Global Tissue and Organ Transplantation Market Analysis By Type (Organ Transplantation, Tissue Transplantation), By Product Type (Tissue Products, Immunosuppressive Drugs, Preservation Solutions), By End-User (Hospital, Transplant Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 84920

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

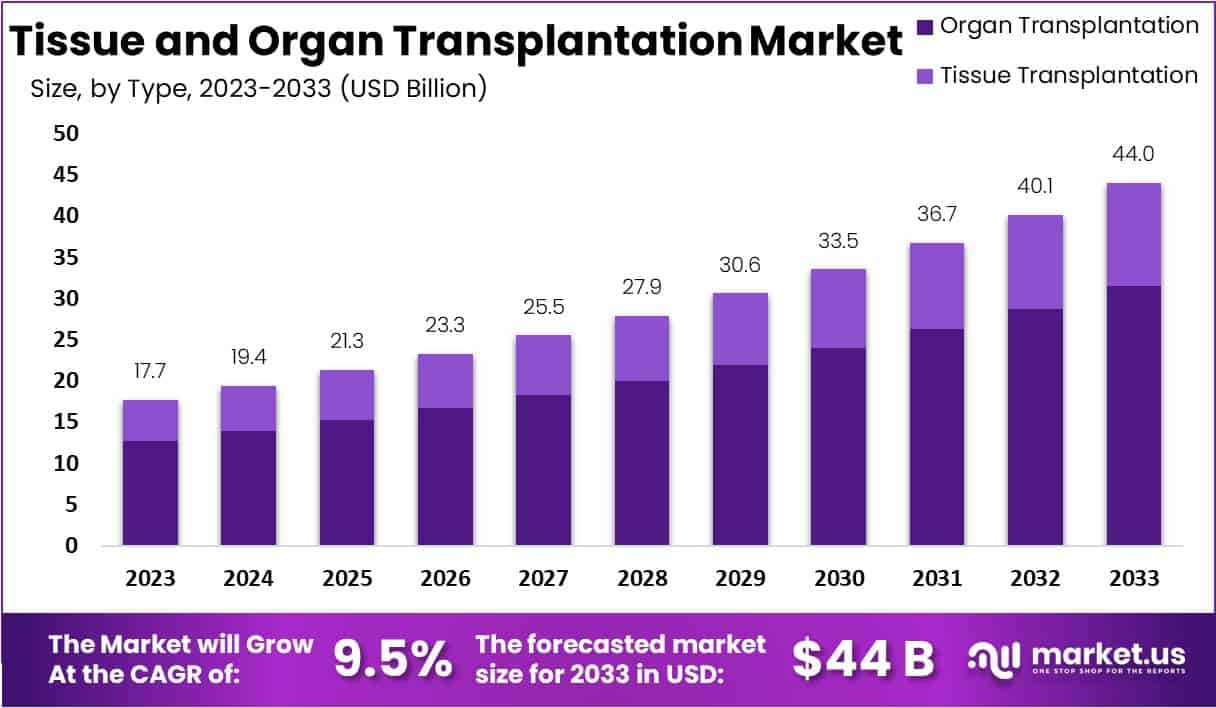

The Tissue And Organ Transplantation Market Size is projected to reach approximately USD 44 billion by 2033, showing significant growth from the 2023 figure of USD 17.7 billion. This represents a Compound Annual Growth Rate (CAGR) of 9.5% anticipated during the forecast period spanning from 2024 to 2033.

*Note: Actual Numbers Might Vary In The Final Report

Tissue and organ transplantation are crucial medical procedures, replacing damaged or failing body parts with healthy ones from donors. These can involve solid organs like the heart, kidneys, or tissues such as corneas and skin. Matching donors and recipients based on factors like blood type is vital. To prevent rejection, patients take immunosuppressive drugs, though this comes with infection risks.

A major challenge is the shortage of donor organs, leading to lengthy waiting lists. Advancements in surgery, organ preservation, and research in xenotransplantation show promise. Ethical and legal frameworks govern the process, aiming for fairness and transparency. Successful transplants greatly improve recipients’ quality of life, allowing normal activities to resume. Ongoing research offers hope for future enhancements in this life-saving field.

The tissue and organ transplantation market constitutes the economic dimension of this medical field, encompassing products, services, and technologies associated with transplantation. This includes organ procurement, preservation, transportation, transplantation surgeries, immunosuppressive medications, and post-transplant care. The market dynamics are influenced by advancements in medical technology, increased awareness about organ donation, and efforts to expand the pool of available organs.

Collaboration among healthcare providers, pharmaceutical companies, and research institutions plays a pivotal role. Despite these advancements, ethical concerns, regulatory challenges, and the limited availability of donor organs pose ongoing obstacles. Continuous efforts focus on overcoming these challenges, improving success rates, and making organ transplantation more accessible for individuals in need.

Key Takeaways

- Market Growth Projection: The Tissue and Organ Transplantation Market is expected to reach USD 44 billion by 2033, growing at a 9.5% CAGR from 2024 to 2033.

- Type Dominance: In 2023, organ transplantation held a 71.6% market share, driven by rising organ failure cases and enhanced transplant methods.

- Tissue Transplantation Growth: Tissue transplantation is poised for rapid growth, driven by applications in wound healing, reconstructive surgeries, and ongoing bioengineering research.

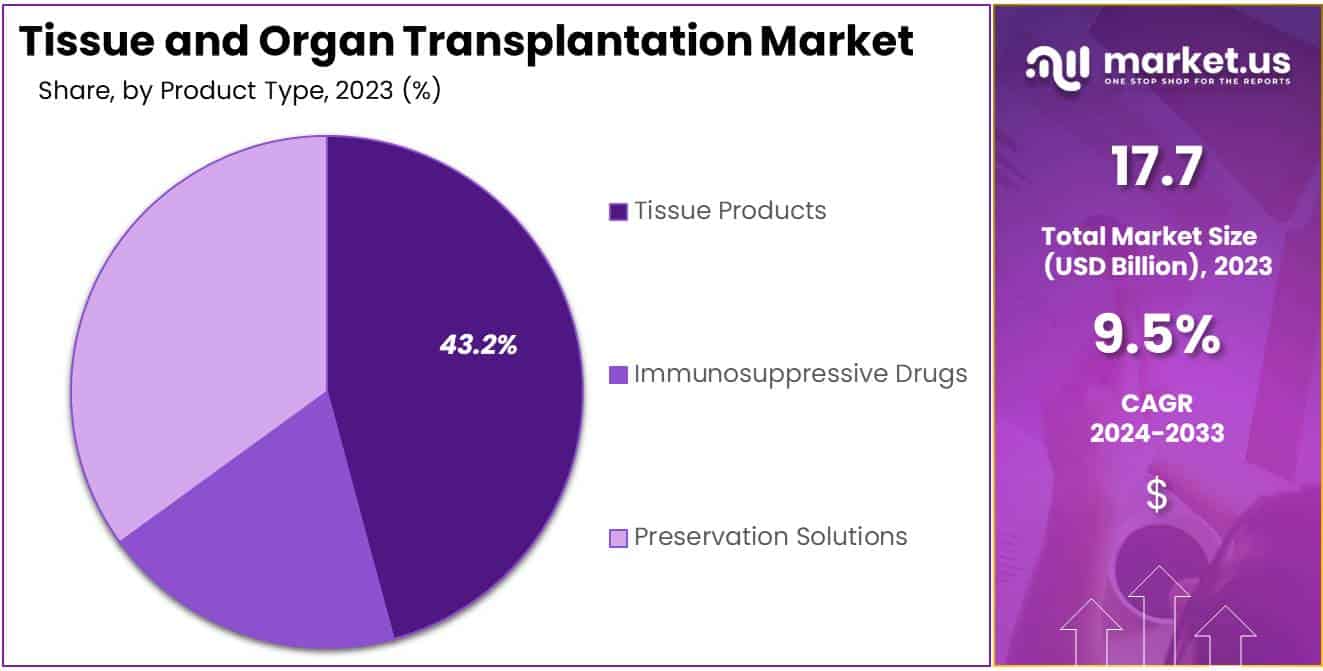

- Product Dominance: In 2023, tissue products commanded a 43.2% market share, with skin grafts for wound treatment being a major demand driver.

- End-User Dominance: Hospitals led with a 38.7% market share in 2023, crucial for transplant procedures, while transplant centers exhibited substantial growth.

- Market Drivers: Technology strides, organ demand, immunology advancements, and increased public awareness are key factors propelling the market.

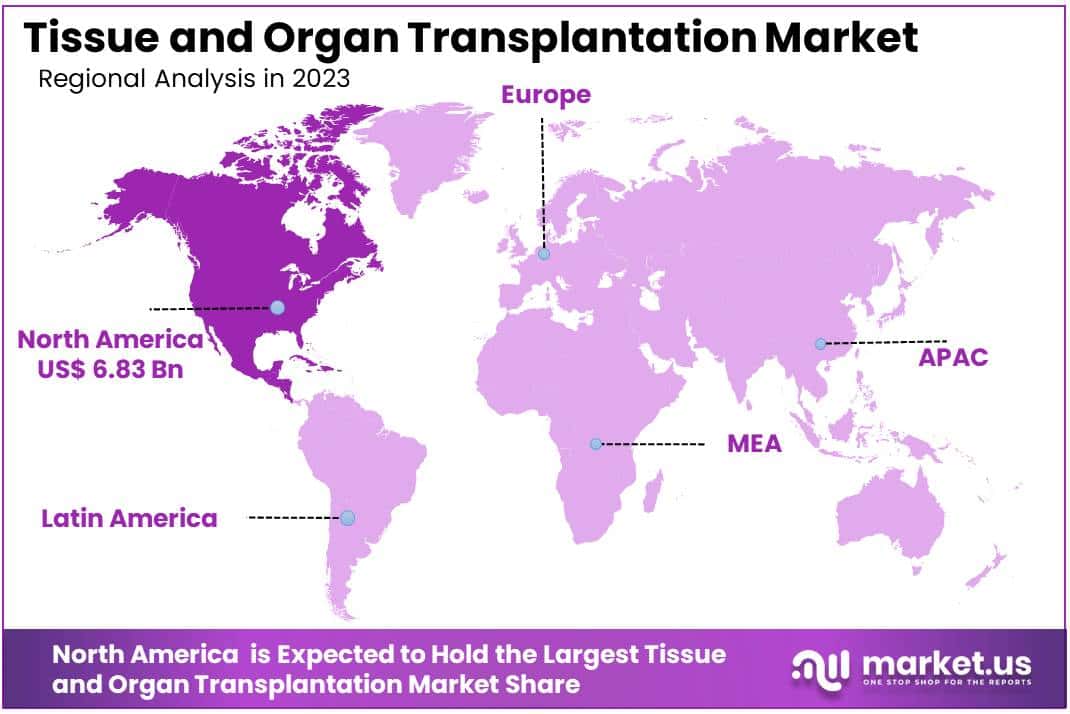

- Dominance of North America: In 2023, North America dominated with a 38.6% market share, attributed to a robust healthcare infrastructure, effective awareness campaigns, and stringent regulatory standards.

Type Analysis

In 2023, the organ transplantation segment held a dominant position in the tissue and organ transplantation market, capturing more than a 71.6% share. This large market share can be attributed to the rising prevalence of organ failure due to various factors like infections, genetics, and lifestyle habits. Additionally, improvements in organ transplant methods and surgical processes have widened the pool of eligible donors.

However, the tissue transplantation segment is poised to expand at a faster pace over the coming years. Growth will be fueled by increasing utilization of tissue transplants like skins grafts and bone grafts for wound healing applications. Other driving factors include a rise in bone and joint reconstructive surgeries needing tissue augmentation as well as higher research on tissue bioengineering and 3D bioprinting of living tissue constructs.

Product Type Analysis

In 2023, the tissue products segment held a dominant position in the tissue and organ transplantation market, capturing more than a 43.2% share. This large market share is attributed to the high use of tissues like skin, bone, veins, heart valves, and corneas for transplantation procedures. Skin grafts for wound treatment represent a major sub-segment driving significant product demand.

However, immunosuppressive drugs used to prevent organ rejection are likely to see rapid uptake over the coming years. Growth will be stimulated by the development of improved drugs causing fewer side effects. Additionally, increasing organ transplants requiring lifelong immunosuppressant therapy will fuel segmental growth.

Meanwhile, the preservation solutions segment will witness steady expansion owing to the critical need for solutions maintaining organ viability until transplantation. Technological advances in storage solutions enabling longer organ preservation times outside the body will further segment growth over the forecast period.

*Note: Actual Numbers Might Vary In The Final Report

End-User Analysis

In 2023, the Hospital segment emerged as a frontrunner in the Tissue and Organ Transplantation market, seizing a commanding market position with a robust share of over 38.7%. Hospitals played a pivotal role in steering the market dynamics, serving as key hubs for transplant procedures.

Transplant Centers, another vital player in this transformative landscape, exhibited substantial growth and contributed significantly to the market. Their role in facilitating organ and tissue transplantation procedures was evident, capturing attention as a noteworthy segment in the industry.

Furthermore, Other end-users also played a crucial role, presenting a diverse landscape of institutions contributing to the transplantation market. These diverse entities encompassed a range of healthcare facilities and organizations, each bringing its unique strengths to the collective effort of advancing transplantation practices.

This multifaceted market scenario signifies the collaborative efforts of various end-users, with Hospitals taking the lead in spearheading advancements in tissue and organ transplantation. As the landscape continues to evolve, the dynamic interplay between these segments is poised to shape the future trajectory of the Tissue and Organ Transplantation market.

Key Market Segments

Type

- Organ Transplantation

- Tissue Transplantation

Product Type

- Tissue Products

- Immunosuppressive Drugs

- Preservation Solutions

End-User

- Hospital

- Transplant Centers

- Others

Drivers

Technological Advancements

Significant strides in technology, such as advanced organ preservation techniques and precision transplant procedures, are propelling the tissue and organ transplantation market. Innovations enhance success rates, reduce rejection risks, and broaden the scope of transplantable organs.

Growing Demand for Organs

Escalating cases of organ failure and the widening gap between organ supply and demand are driving the transplantation market. The rising prevalence of chronic diseases necessitating transplants underscores the critical need for organs, fostering market growth.

Advancements in Immunology

Progress in immunological research and the development of immunosuppressive drugs are pivotal drivers. Improved understanding of immune responses enables better compatibility matching, minimizing rejection and enhancing overall transplant outcomes.

Increasing Public Awareness

Heightened public awareness about organ donation benefits is a key driver. Educational campaigns and advocacy efforts are fostering a positive attitude toward donation, augmenting the availability of organs and tissues for transplantation.

Restraints

Limited Organ Availability

Despite increasing demand, the scarcity of donor organs remains a significant constraint. This shortage hampers the transplantation market’s growth, leading to longer waiting times for patients in need.

High Costs and Affordability

The high costs associated with organ transplantation procedures pose a challenge. Limited insurance coverage and financial constraints for patients can hinder widespread access to transplantation services.

Ethical and Regulatory Challenges

Complex ethical considerations surrounding organ procurement and transplantation, coupled with stringent regulatory frameworks, can impede the market. Balancing ethical standards with the demand for organs presents an ongoing challenge.

Risk of Complications

The inherent risk of post-transplant complications, such as infections and rejection, poses a restraining factor. Concerns about potential adverse effects may deter both patients and healthcare providers from pursuing transplantation options.

Opportunities

Advancements in Xenotransplantation

Emerging opportunities lie in xenotransplantation, utilizing organs from non-human sources. Ongoing research in genetic engineering and immunology offers promising avenues to overcome historical challenges, potentially revolutionizing the transplantation landscape.

Rising Investment in Research and Development

Increasing investments in R&D for novel transplant technologies present growth prospects. Collaborations between academia and industry aim to pioneer breakthroughs in organ preservation, personalized medicine, and regenerative therapies.

Expanding Transplant Tourism

The globalization of healthcare and the rise of medical tourism present growth opportunities. Patients seeking cost-effective and timely transplantation solutions may travel to regions with advanced medical facilities, driving cross-border transplant activities.

Integration of Artificial Intelligence

The integration of artificial intelligence in donor-recipient matching, organ allocation, and post-transplant monitoring opens new growth horizons. AI enhances precision and efficiency, improving transplant success rates and patient outcomes.

Trends

Personalized Medicine in Transplantation

A notable trend is the shift towards personalized medicine, tailoring transplant treatments based on individual patient characteristics. This approach optimizes outcomes by considering genetic, immunological, and lifestyle factors.

Rise of Regenerative Medicine

Regenerative medicine, focusing on tissue engineering and stem cell therapies, is gaining traction. This trend explores innovative solutions for organ repair and regeneration, potentially reducing the reliance on traditional donor organs.

Blockchain in Organ Procurement

The adoption of blockchain technology for secure and transparent organ procurement and distribution is a rising trend. Blockchain ensures traceability, minimizing the risk of organ trafficking and enhancing trust in the transplantation ecosystem.

Collaborative Transplant Research Consortia

Increasing collaboration among research consortia and transplant centers is a prevailing trend. Shared databases, collective clinical trials, and data exchange initiatives accelerate knowledge dissemination, fostering continuous improvement in transplantation practices.

Regional Analysis

In 2023, North America emerged as a pivotal player in the Tissue and Organ Transplantation Market, showcasing a formidable market presence by capturing more than a 38.6% share. The region’s robust dominance is underscored by its substantial market value, reaching USD 6.83 billion for the year. Several factors contribute to North America’s leading position, delineating a comprehensive regional analysis of the Tissue and Organ Transplantation Market.

North America boasts a sophisticated healthcare infrastructure, characterized by state-of-the-art medical facilities, cutting-edge technologies, and a well-established regulatory framework. This infrastructure facilitates seamless organ transplantation procedures, ensuring high success rates and patient outcomes.

North America exhibits commendable rates of organ donation, owing to robust awareness campaigns, effective organ procurement organizations, and a supportive legal framework. The positive attitude towards organ donation enhances the availability of transplantable organs, addressing the growing demand for transplantation procedures.

Government initiatives and funding play a pivotal role in the region’s transplantation landscape. Supportive policies, financial aid, and research grants foster an environment conducive to medical advancements and the expansion of transplantation programs.

Collaborative efforts between research institutions and healthcare providers contribute to the development of innovative transplant solutions. Academic-industry partnerships facilitate knowledge exchange, ensuring the continuous evolution of transplantation techniques and therapies.

North America maintains stringent regulatory standards for organ transplantation, ensuring the safety and efficacy of procedures. This regulatory framework instills confidence among healthcare practitioners and patients, reinforcing the region’s reputation as a reliable and secure market for transplantation activities.

*Note: Actual Numbers Might Vary In The Final Report

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Tissue and Organ Transplantation Market, key players such as Cryolife Inc., Folio Biosciences, Atthrex, and AbbVie Inc. play pivotal roles, contributing significantly to advancements and innovations in the field.

Cryolife Inc. stands out with its focus on providing cutting-edge solutions in preserving and transplanting tissues. Their commitment to technological excellence ensures the viability and success of transplant procedures, fostering trust among healthcare professionals and patients alike.

Folio Biosciences, another key player, demonstrates a commitment to bioengineering solutions. Their innovative approaches contribute to the development of synthetic tissues, expanding the possibilities for organ transplantation. This not only addresses the shortage of donor organs but also opens new avenues for personalized and readily available transplantation options.

Atthrex, with its unique position in the market, specializes in precision tools and technologies essential for successful transplantation procedures. Their emphasis on developing advanced surgical instruments and techniques enhances the overall efficiency of transplantation processes, positively impacting patient outcomes.

In addition to these key players, various other stakeholders contribute to the market’s vibrancy. Collaborations, partnerships, and research initiatives among these entities create a collaborative ecosystem, fostering a continuous cycle of improvement and progress in the Tissue and Organ Transplantation Market. As the market evolves, the combined efforts of these players are expected to drive further innovations, making organ transplantation more accessible and successful for patients in need.

Market Key Players

- Cryolife Inc.

- Folio Biosciences

- Atthrex

- Abbvie Inc.

- Zimmer Biomet

- Medtronic PLC

- Novartis AG

- Stryker Corporation

- BiolifeSolutions Inc.

- Teva Pharmaceuticals

Recent Developments

- In November 2023, Vericel Corporation, a US-based company specializing in bioengineered skin substitutes, completed the acquisition of MatriCell, Inc., a regenerative medicine company, for approximately $288 million. This strategic move expands Vericel’s product portfolio to include cartilage and meniscus repair tissues, reinforcing its position in the regenerative medicine market.

- In October 2023, Miromatrix Medical Inc., based in the US, introduced MiroPure Xtracellular Matrix (ECM) Implant for the treatment of osteoarthritis in knees. Derived from porcine small intestine submucosa, this collagen-based implant serves as a natural scaffold for cartilage regeneration in osteoarthritic knees, offering a potentially less invasive alternative to traditional joint replacement surgery.

- In December 2023, United Therapeutics Corporation (US) and Lung Biotechnology PBC (UK) announced a partnership to collaborate on the development and commercialization of LBT-101, a potential treatment for pulmonary fibrosis. This collaboration leverages United Therapeutics’ expertise in rare respiratory diseases and Lung Biotechnology’s innovative gene therapy platform, accelerating the progress of this promising therapy for organ transplantation patients.

- In October 2023, Cellairis Regenerative Medicine, a US-based company, received FDA clearance for its ReGen Bio-Scaffold designed for skin and soft tissue reconstruction. This regulatory approval marks a significant milestone for Cellairis, paving the way for the use of its bioresorbable collagen scaffold in reconstructive surgeries and presenting new opportunities to enhance patient outcomes in tissue transplantation procedures.

Report Scope

Report Features Description Market Value (2023) USD 17.7 Bn Forecast Revenue (2033) USD 44 Bn CAGR (2024-2033) 9.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Organ Transplantation, Tissue Transplantation), By Product Type (Tissue Products, Immunosuppressive Drugs, Preservation Solutions), By End-User (Hospital, Transplant Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cryolife Inc., Folio Biosciences, Atthrex, Abbvie Inc., Zimmer Biomet, Medtronic PLC, Novartis AG, Stryker Corporation, BiolifeSolutions Inc., Teva Pharmaceuticals, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Tissue and Organ Transplantation market in 2023?The Tissue and Organ Transplantation market size is USD 17.7 billion in 2023.

What is the projected CAGR at which the Tissue and Organ Transplantation market is expected to grow at?The Tissue and Organ Transplantation market is expected to grow at a CAGR of 9.5% (2024-2033).

List the segments encompassed in this report on the Tissue and Organ Transplantation market?Market.US has segmented the Tissue and Organ Transplantation market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Organ Transplantation, Tissue Transplantation. By Product Type the market has been segmented into Tissue Products, Immunosuppressive Drugs, Preservation Solutions. By End-User the market has been segmented into Hospital, Transplant Centers, Others.

List the key industry players of the Tissue and Organ Transplantation market?Cryolife Inc., Folio Biosciences, Atthrex, Abbvie Inc., Zimmer Biomet, Medtronic PLC, Novartis AG, Stryker Corporation, BiolifeSolutions Inc., Teva Pharmaceuticals, and Other Key Players

Which region is more appealing for vendors employed in the Tissue and Organ Transplantation market?North America is expected to account for the highest revenue share of 38.6% and boasting an impressive market value of USD 6.83 billion. Therefore, the Tissue and Organ Transplantation industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Tissue and Organ Transplantation?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Tissue and Organ Transplantation Market.

Tissue and Organ Transplantation MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Tissue and Organ Transplantation MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Cryolife Inc.

- Folio Biosciences

- Atthrex

- Abbvie Inc.

- Zimmer Biomet

- Medtronic PLC

- Novartis AG

- Stryker Corporation

- BiolifeSolutions Inc.

- Teva Pharmaceuticals