Global Telecom Managed Service Market Size, Share, Growth Analysis Report By Service Type (Managed Network Services, Managed Data Center Services, Managed Security Services, Managed Mobility Services, Other Service Types), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132221

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

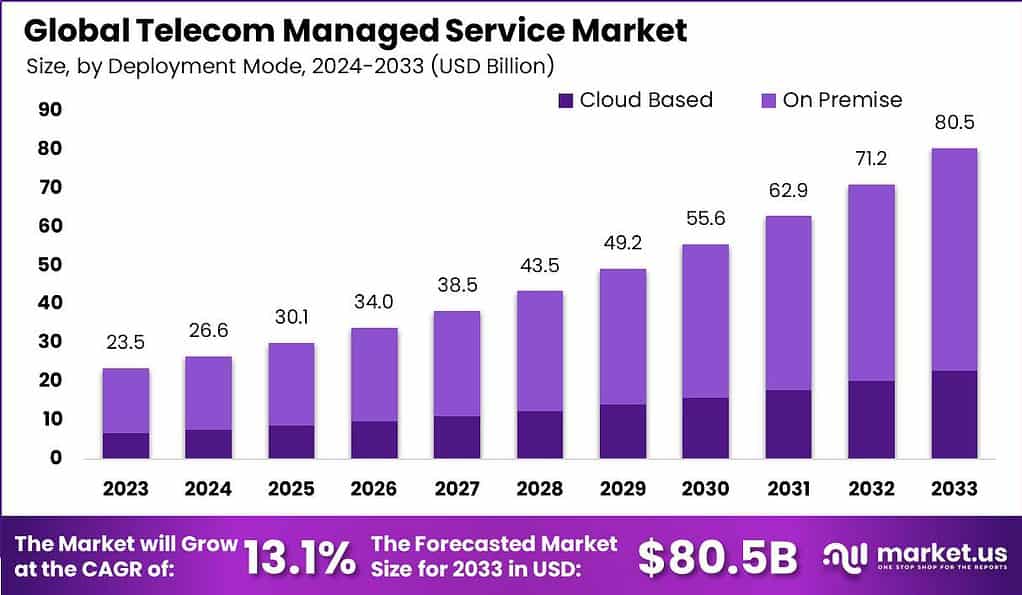

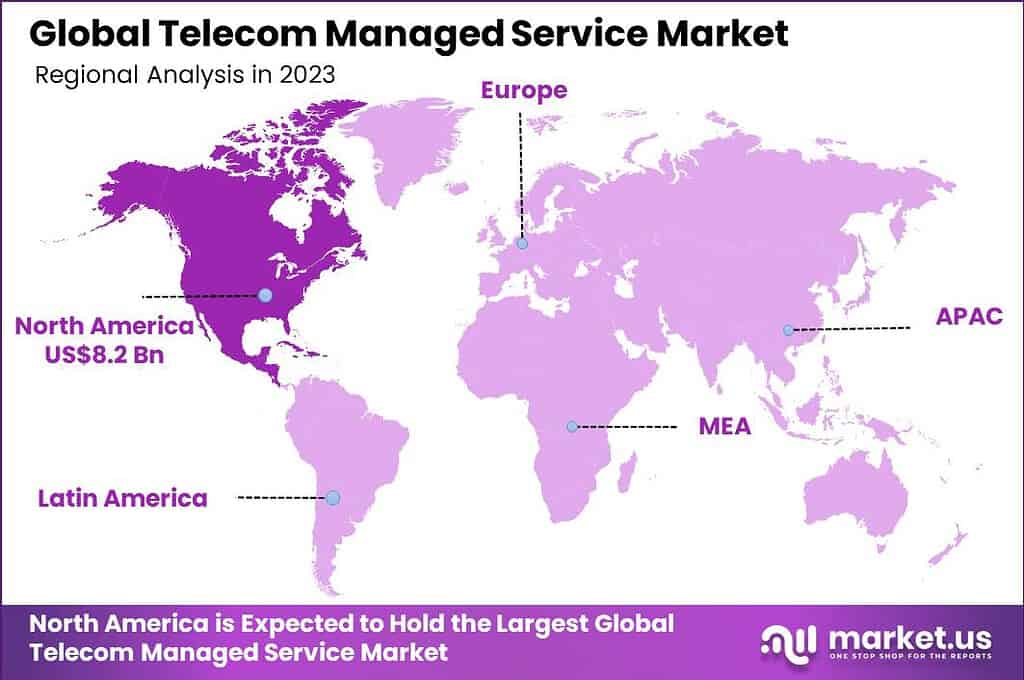

The Global Telecom Managed Service Market size is expected to be worth around USD 80.5 Billion By 2033, from USD 23.5 Billion in 2023, growing at a CAGR of 13.10% during the forecast period from 2024 to 2033. Geographically, North America held a dominant position in the Telecom Managed Service sector in 2023, capturing more than 35.1% of the market share, with revenues reaching USD 8.2 billion.

Telecom Managed Services encompass a wide range of offerings provided by third-party vendors that focus on managing and optimizing a company’s telecommunications systems. These services include the management of network operations, data and information services, communication systems, mobility solutions, and IT equipment, among others.

The market for Telecom Managed Services is driven by businesses’ growing need for reliable and efficient communication systems that are critical for day-to-day operations. As technology advances and becomes more integral to business operations, the complexity of managing telecom services increases. This has prompted many companies to outsource these services to specialized providers who offer cost efficiency, enhanced security, and better performance management.

Telecom Managed Services help companies streamline their operations, reduce costs, and improve overall productivity by allowing them to focus on their core business rather than IT and telecom operations. The primary driving factors for the Telecom Managed Services market include the need for cost reductions in managing IT and telecom infrastructures, the complexity of modern technologies, and the necessity for businesses to maintain a reliable communication system.

For instance, In February 2023, at the Mobile World Congress, HCLTech unveiled a new suite of technology solutions tailored for the 5G sector. This launch showcases HCLTech’s broad capabilities across digital, engineering, cloud, and software services. The solutions are designed to support Communication Service Providers (CSPs) and enterprises by boosting their readiness for 5G and accelerating the financial gains from their 5G investments.

Demand in the Telecom Managed Services market is rising as businesses increasingly recognize the benefits of outsourcing telecom and IT management. These services not only provide operational efficiencies but also offer enhanced security features, which are crucial in protecting sensitive business data and maintaining uninterrupted service delivery.

Technological advancements are continuously shaping the Telecom Managed Services sector. Innovations in artificial intelligence, machine learning, and predictive analytics are enhancing the way services are delivered. These technologies enable more proactive and automated management of networks and services, leading to improved uptime and better customer experiences.

The market presents several opportunities for growth, especially in areas such as cloud-based solutions, cybersecurity, and customized telecom solutions tailored to specific business needs. As more companies undergo digital transformations, the integration of IoT and AI into managed services offers significant prospects for service providers to deliver more sophisticated, predictive maintenance and support

Key Takeaways

- The Global Telecom Managed Service Market is projected to reach USD 80.5 billion by 2033, up from USD 23.5 billion in 2023, growing at a CAGR of 13.10% from 2024 to 2033.

- In 2023, the Cloud-Based segment held a dominant market position, capturing more than 52.8% of the Telecom Managed Service market.

- The Managed Data Center Services segment held a significant share of more than 28.5% within the Telecom Managed Service Market in 2023.

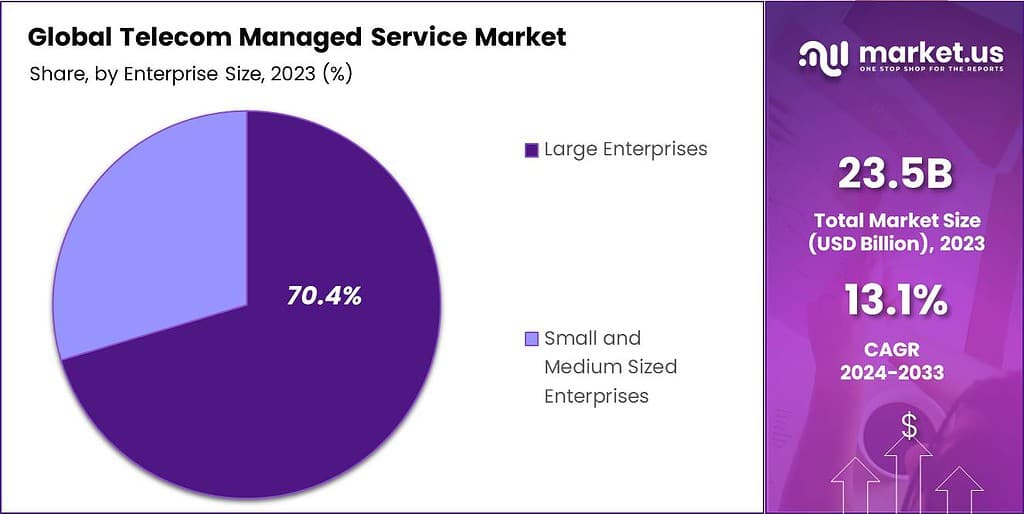

- The Large Enterprises segment also dominated the market in 2023, capturing over 70.4% of the market share.

- North America led the Telecom Managed Service market in 2023, with a share of more than 35.1% and revenues reaching USD 8.2 billion.

Service Type Analysis

In 2023, the Managed Data Center Services segment held a dominant market position within the Telecom Managed Service Market, capturing more than a 28.5% share. This segment leads primarily due to the escalating demand for data storage solutions driven by the surge in data traffic and the proliferation of digital content.

The prominence of this segment is also attributed to the increasing focus on disaster recovery and business continuity planning. Telecom operators are investing in managed data center services to ensure they can maintain operations without interruption, even during unforeseen events. This strategic importance boosts the segment’s growth as it directly correlates with operational resilience and reliability.

The transition to cloud-based platforms and services fuels the expansion of managed data center services. As telecom companies adopt cloud solutions to enhance flexibility and reduce capital expenditure, the need for managed services that can offer seamless cloud integration, management, and support grows. This shift ensures the markets continued relevance and dominance in the telecom managed services landscape.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position, capturing more than a 52.8% share of the Telecom Managed Service market. The popularity of cloud-based solutions can be attributed to their inherent scalability, flexibility, and cost-effectiveness.

One of the key reasons why the Cloud-Based segment is leading is the strong demand for remote and agile working capabilities. With the growing need for telecom providers to offer seamless services across geographies, cloud-based managed services provide a centralized and easily accessible platform that supports remote operations.

This approach has become especially crucial in light of the recent shift towards hybrid and remote work models, where network management and customer service must remain efficient and uninterrupted. Cloud platforms offer real-time monitoring, enhanced data management, and quicker service updates.

Furthermore, the integration of advanced technologies such as 5G, AI, and IoT is significantly simplified through cloud deployments. Telecom providers benefit from the ability to incorporate new services and capabilities more seamlessly, reducing time-to-market and increasing their responsiveness to customer needs.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Telecom Managed Service Market, capturing more than a 70.4% share. This significant market share is largely attributed to the complex operational needs and extensive network infrastructures that characterize large enterprises.

Large enterprises often opt for managed telecom services to mitigate the risks associated with downtime and to streamline operations. By outsourcing their telecom management, these large entities leverage the expertise of specialized service providers to ensure efficiency and technological advancement without the need to invest heavily in internal resources.

The trend among large enterprises to expand into new geographic markets and increase their service offerings requires a scalable telecom infrastructure that can adapt quickly to changing business environments. Managed telecom services provide the flexibility and scalability necessary to support this expansion, driving the demand within this segment.

Key Market Segments

By Service Type

- Managed Network Services

- Managed Data Center Services

- Managed Security Services

- Managed Mobility Services

- Other Service Types

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Small and Medium Sized Enterprises

- Large Enterprises

Driver

High Demand for Telecom Managed Services

The rise in connected devices, the expansion of the Internet of Things (IoT), and the growing complexity of network infrastructures make it challenging for enterprises to manage and secure their telecommunications infrastructure in-house.

Organizations across industries realize that managing telecom networks internally often requires significant resources, including a dedicated team, sophisticated tools, and ongoing training. Telecom managed service providers offer high-end solutions such as network monitoring, security management, and performance optimization, enabling companies to allocate their internal resources more efficiently.

The increasing demand for 5G deployment is driving growth in telecom managed services. As 5G networks are more complex and require ongoing management for smooth operations, businesses are turning to managed service providers to ensure seamless connectivity and performance.

Restraint

Data Security Concerns

While telecom managed services offer numerous benefits, data security and privacy concerns present a major restraint to their adoption. As businesses entrust their sensitive data, communication channels, and network operations to external managed service providers (MSPs), they expose themselves to potential risks of data breaches, unauthorized access, and cybersecurity attacks.

The rising number of cyberattacks and data breaches across the globe has made data security a critical consideration for businesses. Companies fear that any vulnerabilities or lapses in the managed service provider’s security protocols can have far-reaching consequences, including financial losses, damage to reputation, and potential legal liabilities.

Opportunity

Rise of Cloud-Based Solutions

The rapid adoption of cloud-based solutions presents a significant opportunity for the telecom managed service market. As organizations increasingly migrate their data, applications, and communications to the cloud, they require expert management to ensure seamless operations, robust security, and optimized performance.

Cloud-based solutions offer scalability, cost savings, and flexibility, making them an attractive choice for businesses looking to modernize their operations. However, managing a cloud environment can be complex and requires specialized skills, particularly for hybrid and multi-cloud setups. Telecom managed service providers can step in to offer comprehensive support, from initial migration to ongoing optimization and maintenance.

Challenge

Managing Evolving Customer Expectations

One of the significant challenges facing the telecom managed service market is the need to keep pace with evolving customer expectations. As technology rapidly evolves, businesses demand more customized, agile, and innovative services from their managed service providers (MSPs). Meeting these expectations while maintaining profitability and service quality is a complex and ongoing challenge for the industry.

Customers seek tailored solutions that align with their unique business needs and objectives. They expect managed services to go beyond basic network monitoring and maintenance to include advanced capabilities such as predictive analytics, AI-driven insights, and proactive threat mitigation. This requires MSPs to continuously invest in new technologies, upskill their workforce, and develop innovative service offerings.

Emerging Trends

Telecom managed services are evolving rapidly, driven by several key trends such as the integration of 5G technology is a significant development, offering faster and more reliable connectivity. This advancement enables telecom providers to offer enhanced services and improve customer experiences.

Additionally, the adoption of cloud computing is transforming telecom operations. By migrating services to the cloud, companies can achieve greater scalability and flexibility, allowing them to respond swiftly to market changes and customer demands.

Another notable trend is the growing demand for managed mobility services reflects the need for efficient management of mobile devices and remote work environments. These services help businesses maintain productivity and security across various locations and devices.

Top 5 Business Benefits

- Cost Savings: By entrusting telecom management to experts, businesses can reduce expenses related to infrastructure, maintenance, and staffing. This approach allows companies to focus on their core operations while keeping costs in check.

- Enhanced Efficiency: Managed telecom services streamline communication systems, ensuring they operate at peak performance. This optimization leads to smoother operations and improved productivity across the organization.

- Scalability and Flexibility: As your business grows, managed services can easily adapt to increased demands. They offer the flexibility to scale services up or down based on your current needs, ensuring your telecom infrastructure aligns with your business objectives.

- Access to Expertise: Partnering with a managed service provider grants you access to specialized knowledge and the latest technologies. This expertise ensures your telecom systems are up-to-date and secure, without the need for extensive in-house training.

- Improved Customer Service: Efficient telecom systems enable better communication with clients, leading to enhanced customer satisfaction. Reliable and clear communication channels help in addressing customer needs promptly and effectively.

Regional Analysis

In 2023, North America held a dominant market position in the Telecom Managed Service sector, capturing more than a 35.1% share, with revenues reaching USD 8.2 billion. This leadership can be attributed to several key factors that uniquely position North America at the forefront of the telecom managed services industry.

The presence of a highly developed technological infrastructure and the early adoption of advanced telecom technologies have provided a robust foundation for the expansion of managed services. This region is home to some of the world’s largest telecom companies and tech innovators, which not only serve the local market but also set global trends.

North America’s regulatory environment is favorable for the growth of telecom and IT industries, encouraging investments in new technologies and services. This has facilitated significant advancements in cloud computing, IoT, and cybersecurity, all of which are integral to the telecom managed service market. The push towards digital transformation by enterprises has driven demand for outsourcing management functions to handle complex networks and ensure efficiency.

The Telecom sector in North America is also characterized by a high level of competition, which compels service providers to continuously improve their offerings and customer service standards. This competition has led to service innovation and adoption of managed services as a strategic move to enhance core competencies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The telecom managed services market is expanding rapidly as telecom operators seek to outsource network management, security, IT infrastructure, and other non-core services. Several key players are leading the market by offering innovative and comprehensive solutions tailored to meet the needs of telecom providers worldwide.

Telefonaktiebolaget LM Ericsson , commonly known as Ericsson, stands out as a pivotal player in the telecom managed services market. With its long history in the telecommunications sector, Ericsson has mastered the art of innovation and service delivery, making it a trusted partner for many telecom operators worldwide.

Nokia is another significant player offering a wide range of managed services, including network optimization, cloud services, and cybersecurity solutions. The company’s focus on 5G and AI-driven solutions enables telecom operators to improve network performance and customer experience.

Huawei is a key competitor in the telecom managed services space, providing network optimization, cloud management, and security solutions. The company is a leader in 5G technology, offering services that support the deployment and maintenance of next-generation networks.

Top Key Players in the Market

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Fujitsu Limited

- Comarch

- Verizon Communications Inc.

- Wipro Limited

- NTT DATA Group Corporation

- AT&T Inc.

- Cyient

- Other Key Players

Recent Developments

Report Scope

Report Features Description Market Value (2023) USD 23.5 Bn Forecast Revenue (2033) USD 80.5 Bn CAGR (2024-2033) 13.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Managed Network Services, Managed Data Center Services, Managed Security Services, Managed Mobility Services, Other Service Types), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Telefonaktiebolaget LM Ericsson, Nokia Corporation, Fujitsu Limited, Comarch, Verizon Communications Inc., Wipro Limited, NTT DATA Group Corporation, AT&T Inc., Cyient, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Telecom Managed Service MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Telecom Managed Service MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Fujitsu Limited

- Comarch

- Verizon Communications Inc.

- Wipro Limited

- NTT DATA Group Corporation

- AT&T Inc.

- Cyient

- Other Key Players