Global Sustainable Footwear Market Size, Share, Growth Analysis By Type (Non-athletic, Athletic, Others), By End User (Men, Children, Women) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148347

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

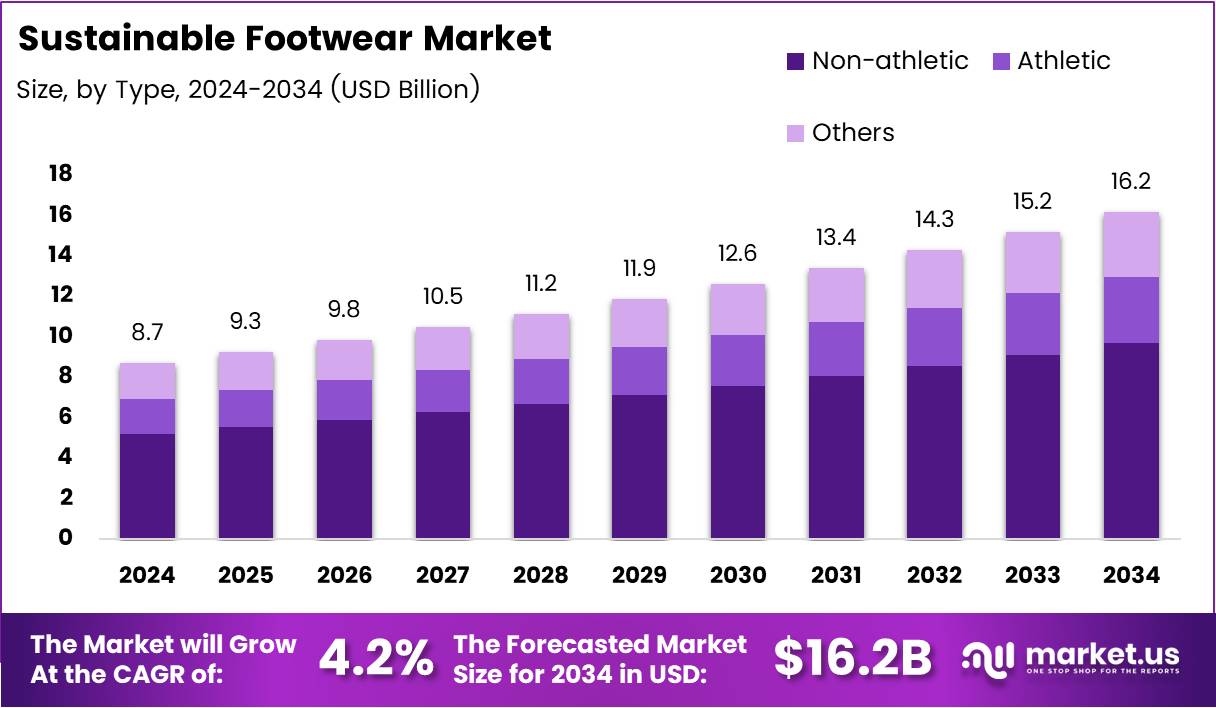

The Global Sustainable Footwear Market size is expected to be worth around USD 16.2 Billion by 2034, from USD 8.7 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The global sustainable footwear market is witnessing significant growth driven by increasing environmental concerns and shifting consumer preferences. With an estimated 24 billion shoes entering the market annually, the footwear industry is a substantial contributor to waste. According to statistics from GreenCitizen, 300 million pairs of shoes end up in landfills annually in the United States alone. This highlights the pressing need for sustainable alternatives in the footwear sector.

Sustainability in footwear is characterized by the use of eco-friendly materials, ethical manufacturing practices, and a reduced environmental footprint. As the impact of waste from the footwear industry becomes more evident, consumers are increasingly seeking brands that prioritize sustainability.

In fact, 90% of shoes are discarded either through landfilling or incineration, exacerbating the environmental burden. As a result, there is a growing opportunity for businesses that integrate sustainable practices into their products to capture market share.

Governments are also playing a crucial role in promoting sustainable practices. Many countries have introduced regulations aimed at reducing waste and encouraging the use of recycled materials. In particular, initiatives aimed at reducing carbon emissions and promoting the circular economy are creating favorable conditions for the growth of sustainable footwear.

Regulatory frameworks such as extended producer responsibility (EPR) and recycling mandates are being introduced to ensure brands take responsibility for their products’ end-of-life stages.

The market presents considerable growth opportunities for innovative companies that can meet the demand for sustainable footwear. Consumer preferences are shifting toward brands that offer high-quality, environmentally friendly options at competitive prices. This trend is expected to accelerate as companies continue to adopt sustainable manufacturing processes, reduce waste, and use eco-conscious materials such as recycled rubber, organic cotton, and plant-based plastics.

Looking ahead, investment in sustainable footwear is set to increase as both businesses and consumers recognize the value of ethical and environmentally friendly alternatives. This market is likely to expand rapidly as governments enforce stricter environmental regulations and consumers demand more sustainable products. For businesses, investing in sustainable footwear practices not only aligns with global trends but also ensures long-term profitability through brand differentiation and consumer loyalty.

Key Takeaways

- Global Sustainable Footwear Market size is expected to reach USD 16.2 Billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

- Non-athletic segment holds a dominant market share of 60.5% in 2024, driven by the rise of casual and lifestyle footwear.

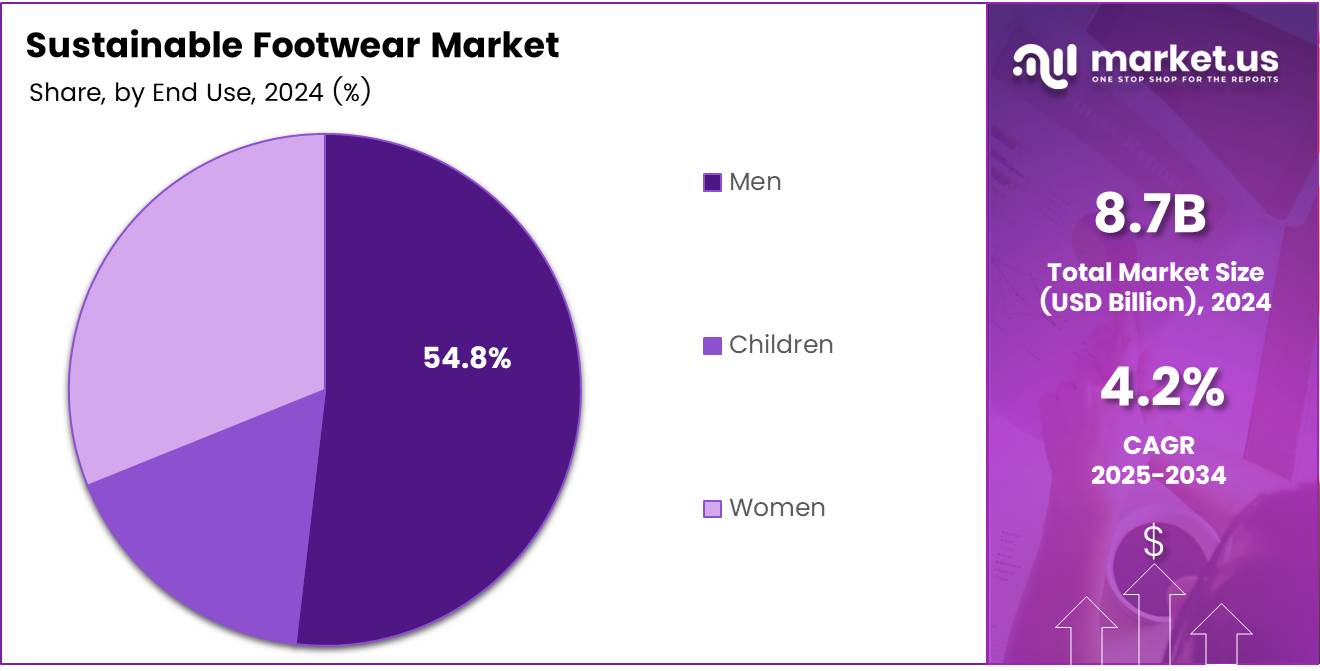

- Men’s footwear segment dominates the market with 54.8% market share in 2024.

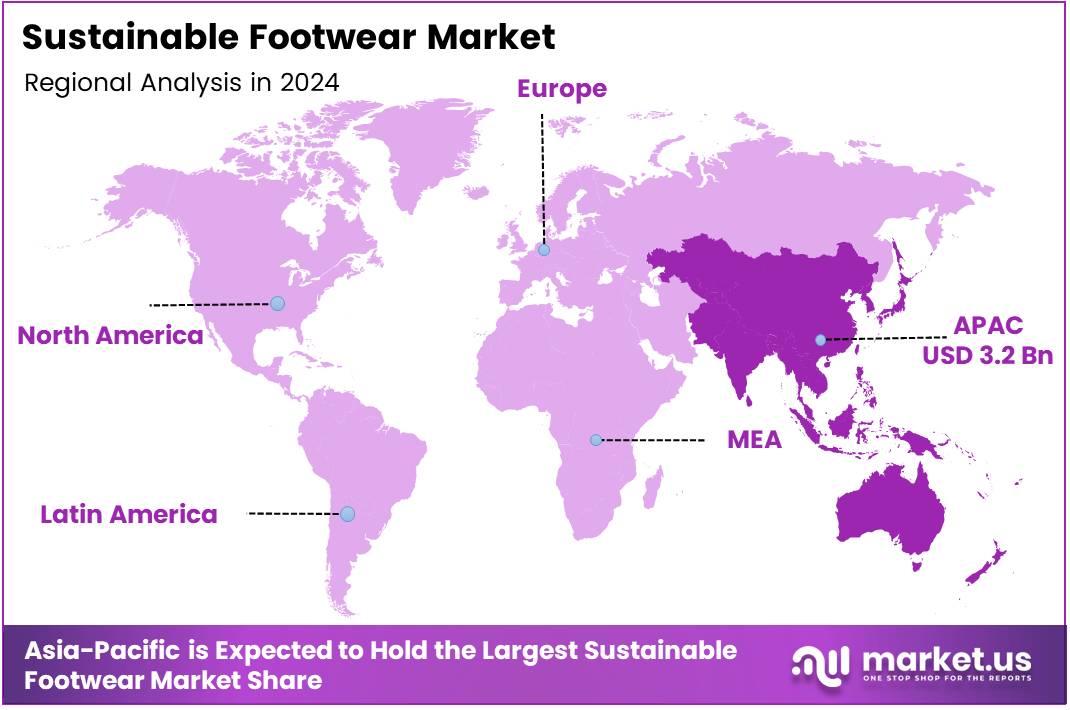

- Asia Pacific leads the market with 37.1% share, valued at USD 3.2 billion in 2024, fueled by increasing environmental awareness and demand for eco-friendly products.

Type Analysis

Non-athletic Footwear Dominates the Sustainable Footwear Market with 60.5% Share in 2024

In 2024, Non-athletic footwear held a dominant position in the By Type Analysis segment of the Sustainable Footwear Market, capturing 60.5% of the market share. This significant share reflects a growing shift toward comfort, casual wear, and eco-consciousness among consumers.

Non-athletic shoes, which include sandals, casual sneakers, and slip-ons, are favored for their versatility and sustainability. The increasing consumer demand for products that align with environmental values is driving the growth of this category.

Athletic footwear, while still a strong segment, represents a smaller portion of the market. As the demand for sustainable products increases, the challenge for athletic footwear brands lies in combining high performance with eco-friendly materials. Despite these challenges, athletic footwear is experiencing gradual growth, driven by eco-conscious athletes and health-focused consumers seeking sustainable alternatives.

The Others segment, which includes work shoes, boots, and niche categories, is also contributing to the market’s growth. Although this segment holds a smaller share, it is expected to expand as more consumers seek footwear designed for specific needs, such as durability and functionality, while remaining eco-friendly.

End User Analysis

Men Dominate the End-User Segment of the Sustainable Footwear Market with 54.8% Share in 2024

In 2024, Men held a dominant position in the By End User Analysis segment of the Sustainable Footwear Market, capturing 54.8% of the market share. The increased demand for eco-friendly footwear among men is primarily driven by the growing awareness of environmental sustainability and a preference for durable, stylish, and comfortable shoes. As more men seek versatile options for daily wear, non-athletic sustainable footwear has become a top choice in this segment.

Children’s footwear also shows steady growth, but it represents a smaller market share. The demand for eco-conscious options in children’s shoes is rising as parents prioritize sustainability. However, the availability of affordable and attractive options for children remains a challenge for this segment’s full potential.

Women’s footwear, while significant, faces more competition due to diverse fashion trends and the strong presence of fast-fashion brands. In 2024, women’s sustainable footwear held a smaller share compared to men’s, as they often face a trade-off between sustainability and the variety offered by mainstream brands.

However, women’s sustainable footwear is growing, with increasing interest in eco-friendly options that balance style, comfort, and environmental impact.

Key Market Segments

By Type

- Non-athletic

- Athletic

- Others

By End User

- Men

- Children

- Women

Drivers

Increased Consumer Demand for Eco-Friendly Products Drives Growth in Sustainable Footwear Market

The rising interest in eco-friendly products is a key driver of growth in the sustainable footwear market. More consumers are prioritizing sustainability when making purchasing decisions, seeking footwear options that are environmentally responsible.

This demand for eco-conscious products is being driven by a growing awareness of the environmental impact of traditional manufacturing processes. As consumers become more informed about issues such as climate change, pollution, and waste, they are looking for alternatives that align with their values.

This shift in consumer preferences is pushing brands to innovate and offer more sustainable footwear choices. Companies are increasingly introducing shoes made from recycled materials, biodegradable components, and plant-based alternatives, offering consumers a chance to make a positive impact with their purchases.

The growing trend toward sustainability is also being amplified by the influence of social media, where influencers and brands alike promote eco-friendly lifestyles. This has further accelerated the demand for sustainable footwear, making it a critical factor for businesses to consider in their strategy.

Restraints

Limited Availability of Sustainable Materials and Consumer Awareness Hinder Sustainable Footwear Market Growth

While the demand for sustainable footwear is rising, there are several challenges that limit market growth. One significant restraint is the limited availability of sustainable materials.

The supply chain for eco-friendly materials, such as recycled fabrics and plant-based components, is still underdeveloped. This scarcity makes it difficult for footwear brands to scale production without compromising on sustainability goals. As a result, companies may face higher costs, limiting their ability to offer affordable sustainable options to consumers.

Additionally, many consumers are still unaware of the benefits of sustainable footwear, which slows down the adoption of eco-friendly products. Despite the growing awareness of environmental issues, the general public often lacks sufficient knowledge about sustainable materials and the long-term advantages of choosing eco-friendly footwear.

This knowledge gap means that consumers may not be fully aware of the environmental impact of their purchasing decisions, reducing the overall demand for sustainable footwear. Overcoming these barriers will require a combination of supply chain improvements and educational efforts to increase consumer understanding of sustainable footwear.

Growth Factors

Expansion in Emerging Markets Creates Opportunities for Sustainable Footwear Growth

The sustainable footwear market has significant growth opportunities, particularly in emerging markets. As the middle-class population continues to grow in countries like India, China, and Brazil, there is an increasing demand for high-quality, affordable products.

This creates an ideal environment for sustainable footwear brands to introduce their offerings to a new, diverse consumer base. In these regions, consumers are becoming more aware of global environmental issues, and many are beginning to seek out products that align with their values.

By expanding into these markets, footwear brands can tap into a new wave of environmentally conscious consumers. Furthermore, collaborations with other eco-friendly brands and companies present additional growth opportunities.

Partnerships allow footwear brands to access new customer segments, share resources, and enhance their credibility in the sustainability space. This strategy of collaboration can help expand the reach of sustainable footwear beyond traditional markets and into new areas where the demand for eco-friendly products is growing.

Emerging Trends

Vegan Footwear and Innovative Designs Drive Trends in the Sustainable Footwear Market

Several emerging trends are shaping the sustainable footwear market. One of the most notable trends is the growing demand for vegan footwear. As veganism and cruelty-free products continue to rise in popularity, there is an increasing demand for footwear made from plant-based or synthetic materials instead of animal products like leather.

This trend aligns with the broader movement toward more ethical and sustainable consumer choices. Alongside this, footwear brands are focusing on innovative designs that prioritize sustainability.

Companies are experimenting with new materials that require fewer resources to produce, are more durable, and can be recycled at the end of their life cycle. These innovations are appealing to consumers who are looking for products that are both functional and environmentally friendly.

Another trend is the influence of social media and sustainability influencers. As platforms like Instagram and TikTok play a significant role in shaping consumer behavior, influencers are using their reach to promote sustainable footwear options and raise awareness about the environmental benefits of choosing eco-friendly products.

This combination of veganism, innovation, and digital influence is creating a dynamic market for sustainable footwear, with brands continually adapting to meet consumer demands.

Regional Analysis

Asia Pacific Dominates the Sustainable Footwear Market with a Market Share of 37.1%, Valued at USD 3.2 Billion

Asia Pacific holds the largest share of the sustainable footwear market, accounting for 37.1% of the market and valued at USD 3.2 billion. This growth is primarily driven by increasing environmental awareness and the rising demand for eco-friendly products in countries like China, India, and Japan.

The region’s large population base and growing urbanization further fuel the market’s expansion, positioning it as a leader in sustainable footwear production and consumption.

Regional Mentions:

North America represents a significant portion of the sustainable footwear market, driven by robust consumer demand for ethical and sustainable products. The United States and Canada have witnessed a shift in consumer preferences towards eco-conscious brands, contributing to a steady growth in this region. With a heightened focus on sustainability and innovation in footwear materials, North America continues to be a key player in the industry.

Europe is another key region in the sustainable footwear market, driven by stringent environmental regulations and high consumer awareness about sustainability. European countries, particularly Germany, the UK, and France, have established themselves as leaders in adopting sustainable fashion trends. The market in this region benefits from strong eco-conscious consumer behavior and innovative manufacturing processes aimed at reducing environmental impact.

The Middle East & Africa (MEA) region, although emerging, is gradually increasing its share in the sustainable footwear market. Rising awareness about environmental issues and a shift towards more sustainable lifestyles are beginning to influence footwear choices in countries like the UAE and South Africa. While the market size remains relatively smaller compared to other regions, the demand for sustainable products is expected to grow steadily in the coming years.

Latin America represents a developing market for sustainable footwear, with key countries like Brazil and Mexico showing increasing interest in eco-friendly products. However, the market is still in the early stages of growth, with limited consumer awareness compared to other regions. As sustainable lifestyles gain traction across Latin America, the market for sustainable footwear is expected to expand, driven by local demand for environmentally conscious and affordable alternatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global sustainable footwear market continues to be shaped by key players committed to eco-friendly practices and materials.

LYMI, Inc., dba Reformation stands out with its strong commitment to sustainability, offering stylish footwear crafted from responsible materials. Their focus on minimizing environmental impact has earned them a loyal customer base.

MATISSE FOOTWEAR has built a reputation for blending fashion with sustainability, using innovative, eco-conscious materials in its designs. Their products cater to the growing demand for sustainable options while maintaining a high standard of quality and style.

VEJA has become synonymous with eco-friendly footwear, utilizing organic cotton, wild rubber from the Amazon, and recycled materials. The brand’s dedication to transparent sourcing and ethical production processes resonates with environmentally conscious consumers worldwide.

Native Canada Footwear Ltd has made significant strides in creating lightweight, durable shoes from sustainable materials. Their commitment to environmental responsibility is reflected in their use of recycled and recyclable materials, setting a strong example in the market. These companies, along with others in the sector, are redefining the footwear industry by prioritizing sustainability in both design and manufacturing processes.

Top Key Players in the Market

- LYMI, Inc., dba Reformation

- MATISSE FOOTWEAR

- VEJA

- Native Canada Footwear Ltd

- Adidas AG

- NISOLO

- THE TROPIC FEEL, S.L.

- Threads 4 Thought

- Amour Vert, Inc

- Rothy’s, Inc.

Recent Developments

- In February 2025, Venturi Partners invested $25 million in the footwear brand JQR, securing a minority stake in the growing company. This strategic investment aims to accelerate JQR’s expansion and innovation in the competitive footwear market.

- In January 2025, the footwear brand CHK successfully raised $2.5 million in a funding round, with participation from Accel and other investors. This funding will help CHK scale its operations and enhance product offerings in the athletic footwear sector.

- In July 2024, the sneaker startup Comet raised $5 million in a funding round led by Elevation Capital and Nexus Ventures. The investment will enable Comet to expand its product range and strengthen its position in the rapidly growing sneaker market.

Report Scope

Report Features Description Market Value (2024) USD 8.7 Billion Forecast Revenue (2034) USD 16.2 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non-athletic, Athletic, Others), By End User (Men, Children, Women) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LYMI, Inc., dba Reformation, MATISSE FOOTWEAR, VEJA, Native Canada Footwear Ltd, Adidas AG, NISOLO, THE TROPIC FEEL, S.L., Threads 4 Thought, Amour Vert, Inc, Rothy’s, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sustainable Footwear MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Sustainable Footwear MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LYMI, Inc., dba Reformation

- MATISSE FOOTWEAR

- VEJA

- Native Canada Footwear Ltd

- Adidas AG

- NISOLO

- THE TROPIC FEEL, S.L.

- Threads 4 Thought

- Amour Vert, Inc

- Rothy’s, Inc.