Surgical Robots Market By Component (Accessories, Systems, and Services), By Surgery (Gynecology Surgery, Neurosurgery, General Surgery, Orthopedic Surgery, Urology Surgery, and Other Surgeries), By End User (Ambulatory Surgical Centers and Hospitals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 12953

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

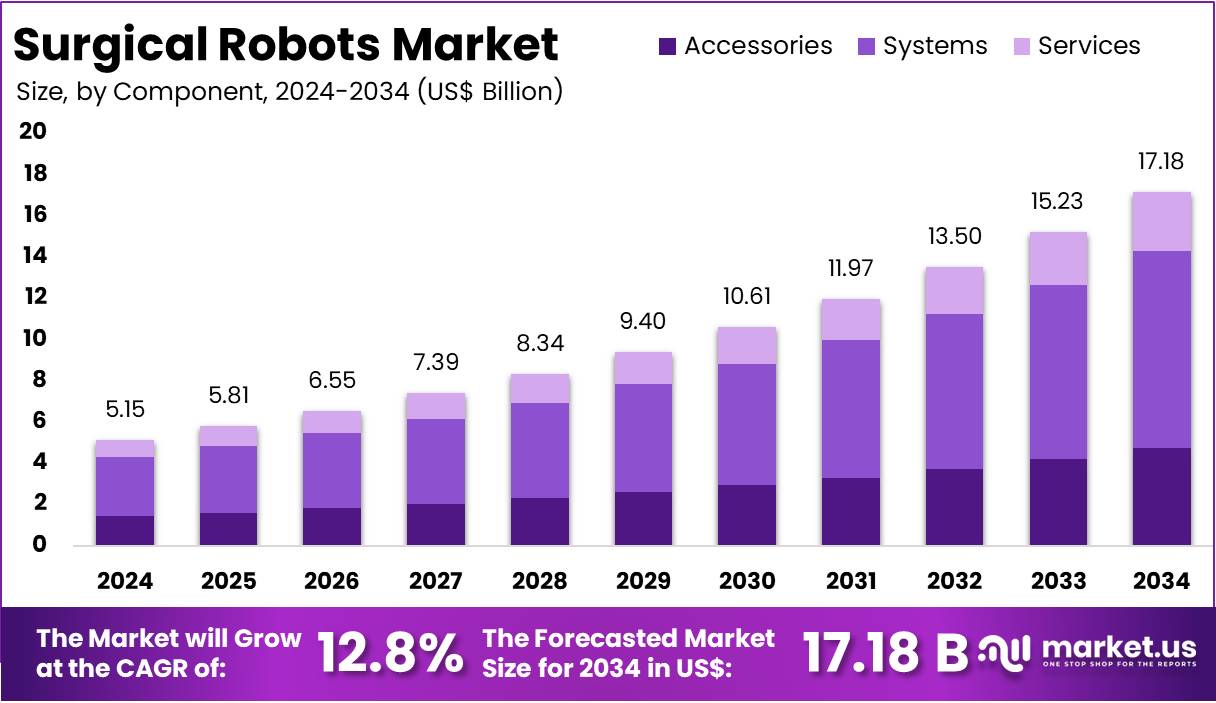

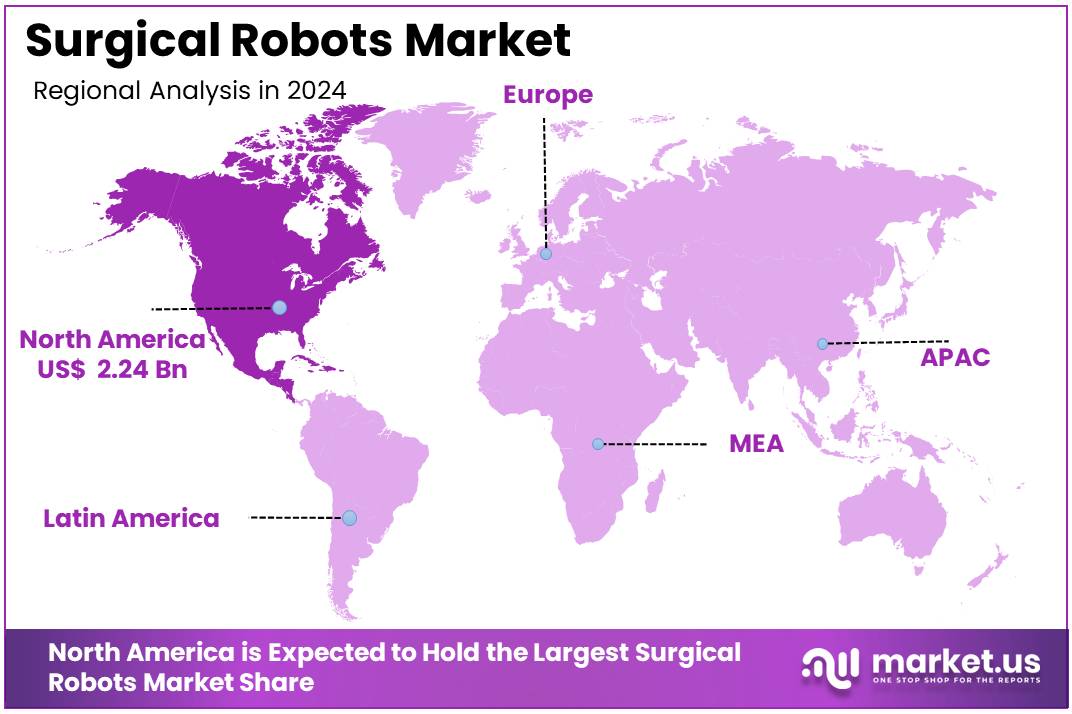

The Surgical Robots Market Size is expected to be worth around US$ 17.18 billion by 2034 from US$ 5.15 billion in 2024, growing at a CAGR of 12.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.5% share and holds US$ 2.24 Billion market value for the year.

Surgical robotics is a rapidly advancing field focused on the development, production, and commercialization of robotic systems used in a variety of surgical procedures. These systems, which assist surgeons in performing minimally invasive surgeries, are enhancing precision, flexibility, and control in the operating room. The growing shortage of skilled surgeons worldwide, combined with the increasing demand for automation in surgeries, is one of the key drivers of market growth.

Recent technological advancements in surgical robotics are playing a significant role in expanding the market. Notable innovations include robotic systems that integrate artificial intelligence (AI) and machine learning to assist in complex decision-making and improve surgical outcomes.

For instance, Intuitive Surgical’s da Vinci X robotic platform, now featuring AI-driven analytics, has revolutionized surgical precision across a wide range of procedures. In addition, increasing investments from both international and regional companies in cutting-edge technology are fueling the industry’s growth. Companies such as Medtronic and Johnson & Johnson are dedicating substantial resources to research and development, introducing new robotic systems that enhance capabilities like 3D imaging and real-time monitoring.

The rising prevalence of degenerative bone disorders and musculoskeletal diseases, such as osteoporosis and arthritis, is further driving demand for robotic-assisted surgeries, especially in the fields of knee and hip replacements. The growing elderly population and a higher incidence of these conditions are expected to contribute significantly to the demand for advanced robotic surgical systems. As these systems offer greater accuracy and faster recovery times, their adoption in orthopedic surgeries is anticipated to see continued growth, positioning surgical robotics as a transformative force in modern healthcare.

Key Takeaways

- The Surgical Robots Market Size is expected to be worth around US$ 17.18 billion by 2034 from US$ 5.15 billion in 2024, growing at a CAGR of 12.8% during the forecast period 2025 to 2034.

- The surgical robots market is forecasted to expand from US$ 5.15 billion in 2024 to US$ 17.18 billion by 2034, at 12.8% CAGR.

- By component, the systems segment, comprising robotic units and related technologies, is projected to dominate with 55.6% market share across the forecasted timeframe.

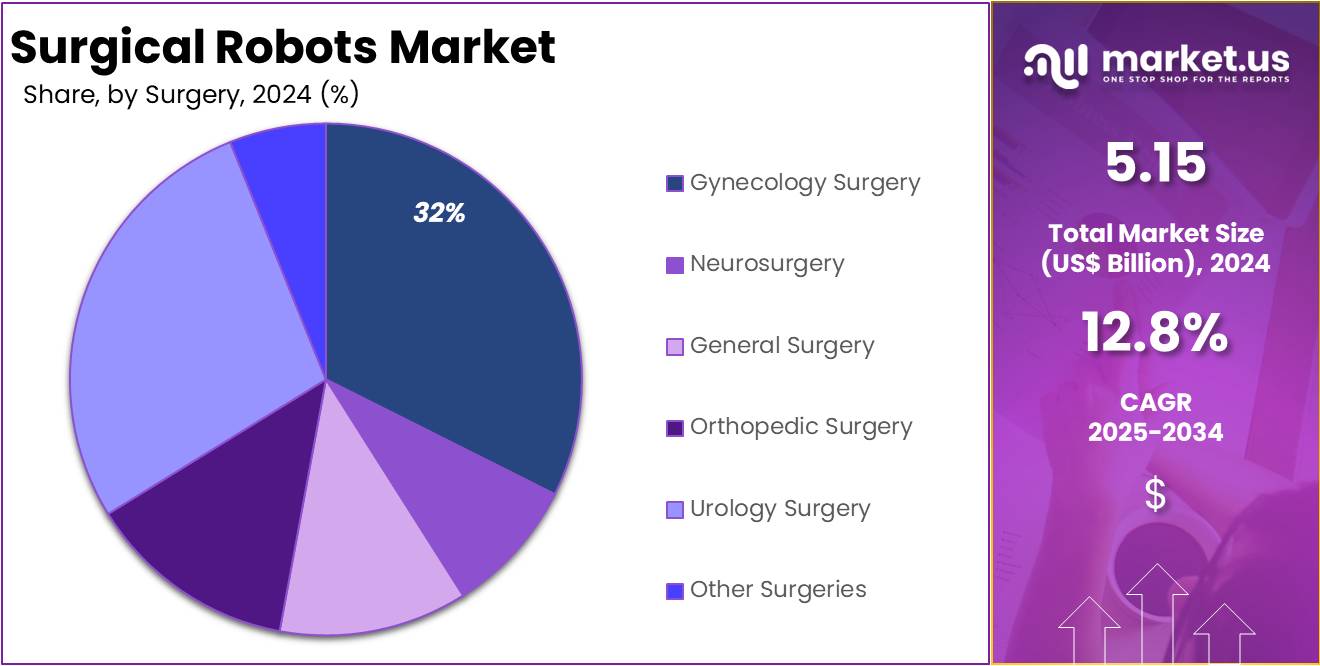

- By surgery type, neurosurgery remained the most lucrative in 2024 and is anticipated to maintain leadership, holding 32.4% of the overall share.

- By end-user, hospitals are the primary adopters of surgical robotics, accounting for 72.4% of the global market share in 2024.

- By region, North America emerged as the largest market in 2024, commanding a share of 43.5% of total global revenues.

Component Analysis

The dominant segment in the Component category is systems which held 55.6% market share, driven by the high demand for specialized instruments and consumables in robotic surgeries. Accessories include a range of tools, such as robotic arms, cameras, and surgical instruments, which are used repeatedly in various surgeries.

For instance, Intuitive Surgical’s da Vinci system requires specialized accessories like endoscopic cameras, which significantly contribute to the overall sales. In 2024, the accessories segment accounted for over 45% of the surgical robots market. The consistent need for replacements and upgrades in these tools helps maintain the dominance of this segment. In comparison, systems and services, while critical, make up a smaller portion of the revenue share.

Surgery Analysis

By Surgery category, Neurosurgery also leads the market due to the increasing complexity of brain and spinal surgeries, where robotic systems provide enhanced precision and reduce risks. For example, the use of robotic systems in brain surgeries has significantly improved patient outcomes.

Neurosurgery accounted for 25% of the total market in 2024. Other surgeries like gynecology and orthopedic surgeries are also growing but have not reached the same level of adoption as neurosurgery, which is often associated with more advanced and intricate procedures requiring robotic assistance.

Furthermore, automated robotic appliances for brain surgeries help grow the market. Hence, the orthopedic Surgery segment has a large market share as there are many injuries owing to road and bike accidents or other types of accidents that demand surgeries. Moreover, the need for robotics has risen in previous years for less invasive laparoscopic surgeries.

End-User Analysis

Based on end-user, the market is segmented into ambulatory surgical centers and hospitals. Among these end-users, the hospital segment is estimated to be the most lucrative segment in the global surgical robotics market, with the largest revenue share of 72.4% and a projected increase with a high CAGR during the forecast period. Owing surgical robots for hospitals will aid with productive patient care.

In the upcoming years, there shall be a rise in the need for surgical reports in different hospital settings, and it will present a lucrative market growth. Several patients meet, and rising surgical procedures in the hospital will guide the market growth. In addition, more considerable hospital infrastructure across the skilled healthcare individuals present in this structure will aid in fluctuating the scenario in different emerging economies.

In September 2025, the All-India Institute of Medical Sciences (AIIMS) in Raipur officially opened its advanced Robotic Surgery Facility, Devhast, in a ceremony attended by Shri Vishnu Deo Sai, the Hon’ble Chief Minister of Chhattisgarh, and Shri Shyam Bihari Jaiswal, the Hon’ble Health Minister.

The facility, equipped with cutting-edge technology, facilitates minimally invasive procedures that ensure enhanced precision and safety, promoting faster recovery, reduced pain, and shorter hospital stays for patients. Additionally, it will function as a hub for academic excellence, providing training and research opportunities in robotic-assisted surgery for postgraduate students and resident doctors.

Key Market Segments

By Component

- Accessories

- Systems

- Services

By Surgery

- Gynecology Surgery

- Neurosurgery

- General Surgery

- Orthopedic Surgery

- Urology Surgery

- Other Surgeries

By End-User

- Ambulatory Surgical Centers

- Hospitals

Drivers

Growth Driven by Enhanced Robotic Surgery Training, Technological Advancements, and Rising Geriatric Population

The surgical robotics market is expected to experience significant growth due to an increased focus on training doctors in robotic surgery, technological advancements, and the rising geriatric population. As the demand for laparoscopic and minimally invasive surgeries grows, the need for skilled robotic surgeons is becoming more critical. To address this, healthcare institutions worldwide are ramping up their training programs. For example, the American College of Surgeons has partnered with leading robotic surgery providers like Intuitive Surgical to offer certification courses for surgeons, ensuring a higher level of proficiency in robotic-assisted procedures.

Technological innovations, particularly in artificial intelligence (AI) and cloud computing, are further accelerating this growth. AI-powered systems, like Medtronic’s Hugo™ robotic system, are enhancing surgical precision and reducing the surgeon’s workload by providing real-time analytics, enabling better decision-making during surgeries. The incorporation of cloud computing in robotic surgery is improving data sharing and remote access, allowing surgeons to collaborate globally, even in remote areas.

Additionally, the rising geriatric population is contributing to the growing demand for robotic surgeries. The World Health Organization (WHO) estimates that the global population aged 60 years or older will reach 2.1 billion by 2050, which directly correlates with an increased need for orthopedic and minimally invasive surgeries. Robotic systems offer numerous benefits for elderly patients, including enhanced accuracy, reduced blood loss, quicker recovery times, minimized pain, and a lower risk of infection, making them an attractive option for both patients and healthcare providers.

Restraints

Robot-Assisted Are Costlier Than Less Invasive Surgeries

A key restraint in the surgical robotics market is the higher cost of robot-assisted surgeries compared to traditional minimally invasive procedures. The initial investment in robotic systems, maintenance, and training for medical professionals contributes to the increased cost of these surgeries. For instance, the cost of a robotic-assisted surgery can be up to three times higher than that of traditional laparoscopic surgeries. The price of robotic surgery systems, such as the da Vinci Surgical System, can range from USD 1.5 million to USD 2 million, further escalating the overall cost of treatment.

Additionally, while robotic surgeries offer several benefits, the risk of surgical errors remains a significant concern. According to the American College of Surgeons, surgical errors still occur in approximately one in four procedures, regardless of the technology used. These errors can complicate surgeries and lead to longer recovery times, higher medical costs, and potential patient harm. For complex procedures, such as robotic hysterectomies, the American Congress of Obstetricians and Gynecologists (ACOG) notes that these technologies are often reserved for intricate or uncommon clinical cases, rather than being universally applied.

Opportunities

Demand for Advanced Technological Surgeries of Robotic and Automation

The demand for advanced technological surgeries, driven by robotics and automation, is creating significant growth opportunities in the surgical robotics market. As the healthcare industry increasingly adopts cutting-edge technologies, surgical robots are becoming an essential tool in performing highly complex and precise procedures.

Current developments in robotic systems, such as the integration of 3D HD imaging sensors and advanced remote navigation systems, are enhancing the accuracy and efficiency of surgeries, providing real-time visualizations, and reducing the need for large incisions. For instance, Medtronic’s Hugo™ robotic system now incorporates high-definition 3D visualization and enhanced robotic arms, improving surgical precision in delicate procedures.

The growing incidence of injuries and accidents, particularly in orthopedic surgeries, is also fueling demand for robotic surgeries. The increasing frequency of road traffic accidents and sports-related injuries is pushing the need for rapid, efficient surgical interventions, where robotic-assisted surgeries offer faster recovery and more accurate outcomes. According to the World Health Organization (WHO), over 20 million road traffic injuries occur annually worldwide, further underscoring the importance of advanced robotic systems in addressing these medical needs.

Emerging markets such as China, India, and Brazil present substantial growth opportunities for the surgical robotics market. As these nations experience economic growth and improvements in healthcare infrastructure, the demand for high-quality medical technologies, including robotic surgery systems, is rising. For example, China’s healthcare industry is expected to grow at a CAGR of 12.5% between 2023 and 2030, driving further adoption of robotic technologies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the surgical robotics market, influencing both demand and supply dynamics. Economic conditions, such as recessions or economic slowdowns, can hinder the adoption of expensive robotic systems due to budget constraints in both public and private healthcare sectors.

In particular, high upfront costs for surgical robots, including system purchase, maintenance, and training, can be a barrier to entry for healthcare facilities in developing countries. For instance, during economic downturns, healthcare institutions may prioritize essential services over the adoption of advanced technologies, affecting the growth rate of the market.

Geopolitical instability also plays a role, especially in regions experiencing political uncertainty or conflict. For example, disruptions in supply chains, regulatory changes, or reduced access to technology due to trade restrictions can delay the introduction and adoption of surgical robots in certain markets. Trade wars or tariffs, particularly between major economic powers like the US and China, can lead to higher costs for components needed for robotic systems, impacting manufacturers’ pricing strategies and product availability.

Latest Trends

Integration of Artificial Intelligence and Expansion in Minimally Invasive Surgeries

AI is increasingly being incorporated into surgical robotics to enhance precision, real-time diagnostics, and automation. AI algorithms assist in interpreting medical imaging, planning surgical procedures, and even automating certain tasks. For instance, researchers at Johns Hopkins University developed an AI-powered robot that autonomously performed a gallbladder removal surgery with a 100% success rate, marking a significant advancement toward fully autonomous surgical procedures.

Robotic systems enable minimally invasive surgeries, which are associated with smaller incisions, reduced pain, and quicker recovery times. The UK’s National Health Service (NHS) plans to increase robot-assisted surgeries from 70,000 to 500,000 annually by 2035, aiming to make robotic surgery the standard for keyhole procedures.

Regional Analysis

North America is estimated to be the Most Lucrative Market

According to the Association of American Medical Colleges (AAMC), by 2034, the U.S. is expected to face a shortage of between 37,800 and 124,000 physicians, highlighting the increased reliance on robotic systems to meet growing surgical demands. Additionally, the widespread adoption of automated surgical instruments is bolstering the market, as healthcare facilities in the U.S. continue to incorporate robotic systems to improve surgical outcomes and efficiency.

The increasing prevalence of chronic diseases, such as cardiovascular diseases, diabetes, and cancer, is also driving the demand for robotic surgeries. The American Heart Association (AHA) reports that heart disease remains the leading cause of death in the U.S., contributing to a growing need for cardiovascular surgeries, many of which are now being performed using robotic assistance. As these chronic conditions rise, the adoption of automated surgical equipment is accelerating, fueling further growth in the North American surgical robotics market.

The Asia Pacific region is projected to experience rapid growth in the surgical robotics market, driven by increasing population sizes, advancements in medical technology, and rising healthcare infrastructure. The region’s growing awareness of robotic surgery and a higher acceptance rate of robotic systems, particularly in countries like China, India, and Japan, are expected to contribute significantly to market expansion.

The increasing availability of advanced healthcare facilities and the expansion of government-backed initiatives are also driving market growth. For instance, in China, the government’s emphasis on modernizing healthcare through its Made in China 2025 initiative is boosting the adoption of robotic systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Surgical Robots market includes Intuitive Surgical, Medtronic, Stryker, Johnson & Johnson (Ethicon), CMR Surgical, Zimmer Biomet, Smith & Nephew, Renishaw, Auris Health (Acquired by Johnson & Johnson), Medrobotics, TransEnterix (Asensus Surgical), Perlove Medical, Karl Storz, Meril Life Sciences, Microbot Medical, and Others.

Known for the Mako™ robotic-arm assisted surgery system, particularly in orthopedic procedures. Stryker is enhancing its robotics portfolio through strategic acquisitions, such as Monogram Technologies. Johnson & Johnson (Ethicon) is developing the OTTAVA surgical robot and the VELYS™ robotic-assisted solution. Their Monarch™ platform focuses on robotic bronchoscopy for lung procedures. CMR Surgical is a UK-based company offering the Versius™ surgical system, designed to be flexible and modular. It has completed over 26,000 procedures globally.

Key Opinion Leaders

Leaders Opinion Dr. Emily S. Williams, Chief Surgeon, St. Joseph’s Medical Center “As a pioneer in the robotic surgery field, Intuitive Surgical’s da Vinci platform has truly revolutionized minimally invasive procedures. Its precision, range of motion, and ability to offer enhanced visualization during surgery have significantly reduced recovery times and improved patient outcomes. The continuous upgrades and integration of AI into the da Vinci systems make it a leading choice for complex surgeries. As a practicing surgeon, I’ve observed that the ability to control the robot in real-time, while still maintaining a high level of tactile feedback, is an invaluable feature.” Dr. Michael T. Harrison, Urologist, Cleveland Clinic “Medtronic’s Hugo robotic system has made a significant mark in the realm of urology and gynecological surgeries. The system’s flexibility and affordability are key reasons it’s gaining adoption in both large hospitals and smaller surgical centers. The integration of advanced imaging technology helps improve the accuracy of delicate surgeries, which has contributed to better patient outcomes. With its commitment to expanding accessibility to surgical robotics, Medtronic is taking significant strides in making robotic-assisted surgery an everyday reality across different clinical settings.” Dr. Karen L. Davis, Orthopedic Surgeon, Mayo Clinic “The Mako robotic-arm system by Stryker has brought about a paradigm shift in orthopedic surgery. I’ve seen firsthand how it improves the precision of joint replacement procedures, especially in knee and hip surgeries. The ability to customize pre-operative planning and perform real-time adjustments during surgery has been a game changer. The system’s accuracy in aligning the components has reduced the risk of complications, which is a major benefit for both patients and surgeons. Stryker’s commitment to continuous improvement ensures that the Mako system will only grow in importance within the orthopedic space.” Top Key Players in the Surgical Robots Market

- Intuitive Surgical

- Medtronic

- Stryker

- Johnson & Johnson (Ethicon)

- CMR Surgical

- Zimmer Biomet

- Smith & Nephew

- Renishaw

- Auris Health (Acquired by Johnson & Johnson)

- Medrobotics

- TransEnterix (Asensus Surgical)

- Perlove Medical

- Karl Storz

- Meril Life Sciences

- Microbot Medical

- Others

Recent Developments

- In September 2025: Indian medical device company Meril unveiled the Mizzo Endo 4000, a next-generation soft tissue surgical robotic system. This system emphasizes precision, minimal invasiveness, and enhanced outcomes in surgical procedures. The introduction of the Mizzo Endo 4000 positions India at the forefront of robotic-assisted surgical solutions, potentially reducing dependence on imported systems.

- In April 2025: Johnson & Johnson MedTech announced the completion of the first clinical cases using the OTTAVA™ Robotic Surgical System. The initial procedures, including a gastric bypass at Memorial Hermann-Texas Medical Center, mark a significant milestone in the clinical evaluation of OTTAVA. The system is designed to support a broad range of procedures across various surgical specialties

- In July 2025: Zimmer Biomet announced a definitive agreement to acquire Monogram Technologies for approximately $177 million. Monogram specializes in semi- and fully autonomous surgical technologies, including a semi-autonomous knee replacement system approved by the FDA in March 2025. This acquisition aims to enhance Zimmer Biomet’s robotics portfolio and expand its capabilities in autonomous surgical solutions.

Report Scope

Report Features Description Market Value (2024) US$ 5.15 Billion Forecast Revenue (2034) US$ 17.18 Billion CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Accessories, Systems, and Services), By Surgery (Gynecology Surgery, Neurosurgery, General Surgery, Orthopedic Surgery, Urology Surgery, and Other Surgeries), By End User (Ambulatory Surgical Centers and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intuitive Surgical, Medtronic, Stryker, Johnson & Johnson (Ethicon), CMR Surgical, Zimmer Biomet, Smith & Nephew, Renishaw, Auris Health (Acquired by Johnson & Johnson), Medrobotics, TransEnterix (Asensus Surgical), Perlove Medical, Karl Storz, Meril Life Sciences, Microbot Medical, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intuitive Surgical

- Medtronic

- Stryker

- Johnson & Johnson (Ethicon)

- CMR Surgical

- Zimmer Biomet

- Smith & Nephew

- Renishaw

- Auris Health (Acquired by Johnson & Johnson)

- Medrobotics

- TransEnterix (Asensus Surgical)

- Perlove Medical

- Karl Storz

- Meril Life Sciences

- Microbot Medical

- Others