Global Timber Logistics Market Size, Share, Growth Analysis By Timber (Industrial Roundwood, Fuelwood, Sawn Timber, Wood Pellets, Others), By Mode of Transportation (Roadway, Railway, Waterway), By Services (Transportation, Warehousing & Storage, Inventory Management, Customs Clearance & Documentation, Value-Added Services, Others), By Application (Construction, Furniture, Paper and Pulp, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160056

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

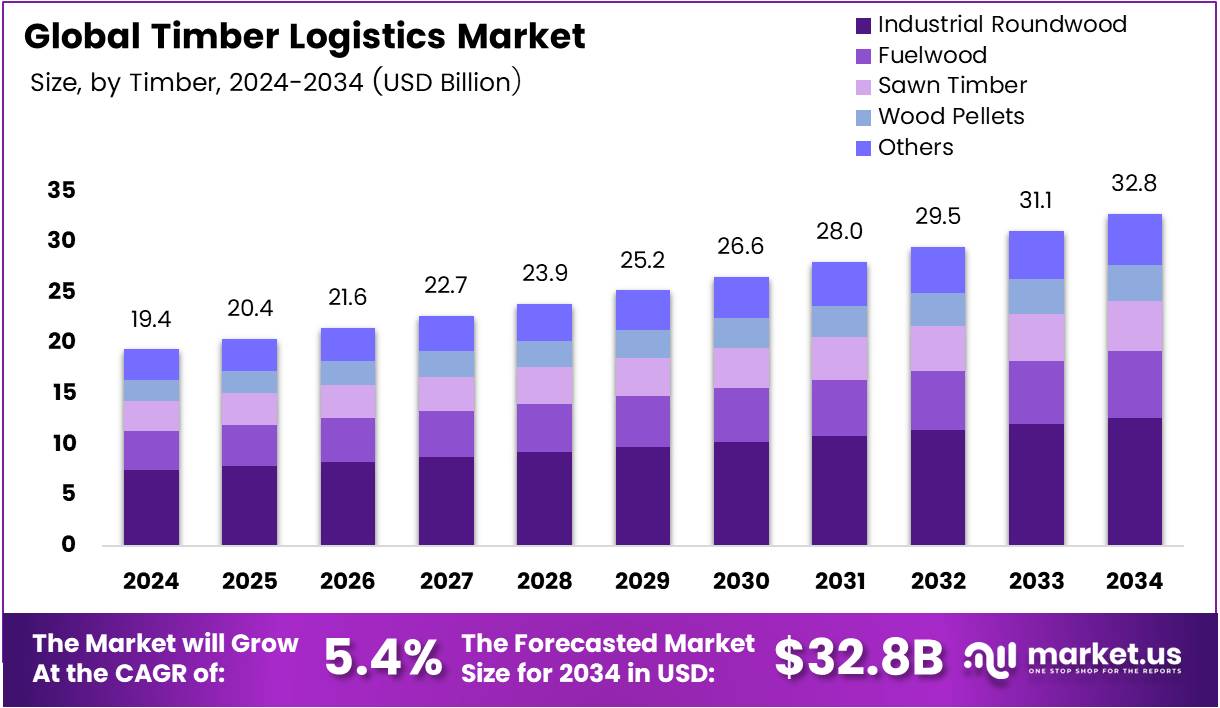

The Global Timber Logistics Market size is expected to be worth around USD 32.3 Billion by 2034, from USD 19.4 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Timber Logistics Market represents a critical segment within the global supply chain, focusing on the transportation, storage, and distribution of timber and forest products. It connects forestry operations with manufacturers, exporters, and end-users, ensuring efficient movement of raw materials. This market plays a key role in supporting sustainable forestry and circular economy goals.

Moreover, rising construction activity, renewable material adoption, and green infrastructure initiatives continue to drive market expansion. As urbanization accelerates, demand for engineered wood, plywood, and lumber logistics intensifies. Consequently, logistics providers are investing in digital tracking, multimodal transport, and port infrastructure to enhance delivery speed, transparency, and cost efficiency.

In addition, opportunities are expanding across emerging economies, where forestry investments are rising alongside domestic production. Governments are actively incentivizing supply chain modernization through sustainable timber trade frameworks and digitized customs operations. This transition enables optimized load management, minimized carbon emissions, and improved traceability within the timber logistics value chain.

Furthermore, public–private partnerships and funding toward green freight corridors are reinforcing market resilience. Advanced technologies like IoT sensors and AI-based route planning are transforming fleet utilization and inventory visibility. As policy frameworks tighten around deforestation and export controls, companies must align operations with evolving regulatory compliance and environmental standards.

According to an industry report by the Food and Agriculture Organization (FAO), global industrial roundwood removals fell 4% to 1.92 billion m³ in 2023, signaling a realignment in demand and trade flow. This shift is reshaping global shipping lanes, prompting capacity recalibration and adaptive freight strategies among timber logistics players.

Additionally, as per the U.S. Department of Agriculture (USDA), U.S. forest products exports reached $9.57 billion in 2024, underscoring robust overseas demand for lumber, panels, pulp, and paper. This export momentum highlights expanding global trade opportunities, reinforcing the need for agile supply chains and strategic port investments in the timber logistics market.

Key Takeaways

- The Global Timber Logistics Market is projected to reach USD 32.3 Billion by 2034, up from USD 19.4 Billion in 2024, growing at a CAGR of 5.4%.

- In 2024, Industrial Roundwood led the By Timber Analysis segment with a 38.6% share due to its vital role in furniture, panel boards, and construction materials.

- The Roadway segment dominated the By Mode of Transportation category with a 56.3% share, driven by cost-effective and flexible short-distance logistics solutions.

- Transportation held the leading position in the By Services Analysis segment with a 43.2% share, backed by advancements in digital route optimization and fleet management.

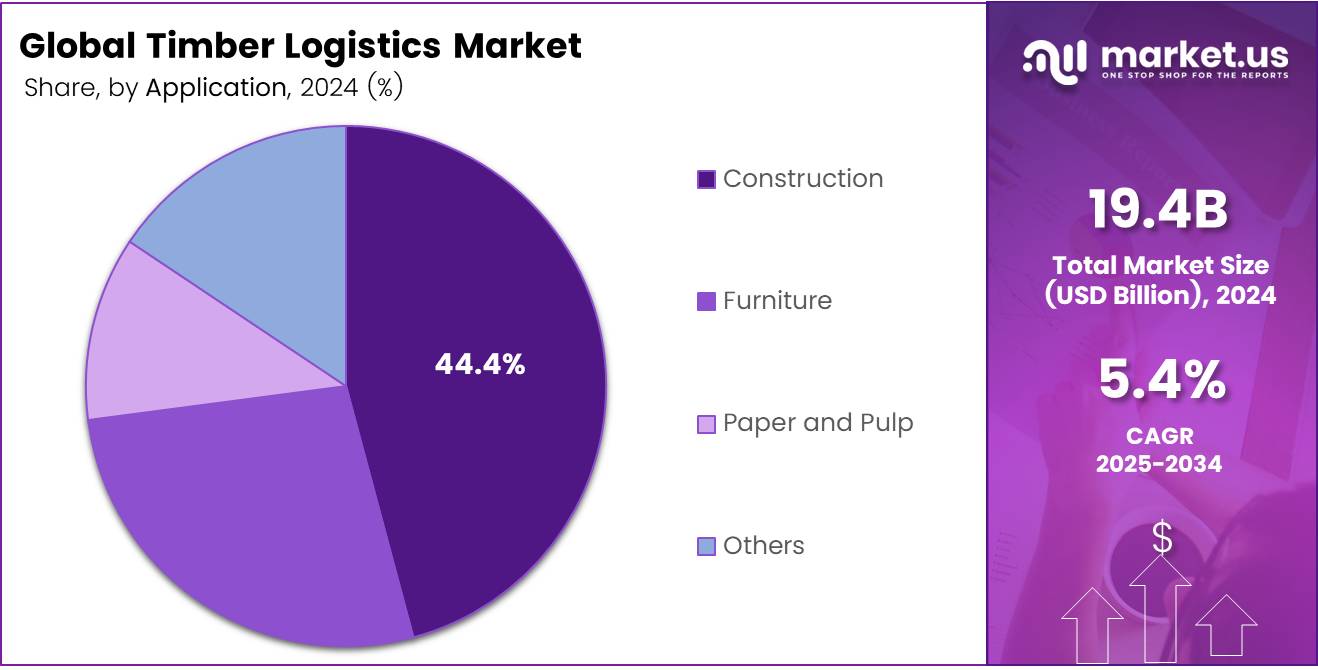

- Construction emerged as the top segment in the By Application Analysis with a 44.4% share, reflecting strong demand for eco-friendly and modular timber in infrastructure projects.

- The Asia Pacific region dominated the market, accounting for 35.9% of the total share and generating USD 6.9 Billion in revenue, supported by high timber production and exports from China, Indonesia, and Malaysia.

By Timber Analysis

Industrial Roundwood dominates with 38.6% due to its strong use in manufacturing, construction, and global timber trade.

In 2024, Industrial Roundwood held a dominant market position in the By Timber Analysis segment of the Timber Logistics Market, with a 38.6% share. This leadership is attributed to its critical role in industrial applications, including furniture, panel boards, and construction materials. Its consistent demand from both domestic and export markets further fuels logistics growth, especially in cross-border transportation.

Fuelwood represents a vital segment driven by its traditional and renewable energy use. Despite modernization, many regions rely on fuelwood for heating and energy production. Its logistics network ensures continuous availability in rural and semi-urban zones, emphasizing efficiency in storage and short-distance transportation.

Sawn Timber contributes significantly as processed wood used in housing and interior design. Its logistics involve specialized handling to maintain quality during shipment. Growing demand from furniture and modular housing industries increases reliance on advanced warehousing and intermodal transport solutions.

Wood Pellets are gaining traction with the rise of sustainable energy practices. As a renewable biomass fuel, logistics providers focus on bulk transport and port operations. Their lightweight, high-density form enables efficient storage and maritime exports to energy-dependent nations.

Others include niche products like veneer logs and specialty woods. Although smaller in scale, their high value requires precision logistics, temperature control, and specialized packaging for international deliveries, ensuring minimal losses and superior quality maintenance.

By Mode of Transportation Analysis

Roadway dominates with 56.3% due to its flexibility, accessibility, and last-mile delivery efficiency across timber supply chains.

In 2024, Roadway held a dominant market position in the By Mode of Transportation Analysis segment of the Timber Logistics Market, with a 56.3% share. The segment’s dominance stems from its cost-effective short-distance movement, door-to-door service, and ease of access to sawmills and industrial sites. Its agility supports frequent shipments and dynamic routing, making it essential in forestry regions.

Railway transport plays a crucial role in long-haul movement of bulk timber. With increasing sustainability concerns, railway logistics offer reduced carbon emissions and efficient handling of heavy loads. Its integration with road transport enhances multimodal operations, especially for inter-state and inter-country deliveries.

Waterway logistics serve international and bulk exports of timber, especially from forest-abundant regions to global markets. Ships and barges support large-capacity movement with lower costs per unit. Maritime ports with warehousing facilities strengthen this segment’s efficiency, particularly in serving Europe and Asia-Pacific trade routes.

By Services Analysis

Transportation dominates with 43.2% due to its critical role in linking timber producers, processors, and distributors globally.

In 2024, Transportation held a dominant market position in the By Services Analysis segment of the Timber Logistics Market, with a 43.2% share. This segment underpins the entire value chain, ensuring seamless movement from forests to processing centers. Its advancement includes digital route optimization, fleet tracking, and cost efficiency in timber haulage.

Warehousing & Storage services are integral for maintaining stockpiles and managing seasonal fluctuations. Timber requires well-ventilated, secure storage to prevent deterioration. Modern warehouses adopt climate monitoring systems to safeguard wood quality during long-term storage.

Inventory Management is gaining importance for balancing demand-supply cycles. Real-time inventory tracking helps minimize losses and streamline procurement schedules. Integration with ERP systems enables predictive demand planning, reducing overstock and waste.

Customs Clearance & Documentation ensures smooth cross-border transactions. With increasing timber trade compliance, this service manages certifications, tariffs, and inspection procedures. Streamlined documentation supports exporters in meeting international sustainability and legal sourcing requirements.

Value-Added Services include timber grading, labeling, and packaging. These enhance product traceability and customer confidence. Specialized logistics providers add treatment and finishing processes to improve delivery readiness.

Others encompass consultancy, risk management, and freight insurance. These services protect shipments from financial losses and ensure smooth operations across volatile trade environments.

By Application Analysis

Construction dominates with 44.4% due to rising urbanization and increasing timber usage in green building structures.

In 2024, Construction held a dominant market position in the By Application Analysis segment of the Timber Logistics Market, with a 44.4% share. Timber’s lightweight, eco-friendly nature boosts demand for modular homes and infrastructure projects. Logistics providers focus on timely delivery, bulk handling, and supply consistency to construction hubs.

Furniture applications drive substantial timber logistics demand, fueled by rising household spending and design innovation. Movement of sawn timber and finished furniture pieces requires damage-resistant packaging and reliable transit. Value chain integration supports just-in-time manufacturing for global furniture brands.

Paper and Pulp industries depend on continuous wood supply for large-scale production. Logistics networks emphasize steady inflow to mills, integrating storage silos and conveyors. Bulk shipping solutions reduce costs, while sustainability certifications enhance export potential.

Others include packaging, crafts, and small-scale industries. These applications rely on customized deliveries and localized supply chains. Flexible logistics ensure cost control and consistent raw material access for micro and small enterprises.

Key Market Segments

By Timber

- Industrial Roundwood

- Fuelwood

- Sawn Timber

- Wood Pellets

- Others

By Mode of Transportation

- Roadway

- Railway

- Waterway

By Services

- Transportation

- Warehousing & Storage

- Inventory Management

- Customs Clearance & Documentation

- Value-Added Services

- Others

By Application

- Construction

- Furniture

- Paper and Pulp

- Others

Drivers

Rising Global Demand for Sustainable Timber Products Drives Market Growth

Consumers worldwide are increasingly preferring eco-friendly building materials, which directly boosts demand for responsibly sourced timber. This shift encourages logistics providers to streamline their supply chains and ensure transparency. Consequently, companies are investing in certified sustainable wood transportation to meet market expectations and environmental standards effectively.

Cross-border wood trade networks are rapidly expanding as emerging economies increase timber imports. This growth drives logistics firms to develop efficient international shipping routes and customs management systems. Therefore, timber logistics services are becoming more sophisticated, connecting global suppliers with manufacturers and construction firms across different continents seamlessly.

Fleet management technologies and real-time tracking systems are being adopted extensively across timber logistics operations. These innovations enhance delivery accuracy, reduce transportation delays, and improve inventory visibility. As a result, logistics providers can optimize route planning, minimize fuel consumption, and ensure timely deliveries while maintaining product quality throughout the transportation journey.

Restraints

Stringent Environmental Regulations on Deforestation Restrain Market Expansion

Strict environmental laws aimed at preventing illegal logging and deforestation are significantly impacting timber logistics operations. Governments enforce rigorous compliance checks, documentation requirements, and certification mandates. Consequently, logistics providers face increased administrative burdens, longer processing times, and higher operational costs, which limit market flexibility and profitability margins substantially.

Remote forest regions often lack adequate transportation infrastructure, including paved roads, bridges, and loading facilities. This shortage creates significant logistical challenges for timber extraction and transportation activities. Therefore, companies experience increased transit times, vehicle maintenance issues, and elevated operational expenses, hindering efficient supply chain management in key timber-producing areas.

Growth Factors

Integration of IoT and Smart Logistics Platforms Unlocks New Growth Opportunities

Internet of Things devices and smart logistics platforms are revolutionizing timber supply chain management through real-time monitoring and data analytics. These technologies enable predictive maintenance, automated inventory tracking, and enhanced operational efficiency. Accordingly, companies can reduce waste, optimize resource allocation, and improve customer service, creating substantial competitive advantages in the timber logistics marketplace.

Developing economies in Asia, Africa, and South America are emerging as significant timber export markets due to rising construction activities. This expansion presents lucrative opportunities for logistics providers to establish new distribution channels and partnerships. Thus, companies entering these markets early can capture market share and build long-term relationships with local suppliers and international buyers.

Automated sorting systems and cargo handling equipment are transforming traditional timber loading and unloading processes. These innovations reduce manual labor requirements, minimize product damage, and accelerate turnaround times at ports and warehouses. Consequently, logistics companies implementing automation technologies achieve higher throughput, improved safety standards, and enhanced operational profitability across their networks.

Renewable construction material projects increasingly require sustainable timber sourcing and logistics solutions aligned with green building certifications. Collaborating with these initiatives provides logistics companies access to premium market segments. Therefore, partnerships with eco-construction projects enable service differentiation, premium pricing opportunities, and alignment with global sustainability trends driving modern building practices.

Emerging Trends

Shift Toward Carbon-Neutral and Green Logistics Practices Shapes Market Trends

Timber logistics companies are actively transitioning toward carbon-neutral operations by adopting electric vehicles, biofuels, and renewable energy sources. This movement responds to growing environmental consciousness among consumers and regulatory pressures. Consequently, businesses implementing green logistics practices enhance brand reputation, attract environmentally conscious clients, and position themselves competitively in sustainability-focused markets.

Blockchain technology is gaining traction for ensuring timber traceability and verifying sustainable sourcing throughout supply chains. This digital ledger system provides transparent, tamper-proof documentation of timber origins and handling processes. Subsequently, logistics providers utilizing blockchain can combat illegal logging, build customer trust, and comply with international certification requirements more efficiently and reliably.

Multimodal transport solutions combining road, rail, and maritime shipping are becoming standard practice in timber logistics operations. This integrated approach optimizes cost efficiency, reduces transit times, and minimizes environmental impact. Therefore, companies leveraging multimodal networks achieve better route flexibility, lower carbon emissions, and improved service reliability across domestic and international timber distribution channels.

Circular supply chain models emphasizing timber recycling, reuse, and waste reduction are increasingly popular within forestry industries. These sustainable practices align with global environmental goals and resource conservation efforts. Accordingly, logistics providers supporting circular economy initiatives develop innovative reverse logistics capabilities, create additional revenue streams, and contribute to sustainable forest management and environmental preservation.

Regional Analysis

Asia Pacific Dominates the Timber Logistics Market with a Market Share of 35.9%, Valued at USD 6.9 Billion

In 2024, the Asia Pacific region held a dominant position in the Timber Logistics Market, capturing 35.9% of the total share and generating revenues worth USD 6.9 Billion. The region’s dominance is attributed to the high volume of timber production and exports across countries like China, Indonesia, and Malaysia.

Rapid urbanization, growing construction activities, and strong demand for furniture-grade timber have accelerated the need for efficient logistics and transportation services. Additionally, government initiatives to promote sustainable forestry and cross-border trade are enhancing regional supply chain networks.

North America Timber Logistics Market Trends

North America exhibits steady growth in timber logistics, driven by a well-established forestry sector and robust domestic consumption in the U.S. and Canada. Rising infrastructure development, housing projects, and the increasing adoption of digital logistics platforms support market expansion. The region also benefits from advanced transportation infrastructure, including highways and rail systems that facilitate efficient timber movement across states and borders.

Europe Timber Logistics Market Trends

Europe’s timber logistics market is supported by strong environmental regulations and sustainable forest management practices. Countries such as Finland, Sweden, and Germany contribute significantly to timber trade, driven by high exports of softwood and processed wood. The region’s focus on circular economy principles and renewable construction materials further strengthens demand for organized and traceable logistics systems.

Middle East and Africa Timber Logistics Market Trends

The Middle East and Africa region is witnessing moderate growth, primarily due to rising timber imports for construction and infrastructure development. Countries in the Gulf Cooperation Council (GCC) are investing heavily in real estate and hospitality projects, increasing demand for high-quality timber. However, limited local production makes the region reliant on efficient port-based and multimodal logistics solutions.

Latin America Timber Logistics Market Trends

Latin America’s timber logistics market benefits from abundant forest resources in Brazil and Chile. The region is emerging as a key supplier of tropical hardwood and pulpwood for global markets. Investments in port modernization, sustainable forest certification, and export-oriented supply chains are helping improve efficiency, reduce transportation costs, and enhance competitiveness in international trade.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Timber Logistics Company Insights

The global Timber Logistics Market in 2024 is witnessing steady expansion, driven by rising demand for sustainable forest products, improved transportation infrastructure, and integrated supply chain services. Several leading logistics providers are playing a key role in shaping the market landscape through innovation, digitalization, and end-to-end service offerings.

DHL has established a strong foothold in the timber logistics ecosystem through its advanced freight management systems and sustainable supply chain solutions. Its expertise in multimodal transport and real-time tracking enhances efficiency in the movement of timber across global trade routes, catering to both industrial and construction-grade wood logistics.

Maersk, leveraging its extensive maritime network, remains a pivotal player in international timber shipping. The company’s integrated logistics solutions enable end-to-end visibility, optimizing ocean freight and inland transportation. Maersk’s focus on decarbonization and digital logistics platforms strengthens its role in connecting major timber-exporting regions like Asia Pacific and Europe.

Kuehne + Nagel International AG continues to dominate the specialized logistics segment with value-added services such as warehousing, customs clearance, and sustainability reporting. Its innovative digital solutions support clients in managing complex timber flows while adhering to environmental compliance and certification requirements across global markets.

DSV Global has enhanced its position in the timber logistics sector by expanding its road and rail freight networks. Through scalable logistics models and tailored transport solutions, DSV ensures cost-effective and timely delivery of wood products, catering to both bulk shipments and customized industrial needs, strengthening its global market competitiveness.

Top Key Players in the Market

- DHL

- Maersk

- Kuehne + Nagel International AG

- DSV Global

- DB Schenker

- C.H. Robinson

- FedEx

- DFDS Seaways

- Ponsse PLC

Recent Developments

- In Nov 2024, Timber Hill Group launched its TH Cross Border Fund I LLC, marking a strategic expansion with four acquisitions in Laredo. This move strengthens its cross-border timber logistics presence and enhances its asset portfolio in the North American trade corridor.

- In Aug 2025, Lignufy secured a €40,000 investment from Czech Founders VC and gained entry into the Sherpa accelerator program. This funding aims to support market entry, platform development, and pilot testing with its first set of customers across Europe.

- In May 2023, the First UK Electric Timber Truck received £452k of funding, signaling a shift toward sustainable forestry logistics. This initiative emphasizes decarbonization in the timber transport sector through innovative electric vehicle integration.

- In Feb 2025, Cambium raised $18.5 million in funding to advance its mass timber efforts. The capital will accelerate sustainable construction material development and scale its production capabilities across key green building markets.

Report Scope

Report Features Description Market Value (2024) USD 19.4 Billion Forecast Revenue (2034) USD 32.3 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Timber (Industrial Roundwood, Fuelwood, Sawn Timber, Wood Pellets, Others), By Mode of Transportation (Roadway, Railway, Waterway), By Services (Transportation, Warehousing & Storage, Inventory Management, Customs Clearance & Documentation, Value-Added Services, Others), By Application (Construction, Furniture, Paper and Pulp, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DHL, Maersk, Kuehne + Nagel International AG, DSV Global, DB Schenker, C.H. Robinson, FedEx, DFDS Seaways, Ponsse PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DHL

- Maersk

- Kuehne + Nagel International AG

- DSV Global

- DB Schenker

- C.H. Robinson

- FedEx

- DFDS Seaways

- Ponsse PLC