Global Theme Park Market Size, Share, Growth Analysis By Type (Theme Parks, Water Parks, Adventure Parks, Zoo Parks), By Ride (Mechanical Rides, Water Rides, Others), By Age-Group (19 to 35 years, Up to 18 years, 36 to 50 years, 51 to 65 years, Above 65 years), By Revenue Source (Tickets, Food & Beverage, Merchandise, Hotel & Resorts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176324

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

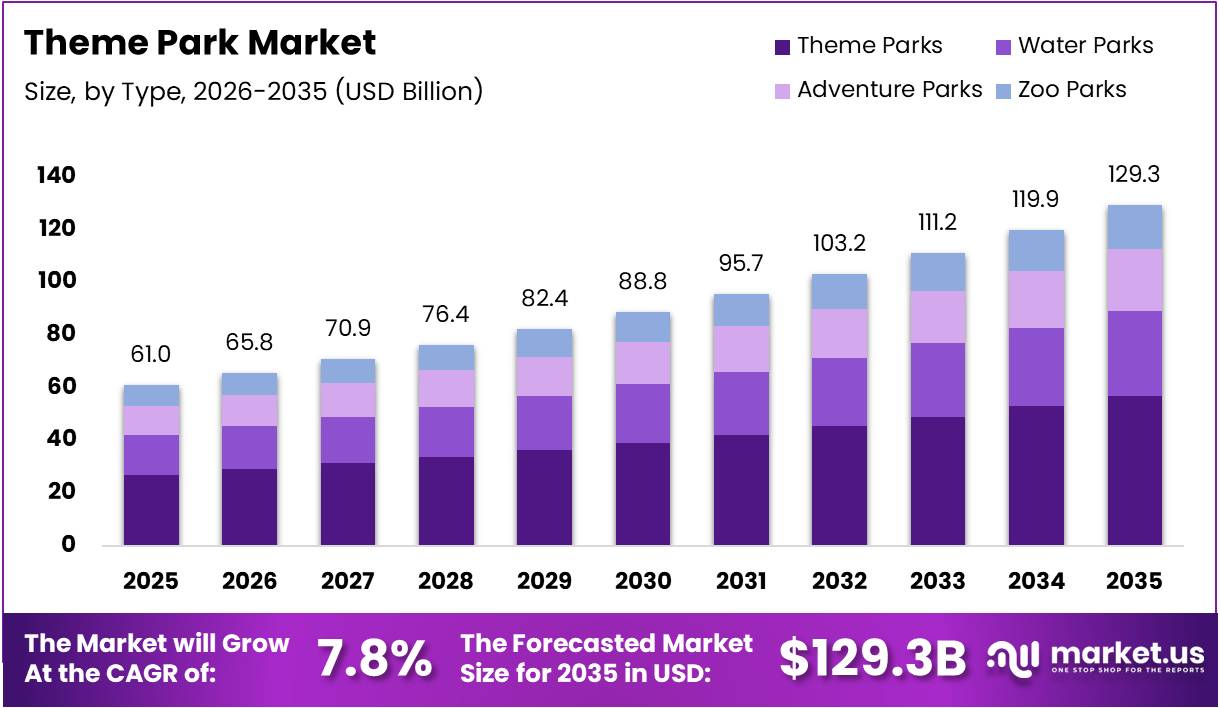

The Global Theme Park Market size is expected to be worth around USD 129.3 Billion by 2035 from USD 61.0 Billion in 2025, growing at a CAGR of 7.8% during the forecast period 2026 to 2035.

Theme parks represent entertainment destinations offering various attractions, rides, and immersive experiences for visitors across all age groups. These venues combine mechanical rides, water attractions, adventure zones, and themed environments. Consequently, they serve as major leisure destinations driving tourism and hospitality sectors globally.

The market demonstrates robust expansion driven by rising disposable incomes and growing demand for experiential entertainment. Moreover, integrated resort developments combining parks with hotels and retail spaces attract diverse visitor segments. Therefore, operators focus on delivering comprehensive entertainment experiences beyond traditional ride-based attractions.

Government initiatives supporting tourism infrastructure development create favorable conditions for market growth. Additionally, expansion into emerging markets and secondary cities opens new revenue opportunities. However, operators must navigate seasonal attendance patterns and maintain strict safety compliance standards throughout their operations.

Family-oriented entertainment drives substantial market demand as groups seek shared leisure experiences. Furthermore, integration of licensed intellectual properties and global franchises enhances attraction appeal. Consequently, theme parks invest heavily in branded content and character-based experiences to differentiate their offerings.

Technological advancement reshapes visitor experiences through augmented reality and virtual reality attractions. Moreover, smart queuing systems and mobile-based park management improve operational efficiency. Additionally, dynamic pricing models and annual pass programs optimize revenue generation while enhancing visitor accessibility and engagement.

According to PMC, typical U.S. theme park visitor parties include approximately 3 adults and 2 children under 18, with roughly 65% making day-trip visits and 61% visiting during summer months. Furthermore, According to The Themed Attraction, 83% of guests visit theme parks seeking escapism from everyday lives.

According to research, 40% of theme park visitors globally represent repeat customers, demonstrating strong loyalty and satisfaction levels. Therefore, operators prioritize experience quality and innovation to maintain competitive positioning. Additionally, sustainability initiatives and energy-efficient operations align with evolving consumer preferences and regulatory requirements.

Key Takeaways

- Global Theme Park Market valued at USD 61.0 Billion in 2025, projected to reach USD 129.3 Billion by 2035 at 7.8% CAGR

- Theme Parks segment dominates by type with 44.1% market share in 2025

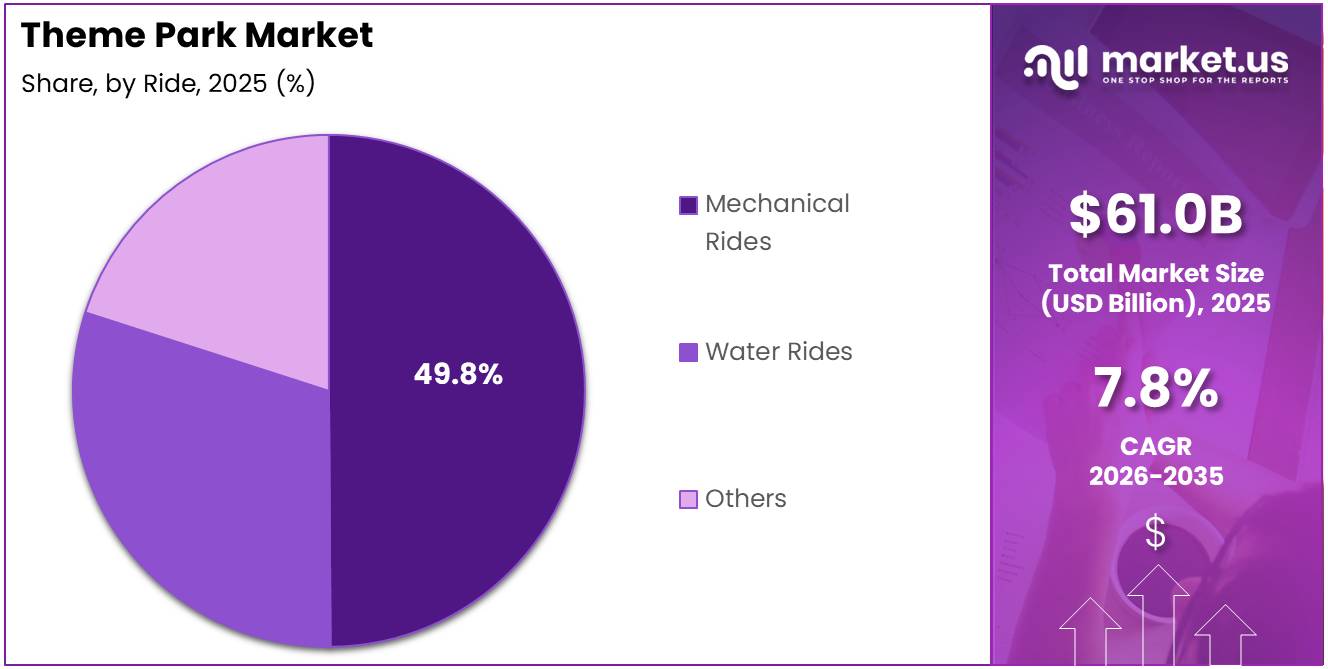

- Mechanical Rides segment holds 49.8% share in ride category

- 19 to 35 years age group leads with 42.6% market share

- Tickets revenue source captures 49.9% of total market revenue

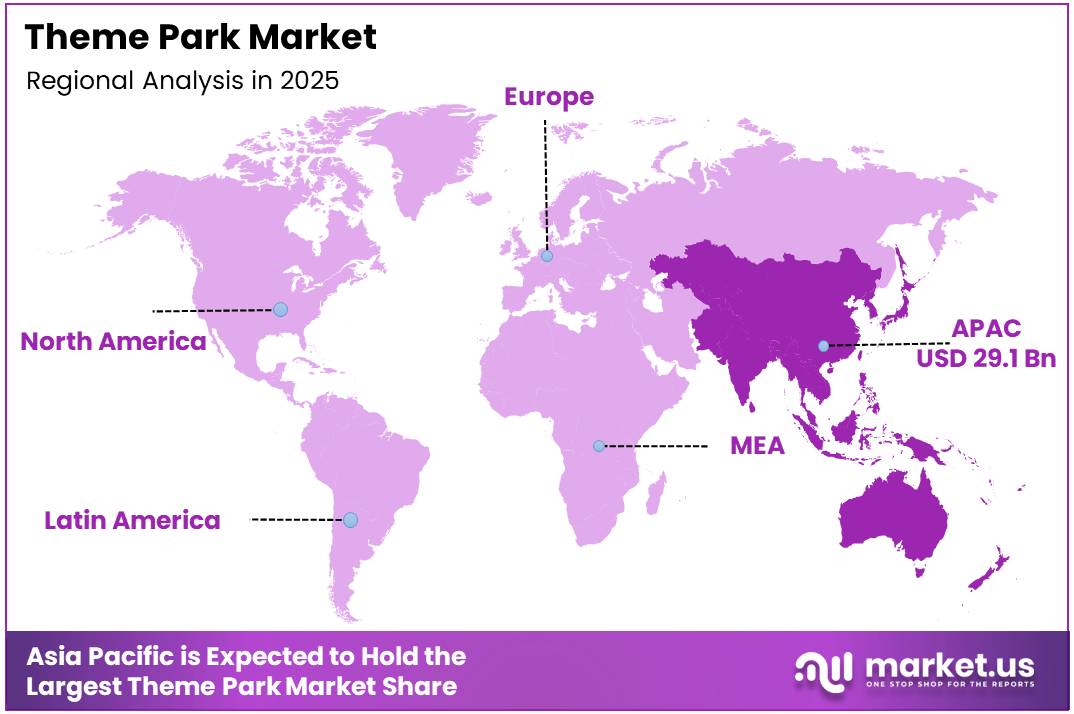

- Asia Pacific dominates regional market with 47.80% share, valued at USD 29.1 Billion

- Approximately 40% of global theme park visitors are repeat customers

- 83% of guests visit theme parks for escapism from everyday life

Type Analysis

Theme Parks held a dominant market position in the By Type segment of Theme Park Market, with a 44.1% share.

In 2025, Theme Parks held a dominant market position in the By Type segment of the Theme Park Market, accounting for a 44.1% share. These destinations offer a wide range of attractions, live shows, character interactions, and diverse dining options. As a result, theme parks attract millions of visitors annually through innovative rides and immersive themed environments, while continuous investment in new attractions by major operators supports repeat visitation and sustained competitive advantage.

Water Parks provide aquatic-based entertainment featuring slides, wave pools, and lazy rivers designed for summer seasons. These facilities attract families seeking refreshing recreational activities during warmer months. Moreover, water parks often integrate with traditional theme parks to extend seasonal operations. Therefore, operators leverage combined offerings to maximize annual attendance and revenue streams.

Adventure Parks focus on outdoor activities including zip lines, rope courses, and nature-based experiences. These venues cater to thrill-seekers and active visitors preferring physical challenges. Additionally, adventure parks require lower infrastructure investment compared to traditional theme parks. However, they face weather-related operational constraints limiting year-round accessibility.

Zoo Parks combine wildlife conservation with educational entertainment, appealing to environmentally conscious visitors. These facilities emphasize animal welfare and species preservation alongside recreational experiences. Furthermore, zoo parks attract school groups and educational institutions seeking experiential learning opportunities. Consequently, they maintain steady attendance through diversified visitor segments.

Ride Analysis

Mechanical Rides held a dominant market position in the By Ride segment of Theme Park Market, with a 49.8% share.

In 2025, Mechanical Rides held a dominant market position in the By Ride segment of the Theme Park Market, accounting for a 49.8% share. These rides include roller coasters, spinning attractions, and motion simulators that deliver high-intensity thrill experiences. As a result, mechanical rides represent major capital investments supported by advanced engineering and safety systems, while also acting as primary draw attractions that influence visitor choice and park differentiation strategies.

Water Rides encompass flume rides, river rapids, and splash attractions providing cooling entertainment during peak seasons. These installations combine thrill elements with refreshing experiences appealing to broad demographics. Additionally, water rides integrate theming and storytelling to enhance immersive qualities. Therefore, parks utilize water attractions to balance ride portfolios and manage capacity distribution.

Others category includes gentle rides, children’s attractions, and interactive experiences suitable for all ages. These offerings ensure family-friendly environments accommodating younger visitors and risk-averse guests. Furthermore, gentle rides provide accessibility options for visitors with mobility constraints. Consequently, diversified ride portfolios maximize market reach across demographic segments.

Age Group Analysis

19 to 35 years held a dominant market position in the By Age-Group segment of Theme Park Market, with a 42.6% share.

In 2025, the 19 to 35 years segment held a dominant market position in the By Age-Group segment of the Theme Park Market, accounting for a 42.6% share. This demographic actively seeks social and shareable experiences suited for friend groups and couples. As a result, young adults exhibit higher spending on premium offerings such as fast passes and exclusive events, prompting parks to design targeted attractions and marketing strategies aligned with Millennial and Gen Z preferences.

Up to 18 years represents children and teenagers requiring family-supervised visits and age-appropriate attractions. This segment drives family vacation decisions and influences household leisure spending patterns. Additionally, character-based attractions and franchise integrations appeal strongly to younger demographics. Consequently, operators prioritize safety features and parental amenities to accommodate family groups effectively.

36 to 50 years demographic consists primarily of parents accompanying children and seeking balanced entertainment options. These visitors value convenience amenities including stroller rentals and family dining facilities. Furthermore, this age group demonstrates strong preference for multi-day visits and resort accommodations. Therefore, integrated offerings combining park access with lodging appeal to family-oriented travelers.

51 to 65 years segment represents empty nesters and mature adults seeking nostalgic and leisurely experiences. These visitors prefer gentler attractions and comfortable facilities over high-intensity rides. Additionally, this demographic shows interest in cultural shows and seasonal events. However, they typically visit during off-peak periods avoiding summer crowds.

Above 65 years includes senior citizens requiring accessibility accommodations and health-conscious facilities. This segment demonstrates lower attendance frequency but appreciates discounted pricing and special programs. Moreover, senior visitors prefer educational attractions and scenic park environments. Consequently, operators enhance accessibility features and rest areas to accommodate aging populations.

Revenue Source Analysis

Tickets held a dominant market position in the By Revenue Source segment of Theme Park Market, with a 49.9% share.

In 2025, Tickets held a dominant market position in the By Revenue Source segment of the Theme Park Market, accounting for a 49.9% share. Ticket sales generate core revenue through single-day passes, multi-day tickets, and annual memberships. As a result, operators use dynamic and tiered pricing strategies to optimize revenue based on demand fluctuations and seasonal patterns, improving yield management and capacity utilization.

Food & Beverage generates substantial ancillary revenue through dining outlets, snack stands, and beverage sales throughout park premises. These offerings provide necessary refreshments for all-day visitors while creating additional monetization opportunities. Additionally, premium dining experiences and character meals command higher price points. Consequently, F&B operations contribute significantly to per-capita spending and overall profitability.

Merchandise encompasses souvenir shops, branded apparel, and collectible items reinforcing visitor memories and park branding. These retail operations capitalize on emotional connections and nostalgia driving impulse purchases. Furthermore, exclusive merchandise tied to attractions and franchises enhances perceived value. Therefore, strategic retail placement throughout parks maximizes conversion rates and transaction values.

Hotel & Resorts revenue derives from on-site accommodations encouraging extended stays and repeat visits. Integrated resort models provide convenience and exclusive benefits for overnight guests. Moreover, proximity to park entrances delivers premium value justifying higher room rates. Additionally, package deals combining lodging with park access optimize revenue capture and visitor satisfaction levels.

Others category includes parking fees, locker rentals, photo packages, and special event charges diversifying income streams. These ancillary services enhance visitor convenience while generating incremental revenue. Furthermore, premium experiences like VIP tours and behind-the-scenes access command substantial pricing. Consequently, diversified revenue sources reduce dependence on admission tickets and improve financial stability.

Key Market Segments

By Type

- Theme Parks

- Water Parks

- Adventure Parks

- Zoo Parks

By Ride

- Mechanical Rides

- Water Rides

- Others

By Age-Group

- 19 to 35 years

- Up to 18 years

- 36 to 50 years

- 51 to 65 years

- Above 65 years

By Revenue Source

- Tickets

- Food & Beverage

- Merchandise

- Hotel & Resorts

- Others

Drivers

Rising Disposable Income Supporting Premium Leisure Spending

Growing household incomes globally enable families to allocate larger budgets toward experiential entertainment and leisure activities. Consequently, theme park visits transition from occasional treats to regular recreational options. Moreover, middle-class expansion in emerging markets creates substantial new visitor bases. Therefore, operators strategically position offerings to capture increasing consumer spending power.

Expansion of integrated resorts combining parks, hotels, and retail creates comprehensive entertainment destinations. These developments attract extended-stay visitors and drive higher per-capita spending through multiple touchpoints. Additionally, resort models generate synergies between accommodation and attraction operations. Furthermore, bundled packages enhance value perception while optimizing revenue capture across business segments.

Strong demand for family-oriented and group entertainment experiences drives consistent market growth. Families prioritize shared activities creating lasting memories and strengthening social bonds. Moreover, group discounts and corporate event packages expand visitor demographics beyond traditional leisure segments. Additionally, government support for tourism-led infrastructure development provides favorable policy environments and investment incentives for expansion.

Restraints

Strict Safety Regulations and Compliance Requirements

Theme park operators face extensive safety regulations governing ride inspections, maintenance protocols, and emergency procedures. Compliance requires substantial ongoing investments in specialized personnel and certification processes. Moreover, regulatory frameworks vary across jurisdictions creating operational complexities for multi-location operators. Therefore, safety compliance represents significant cost burdens impacting profitability margins.

Seasonal attendance fluctuations create revenue instability as visitor numbers concentrate during peak vacation periods. Weather dependencies particularly affect outdoor attractions reducing operational days in certain regions. Additionally, staffing challenges emerge from seasonal employment patterns requiring extensive recruitment and training investments. Consequently, operators struggle to maintain consistent service quality throughout fluctuating demand cycles.

High capital requirements for attraction development and infrastructure upgrades limit market entry and expansion capabilities. New ride installations demand multi-million dollar investments with extended payback periods. Furthermore, ongoing maintenance and technology updates require continuous capital allocation. Additionally, insurance costs and liability concerns add financial pressures. Therefore, smaller operators face difficulties competing against established players with deeper financial resources.

Growth Factors

Development of Indoor and All-Weather Theme Parks

Indoor theme park development enables year-round operations eliminating weather-related attendance disruptions. Climate-controlled environments attract visitors during off-peak seasons and adverse conditions. Moreover, indoor facilities allow operations in markets with challenging climates previously unsuitable for traditional parks. Therefore, all-weather venues expand addressable markets and stabilize revenue streams.

Untapped demand in secondary cities and emerging tourist destinations presents substantial expansion opportunities. Populations in tier-two and tier-three cities demonstrate growing leisure spending without local entertainment options. Additionally, reduced competition and lower real estate costs improve project economics. Furthermore, regional attractions cater to local preferences avoiding saturated primary markets.

Licensing of global entertainment franchises and IP-based attractions drives visitor interest through familiar characters and stories. Popular franchises guarantee built-in fan bases reducing marketing requirements for new attractions. Moreover, IP partnerships enhance immersive experiences through authentic theming and storytelling. Additionally, monetization through dynamic pricing and annual pass models optimizes revenue generation while improving accessibility and visitor retention.

Emerging Trends

Adoption of Immersive Technologies Including AR and VR Attractions

Augmented reality and virtual reality technologies transform traditional attractions into interactive digital experiences. These innovations enable storylines and environments impossible with physical infrastructure alone. Moreover, technology-based attractions require lower ongoing maintenance compared to mechanical rides. Therefore, operators integrate digital experiences to differentiate offerings and appeal to tech-savvy demographics.

Focus on sustainability and energy-efficient park operations addresses environmental concerns and operational cost reduction. Solar installations, water recycling systems, and LED lighting decrease resource consumption and environmental footprints. Additionally, sustainable practices enhance brand reputation attracting environmentally conscious visitors. Furthermore, green certifications provide marketing advantages and potential regulatory benefits in environmentally focused markets.

Integration of smart queuing and mobile-based visitor management enhances operational efficiency and guest satisfaction. Mobile apps provide real-time wait times, dining reservations, and navigation assistance throughout park facilities. Moreover, virtual queuing systems reduce physical line congestion improving overall experience quality. Additionally, growing popularity of themed events and limited-time experiences drives repeat visitation creating urgency and exclusivity appealing to core audiences.

Regional Analysis

Asia Pacific Dominates the Theme Park Market with a Market Share of 47.80%, Valued at USD 29.1 Billion

Asia Pacific leads global theme park growth driven by massive populations, rising incomes, and expanding tourism infrastructure. China, Japan, and India represent major markets with growing middle classes prioritizing experiential entertainment. Moreover, government initiatives supporting tourism development create favorable investment environments. Therefore, international operators expand aggressively throughout the region capturing emerging opportunities and establishing market presence.

North America Theme Park Market Trends

North America maintains mature market status with established operators and iconic destinations attracting domestic and international visitors. The United States dominates regional attendance with Florida and California serving as primary destinations. Moreover, Canadian markets demonstrate steady growth though remaining smaller relative to U.S. operations. Additionally, innovation in attractions and technologies sustains visitor interest despite market maturity.

Europe Theme Park Market Trends

Europe showcases diverse theme park landscape ranging from large-scale resorts to regional attractions serving local populations. Germany, France, and United Kingdom host major international brands alongside domestic operators. Moreover, cultural heritage sites integrate entertainment elements creating unique hybrid attractions. Therefore, European markets balance tradition with modern entertainment preferences while navigating varied regulatory environments across countries.

Latin America Theme Park Market Trends

Latin America demonstrates growing potential as economic development increases discretionary spending on leisure activities. Brazil and Mexico represent primary markets with expanding middle classes and tourism sectors. Moreover, tropical climates support year-round outdoor operations reducing seasonal dependencies. However, economic volatility and infrastructure challenges constrain consistent growth trajectories requiring strategic patience from investors.

Middle East & Africa Theme Park Market Trends

Middle East & Africa exhibits emerging opportunities particularly in Gulf Cooperation Council nations investing heavily in tourism diversification. Dubai and Abu Dhabi develop world-class entertainment destinations attracting international visitors. Moreover, South Africa maintains established regional presence serving domestic and African tourist markets. Therefore, strategic developments focus on creating differentiated offerings suitable for diverse cultural contexts and climate conditions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Disney maintains global leadership through iconic franchises, superior storytelling capabilities, and integrated entertainment ecosystems spanning films, merchandise, and streaming. The company operates flagship destinations worldwide delivering premium experiences justified by higher pricing. Moreover, continuous franchise development ensures fresh content pipelines sustaining attraction relevance. Therefore, Disney captures premium market segments through unmatched brand equity and intellectual property portfolios creating sustainable competitive advantages.

Merlin Entertainments operates diversified portfolio including LEGOLAND parks, Madame Tussauds, and SEA LIFE attractions serving varied demographics. The company emphasizes regional presence and scalable attraction formats enabling rapid expansion. Moreover, franchise partnerships provide access to proven intellectual properties reducing development risks. Additionally, Merlin focuses on family-friendly experiences and educational entertainment differentiating from pure thrill-oriented competitors while maintaining operational efficiency.

Overseas Chinese Town Company dominates Chinese market through extensive domestic park network and integrated resort developments. The company leverages local market knowledge and government relationships facilitating approvals and site acquisitions. Moreover, cultural integration in attraction design resonates with domestic visitors preferring locally relevant themes. Therefore, OCT captures substantial market share within world’s fastest-growing theme park market through strategic positioning and operational scale.

Universal Studios competes directly with Disney through blockbuster film franchises and immersive themed environments. The company recently expanded capacity through Epic Universe opening featuring cutting-edge attractions and technologies. Moreover, Universal emphasizes thrill rides and teenage-adult demographics complementing Disney’s family focus. Additionally, strategic franchise licensing including Nintendo and Harry Potter drives visitor interest and merchandise revenue creating comprehensive entertainment experiences.

Key Players

- Disney

- Merlin Entertainments

- Overseas Chinese Town Company

- Universal Studios

- Six Flags Entertainment Corporation

- United Parks & Resorts Inc.

- PARQUES REUNIDOS

- Fantawild Holdings Inc.

- Aspro Parks

Recent Developments

- November 2025 – Herschend announced acquisition of Silverwood, the Pacific Northwest’s largest theme and water park, expanding company’s regional footprint. This strategic transaction strengthens Herschend’s presence in underserved Western markets while adding established operations to portfolio.

- May 2025 – Universal officially opened Epic Universe in Orlando, its most ambitious theme park featuring five immersive worlds including Super Nintendo World and Dark Universe. This landmark development represents multi-billion dollar investment expanding Universal’s capacity and competitive positioning against regional rivals.

- March 2025 – Adventureland joined Herschend Family Entertainment portfolio as part of larger acquisition strategy consolidating regional attractions. The transaction demonstrates ongoing industry consolidation trends favoring established operators with proven management capabilities and financial resources.

- March 2025 – Herschend and Parques Reunidos signed definitive agreement under which Herschend will acquire all Palace Entertainment’s U.S. properties. This transaction significantly expands Herschend’s domestic operations adding multiple established regional parks to company’s growing portfolio.

- March 2025 – Dutch Wonderland acquired by Herschend Family Entertainment strengthening company’s East Coast presence. The acquisition adds family-oriented attraction to Herschend’s portfolio complementing existing properties and creating operational synergies through shared management expertise.

- November 2024 – Merlin Entertainments announced $110 million investment in first two Minecraft-themed attractions globally. This franchise partnership leverages popular gaming intellectual property attracting younger demographics and demonstrating Merlin’s strategy of licensing proven entertainment brands for attraction development.

Report Scope

Report Features Description Market Value (2025) USD 61.0 Billion Forecast Revenue (2035) USD 129.3 Billion CAGR (2026-2035) 7.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Theme Parks, Water Parks, Adventure Parks, Zoo Parks), By Ride (Mechanical Rides, Water Rides, Others), By Age-Group (19 to 35 years, Up to 18 years, 36 to 50 years, 51 to 65 years, Above 65 years), By Revenue Source (Tickets, Food & Beverage, Merchandise, Hotel & Resorts, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Disney, Merlin Entertainments, Overseas Chinese Town Company, Universal Studios, Six Flags Entertainment Corporation, United Parks & Resorts Inc., PARQUES REUNIDOS, Fantawild Holdings Inc., Aspro Parks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Disney

- Merlin Entertainments

- Overseas Chinese Town Company

- Universal Studios

- Six Flags Entertainment Corporation

- United Parks & Resorts Inc.

- PARQUES REUNIDOS

- Fantawild Holdings Inc.

- Aspro Parks