Global Superconducting Magnetic Energy Storage System Market Size, Share Analysis Report By Conductor Type (High Temperature, Low Temperature), By Application (Low Energy Storage, High Energy Storage), By End-user (Industrial Energy Storage, Renewable Energy Storage, Other) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160379

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

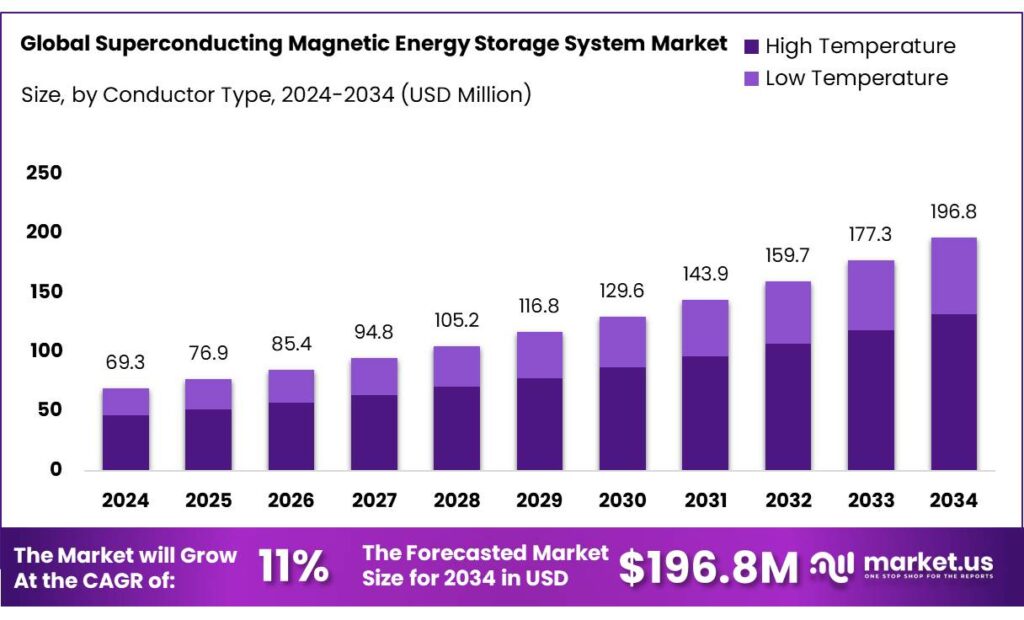

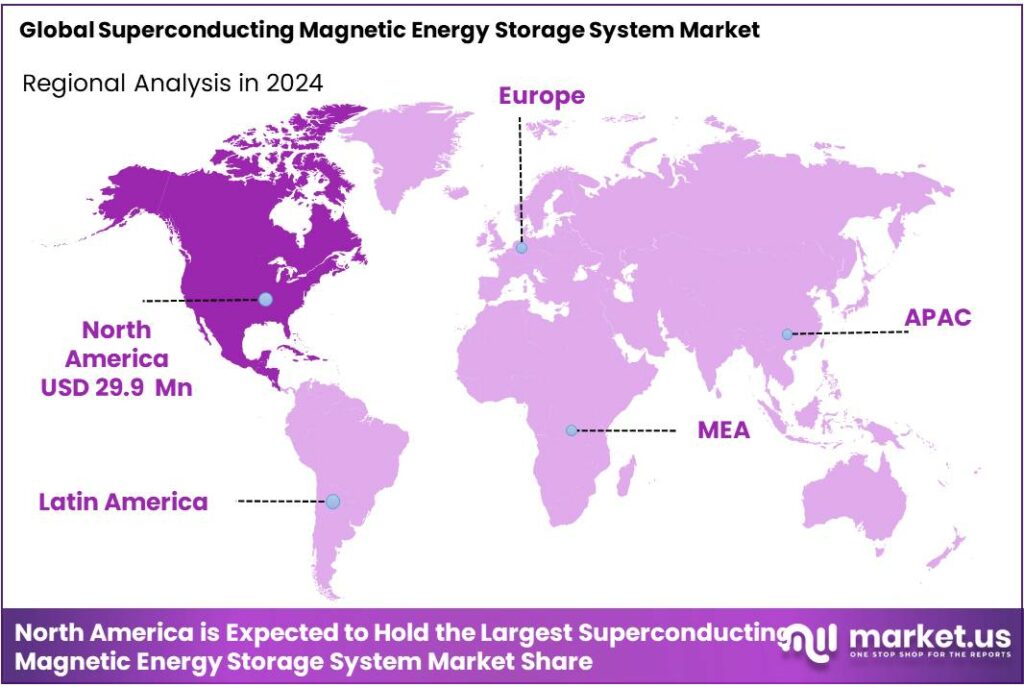

The Global Superconducting Magnetic Energy Storage System Market size is expected to be worth around USD 196.8 Million by 2034, from USD 69.3 Million in 2024, growing at a CAGR of 11.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.20% share, holding USD 29.9 Billion in revenue.

Superconducting Magnetic Energy Storage (SMES) systems store electrical energy in the magnetic field of a superconducting coil that is maintained at cryogenic temperatures. The technology is characterized by negligible resistive losses in the coil and by rapid power delivery; round-trip efficiencies are widely reported to exceed 95% and, under optimal designs, approach 97–98%, which positions SMES favourably for high-efficiency, short-duration services.

The industrial scenario for Superconducting Magnetic Energy Storage (SMES) is currently defined by niche commercial deployments, pilot demonstrations and continued research targeting scale-up and cost reduction. The SMES response time to grid events is effectively instantaneous — typically full power can be delivered in under 100 milliseconds — which makes the technology uniquely suited for frequency regulation, fault current limitation, power-quality correction and transient stability services.

Market drivers have been identified as increasing penetration of variable renewables, heightened need for fast-response ancillary services, and public R&D and innovation funding that target superconducting materials and cryogenic systems. Global grid-scale storage requirements have been estimated to expand substantially — the International Energy Agency indicates that electricity storage capacity needs could grow to nearly 1 500 GW by 2030 under scenarios aligned with deep decarbonisation targets, highlighting a material addressable need for diverse storage technologies that provide complementary durations and response characteristics.

Government initiatives and research programmes have been enacted to accelerate advanced magnetic and superconducting technologies. For example, U.S. federal bodies continue to fund energy storage R&D (multiple solicitations and FOAs were released in 2024–2025), and a specific Office of Electricity announcement in mid-2025 provided up to US$15 million for three storage technology projects — demonstrating active public support for novel storage pathways.

Key Takeaways

- Superconducting Magnetic Energy Storage System Market size is expected to be worth around USD 196.8 Million by 2034, from USD 69.3 Million in 2024, growing at a CAGR of 11.0%.

- High Temperature Superconductors (HTS) held a dominant market position, capturing more than a 67.9% share in the global Superconducting Magnetic Energy Storage (SMES) system market.

- High Energy Storage held a dominant market position, capturing more than a 69.20% share.

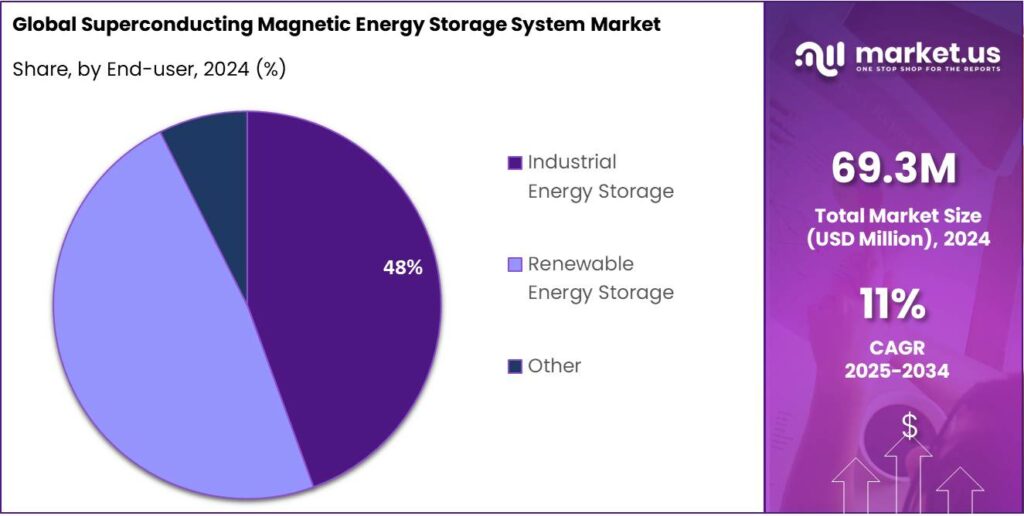

- Industrial Energy Storage held a dominant market position, capturing more than a 48.4% share in the global Superconducting Magnetic Energy Storage (SMES) system market.

- North America held a dominant position in the global Superconducting Magnetic Energy Storage (SMES) system market, capturing more than a 43.20% share valued at approximately USD 29.9 million.

By Conductor Type Analysis

High Temperature Superconductors dominate with 67.9% share owing to superior efficiency and wider operational range

In 2024, High Temperature Superconductors (HTS) held a dominant market position, capturing more than a 67.9% share in the global Superconducting Magnetic Energy Storage (SMES) system market. The strong presence of HTS conductors is mainly attributed to their ability to operate at higher temperatures — typically between 20 K and 77 K — which significantly reduces cooling costs and enhances overall system efficiency. These conductors, made primarily from materials such as yttrium barium copper oxide (YBCO) and bismuth strontium calcium copper oxide (BSCCO), offer lower energy losses and higher current densities compared to conventional low-temperature superconductors.

The demand for HTS-based SMES systems increased notably in 2024, driven by their suitability for large-scale grid applications and rapid-response energy storage in renewable energy integration. Utilities and industrial facilities have increasingly adopted HTS coils due to their superior magnetic flux density and compact design, enabling higher energy storage capacity per unit volume. Additionally, advancements in cryocooler technology have further reduced operational costs, making HTS systems economically viable for commercial and utility-scale projects.

By Application Analysis

High Energy Storage dominates with 69.20% share owing to its growing use in large-scale grid stability and renewable integration

In 2024, High Energy Storage held a dominant market position, capturing more than a 69.20% share in the global Superconducting Magnetic Energy Storage (SMES) system market. This strong dominance was driven by the rising need for advanced energy storage technologies capable of supporting grid reliability and balancing variable renewable energy sources such as wind and solar. High energy SMES systems are designed to store and deliver substantial amounts of power over short durations, making them ideal for high-demand applications like load leveling, voltage stabilization, and system frequency regulation.

The utilities and industrial sectors increasingly adopted high energy SMES systems due to their superior round-trip efficiency—typically above 95%—and their ability to provide instantaneous power output. These systems were also integrated into renewable projects to manage sudden power fluctuations and ensure continuous supply. The increasing investment in modernizing electrical grids, particularly in North America and East Asia, further accelerated the demand for high energy SMES installations.

By End-user Analysis

Industrial Energy Storage dominates with 48.4% share driven by rising demand for uninterrupted and high-efficiency power supply

In 2024, Industrial Energy Storage held a dominant market position, capturing more than a 48.4% share in the global Superconducting Magnetic Energy Storage (SMES) system market. This dominance was largely due to the growing need among industrial facilities for reliable, high-efficiency, and instantaneous energy backup solutions. Industries such as semiconductor manufacturing, steel processing, chemical production, and data centers have increasingly adopted SMES systems to maintain power quality, minimize voltage dips, and prevent equipment shutdowns during grid fluctuations.

The adoption of SMES systems in industrial applications accelerated as companies sought to improve operational stability and energy efficiency. SMES technology offers unique advantages such as extremely fast response time (less than 100 milliseconds), high power density, and a long operational life cycle with minimal degradation. These features make it especially valuable in environments where even minor power interruptions can lead to significant production losses. The industrial sector’s growing emphasis on automation and precision-based processes further fueled demand for stable and clean energy storage systems like SMES.

Key Market Segments

By Conductor Type

- High Temperature

- Low Temperature

By Application

- Low Energy Storage

- High Energy Storage

By End-user

- Industrial Energy Storage

- Renewable Energy Storage

- Other

Emerging Trends

Rise of Hybrid and Multi-Modal Energy Storage Architectures

One of the most noticeable recent trends in SMES (Superconducting Magnetic Energy Storage) is its integration into hybrid or multi-modal energy storage systems rather than as a standalone technology. In simple terms, SMES is being paired with batteries, supercapacitors, or flywheels to combine their strengths and mitigate their individual weaknesses. This approach is gaining traction because it lets each technology “cover its own lane” in the speed vs. capacity trade-off.

In hybrid configurations, SMES often handles the ultra fast, short-duration stability tasks—like responding within microseconds to voltage dips or frequency fluctuations—while batteries cover bulk energy shifting over hours. Because battery systems have matured rapidly, this pairing is increasingly seen as practical. For instance, in 2024 the U.S. added 10.4 GW of new battery storage capacity, pushing cumulative utility-scale battery storage past 26 GW. That scale shows how dominant battery storage is becoming for the “bulk shifting” role; SMES has to find its niche by focusing on speed and precision.

Another boosting factor: with the fast growth of data centers and other critical loads, the tolerance for micro disturbances is shrinking. The U.S. Department of Energy reported that data center electricity demand has tripled over the last decade and is expected to double or triple again by 2028. Hybrid systems using SMES can help protect these sensitive loads from voltage sags, brief outages, or transients by acting as a buffer while the battery or grid rebalances.

What makes the hybrid trend human and practical is that it acknowledges real limits—no one technology is perfect. SMES on its own is pricey and hard to scale for hours of storage; batteries struggle to respond extremely fast; and flywheels have limited energy capacity. By combining them, a more resilient, efficient, and cost-balanced system emerges. From the grid operator’s perspective, this is like having a sprinter (SMES) alongside a marathon runner (battery)—each stepping in when their strength is needed.

Drivers

Rapid Growth of Renewable Energy and Grid Instability as a Key Driver

One major driving factor fueling interest in Superconducting Magnetic Energy Storage (SMES) systems is the accelerating growth of renewable generation, which introduces variability and instability to power grids—and necessitates ultra-fast response storage solutions. The more solar and wind you put on the grid, the more fluctuations you encounter, and that creates demand for technologies that can inject or absorb power almost instantaneously.

Globally, renewable electricity generation is projected to climb to over 17,000 TWh by the end of this decade—an increase of nearly 90% over 2023 levels. As variable sources grow, balancing supply and demand on fine time scales becomes ever more challenging. In effect, grids require buffering capacity that can respond in milliseconds, not minutes. SMES’s key advantage is precisely that: almost instantaneous response, which makes it ideal to smooth small fluctuations, maintain frequency, or support critical infrastructure during transient events.

In the United States, the pressure is already visible. The U.S. energy storage market added 12.3 GW of new capacity in 2024—the largest single-year increase—and is projected to add another 15.2 GW in 2025. That rapid growth partly arises because grid operators are increasingly valuing fast, flexible storage options to stabilize systems with high shares of solar and wind. Meanwhile, the U.S. Department of Energy has set up funding programs such as its Critical Facility Energy Resilience (CiFER) initiative, awarding USD 5 million each to three demonstration storage projects that will support critical infrastructure during outages.

Policy incentives also support this trend. Under the U.S. Infrastructure Investment and Jobs Act, USD 500 million was allocated toward long-duration energy storage prototypes and pilots, which indirectly benefits all advanced storage research, including SMES. In parallel, the Inflation Reduction Act further promotes technology neutrality by providing strong incentives to grid energy storage. Under that law, about USD 128 billion is earmarked for renewable energy and grid energy storage deployment and incentives.

Restraints

High Capital and Operating Cost — A Major Restraining Factor

One of the biggest brakes on the widespread adoption of SMES is simply cost — both in terms of building and maintaining the system over its lifetime. These costs arise primarily from the superconductor materials, cryogenic cooling, and mechanical support needed to resist enormous magnetic stresses.

Superconducting wire (especially high-temperature superconductors, or HTS) remains expensive. Current bulk prices for HTS wire are reported in the range of USD 150 to 200 per kA-m (i.e., kiloampere-meter) for commercial volumes. Analysts often cite that the “breakthrough” price target for power applications would be closer to USD 50/kA-m or lower, but we’re still far from that. Because the cost of the superconducting wire dominates the capital expense, any scale-up demands dramatic reductions in wire cost, which have not yet been realized.

Then add to that the cost and energy consumption of cryogenic cooling. SMES systems must maintain the superconducting coil at cryogenic temperatures, which requires continuous refrigeration. The parasitic load (power consumed to cool) reduces net efficiency, and adds to operating expenses. Also, the mechanical structure to counter the strong Lorentz forces inside the magnet must be robust and well engineered, adding further cost overhead.

Another dimension is scale: SMES systems delivering utility-scale storage (say, multiple MWh or GWh) require extremely long superconducting loops or massive coil structures. One reference suggests that to store around 5 GWh of energy, a superconducting loop of about 800 m in diameter (or equivalent length) might be needed, which demands large land footprint and complex infrastructure. Such scale amplifies both capital and maintenance challenges.

Opportunity

Niche Role in Ultra Fast Power Stability

One of the biggest growth opportunities for SMES lies in its unique ability to deliver sub-millisecond response to power disturbances—something few energy storage systems can match. In a grid increasingly strained by the variability of renewables, that speed becomes invaluable. For many utilities, disturbances like voltage sags, sudden load changes, or transient faults can last mere milliseconds—but they can cascade into bigger outages if not corrected almost instantly. SMES can provide that stabilizing “shock absorber” for the grid.

Take the scale at which storage is expected to grow: in the U.S., the cumulative utility-scale battery storage capacity crossed 26 GW in 2024, after adding 10.4 GW new capacity that year. Meanwhile, the U.S. Department of Energy estimates that to support a zero-carbon grid by 2050, the country may need as much as 930 GW of storage capacity (including both fast-response and long-duration types). This enormous scale hints at room for specialized technologies—like SMES—to co-exist with battery systems, especially where speed matters more than capacity.

Government and public institutions are already pushing toward grid modernization and resilience. For instance, the U.S. DOE’s Storage Futures Study explores how emerging storage technologies could integrate with the future grid. Also, 12 U.S. states have set binding energy storage deployment targets—such as Michigan’s goal of 2.5 GW by 2030. These policies gradually force system operators and regulators to value faster, more responsive storage options, not just bulk energy shifting.

Internationally, governments are funding grid-scale storage projects. In Australia, the Australian Renewable Energy Agency (ARENA) has committed support for 2 GW / 4.2 GWh of new grid storage capacity. Such support covers system flexibility and resilience, which are exactly zones where SMES can offer unique benefits.

Regional Insights

North America leads the SMES market with 43.20% share valued at USD 29.9 million, driven by strong grid modernization and renewable integration initiatives

In 2024, North America held a dominant position in the global Superconducting Magnetic Energy Storage (SMES) system market, capturing more than a 43.20% share valued at approximately USD 29.9 million. The region’s leadership can be attributed to its strong focus on grid reliability, renewable integration, and ongoing investments in advanced energy storage technologies.

In 2024, the DOE allocated over USD 15 million to energy storage demonstration programs aimed at enhancing grid flexibility and power quality — a portion of which focused on superconducting systems and related magnetic technologies.

The region’s industrial and utility sectors are increasingly utilizing SMES for fast-response grid stabilization and voltage support, especially in areas with high renewable energy penetration. The growing need to manage fluctuations from wind and solar sources across states such as California and Texas has accelerated deployment of high-capacity SMES prototypes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB has been pioneering applications of high-temperature superconducting (HTS) devices in grid infrastructure. For example, ABB delivered the world’s first HTS fault current limiter (rated 1 MVA at 10.5 kV) in a Swiss hydro power plant to protect against short-circuit faults. The company has also signed development agreements (e.g. with American Superconductor & EDF) to drive down costs and scale HTS transformer technology. ABB’s strength lies in combining engineering scale, power electronics, and deep grid-level deployment capability.

BEST is a world leader in producing both low-temperature superconductors (LTS) (NbTi, Nb3Sn) and high-temperature superconductors. The company supplies superconducting wire in vast quantities (over 60,000 km/year of advanced metallic superconductors) from its plants in Germany and the USA. BEST also holds multi-million‐dollar contracts with ITER and other fusion projects involving high current density superconductors.

Fujikura has developed rare-earth–based high-temperature superconductors (HTS), particularly Yttrium-based 2G HTS tape/wire. It built the world’s largest YBCO (yttrium-based HTS) magnet with a 20 cm room-temperature bore in 2012: 7,200 m of wire, operating current 333 A @25 K, stored energy ~426 kJ. The company is expanding practical applications (e.g. power cables, coils) and improving wire length, critical current, and manufacturing uniformity.

Top Key Players Outlook

- ABB Inc.

- American Superconductor Corporation

- ASG Superconductors SpA

- Bruker Energy & Supercon Technologies

- Fujikura Ltd.

- Hyper Tech Research Inc.

- Nexans SA

Recent Industry Developments

In 2024, Fujikura Ltd. reported revenue of approximately USD 5.28 billion for the fiscal year ending March 31, 2024, down from about USD 6.07 billion the prior year.

In fiscal 2023, American Superconductor Corporation posted revenues of approximately USD 145.6 million, up from USD 106.0 million in 2022.

Report Scope

Report Features Description Market Value (2024) USD 69.3 Mn Forecast Revenue (2034) USD 196.8 Mn CAGR (2025-2034) 11% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Conductor Type (High Temperature, Low Temperature), By Application (Low Energy Storage, High Energy Storage), By End-user (Industrial Energy Storage, Renewable Energy Storage, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Inc., American Superconductor Corporation, ASG Superconductors SpA, Bruker Energy & Supercon Technologies, Fujikura Ltd., Hyper Tech Research Inc., Nexans SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Superconducting Magnetic Energy Storage System MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Superconducting Magnetic Energy Storage System MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Inc.

- American Superconductor Corporation

- ASG Superconductors SpA

- Bruker Energy & Supercon Technologies

- Fujikura Ltd.

- Hyper Tech Research Inc.

- Nexans SA