Global Tire Recycling Market Size, Share, Growth Analysis By Product (Rubber, Tire-derived Fuel, Tire-derived Aggregate, Carbon Black, Steel Wires, Others), By Component (Solution, Services), By Process (Shredding, Pyrolysis, Refurbishing), By Application (Automotive, Construction, Manufacturing, Rubber & Plastics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171291

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

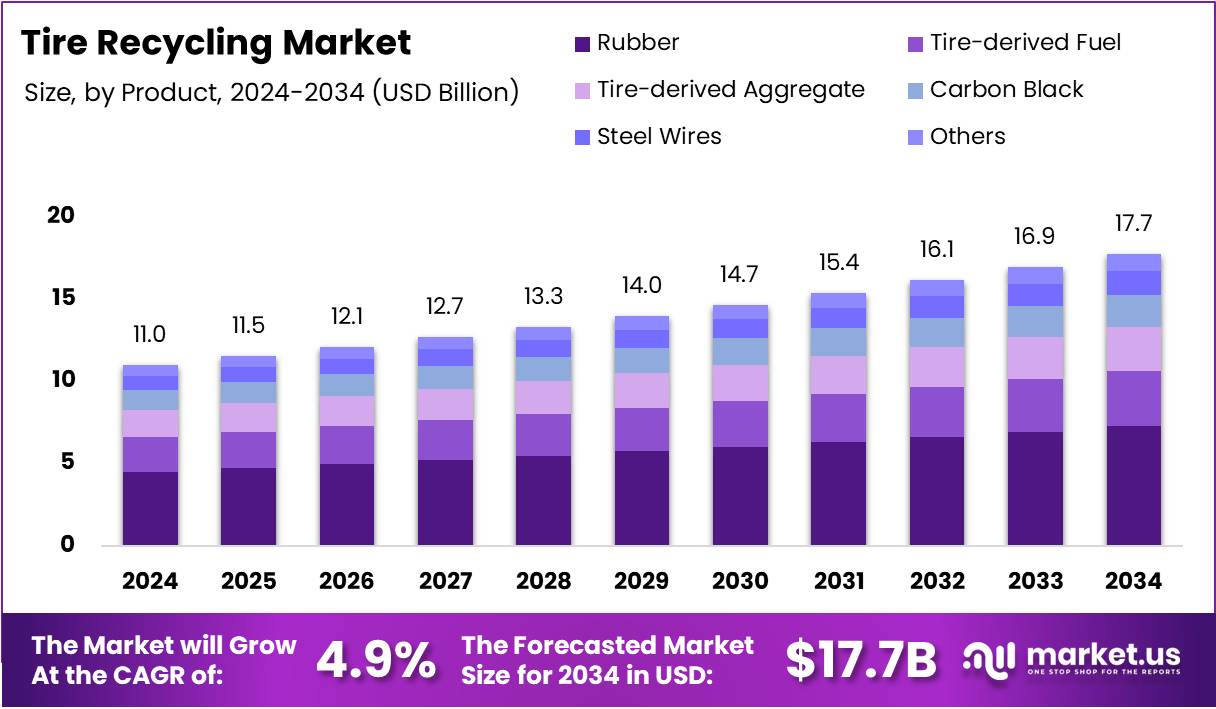

The Global Tire Recycling Market size is expected to be worth around USD 17.7 Billion by 2034, from USD 11.0 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Tire recycling market encompasses systematic collection, processing, and conversion of end-of-life tires into reusable materials. This sector transforms discarded tires into valuable products including crumb rubber, tire-derived fuel, and carbon black. Consequently, the market addresses environmental concerns while creating economic opportunities through sustainable waste management practices and circular economy principles.

Growth momentum accelerates as environmental awareness intensifies globally. The market demonstrates robust expansion driven by increasing vehicle populations and stringent waste disposal regulations. Furthermore, technological advancements enhance processing efficiency, making recycling operations more profitable. Industrial applications for recycled tire materials continue expanding, particularly in construction, automotive manufacturing, and energy sectors.

Significant opportunities emerge through innovative material recovery technologies and product diversification. Manufacturers increasingly adopt devulcanization processes to produce high-quality recycled rubber. Additionally, the developing infrastructure sector demands rubberized asphalt and playground surfaces. These applications create substantial revenue streams while reducing dependency on virgin materials and petroleum-based products.

Government investment plays a pivotal role in market development across major economies. Regulatory frameworks mandate proper tire disposal and incentivize recycling initiatives through subsidies and tax benefits. Moreover, environmental policies prohibit landfill dumping, compelling stakeholders to establish efficient collection networks. Public-private partnerships facilitate infrastructure development, ensuring comprehensive waste management systems operate effectively nationwide.

Regional performance varies considerably, reflecting different regulatory maturity levels and infrastructure capabilities. European markets maintain an impressive 95% collection rate for end-of-life tires, processing approximately 3.6 million tonnes annually. Material recycling accounts for 55% of collected volume, while energy recovery utilizes 40%. Meanwhile, North American operations indicate over 300 million tires discarded yearly, achieving recycling rates near 80%. Certain developed nations demonstrate operational excellence, processing roughly 0.78 tires per capita annually, showcasing effective national waste management strategies.

Key Takeaways

- The Global Tire Recycling Market is projected to reach USD 17.7 Billion by 2034, from USD 11.0 Billion in 2024, growing at a CAGR of 4.9%.

- Rubber leads the market by product with a 41.2% share in 2024.

- Solution dominates by component, accounting for 74.6% of the market in 2024.

- Shredding is the leading process segment with a 56.3% share in 2024.

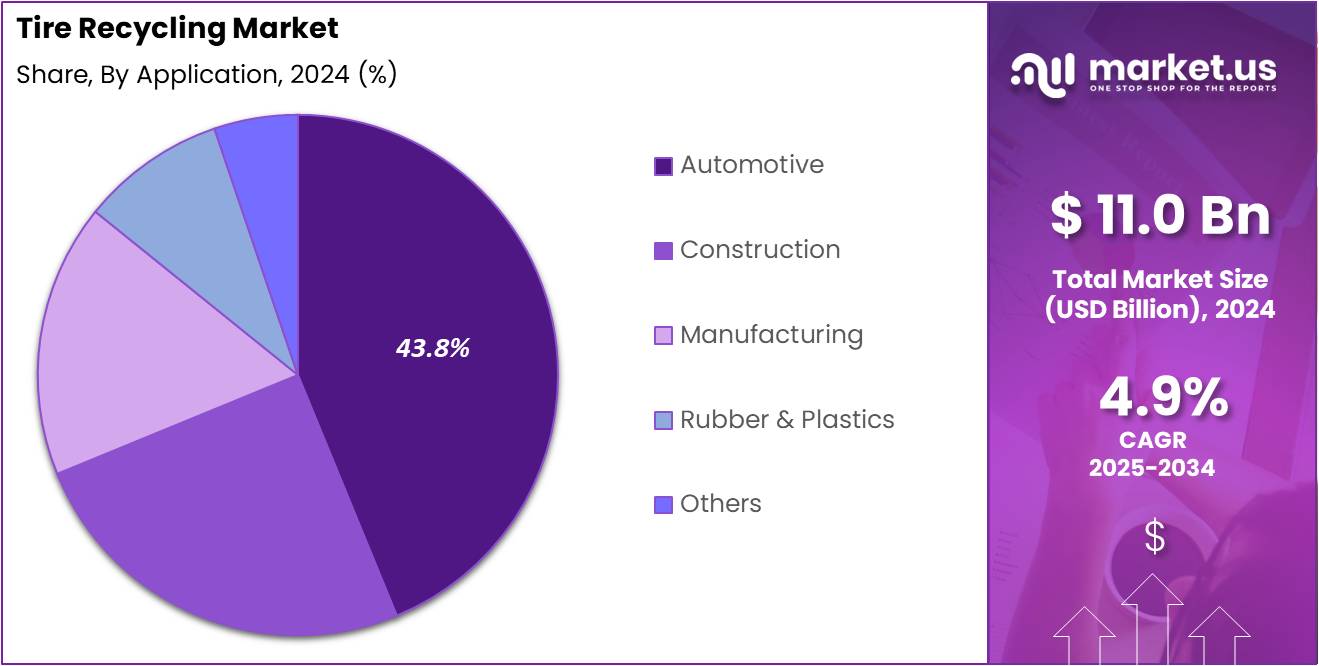

- Automotive is the largest application, representing 43.8% of the market in 2024.

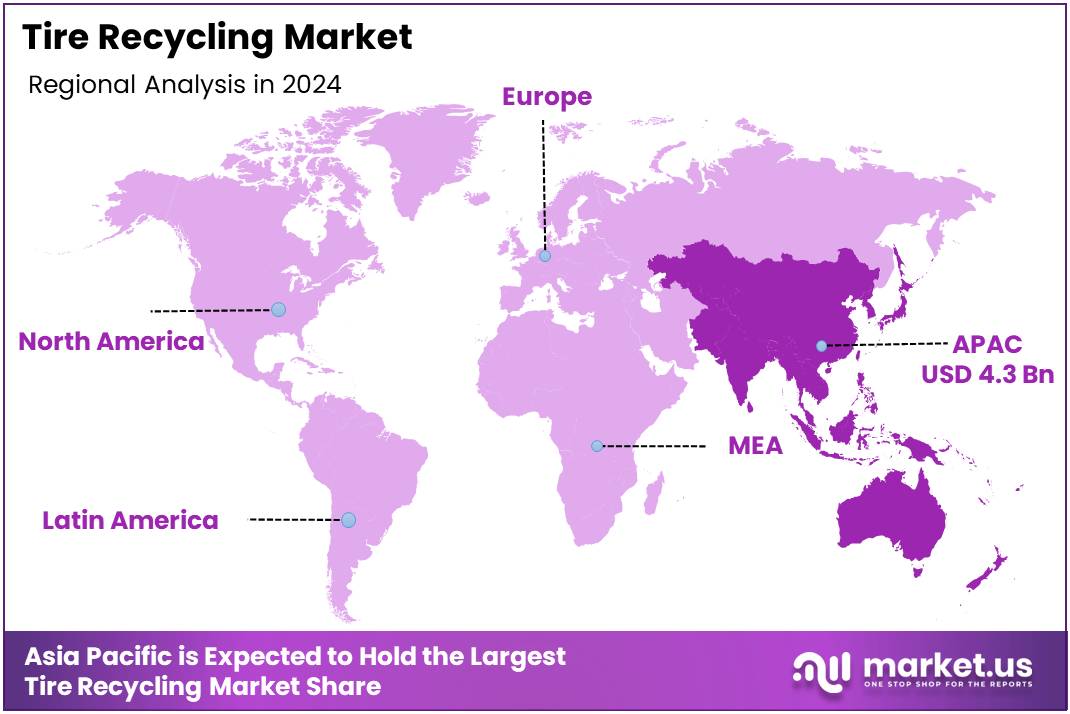

- Asia Pacific holds the largest regional market share of 39.2%, valued at USD 4.3 Billion.

By Product Analysis

Rubber dominates with 41.2% due to its extensive applications and high demand across multiple industries.

In 2024, Rubber held a dominant market position in the By Product Analysis segment of Tire Recycling Market, with a 41.2% share. Recycled rubber remains highly valued for its versatility and cost-effectiveness in manufacturing various products. Industries prefer rubber due to its durability and environmental benefits, making it the preferred choice for sustainable production processes across automotive and industrial applications.

Tire-derived Fuel represents a growing segment as industries seek alternative energy sources to reduce carbon footprints. This recycled product offers significant calorific value, making it suitable for cement kilns and power generation facilities. The increasing focus on renewable energy drives demand for tire-derived fuel as an economically viable alternative to traditional fossil fuels.

Tire-derived Aggregate finds extensive use in civil engineering and construction projects, particularly in road construction and drainage systems. This lightweight material provides excellent insulation properties and shock absorption capabilities. Moreover, its cost-effectiveness compared to traditional aggregates makes it increasingly popular among construction companies seeking sustainable building solutions.

Carbon Black serves as a crucial ingredient in manufacturing new tires and rubber products, offering reinforcement properties. The recovery of carbon black from recycled tires reduces dependency on virgin materials while maintaining product quality standards. Additionally, industries recognize its value in pigments and coatings applications, further expanding market opportunities.

Steel Wires extracted during tire recycling processes provide valuable scrap metal for steel manufacturing industries. These wires maintain structural integrity and can be reprocessed efficiently into new steel products. Furthermore, the metal recycling sector actively purchases steel wires, creating a steady revenue stream for tire recycling facilities worldwide.

Others category encompasses various specialized products including textile fibers and synthetic materials recovered during recycling operations. These materials find niche applications in insulation, molded products, and composite materials. Consequently, innovation in recycling technologies continues to unlock new possibilities for utilizing these recovered components effectively.

By Component Analysis

Solution dominates with 74.6% due to comprehensive technology integration and operational efficiency.

In 2024, Solution held a dominant market position in the By Component Analysis segment of Tire Recycling Market, with a 74.6% share. Integrated recycling solutions encompass complete systems including machinery, software, and processing technologies that enable efficient tire waste management. Organizations prefer comprehensive solutions as they streamline operations, reduce implementation complexities, and ensure consistent output quality throughout the recycling process.

Services component includes maintenance, consulting, and operational support that complement recycling infrastructure. Professional services ensure optimal equipment performance, regulatory compliance, and process optimization for recycling facilities. Additionally, training programs and technical assistance help operators maximize efficiency while minimizing downtime, thereby enhancing overall productivity and profitability in tire recycling operations.

By Process Analysis

Shredding dominates with 56.3% due to its simplicity and effectiveness in initial tire processing.

In 2024, Shredding held a dominant market position in the By Process Analysis segment of Tire Recycling Market, with a 56.3% share. Mechanical shredding serves as the primary method for breaking down whole tires into manageable pieces. This process offers high throughput capacity and relatively low operational costs, making it accessible for facilities of various sizes worldwide.

Pyrolysis represents an advanced thermal decomposition process that converts tire waste into valuable products including oil, gas, and carbon black. This technology operates in oxygen-free environments, enabling complete material recovery without combustion. Moreover, pyrolysis addresses environmental concerns while producing commercially viable outputs, attracting investments from environmentally conscious enterprises seeking sustainable waste management solutions.

Refurbishing focuses on extending tire lifespan through retreading and repair processes rather than complete recycling. This approach proves particularly economical for commercial vehicle tires and industrial applications where tire casings remain structurally sound. Furthermore, refurbishing reduces raw material consumption and manufacturing energy requirements, positioning it as an environmentally responsible option for extending tire utility effectively.

By Application Analysis

Automotive dominates with 43.8% due to massive tire consumption and replacement cycles.

In 2024, Automotive held a dominant market position in the By Application Analysis segment of Tire Recycling Market, with a 43.8% share. The automotive industry generates substantial tire waste from passenger vehicles, trucks, and motorcycles requiring regular tire replacements. Recycled materials find applications in manufacturing new automotive components, floor mats, and sound dampening materials, creating a circular economy within the automotive sector.

Construction sector utilizes recycled tire materials extensively in infrastructure development including roads, playgrounds, and sports surfaces. Rubberized asphalt incorporating recycled tire content demonstrates superior durability and noise reduction properties. Additionally, construction companies increasingly adopt sustainable practices, driving demand for recycled tire products that meet environmental standards while delivering performance benefits.

Manufacturing industries leverage recycled tire materials for producing diverse products ranging from industrial mats to molded rubber goods. These materials offer cost advantages while maintaining quality standards required for industrial applications. Consequently, manufacturers appreciate the consistent supply and predictable pricing of recycled materials, supporting production planning and cost management strategies.

Rubber & Plastics sector incorporates recycled tire content into new rubber compounds and polymer blends for various applications. This integration reduces raw material costs while enhancing sustainability profiles of finished products. Furthermore, technological advancements enable better processing of recycled materials, improving compatibility with virgin materials and expanding application possibilities significantly.

Others application category includes agricultural uses, energy generation, and specialty products that utilize recycled tire materials innovatively. Agricultural applications involve using shredded tires for livestock bedding and erosion control measures. Meanwhile, creative applications continue emerging as research reveals new possibilities for incorporating recycled tire materials into diverse product categories effectively.

Key Market Segments

By Product

- Rubber

- Tire-derived Fuel

- Tire-derived Aggregate

- Carbon Black

- Steel Wires

- Others

By Component

- Solution

- Services

By Process

- Shredding

- Pyrolysis

- Refurbishing

By Application

- Automotive

- Construction

- Manufacturing

- Rubber & Plastics

- Others

Drivers

Increasing Vehicle Fleet Size and Tire Consumption Globally Drives Market Growth

The tire recycling market is experiencing significant expansion due to the growing number of vehicles worldwide. As more cars, trucks, and commercial vehicles hit the roads, tire consumption continues to rise sharply. This creates a massive volume of end-of-life tires that need proper disposal and recycling solutions.

The demand for rubber-based secondary products is another key factor pushing market growth. Recycled tire materials are increasingly used in manufacturing rubberized asphalt, playground surfaces, athletic tracks, and various industrial products. These applications offer cost-effective alternatives to virgin rubber while reducing environmental impact.

Government support plays a crucial role in advancing tire recycling initiatives. Many countries have introduced strict regulations requiring proper tire disposal and offering financial incentives for recycling operations. These policies encourage businesses to invest in recycling infrastructure and promote sustainable waste management practices. Extended producer responsibility programs also mandate tire manufacturers to manage end-of-life tire collection and recycling, further strengthening market development.

Restraints

Limited Availability of Advanced Recycling Infrastructure Restrains Market Expansion

The tire recycling market faces challenges due to insufficient advanced recycling facilities in many regions. Developing countries particularly struggle with inadequate infrastructure for processing large volumes of scrap tires. The high capital investment required for establishing modern recycling plants discourages potential investors, creating supply-demand gaps in the market.

Setting up efficient tire recycling operations demands specialized equipment, trained personnel, and technological expertise. Many smaller operators lack the financial resources to upgrade their facilities with advanced machinery capable of maximizing material recovery and product quality. This infrastructure deficit limits the market’s ability to handle growing tire waste volumes effectively.

Stringent regulatory compliance and environmental standards add another layer of complexity to market operations. Recycling companies must navigate complicated licensing procedures, emission controls, and waste management regulations that vary across different jurisdictions. Meeting these requirements involves substantial compliance costs and operational adjustments. Environmental agencies closely monitor recycling processes to prevent air pollution, water contamination, and soil degradation. These strict oversight measures, while necessary for environmental protection, can slow down market entry for new players and increase operational expenses for existing businesses.

Growth Factors

Adoption of Sustainable Tires and Circular Economy Initiatives Creates Growth Opportunities

The tire recycling market is witnessing promising opportunities through circular economy models that emphasize resource reuse and waste minimization. Automotive companies are increasingly designing tires with recyclability in mind, making material recovery more efficient. This shift toward sustainable tire production creates new business opportunities for recyclers who can process these advanced materials effectively.

Technological advancements in pyrolysis and devulcanization processes are opening new revenue streams for the industry. Modern pyrolysis systems convert scrap tires into valuable products like fuel oil, carbon black, and steel wire with minimal environmental impact. Devulcanization technology allows rubber to be broken down and reused in new tire manufacturing, significantly reducing reliance on virgin materials. These innovations improve profitability while addressing environmental concerns.

The construction and civil engineering sectors present substantial expansion possibilities for tire-derived products. Recycled tire materials are gaining popularity in road construction, drainage systems, lightweight fill applications, and erosion control projects. These applications not only consume large volumes of recycled tires but also offer superior performance characteristics like flexibility, durability, and shock absorption compared to traditional materials.

Emerging Trends

Rising Collaborations Between Automotive Manufacturers and Recycling Companies Shape Market Trends

Strategic partnerships between vehicle manufacturers and tire recycling firms are becoming increasingly common in the industry. These collaborations aim to establish closed-loop systems where end-of-life tires are efficiently collected, processed, and reintegrated into production cycles. Automotive giants recognize their environmental responsibility and are actively supporting recycling initiatives through funding and operational partnerships.

Technology integration is transforming tire waste management practices significantly. Artificial intelligence and Internet of Things solutions are being deployed to optimize collection routes, predict tire lifespan, and improve sorting accuracy at recycling facilities. Smart sensors track tire conditions in real-time, enabling timely replacement and efficient waste stream management. These digital tools enhance operational efficiency while reducing processing costs.

Consumer awareness about environmentally responsible tire disposal is rising steadily across global markets. People are increasingly choosing brands that demonstrate commitment to sustainability and offer tire take-back programs. Social media campaigns and environmental advocacy groups are educating the public about the environmental hazards of improper tire disposal. This growing consciousness is pressuring manufacturers and retailers to implement transparent recycling programs and communicate their sustainability efforts effectively to environmentally conscious consumers.

Regional Analysis

Asia Pacific Dominates the Tire Recycling Market with a Market Share of 39.2%, Valued at USD 4.3 Billion

Asia Pacific leads the global tire recycling market with a commanding share of 39.2%, valued at USD 4.3 billion. The region’s dominance stems from rapid industrialization, massive automotive production, and stringent environmental regulations across China, India, Japan, and South Korea. Growing awareness of sustainable waste management and government initiatives promoting circular economy principles drive significant investments in advanced recycling technologies and applications across construction, manufacturing, and energy sectors.

North America Tire Recycling Market Trends

North America represents a mature tire recycling market with well-established infrastructure and sophisticated processing facilities. Stringent environmental regulations and comprehensive tire disposal laws ensure proper end-of-life tire management. Growing demand for crumb rubber in sports surfaces, asphalt modification, and tire-derived fuel applications, combined with continuous innovation in pyrolysis technologies, strengthens the region’s market position.

Europe Tire Recycling Market Trends

Europe maintains a strong market presence driven by circular economy initiatives and Extended Producer Responsibility regulations. The EU’s comprehensive waste management directives have created a highly organized tire collection and recycling ecosystem, with Germany, France, and the UK leading in advanced recycling technologies. High recovery rates and emphasis on producing quality recycled materials for automotive and civil engineering applications reinforce Europe’s market significance.

Middle East and Africa Tire Recycling Market Trends

The Middle East and Africa market is experiencing gradual growth supported by increasing urbanization and expanding automotive sectors. While relatively nascent, governments are implementing regulatory frameworks to address tire waste challenges. The construction boom in GCC countries creates opportunities for recycled tire materials in infrastructure projects, while growing investments in waste-to-energy facilities accelerate market development.

Latin America Tire Recycling Market Trends

Latin America presents an emerging market with significant growth potential driven by increasing vehicle ownership and evolving environmental regulations. Brazil and Mexico lead regional development through mandatory tire collection programs and expanding recycling infrastructure. Despite challenges from informal disposal practices, public-private partnerships and rising demand for recycled materials in civil engineering and energy applications position the region for future growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tire Recycling Company Insights

Davis Rubber Company Inc. has established itself as a prominent player in the tire recycling industry through its comprehensive approach to converting waste tires into valuable rubber products. The company’s focus on quality control and sustainable processing methods has enabled it to maintain a competitive edge in the market. Their extensive experience in rubber reclamation and tire-derived products positions them as a reliable supplier for various industrial applications.

Tyre Recycling Solution demonstrates strong capabilities in implementing advanced tire recycling technologies and offering end-to-end waste management services. The company has built a reputation for its innovative processing techniques that maximize material recovery rates while minimizing environmental impact. Their commitment to circular economy principles and continuous investment in recycling infrastructure has strengthened their market presence.

Liberty Tire Recycling stands as one of North America’s largest tire recycling companies, processing millions of tires annually across its extensive network of facilities. The company’s integrated collection and processing operations enable efficient handling of scrap tires from diverse sources. Their diversified product portfolio, including tire-derived fuel, crumb rubber, and steel recovery, serves multiple end-use industries and demonstrates their market leadership position.

Genan Holding A/S operates as a leading European tire recycling specialist with a strong focus on producing high-quality recycled rubber materials. The company’s automated processing facilities and stringent quality standards ensure consistent output for demanding applications in sports surfaces, playground materials, and new tire manufacturing. Their strategic expansion across multiple countries and commitment to sustainable practices reinforces their position as an industry innovator in the global tire recycling market.

Top Key Players in the Market

- Davis Rubber Company Inc.

- Tyre Recycling Solution

- Liberty Tire Recycling

- Genan Holding A/S

- ResourceCo

- GRP LTD

- Lehigh Technologies, Inc.

Recent Developments

- In October 2025, I Squared Capital signed a definitive agreement to acquire Liberty Tire Recycling, the largest tire recycler in North America. This acquisition includes plans to heavily invest in AI-driven automation to enhance operational efficiency and processing capacity.

- In February 2025, Tiger Infrastructure Partners made a major investment in Bolder Industries. The funding is aimed at expanding tire-to-resource facilities in Indiana, USA, and Belgium, supporting sustainable tire recycling and resource recovery initiatives.

- In January 2024, Liberty Tire Recycling acquired Empire Tire of Edgewater (Orlando) and McGee Tire (Apopka). This move expanded its scrap tire collection and processing footprint in Central Florida, strengthening regional recycling infrastructure and operational capacity.

- In January 2024, Toyo Tires unveiled a sustainable concept tire made of 90% recycled and renewable materials. The tire incorporates recycled carbon black and biomass-derived rubber, highlighting innovations in eco-friendly tire manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 11.0 Billion Forecast Revenue (2034) USD 17.7 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Rubber, Tire-derived Fuel, Tire-derived Aggregate, Carbon Black, Steel Wires, Others), By Component (Solution, Services), By Process (Shredding, Pyrolysis, Refurbishing), By Application (Automotive, Construction, Manufacturing, Rubber & Plastics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Davis Rubber Company Inc., Tyre Recycling Solution, Liberty Tire Recycling, Genan Holding A/S, ResourceCo, GRP LTD, Lehigh Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Davis Rubber Company Inc.

- Tyre Recycling Solution

- Liberty Tire Recycling

- Genan Holding A/S

- ResourceCo

- GRP LTD

- Lehigh Technologies, Inc.