Global Tetrasodium Edta Market Size, Share Analysis Report By Form (Liquid, Powder), By Functionality(Stabilizing Agent, Sequestering Agent, pH Buffering Agent), By End-User Industry (Water Treatment, Agriculture, Chemical Manufacturing, Textile, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161923

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

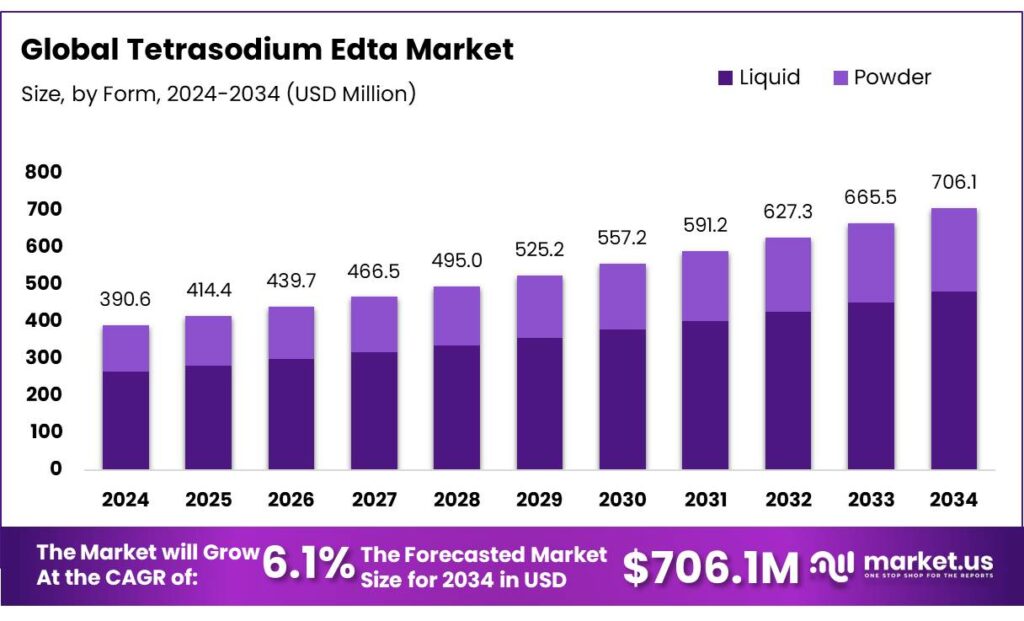

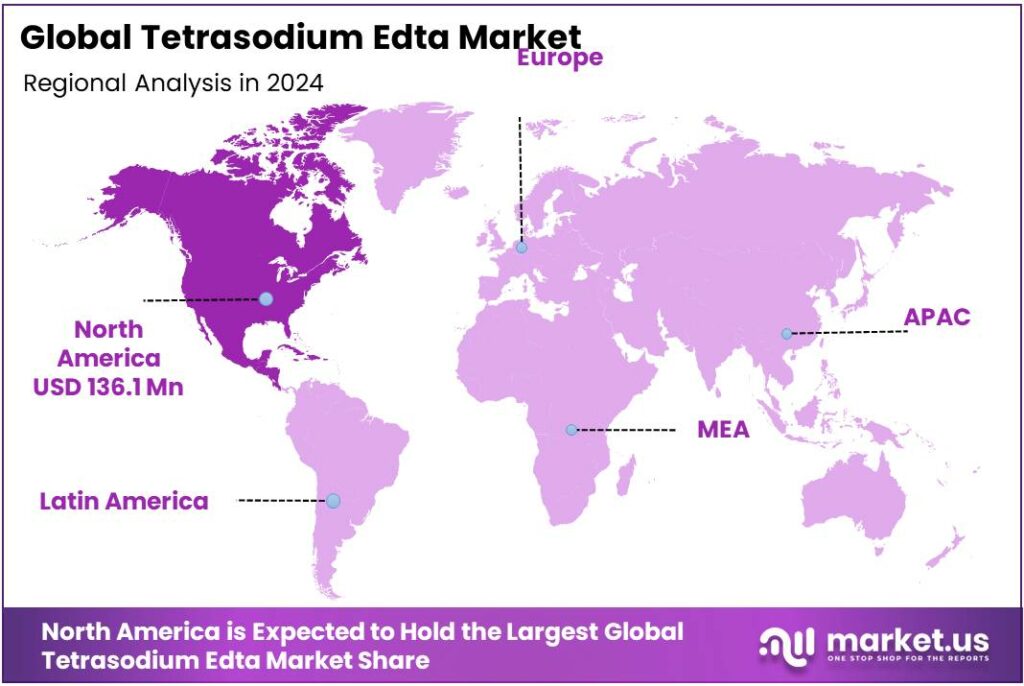

The Global Tetrasodium Edta Market size is expected to be worth around USD 706.1 Million by 2034, from USD 390.6 Million in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.90% share, holding USD 136.1 Million in revenue.

Tetrasodium EDTA (Na₄EDTA) is a versatile aminopolycarboxylate chelating agent used to bind and sequester multivalent metal ions across water treatment, detergents, personal care, pulp & paper, metal finishing, and energy-adjacent maintenance chemistries. Public sources note EDTA’s role in boiler and cooling-water treatment, nickel plating, wood pulping, industrial germicides, metal-cutting fluids, and detergents—applications that rely on its strong complexation with Ca²⁺, Mg²⁺ and transition metals to prevent scale, discoloration, and catalytic degradation.

- In 2024, global electricity use jumped by ~1,100 TWh (+4.3%), almost twice the recent average, signalling higher throughput in utilities and large process industries that depend on water conditioning and metal-ion control.

Industrial demand is closely tied to water quality management and metals control. The US EPA estimates about 44,000 facilities conduct metal-finishing operations that discharge process wastewater—an addressable base where chelants like tetrasodium EDTA are routinely used to manage metal ions and enhance downstream removal efficiency under technology-based limits (40 CFR Part 433). Beyond industry, municipal drivers matter: in 2024, 56% of global domestic wastewater—332 billion m³—was safely treated, leaving substantial room for treatment chemistry penetration in the remaining flows as countries scale infrastructure.

Energy-linked maintenance remains another pull. Refining and petrochemical complexes rely on periodic descaling and passivation; the IEA projects global refinery crude runs averaging 82.7 mb/d in 2024 and 83.3 mb/d in 2025, with capacity rising by 3.3 mb/d from 2023–2030—indicating a large installed base that will continue to require cleaning and water-treatment chemistries where chelation is central.

Policy-led infrastructure is amplifying future opportunities. In Dubai, the Hassyan RO project targets 818,000 m³/day with an announced 2.9 kWh/m³ specific energy, scheduled to ramp in 2026–2027—illustrating how giga-scale plants tighten operations around fouling control and cleaning chemistries. At the same time, utilities are pressed to curb energy use in WWT—IEA’s 4% electricity share baseline provides a measurable target for chemicals and process optimization that maintain performance while enabling lower-energy operation.

Key Takeaways

- Tetrasodium Edta Market size is expected to be worth around USD 706.1 Million by 2034, from USD 390.6 Million in 2024, growing at a CAGR of 6.1%.

- Liquid held a dominant market position, capturing more than a 67.3% share of the global Tetrasodium EDTA market.

- Stabilizing Agent held a dominant market position, capturing more than a 59.2% share of the global Tetrasodium EDTA market.

- Water Treatment held a dominant market position, capturing more than a 38.8% share of the global Tetrasodium EDTA market.

- North America held a dominant position in the global Tetrasodium EDTA market, capturing more than 34.90% of the market share, equivalent to approximately USD 136.1 million.

By Type Analysis

Liquid Form Dominates Tetrasodium EDTA Market with 67.3% Share in 2024

In 2024, Liquid held a dominant market position, capturing more than a 67.3% share of the global Tetrasodium EDTA market. This strong preference for the liquid form can be attributed to its ease of handling, uniform consistency, and faster solubility, which makes it ideal for applications in detergents, water treatment, and personal care products. Industries favor the liquid form for large-scale formulations, as it reduces processing time and ensures better dispersion in end products.

The dominance of liquid Tetrasodium EDTA has been consistent through 2024 and early 2025, driven by its operational efficiency and compatibility across diverse industrial applications. As manufacturers continue to prioritize streamlined production and product stability, the liquid segment is expected to maintain its leading position, reinforcing its critical role in the Tetrasodium EDTA market landscape.

By Nature Analysis

Stabilizing Agent Leads Tetrasodium EDTA Market with 59.2% Share in 2024

In 2024, Stabilizing Agent held a dominant market position, capturing more than a 59.2% share of the global Tetrasodium EDTA market. This prominence is largely due to its critical role in enhancing product stability and extending shelf life across a wide range of applications, including personal care, pharmaceuticals, and food processing.

By preventing discoloration, precipitation, and degradation caused by metal ions, Tetrasodium EDTA as a stabilizing agent ensures consistent quality and effectiveness in end products. The segment maintained its strong performance through 2024 and into 2025, supported by growing industrial demand for reliable and high-quality formulations. With increasing focus on product longevity and efficiency, the stabilizing agent functionality is expected to continue as the leading application in the Tetrasodium EDTA market.

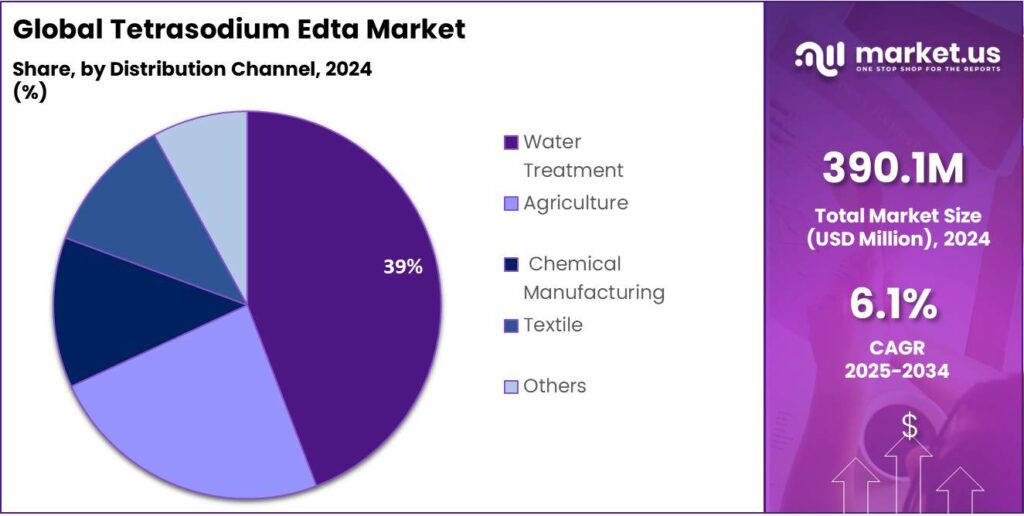

By Distribution Channel Analysis

Water Treatment Leads Tetrasodium EDTA Market with 38.8% Share in 2024

In 2024, Water Treatment held a dominant market position, capturing more than a 38.8% share of the global Tetrasodium EDTA market. This significant share is driven by the compound’s effectiveness in removing heavy metals and preventing scale formation in industrial and municipal water systems. Tetrasodium EDTA’s ability to chelate metal ions ensures cleaner water and protects equipment from corrosion, making it highly preferred in large-scale water treatment operations.

The segment maintained steady growth through 2024 and into 2025, supported by increasing urbanization, rising demand for safe drinking water, and stricter regulatory standards for water quality. As industries continue to prioritize efficient water management and sustainability, water treatment remains the leading end-user segment for Tetrasodium EDTA.

Key Market Segments

By Form

- Liquid

- Powder

By Functionality

- Stabilizing Agent

- Sequestering Agent

- pH Buffering Agent

By End-User Industry

- Water Treatment

- Agriculture

- Chemical Manufacturing

- Textile

- Others

Emerging Trends

Reuse-ready sanitation and micro-dosed chelation in food & beverage plants

A clear trend is emerging inside food and beverage plants: sanitation programs are being redesigned for water reuse, and chelation is being micro-dosed to keep metals from derailing quality, membrane uptime, and shelf life. The driver starts with public-health and waste realities. Each year, 600 million people fall ill from unsafe food and 420,000 die; preventing oxidation, off-flavors, and biofilm formation in process lines is not cosmetic—it is food safety. At the same time, supply chains still lose food before it reaches retail; FAO estimates 13.2% of food is lost after harvest and before retail, so stabilizing products and cleaning systems has become a priority for plant managers and brand owners.

Water is the second push behind this trend. Between 2015 and 2024, 961 million people gained access to safely managed drinking water, lifting global coverage from 68% to 74%, yet 2.1 billion people still lack safely managed services. That uneven water quality at the tap often shows up as variable hardness and trace metals entering plants—conditions that destabilize preservatives, foul membranes, and corrode equipment unless metal ions are tightly controlled.

Regulatory guardrails provide workable boundaries for formulating near food. Codex maintains the global General Standard for Food Additives, which sets maximum-use concepts and good-manufacturing-practice principles; for EDTA chemistry, the pathway typically uses approved EDTA salts (e.g., INS 385) with category-specific limits. In the United States, 21 CFR 172.120 lists maximum levels such as 75 mg/kg in salad dressing, 100 mg/kg in sandwich spreads, 75 mg/kg in sauces, 60 mg/kg in spice extractives, and 250 mg/kg in cooked, canned shrimp—clear numbers that let processors design chelation into recipes or contact applications without guesswork.

Drivers

Stricter food-safety standards and longer shelf-life needs

A powerful driver for tetrasodium EDTA is the global push to make packaged foods safer and more stable while cutting waste. Unsafe food still hurts public health: the World Health Organization estimates 1 in 10 people fall ill every year from foodborne diseases. That pressure is translating into tougher national strategies—WHO’s Global Strategy for Food Safety 2022–2030 and a World Health Assembly mandate to publish new global burden estimates by 2025—which keep manufacturers focused on proven controls against oxidation, discoloration, and metal-catalyzed spoilage.

Regulatory clarity also supports adoption. In the United States, FDA regulations explicitly permit EDTA salts in specific foods at set limits—for example, 75 ppm in salad dressings, mayonnaise, and sauces; 100 ppm in sandwich spreads; and 165 ppm in canned legumes to maintain color. These are long-standing, transparent benchmarks that let formulators design shelf-stable products without sacrificing safety.

Globally, the Codex Alimentarius keeps EDTA provisions current through its General Standard for Food Additives (GSFA), giving regulators and companies a harmonized reference for trade and compliance. Codex lists Calcium Disodium EDTA (INS 385), with food-category uses adopted by the Commission in 2024 updates—another sign that authorities continue to recognize chelation as a legitimate, tightly controlled tool for safety and quality. For many exporters, alignment with Codex is essential to access multiple markets efficiently.

Restraints

Environmental persistence and tightening eco-label/food limits

A major restraint on Tetrasodium EDTA is the combination of environmental persistence and stricter product-policy limits that push formulators to reduce or replace EDTA. Regulators and eco-labels increasingly focus on biodegradability. Official dossiers report that EDTA is not readily or inherently biodegradable under OECD tests, meaning it can pass through treatment plants and persist in receiving waters; Australia’s national industrial chemicals evaluator summarized this in March 2025 and noted degradation depends on specific light and metal-complex conditions.

This persistence shows up in monitoring: an EU-wide survey of polar pollutants found median EDTA concentrations of 60 µg/L in European surface waters, placing it among the highest measured compounds in that campaign and keeping pressure on downstream discharge limits. In some local studies, most river samples were below detection, but detectable concentrations up to tens of µg/L were observed, underscoring variability tied to urban discharges.

Food-related rules add a second brake. Tetrasodium EDTA itself is generally not the approved sequestrant in foods; instead, calcium disodium EDTA (E 385) is permitted with strict limits. The U.S. FDA codifies maximum levels—e.g., 25 ppm in distilled alcoholic beverages, 25 ppm in fermented malt beverages, and 75 ppm in French dressing and other non-standardized dressings—constraining how much EDTA-salt functionality can be used in recipes and processing aids.

On the exposure side, EFSA has reaffirmed a conservative benchmark; its scientific work indicates that EDTA is of no safety concern provided intake does not exceed 1.9 mg/kg body weight/day (as EDTA), which keeps manufacturers attentive to low-use levels and substitution options. EFSA’s June 27, 2024 call for data to re-evaluate E 385 signals that Europe is still actively reviewing exposure and use patterns, adding regulatory uncertainty for long-term EDTA deployment in food-adjacent applications.

Opportunity

Cutting food loss and boosting safe water reuse in processing

Reducing food loss and improving hygiene in processing plants create a strong growth path for Tetrasodium EDTA. Globally, about 13.3% of food is lost after harvest and before retail—in storage, transport, wholesale, and processing—according to FAO’s SDG 12.3 indicator (2023). Every percentage point recovered reduces waste, saves cost, and protects margins. It also pushes factories to stabilise products and cleaning systems more reliably—roles where chelating agents help by binding troublesome metal ions that drive oxidation, discoloration, off-flavours, and equipment fouling.

Food safety pressure adds urgency. WHO estimates 600 million people fall ill from unsafe food each year, with 420,000 deaths and US$110 billion in productivity/medical losses in low- and middle-income countries. Plants are doubling down on sanitation, clean-in-place (CIP), and water quality controls so hazards do not reach the plate. Chelation supports these programs by improving preservative performance and mitigating catalytic metals (iron, copper, manganese) that accelerate spoilage. The human reason is simple: safer food and longer shelf life mean fewer recalls and fewer families affected by preventable illness.

Water is the other front where EDTA can unlock improvements. Beverage and food processors are moving from single-pass water use to treatment and reuse to meet sustainability targets and manage costs. A U.S. government–supported white paper under the National Water Reuse Action Plan explains that water reuse can maximize both energy efficiency and water recovery in beverage operations, directly linking reuse to business performance. That same initiative highlights how discharge quality rules and drought risk are pushing factories to adopt advanced treatment trains—membranes and oxidants that work best when metals are tightly controlled. This is the space where chelants become essential to keep systems stable and efficient.

Access to safe water remains uneven, so factories cannot always rely on consistent incoming quality. UNICEF/WHO data show global safely managed drinking-water coverage rose to 74% in 2024, yet 2.1 billion people still lacked safely managed water. In regions with lower coverage, processors often face variable hardness and trace metals at the tap, which can compromise CIP and product quality. Chelation offers a practical buffer against this variability, improving reproducibility batch after batch and making reuse schemes more resilient.

Regional Insights

North America Leads Tetrasodium EDTA Market with 34.90% Share in 2024

In 2024, North America held a dominant position in the global Tetrasodium EDTA market, capturing more than 34.90% of the market share, equivalent to approximately USD 136.1 million. This leadership is primarily attributed to the region’s robust industrial infrastructure, high demand across key sectors such as water treatment, detergents, and pharmaceuticals, and stringent regulatory frameworks that promote the use of efficient and environmentally friendly chelating agents.

The U.S., in particular, has witnessed consistent growth in the Tetrasodium EDTA market, driven by increasing applications in industrial cleaning, personal care, and food processing industries. Additionally, the region’s emphasis on sustainable practices and the adoption of advanced chemical formulations have further bolstered the demand for Tetrasodium EDTA. As industries continue to prioritize product stability and quality, North America is expected to maintain its leading position in the Tetrasodium EDTA market in the coming years.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1971, Spectrum Chemical Mfg. Corp. is a leading global supplier of high-quality chemicals, laboratory supplies, and equipment. The company offers a range of Tetrasodium EDTA products, including solutions and dihydrate forms, suitable for industrial and research applications. Their facilities in California and New Jersey are ISO 9001:2015 certified and FDA registered, ensuring compliance with current Good Manufacturing Practices (cGMP).

Established in 1995, Mudanjiang Fengda Chemicals Corp. is a specialized chemical enterprise based in China. They offer Tetrasodium EDTA in various forms, including tetrahydrate and dihydrate, catering to industries such as textile, water treatment, and pharmaceuticals. The company is ISO 9001:2015 certified and holds multiple international registrations, ensuring product quality and compliance with global standards.

SHANDONG PULISI CHEMICAL CO., Ltd., based in China, is a prominent supplier of specialty chemicals, including Tetrasodium EDTA. Their product offerings are utilized across various industries, such as oil, textile, and printing. The company has established long-term partnerships with major corporations, including PetroChina and Saint-Gobain, highlighting its reliability and commitment to quality.

Top Key Players Outlook

- Spectrum Chemical Mfg. Corp

- Otto Chemie Pvt. Ltd

- Mudanjiang Fengda Chemicals

- SHANDONG PULISI CHEMICAL CO.Ltd.

- Unicorn Petroleum Industries Private Limited

- Shalibhadra Dyechem Private Limited

- New Alliance Fine Chem Private Limited

- Angel Chemicals

- Ozone Enterprise

Recent Industry Developments

In 2024 SHANDONG PULISI CHEMICAL CO., Ltd, continued to offer high-quality Tetrasodium EDTA 4Na with a purity of 99%, catering to various industrial applications such as water treatment, detergents, and textile processing. Their products are competitively priced between $1,999 and $2,999 per ton, with a minimum order quantity of 1 ton, making them accessible to a broad customer base.

In 2024 Otto Chemie Pvt. Ltd, continued to produce high-purity Tetrasodium EDTA (E1515), with an assay of 99%, catering to various industrial applications such as water treatment, detergents, and personal care products.

Report Scope

Report Features Description Market Value (2024) USD 390.6 Mn Forecast Revenue (2034) USD 706.1 Mn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Functionality(Stabilizing Agent, Sequestering Agent, pH Buffering Agent), By End-User Industry (Water Treatment, Agriculture, Chemical Manufacturing, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Spectrum Chemical Mfg. Corp, Otto Chemie Pvt. Ltd, Mudanjiang Fengda Chemicals, SHANDONG PULISI CHEMICAL CO.Ltd., Unicorn Petroleum Industries Private Limited, Shalibhadra Dyechem Private Limited, New Alliance Fine Chem Private Limited, Angel Chemicals, Ozone Enterprise Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Spectrum Chemical Mfg. Corp

- Otto Chemie Pvt. Ltd

- Mudanjiang Fengda Chemicals

- SHANDONG PULISI CHEMICAL CO.Ltd.

- Unicorn Petroleum Industries Private Limited

- Shalibhadra Dyechem Private Limited

- New Alliance Fine Chem Private Limited

- Angel Chemicals

- Ozone Enterprise