Global Sustainable Catering Services Market Size, Share Analysis Report By Service Type (Full-Service Catering, Quick-Service / Drop-Off Catering, Mobile / Food-Truck Catering, Buffet And Plated Meal Services, Boxed / Grab-and-Go Lunches), By Contract Type (Contract Catering, Self-Operated / Non-Contract, Short-Term Event Contracts, Long-Term Facilities Contracts), By Food Category (Plant-Based / Vegan Menus, Organic And Biodynamic Ingredients, Local And Seasonal Procurement, Fair-Trade And Ethically-Sourced Products, Low-Carbon / Climate-Smart Menus) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163159

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

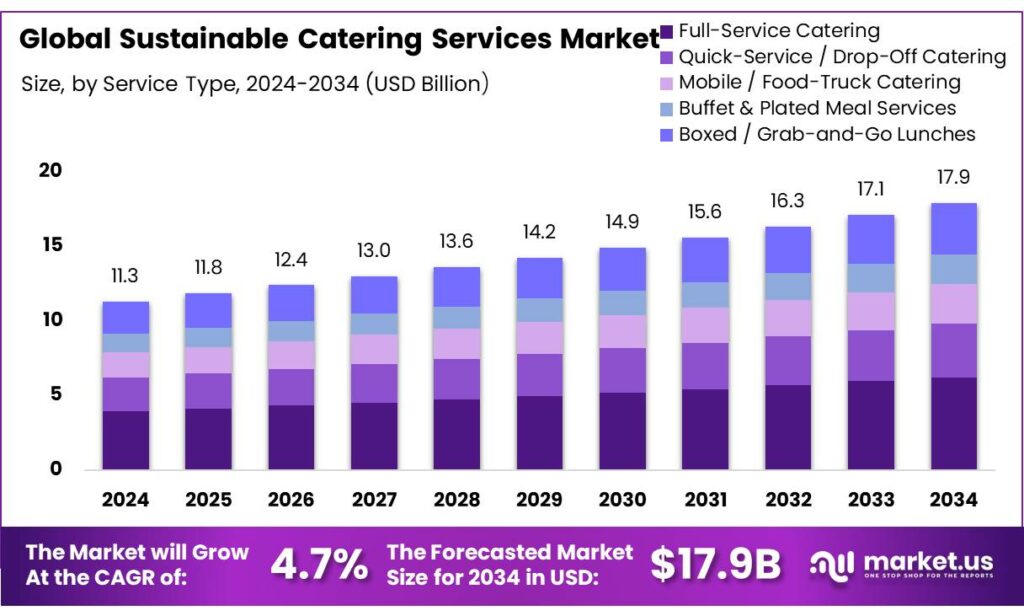

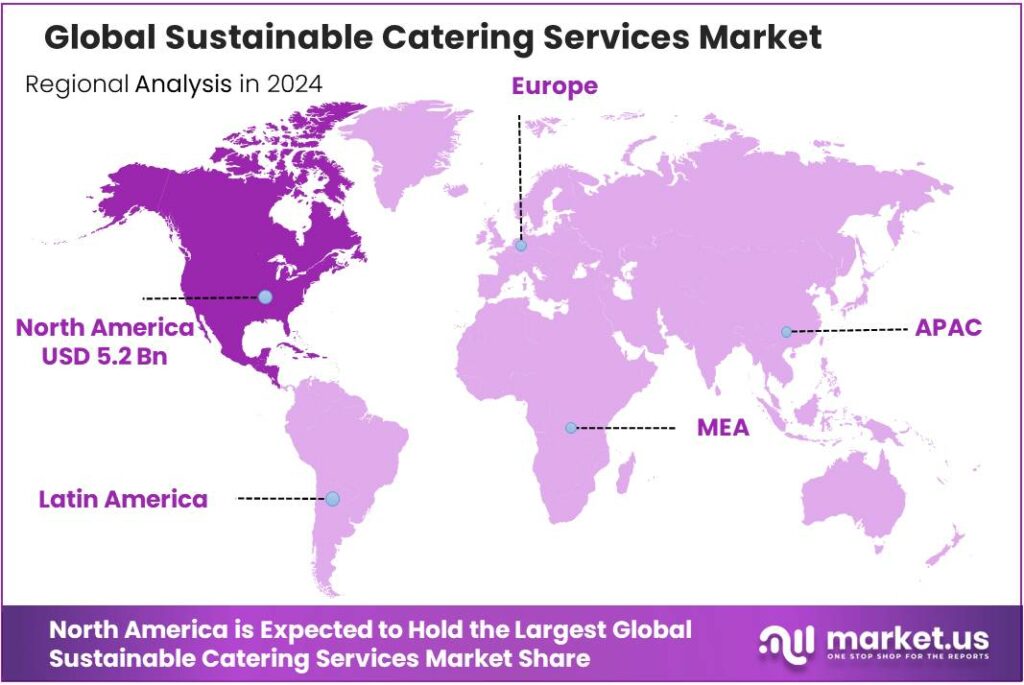

The Global Sustainable Catering Services Market size is expected to be worth around USD 17.9 Billion by 2034, from USD 11.3 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 46.9% share, holding USD 5.2 Billion in revenue.

Sustainable catering services are evolving from a niche to a procurement and operations priority as corporates, schools, hospitals, airlines, venues, and public bodies push to cut food waste, switch to cleaner energy, and comply with plastics and green-purchasing rules. The scale of the opportunity is significant: the UN’s 2024 Food Waste Index estimates 1.05 billion tonnes of food were wasted in 2022, with food services responsible for 28% of that total, underscoring the sector’s direct climate and cost exposure.

Industrial dynamics are being shaped by both energy and waste policy. In buildings—where professional kitchens operate—the IEA notes sectoral energy use rose ~1% in 2022, keeping efficiency and electrification in sharp focus for net-zero alignment. On the waste side, the U.S. EPA estimates 58% of fugitive methane from municipal landfills comes from landfilled food waste, emphasizing why upstream prevention and diversion programs are moving from pilots to portfolio-wide contracts.

- At the same time, renewable electricity availability is improving the footprint of electrified kitchen loads: the IEA projects global annual renewable capacity additions rising from 666 GW in 2024 to almost 935 GW by 2030, increasing access to low-carbon power for sites that procure green tariffs or onsite PPAs.

Operational levers are increasingly quantifiable. ENERGY STAR reports commercial fryers up to 35% more energy-efficient than standard models, while commercial dishwashers use ~12% less energy and ~50% less water, saving ~2,400 kWh annually per unit on average—directly improving kitchen OPEX and Scope 2 intensity when paired with renewable supply. Menu decarbonization is also gaining traction: initiatives such as WRI’s Coolfood support foodservice operators to shift toward plant-rich menus that measurably lower meal-level emissions, a growing differentiator in tenders and ESG reporting.

ENERGY STAR-certified convection ovens are ~27% more energy-efficient than standard models, and broader ENERGY STAR commercial food-service categories cut energy and water without performance penalty, improving asset life and utility KPIs for caterers. Waste prevention also has clear economics: in the UK, hospitality and food service waste costs are estimated at £3.2 billion annually, making analytics-led portioning and redistribution financially attractive.

Key Takeaways

- Sustainable Catering Services Market size is expected to be worth around USD 17.9 Billion by 2034, from USD 11.3 Billion in 2024, growing at a CAGR of 4.7%.

- Full-Service Catering held a dominant market position, capturing more than a 34.8% share in the sustainable catering services market.

- Contract Catering held a dominant market position, capturing more than a 46.5% share of the sustainable catering services market.

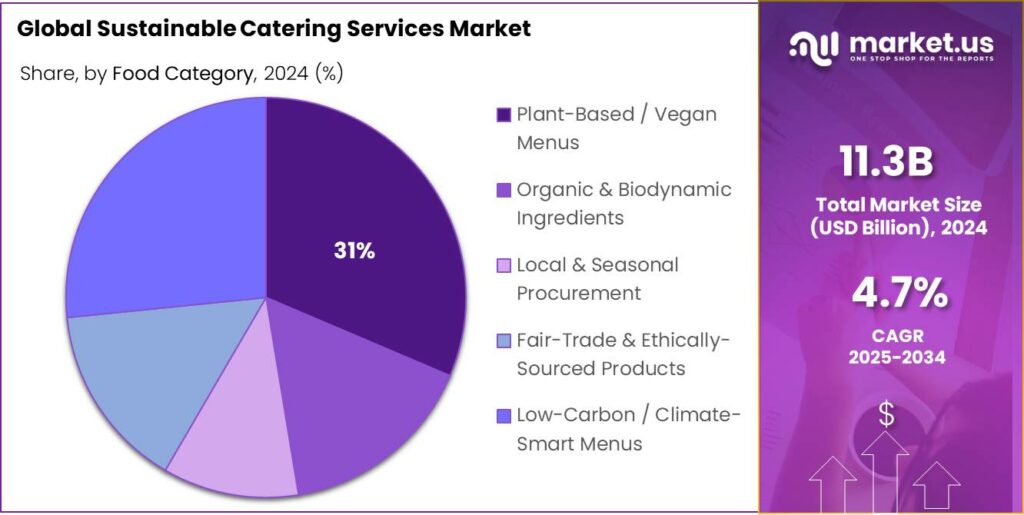

- Plant-Based / Vegan Menus held a dominant market position, capturing more than a 31.4% share in the sustainable catering services market.

- North America leads Sustainable Catering Services with 46.90% share about USD 5.2 Bn.

By Service Type Analysis

Full-Service Catering dominates with 34.8% share driven by demand for sustainable and customized event solutions

In 2024, Full-Service Catering held a dominant market position, capturing more than a 34.8% share in the sustainable catering services market. This segment’s leadership was driven by the growing demand for comprehensive event solutions that integrate sustainable menu planning, zero-waste serving practices, and energy-efficient kitchen operations. Corporate events, institutional gatherings, and weddings increasingly preferred full-service providers capable of managing end-to-end operations—from locally sourced ingredients to waste segregation and composting—aligned with sustainability standards.

By 2025, the segment is expected to sustain its strong position as businesses and public institutions continue to include environmental and social governance (ESG) criteria in their vendor selection processes. The shift toward eco-conscious dining, carbon-neutral catering services, and partnerships with local organic farms is supporting steady growth. Full-service caterers have been quick to adopt biodegradable packaging, energy-saving appliances, and transparent sourcing models, ensuring regulatory compliance and consumer trust.

By Contract Type Analysis

Contract Catering dominates with 46.5% share supported by long-term institutional partnerships and sustainability mandates

In 2024, Contract Catering held a dominant market position, capturing more than a 46.5% share of the sustainable catering services market. This strong performance was primarily driven by its integration within corporate offices, educational institutions, hospitals, and government organizations that are increasingly adopting long-term food service agreements emphasizing sustainability. Many organizations have shifted to contract-based catering to ensure consistent food quality, nutritional balance, and compliance with waste reduction and energy efficiency goals.

By 2025, the contract catering segment is expected to maintain its leadership as public and private sectors expand their sustainability commitments under ESG frameworks. Caterers operating under long-term contracts are investing in low-emission cooking systems, renewable energy usage, and digital waste-monitoring tools to align with government initiatives targeting carbon neutrality. In addition, the inclusion of plant-forward menus, local sourcing policies, and transparent supply chains has strengthened the reliability and attractiveness of contract-based service models.

By Food Category Analysis

Plant-Based / Vegan Menus dominate with 31.4% share driven by rising consumer preference for sustainable and ethical dining

In 2024, Plant-Based / Vegan Menus held a dominant market position, capturing more than a 31.4% share in the sustainable catering services market. This leadership was supported by the strong shift in consumer preferences toward health-conscious, eco-friendly, and cruelty-free food options. Corporate events, educational institutions, and large hospitality venues increasingly adopted plant-based catering as part of their sustainability commitments, aiming to lower their carbon footprint and align with global dietary trends that favor reduced animal-based consumption.

The demand for vegan and plant-based catering is expected to grow further as awareness about climate change, resource conservation, and animal welfare continues to influence food choices. Caterers are expanding menu innovations using locally sourced vegetables, legumes, and plant proteins, while reducing dependency on imported meat alternatives to enhance supply chain sustainability. Additionally, advancements in plant-based ingredients and improved culinary techniques have helped caterers deliver diverse, nutrient-rich menus that appeal to both vegan and non-vegan consumers alike.

Key Market Segments

By Service Type

- Full-Service Catering

- Quick-Service / Drop-Off Catering

- Mobile / Food-Truck Catering

- Buffet & Plated Meal Services

- Boxed / Grab-and-Go Lunches

By Contract Type

- Contract Catering

- Self-Operated / Non-Contract

- Short-Term Event Contracts

- Long-Term Facilities Contracts

By Food Category

- Plant-Based / Vegan Menus

- Organic & Biodynamic Ingredients

- Local & Seasonal Procurement

- Fair-Trade & Ethically-Sourced Products

- Low-Carbon / Climate-Smart Menus

Emerging Trends

Smart Kitchen Technologies And Waste-Monitoring in Sustainable Catering Services

One of the most promising recent trends in sustainable catering services is the adoption of smart kitchen technologies and real-time waste-monitoring systems. Kitchens are becoming more than places for cooking—they’re turning into data-driven operations. For example, in the food-service world, one study found that restaurants could generate cost savings of roughly US $8 for every US $1 invested in food-waste reduction practices such as tracking waste or practising safe donation.

These technologies are helping kitchens identify what is being thrown away, how much, and why. In one case reported in 2024, a hotel chain using AI to monitor food waste at breakfast buffets achieved reductions of up to 76% in kitchen waste and 55% in post-consumer waste in pilot operations.

Simultaneously, global measurement of food-waste baselines continues to sharpen. The United Nations Environment Programme (UNEP) estimates that in 2022 about 1.05 billion tonnes of food was wasted worldwide—amounting to nearly 19% of food available to consumers.

From a human perspective, this trend represents a shift in culture from “cook and serve” to “measure, improve and reuse”. Catering teams are not only turning off unnecessary ovens or trimming menus, they are developing dashboards to track kilograms of waste by meal type, training staff to recognise common waste sources and reporting regularly to clients on progress. A recent industry article found that 73% of consumers said they wanted catering operations to reduce food waste.

Drivers

Food-waste cuts becoming a procurement and climate requirement

The single strongest push behind sustainable catering is the hard pivot from “nice-to-have” to required food-waste reduction. Governments and large buyers are writing waste-tracking and diversion into contracts because the food system drives climate risk and avoidable cost. Globally, agrifood systems generate about one-third of human-caused GHG emissions, so every kilogram wasted carries embedded emissions that public institutions now want out of their footprints.

The scale of waste in food service is also now quantified, making it targetable in tenders. The UNEP Food Waste Index 2024 estimates 1.05 billion tonnes of food were wasted in 2022, equal to 19% of all food available to consumers; the food-service sector accounted for ~290 million tonnes (28%) of that total, with households at 60% and retail at 12%. These numbers have become the baseline for country-level SDG 12.3 plans and for caterers’ reduction roadmaps, because they translate directly into measurable Key Performance Indicators (KPIs) for contracts—kilograms per cover, diversion rates, and donation volumes.

Climate urgency adds another layer of compulsion: food landfilled emits methane quickly, so reducing waste upstream and diverting organics deliver fast abatement. The U.S. EPA quantifies that 58% of fugitive methane from municipal solid-waste landfills comes from landfilled food waste, elevating food-waste prevention and separate collection from “CSR” to a core climate lever for cities and public agencies. For caterers, this means rising requirements for on-site segregation, contracts with donation partners, and audits proving landfill diversion—often tied to payment milestones or award points.

The economics align with policy. In the UK alone, food waste costs hospitality and food service about £3.2 billion per year—~£10,000 per outlet—so kitchens that deploy waste-tracking software, smarter portioning, and donation logistics can defend margins as energy, labor and ingredient costs rise. Public buyers increasingly recognize these savings and specify waste-analytics and staff training in tender documents, rewarding bidders who can demonstrate prior reductions with before-and-after data.

Restraints

Cost and resource burden inhibiting sustainable catering services

In the food-service sector, more subtle cost implications also emerge. While sustainability means better sourcing, reduced waste and energy savings eventually, many cafés, kitchens and event-services struggle initially with higher unit costs for certified or local seasonal produce, logistic complexity for reusable service-ware, and capital outlay for waste-tracking tools. Anecdotally, in food-service operations the average waste-related cost per outlet in the UK has been estimated at around £10,000 annually. That kind of figure means that any sustainable menu plan or packaging switch must either reduce this cost or recover it from elsewhere.

Thirdly, the procurement and supply-chain side brings hidden burdens. For example, while sustainable sourcing is a driver, it is also a cost. One study of more than 800 retail-food items across 181 countries found that cheaper items often carried lower carbon and water footprints, meaning that firms wanting lower-impact menus must often pay more or accept lower margin, or redesign menus and sell fewer premium items. In practical terms, a catering firm shifting to local, seasonal and ethical ingredients may find cost per meal rising, unless offset by scale or waste reduction gains.

Public-sector buyers increasingly demand evidence of waste reduction, circular packaging and carbon tracking, but many small or mid-size caterers lack the systems to capture, verify and report these metrics easily. That means they either invest in measurement tools (cost) or risk losing tenders. In short: the burden of meeting higher standards can lock smaller providers out or force them to pass cost increases to buyers or end-users—limiting growth and slowing the transition.

Opportunity

Plant-Forward Menus and Ingredient Innovation

One of the most compelling growth opportunities for sustainable catering services lies in the shift toward plant-forward menus and innovative ingredient sourcing. As more people become aware of health, environment and ethical concerns, the demand for meals that feature fewer animal-based products and more plant-based alternatives keeps rising.

- For example, in the U.S. food-service channel, the Good Food Institute reports that in 2023 plant-based milk sales in food service reached $222 million, representing a 19% share of the total milk category in that channel. At the same time, analog plant-based proteins—such as meat replacements—are gaining traction: from 2019 to 2023, pound-sales growth of plant-based chicken analogues rose by 78%, plant-based pork by 45% and plant-based beef by 7%.

These numbers matter for catering because they highlight that not only are consumers ready for change, but institutions and contracts — e.g., university dining halls, corporate cafeterias and healthcare food-service operations — are actively committing to plant-forward strategies. For instance, major service-providers like Sodexo have committed to increasing the percentage of plant-based menu items at their U.S. campus operations to 50% by 2025.

The global adoption of plant-based diets (or flexitarian approaches) carries large environmental benefits: one widely-cited study reports that if everyone adopted a plant-based diet, global agricultural land use could drop by 75%, freeing up resources and reducing emissions.

- Government and institutional initiatives amplify this opportunity. Many national dietary guidelines now mention plant-based alternatives: a study found that 45% of all national food-based dietary guidelines (FBDGs) globally now include mention of plant-based meat or milk alternatives.

Regional Insights

North America (Dominating Region: 46.90%, USD 5.2 Bn)

North America leads Sustainable Catering Services with 46.90% share (about USD 5.2 Bn), underpinned by stringent waste policies, energy-efficient kitchens, and procurement standards that make sustainability contractual. The U.S. has a national goal to halve food loss and waste by 2030, jointly led by USDA and EPA, which is now embedded in agency programs and buyer expectations.

Energy performance is a parallel growth driver. Kitchens adopting ENERGY STAR equipment cut consumption by ~20–30%, lowering operating costs and emissions—outcomes now tracked in federal and corporate contracts. Federal buyers also steer the market: GSA’s green purchasing guidance explicitly covers cafeteria and food services, favoring suppliers with verifiable sustainability practices and reporting.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Compass Group PLC leads sustainable catering through global food-waste reduction and carbon-neutral initiatives. The company’s “Sustainability Roadmap to 2030” targets net-zero emissions by 2050 and aims to source 70% of fresh produce locally across North America and Europe. In 2024, Compass expanded its carbon-tracking partnership with Foodsteps to measure plate-level emissions across universities and hospitals, cutting waste by 30% through analytics-led menu planning. Its strong institutional contracts make it a global reference for sustainable food operations.

Sodexo SA remains a pioneer in sustainable catering through its “Better Tomorrow 2025” plan, which includes cutting food waste by 50% by 2025. The company has deployed WasteWatch powered by Leanpath in over 3,000 sites, preventing more than 5,000 tonnes of food waste annually, as per 2024 data. Sodexo’s expansion of plant-based menus in the U.S. and Europe—targeting 50% plant-forward meals by 2025—aligns with client sustainability targets and government green procurement frameworks.

Elior Group focuses on circular economy and energy efficiency. By 2024, the company had reduced kitchen waste by 40% through AI-based portioning systems and composting programs in France and Spain. It also expanded partnerships with local farmers for sustainable sourcing, aligning with EU’s Farm to Fork Strategy. Elior’s “Planet Care” initiative integrates renewable electricity and packaging reuse schemes, giving it a strong ESG position in European public catering contracts.

Top Key Players Outlook

- Compass Group PLC

- Sodexo SA

- Aramark Corporation

- Elior Group

- ISS A/S

- Delaware North Companies

- DO & CO AG

- Bon Appetit Management Company

- Guckenheimer Services

- Sweetgreen Inc.

Recent Industry Developments

In 2024 Sodexo SA, reported a -40.7% reduction in food-waste levels at key sites through its WasteWatch programme.

In 2023 Aramark Corporation, reported that 39% of its U.S. Workplace Experience, Collegiate Hospitality and Healthcare+ main dishes and sides are vegan, vegetarian or plant-forward — up from 38% in 2022.

Report Scope

Report Features Description Market Value (2024) USD 11.3 Bn Forecast Revenue (2034) USD 17.9 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Full-Service Catering, Quick-Service / Drop-Off Catering, Mobile / Food-Truck Catering, Buffet And Plated Meal Services, Boxed / Grab-and-Go Lunches), By Contract Type (Contract Catering, Self-Operated / Non-Contract, Short-Term Event Contracts, Long-Term Facilities Contracts), By Food Category (Plant-Based / Vegan Menus, Organic And Biodynamic Ingredients, Local And Seasonal Procurement, Fair-Trade And Ethically-Sourced Products, Low-Carbon / Climate-Smart Menus) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Compass Group PLC, Sodexo SA, Aramark Corporation, Elior Group, ISS A/S, Delaware North Companies, DO & CO AG, Bon Appetit Management Company, Guckenheimer Services, Sweetgreen Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sustainable Catering Services MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Sustainable Catering Services MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Compass Group PLC

- Sodexo SA

- Aramark Corporation

- Elior Group

- ISS A/S

- Delaware North Companies

- DO & CO AG

- Bon Appetit Management Company

- Guckenheimer Services

- Sweetgreen Inc.