Global Store Fulfillment App Market By Type of Service (Order Fulfillment Services, Warehousing and Storage Fulfillment Services, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Sales Channel (Business-to-Business (B2B), Business-to-Customer (B2C)), By Application (Retail, Telecom, Pharmaceuticals and Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 168674

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights

- By Type of Service

- By Enterprise Size

- By Sales Channel

- By Application

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

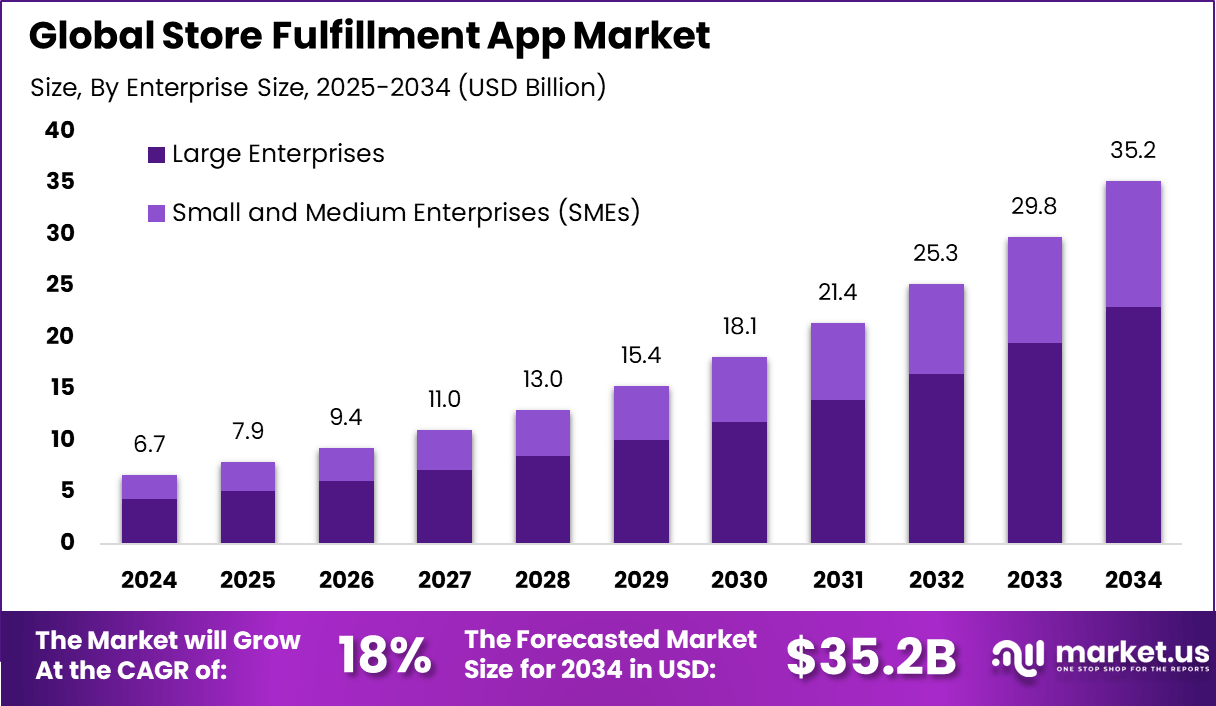

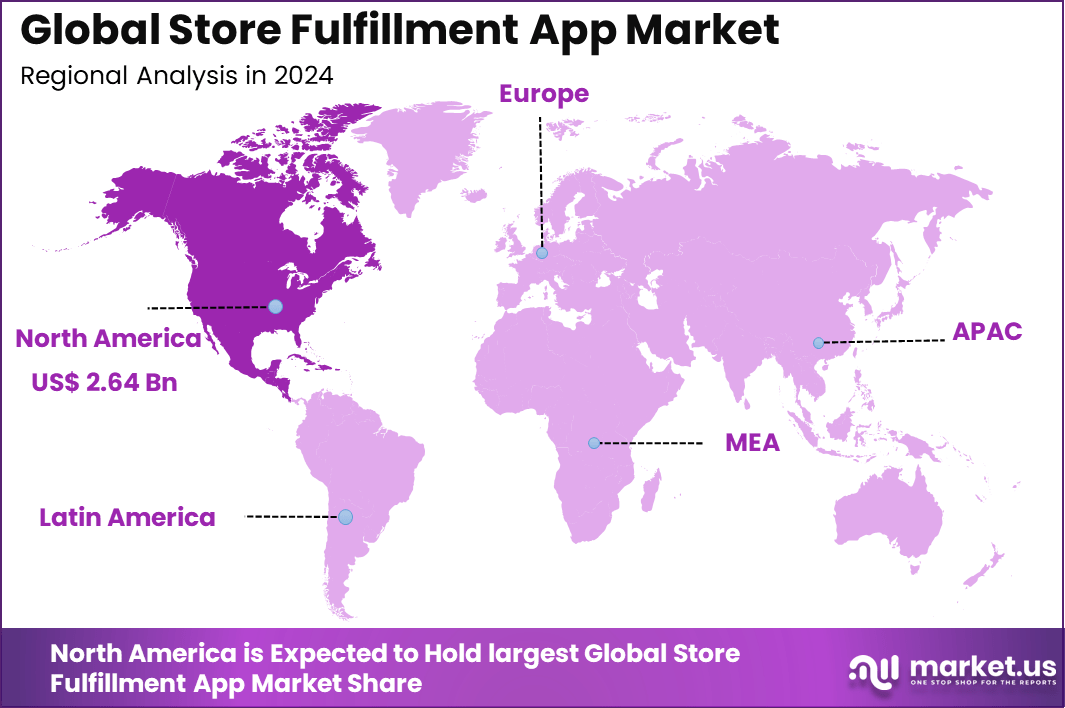

The Global Store Fulfillment App Market generated USD 6.7 billion in 2024 and is predicted to register growth from USD 7.9 billion in 2025 to about USD 35.2 billion by 2034, recording a CAGR of 18% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.4% share, holding USD 2.64 Billion revenue.

The store fulfillment app market has expanded as retailers adopt digital tools to manage pick, pack and handoff processes for online orders placed through physical stores. Growth reflects the shift toward hybrid shopping, rising consumer expectations for same day delivery and the increasing role of stores as micro fulfillment hubs. Store fulfillment apps now support curbside pickup, ship from store and in store order processing across large retail networks and small independent stores.

The growth of the market can be attributed to increasing omnichannel demand, rising pressure to reduce delivery time and growing need for accurate inventory visibility. Retailers face strong competition from fast delivery services and rely on store fulfillment tools to streamline operations. The expansion of click and collect services and rising order volumes from mobile commerce further strengthen adoption.

Top Market Takeaways

- By type of service, order fulfillment services lead with 40.1% share, encompassing picking, packing, shipping, and last-mile delivery management essential for efficient order processing in both online and physical retail channels.

- By enterprise size, large enterprises hold 65.4% share, driven by their ability to deploy and integrate sophisticated fulfillment apps for multi-location inventory, automated workflows, and high order volumes.

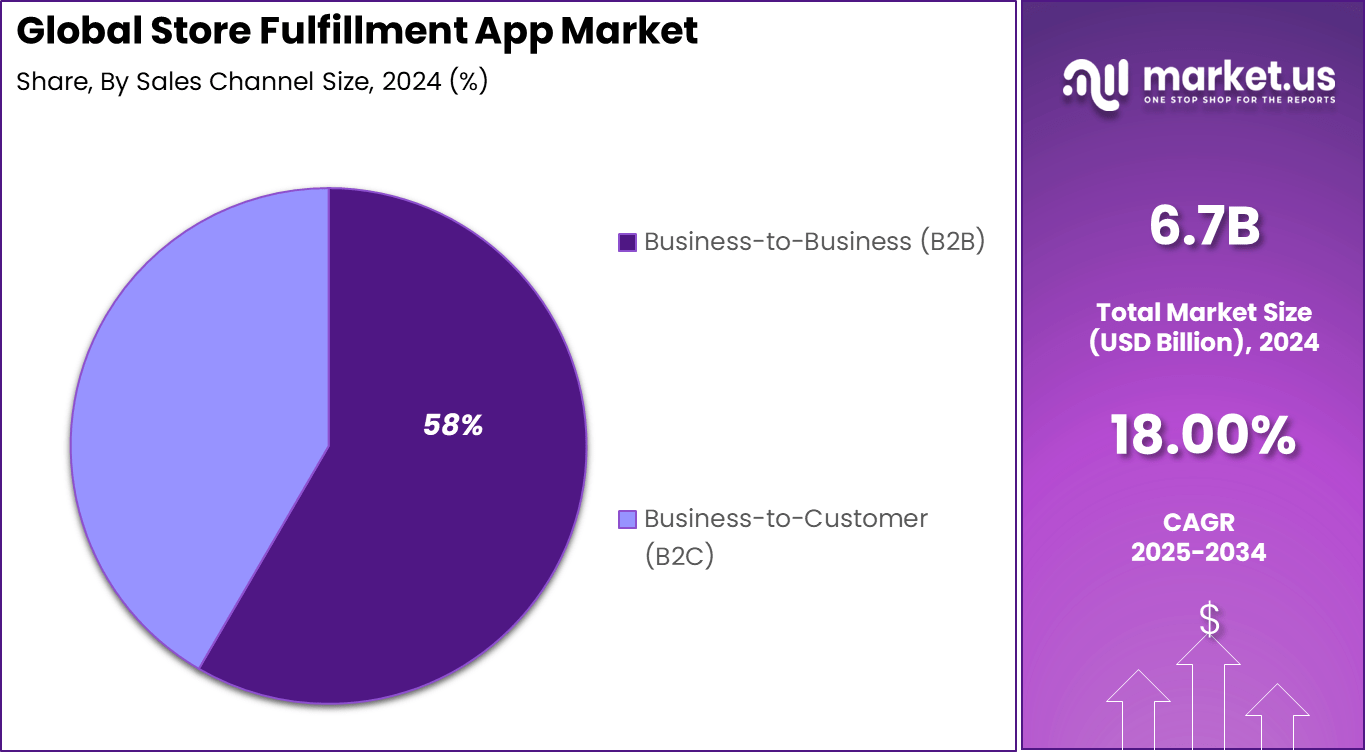

- By sales channel, business-to-business (B2B) dominates with 58.4% share, as wholesalers, distributors, and manufacturers increasingly leverage store fulfillment apps to meet retailer demands and streamline complex supply chains.

- By application, retail accounts for 28.4%, reflecting the integration of online and brick-and-mortar store inventory to enable omnichannel fulfillment, curbside pickup, and quick delivery programs.

- Regionally, North America commands about 39.4% of the market.

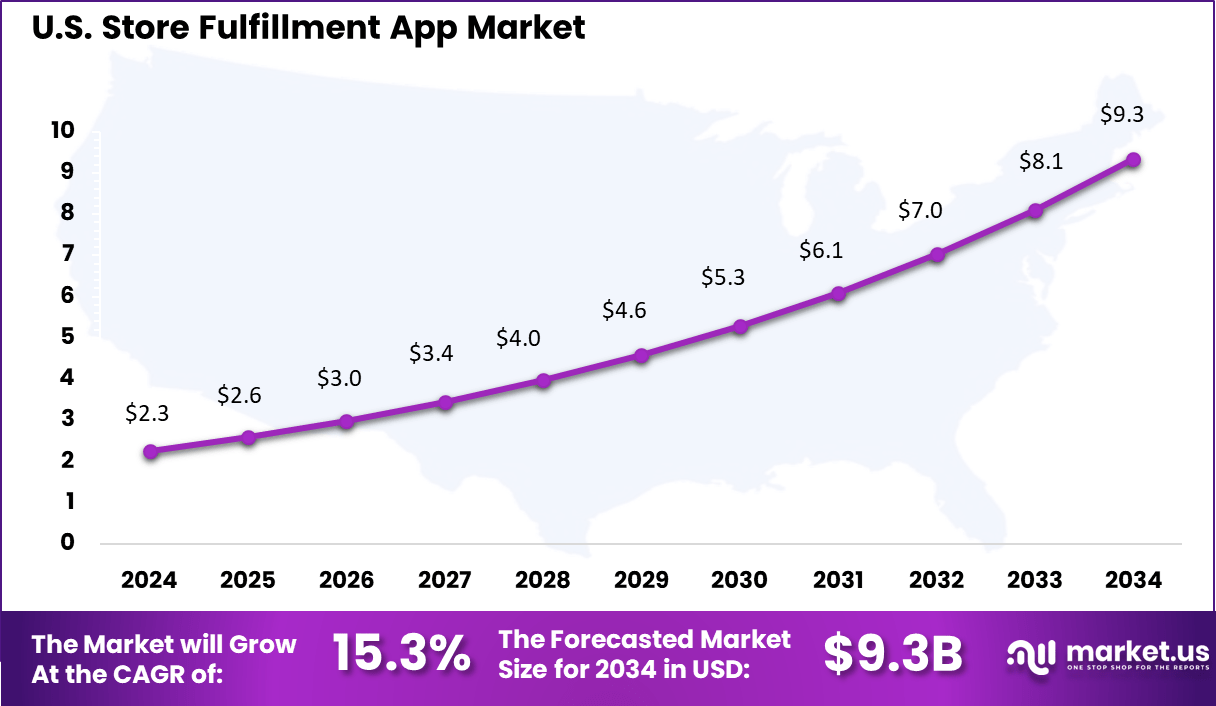

- The U.S. market size is valued at around USD 2.25 billion in 2025.

- The market grows at a CAGR of 15.3%, supported by e-commerce growth, automation adoption in warehouses and stores, increasing demand for faster fulfillment, and digital transformation initiatives.

Key Insights

- The uptake of fulfillment applications continues to rise as more merchants rely on digital tools to manage logistics. More than 85% of online sellers use apps to run core functions, and most operate with an average of six apps to optimize daily workflows. The strong installation rate of fulfillment solutions, reaching 92.3%, reflects sustained demand for integrated order management across retail operations.

- Technology adoption in fulfillment is moving steadily, with 65% of e-commerce businesses using dedicated software to manage orders. This indicates that digital tools are becoming essential for operational accuracy and quicker processing in a high-volume retail environment.

- Consumer experience inside stores is changing as in-store picking and packing activities increase. About 42% of shoppers feel these activities disrupt their visit, showing a growing need for better coordination between online and physical operations. At the same time, 31% of consumers prefer mobile apps for shopping because of a smoother experience.

- Omnichannel readiness is strengthening as a large volume of retailers provide local pickup options. This shift connects physical stores with online fulfillment and supports faster handovers to customers. When inside a store, shoppers look for app features that help them locate products (71%), notify staff for curbside or pickup (65%), and scan items for extra information (51%).

- Delivery expectations are rising as shoppers become more sensitive to pricing and speed. Unexpected shipping charges push 25% of buyers to leave their carts, and high fees cause 63% to cancel purchases. Free shipping remains a decisive factor for 74% of shoppers, and 94% actively adjust their behavior to qualify for it.

- Delivery timelines directly affect purchase decisions. If an item takes more than a week to arrive, 38% of shoppers abandon the order. Faster delivery is becoming a standard expectation, and about 51% of consumers are projected to prefer same-day services. Half of all customers, or 50%, say that the overall delivery experience influences their loyalty to a retailer.

By Type of Service

Order fulfillment services lead the store fulfillment app market with a strong 40.1% share. These services handle picking, packing, shipping, and returns directly from store inventory, enabling retailers to leverage physical locations as mini-distribution centers.

Store apps coordinate real-time inventory visibility across channels, ensuring accurate order allocation and same-day fulfillment options that delight customers expecting fast delivery. The integration of mobile tools for store associates streamlines the entire process, from order wave planning to label printing, reducing errors and speeding up execution in busy retail environments.

Retailers increasingly rely on these services to compete with pure e-commerce players by offering buy-online-pickup-in-store and curbside options. Apps provide dashboards showing fulfillment capacity by store, helping managers balance online orders with in-store sales while minimizing stockouts during peak demand periods.

By Enterprise Size

Large enterprises dominate with 65.4% market share, driven by their extensive store networks and complex omnichannel strategies. These retailers deploy store fulfillment apps across hundreds of locations to synchronize inventory, labor, and customer demand in real time.

Enterprise-grade apps offer advanced features like predictive order routing, workforce scheduling, and performance analytics that optimize fulfillment across regions. Their scale justifies investments in customized integrations with ERP systems and carrier networks for seamless end-to-end operations.

Large chains benefit from centralized control that turns every store into a strategic asset for faster delivery and higher customer satisfaction. The apps enable data-driven decisions on store clustering and micro-fulfillment, transforming traditional retail footprints into competitive advantages in the e-commerce era.

By Sales Channel

B2B sales channels account for 58.4% of the store fulfillment app market, reflecting the need for efficient bulk order processing from physical stores. These apps support complex B2B workflows like pallet picking, custom packaging, and scheduled deliveries for wholesale customers.

Retailers use them to fulfill large orders quickly by tapping store inventory closer to business clients, cutting shipping costs and lead times. Features like order splitting across stores and B2B portal integrations streamline the process for corporate buyers.

B2B fulfillment from stores gains traction as retailers expand wholesale operations alongside consumer sales. Apps provide visibility into bulk inventory availability and carrier options, enabling competitive service levels that strengthen business relationships and open new revenue streams.

By Application

Retail applications represent 28.4% of the market, powering store-based fulfillment for everyday consumer goods. Apps enable grocers, apparel stores, and general merchandise retailers to process online orders using existing store staff and layouts.

They optimize pick paths through aisles, manage perishable items with time-sensitive routing, and support flexible fulfillment like ship-from-store or local delivery. Retail-specific features ensure compliance with food safety and return policies unique to physical goods.

The retail sector embraces these apps to bridge online and offline worlds, turning stores into fulfillment hubs that drive foot traffic and loyalty. Real-time demand forecasting helps balance store replenishment with online orders, maintaining service levels during promotions and holidays when fulfillment volumes spike dramatically.

Key Reasons for Adoption

- Retailers are adopting store fulfillment apps to handle the growing demand for fast and flexible delivery in an omnichannel shopping environment.

- These apps help retailers efficiently manage inventory across multiple locations, reducing stockouts and saving costs on excess inventory.

- Customers expect quick delivery or convenient in-store pickup options, pushing businesses to improve fulfillment speed and accuracy.

- Supply chain disruptions and rising delivery costs make localized fulfillment from stores a practical choice to reduce transit times and expenses.

- Automation and AI-powered order processing in these apps lower manual errors and improve resource allocation, supporting scalability during peak sales.

Benefits

- Store fulfillment apps provide real-time inventory visibility across store networks, helping fulfill orders faster and reduce overselling.

- They streamline order routing to the nearest store with available stock, speeding up delivery or pickup and enhancing customer satisfaction.

- Automated workflows reduce labor costs by optimizing picking and packing tasks, which also minimizes shipping errors.

- These apps improve coordination between online and offline sales channels, helping retailers deliver a seamless shopping experience.

- Enhanced reporting and analytics support data-driven decisions for inventory management, promotions, and logistics planning.

Usage

- Retailers integrate store fulfillment apps with e-commerce platforms, POS systems, and third-party logistics to automate the entire fulfillment lifecycle.

- There is growing use of micro-fulfillment centers inside stores or nearby locations to handle fast-moving SKUs, especially for groceries and electronics.

- Same-day and next-day delivery options are increasingly supported by these apps, meeting consumer expectations for speed.

- Retailers leverage real-time customer updates and flexible delivery windows through the apps to enhance convenience and build loyalty.

- AI-driven demand forecasting and inventory optimization are commonly used to reduce overstock and stockouts, especially during seasonal peaks.

Emerging Trends

Key Trends Description AI and Predictive Analytics Use of AI to forecast demand, optimize inventory, and streamline order processing for faster fulfillment. Omnichannel Integration Seamless management of orders from multiple channels including online, in-store, and mobile platforms. Mobile-First Applications Apps designed for store associates to manage picking, packing, and customer interactions on the go. Automation and Robotics Incorporation of automated guided vehicles (AGVs) and robotics to improve in-store fulfillment efficiency. Personalized Delivery Options Offering customers flexible delivery preferences such as curbside pickup, scheduled delivery, and locker pickups. Growth Factors

Key Factors Description Rising E-commerce and Online Shopping Increased online shopping driving demand for efficient and fast in-store fulfillment systems. Consumer Demand for Speed and Convenience Growing preference for same-day and next-day delivery options fueling adoption of fulfillment apps. Expansion of Retail Omnichannel Strategies Retailers investing in integrated fulfillment solutions to provide consistent customer experience across platforms. Technological Advancements Advances in AI, mobile technology, and automation enhancing app capabilities and operational efficiency. Urbanization and Last-Mile Delivery Focus Need for localized inventory and quick delivery in urban areas boosting store-based fulfillment adoption. Key Market Segments

By Component

- Solution

- Antivirus

- Anti-Spyware

- Firewall

- Endpoint Device Control

- Anti-Phishing

- Endpoint Application Control

- Others

- Services

- Managed Services

- Consulting & Integration

- Training & Support

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Manufacturing

- Education

- Retail

- Media & Entertainment

- Government & Defense

- Others

Regional Analysis

North America led the store fulfillment app market, holding a substantial 39.4% share driven by the region’s highly developed retail infrastructure and increasing demand for seamless omnichannel shopping experiences. The growth is fueled by widespread digital transformation in retail operations, with retailers adopting advanced store fulfillment apps to optimize inventory management, automate order processing, and accelerate last-mile delivery.

High consumer expectations for faster delivery and real-time order tracking compel retailers to invest heavily in app-based fulfillment technologies. The presence of major players like Amazon and Walmart, coupled with innovations in AI and IoT integration, further strengthens North America’s market dominance.

The U.S. represents the largest market segment, valued at approximately USD 2.25 billion in 2024, with a strong CAGR of 15.3%. The U.S. retail sector’s emphasis on enhancing customer convenience through speedy and flexible fulfillment options drives app adoption. Retailers focus on integrating store inventory systems with online platforms using sophisticated fulfillment apps to enable in-store pickup, curbside delivery, and same-day shipping.

The rise of micro-fulfillment centers and automation technologies plays a critical role in improving operational efficiency and reducing costs. This robust innovation ecosystem positions the U.S. as the primary engine for growth in the North American store fulfillment app market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growth of Omnichannel Retail

The store fulfillment app market is driven by the rapid growth of omnichannel retail, where customers expect seamless shopping experiences across online and offline channels. Retailers use fulfillment apps to unify inventory management, accelerate order processing, and coordinate delivery options like in-store pickup, ship-from-store, and curbside service. This helps retailers meet rising customer expectations for faster and flexible deliveries, enhancing satisfaction and loyalty.

Retailers investing in digital transformation and automation adopt these apps to optimize warehouse and store operations, reduce human errors, and cut costs. These combined forces underpin strong market momentum as retail evolves.

Restraint

High Initial Costs and Integration Complexity

High initial costs for deploying fulfillment apps and integrating them with existing retail systems are significant restraints. Many stores require custom solutions to connect with legacy point-of-sale and warehouse management systems, demanding technical expertise and prolonged implementation.

Complex setups and data synchronization challenges slow adoption, especially among small to medium retailers with limited IT resources. These financial and operational barriers temper market growth despite clear efficiency benefits.

Opportunity

AI and Robotics-Driven Efficiency

There is ample opportunity in integrating AI and robotics into fulfillment apps to improve demand forecasting, inventory placement, and order routing. Automated picking systems and autonomous vehicles within warehouses accelerate operations and reduce labor costs.

Expanding micro-fulfillment centers and last-mile delivery solutions create niches for apps that provide real-time tracking and dynamic workflow management. Providers offering scalable, user-friendly AI-powered platforms stand to gain from accelerating e-commerce and on-demand delivery trends.

Challenge

Managing Last-Mile Fulfillment and Customer Expectations

Challenges include managing last-mile delivery logistics and meeting stringent customer expectations for speed, accuracy, and transparency. Coordinating multiple carriers, shipment routes, and delivery slots without errors requires robust software and constant optimization.

Customer demands for same-day or scheduled delivery add pressure on retailers and fulfillment apps alike. Balancing cost control with high service levels, and ensuring real-time visibility throughout the fulfillment cycle, remain ongoing hurdles for market participants.

Competitive Analysis

The store fulfillment app market is highly competitive, with companies such as Manhattan Associates, Oracle Corporation, SAP SE, IBM Corporation, Zebra Technologies, Softeon, Blue Yonder, Kibo Commerce, Radial Inc., Infor, Tecsys, Epicor Software Corporation, HighJump (Körber), Salesforce Commerce Cloud, Shopify, SPS Commerce, Descartes Systems Group, JDA Software, Vinculum Group, Deposco, and others offering comprehensive solutions.

Market players differentiate themselves by offering cloud-based, scalable, and integrated solutions that support real-time inventory visibility, automated workflow optimization, and seamless integration with e-commerce and retail systems. Emphasis is placed on user-friendly interfaces, mobile capabilities, and AI-driven analytics to enhance decision-making and operational efficiency.

Strategic partnerships, robust customer support, and adaptability to changing retail trends, such as the growth of same-day delivery and buy-online-pickup-in-store (BOPIS) services, play a critical role in sustaining competitiveness within the dynamic retail fulfillment landscape.

Top Key Players in the Market

- Manhattan Associates

- Oracle Corporation

- SAP SE

- IBM Corporation

- Zebra Technologies

- Softeon

- Blue Yonder

- Kibo Commerce

- Radial Inc.

- Infor

- Tecsys

- Epicor Software Corporation

- HighJump (Körber)

- Salesforce Commerce Cloud

- Shopify

- SPS Commerce

- Descartes Systems Group

- JDA Software

- Vinculum Group

- Deposco

- Others

Future Outlook

The store fulfillment app market is set for strong growth driven by the rise of omnichannel retail strategies, where physical stores increasingly serve as micro-fulfillment centers for online orders like BOPIS, curbside pickup, and ship-from-store.

AI-powered inventory optimization, real-time visibility, and automation will enhance operational efficiency, while expanding e-commerce adoption accelerates demand for seamless integration between in-store and digital channels. Retailers are prioritizing apps that support rapid scaling during peak periods and personalized customer experiences across urban and suburban markets.

Opportunities lie in

- AI-driven demand forecasting and dynamic inventory allocation to minimize stockouts and optimize store-level replenishment.

- Expansion of micro-fulfillment in stores enabling same-day delivery and curbside options for urban consumers.

- Integration with POS, ERP, and e-commerce platforms for unified omnichannel order orchestration.

Recent Developments

- May, 2025, Manhattan Associates showcased unified supply chain commerce innovations at Momentum 2025, featuring agentic AI and B2B commerce capabilities for store fulfillment optimization

- June, 2025, SAP highlighted Advanced ATP order fulfillment enhancements within S/4HANA, providing real-time availability checks, backorder processing, and alternative-based confirmations for precise store fulfillment

Report Scope

Report Features Description Market Value (2024) USD 6.7 Bn Forecast Revenue (2034) USD 35.2 Bn CAGR(2025-2034) 18% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Service(Order Fulfillment Services, Warehousing and Storage Fulfillment Services, Others)By Enterprise Size(Large Enterprises, Small and Medium Enterprises (SMEs))By Sales Channel(Business-to-Business (B2B), Business-to-Customer (B2C))By Application(Retail, Telecom, Pharmaceuticals and Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Manhattan Associates, Oracle Corporation, SAP SE, IBM Corporation, Zebra Technologies, Softeon, Blue Yonder, Kibo Commerce, Radial Inc., Infor, Tecsys, Epicor Software Corporation, HighJump (Körber), Salesforce Commerce Cloud, Shopify, SPS Commerce, Descartes Systems Group, JDA Software, Vinculum Group, Deposco, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Store Fulfillment App MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Store Fulfillment App MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Manhattan Associates

- Oracle Corporation

- SAP SE

- IBM Corporation

- Zebra Technologies

- Softeon

- Blue Yonder

- Kibo Commerce

- Radial Inc.

- Infor

- Tecsys

- Epicor Software Corporation

- HighJump (Körber)

- Salesforce Commerce Cloud

- Shopify

- SPS Commerce

- Descartes Systems Group

- JDA Software

- Vinculum Group

- Deposco

- Others