Global Thermoplastic Vulcanizates Market By Processing Method (Injection Molding, and Extrusion), By Application (Automotive, Fluid Handling, Consumer Goods, Medical, Footwear, and Other), By End-user Industry (Automotive, Building and Construction, Consumer Goods, Healthcare, and Other End-user Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100216

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

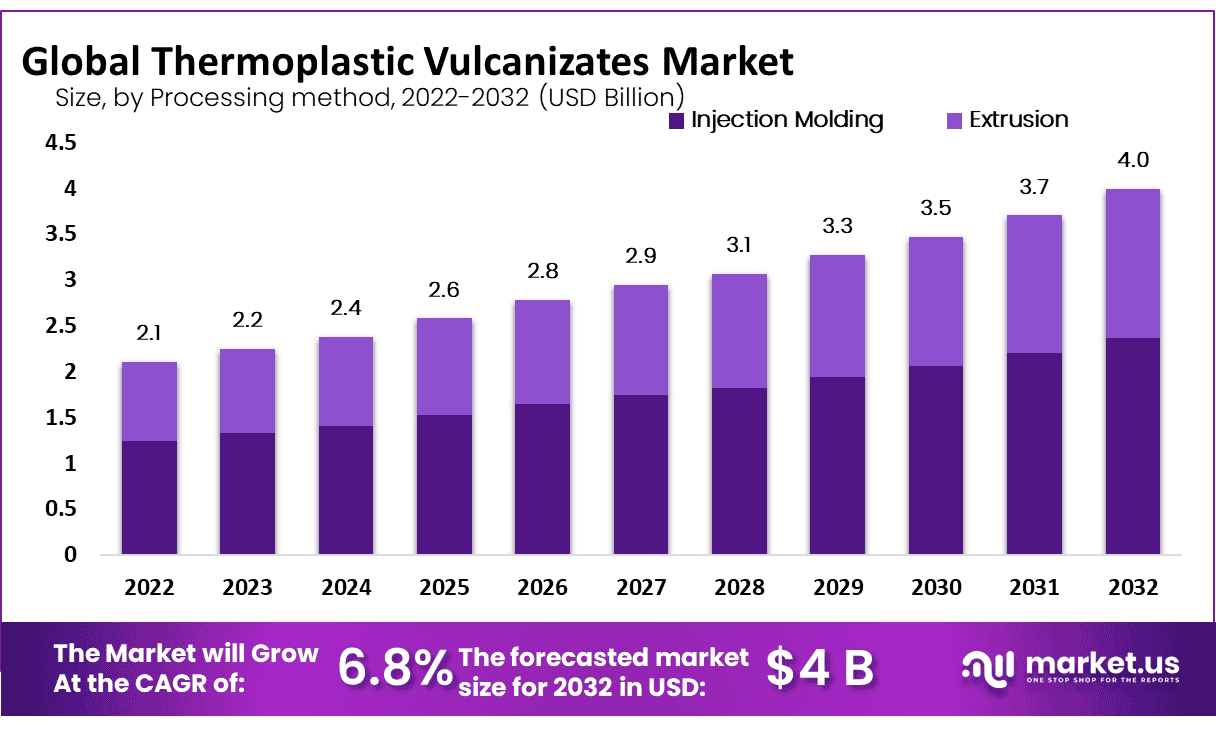

The Global Thermoplastic Vulcanizates Market size is expected to be worth around USD 4 Billion by 2032 from USD 2.1 Billion in 2022, growing at a CAGR of 6.80% during the forecast period from 2023 to 2032.

Thermoplastic vulcanizates (TPVs) are a type of thermoplastic elastomer that combines the properties of vulcanized rubber and thermoplastics. They are made by blending a vulcanized rubber phase, typically made of ethylene propylene diene monomer (EPDM) or natural rubber, with a thermoplastic phase, usually made of polypropylene (PP) or polyethylene (PE).

TPVs exhibit the elasticity and durability of vulcanized rubber, while also offering the processing ease, recyclability, and design flexibility of thermoplastics. They are used in a variety of applications, including automotive parts, consumer goods, industrial equipment, and construction materials.

Key Takeaways

- Market Growth: The global thermoplastic vulcanizates (TPV) market is experiencing strong expansion with an expected Compound Annual Growth Rate (CAGR) from 2023-2032 of 6.80%.

- Overview: Thermoplastic Vulcanizates (TPVs) are versatile materials that combine characteristics from thermoplastics and elastomers. Their excellent properties such as flexibility, weather resistance, and high-temperature stability make them invaluable in various applications.

- Processing Method Analysis: The thermoplastic vulcanizates market can be divided into two broad processing categories based on processing method; injection molding and extrusion are respectively dominant methods within this sector, with injection molding dominating in terms of market presence. With injection molding being the dominant manufacturing technique where plastic pellets are heated before being melted down and injected into mold cavities to produce desired products, injection molding remains dominant within its segment of the thermoplastic vulcanizates market.

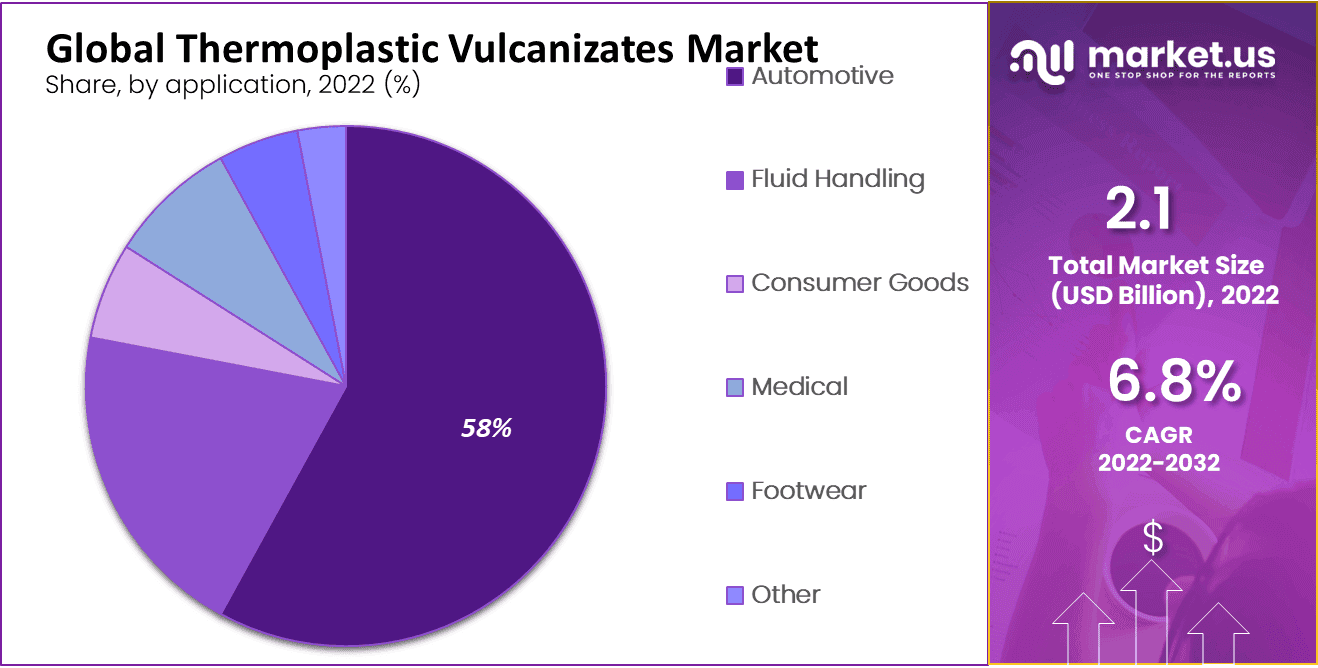

- Applications: In terms of applications, the market can be broken down into various segments such as automotive, fluid handling, consumer goods, medical footwear, and footwear among others. Automotive was found to hold 58% market share at first.

- End Users: In terms of end users, the market can be broken down into automotive, building and construction, consumer goods, healthcare, and other industries. In construction alone, TPVs find widespread application as seals, gaskets, roofing material, and weather stripping solutions.

- Drivers: Key factors driving market expansion include an increasing automotive industry, awareness of lightweight materials for fuel efficiency, and rising demand for sustainable and recyclable products – with TPV’s combination of rubber and plastic properties fuelling market expansion.

- Restraints: Market challenges involve fluctuating raw material prices and ongoing research and development efforts in order to further optimize TPV properties. In addition, regulatory compliance issues and evolving thermoplastic vulcanizates industry standards present additional restraints.

- Opportunity: Market expansion lies within developing bio-based TPV materials and forging partnerships across the value chain to develop sustainable production methods, while innovation within TPV technology and applications provides thermoplastic vulcanizates market growth potential.

- thermoplastic vulcanizates market Trends: Current market trends include an emphasis on bio-based TPV products, improved manufacturing techniques, and an emphasis on circular economy principles. Collaboration for thermoplastic vulcanizates material innovations and recycling initiatives also represent notable developments.

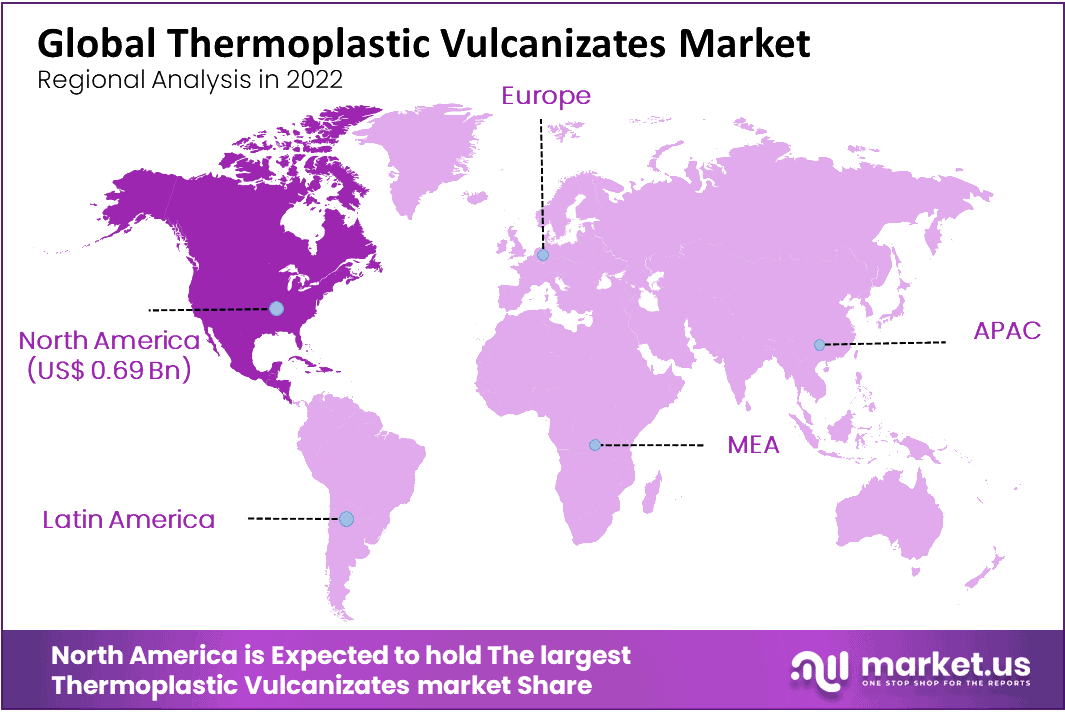

- Regional Analysis: The thermoplastic vulcanizates (TPV) market can be broken into six main regions: North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa – North America being the dominant region with a 33% market share.

- Key Players in the TPV Market: Established companies and startups specializing in the thermoplastic vulcanizates production and applications of TPV dominate this dynamic industry, investing heavily in research & development, sustainability initiatives, strategic collaborations, and competitive collaborations to meet changing market demands while maintaining an edge over rival players.

Driving Factors

The global thermoplastic vulcanizates (TPVs) market is being driven by several key factors. One major driver is the rising demand for lightweight and durable materials across various end-use industries such as automotive, consumer goods, industrial equipment, construction, etc. TPVs boast superior properties like elasticity, toughness, and chemical resistance that make them suitable for numerous applications.

Another major influencer is the growing awareness of sustainability and the demand for materials that can be easily recycled or reused. TPVs are fully recyclable and processed using standard injection molding equipment, providing manufacturers with both cost-effective and eco-friendly alternatives.

The growth of this market is driven by rising demands in automotive and construction materials across countries like China, India, and Japan. Rapid urbanization, infrastructure development, and rising disposable incomes have created an increasing need for high-quality materials with long-lasting durability, making TPVs an attractive option for manufacturers. Furthermore, rising demands for lightweight sustainable materials along with increasing needs in various industries are fueling growth in this global thermoplastic vulcanizates market.

Restraining Factors

Though the thermoplastic vulcanizates (TPVs) market looks positive, there are potential obstacles that could hinder its expansion. One major hurdle is the high cost of TPVs compared to other thermoplastic materials like polyethylene and polypropylene; this could limit their adoption in price-sensitive markets.

Furthermore, limited raw material availability (e.g. EPDM rubber) could cause price fluctuations and supply chain disruptions, potentially impacting manufacturers’ profitability and restricting TPV availability on the market.

Growth Opportunities

The global thermoplastic vulcanizates (TPVs) market offers several prospects for growth and innovation. One primary driver is the increasing demand for sustainable materials, along with the growing trend toward circular economy practices.

TPVs are fully recyclable and offer an alternative to traditional materials which are difficult or impossible to recycle or dispose of. This provides manufacturers with a unique chance to develop new TPV-based products and applications that adhere to eco-friendly principles.

Another opportunity lies in the growing use of TPVs in healthcare. These valves boast several advantages such as biocompatibility, sterilization resistance, and good chemical resistance that make them suitable for medical applications like tubing, drug delivery systems, and surgical instruments.

With an increasing demand for high-quality medical devices and equipment comes an exciting prospect for TPV manufacturers to expand into this growing market.

The automotive industry presents an opportunity for TPV manufacturers. TPVs are widely used in several automotive applications, such as seals, gaskets, and weatherstripping due to their exceptional weathering resistance, chemical resistance, and ease of processing.

With the growing demand for lightweight and fuel-efficient vehicles coming online, there is a significant window of opportunity for TPV manufacturers to create innovative products that address these changing demands.

Trending Factors

The global thermoplastic vulcanizates (TPVs) market is witnessing several trends that will shape its future growth trajectory. One major development is the rising demand for lightweight and high-performance materials across various end-use industries.

TPVs boast properties like elasticity, toughness, and chemical resistance that make them ideal for use in industries such as automotive, consumer goods, and construction.

Another trend in manufacturing is a growing emphasis on sustainability and circular economy principles. TPVs, which are fully recyclable and offer an environmentally friendly alternative to traditional materials that are difficult to recycle or dispose of, make them attractive alternatives for companies seeking to reduce their environmental impact.

The Asia-Pacific region is witnessing a trend towards rapid industrialization, urbanization, and infrastructure development that is increasing demand for high-quality and durable materials such as TPVs. Forecasts predict that this region will become the largest and fastest-growing market for TPVs due to its expanding manufacturing sector, rising disposable incomes, and expanding population.

Additionally, the healthcare industry is seeing an increasing trend toward using innovative and biocompatible materials in medical devices and equipment – such as TPVs. TPVs offer several advantages like biocompatibility, sterilization resistance, and good chemical resistance that make them suitable for applications such as medical tubing or surgical instruments.

Processing Method Analysis

On the basis of the processing method, the market for thermoplastic vulcanizates is segmented into injection molding and extrusion. Among these segments, it is seen that the injection molding method is dominant in the market. Injection molding is a manufacturing process that involves melting plastic pellets and injecting the molten material into a mold cavity.

Under high pressure, this TPV material is forced into the mold cavity before cooling to form its final product. Injection molding is a widely used processing method for thermoplastic valves (TPVs) due to its precision in creating complex shapes and accurate dimensions. Extrusion, on the other hand, involves pushing molten material through a die in order to form one continuous profile or tube.

Extrusion is a popular process for producing profiles, tubing, and sheet materials. TPV extrusion can be accomplished using either single or twin-screw extruders; single-screw extruders are ideal for creating simpler shapes while twin-screw extruders offer greater versatility when crafting more complex shapes and formulations.

Application Analysis

By application, the market is divided into different segments such as automotive, fluid handling, consumer goods, medical, footwear, and other applications. Automotive emerged as the largest application segment with a market share of about 58%. In the automotive industry, TPVs are widely used to create a variety of parts, including seals, gaskets, weatherstripping, and interior trim.

They are perfect for automotive applications because of their exceptional weather ability, low compression set, and long-term durability. Consumer products like toys, sporting items, and home appliances are made using TPVs. They are perfect for applications requiring a soft touch and grip thanks to their exceptional flexibility, softness, and elasticity.

End-User Analysis

Based on end users, the market is segmented into automotive, building and construction, consumer goods, healthcare, and other end-user industries. TPVs are widely used in the construction industry for applications such as seals, gaskets, roofing materials, and weather stripping.

Their excellent weather ability, UV resistance, and durability make them perfect for construction jobs. In healthcare too, TPVs find applications such as tubing, connectors, and seals on medical devices due to their chemical resistance, biocompatibility, and sterilization compatibility, making them perfect choices for medical usage.

Key Market Segments

Based on the Processing Method

- Injection Molding

- Extrusion

Based on Application

- Automotive

- Fluid Handling

- Consumer Goods

- Medical

- Footwear

- Other

Based on End-user Industry

- Automotive

- Building and Construction

- Consumer Goods

- Healthcare

- Other End-user Industries

Regional Analysis

The global thermoplastic vulcanizates (TPV) market is segmented into several regions, including North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa. From these regions, the North American region is dominant in the market with 33% of the market share.

The Asia-Pacific region is expected to be the largest and fastest-growing market for TPVs, driven by factors such as rapid industrialization, urbanization, and infrastructure development in countries like China, India, and Japan. The region is also home to several major automotive manufacturers, which creates a significant demand for TPVs in the automotive industry.

North America and Europe are mature markets for TPVs, with established end-use industries such as automotive, consumer goods, and construction. The regions are characterized by high levels of innovation and technological advancements, which drive demand for high-performance and innovative materials such as TPVs.

Latin America the Middle East and Africa are emerging markets for TPVs, with increasing demand for durable and high-quality materials in various end-use industries. The regions are expected to experience significant growth in the coming years due to their expanding manufacturing sectors, rising disposable incomes, and growing population.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global thermoplastic vulcanizates (TPV) market is highly competitive, with several major players operating within it. Companies are actively engaged in R&D activities to develop new products and applications for TPVs; they also compete on product quality, innovation, and price.

To meet growing demands for novel materials across various end-use industries, it’s expected that major players within TPV will continue investing in research and development initiatives.

Market Key Players

- JSR Corporation

- Exxon Mobil Corp

- RTP Company

- DuPont de Nemours Inc

- Mitsui Chemicals Inc

- Celanese Corp

- Lyondell Basell Industries Holdings B V

- Mitsubishi Chemical Corp

- Ravago Manufacturing

- KUMHO POLY CHEM

- Avient Corporation

- FM Plastics

- Elastron TPE

- LCY GROUP

- Other Key Players

Recent Developments

- In April 2023, ExxonMobil introduced its new TPV product called Exceed™ 80CR. It is a high-performance material used in tough applications like automotive and industrial.

- In May 2023, Lanxess expanded its TPV production in China, which will finish in 2024. This expansion will increase their production capacity by 50%.

- In June 2023, the International Organization for Standardization (ISO) released a new standard for TPV, known as ISO 18064-1:2023. This standard provides specifications for testing and characterizing TPV materials.

Report Scope

Report Features Description Market Value (2022) USD 2.1 Bn Forecast Revenue (2032) USD 4.0 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Processing Method-Injection Molding, and Extrusion; By Application-Automotive, Fluid Handling, Consumer Goods, Medical, Footwear, and Other; By End-user Industry-Automotive, Building and Construction, Consumer Goods, Healthcare, and Other End-user Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape JSR Corporation, Exxon Mobil Corp, RTP Company, DuPont de, Nemours Inc, Mitsui Chemicals Inc, Celanese Corp, Lyondell Basell Industries Holdings B V, Mitsubishi Chemical Corp, Ravago Manufacturing, KUMHO POLYCHEM, Avient Corporation, FM Plastics, Elastron TPE, LCY GROUP, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Thermoplastic Vulcanizates Market CAGR?The Thermoplastic Vulcanizates Market CAGR is growing at a CAGR of 6.80% during the forecast period from 2023 to 2032.

What is the Thermoplastic Vulcanizates Market Size in 2022?The Thermoplastic Vulcanizates Market size was USD 2.1 Billion in 2022, growing at a CAGR of 6.80%.

What is the Thermoplastic Vulcanizates Market Size Expected During the Forecast Period?The Thermoplastic Vulcanizates Market size is expected to be worth around USD 4 Billion by 2032.

Thermoplastic Vulcanizates MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Thermoplastic Vulcanizates MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- JSR Corporation

- Exxon Mobil Corp

- RTP Company

- DuPont de Nemours Inc

- Mitsui Chemicals Inc

- Celanese Corp

- Lyondell Basell Industries Holdings B V

- Mitsubishi Chemical Corp

- Ravago Manufacturing

- KUMHO POLY CHEM

- Avient Corporation

- FM Plastics

- Elastron TPE

- LCY GROUP

- Other Key Players