Global Thin-film Photovoltaic Market Size, Share and Report Analysis By Material Type (Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si)), By End User (Residential, Commercial, Industrial), By Installation (On-Grid, Off-Grid) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 176213

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

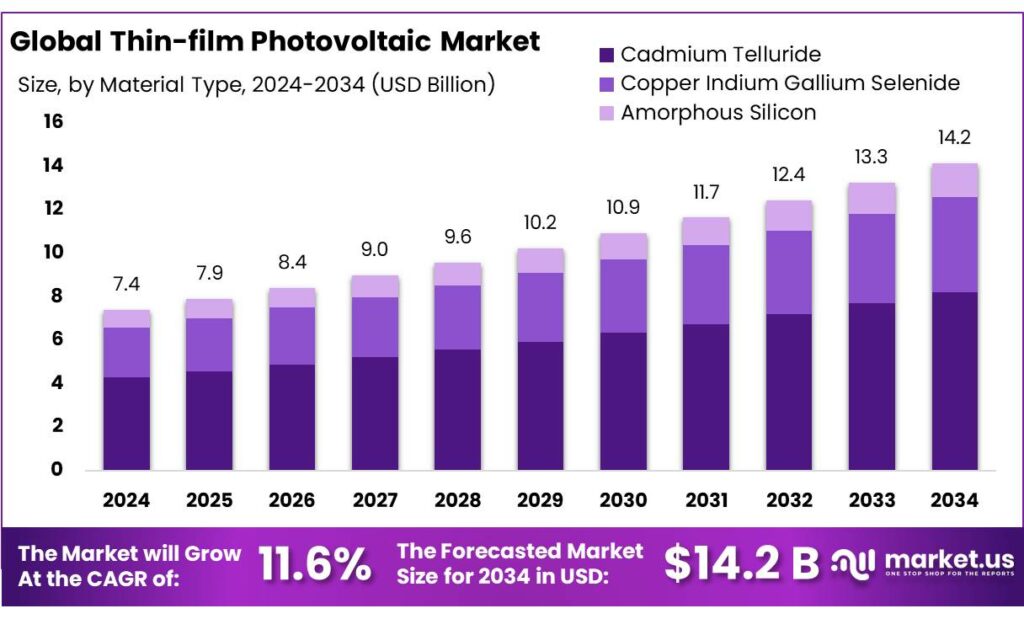

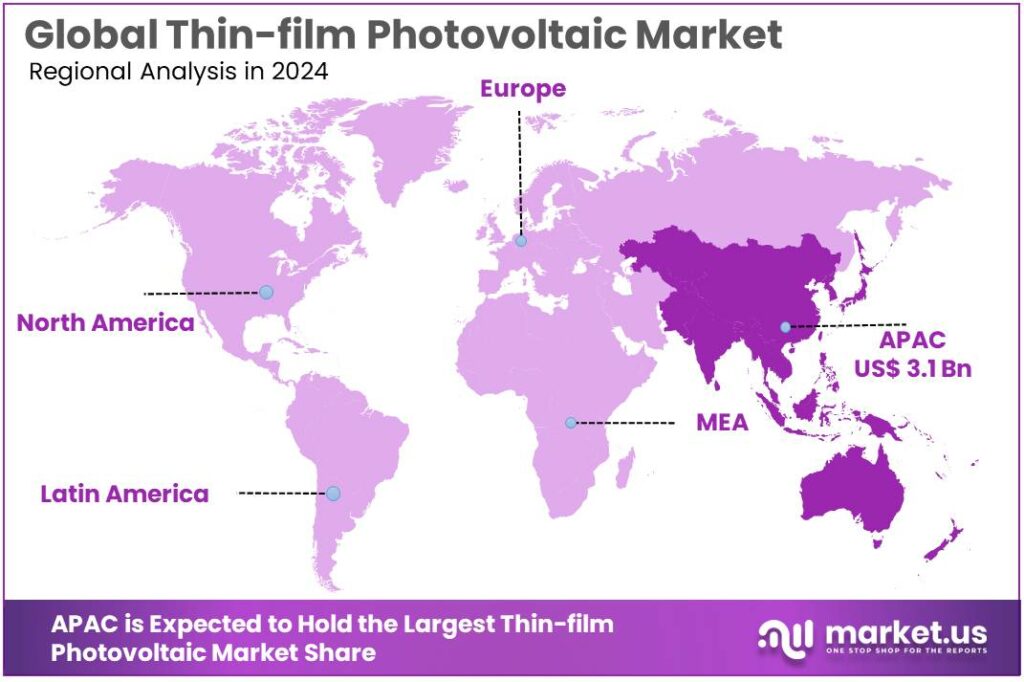

Global Thin-film Photovoltaic Market size is expected to be worth around USD 14.2 Billion by 2034, from USD 7.4 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 42.3% share, holding USD 16.9 Billion in revenue.

Thin-film photovoltaics (TFPV) refers to solar modules made by depositing very thin semiconductor layers—most commonly cadmium telluride and copper indium gallium selenide—onto glass or flexible substrates. In industry terms, TFPV is positioned as a high-throughput, materials-efficient alternative to crystalline silicon, typically valued for strong energy yield in hot climates, good low-light response, and attractive performance for utility-scale plants and certain lightweight or building-integrated uses. Even so, it remains a smaller slice of total PV supply: Fraunhofer ISE reports thin-film technology at roughly 2–3% of the global PV technology mix in recent market tracking.

The broader industrial scenario is shaped by an unprecedented scale-up of solar deployment and manufacturing, which indirectly benefits thin film by expanding the addressable market. REN21 estimates a record 602 GW of solar PV capacity was added in 2024, taking global installed solar PV to 2,247 GW by end-2024. In parallel, International Energy Agency notes that global solar PV investment in capacity additions surpassed USD 480 billion in 2023, highlighting the size of the capital funnel feeding module supply chains.

Key driving factors for thin film are now tightly linked to policy-supported “onshoring,” bankable scale, and technology differentiation. In the United States, U.S. Department of Energy awarded USD 44 million under an “Advancing U.S. Thin-Film Solar Photovoltaics” funding program to strengthen domestic thin-film R&D and demonstration.

At the company level, First Solar is the clearest industrial bellwether for CdTe scaling: its 2024 annual report cites commissioning a new 3.5 GW manufacturing facility in Alabama and advancing construction of another 3.5 GW factory in Louisiana. The same firm also communicates an expected global annual nameplate capacity of about 25 GW in 2026, reinforcing the point that thin film’s growth path depends on a handful of very large, execution-capable platforms.

Key Takeaways

- Thin-film Photovoltaic Market size is expected to be worth around USD 14.2 Billion by 2034, from USD 7.4 Billion in 2024, growing at a CAGR of 11.6%.

- Cadmium Telluride (CdTe) held a dominant market position, capturing more than a 58.4% share.

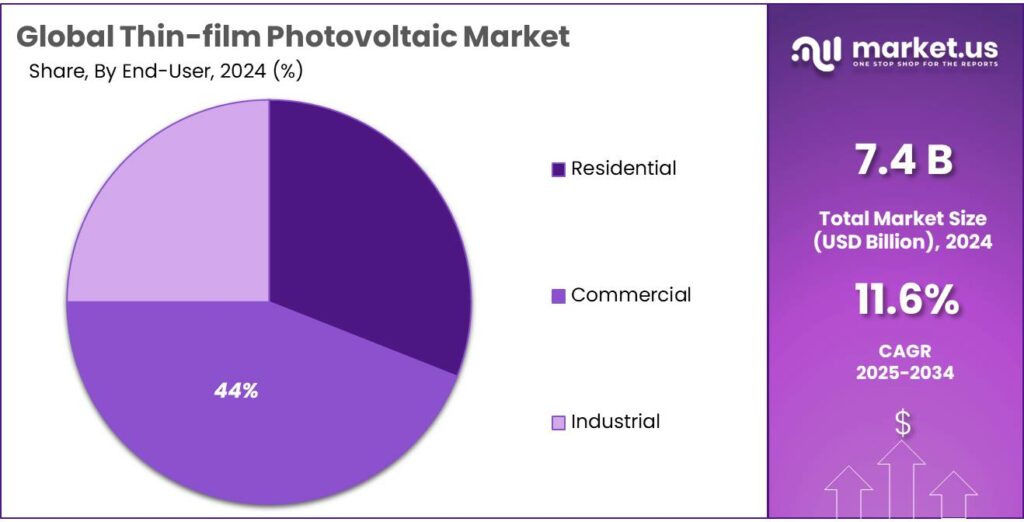

- Synthetic held a dominant market position, capturing more than a 44.1% share in the thin-film photovoltaic market.

- On-Grid held a dominant market position, capturing more than a 72.7% share in the thin-film photovoltaic market.

- Asia Pacific dominates the Thin-film Photovoltaic market with a 42.3% share, valued at USD 16.9 Bn.

By Material Type Analysis

Cadmium Telluride (CdTe) leads the thin-film photovoltaic space with a strong 58.4% share

In 2024, Cadmium Telluride (CdTe) held a dominant market position, capturing more than a 58.4% share within the global thin-film photovoltaic market. This leadership comes from its proven efficiency in high-temperature regions, reliable field performance, and a strong manufacturing base that continues to expand.

CdTe modules remained widely adopted across large-scale solar farms in 2024, helped by their higher energy yield in hot climates and reduced performance losses when compared with traditional crystalline silicon modules. The year also marked continued investment in production lines dedicated to CdTe, reinforcing its position in the thin-film segment.

By End User Analysis

Synthetic dominates the thin-film photovoltaic end-user landscape with a strong 44.1% share in 2024.

In 2024, Synthetic held a dominant market position, capturing more than a 44.1% share in the thin-film photovoltaic market across commercial end-use applications. This leadership reflects the rising shift of commercial facilities toward lightweight, flexible, and installation-friendly thin-film solutions that suit rooftops, industrial sheds, and structurally sensitive buildings.

During 2024, commercial users increasingly preferred Synthetic-based thin-film designs for their stable performance, reduced balance-of-system requirements, and cost-effective deployment across large commercial roofs where traditional crystalline panels are harder to mount. These advantages helped Synthetic materials secure a larger share of commercial installations throughout the year.

By Installation Analysis

On-Grid installations dominate thin-film photovoltaics with a powerful 72.7% share in 2024.

In 2024, On-Grid held a dominant market position, capturing more than a 72.7% share in the thin-film photovoltaic market. This strong lead is supported by the growing adoption of utility-scale and commercial solar projects that rely heavily on grid-connected systems for stable power delivery.

Throughout 2024, governments and energy developers continued to favor on-grid installations because they ensure consistent electricity supply, easier integration into national grids, and access to incentives such as feed-in tariffs and net-metering programs. Thin-film modules, especially in large arrays, were widely chosen for their high temperature tolerance and reliable performance during peak sunlight hours, further strengthening on-grid deployment.

Key Market Segments

By Material Type

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

By End User

- Residential

- Commercial

- Industrial

By Installation

- On-Grid

- Off-Grid

Emerging Trends

Perovskite thin-film tandems are moving from lab records to early commercial panels

One clear latest trend in thin-film photovoltaics is the fast shift of perovskite thin-film technology from research headlines into tandem products that can be manufactured and sold. Perovskite is a thin-film semiconductor that can be coated in very thin layers, and the big industry push is to place it on top of silicon (a “tandem” design). The logic is simple: tandems can produce more electricity from the same rooftop or land area, which makes them attractive where space is limited or power demand is high.

The progress in efficiency is moving quickly and has become a major signal to investors and buyers. In April 2025, LONGi announced a 34.85% conversion efficiency for a two-terminal silicon-perovskite tandem solar cell, certified by the U.S. National Renewable Energy Laboratory (NREL). This matters because it shows thin-film perovskite is no longer a “nice idea” sitting far away from silicon—it is being engineered to work directly with the mainstream PV platform. While cell records are not the same as mass-market modules, they still set the direction of travel for product roadmaps and manufacturing upgrades.

What makes this trend “latest” is that commercialization has started to show real movement, not just lab performance. Oxford PV has publicly stated that its first panels available on the market have 24.5% module efficiency, and that the panels are produced on a megawatt-scale pilot line in Brandenburg an der Havel, Germany. In August 2025, Oxford PV also reported a record 25% efficient tandem solar panel, reinforcing that high efficiency is beginning to appear at the panel level, not only in small devices. For thin-film PV, this is a key milestone: it shows manufacturers are learning how to scale thin-film coatings into larger, repeatable products with bankable performance claims.

Government-backed R&D is also feeding this trend by reducing technical risk and speeding up improvements in durability and manufacturing. The U.S. Department of Energy’s Solar Energy Technologies Office (SETO) highlights ongoing support for perovskite solar R&D focused on improving efficiency and lifetime while lowering manufacturing costs. Separately, DOE’s FY 2024 Small Innovative Projects in Solar (SIPS) program provides $5.4 million for early-stage, high-risk PV innovation projects—exactly the kind of funding channel that helps thin-film ideas move toward manufacturable solutions.

Drivers

Policy-backed scale-up is the key driver pushing thin-film photovoltaics into bigger, bankable projects

One major driving factor for thin-film photovoltaics is the rapid expansion of grid-scale solar, strengthened by government-backed manufacturing and technology programs. As power grids add more solar each year, developers look for module options that can deliver reliable output in real operating conditions, not just in lab ratings. The size of the overall solar buildout matters here: International Renewable Energy Agency reports that over 451 GW of new solar PV capacity was added in 2024 alone, underlining how quickly procurement volumes are expanding and why manufacturers that can supply at scale gain an advantage.

Investment levels show the same push. International Energy Agency notes that global solar PV investments in capacity additions surpassed USD 480 billion in 2023 after rising about 30% year over year. When capital flows reach this level, buyers tend to prioritize proven supply chains, long-term warranties, and modules that can be delivered in consistent volumes for multi-hundred-megawatt projects. That preference supports thin-film producers that can demonstrate steady manufacturing quality, bankable project execution, and a credible multi-year capacity ramp.

Government initiatives further reinforce this driver by reducing technology and scale risk. In the United States, U.S. Department of Energy launched the “Advancing U.S. Thin-Film Solar Photovoltaics” program, awarding USD 44 million for research, development, and demonstration projects focused on major thin-film PV technologies. This kind of targeted support matters because it helps move thin-film improvements from pilot lines into manufacturable upgrades—such as higher throughput, better materials utilization, and stronger domestic component ecosystems—without forcing industry to carry all early-stage costs alone.

On the industry side, manufacturer capacity expansion is a practical signal of how demand is translating into real factories. First Solar reports that in 2024 it commissioned a new 3.5 GW manufacturing facility in Alabama and progressed construction of another 3.5 GW factory in Louisiana. In addition, the company communicated expectations of reaching about 25 GW of global annual nameplate capacity by the end of 2026, showing how thin-film supply is being scaled to meet large, utility-grade procurement cycles.

Restraints

High material and manufacturing constraints continue to limit thin-film photovoltaic expansion

One significant restraining factor for thin-film photovoltaics is the limited availability of key raw materials, especially cadmium, tellurium, and indium—elements that are far less abundant than those used in conventional crystalline silicon modules. Thin-film manufacturing depends heavily on these metals, and their constrained supply chains restrict large-scale capacity growth. For instance, the U.S. Geological Survey notes that global tellurium production remains extremely small, at only around 580–600 metric tons per year, making it one of the least abundant elements used in energy technologies.

Another challenge comes from recycling and recovery limitations. While crystalline silicon can be produced from abundant sand-based feedstock, thin-film materials depend on secondary supply streams—like copper refining and base-metal by-product recovery. According to the International Renewable Energy Agency (IRENA), less than 1% of critical materials like indium and tellurium are currently recovered through recycling, limiting the circular supply needed for steady scaling.

Environmental and regulatory pressure also contributes to the restraint. Cadmium, used in CdTe thin-film modules, is classified as a toxic heavy metal, and governments impose strict handling, transport, and disposal guidelines. The European Commission continues to evaluate cadmium-containing products under REACH regulations, highlighting health and environmental concerns. The EU has restricted cadmium in many electronics, and although solar modules receive exemptions, the regulatory environment remains cautious.

Opportunity

Commercial rooftops and corporate clean-power buying create a strong growth runway for thin-film photovoltaics

A major growth opportunity for thin-film photovoltaics is the fast expansion of commercial and industrial (C&I) solar—especially rooftop systems—driven by corporate energy targets and the need to cut electricity risk. Thin-film modules are often a practical fit for big, flat roofs (warehouses, food plants, logistics hubs, cold storage) because they can be lightweight, flexible in design, and dependable in hot conditions. As more companies push renewable procurement deeper into their operations, the demand for “easy-to-deploy” rooftop solar keeps rising, opening room for thin-film technologies to compete beyond traditional utility-scale projects.

The scale of rooftop growth itself is already large enough to support new technology adoption. REN21 reports that in 2024, the world added a record 602 GW of solar PV capacity, and rooftop/distributed systems alone grew by 200 GW. That kind of rooftop volume matters because it expands the number of buildings where thin-film can win on physical constraints—like weak roof loading limits, uneven surfaces, and heat stress—where standard modules may require heavier mounting solutions. In simple terms: when rooftops grow at this pace, even a small percentage shift toward thin-film translates into meaningful shipments.

Corporate energy commitments are another direct pull factor, and the food and beverage industry is a visible example. PepsiCo states that in 2024, 89% of its direct global electricity needs were met with renewable electricity—around 3,900 GWh—out of roughly 4,400 GWh total electricity use that year. Nestlé reports that by the end of 2024, it reached 95.3% sourced renewable electricity across its manufacturing sites, with a stated aim of 100% by 2025. These are not “small pilots”; they show how large, power-hungry companies are moving from ambition to execution.

Policy also supports this opportunity by encouraging more local clean-tech supply and faster project pipelines. In Europe, the European Commission’s Net-Zero Industry Act sets a goal for net-zero technology manufacturing capacity to meet at least 40% of the EU’s annual deployment needs by 2030, aiming to improve certainty for manufacturers and investors. As regions push for more resilient supply chains, thin-film manufacturers that can scale locally and serve C&I demand with consistent deliveries can find new commercial lanes.

Regional Insights

Asia Pacific is the center of gravity for thin-film photovoltaic activity, supported by scale in solar build-outs, deep manufacturing ecosystems, and fast-moving policy programs. Asia Pacific dominates the Thin-film Photovoltaic market with a 42.3% share, valued at USD 16.9 Bn. This leadership is closely tied to the region’s ability to execute large, grid-connected projects quickly and to source modules and components through dense supplier networks. China, in particular, keeps raising the ceiling on deployment volume—U.S. EIA, citing China’s National Energy Administration, reported 277 GW of utility-scale solar capacity installed in China in 2024 alone, and utility-scale solar capacity in China exceeded 880 GW in 2024.

The industrial environment also favors Asia Pacific because the region is the backbone of global PV manufacturing scale. The IEA has noted that China accounted for over 95% of new solar PV manufacturing facilities across the supply chain in 2022, and that China was expected to claim over 90% of the manufacturing capacity increase as global PV manufacturing expanded across 2023–2024. This matters for thin-film as well, because tighter supplier lead times and localized equipment/service support reduce project risk and improve delivery certainty—two issues that strongly influence developer purchasing decisions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

First Solar — scale and contracted demand strength (2024–2025): In 2024, it reported $4.2B net sales and $12.02 EPS, ending with $1.2B net cash. It also booked 4.4 GW in 2024 at an average selling price of 30.5¢/W (excluding specified adjusters). For 2025, it guided net sales of $5.3B–$5.8B, reflecting a strong contracted utility pipeline.

Oxford Photovoltaics Ltd. — perovskite tandems entering market reality (2025): In 2025, it stated its first commercial panels achieved 24.5% module efficiency, produced on a megawatt-scale pilot line in Brandenburg an der Havel, Germany. It also announced a tandem solar panel reaching 25% efficiency. The company’s public roadmap targets 27% module efficiency by 2027, signaling a shift from lab progress to sellable product.

JA SOLAR Technology Co., Ltd. — volume manufacturing and high R&D intensity: In 2024, it disclosed operating revenue of 70,120,697,029.73 yuan, with PV modules contributing 66,627,740,897.28 yuan. It spent 3,710,699,801.90 yuan on R&D (about 5.29% of revenue) and reported 1,899 valid patents, including 1,031 invention patents—showing scale backed by technology investment.

Top Key Players Outlook

- First Solar

- Oxford Photovoltaics Ltd.

- JA SOLAR Technology Co., Ltd.

- Enecom S.r.l.

- QS SOLAR

- Heliatek

- Panasonic Holdings Corporation

- REC Solar Holdings AS

- KANEKA CORPORATION

- Hanwha Qcells

Recent Industry Developments

Oxford PV’s work is not just about setting records; the company is building a practical path toward higher-yield solar products that can deliver more power from the same roof or ground space, often over 20% more energy compared to conventional panels, a fact the firm highlights to show real benefits for end users and developers.

In the thin-film photovoltaic sector, Enecom S.r.l. from Italy is carving out a niche by focusing on flexible, ultra-thin, and lightweight PV modules suited for special installations where traditional rigid panels don’t fit. Enecom’s HF series panels range from HF 45 (45 Wp) up to HF 185 and beyond, offering power outputs such as 145 W, 165 W, and 205 W depending on the model, with weights as low as about 3.7 kg to 5 kg and thickness near 3.5 mm, making installation simpler on curved or weight-sensitive surfaces like boat decks, roofs, and mobile applications.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Bn Forecast Revenue (2034) USD 14.2 Bn CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si)), By End User (Residential, Commercial, Industrial), By Installation (On-Grid, Off-Grid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape First Solar, Oxford Photovoltaics Ltd., JA SOLAR Technology Co., Ltd., Enecom S.r.l., QS SOLAR, Heliatek, Panasonic Holdings Corporation, REC Solar Holdings AS, KANEKA CORPORATION, Hanwha Qcells Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thin-film Photovoltaic MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Thin-film Photovoltaic MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- First Solar

- Oxford Photovoltaics Ltd.

- JA SOLAR Technology Co., Ltd.

- Enecom S.r.l.

- QS SOLAR

- Heliatek

- Panasonic Holdings Corporation

- REC Solar Holdings AS

- KANEKA CORPORATION

- Hanwha Qcells