Global Tokenized Assets Market Size and Forecast Industry Analysis Report By Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts), By Type (Security Tokens, Utility Tokens, Asset-Backed Tokens), By End-Use (Real Estate, Financial Services, Art & Collectibles, Gaming and NFTs, Supply Chain and Logistics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159308

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Government-led Investments

- Investment and Business Benefits

- US Market Size

- Emerging Trends

- Growth Factors

- By Component

- By Type

- By End-Use

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

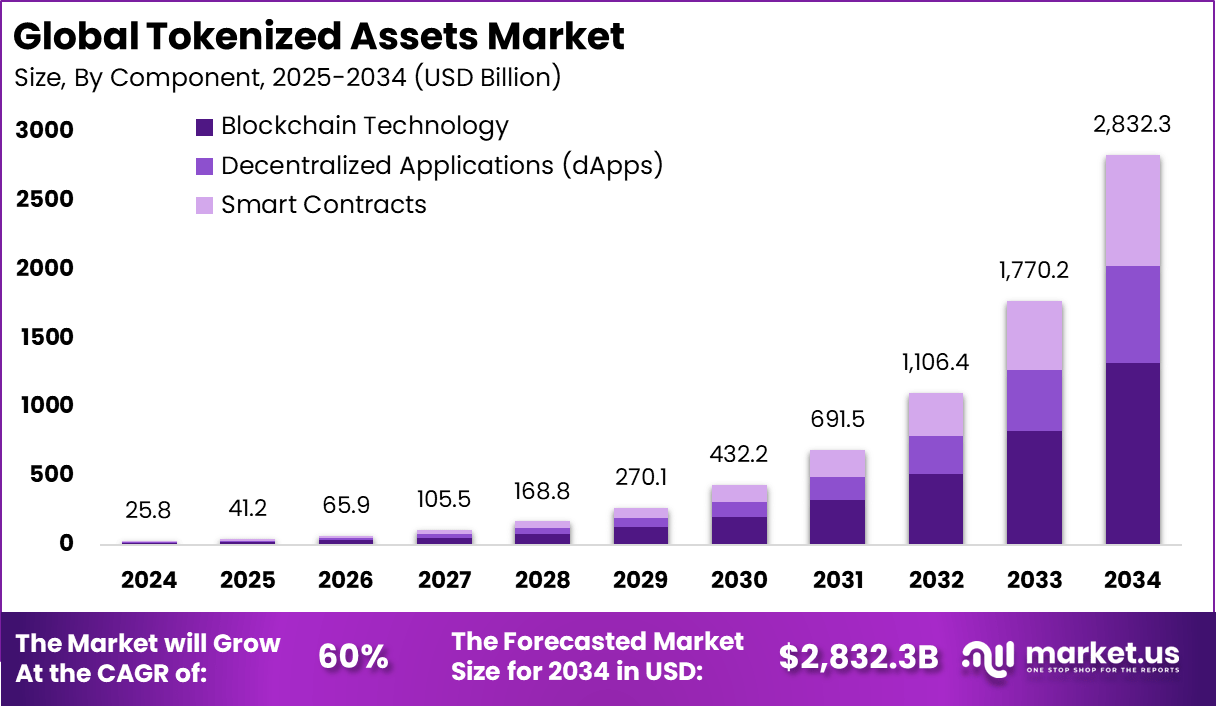

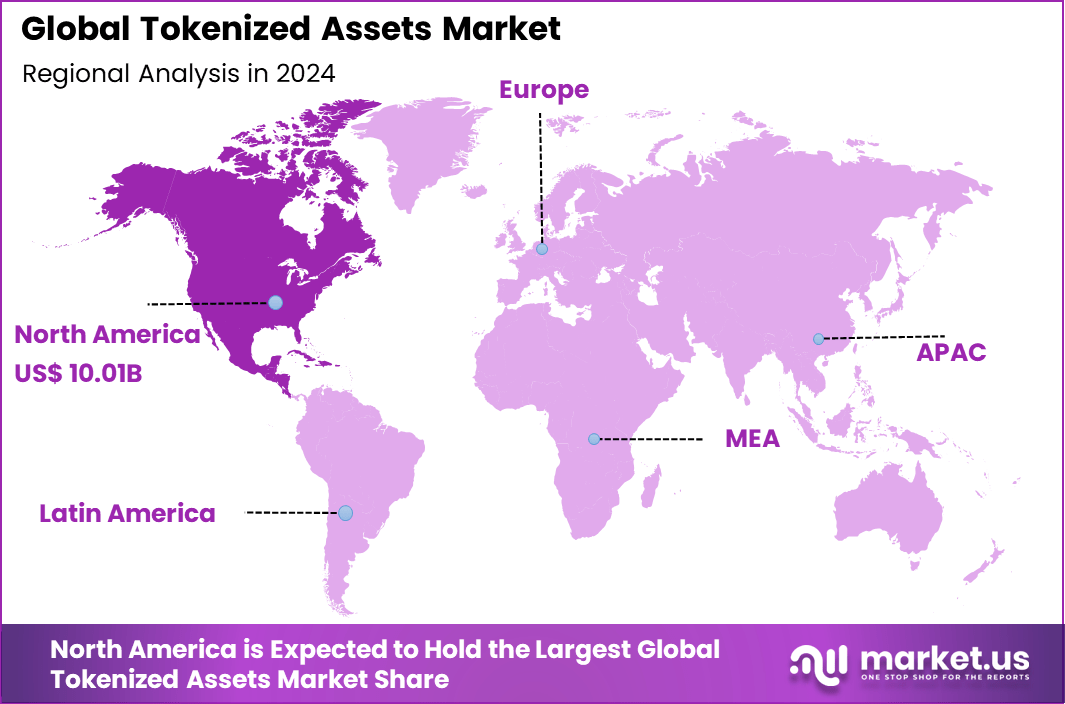

The Global Tokenized Assets Market size is expected to be worth around USD 2,832.3 Billion By 2034, from USD 25.8 billion in 2024, growing at a CAGR of 60% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.8% share, holding USD 10.01 Billion revenue.

The Tokenized Assets Market refers to systems, platforms, and services that convert ownership rights of real-world or financial assets into digital tokens recorded on a blockchain or distributed ledger. These tokens represent fractional ownership, claims, or securities linked to assets like real estate, commodities, private credit, real-estate investment trusts, art and collectibles, equity, and other instruments.

Over the past year, the asset tokenization market pushed past the privately-held threshold with well over $21 billion in tokenized value by April 2025, a nearly 245-fold increase since 2020. Institutional participation is particularly notable, with nearly 70% of deployed capital in 2024 stemming from large investors seeking improved efficiency and access to alternative yield and liquidity.

A primary driver behind the surge in tokenized assets lies in improving market liquidity and operational efficiency. Historically, assets such as real estate and credit were considered illiquid, but tokenization now lets investors buy and sell fractions of these holdings, broadening access by reducing minimum investment sizes. Private credit alone made up over 58% of tokenized real-world asset flows in the first half of 2025, while tokenized US Treasuries accounted for 34%, pointing to strong institutional adoption.

According to Coinlaw.io, tokenized treasury and money-market fund assets reached $7.4 billion in 2025, marking an 80% increase year-to-date. This growth reflects the rising demand for tokenized financial products as investors seek more efficient and transparent access to traditional assets. Real estate tokenization has also gained traction, with the market valued at approximately $20 billion in 2025.

Some optimistic forecasts suggest the sector could climb toward $1.5 trillion by 2025, although this figure represents a high-end estimate and depends on regulatory developments and adoption levels. Overall, the tokenization of real-world assets has expanded rapidly, reaching a market size of $24 billion in 2025. This represents a 308% increase over the past three years, highlighting the accelerating pace at which traditional asset classes are being digitized and integrated into blockchain-based ecosystems.

Key Insight Summary

- By component, Blockchain Technology accounted for 46.7%, emphasizing its critical role as the foundation for secure and transparent tokenization.

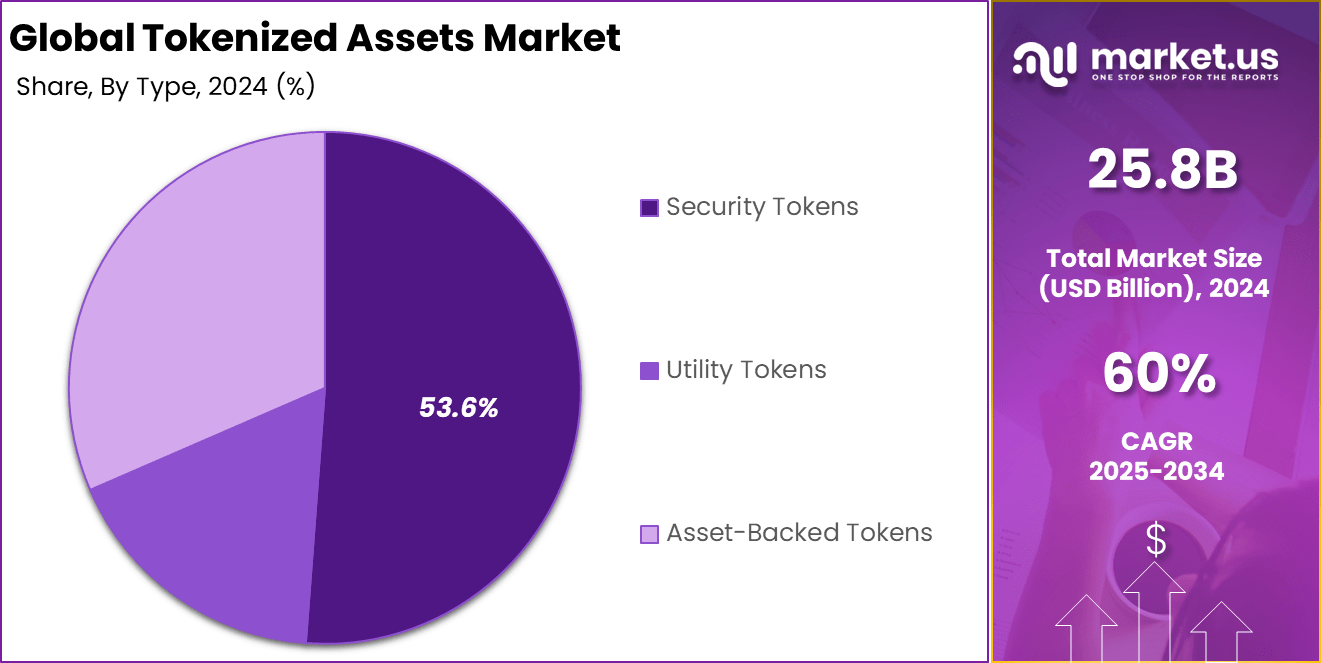

- By type, Security Tokens dominated with 53.6%, showing strong investor preference for regulated and asset-backed digital tokens.

- By end-use, Real Estate led with 38.8%, highlighting the growing adoption of tokenization to fractionalize high-value property assets.

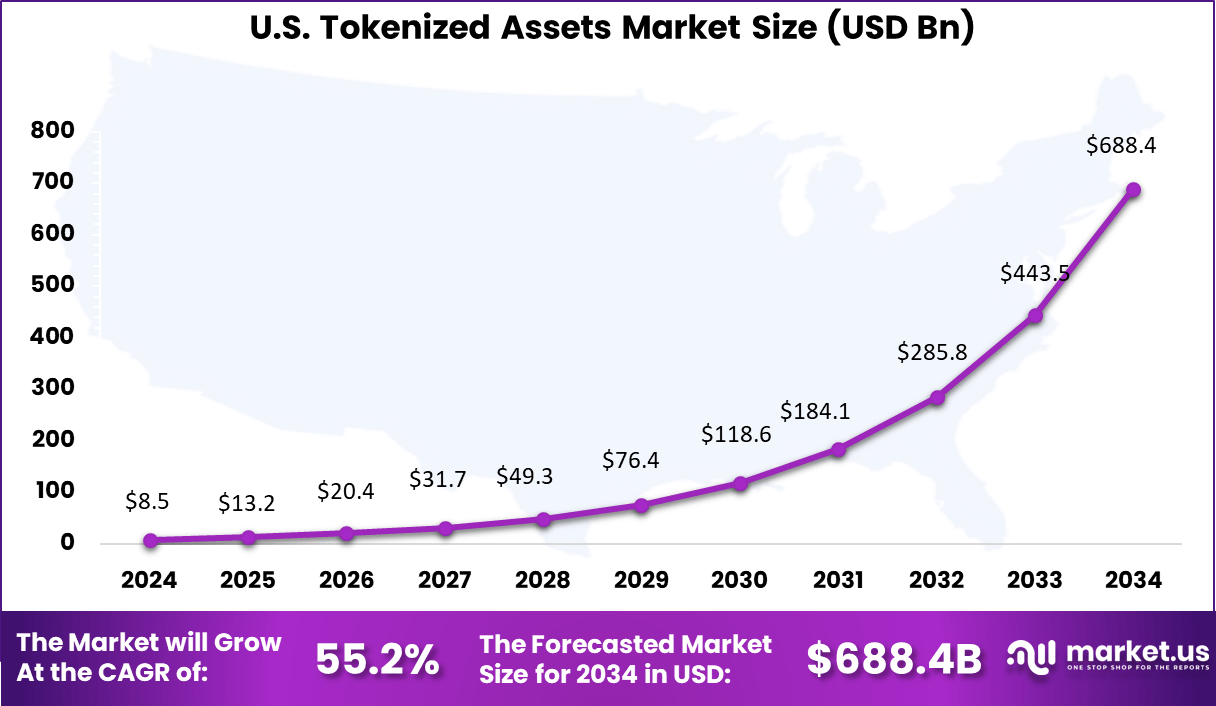

- Regionally, North America captured 38.8% of the market, with the U.S. contributing the largest share, supported by revenues of USD 8.49 billion and a remarkable CAGR of 55.2%.

Analysts’ Viewpoint

Demand is growing fast across alternative investment products and global regions because investors seek both yield and diversification in a volatile market. Real estate has remained the largest single class, making up nearly 31% of tokenized issuance in 2024, with commodities now expanding fastest at more than 50% growth rates per year.

Advanced technologies are at the heart of increasing adoption. Decentralized ledgers and smart contracts automate settlement, remove reconciliation delays, and enable programmable governance. Permissionless blockchains have begun to outpace private chains, supporting over 53% annual global growth between 2025 and 2030.

The main reasons for adopting tokenized assets are improved liquidity, lower transaction and settlement costs, enhanced transparency, and instant cross-border transfer. Automation through smart contracts reduces manual back-office intervention, allowing transactions that used to take days to settle to clear in minutes. Tokenization could add $2.4 trillion a year to the global economy by improving trading, custody, and settlement efficiency.

Government-led Investments

Government-led investments are playing a decisive role in shaping the sector, with the US government in March 2025 having created two national crypto reserves valued at $21 billion. Regulatory frameworks like the Financial Innovation and Technology for the 21st Century Act are giving digital assets a clear structure for oversight, further legitimizing tokenized finance.

Regulatory clarity and central bank activity have collectively helped draw over $300 billion in new investments to the space, signaling strong policy-driven momentum and laying foundations for long-term growth. Governments worldwide have also committed resources to develop sovereign digital assets and bolster strategic reserves, which are shaping foundational infrastructure for tokenization in mainstream markets.

Investment and Business Benefits

Opportunities for investment are rapidly expanding, especially as more asset classes become accessible to a broader population. For instance, funds and asset managers are increasingly allocating into tokenized US Treasuries and private credit as vehicles to deliver stable yield and improved collateral efficiency.

The entire market, from funds to real estate portfolios, is predicted to represent trillions in annual turnover, with aggregate figures growing by over 260% for real-world assets through the first half of 2025. Key business benefits of tokenization include the ability to reach a larger investor base, reduced counterparty risk, and greater market transparency.

Asset owners can issue tokens representing partial ownership to unlock capital without liquidating the whole asset. Markets are also more flexible, as digital tokens trade 24/7 on platforms, speeding up capital formation for businesses and investors alike. Blockchain’s auditable record greatly reduces the complexity and cost of recordkeeping by automating compliance and reporting.

US Market Size

The U.S. Tokenized Assets Market was valued at USD 8.5 Billion in 2024 and is anticipated to reach approximately USD 688.4 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 55.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 38.8% share and generating USD 10.01 billion in revenue in the tokenized assets market. The region’s leadership is driven by its advanced financial ecosystem, early adoption of blockchain technologies, and strong presence of institutional investors exploring tokenization for real estate, equities, and alternative assets.

The United States, in particular, has played a central role by fostering pilot projects and partnerships between fintech firms, traditional banks, and asset managers, which has accelerated commercialization of tokenized solutions. North America’s dominance is also reinforced by favorable investment conditions and a growing regulatory focus on digital assets.

While the legal framework is still evolving, regulators in the U.S. and Canada are increasingly addressing issues related to security tokens, compliance, and investor protection, providing greater clarity for market participants. This has encouraged large financial institutions to explore tokenized platforms as a way to enhance liquidity, enable fractional ownership, and reduce settlement times.

Emerging Trends

Emerging trends in the tokenized asset space are defined by rapid growth in institutional participation and broader asset classes. Real-world asset tokenization jumped by 80% year-to-date for U.S. Treasury products, and the total value of tokenized “real-world” assets surpassed $26 billion on public blockchains as of late August 2025.

Fractional ownership is expanding at an estimated 30% annual rate, regulatory advances are pulling in nearly $300 billion in new investments, and over 60% of US and European asset managers plan to offer tokenized products this year. Commodities, private credit, and real estate are among the fastest-growing segments, resulting in a vibrant landscape where new digital categories represent the largest growth opportunity in tokenization by 2030.

Growth Factors

Several factors are fueling growth in these markets. Institutional investors currently account for 69.8% of deployed capital, pointing to a structural shift in portfolio strategies that are increasingly turning toward tokenization for liquidity, cost savings, and 24/7 accessibility.

Improved regulatory clarity and advances in blockchain interoperability are driving market expansion with a reported compound annual growth rate of over 45%, while the benefits of cross-border instant settlement and fractional access are helping democratize investing in high-value assets. Enhanced transparency from blockchain traceability is also boosting investor trust by 25%, encouraging further adoption across asset types.

By Component

In 2024, Blockchain technology held a commanding share of 46.7% in the tokenized assets market. It acts as the core infrastructure enabling secure, transparent, and immutable recording of tokenized assets. The decentralized nature of blockchain enhances trust among market participants while facilitating seamless verification and transaction processes, which are critical in broadening market acceptance.

Ongoing advancements to improve scalability and interoperability continue to play an important role in boosting adoption and enhancing user experience. Improved blockchain frameworks have led to reductions in transaction costs and times, making tokenized asset platforms more efficient and accessible. This foundational technology supports a range of innovative applications across various asset classes, solidifying its leadership position within the market.

By Type

In 2024, security tokens commanded a market share of 53.6%, positioning them as the leading type of tokenized assets. These tokens represent traditional securities such as equities and bonds in a digital form that can be traded on blockchain platforms. The appeal of security tokens lies in the promise of improved liquidity, faster settlement processes, and increased transparency compared to conventional securities markets.

Increased regulatory clarity in major financial hubs supported the growth of security tokens, encouraging institutional and retail investors to embrace tokenized securities. Security tokens facilitate fractional ownership and open access to previously illiquid markets, making them an attractive option for diversifying investment portfolios and expanding market participation.

By End-Use

In 2024, Real estate formed 38.8% of end-use demand. Tokenization of property has gained traction because it allows fractional ownership, lowering the barrier for investors to access high-value assets. This democratization of investment reshapes the real estate market by enabling a larger pool of investors to participate.

The inclusion of real estate in tokenized markets also brings liquidity to traditionally illiquid assets. Investors can easily trade tokens representing partial property ownership, providing flexibility that was previously absent. This makes the sector one of the strongest and most immediate beneficiaries of tokenization.

Key Market Segments

By Component

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

By Type

- Security Tokens

- Utility Tokens

- Asset-Backed Tokens

By End-Use

- Real Estate

- Financial Services

- Art & Collectibles

- Gaming and NFTs

- Supply Chain and Logistics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Institutional Adoption and Tokenized Funds

One strong driver behind the growth of the tokenized assets market is the increasing institutional adoption of tokenized investment products. Institutions are progressively allocating capital into tokenized money-market instruments, fixed-income products, and funds. This trend is evident as large financial players launch substantial tokenized funds, reflecting a growing appetite for these digital asset forms.

For instance, an institutional digital liquidity fund attracted over USD 550 million shortly after launch, highlighting clear demand for transparent, on-chain investments. The institutional focus also encourages the development of compatible infrastructure across custodians and fund administrators, creating a network of robust support that accelerates market growth.

This institutional trend is particularly strong in regions like North America and Asia-Pacific, where regulatory clarity and technological infrastructure are more established. The role of institutional investors is critical in bringing scale and legitimacy to tokenized assets. Their participation boosts market confidence and encourages other investors to explore tokenized securities, driving adoption further.

Restraint Analysis

Regulatory Uncertainty

Regulatory uncertainty remains a significant challenge slowing the widespread adoption of tokenized assets. Different countries have varied and evolving rules on how tokenized assets are classified, issued, and traded. In some major markets, unclear or insufficient regulatory frameworks lead to confusion among issuers, investors, and intermediaries, hindering larger-scale participation.

This patchwork of regulations puts investors at risk of facing legal complications, especially in cross-border transactions involving multiple jurisdictions. For example, firms looking to tokenize assets may delay launches or limit offerings due to compliance concerns, reflecting broader caution in the market. The lack of standardization complicates operational and technological integration of tokenized asset platforms.

Regulatory uncertainty also impedes the development of liquid secondary markets, as participants may hesitate to trade assets without clear legal protections. These factors contribute to slower growth than the technology alone would suggest, limiting immediate scalability despite growing market interest. A more harmonized regulatory landscape is needed to unlock the full potential of asset tokenization across global markets.

Opportunity Analysis

Unlocking Liquidity for Illiquid Assets

Tokenization presents a clear opportunity by enabling liquidity for assets that have traditionally been difficult to trade. Real estate, private equity, art, and other illiquid asset classes can be converted into digital tokens that represent fractional ownership. This fractionalization lowers investment minimums and opens access for a broader range of investors who were previously excluded due to high capital requirements.

For instance, tokenized real estate platforms allow investors to buy shares in properties with small amounts, enabling diverse and flexible portfolios. This ability to unlock liquidity not only benefits investors but also asset owners, who can generate new revenue streams and tap into previously inaccessible capital pools.

The increased liquidity can stimulate economic activity by facilitating faster and more efficient trades, reducing the costs and delays associated with traditional asset sale processes. Furthermore, tokenization can introduce transparency and a verifiable transaction history, building trust and reducing friction in markets that often suffer from opacity. This opportunity could reshape investment dynamics by broadening participation and making markets more efficient.

Challenge Analysis

Market Adoption and Liquidity Issues

A key challenge facing tokenized assets is achieving sufficient market adoption to ensure liquidity. While tokenization promises liquidity improvement, this depends heavily on having a critical mass of participants and functioning secondary markets. Early-stage tokenized assets often suffer from thin markets where finding buyers or sellers is difficult.

Without reliable liquidity, investors may be reluctant to commit capital, creating a chicken-and-egg problem for the market. Moreover, market trust in blockchain technologies and tokenized assets remains limited, especially among traditional investors unfamiliar with the space. They may be cautious about technical risks, cyber threats, and valuation uncertainties inherent in newer markets.

Practical issues such as the complexity of managing digital wallets and integrating traditional asset management practices with blockchain systems also add operational friction. Educating market participants and building robust trading infrastructure will be essential to overcome these challenges and enable tokenized assets to realize their liquidity potential.

Competitive Analysis

In the tokenized assets market, Compound Labs, MakerDAO, and Aave are recognized as leading players. These platforms enable lending, borrowing, and stablecoin-based tokenization that support liquidity and decentralized finance operations. Their protocols are widely used to tokenize real-world and digital assets, creating flexible financial instruments.

Other decentralized exchanges such as Uniswap, SushiSwap, Curve Finance, and Balancer play critical roles in driving token liquidity and accessibility. Their platforms allow seamless trading and swapping of tokenized assets, providing market depth and efficiency. Through automated market-making mechanisms, these players enhance liquidity pools and support the broader adoption of asset tokenization across global markets.

Additional contributors including Synthetix, Bancor Network, and Badger DAO expand the ecosystem with specialized solutions. They focus on synthetic assets, liquidity protection, and tokenized Bitcoin products, offering investors diversified exposure. Their innovative approaches complement the broader DeFi landscape, ensuring that tokenized assets continue to gain traction as a growing segment of digital finance.

Top Key Players in the Market

- Compound Labs, Inc.

- MakerDAO

- Aave

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

- Others

Recent Developments

- August 2025 – Aave Labs launched Horizon, a dedicated platform targeting institutional borrowers to access stablecoin loans collateralized by tokenized real-world assets. Horizon integrates tokenized U.S. Treasury products and other institutional-grade RWAs into DeFi lending. The launch reflects an expanding $26 billion RWA tokenization market and aims to provide institutions a way to deploy capital efficiently on-chain.

- August 2024 – MakerDAO initiated a major program to tokenize up to $1 billion in real-world assets (RWA). The initiative invited community proposals focusing on tokenizing assets such as US Treasury bonds and short-term debt. MakerDAO aims to provide secure liquidity sources by expanding tokenized money markets and integrating these assets into its DeFi ecosystem, including the Spark sub-DAO.

Report Scope

Report Features Description Market Value (2024) USD 25.8 Bn Forecast Revenue (2034) USD 2,832.3 Bn CAGR(2025-2034) 60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts), By Type (Security Tokens, Utility Tokens, Asset-Backed Tokens), By End-Use (Real Estate, Financial Services, Art & Collectibles, Gaming and NFTs, Supply Chain and Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Compound Labs, Inc., MakerDAO, Aave, Uniswap, SushiSwap, Curve Finance, Synthetix, Balancer, Bancor Network, Badger DAO, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Compound Labs, Inc.

- MakerDAO

- Aave

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

- Others