Global Telecom Billing and Revenue Management Market Size, Share Analysis By Component (Solutions (Mediation, Billing and Charging, Revenue Assurance, Fraud Management, Others), Services (Professional Services, Managed Services)), By Deployment Model (On-premises, Cloud-based), By Operator Type (Mobile Operator (MNO, MVNO, & MVNE), Internet Service Provider), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154986

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of AI

- US Market Size

- Top 5 Trends and Innovations

- Top 5 Growth Factors

- By Component

- By Deployment Model

- By Operator Type

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis and Coverage

- Recent Developments

- Report Scope

Report Overview

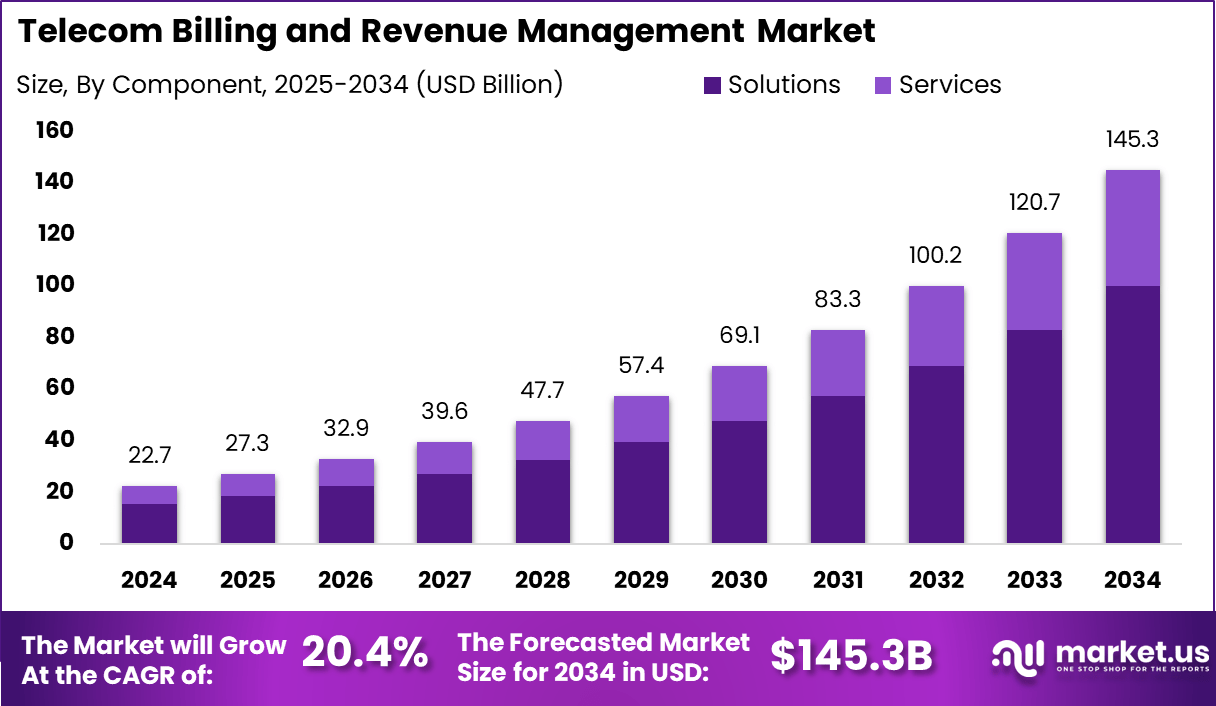

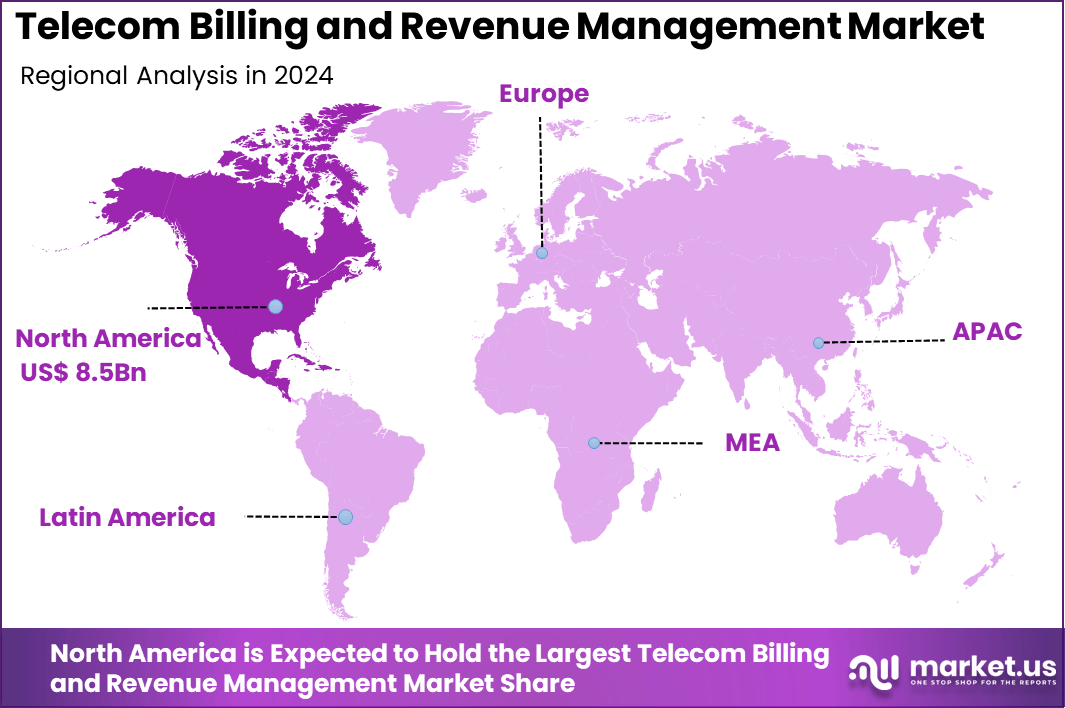

The Telecom Billing and Revenue Management Market was valued at USD 22.7 billion in 2024 and is projected to rise to USD 27.3 billion in 2025, growing at a CAGR of 20.4% to reach USD 145.3 billion by 2034. In 2024, North America held a dominant market position, capturing more than a 37.8% share, holding USD 8.5 Billion revenue.

The Telecom Billing and Revenue Management (BRM) system refers to the comprehensive suite of software and service solutions that support charging, billing, invoicing, and revenue tracking – often enhanced with analytics and customer‑centric functionalities. These systems are integral to telecom operations, ensuring accurate monetization and financial control in increasingly complex service environments

Key driving factors include the increasing need for fraud detection and revenue assurance solutions amid rising revenue leakage risks. Telecom operators are adopting advanced billing platforms integrated with artificial intelligence and machine learning to automate billing functions, detect anomalies, and personalize customer engagements.

The push for real-time billing and charging systems ensures seamless processing of complex transactions, enabling quicker payment cycles and enhanced customer satisfaction. For instance, in March 2024, Hrvatski Telekom announced its intent to extend its partnership with Netcracker by adopting Netcracker Revenue Management, a key component of Netcracker’s Digital BSS (Business Support System) solution.

Demand for these solutions is expanding due to heightened consumer expectations for transparent, timely billing and flexible payment options. As telecom offerings grow more diverse with bundled services and usage-based pricing, operators rely on BRM systems to support these models efficiently while maintaining compliance with regulatory mandates on billing accuracy and data protection.

Market Size and Growth

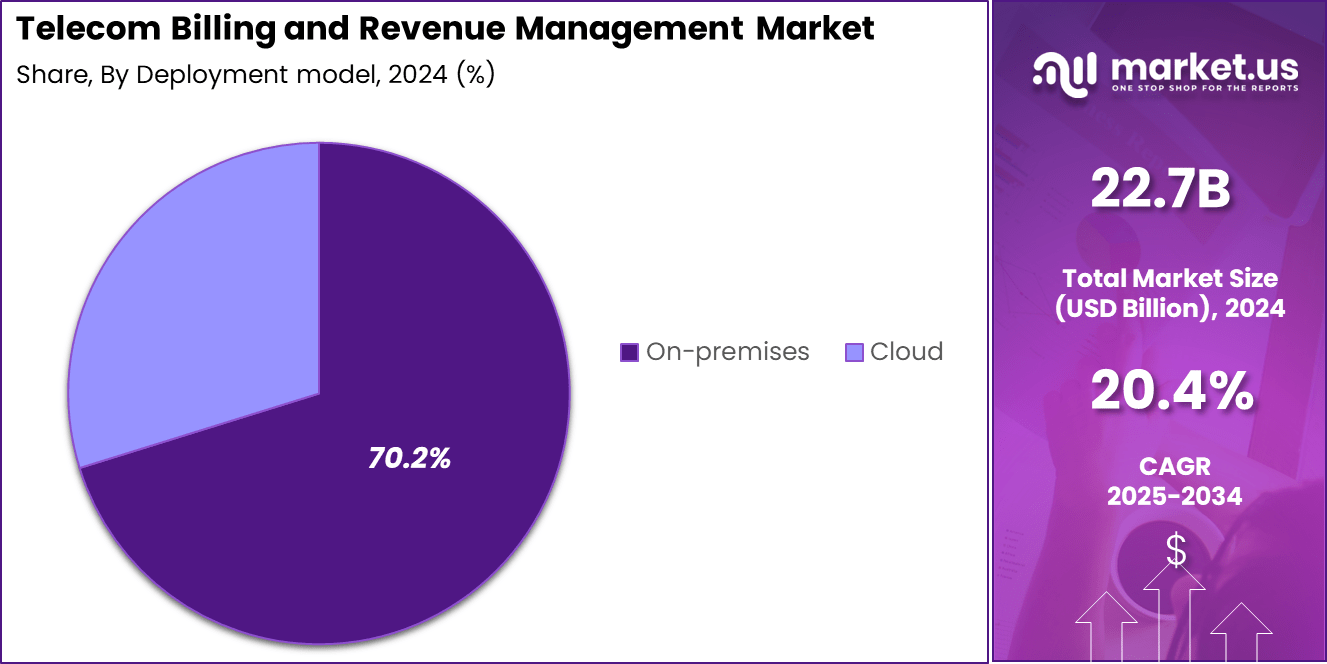

Metric Statistic / Value Market Value (2024) USD 22.7 Bn Forecast Revenue (2034) USD 145.3 Bn CAGR(2025-2034) 20.4% Leading Segment On-premises: 70.2% Leading Region Share North America [37.8% Market Share] Largest Country U.S. [USD 7.29 Bn Market Revenue], CAGR: 17.2% Key Insight Summary

- The global market is projected to surge from USD 22.7 billion in 2024 to USD 145.3 billion by 2034, growing at a strong CAGR of 20.4%, driven by digital transformation, 5G rollout, and increasing complexity in telecom services and pricing models.

- North America held a leading 37.8% market share in 2024, generating USD 8.5 billion in revenue, supported by early adoption of convergent billing systems and high telecom penetration.

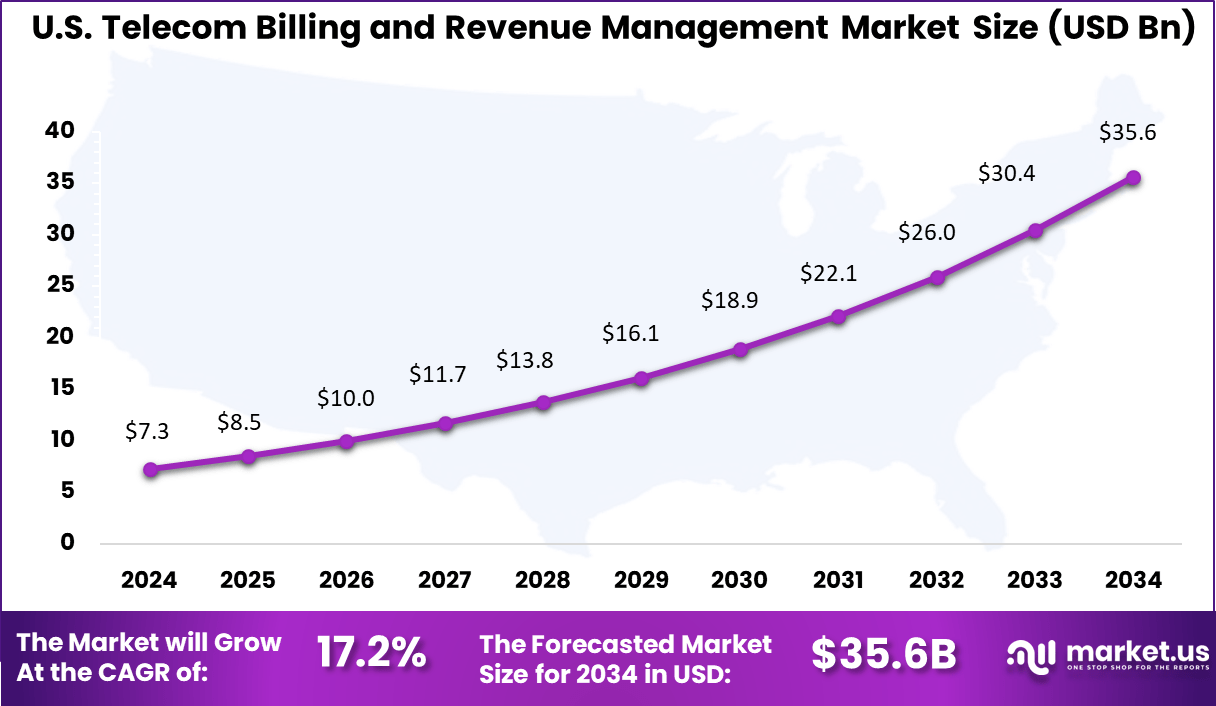

- The U.S. market alone contributed USD 7.29 billion and is expected to expand at a CAGR of 17.2%, reflecting ongoing investments in real-time billing, cloud monetization, and customer experience platforms.

- The Solutions segment led by component with a 68.8% share, highlighting telecom operators’ demand for agile, scalable, and integrated billing software to manage service innovation and revenue leakage.

- On-premises deployment remained dominant with a 70.2% share, especially among large operators requiring secure, customizable systems aligned with internal compliance protocols.

- The Mobile Operator category, including MNOs, MVNOs, and MVNEs, accounted for 60.5% of the market, as mobile networks continue to scale with increased data usage, multi-service plans, and partner ecosystems.

Role of AI

Role/Function Description Automated Billing & Invoicing AI automates data entry, invoice creation, and reconciliation, reducing errors and speeding up billing cycles. Fraud Detection Machine learning detects billing anomalies and suspicious usage patterns to prevent revenue leakage and fraud. Real-Time Dynamic Pricing AI enables real-time and usage-based pricing adjustments, supporting customer-centric, flexible billing models (e.g., for 5G services). Customer Segmentation & Personalization AI analyzes customer data to tailor billing plans, offers, and communication, improving customer satisfaction and retention. Predictive Analytics Forecasts usage patterns, billing events, and revenue trends for better operational planning. Enhanced Customer Support AI-driven chatbots and virtual assistants handle billing inquiries 24/7 with fast, personalized responses. Revenue Assurance & Leakage Prevention AI-driven monitoring identifies gaps and optimizes revenue recovery across complex telecom ecosystems. US Market Size

The U.S. Telecom Billing and Revenue Management Market was valued at USD 7.3 Billion in 2024 and is anticipated to reach approximately USD 35.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 17.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position in the Telecom Billing and Revenue Management (BRM) sector, capturing more than a 37.8% share and accounting for approximately USD 8.5 billion in revenue.

This pre‑eminence can be attributed to high levels of telecom service penetration, widespread adoption of advanced billing technologies such as convergent and cloud‑based systems, and a highly competitive landscape that drives continual innovation.

The presence of major telecom operators with deep pockets for digital transformation initiatives, as well as supportive regulatory frameworks that encourage investment in next‑generation revenue assurance tools, further bolstered the region’s leadership.

Top 5 Trends and Innovations

Trend/Innovation Description Cloud-Based & SaaS Billing Solutions Migration to cloud platforms offers flexibility, reduced costs, and seamless integration with telecom infrastructure. AI and Machine Learning Integration Widespread use of AI/ML for automation, predictive analytics, fraud detection, dynamic pricing, and personalized customer engagement. Real-Time Billing and Data Processing Systems capable of immediate charge computation and billing updates aligned with real-time service consumption. Customer-Centric Billing Models Emphasis on personalized pricing, usage monitoring, self-service portals, and digital payment options to enhance customer experience. Converged and Multi-Service Billing Unified billing platforms supporting mobile, broadband, IoT, cloud, and OTT services under a single system for ease of management. Top 5 Growth Factors

Key Factors Description Rising Mobile and Internet Subscribers Increasing global mobile device and internet user base drives demand for efficient billing solutions. 5G and IoT Network Expansion Complex, high-speed data services require sophisticated, real-time billing and revenue management systems. Cloud and Digital Transformation Shift toward cloud-based, SaaS billing platforms enables scalability, agility, and integration with digital services and ecosystems. Increasing Service Complexity Diverse telecom offerings (bundled plans, prepaid/postpaid, OTT services) demand flexible, configurable billing and revenue systems. Regulatory Compliance & Fraud Detection Heightened regulatory standards and the need to combat sophisticated telecom fraud drive advanced revenue assurance implementations. By Component

In 2024, The solutions segment holds a commanding share of 68.8% in the telecom billing and revenue management market. This dominance highlights the critical role of software solutions, including mediation, billing and charging, revenue assurance, and fraud management.

These integrated platforms enable telecom operators to accurately track service usage, apply complex pricing models, and ensure precise revenue collection. Solutions help providers improve operational efficiency, reduce errors, and enhance customer experience through real-time billing and customizable service packages.

The growing adoption of these solutions is driven by the increasing demand for automation and digital transformation across telecom networks. Operators leverage advanced analytics and artificial intelligence embedded within billing solutions to predict revenue leakage, detect fraud, and streamline billing processes to keep pace with evolving service offerings such as 5G and IoT.

By Deployment Model

In 2024, On-premises deployment accounts for 70.2% of the market, reflecting a preference among telecom operators for maintaining control over billing infrastructure. This deployment model appeals to operators with strict regulatory compliance requirements or those who prioritize data security and immediate system responsiveness.

On-premises systems allow telecom companies to integrate billing functions seamlessly with existing operational technologies and customize platforms per their unique business needs. Despite growing interest in cloud-based solutions, many operators continue to favor on-premises deployments due to the need for greater reliability and control in mission-critical financial operations.

By Operator Type

In 2024, Mobile operators, including MNOs, MVNOs, and MVNEs, dominate the telecom billing and revenue management market with a 60.5% share. The rapid rise in mobile subscriptions worldwide, coupled with the complexity of pricing models for voice, data, and value-added services, drives this segment’s leadership.

Mobile operators require sophisticated billing systems capable of real-time charging, bundle management, and partner settlements to handle prepaid, postpaid, and hybrid customer plans effectively. The mobile sector’s growth is further accelerated by the proliferation of 5G technology and expanding mobile financial services, necessitating agile and scalable billing architectures.

Operators in this segment invest heavily in innovative billing and revenue management solutions that enable seamless customer experiences, reduce fraud, and optimize revenue streams in a highly competitive market.

Key Market Segments

By Component

- Solutions

- Mediation

- Billing and Charging

- Revenue Assurance

- Fraud Management

- Others

- Services

- Professional Services

- Managed Services

By Deployment Model

- On-premises

- Cloud-based

By Operator Type

- Mobile Operator (MNO, MVNO, & MVNE)

- Internet Service Provider

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver for market growth is the exponential increase in mobile subscribers and the adoption of next-generation telecom technologies worldwide, particularly in Asia-Pacific and Africa. The proliferation of smartphones and connected devices, alongside rising data consumption, creates demand for sophisticated billing solutions capable of supporting real-time usage tracking and complex pricing structures like bundling and subscription-based plans.

Additionally, heightened consumer expectations for transparent, personalized billing and self-service options compel telecom operators to upgrade their revenue management systems. The push towards regulatory compliance, fraud detection, and revenue assurance further encourages investment in advanced billing technologies. These factors collectively motivate telecom companies to adopt scalable, AI-powered platforms to optimize revenue streams, reduce leakage, and improve customer satisfaction.

Restraint Analysis

The telecom billing and revenue management market faces challenges such as high initial implementation costs and the complexity of integrating modern billing solutions with legacy infrastructure. Smaller and mid-sized operators often encounter financial and technical barriers to adopting advanced systems. The intricate nature of billing models, including usage-based pricing, bundled services, and evolving customer demands, increases operational complexity and risk of errors.

Privacy and data security concerns, heightened by the handling of sensitive customer information and compliance with stringent regulations, also restrain market expansion. In addition, ensuring ongoing system reliability amid fast technological changes and the need for skilled personnel to manage sophisticated billing platforms pose significant hurdles in market adoption and scalability.

Opportunity Analysis

There are substantial opportunities to innovate billing and revenue management through the adoption of AI, ML, and cloud technologies enabling real-time analytics, dynamic pricing, and predictive revenue assurance. These technologies allow telecom providers to enhance operational efficiency, offer customized customer experiences, and reduce revenue leakage.

Growing digital ecosystems and the rise of 5G and IoT services unlock new revenue streams like mobile payments, subscription models, and partner settlements. Smart integration of billing with customer relationship management and the implementation of converged billing systems create avenues for faster market responsiveness and improved customer engagement.

Emerging markets, with rapid telecom infrastructure expansion and increasing smartphone penetration, present significant growth potential. Furthermore, the adoption of edge computing and blockchain for enhanced security and transparency in billing processes represent promising innovation frontiers.

Challenge Analysis

A primary challenge is managing the complexity and accuracy of telecom billing processes to prevent revenue leakage and customer dissatisfaction. Telecom operators must navigate diverse pricing models, real-time data processing, and error-prone legacy system integrations.

Ensuring data security and regulatory compliance while adapting to rapidly evolving telecom services demands continuous investment and expertise. Balancing automation and AI-driven billing efficiencies with preserving service quality and human oversight is critical.

Moreover, addressing operational disruptions during digital transformations and maintaining agile billing infrastructure amid fierce market competition require strategic planning. Finally, preventing fraud, managing large-scale data environments, and meeting consumer expectations for transparency remain ongoing challenges that operators must overcome to sustain revenue growth and market relevance.

Competitive Analysis and Coverage

The telecom billing and revenue management market is shaped by several influential players, each bringing advanced solutions and strong regional presence. Amdocs, Oracle, and SAP SE remain key contributors due to their broad telecom portfolios and robust cloud-native platforms. Their consistent focus on automation, customer experience, and digital transformation supports their market dominance.

Additionally, Netcracker and CSG Systems, Inc. have built strong reputations for real-time billing, BSS modernization, and managed services, which have enabled telcos to scale billing operations across hybrid infrastructure environments. Companies such as Cerillion Technologies Ltd, Comarch SA, and Formula Telecom Solutions Ltd contribute significantly through agile billing systems, enabling digital service providers to reduce operational complexities.

SUBEX and STL Tech have strengthened their positions by providing fraud management, revenue assurance, and AI-driven analytics. These vendors cater to growing operator needs for revenue protection and business agility. Their solutions are often deployed by tier-2 telecom operators seeking flexible, cost-effective alternatives to traditional legacy systems.

Other players like Comviva, Intracom Telecom, Optiva Inc., and Huawei Technologies Co., Ltd. focus on scalable convergent charging, mobile money billing, and 5G readiness. Telefonaktiebolaget LM Ericsson supports revenue management integration with virtualized networks and IoT monetization tools. These firms remain committed to innovation in telecom monetization frameworks.

Top Key Players in the Market

- Amdocs

- Cerillion Technologies Ltd

- Comarch SA

- CSG Systems, Inc.

- Formula Telecom Solutions Ltd

- Huawei Technologies Co., Ltd

- Intracom Telecom

- Comviva

- Netcracker

- Optiva, Inc.

- Oracle

- SAP SE

- STL Tech

- SUBEX

- Telefonaktiebolaget LM Ericsson

- Others

Recent Developments

- In April 2025, Cass Information Systems finalized the divestiture of its Telecom Expense Management business to Asignet, aligning with a broader strategic shift and illustrating the ongoing consolidation trend in telecom expense management services.

- In March 2025, Amdocs was chosen by Botswana Telecommunications Corporation to modernize its convergent charging and billing platform. This initiative supports BTC’s transition from a traditional telecom operator to a digital services provider, with a focus on unlocking new revenue streams from 5G and cloud services.

- In May 2024, Ooredoo in Qatar extended its partnership with Netcracker, continuing to utilize managed services and a digital BSS suite. This collaboration reflects the operator’s ongoing investment in robust telecom billing and revenue management capabilities.

- In October 2023, Covenant Telecom partnered with OneBill to upgrade its billing and revenue systems. The upgrade aims to enhance operational efficiency in wholesale and retail billing while strengthening the company’s overall revenue management performance.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (Mediation, Billing and Charging, Revenue Assurance, Fraud Management, Others), Services (Professional Services, Managed Services)), By Deployment Model (On-premises, Cloud-based), By Operator Type (Mobile Operator (MNO, MVNO, & MVNE), Internet Service Provider) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amdocs, Cerillion Technologies Ltd, Comarch SA, CSG Systems, Inc., Formula Telecom Solutions Ltd, Huawei Technologies Co., Ltd, Intracom Telecom, Comviva, Netcracker, Optiva, Inc., Oracle, SAP SE, STL Tech, SUBEX, Telefonaktiebolaget LM Ericsson, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Telecom Billing and Revenue Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Telecom Billing and Revenue Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amdocs

- Cerillion Technologies Ltd

- Comarch SA

- CSG Systems, Inc.

- Formula Telecom Solutions Ltd

- Huawei Technologies Co., Ltd

- Intracom Telecom

- Comviva

- Netcracker

- Optiva, Inc.

- Oracle

- SAP SE

- STL Tech

- SUBEX

- Telefonaktiebolaget LM Ericsson

- Others