Global Tequila Market By Type(Blanco, Reposado, Anejo, Others), By Grade(100% Tequila, Mixed Tequila), By Distribution Channel(On-trade, Bars, Restaurants, Clubs, Off-trade, Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 124564

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

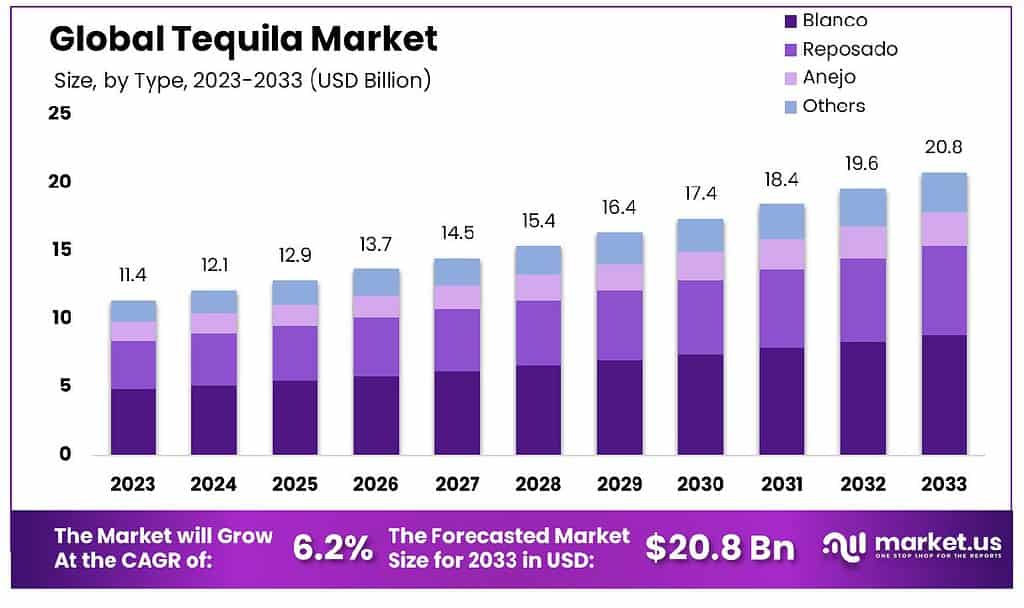

The Global Tequila Market size is expected to be worth around USD 20.8 Billion by 2033, From USD 11.4 Billion by 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Tequila is a popular spirit, that originated in Mexico. It is manufactured from blue agave & natural sugars and is available as a distilled and natural spirit. One oz of natural tequila has calories as low as 64, which attracts customers who are following weight management diets. Currently, tequila is mainly consumed at clubs, restaurants, and bars due to the rising trend of parties on weekends, corporate events, and other functions.

The growing consumer perception toward tequila as a premium spirit and the increasing alcohol consumption are projected to bolster the market growth during the forecast period. For instance, according to the report published by the World Health Organization (WHO), on June 28, 2024, about 400 million people above age 15 consumed alcohol in 2019, while the global number of alcohol consumers is consistently on the rise.

Moreover, the rising demand for cock-tails and natural spirits from global consumers is poised to drive the market. Alcohol is not considered a taboo, especially in Western cultures hence it is mostly consumed in formal gatherings, business functions, hotels & restaurants, and parties.

The changing consumer lifestyles have led to increasing familiarity with alcohol for a majority of people. Players in the market are establishing efficient supply chains thereby enabling the wide availability of alcohol, particularly tequila. These factors along with the increasing cost affordability of tequila have attracted many new buyers who are trying to develop the palette for tequila.

The increasing demand for high-quality spirits and the rising popularity of Mexican culture are also projected to significantly fuel the market during the projection period. This is mainly because of the traditional significance of tequila consumption as a medicine. It helps regulate blood sugar levels, promotes better sleep, and boosts the metabolism. Naturally obtained tequila contains plenty of antioxidants that help aid digestive issues and cleanse the colon when consumed in moderation.

Key Takeaways

- In 2023, the global tequila market generated a revenue of USD 4 billion, with a CAGR of 6.2%, and is expected to reach USD 21 billion by the year 2033.

- The type segment held a major share of the market, with the Blanco segment taking the lead in 2023 with a market share of 6% owing to its 100% pure blue agave blend, premium taste, and refined quality.

- By grade, the 100% tequila segment accounted for a significant share of 7% owing to the increasing global popularity of natural spirits.

- By distribution channel, the on-trade segment held the largest share of the market at 4% due to increasing consumer interest in bars, restaurants, and clubs for enjoyment purposes.

- The North American region led the market by securing a market share of 3% in 2023.

By Type Analysis

Based on type, the market is categorized into blanco, reposado, anejo, and others. The blanco segment held a dominant share of the market in 2023, by claiming a share of 42.6% owing to its increasing appeal to a wide range of customers. The Blanco tequila is the purest form of tequila, aged up to two months. It is transparent and retains the distinctive essence of blue agave.

Its flavor is lightly sweet & earthy which is adored by a majority of tequila consumers. It is widely consumed as tequila shots owing to its bold & intense flavor. When consumed in the form of shots, blanco provides a light buzz leaving room for more shots. The increasing popularity of cocktail- culture and the rising interest in drinking without boozing fueled this segment.

The reposado segment is projected to grow at a significant growth rate during the forecast period owing to the increasing demand for craft spirits across the globe. Reposado is considered a fine craft spirit and is aged for up to 12 months in oak barrels. It is known for its sensory appeal owing to its mellow flavor. This spirit has a golden color due to added caramel, vanilla, and oak.

It is smooth and comes in various spice blends. Its distinctive taste and texture appeal to adventurous customers who are interested in exploring their palette in newer blends of craft spirits. The spirit is costly compared to other types of tequila hence comes into the premium spirits category. The global inclination toward authentic agave-based spirits is projected to drive this segment in the coming years.

By Grade Analysis

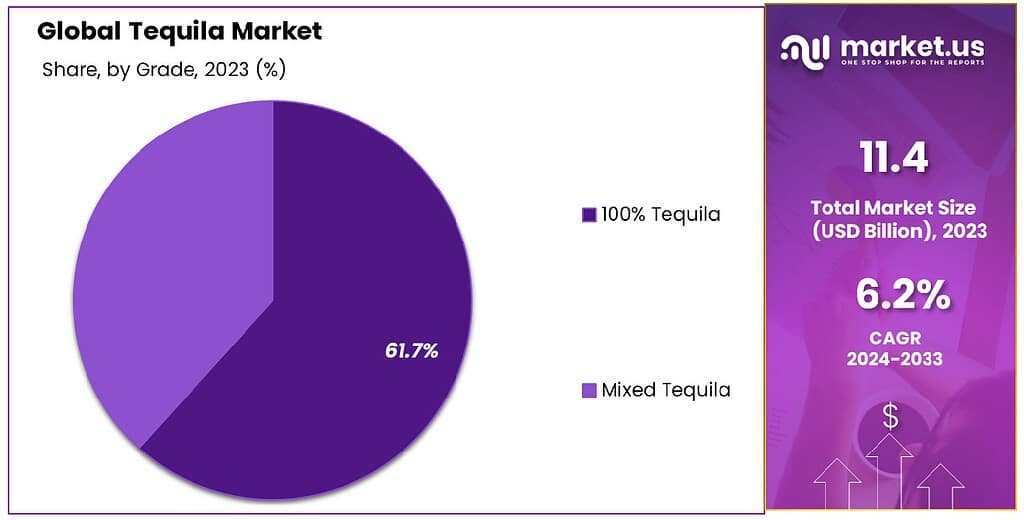

Considering grade, the market is divided into 100% tequila and mixed tequila. Among these, the 100% tequila segment held a significant share of 61.7%. This is attributed to the increasing demand for high-quality craft spirits worldwide. The purest form of tequila is generally not aged at all and does not contain empty calories. It is thus mostly preferred by consumers who wish to enjoy mindful drinking or while watching their weight.

The rapidly expanding beverage industry and the rising trends in the food industry have encouraged players in the market to experiment with 100% tequila to introduce newer spirit blends with minimal additives. The increasing popularity of clubbing has consequently boosted the cost-effectiveness of the drink by making it accessible to a wider number of people, which in turn drove this segment.

The mixed tequila segment is projected to grow at a significant rate during the assessment period owing to the increasing demand for cost-effective agave-based drinks. The mixed tequila contains a minimum of 51% agave spirit blended with a variety of other spirits such as corn spirits, neutral grain spirits, sugarcane spirits, sweeteners, and flavorings. Mixed tequila is widely used in making various tequila-based cocktails such as El Diablo, Tequila Punch, Tequila Sunrise, Paloma, Margarita, and others.

These cocktails are well known for their exotic, refreshing, fruity, and tangy flavor. They are presented creatively by bartenders, thereby providing an exotic touch to the consumer’s experience. This is mostly appreciated by consumers who occasionally consume alcohol while treating their palette with diverse flavors. Furthermore, the rising global influence of social media encourages consumers to try different varieties of craft spirits, new-in-town diners & their delicacies, paired with various spirits and wines. This has been creating lucrative opportunities for the food & beverage industry, which is expected to propel the mixed tequila segment in the coming years.

By Distribution Channel Analysis

The global tequila market is segmented based on distribution channels into on-trade, bars, restaurants, clubs, and off-trade, supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. The on-trade segment had a tremendous growth rate, with a revenue share of 71.4% owing to the rising demand for tequila from various on-trade sales channels from across the world. The on-trade segment deals with the beverage sales taking place from restaurants, clubs, bars, and other sales channels where alcohol is readily served.

Currently, consumers are increasingly seeking experiential spirits to diversify their taste palettes. The rising global urbanization has popularized trends such as clubbing on weekends, karaoke night, dance clubs, tipsy parties, and Mexican theme clubs that avail various types of tequila spirits along with authentic dining experiences for consumers.

Moreover, various clubs, restaurants, and bars use several marketing strategies to attract customers to their venues. They avail their space for different corporate events, pool parties, social gatherings, and different functions. They also offer special discounts, loyal customer schemes, lounge facilities, and rewards to engage maximum customers. These factors are expected to boost this segment during the projection period.

Key Market Segments

By Type

- Blanco

- Reposado

- Anejo

- Others

By Grade

- 100% Tequila

- Mixed Tequila

By Distribution Channel

- On-trade

- Bars

- Restaurants

- Clubs

- Off-trade

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

Drivers

The rapid expansion of the distribution channels drives the market.

Restaurants, bars, clubs, liquor stores, and supermarkets are some of the main distribution channels of tequila. This is attributed to the increasing global consumer shift toward clubbing & nightlife for entertainment. The rapid urbanization has altered the lifestyle choices of a majority of consumers.

The association of alcohol consumption with entertainment has significantly fueled its demand for tequila. Moreover, the increasing global appreciation for Mexican culture, food, and lifestyle has given rise to Mexican theme-based restaurants, which in turn fuel the market.

The increasing popularity of premium spirits and cocktails drives the market.

Tequila is a versatile spirit that is traditionally consumed neat. It is added to a variety of cocktails as a main ingredient such as Margaritas and Paloma. It has a smooth and rich flavor and is hence consumed neat or taken as a shot.

It can be made into a variety of spice blends and concentrations. It has been marketed as a high-end spirit and launched by premium brands. Additionally, it is also used in the preparation of a range of seafood, sauces, desserts, and chocolates to give these foods a depth of flavor, which is expected to boost the market.

Restraints

Fluctuations in the costs of raw materials are likely to hamper the market.

Agave, the source of tequila takes about 8-12 years to mature completely, however, its different varieties mature at different times. The agave produce is subject to a shortage due to adverse weather conditions or inefficient supply chains. This leads to high manufacturing costs thereby resulting in high end-product prices and refraining the cost-sensitive consumers from buying it.

Moreover, after harvesting the heart of the agave plant, immense wastes are left behind that currently have a limited scope for use, which is likely to hamper the market. When demand outpaces supply, producers may face increased costs, which can affect profitability and pricing. Moreover, the time lag between planting and harvesting makes it difficult for producers to respond swiftly to market changes, contributing to potential supply bottlenecks.

Market Competition and Brand Loyalty

The tequila market is highly competitive, with a few large multinational companies dominating the space alongside numerous smaller, artisanal producers. This competitive environment makes it challenging for new entrants to establish themselves, particularly given the strong brand loyalty that exists among consumers.

Established brands benefit from significant marketing budgets, well-developed distribution networks, and consumer trust, making it difficult for smaller players to compete on price, quality, or brand recognition. Moreover, the rise of other premium spirits, such as mezcal, whiskey, and vodka, provides consumers with a wide range of alternatives, which can dilute the demand for tequila.

Opportunities

The increasing popularity of artisanal tequila is projected to create several opportunities for the market.

Artisanal tequila is manufactured by using the traditional method of small-batching. The process helps retain natural flavors and agave terroir. This reaps in the rich characteristic flavor of tequila and reflects the craftsmanship. The increasing awareness of craft or artisanal tequila is expected to gain traction in the market in the coming years.

The wide scope of product innovation is expected to create lucrative opportunities for the market.

Players in the market are focused on experimenting to create diverse flavors and concentrations in tequila. Tequila blended with different spices, unique fruits, and sweeteners are likely to attract adventurous customers who like to explore their palette. For instance, in January 2024, Diageo-owned brand, Don Julio launched a new variety of tequila, Alma Miel. It retains a refined flavor of oven-roasted agave nectar and has a blend of blanco & añejo. Moreover, manufacturing tequila with different alcohol concentrations is poised to attract consumers looking for the medicinal benefits of tequila, thereby propelling the market.

Latest Trends

The rising trend of sustainable packaging is expected to drive the market.

Consumers are growing mindful of their environmental footprint. This encourages players in the market to create innovative sustainable packaging for distilled liquors such as tequila. Manufacturing biodegradable or recyclable bottles for effective waste management is expected to attract customers consuming eco-friendly products. Additionally, creating credible reusable packaging or building schemes for loyal customers who bring back bottles for refills is anticipated to boost the market in the coming years.

The growing popularity of alcohol delivery apps is projected to fuel the market.

Increasing consumer trust in online shopping is mainly responsible for the growing consumer base of alcohol delivery apps. These apps avail a wide variety of liquor including beer, whiskey, wine, tequila, gin, rum, and others with finely aged limited edition launches. The apps prioritize consumer privacy while ensuring consumer safety and security. They encourage consumers to drink responsibly. The rising consumer inclination toward convenience buying is anticipated to gain traction in the market in the years to come.

Geopolitical Impact Analysis

Geopolitical factors are crucial in terms of shaping the growth trajectory of the global tequila market owing to their significant influence on the market dynamics. One of the most direct geopolitical influences on the tequila market is trade policy, particularly between Mexico and its key export markets, such as the United States, Canada, and the European Union. The United States, as the largest consumer of tequila, plays a critical role in the market.

Any changes in trade agreements, such as the renegotiation of NAFTA into the USMCA (United States-Mexico-Canada Agreement), can have significant repercussions. While the USMCA largely maintained favorable conditions for the tequila trade, any future disputes or alterations in trade policies could lead to tariffs or trade barriers, increasing costs for producers and consumers alike. The 2020 USMCA Trade Agreement has enabled duty-free access to Mexico’s tequila exports to the US. This has significantly boosted the profit margins for local Mexican tequila manufacturers as the US owns the largest tequila market.

The Russia-Ukraine conflict in 2022, imposed several bans on Russian liquor imports from countries that stood in support of Ukraine. This majorly impacted Russia’s Vodka exports and brought about a consumer shift toward available fine spirits. This is where well-established supply chains of tequila suppliers came into the picture and gained traction to the spirit in global markets. Furthermore, the availability of tequila in abundance encouraged players to create more varieties of tequila in mixed concentrations which further bolstered the market growth.

The tequila market is deeply intertwined with geopolitical dynamics, from trade policies and agricultural regulations to international relations and cultural diplomacy. While favorable geopolitical conditions can open new markets, enhance brand protection, and boost exports, challenges such as trade disputes, environmental issues, and regulatory changes can pose significant risks. As the global landscape continues to evolve, stakeholders in the tequila market must remain vigilant and adaptable to the shifting geopolitical currents that can impact this iconic industry.

Regional Analysis

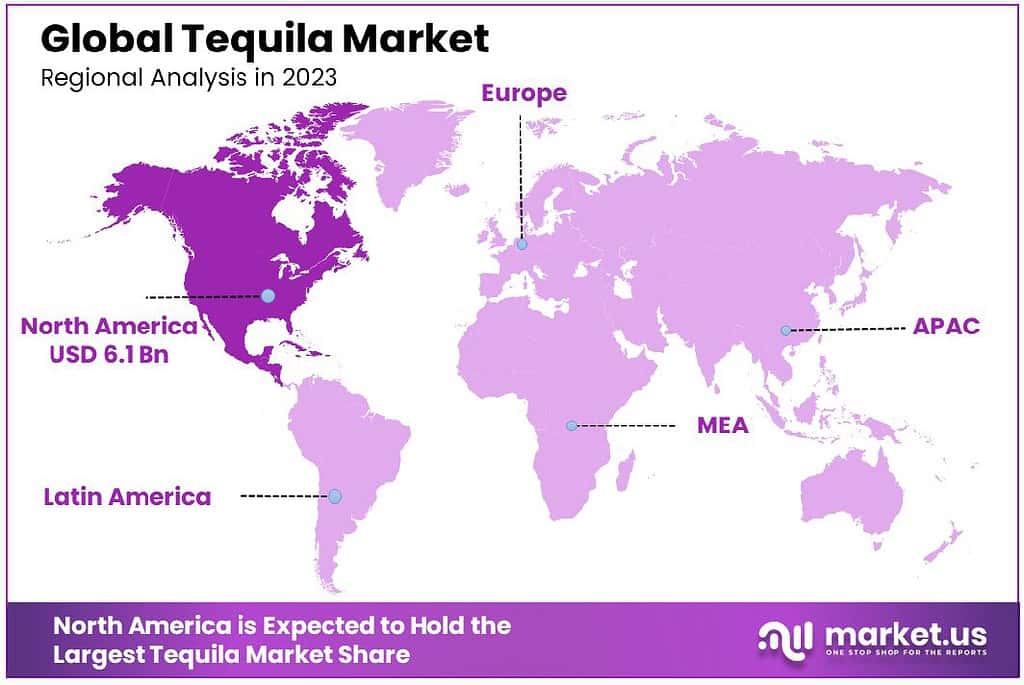

North America is leading the Global Tequila Market

North America dominated the market with the highest revenue 6.1 billion, commanding a share of 54.3% owing to the increasing demand for premium spirits in the region. Countries such as the US, Mexico, Canada, and others are major consumers of tequila in the region.

The US owns the largest tequila market after Mexico. This is also attributed to the increasing number of Mexican immigrants in the country. For instance, according to the report published by the International Wine and Spirits Record (IWSR), on June 26, 2024, agave-based spirits sales increased by 4% in 2023, compared to that of the previous year.

As a national drink of Mexico, tequila is celebrated at the National Tequila Fair in Jalisco and Tequila cities during year-end. Tequila is also consumed for its medicinal benefits traditionally, in different concentrations across North America.

The traditional significance of tequila consumption in Mexico continues to be a key factor for the region’s dominant share in the market. Moreover, the increasing popularity of tequila as a high-profile luxury spirit and its growing affordability are expected to continue to drive the market in the region, during the projection period.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major players in the global tequila market are continuously investing in innovation and expansion. They implement multiple business strategies to position themselves higher on the competitive ground.

El Grado Tequila LLC, Jose Cuervo S.A. de C.V., Dos Lunas Spirits LLC, and The Molson Coors Brewing Company, are the major players known for their diversified product portfolio and efficient supply chain networks. These key players along with other industry participants collectively influence the global tequila market’s growth, supply, and demand dynamics.

Players in the market are investing in studies to improve the quality and taste attributes of tequila. Recently, advanced technologies such as nano-filtration have been experimentally used by some players to bring out a refined flavor of tequila.

Researchers are also studying the genetic makeup of blue agave to study its medicinal properties and reduce its maturity period to gain maximum yield in less time. Additionally, players in the market are focused on adopting sustainable practices such as harvesting rainwater and solar energy to meet everyday crop and farming requirements.

They are also encouraged to find different ways to use the wastes of agave plants after harvest in areas such as developing agave-based biofuels and other medicinal blends. This is projected to significantly propel the market.

Top Key Players

- El Grado Tequila LLC

- Jose Cuervo S.A. de C.V.

- Dos Lunas Spirits LLC

- Teremana

- PATRÓN Tequila

- The Molson Coors Brewing Company

- Constellation Brands Inc.

- Thai Beverage Public Company Limited

- Casamigos Spirits Co.

- Bacardi Limited

- Brown-Forman Corporation

- Clase Azul Tequila S.A. de C.V.

- Ambhar Global Spirits LLC

- Patron Spirits International LLC

- Pernod Ricard

- Proximo Spirits LLC

- Milagro Tequila LLC

- Other Key Players

Recent Developments

- On May 28, 2024, Pernod Ricard entered into a strategic partnership with ecoSPIRITS for a global licensing agreement for the next five years. The company planning to distribute its spirits globally will the help of this alliance.

- On April 8, 2024, Teremana, a tequila brand co-founded by Dwayne Johnson, announced its expansion of distillery to cater to the increasing demand for premium tequila in the region.

- On November 7, 2022, PATRÓN Tequila launched PATRÓN EL ALTO. The spirit is made from 100% Weber blue agave grown in Mexico and Jalisco.

Report Scope

Report Features Description Market Value (2023) USD 11.4 Billion Forecast Revenue (2033) USD 20.8 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Blanco, Reposado, Anejo, Others), By Grade(100% Tequila, Mixed Tequila), By Distribution Channel(On-trade, Bars, Restaurants, Clubs, Off-trade, Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape El Grado Tequila LLC, Jose Cuervo S.A. de C.V., Dos Lunas Spirits LLC, The Molson Coors Brewing Company, Constellation Brands Inc., Thai Beverage Public Company Limited, Casamigos Spirits Co., Bacardi Limited, Brown-Forman Corporation, Clase Azul Tequila S.A. de C.V., Ambhar Global spirits LLC, Patron Spirits International LLC, Proximo Spirits LLC, Milagro Tequila LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Tequila Market Size in 2023?The Global Tequila Market Size is USD 11.4 Billion in 2023.

What is the projected CAGR at which the Global Tequila Market is expected to grow at?The Global Tequila Market is expected to grow at a CAGR of 6.2% (2024-2033).

List the segments encompassed in this report on the Global Tequila Market?Market.US has segmented the Global Tequila Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Blanco, Reposado, Anejo, Others), By Grade(100% Tequila, Mixed Tequila), By Distribution Channel(On-trade, Bars, Restaurants, Clubs, Off-trade, Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores)

List the key industry players of the Global Tequila Market?El Grado Tequila LLC, Jose Cuervo S.A. de C.V., Dos Lunas Spirits LLC, The Molson Coors Brewing Company, Constellation Brands Inc., Thai Beverage Public Company Limited, Casamigos Spirits Co., Bacardi Limited, Brown-Forman Corporation, Clase Azul Tequila S.A. de C.V., Ambhar Global spirits LLC, Patron Spirits International LLC, Proximo Spirits LLC, Milagro Tequila LLC

-

-

- El Grado Tequila LLC

- Jose Cuervo S.A. de C.V.

- Dos Lunas Spirits LLC

- The Molson Coors Brewing Company

- Constellation Brands Inc.

- Thai Beverage Public Company Limited

- Casamigos Spirits Co.

- Bacardi Limited

- Brown-Forman Corporation

- Clase Azul Tequila S.A. de C.V.

- Ambhar Global spirits LLC

- Patron Spirits International LLC

- Proximo Spirits LLC

- Milagro Tequila LLC