Global Tin Container Market Size, Share, Growth Analysis By Product Type (Built-up Containers, Shallow Drawn Containers), By Capacity (Less than 1 liter, 1-5 liters, 5-10 liters, More than 10 liters), By Material (Tinplate, Steel, Aluminum, Plastic), By Application (Paint Containers, Cone Top Containers, Mono Top Containers, Oblong/F-style Containers, Edible Oil Containers, Aerosol Containers, Others), By End-use (Food and Beverage, Aerosols, Chemicals, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177142

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

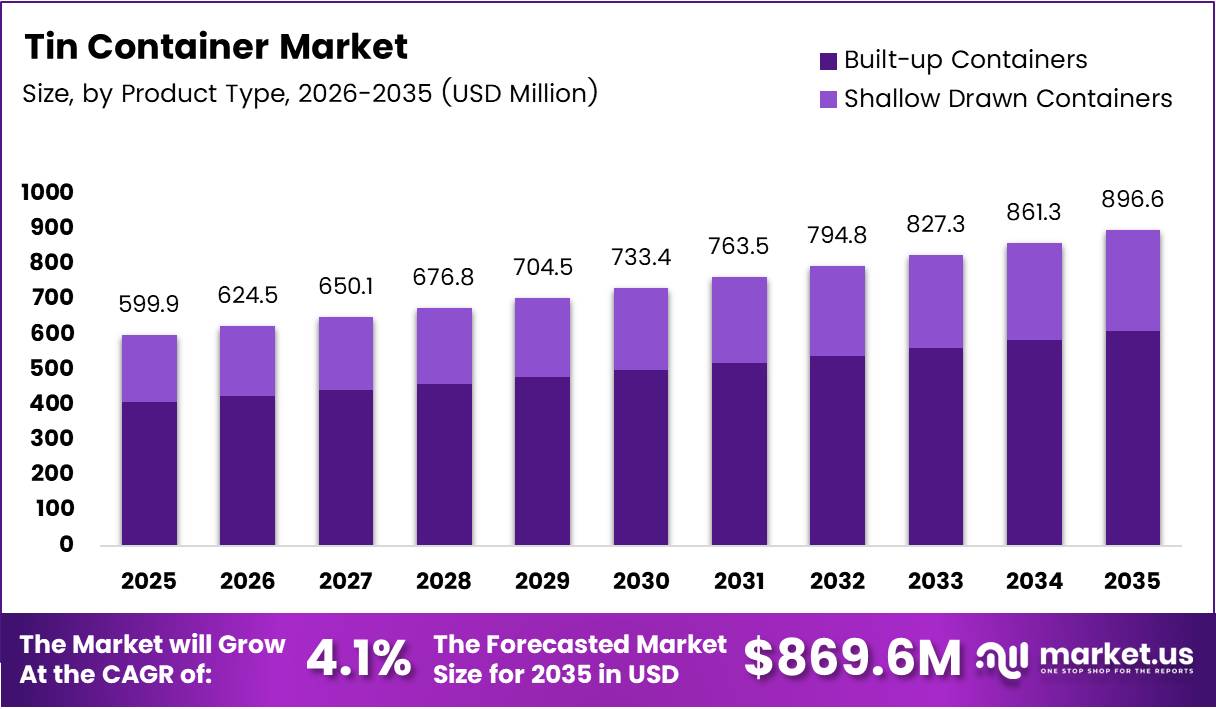

Global Tin Container Market size is expected to be worth around USD 869.6 Million by 2035 from USD 599.9 Million in 2025, growing at a CAGR of 4.1% during the forecast period 2026 to 2035.

Tin containers represent rigid metal packaging solutions manufactured primarily from tinplate, steel, and aluminum materials. These vessels serve critical storage and distribution functions across food, beverage, chemical, and pharmaceutical industries. Moreover, their superior barrier properties protect contents from moisture, light, and oxygen contamination effectively.

The market demonstrates strong growth momentum driven by increasing consumer preference for sustainable packaging alternatives. Manufacturers recognize metal containers deliver superior product protection compared to flexible packaging formats. Consequently, brands across multiple sectors adopt tin packaging to extend shelf life and maintain product integrity.

Global sustainability initiatives accelerate tin container adoption as recycling infrastructure expands worldwide. Businesses transition toward circular economy models favoring fully recyclable metal packaging solutions. Therefore, regulatory frameworks increasingly mandate recyclable packaging formats, benefiting tin container manufacturers significantly.

Industry consolidation reshapes competitive dynamics as major players pursue strategic acquisitions and capacity expansion. In June 2024, Sonoco Products announced acquisition of European food-can manufacturer Eviosys for approximately $3.9 billion to expand metal and aerosol packaging capabilities. This transaction demonstrates strong industry confidence and generates over $100 million in expected integration synergies.

According to thyssenkrupp Steel, 94.3% of tinplate packaging from private end consumption was recycled in Germany based on latest industry recycling reporting published in 2026. This achievement represents peak performance in metal packaging circularity. Additionally, total tinplate recycling rate reached 92.5% across overall tinplate consumption streams, reinforcing the material’s environmental credentials.

Premium product segments drive decorative tin container demand as brands leverage distinctive packaging for differentiation. E-commerce growth creates new opportunities for durable, tamper-resistant packaging formats that withstand distribution challenges. However, manufacturers face ongoing pressure from volatile raw material costs and competition from alternative packaging materials.

Technological advancement enables lightweight tinplate development, reducing material usage while maintaining structural integrity. Digital printing capabilities allow customized, limited-edition designs that enhance brand visibility and consumer engagement. Therefore, the market continues evolving toward smarter, more sustainable, and visually appealing metal packaging solutions.

Key Takeaways

- Global Tin Container Market projected to reach USD 869.6 Million by 2035 from USD 599.9 Million in 2025

- Market expected to grow at CAGR of 4.1% during forecast period 2026-2035

- Built-up Containers segment dominates By Product Type with 57.4% market share

- Tinplate material segment leads with 52.5% share in By Material category

- 1-5 liters capacity range holds 47.8% share in By Capacity segment

- Paint Containers represent 17.7% share in By Application segment

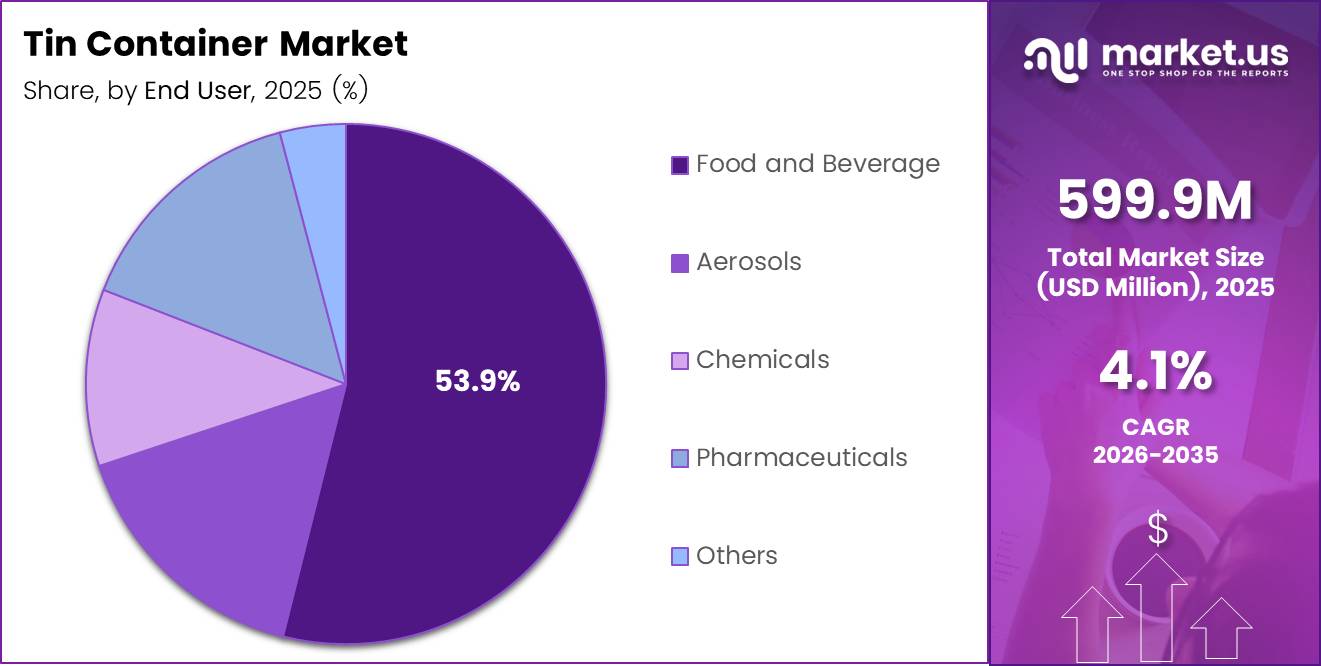

- Food and Beverage end-use dominates with 53.9% market share

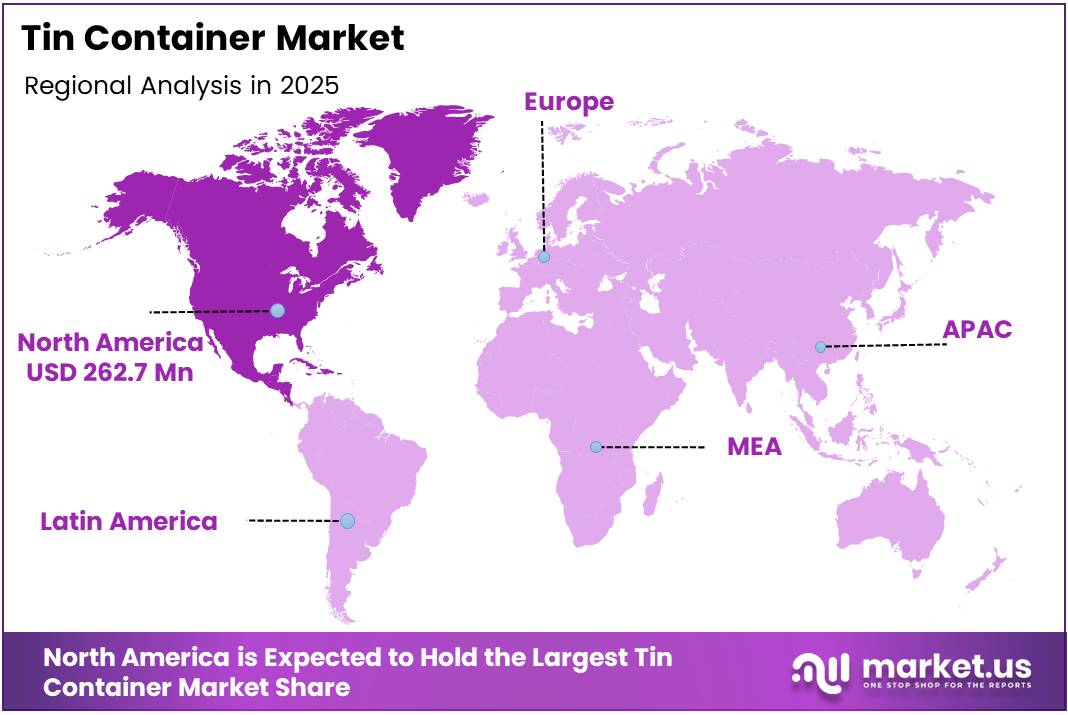

- North America leads regional markets with 43.80% share valued at USD 262.7 Million

Product Type Analysis

Built-up Containers dominate with 57.4% due to superior structural strength and versatility across diverse applications.

In 2025, Built-up Containers held a dominant market position in the By Product Type segment of Tin Container Market, with a 57.4% share. These containers utilize multiple component assembly methods that enable complex shapes and larger capacity formats. Manufacturers prefer this construction technique for paint, chemical, and industrial product packaging requiring robust durability. Therefore, built-up containers maintain leadership across high-volume commercial applications.

Shallow Drawn Containers serve specialized applications requiring seamless construction and aesthetic appeal for consumer-facing products. This production method creates containers through single-piece metal forming processes without visible seams or joints. Food manufacturers utilize shallow drawn formats for premium confectionery, tea, and gourmet product packaging. Consequently, this segment captures growing demand from luxury and decorative packaging markets.

Capacity Analysis

1-5 liters capacity dominates with 47.8% due to optimal size for household and commercial product packaging needs.

In 2025, 1-5 liters held a dominant market position in the By Capacity segment of Tin Container Market, with a 47.8% share. This capacity range perfectly matches consumer purchasing patterns for paint, edible oils, and household chemicals. Retailers prefer this size for efficient shelf space utilization and inventory management. Moreover, consumers find this volume convenient for storage and handling in residential settings.

Less than 1 liter containers serve small-format packaging needs across food, pharmaceutical, and specialty chemical applications. These compact vessels enable precise portion control and premium product positioning strategies. Additionally, travel-size and sample packaging drives demand in cosmetics and personal care segments.

5-10 liters containers address commercial and semi-industrial application requirements for bulk product distribution. Professional contractors utilize this capacity range for paint, coatings, and industrial lubricants. Therefore, this segment maintains steady demand from construction and manufacturing sectors.

More than 10 liters containers fulfill large-volume industrial and institutional packaging needs for chemicals and food ingredients. Manufacturing facilities require these formats for efficient material handling and storage operations. Consequently, bulk packaging applications sustain this specialized market segment.

Material Analysis

Tinplate dominates with 52.5% due to excellent corrosion resistance and established recycling infrastructure supporting circular economy goals.

In 2025, Tinplate held a dominant market position in the By Material segment of Tin Container Market, with a 52.5% share. This material combines steel substrate with tin coating, providing superior barrier properties against moisture and oxygen. Food manufacturers prefer tinplate for its proven safety record and compatibility with acidic products. Moreover, tinplate’s exceptional recyclability aligns with corporate sustainability commitments globally.

Steel containers offer robust structural integrity for heavy-duty industrial applications requiring maximum durability and impact resistance. Chemical manufacturers utilize steel formats for hazardous material storage and transportation compliance. Additionally, steel’s strength-to-weight ratio proves advantageous for bulk packaging applications.

Aluminum provides lightweight alternatives that reduce transportation costs and appeal to portable product categories. Beverage and aerosol industries favor aluminum for its formability and premium appearance. Therefore, this material captures specialized segments prioritizing weight reduction.

Plastic coated metal containers combine metal durability with chemical resistance for specialized pharmaceutical and food applications. These hybrid formats address unique product compatibility requirements not met by single-material solutions. Consequently, niche applications sustain this innovative material segment.

Application Analysis

Paint Containers dominate with 17.7% due to construction industry demand and paint’s specific packaging requirements for preservation.

In 2025, Paint Containers held a dominant market position in the By Application segment of Tin Container Market, with a 17.7% share. The construction and renovation sectors drive consistent demand for durable paint packaging solutions. Metal containers prevent solvent evaporation and maintain paint quality throughout extended storage periods. Moreover, standardized paint container formats facilitate efficient retail display and consumer recognition.

Cone Top Containers serve specialized beverage and liquid product applications requiring controlled dispensing and leak prevention. This historical container design maintains niche appeal for traditional and heritage brand positioning. Additionally, collectors value vintage cone top formats for aesthetic and nostalgic purposes.

Mono Top Containers provide single-opening designs that simplify manufacturing processes and reduce production costs for high-volume applications. Food processors utilize this format for efficient filling line operations. Therefore, cost-sensitive packaging applications favor this streamlined construction method.

Oblong/F-style Containers deliver ergonomic handling and space-efficient storage for industrial chemicals and specialty liquids. Professional users prefer these shapes for workshop and facility storage optimization. Consequently, commercial and industrial sectors sustain demand for functional container designs.

Edible Oil Containers protect light-sensitive oils from oxidation while providing convenient dispensing for household cooking applications. Metal construction ensures product freshness throughout the distribution chain. Additionally, emerging markets drive growth as packaged edible oil consumption increases.

Aerosol Containers enable pressurized product delivery across personal care, household, and industrial categories requiring spray application. Technical specifications ensure safety and performance under pressure. Moreover, regulatory compliance drives continuous innovation in aerosol container manufacturing.

Others category encompasses diverse specialty applications including pharmaceuticals, cosmetics, and promotional packaging formats. Custom container designs serve limited-edition and seasonal product launches. Therefore, this segment demonstrates flexibility and innovation potential within the broader market.

End-use Analysis

Food and Beverage dominates with 53.9% due to metal’s superior barrier properties and consumer preference for recyclable packaging.

In 2025, Food and Beverage held a dominant market position in the By End-use segment of Tin Container Market, with a 53.9% share. This sector demands packaging that preserves product freshness, prevents contamination, and extends shelf life significantly. Metal containers provide hermetic seals that protect against moisture, oxygen, and light degradation. Moreover, food safety regulations favor materials with proven track records in maintaining product integrity.

Aerosols require specialized containers that withstand internal pressure while ensuring safe product delivery across multiple applications. Personal care, household cleaning, and industrial products utilize pressurized metal packaging formats. Additionally, technical innovation continues improving aerosol container performance and sustainability.

Chemicals demand robust packaging solutions that ensure safe storage and transport of potentially hazardous materials. Metal containers meet stringent regulatory requirements for chemical compatibility and leak prevention. Therefore, industrial chemical manufacturers rely on proven metal packaging systems.

Pharmaceuticals utilize metal containers for specialty formulations requiring exceptional barrier protection and tamper-evidence features. Regulatory compliance and product stability drive packaging material selection decisions. Consequently, pharmaceutical applications maintain specific quality and traceability standards.

Others encompasses emerging applications in cosmetics, automotive products, and specialty consumer goods requiring durable packaging. Innovation in decorative finishes and custom designs expands metal container adoption. Moreover, premium positioning strategies increasingly favor distinctive metal packaging formats.

Key Market Segments

By Product Type

- Built-up Containers

- Shallow Drawn Containers

By Capacity

- Less than 1 liter

- 1-5 liters

- 5-10 liters

- More than 10 liters

By Material

- Tinplate

- Steel

- Aluminum

- Plastic

By Application

- Paint Containers

- Cone Top Containers

- Mono Top Containers

- Oblong/F-style Containers

- Edible Oil Containers

- Aerosol Containers

- Others

By End-use

- Food and Beverage

- Aerosols

- Chemicals

- Pharmaceuticals

- Others

Drivers

Rising Global Demand for Shelf-Stable Packaged Food and Ready-to-Drink Beverages Drives Market Growth

Consumer lifestyle changes accelerate demand for convenient, long-lasting packaged food and beverage products globally. Metal containers provide exceptional barrier protection that extends product shelf life without refrigeration requirements. Urbanization and changing dietary patterns increase consumption of processed and ready-to-consume food items. Therefore, manufacturers invest in metal packaging to meet growing distribution and storage demands.

According to World Aerosols, tinplate recycling rates have remained stable at around 90% for nearly two decades, showing long-term operational circularity performance. This sustainability track record strengthens consumer and corporate confidence in metal packaging solutions. Moreover, proven recycling infrastructure supports brands pursuing environmental responsibility goals while maintaining product quality standards.

E-commerce expansion requires durable packaging that withstands distribution challenges without product damage or quality degradation. Metal containers deliver superior protection during transportation compared to alternative materials. Consequently, online retailers and food delivery services increasingly specify metal packaging for temperature-sensitive and fragile products.

Restraints

High Volatility in Tin, Steel, and Energy Input Costs Affects Manufacturing Margins

Raw material price fluctuations create significant financial uncertainty for tin container manufacturers managing production costs. Global commodity markets experience periodic volatility affecting steel, tin, and aluminum procurement expenses. Energy-intensive manufacturing processes amplify cost pressures when fuel and electricity prices rise. Therefore, producers struggle maintaining competitive pricing while protecting profit margins during cost spikes.

Supply chain disruptions periodically constrain raw material availability, forcing manufacturers to accept premium pricing or reduce production. Geopolitical tensions and trade policies introduce additional uncertainty into international material sourcing strategies. Moreover, smaller manufacturers lack purchasing power to negotiate favorable long-term supply contracts.

Manufacturing facilities require substantial capital investment for specialized equipment and quality control systems. Modern production lines demand continuous maintenance and periodic technology upgrades to maintain efficiency standards. Consequently, fixed cost structures limit operational flexibility when market demand fluctuates or pricing pressures intensify.

Growth Factors

Technological Advancements Accelerate Market Expansion

Lightweight tinplate technology development reduces material consumption while maintaining structural integrity and barrier properties. Manufacturers achieve significant cost savings through optimized material usage and reduced transportation expenses. Innovation in coating technologies improves corrosion resistance and extends container lifespan across demanding applications. Therefore, technical progress enhances both economic and environmental performance simultaneously.

According to World Aerosols, tinplate can be recycled almost 100% repeatedly without material quality loss, enabling closed-loop metal packaging reuse. This unique characteristic positions tin containers as ideal solutions for circular economy initiatives. Corporate sustainability strategies increasingly prioritize materials supporting zero-waste manufacturing and distribution systems.

Digital printing capabilities enable cost-effective customization for limited-edition releases and promotional campaigns without traditional tooling expenses. Advanced surface finishing techniques deliver premium aesthetics that enhance brand differentiation and shelf appeal. Consequently, decorative metal packaging expands into luxury cosmetics, gourmet foods, and collectible product segments.

Emerging Trends

Rapid Adoption of Sustainable Packaging Due to High Metal Recycling Efficiency Reshapes Market Landscape

Corporate environmental commitments drive accelerated transition toward packaging materials supporting circular economy principles globally. Brands face increasing stakeholder pressure to demonstrate measurable sustainability improvements across supply chains. Metal containers deliver verified recycling performance that enables credible environmental claims and regulatory compliance. Therefore, sustainability considerations increasingly influence packaging material selection decisions.

According to Tinboxes China, European steel packaging including tinplate formats achieved approximately 82.5% verified real recycling rate under audited EU methodology. These independently verified metrics provide transparency that builds consumer trust and regulatory acceptance. Moreover, established collection infrastructure ensures recycling systems function effectively across diverse geographic markets.

Smart coating integration enables interactive packaging features including temperature indicators and freshness monitoring capabilities. These technological enhancements provide consumers with real-time product quality information throughout storage periods. Additionally, Internet of Things connectivity creates opportunities for enhanced supply chain traceability and consumer engagement.

Regional Analysis

North America Dominates the Tin Container Market with a Market Share of 43.80%, Valued at USD 262.7 Million

North America maintains market leadership driven by established food processing infrastructure and robust chemical manufacturing sectors. The region demonstrates strong demand for paint containers supporting active construction and renovation markets. Moreover, North America held 43.80% market share valued at USD 262.7 Million, reflecting mature packaging consumption patterns. Regulatory frameworks favoring recyclable materials and corporate sustainability initiatives strengthen metal container adoption across industries.

Europe Tin Container Market Trends

Europe exhibits advanced recycling infrastructure and stringent environmental regulations driving metal packaging preference among manufacturers. The region leads global sustainability initiatives with comprehensive circular economy policies supporting tin container recovery. Food safety standards and quality requirements favor proven packaging materials across beverage and processed food sectors. Additionally, premium confectionery and gourmet product markets sustain decorative tin container demand.

Asia Pacific Tin Container Market Trends

Asia Pacific demonstrates rapid growth potential driven by expanding food processing capacity and rising packaged goods consumption. Urbanization accelerates demand for shelf-stable products requiring protective metal packaging solutions. Manufacturing cost advantages and growing export activities support regional production capacity expansion. Therefore, emerging middle-class consumer populations create substantial long-term market opportunities.

Middle East and Africa Tin Container Market Trends

Middle East and Africa markets show steady development supported by food import requirements and growing chemical manufacturing investments. Climate conditions favor packaging materials providing superior heat and moisture protection for stored products. Infrastructure development projects drive paint and coating container demand across construction sectors. Consequently, regional economic diversification initiatives support gradual market expansion.

Latin America Tin Container Market Trends

Latin America experiences moderate growth driven by food and beverage industry expansion and agricultural product processing development. Traditional preferences for metal packaging in cooking oil and specialty food segments sustain consistent demand. Economic development and infrastructure investment create opportunities for industrial and commercial packaging applications. Moreover, improving recycling systems gradually enhance sustainability performance across regional markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Colep Portugal S.A. operates comprehensive metal packaging solutions across aerosol, food, and industrial container segments with global manufacturing presence. The company maintains advanced production capabilities supporting diverse customer requirements throughout Europe and international markets. Strategic investments in sustainable manufacturing processes strengthen competitive positioning as environmental regulations evolve. Moreover, technical expertise in specialty coatings and printing enables premium product differentiation for brand-focused customers.

Ardagh Group S.A. represents a major global packaging manufacturer delivering metal and glass container solutions across beverage, food, and specialty markets. The organization operates extensive production facilities supporting regional customer bases with reliable supply chain capabilities. In July 2025, Ardagh Group agreed on a major recapitalization restructuring deal transferring majority ownership to creditors as part of financial restructuring. This strategic financial realignment positions the company for continued market participation despite challenging economic conditions.

Ball Corporation maintains leadership in aluminum packaging innovation serving beverage, aerosol, and food industries with sustainable container solutions. The company invests significantly in lightweight material development and recycling infrastructure supporting circular economy objectives. Advanced manufacturing technologies enable efficient high-volume production while maintaining stringent quality standards. Therefore, Ball Corporation continues capturing market share through operational excellence and sustainability leadership.

Aryum Aerosol Cans Ltd. specializes in aerosol container manufacturing serving personal care, household, and industrial product segments globally. The company focuses on technical innovation delivering safe, reliable pressurized packaging solutions meeting international safety standards. Strategic capacity expansion initiatives support growing customer demand across emerging markets. Consequently, specialized expertise positions Aryum competitively within the aerosol container market segment.

Key Players

- Colep Portugal S.A.

- Ardagh Group S.A.

- Aryum Aerosol Cans Ltd.

- Ball Corporation

- Jamestrong Packaging

- NCI Packaging

Recent Developments

- January 2026 – AB InBev announced buyback of US can manufacturing plants from Apollo Global Management for approximately $3 billion, strengthening vertical integration capabilities and securing critical aluminum container supply chain control for beverage operations.

- July 2024 – Novvia Group completed strategic acquisition of Andicor’s Container Distribution Division, expanding regional distribution network and enhancing customer service capabilities across specialized industrial packaging segments through integrated logistics infrastructure.

Report Scope

Report Features Description Market Value (2025) USD 599.9 Million Forecast Revenue (2035) USD 869.6 Million CAGR (2026-2035) 4.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Built-up Containers, Shallow Drawn Containers), By Capacity (Less than 1 liter, 1-5 liters, 5-10 liters, More than 10 liters), By Material (Tinplate, Steel, Aluminum, Plastic), By Application (Paint Containers, Cone Top Containers, Mono Top Containers, Oblong/F-style Containers, Edible Oil Containers, Aerosol Containers, Others), By End-use (Food and Beverage, Aerosols, Chemicals, Pharmaceuticals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Colep Portugal S.A., Ardagh Group S.A., Aryum Aerosol Cans Ltd., Ball Corporation, Jamestrong Packaging, NCI Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Colep Portugal S.A.

- Ardagh Group S.A.

- Aryum Aerosol Cans Ltd.

- Ball Corporation

- Jamestrong Packaging

- NCI Packaging