Global Tactical Footwear Market Size, Share, Growth Analysis By Product (Boots, Shoes), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148189

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

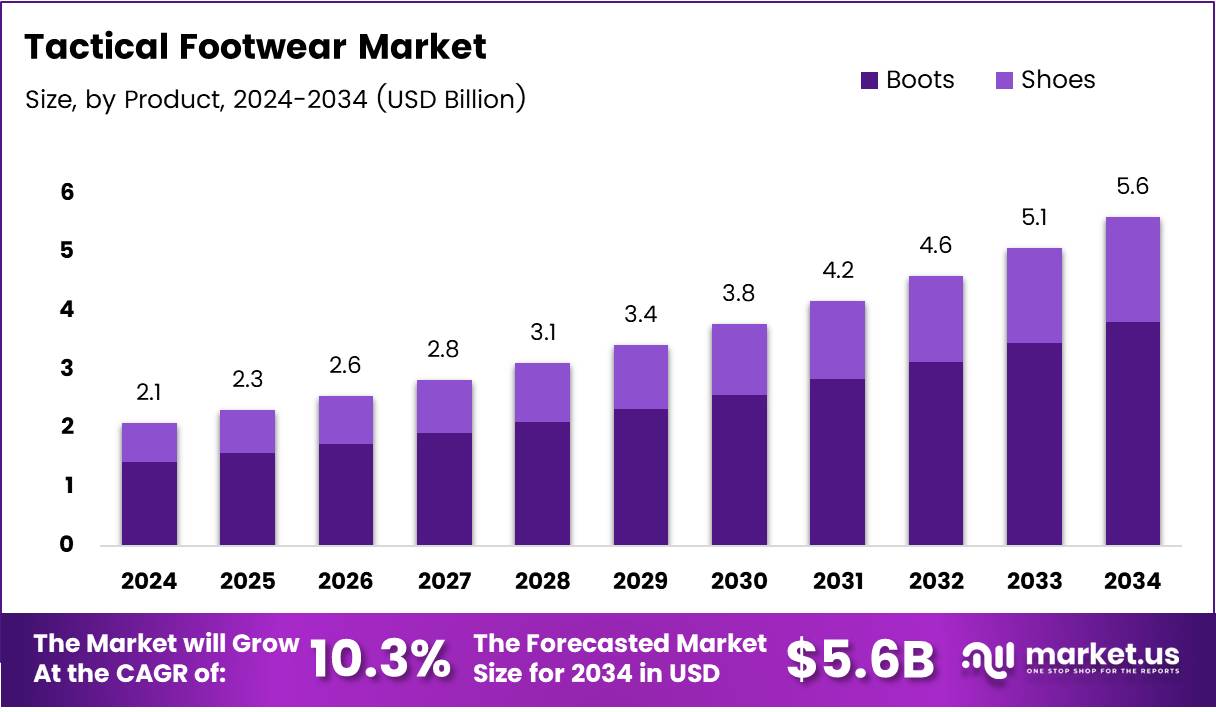

The Global Tactical Footwear Market size is expected to be worth around USD 5.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034.

The Tactical Footwear Market comprises specialized boots designed for law enforcement, military personnel, security professionals, and outdoor enthusiasts. These shoes are built to withstand harsh environments, offering durability, grip, and protection. Market demand is influenced by defense budgets, rising security threats, and growing outdoor recreation trends.

Tactical footwear serves a critical role in high-performance occupations where agility, safety, and endurance are essential. As per military health, wearing modern combat boots increases the energetic cost of walking by approximately 10% compared to running shoes. This highlights a trade-off between protection and performance in boot design.

Furthermore, crate club reports each tactical boot weighs 1.5 to 2.5 pounds, affecting speed and fatigue. Manufacturers are responding by developing lightweight materials to balance protection and mobility. This innovation opens doors for newer, tech-integrated designs across defense and adventure sports segments.

Meanwhile, cost remains a pivotal factor. Propper notes that a quality pair of army boots ranges between $80 to $150, influenced by material, sole design, and manufacturing technology. As procurement budgets vary across regions, value-driven offerings are gaining attention from both military and civilian users.

Globally, the tactical footwear market is witnessing consistent growth, driven by increased military modernization. Government investments into defense infrastructure, especially in the U.S., China, and India, are catalyzing procurement of advanced gear. Many countries are revisiting soldier mobility requirements to include footwear upgrades.

Additionally, regulatory standards for soldier safety are tightening, urging manufacturers to meet compliance benchmarks. This has resulted in the adoption of certified, lab-tested tactical boots with ergonomic enhancements and energy return technology. Such regulations are shaping competitive dynamics in the industry.

New opportunities are arising from commercial demand, particularly from hikers, survivalists, and law enforcement trainees. Tactical boots are increasingly seen as lifestyle wear due to their durability and aesthetics. Market players are leveraging e-commerce to tap into this expanding user base.

Transitioning into emerging markets, countries in Latin America and Southeast Asia are stepping up defense allocations. Local manufacturing incentives are encouraging regional players to enter the market. As a result, the tactical footwear industry is projected to expand with diversified price offerings and broader distribution channels.

Key Takeaways

- Global Tactical Footwear Market is projected to reach USD 5.6 Billion by 2034, up from USD 2.1 Billion in 2024.

- Market is expected to grow at a CAGR of 10.3% from 2025 to 2034.

- In 2024, Boots dominated the product segment with a 69.2% market share due to their durability and support.

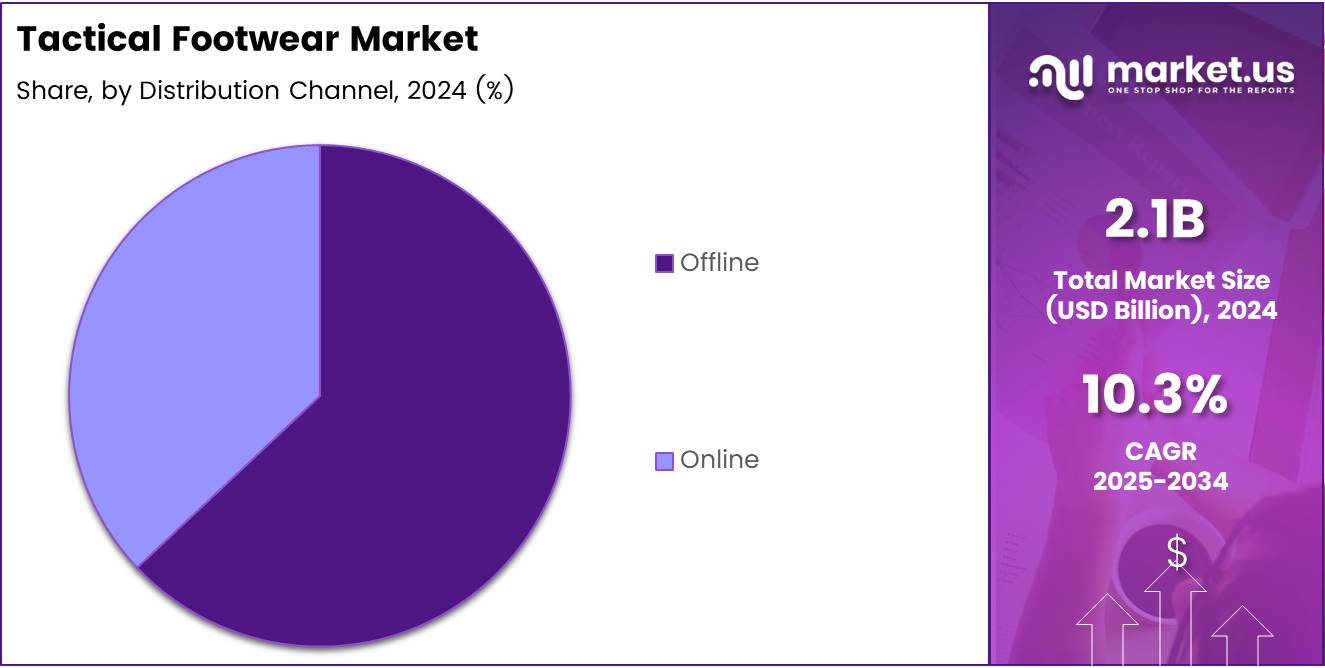

- Offline distribution channels led the market in 2024, reflecting consumer preference for in-store product trials.

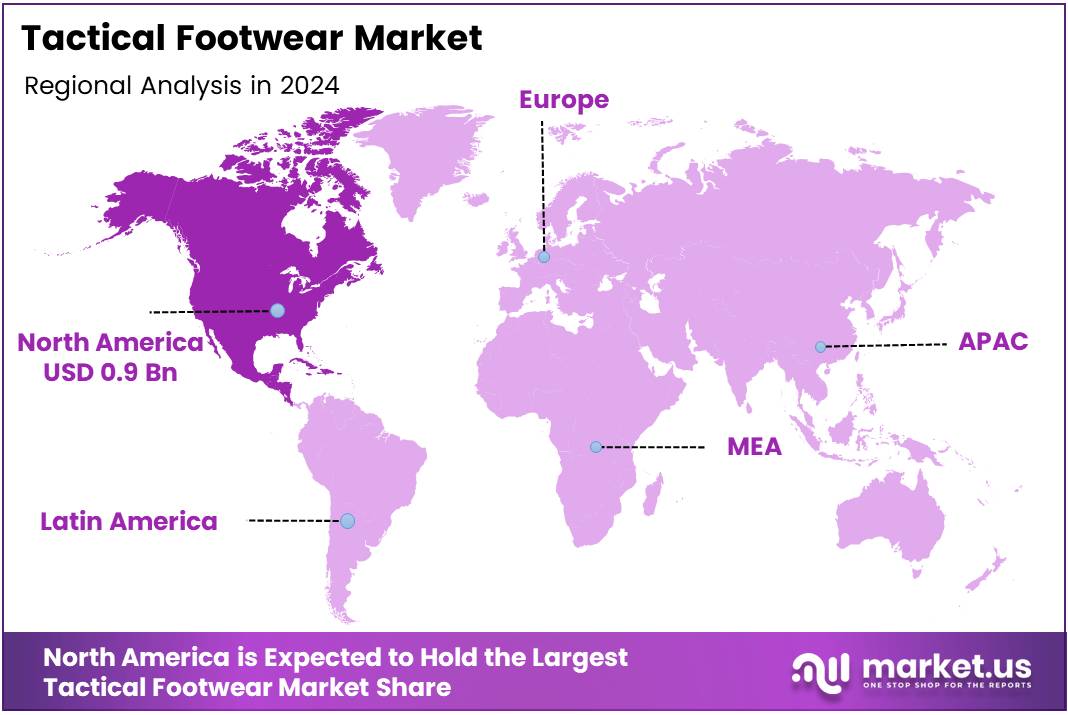

- North America holds the largest market share at 40.2%, driven by strong demand from military, law enforcement, and outdoor sectors.

Product Analysis

Boots dominate with 69.2% due to their durability and tactical reliability.

In 2024, Boots held a dominant market position in the By Product Analysis segment of the Tactical Footwear Market, with a 69.2% share. Their rugged build, superior ankle support, and long-lasting performance have made them a preferred choice among military personnel, law enforcement officers, and outdoor enthusiasts.

The segment’s strength also stems from the increasing adoption of boots in tactical training and harsh terrain operations. Consumers prioritize durability and protection over style in this segment, which has further propelled demand for tactical boots in both professional and recreational contexts.

In contrast, shoes within the tactical footwear category cater to a niche audience that values flexibility and lightness. While they offer comfort and agility, tactical shoes are often limited to environments where mobility is prioritized over protection. This has resulted in a comparatively restrained market share.

Despite the growing appeal of athleisure trends, the tactical boots category continues to outperform, driven by robust design innovations and expanding defense expenditures worldwide. As manufacturers refine boot technology for comfort and protection, the boots segment is expected to maintain its lead in the foreseeable future.

Distribution Channel Analysis

Offline channels lead due to consumer preference for physical trial and immediate purchase.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Tactical Footwear Market. Physical retail outlets and specialty stores continue to be the primary purchasing platforms for tactical footwear, as consumers often prefer to physically inspect, try on, and assess products before making a purchase.

Offline channels also benefit from a consultative buying experience, where customers can receive personalized assistance. This is particularly valuable in tactical footwear, where precise fit and specific performance features are crucial.

While the Online segment is steadily gaining traction, particularly among tech-savvy and urban consumers, it is still limited by challenges such as product returns, size mismatches, and lack of tactile engagement. That said, the convenience and broad selection offered by e-commerce platforms are gradually influencing buying behavior.

However, for now, offline retail maintains its dominance due to strong customer trust, enhanced product interaction, and the immediate gratification it offers. Retailers are further enhancing this experience through in-store promotions, loyalty programs, and expert guidance—factors that online platforms are yet to replicate at scale.

Key Market Segments

By Product

- Boots

- Shoes

By Distribution Channel

- Offline

- Online

Drivers

Military and Defense Demand Boosts Tactical Footwear Market Growth

The tactical footwear market is strongly driven by the steady demand from military and defense sectors. Armed forces in various countries consistently procure high-performance boots to ensure soldiers are equipped with durable, comfortable, and protective footwear. This regular procurement cycle keeps the market active and ensures a consistent revenue stream for manufacturers. Moreover, ongoing defense modernization efforts across regions further support this trend.

Another key factor is the growing recruitment in law enforcement agencies. As police forces and paramilitary units expand, especially in developing nations, the need for reliable tactical footwear rises. These users require footwear that performs well in tough environments, contributing to market stability and growth.

Additionally, the popularity of outdoor activities like hiking, trekking, and airsoft is rising globally. Adventure enthusiasts prefer tactical boots due to their rugged design and long-lasting comfort. This consumer behavior shift extends the use of tactical footwear beyond traditional military users and adds momentum to the overall market expansion.

Restraints

High Product Cost Limits Wider Adoption of Tactical Footwear

One of the main challenges for the tactical footwear market is its high product cost. Tactical boots are made using specialized materials and advanced manufacturing techniques to meet durability and safety standards. This makes them expensive, especially for casual users or people who want to buy them for everyday use or recreation. As a result, many potential buyers turn to cheaper alternatives, which slows down market penetration.

Another issue is the strict quality requirements, especially for products meant for defense and law enforcement. Manufacturers must meet military-grade specifications, which often increases production complexity and cost.

Meeting these standards can also delay the product launch timeline, affecting how quickly new designs enter the market. This slows innovation and adds operational pressure to manufacturers, especially smaller ones. Overall, these restraints make it harder for tactical footwear to reach a broader consumer base despite its growing demand.

Growth Factors

Women-Specific Tactical Footwear Offers Untapped Market Potential

A major growth opportunity in the tactical footwear market lies in addressing the needs of female users. With more women joining military forces and participating in outdoor activities like hiking and adventure sports, the demand for women-specific tactical boots is rising.

Traditional tactical footwear often doesn’t suit female anatomy perfectly, which creates discomfort. Brands that design footwear specifically for women—offering better fit and ergonomics—are likely to capture this growing segment and gain a competitive edge.

The market is also set to benefit from the integration of smart technologies into tactical footwear. Features such as GPS tracking, foot pressure sensors, and temperature monitoring can improve performance, safety, and situational awareness for users in critical missions or harsh environments. This innovation adds value and sets the stage for next-generation tactical boots that cater to tech-savvy users and professional forces alike.

Lastly, the expanding private security sector globally is boosting demand for tactical gear, including footwear. With increased hiring in the private security industry due to rising urbanization and safety concerns, companies are equipping their personnel with reliable, durable boots. This sector offers a consistent and growing customer base, further opening avenues for tactical footwear brands to diversify their offerings and boost sales.

Emerging Trends

Lightweight and Breathable Designs Shape Tactical Footwear Trends

Recent trends show a strong preference for lightweight and breathable tactical footwear. Users now demand boots that not only offer protection and durability but also provide comfort during long wear. This has led to a shift towards advanced materials and flexible designs, making tactical footwear more practical for extended use in different climates and terrains. It is especially appealing to both professionals and outdoor enthusiasts who seek a balance between strength and comfort.

Another trend is the growing crossover between tactical footwear and everyday fashion. The rise of tactical athleisure blends functionality with streetwear style. Boots once used solely by military personnel are now seen in urban settings as a fashion statement. This trend expands the consumer base by attracting young, fashion-conscious buyers looking for tough, performance-inspired shoes that also look good.

Eco-friendly production is also gaining traction. Many brands are focusing on sustainable manufacturing by using recycled materials and reducing their environmental footprint. This aligns with growing consumer awareness about sustainability. Buyers now consider the ethical and environmental impact of their purchases, pushing companies to innovate responsibly. As a result, eco-conscious design is becoming a key factor in market differentiation.

Regional Analysis

North America Dominates the Tactical Footwear Market with a Market Share of 40.2%, Valued at USD 0.9 Billion

North America leads the global tactical footwear market, accounting for 40.2% of the total share, driven by high demand from law enforcement and military personnel, along with increasing adoption for outdoor and adventure activities. The region’s advanced manufacturing capabilities and early adoption of high-performance footwear technologies further support its dominant position. Rising awareness about foot safety and product durability also contributes to sustained growth in this market.

Regional Mentions:

Europe follows with steady demand, supported by increasing security measures and modernization programs within defense sectors. The market benefits from strong consumer awareness regarding tactical-grade gear and an expanding outdoor recreation culture, particularly in countries such as Germany and the UK. Regulatory support for quality and safety standards continues to shape the regional market landscape.

Asia Pacific is emerging as a fast-growing region due to rising defense budgets, urbanization, and a growing interest in hiking and trekking activities. Countries such as China, India, and Japan are witnessing an uptick in demand for tactical footwear, fueled by both civilian and governmental end-users. Local manufacturing expansion and e-commerce penetration are further accelerating regional growth.

The Middle East & Africa region shows moderate growth, primarily driven by government contracts and heightened security concerns. Increased military modernization efforts and strategic alliances in key countries such as the UAE and Saudi Arabia support market development. However, overall adoption in the civilian sector remains limited compared to other regions.

Latin America exhibits gradual growth, led by demand in countries such as Brazil and Mexico, where public safety initiatives and outdoor sports activities are contributing to market expansion. While economic challenges and supply chain constraints slightly hinder progress, the region holds long-term potential due to its youthful population and growing interest in tactical lifestyle products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global tactical footwear market continues to be shaped by innovation, durability demands, and a shift toward lightweight and multi-functional designs. adidas AG maintains a stronghold through its integration of cutting-edge materials and modern aesthetics, appealing not only to tactical professionals but also to a growing base of lifestyle consumers seeking performance gear. The brand’s global recognition and continual R&D investments ensure its competitive edge in both military and civilian tactical segments.

Maelstrom Footwear has carved out a niche by offering cost-effective tactical boots tailored to military and law enforcement agencies. The company’s focus on comfort, durability, and value for money helps it remain a preferred choice among budget-conscious procurement entities without compromising on performance standards.

VF Corporation, the parent company behind several major brands, leverages its broad distribution network and marketing prowess to stay influential in the tactical segment. With brands under its umbrella offering robust tactical footwear, it balances heritage craftsmanship with modern innovation to meet the evolving demands of outdoor and defense professionals.

Belleville Boot Co., a long-time supplier to the U.S. military, continues to set industry standards for combat-ready footwear. Their deep specialization in military-grade boots ensures a loyal customer base, bolstered by their consistent focus on safety features, compliance, and ruggedness.

Together, these players reinforce a competitive landscape in 2024 that emphasizes product performance, brand credibility, and an ability to adapt quickly to tactical gear requirements across varied operational environments.

Top Key Players in the Market

- adidas AG

- Maelstrom Footwear

- VF Corporation

- Belleville Boot Co.

- Wolverine World Wide, Inc.

- Magnum Boots International

- LaCrosse Footwear

- Under Armour, Inc.

Recent Developments

- In Jan 2025, Magnum Boots partners with K Brands, naming them the exclusive distributor for the U.S. market. This strategic alliance aims to expand Magnum’s footprint in tactical and work footwear across the country.

- In Nov 2024, OTB Boots launches its new Elite Tactical Footwear line designed for military and law enforcement use. The line emphasizes durability, lightweight materials, and enhanced mobility features.

- In Apr 2024, Oros Labs raises $22 million in funding to develop advanced insulation for outdoor gear. The investment will support innovations in boots and tents using their patented SOLARCORE technology.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Boots, Shoes), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape adidas AG, Maelstrom Footwear, VF Corporation, Belleville Boot Co., Wolverine World Wide, Inc., Magnum Boots International, LaCrosse Footwear, Under Armour, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- adidas AG

- Maelstrom Footwear

- VF Corporation

- Belleville Boot Co.

- Wolverine World Wide, Inc.

- Magnum Boots International

- LaCrosse Footwear

- Under Armour, Inc.