for affordable portable tool storage options. Expansion of small and mid-sized workshops drives product penetration across key markets. The region also benefits from increasing adoption of compact tool solutions among field technicians and contractors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tool Storage Products Market Company Insights

In 2024, the global Tool Storage Products Market reflected steady competitiveness, with established manufacturers strengthening product durability, modularity, and ergonomics. Apollo Tools maintained a notable presence by focusing on value-driven toolboxes and compact storage units aimed at home users and light-duty technicians. Its emphasis on affordability and essential functionality continued to support strong adoption among beginner and DIY segments, especially across growing residential maintenance activities.

Bosch reinforced its position through precision-engineered storage systems aligned with its power tools portfolio. The company’s interlocking L-Boxx series remained integral to workflow optimization for technicians seeking organized, impact-resistant solutions. Bosch’s ongoing improvements in material strength and portability supported wider preference across automotive, construction, and industrial service environments.

DeWalt sustained market leadership in professional tool storage, driven by rugged build quality and compatibility across expanding modular ecosystems. The TSTAK and TOUGHSYSTEM ranges remained favored among contractors requiring high-load capacity, weather-resistant, and stackable storage. DeWalt’s product strength and advanced latch mechanisms continued to appeal to users prioritizing reliability in demanding field conditions.

GearWrench demonstrated continued advancement in technician-focused storage designs targeting automotive and heavy-duty service applications. Its tool chests, mobile carts, and drawer-based cabinets emphasized smooth-glide mechanisms and enhanced weight distribution. The brand’s commitment to workshop productivity and smart organization solutions supported its rising relevance among professionals seeking mid-premium tool management options.

Together, these companies strengthened the competitive framework of the Tool Storage Products Market in 2024 by prioritizing durability, modularity, and real-world technician efficiency, shaping evolving purchasing patterns across both professional and consumer categories.

Top Key Players in the Market

- Apollo Tools

- Bosch

- DeWalt

- GearWrench

- Husky

- Husqvarna

- Irwin Tools

- Kobalt

- Makita

- Milwaukee Tool

- RIDGID

Recent Developments

- In December 2024, Husky released its heavy-duty steel tool chest series, offering a 1,800-lb weight capacity. The release strengthened Husky’s positioning in the professional workshop segment with advanced drawer-glide technology.

- In October 2025, Irwin Tools unveiled its new contractor-grade tool carrier line offering 30% more compartment space. The launch addressed growing demand for portable equipment and ergonomic jobsite storage solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.8 billion Forecast Revenue (2034) USD 2.9 billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Portable Tool Boxes, Tool Cabinets & Chests, Tool Push Carts, Tool Bags & Pouches, Others), By Material (Metal, Plastic, Wood), By End Use (Residential, Commercial, Industrial), By Distribution Channel (Direct, Indirect) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Apollo Tools, Bosch, DeWalt, GearWrench, Husky, Husqvarna, Irwin Tools, Kobalt, Makita, Milwaukee Tool, RIDGID Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Tool Storage Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Tool Storage Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apollo Tools

- Bosch

- DeWalt

- GearWrench

- Husky

- Husqvarna

- Irwin Tools

- Kobalt

- Makita

- Milwaukee Tool

- RIDGID