Global Texture Generation AI Market Size, Share, Industry Analysis Report By Component (Software, Hardware, Services), By Application (Gaming, Film & Animation, Architecture & Design, Virtual Reality, Automotive, Fashion, Others), By Deployment Mode (On-Premises, Cloud), By End-User (Entertainment, Automotive, Architecture, Fashion, Advertising, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166924

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics and Trends

- Role of Generative AI

- Investment and Business Benefits

- U.S. Texture Generation AI Market Size

- Component Analysis

- Application Analysis

- Deployment Mode Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

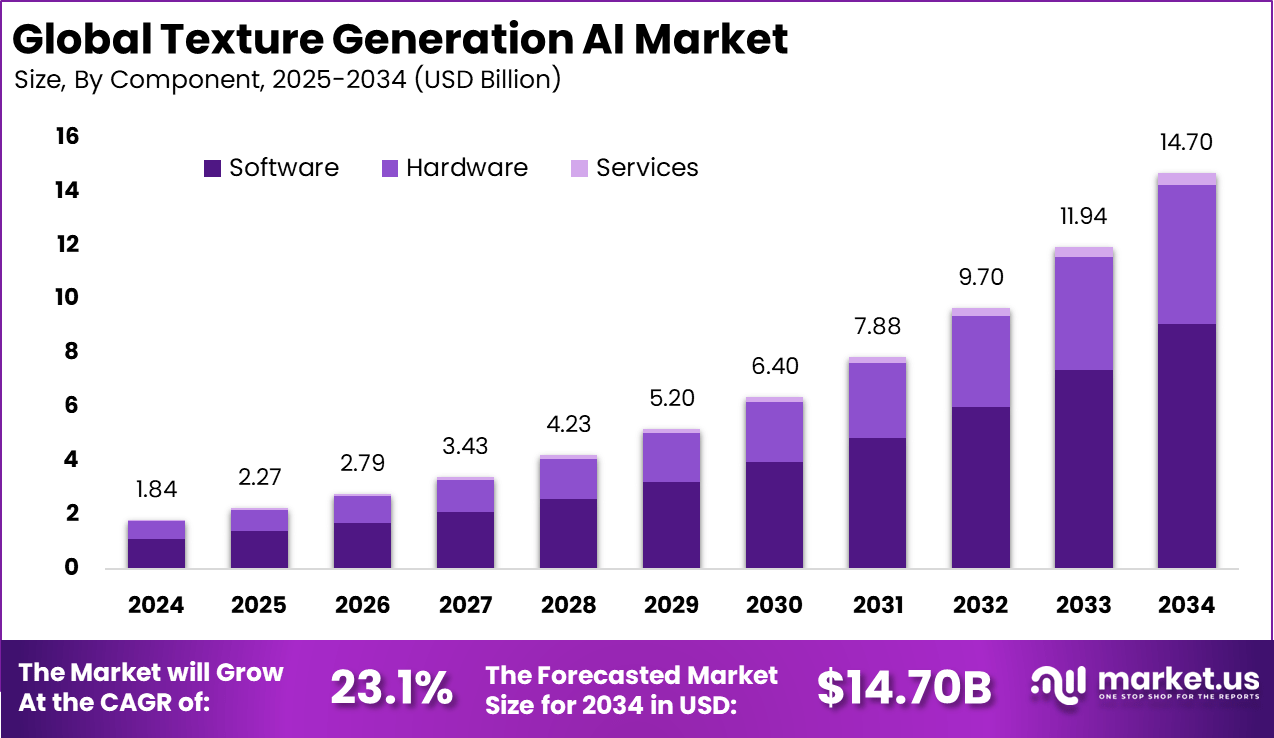

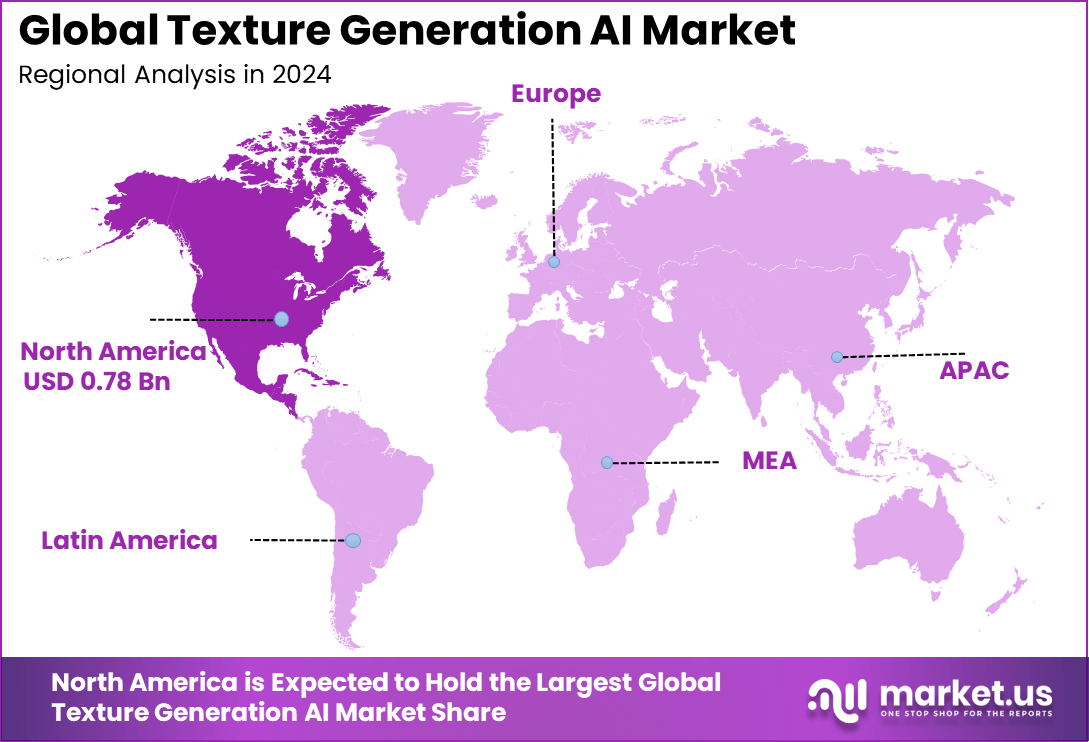

The Global Texture Generation AI Market size is expected to be worth around USD 14.70 billion by 2034, from USD 1.84 billion in 2024, growing at a CAGR of 23.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.5% share, holding USD 0.78 billion in revenue. `

Texture Generation AI refers to the use of artificial intelligence technologies to create and enhance digital textures automatically. These textures are used in various industries such as gaming, film, architecture, and automotive design to produce realistic surfaces and materials. By leveraging AI, this process becomes much faster and more efficient compared to traditional manual methods.

The main factors driving the rapid adoption of Texture Generation AI include the increasing demand for high-quality digital content and the need for realistic visuals in immersive experiences like virtual reality and augmented reality. The gaming and entertainment sectors especially push for increasingly photorealistic textures to captivate audiences. Additionally, industries such as automotive and fashion rely on AI-generated textures to speed up design iterations and customization.

The growth of cloud computing and advances in powerful AI hardware also facilitate wider use and scalability of these solutions. There is a growing demand for AI-generated textures due to accelerating creative production cycles. More than 40% of digital content creators reported using AI-assisted tools to expedite texture creation by 2024. This technology supports rapid prototyping and endless variation of materials, allowing creators to explore new aesthetic possibilities without the time cost of manual design.

For instance, in September 2025, Stability AI launched Stable Audio 2.5, an enterprise-grade audio generation model that, while focused on sound, indicates broader AI model advancements with improved control, speed, and quality in generative AI. Their continued innovation in AI supports texture generation AI through advanced generative model development.

Key Takeaway

- The Software segment led the market with a 61.8% share, supported by rising adoption of AI-powered texture engines, design tools, and creative automation platforms.

- The Gaming industry held 34.9%, underscoring strong demand for high-quality, auto-generated textures in 3D environments, character design, and asset creation.

- On-premises deployment dominated with 73.4%, reflecting the need for data security, faster rendering speeds, and workflow control in professional design pipelines.

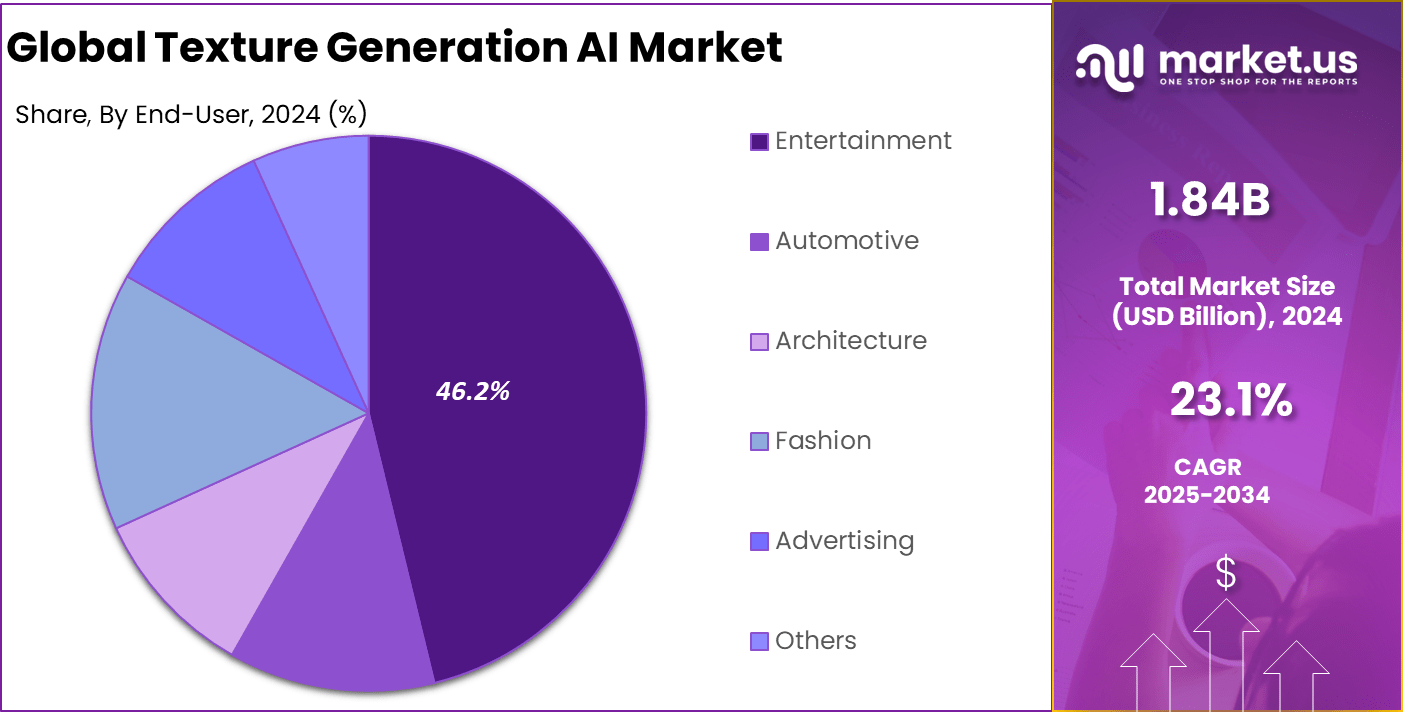

- The Entertainment sector accounted for 46.2%, driven by increased use of AI in VFX, animation, virtual production, and digital content creation.

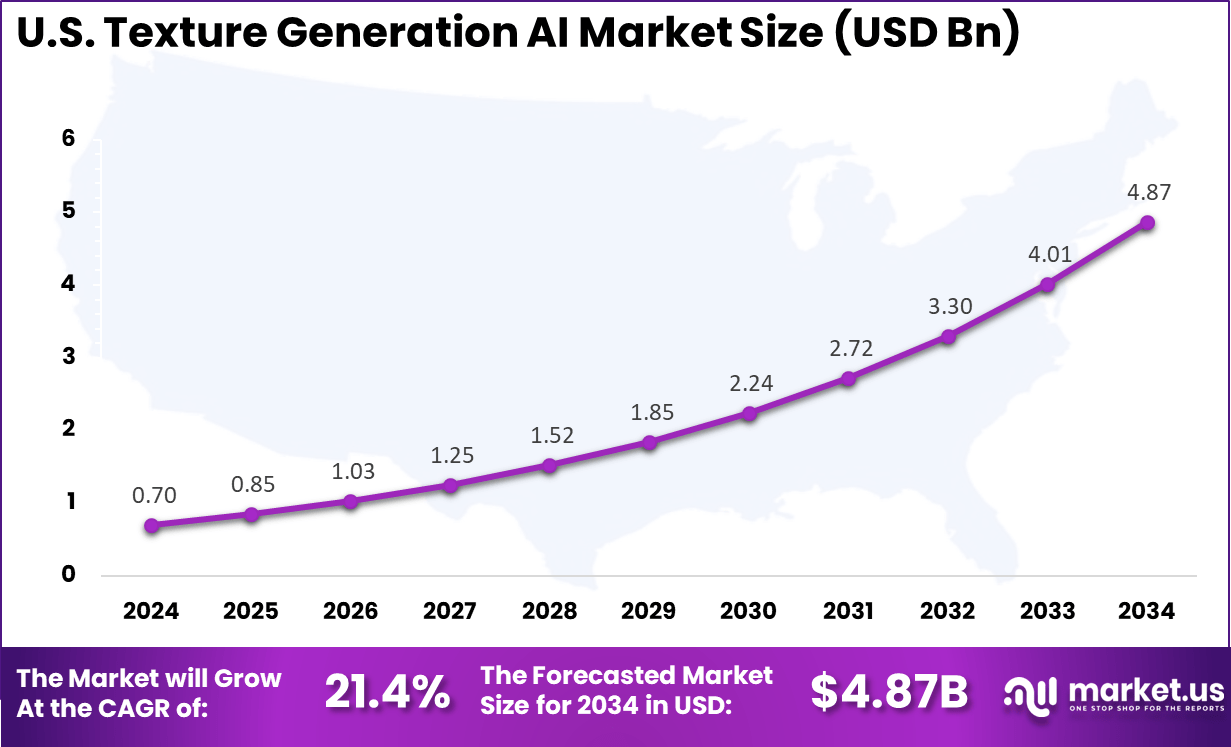

- The U.S. market was valued at USD 0.70 billion in 2024, expanding at a strong 21.4% CAGR, supported by rapid AI integration in creative industries and gaming studios.

- North America maintained leadership with over 42.5% share, backed by advanced digital ecosystems, significant investment in generative AI tools, and strong presence of game development and media companies.

Key Statistics and Trends

- Market Adoption: More than 40% of digital creators were expected to use AI texture tools by 2024, and current estimates show that 86% of creators now rely on creative generative AI in their workflows.

- Industry Integration: A 2025 survey indicated that 60% of studios are evaluating AI to lower production costs. The gaming sector has reported a 20% rise in player engagement driven by improved visual quality supported by AI-generated textures.

- Workflow Efficiency: AI texture generation has become significantly faster. Some methods can produce textures in around 3 seconds, compared with earlier approaches that required over one minute.

- User Satisfaction and Use Cases: Nearly 50% of artists consider text-to-image systems very useful. The most common uses include editing (55%) and creating new visual assets (52%).

- Technical Performance: In controlled tests, an AI texture generator successfully produced high-quality outputs in 42 of 50 trials, demonstrating consistent performance and reliability.

Role of Generative AI

Generative adversarial networks, or GANs, are a type of AI model that consists of two neural networks working against each other. One network creates images or textures, starting from random noise, trying to make them look real. The other network checks these creations, determining whether they seem genuine or not. Through this ongoing competition, both networks improve, and the system gets better at generating highly realistic textures that can be used in various digital applications.

In the case of texture generation, GANs are trained to produce seamless, high-quality pattern images that look and feel natural. Modern techniques use a patch-by-patch approach, which allows for creating textures of any size without losing coherence. This method divides large textures into smaller sections that fit together smoothly when combined, making the process more scalable and consistent. These advances mean the textures can be more detailed and diverse while remaining visually cohesive.

Investment and Business Benefits

Investment prospects lie largely in advancing AI algorithms for even more realistic and diverse textures, expanding cloud infrastructure for scalable deployment, and integrating texture AI more deeply with simulation and digital twin technologies used in automotive and architectural sectors. Enhancing AI models’ ability to dynamically respond to lighting and environment changes creates strong differentiation potential.

Businesses gain from using Texture Generation AI through faster time-to-market, higher product quality, and enabling innovation that sets products apart visually. The technology reduces dependency on costly manual texturing processes and extensive asset libraries, lowering production costs.

Enhanced realism in digital assets improves customer engagement, especially in sectors like automotive virtual showrooms or gaming, where visual fidelity drives consumer interest. Furthermore, AI’s consistency in output supports brand and product uniformity across multiple projects and platforms.

U.S. Texture Generation AI Market Size

The market for Texture Generation AI within the U.S. is growing tremendously and is currently valued at USD 0.70 billion, the market has a projected CAGR of 21.4%. The market is growing due to the increasing demand for realistic digital content in gaming, entertainment, and design industries. Advancements in AI software allow creators to produce high-quality textures quickly and efficiently, reducing costs and boosting productivity.

The rise of immersive technologies like virtual and augmented reality further fuels this demand, as detailed textures are critical for user experience. Additionally, strong investment in AI research and the presence of major technology companies in the U.S. support continuous innovation and adoption, sustaining market expansion.

For instance, in October 2025, Microsoft Corporation launched MAI-Image-1, its first homegrown AI image generation model that produces photorealistic textures and images quickly with minimal repetitive outputs. This model is integrated into products like Bing Image Creator, enhancing creative workflows through AI-driven texture generation.

In 2024, North America held a dominant market position in the Global Texture Generation AI Market, capturing more than a 42.5% share, holding USD 0.78 billion in revenue. This leadership is driven by the region’s strong technology infrastructure and significant presence of AI-focused companies. The concentration of major gaming, entertainment, and design studios accelerates demand for advanced texture generation solutions.

Additionally, substantial R&D investments in AI and supportive innovation ecosystems enable rapid adoption of cutting-edge tools. These factors combined create a robust environment for the growth and continued dominance of North America in this market.

For instance, in August 2025, Unity Technologies released Unity 6.2, featuring Unity AI, a suite of AI tools including generative AI for sprites, textures, and animations. Their AI models generate tileable textures from text prompts or image references, improving efficiency and customization for game developers.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 61.8% share of the Global Texture Generation AI Market. This dominance stems from the increasing sophistication of AI-driven texture generation applications that leverage deep learning and generative adversarial networks to automate the creation of complex, high-resolution textures.

Software solutions are preferred for their flexibility, scalability, and ability to integrate seamlessly into existing creative workflows, making them an essential tool for industries requiring photorealistic digital content. The growth in this segment is supported by ongoing advancements in software algorithms that reduce manual labor, speed up production, and enhance visual quality, fueling widespread adoption across fields such as gaming, film, and design.

For Instance, in August 2025, Google DeepMind integrated an advanced AI image editing model into its Gemini app, enabling precise texture editing, multi-image fusion, and style transfers while maintaining consistency across edits. This software upgrade enhances user control and quality in texture-related content creation.

Application Analysis

In 2024, the Gaming segment held a dominant market position, capturing a 34.9% share of the Global Texture Generation AI Market. Game developers extensively rely on AI-powered texture generation tools to create rich, immersive environments and detailed character designs quickly and efficiently. The demand for highly realistic and diverse game visuals is a primary factor driving this trend, as players increasingly seek more engaging and visually stunning gameplay experiences.

The gaming industry benefits from the ability of AI to generate various textures that adapt dynamically to different game scenarios, making the creative process more fluid and cost-effective. This has resulted in faster development cycles and greater innovation in game art, improving overall player satisfaction and competitive differentiation.

For instance, in October 2025, Stability AI partnered with Electronic Arts to develop AI workflows for faster creation of Physically Based Rendering (PBR) materials, enabling game artists to generate 2D textures with accurate color and lighting fidelity more efficiently.

Deployment Mode Analysis

In 2024, The On-Premises segment held a dominant market position, capturing a 73.4% share of the Global Texture Generation AI Market. On-premises systems also provide the reliability and speed needed for real-time texture creation tasks. Organizations such as game studios, film production houses, and design firms often opt for on-premises solutions due to stringent data security needs and compliance with industry regulations.

Additionally, on-premises systems provide advantages like low-latency processing crucial for real-time texture creation and rendering workflows. Despite higher upfront costs, many enterprises prioritize the reliability and control that on-premises deployment offers for confidential creative assets and proprietary technology integration.

For Instance, in November 2025, Microsoft launched its first in-house text-to-image AI model, MAI-Image-1, focusing on fast photorealistic image output for potential integration in enterprise products such as Bing Image Creator, highlighting robust on-premises capabilities for organizations requiring secure AI texture generation.

End-User Analysis

In 2024, The Entertainment segment held a dominant market position, capturing a 46.2% share of the Global Texture Generation AI Market. This sector encompasses gaming, film, and animation industries, all of which have a strong need for advanced texture generation capabilities to meet the increasing demand for realistic and compelling digital content. The pursuit of visual innovation is driving wide adoption as AI tools help creators deliver high-quality textures faster and at lower costs.

Entertainment companies are leveraging these AI-driven texture solutions to enhance storytelling and audience engagement by producing visually stunning graphics that push the boundaries of immersive experiences. The sector’s openness to technological innovation continues to fuel investment in and utilization of these AI tools.

For Instance, in September 2025, Autodesk unveiled AI tools at AU 2025 to accelerate animation and character creation, enabling entertainment studios to generate textured 3D characters from text prompts with interactive editing options, significantly speeding up creative processes.

Emerging trends

Emerging trends in texture generation AI center on text-to-texture creation and real-time interactive texture painting. Text-to-texture systems let users describe materials with simple prompts, instantly generating seamless textures, thus speeding up workflows.

Interactive AI texture painting tools allow artists to add local details with infinite variations directly onto 3D models, making the design process more intuitive and flexible. These advanced applications are gaining traction, with tools leveraging AI to consistently produce photorealistic effects, thereby reducing manual labor and increasing output quality.

The market is also seeing growth in cloud-integrated AI texture generation technologies. Cloud platforms offer scalable resources for training and deploying complex AI models, enabling improvements and updates without interrupting users. Furthermore, subscription-based pricing models make these solutions more accessible to various industries, from digital marketing to architecture. This trend supports smoother adoption and allows firms to scale texture generation capabilities according to project demands.

Growth Factors

Growth factors driving this market include the surge in demand for photorealistic digital content, especially in gaming and entertainment. Consumers expect immersive, high-fidelity visuals, which AI-generated textures help achieve efficiently. Virtual and augmented reality applications also boost demand, as designers in the architecture, automotive, and fashion sectors rely on AI for accurate, detailed material representations.

Additionally, integration with cloud infrastructure and advanced computing hardware is enhancing AI’s capability to deliver real-time, high-resolution textures. Rapid digitalization and the rise of mobile gaming create fertile ground for texture generation AI growth. Increasing investments in AI, especially in Asia-Pacific and North America, support innovation and infrastructure development.

The synergy between AI and cloud computing enables continuous algorithmic advancements, fueling adoption across creative and industrial applications. This widening use of AI texture generation is helping sectors reduce production time while improving artistic outcomes.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Application

- Gaming

- Film & Animation

- Architecture & Design

- Virtual Reality

- Automotive

- Fashion

- Others

By Deployment Mode

- On-Premises

- Cloud

By End-User

- Entertainment

- Automotive

- Architecture

- Fashion

- Advertising

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Photorealistic Textures

A key driver for the Texture Generation AI market is the growing demand for photorealistic and procedurally generated textures, especially in gaming, film, and immersive tech sectors. Consumers want highly realistic visuals, which push developers to adopt AI tools that can create complex textures quickly and cost-effectively. AI-driven texture generation significantly reduces manual labor and production time while enhancing creativity.

Industries like automotive and fashion also benefit from AI-generated textures to accelerate prototyping and design customization. This broad application across sectors ensures steady adoption and market growth fueled by increasing content quality expectations.

For instance, In February 2025, Google DeepMind introduced advanced AI models designed to improve physical agent behavior and environment understanding. This progress reflects a growing need for realistic and adaptable textures in virtual settings, supported by stronger visual intelligence. The emphasis on AI for physical agents suggests rising demand for high-detail textures across robotics, gaming, and simulation applications, creating new growth opportunities for texture generation AI.

Restraint

High Computational and Infrastructure Costs

One major restraint in the market is the high cost associated with the computational power and infrastructure required for state-of-the-art AI texture generation. Advanced AI models often need powerful GPUs, cloud services, or specialized hardware, which can be expensive. This can be a barrier for smaller companies or independent creators who lack the resources to invest in such technologies.

Furthermore, the complexity of deploying and managing these AI systems requires technical skills and training. This learning curve can slow down adoption among users unfamiliar with AI tools, preventing more widespread use despite its benefits.

For instance, In May 2025, Meta’s Horizon Desktop Editor added AI driven mesh and texture generation tools to simplify 3D content creation. The company noted that producing textures with consistent quality across complex objects remains difficult, limiting wider use in areas such as gaming and VR. This ongoing challenge continues to slow broader adoption despite clear progress in generative design capabilities.

Opportunities

Advancements in AI Algorithms

The Texture Generation AI market offers a promising opportunity with continuous advancements in AI algorithms. More sophisticated models can generate even more realistic and diverse textures that closely mimic real-world materials, responding dynamically to lighting and environmental conditions. This unlocks new creative possibilities for designers and content creators.

Increased algorithm capability combined with larger datasets will allow texture solutions to become more precise and useful across more applications, including gaming, virtual reality, and digital marketing. There is also room for innovative applications like real-time texture generation for interactive environments.

For instance, in October 2025, Unity launched Muse’s new texture capability, transforming natural language and visual inputs into PBR-enabled materials. The technology allows instant creation of realistic textures, opening opportunities for game developers and 3D artists to streamline their workflows and reduce manual effort. As these models improve, a broader market for accessible, high-quality AI-driven textures is emerging.

Challenges

Dataset Bias and Ethical Concerns

A pressing challenge for the market is the risk of bias and lack of diversity in AI-generated textures due to limited or unrepresentative training datasets. This can lead to repetitive styles or exclusion of certain materials, limiting creativity and potentially perpetuating digital inequalities.

Ethical concerns extend to ownership and copyright of AI-generated content, alongside challenges in ensuring transparent and fair AI practices. Addressing these issues requires ongoing efforts in dataset curation, ethical standards development, and regulatory clarity to ensure the technology’s fair and responsible use.

For instance, in November 2025, Microsoft’s recent rollout of its proprietary image AI, MAI-Image-1, faced skepticism over transparency regarding training data and regional compliance. Such concerns about data sourcing, ownership, and ethical use continue to challenge the adoption of texture AI solutions. Ensuring transparency and regulatory compliance remains critical for mainstream acceptance in this market.

Key Players Analysis

Google DeepMind, Meta, IBM, Microsoft, NVIDIA, Adobe, and OpenAI lead the texture generation AI market with advanced generative models that create realistic textures and detailed surface patterns. Their platforms support gaming, visual effects, digital design, and simulation work. These companies focus on improving rendering quality, style control, and real-time performance. Strong integration with creative workflows reinforces their leadership as demand grows for automated and high-fidelity asset creation.

Unity Technologies, Autodesk, Stability AI, Runway ML, Promethean AI, and Lightricks strengthen the market with solutions optimized for 3D modeling and virtual production pipelines. Their tools help artists generate textures quickly, reduce manual workload, and maintain visual consistency. These platforms combine procedural generation with AI refinement, supporting faster asset development. Adoption increases as studios and developers prioritize scalable, cost-efficient content creation methods.

DeepArt.io, Obvious, Prisma Labs, Playform IO, Wombo AI, and other emerging players expand the landscape with accessible tools aimed at digital creators and indie developers. Their applications offer style transformation, custom textures, and mobile-friendly AI features. These companies focus on ease of use, rapid generation, and creative variety. Rising demand for personalized digital assets across AR/VR, gaming, and social content continues to support their market relevance.

Top Key Players in the Market

- Google DeepMind

- Meta Platforms, Inc.

- IBM Corporation

- Microsoft Corporation

- Unity Technologies

- Autodesk, Inc.

- Stability AI

- Runway ML

- Promethean AI

- Lightricks

- Adobe Inc.

- NVIDIA Corporation

- OpenAI

- DeepArt.io

- Obvious

- Prisma Labs

- Playform IO

- Wombo AI

- Others

Recent Developments

- In October 2025, Microsoft unveiled its first fully in-house AI image generator called MAI-Image-1. Launched in early October, this model generates photorealistic textures and images quickly, minimizing repetitive or generic outputs. It is being integrated into Microsoft Copilot and Bing Image Creator for creative professionals.

- In August 2025, Unity Technologies rolled out a major update to Unity Muse, their AI platform, improving texture generation with the Photo-Real-Unity-Texture-2 model. This upgrade enhances materials like wood, leather, metal, and soil textures by improving realism, color consistency, and heightmap creation. The model supports both text prompts and image references for generating PBR materials.

Report Scope

Report Features Description Market Value (2024) USD 1.84 Bn Forecast Revenue (2034) USD 14.7 Bn CAGR(2025-2034) 23.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Application (Gaming, Film & Animation, Architecture & Design, Virtual Reality, Automotive, Fashion, Others), By Deployment Mode (On-Premises, Cloud), By End-User (Entertainment, Automotive, Architecture, Fashion, Advertising, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google DeepMind, Meta Platforms, Inc., IBM Corporation, Microsoft Corporation, Unity Technologies, Autodesk, Inc., Stability AI, Runway ML, Promethean AI, Lightricks, Adobe Inc., NVIDIA Corporation, OpenAI, DeepArt.io, Obvious, Prisma Labs, Playform IO, Wombo AI, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Texture Generation AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Texture Generation AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Google DeepMind

- Meta Platforms, Inc.

- IBM Corporation

- Microsoft Corporation

- Unity Technologies

- Autodesk, Inc.

- Stability AI

- Runway ML

- Promethean AI

- Lightricks

- Adobe Inc.

- NVIDIA Corporation

- OpenAI

- DeepArt.io

- Obvious

- Prisma Labs

- Playform IO

- Wombo AI

- Others