Global Stone Analysis Software Market By Product Type (Standalone Software, and Integrated Software), By Application (Kidney Stone Analysis, Research & Laboratory, and Urolithiasis Diagnosis), By End User (Hospitals, Research & Academic Institutes, and Diagnostic Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159262

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

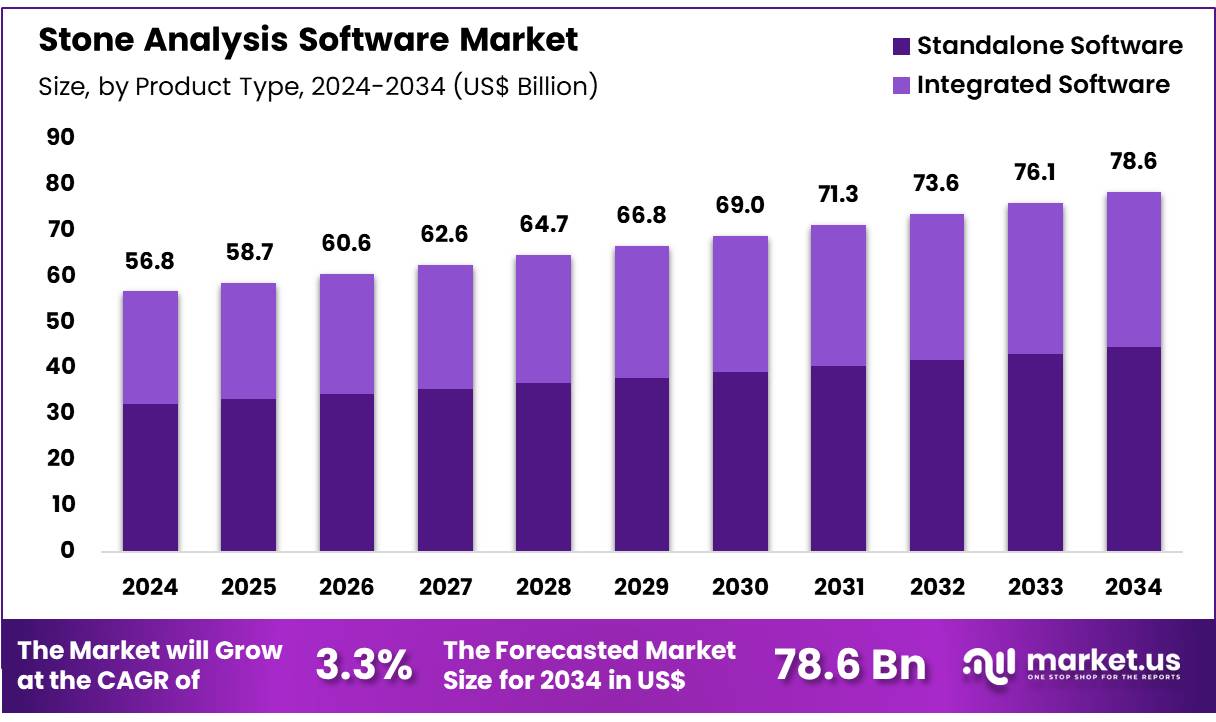

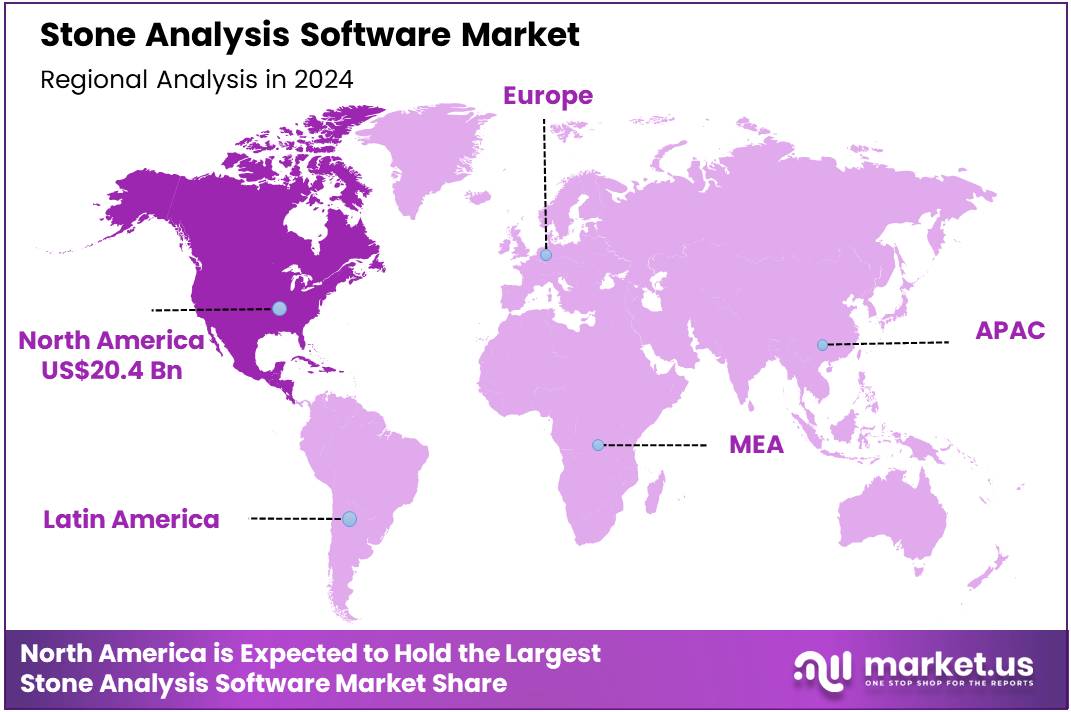

Global Stone Analysis Software Market size is expected to be worth around US$ 78.6 Billion by 2034 from US$ 56.8 Billion in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 35.9% share with a revenue of US$ 20.4 Billion.

Rising prevalence of urinary calculi propels the stone analysis software market as urologists seek advanced tools for accurate composition identification and recurrence prevention. Clinicians increasingly deploy these software solutions for infrared spectroscopy integration, which analyzes stone samples to determine calcium oxalate or uric acid dominance in real-time diagnostics. This driver accelerates with the rising incidence of metabolic disorders, where software facilitates personalized dietary recommendations to mitigate future formations.

Hospitals apply the technology in lithotripsy planning, optimizing energy delivery based on stone density simulations. According to the CDC’s National Health and Nutrition Examination Survey, approximately 9.25% of the US population experiences kidney stones, intensifying demands for efficient analytical workflows. These drivers solidify stone analysis software’s essential role in enhancing diagnostic precision across clinical applications.

Growing integration of artificial intelligence unlocks significant opportunities in the stone analysis software market. Developers innovate AI algorithms that predict stone fragility from CT scans, expanding uses in minimally invasive procedures like percutaneous nephrolithotomy. Research institutions harness these platforms for epidemiological studies, aggregating anonymized data to uncover environmental risk factors.

Opportunities further emerge in patient engagement apps, where software visualizes stone growth trajectories to promote adherence to hydration protocols. Pharmaceutical companies utilize predictive modeling for drug efficacy trials targeting cystine stones. According to the National Kidney Foundation, 1 in 10 individuals develops a kidney stone, underscoring the potential for software to drive preventive strategies. Such opportunities position stone analysis software as a catalyst for tailored, proactive urological care.

Recent trends in the stone analysis software market spotlight cloud-based collaborations and enhanced imaging interoperability that streamline multidisciplinary workflows. Innovators prioritize machine learning enhancements for automated classification, supporting applications in emergency room triage for acute colic episodes. Software providers focus on seamless data export to electronic health records, enabling longitudinal tracking in chronic stone management.

Trends also encompass virtual reality overlays for surgical rehearsals, reducing operative times in complex staghorn calculus removals. Key advancements include robust encryption protocols to safeguard sensitive spectroscopic data during remote consultations. The incidence of stone passage stands at 1.8% annually, as reported in recent cohort studies, highlighting the market’s momentum toward integrated, resilient solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 56.8 Billion, with a CAGR of 3.3%, and is expected to reach US$ 78.6 Billion by the year 2034.

- The product type segment is divided into standalone software and integrated software, with standalone software taking the lead in 2023 with a market share of 56.8%.

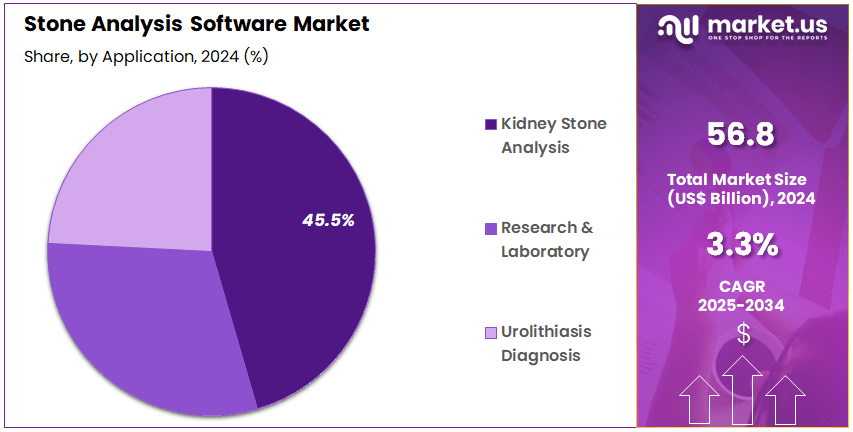

- Considering application, the market is divided into kidney stone analysis, research & laboratory, and urolithiasis diagnosis. Among these, kidney stone analysis held a significant share of 45.5%.

- Furthermore, concerning the end user segment, the market is segregated into hospitals, research & academic institutes, and diagnostic centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 52.5% in the market.

- North America led the market by securing a market share of 35.9% in 2023.

Product Type Analysis

Standalone software holds the largest share at 56.8%. This growth is largely driven by the increasing demand for specialized stone analysis solutions that are independent and easier to integrate into existing hospital systems. Standalone software offers flexibility in terms of implementation and maintenance, and its popularity is further fueled by the ease of use it offers to medical professionals in diagnostic centers and hospitals.

The rise in urological diseases, especially kidney stones, is expected to drive the adoption of such software solutions. With the growing focus on precision medicine and personalized treatment plans, standalone software allows for tailored analysis, making it a preferred choice in the market. Hospitals are likely to continue adopting standalone software as part of their broader digital transformation initiatives.

Application Analysis

Kidney stone analysis holds the largest share at 45.5% in the application segment. This dominance is expected to continue as the incidence of kidney stones increases globally. Kidney stone disease is one of the most common conditions among adults, with growing numbers of patients seeking effective diagnostic and treatment options.

Advances in stone analysis technologies have made it easier for healthcare professionals to detect and assess kidney stones, contributing to the growth of this segment. The demand for non-invasive and accurate diagnostic tools is projected to rise, further boosting the adoption of stone analysis software. Additionally, the increasing awareness about kidney health and the need for precise, timely diagnosis will continue to fuel this market segment’s growth.

End-User Analysis

Hospitals dominate the end-user segment with 52.5% share. This is primarily due to the critical role hospitals play in the diagnosis and treatment of kidney stones and other urological conditions. The integration of advanced stone analysis software in hospital settings is expected to streamline diagnostic processes and improve patient outcomes. The ongoing trend toward digitalization and the adoption of electronic health records (EHR) in hospitals further contributes to the growth of the stone analysis software market.

Additionally, hospitals are anticipated to invest more in specialized tools to enhance diagnostic accuracy and treatment planning, especially in areas like urology. The shift toward personalized medicine and precision diagnostics within hospitals is likely to drive sustained growth in the stone analysis software market.

Key Market Segments

By Product Type

- Standalone Software

- Integrated Software

By Application

- Kidney Stone Analysis

- Research & Laboratory

- Urolithiasis Diagnosis

By End User

- Hospitals

- Research & Academic Institutes

- Diagnostic Centers

Drivers

The rising prevalence of kidney stone disease is driving the market.

The market for stone analysis software is being driven by the rising global prevalence and recurrence of kidney stone disease. Kidney stones are a common and painful condition, and their incidence has been increasing over the past few decades due to factors such as diet, hydration, and climate change. Effective treatment requires more than just removing the stone; it also necessitates a clear understanding of its composition to prevent future occurrences.

Stone analysis software enables urologists and nephrologists to precisely identify the chemical makeup of a stone, allowing them to recommend specific dietary changes and medical therapies tailored to the patient’s unique needs. This move from a reactive to a preventative care model is a key driver.

According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), a part of the National Institutes of Health (NIH), the prevalence of kidney stones in the United States has risen significantly, affecting over one in ten Americans. This high and increasing prevalence creates a continuous demand for advanced tools that can help clinicians manage this widespread condition.

Restraints

The high cost of hardware is restraining the market.

A significant restraint on the stone analysis software market is the high cost of the specialized hardware required to perform the analysis. While the software itself is a key component, its functionality is entirely dependent on sophisticated instruments like Fourier-transform infrared (FTIR) spectrometers or X-ray diffraction (XRD) systems. These machines are essential for determining the precise chemical composition of a kidney stone but come with a substantial price tag that can be a major barrier to adoption for many hospitals, independent laboratories, and smaller clinics.

In addition to the initial purchase price, there are ongoing costs for maintenance, calibration, and training. For example, a single high-end FTIR spectrometer used for clinical analysis from a key player such as Bruker can cost in the tens of thousands of dollars, a figure that requires a significant capital investment. This prohibitive cost limits the widespread adoption of the technology and, by extension, the market for the software that supports it.

Opportunities

The shift toward preventative care is creating growth opportunities.

A key growth opportunity for the stone analysis software market lies in the shift from a reactive, procedure-focused treatment model to one centered on preventative care. While surgical removal of a kidney stone is a necessary step, the high rate of recurrence for many patients underscores the need for a better long-term management strategy. Stone analysis software is at the heart of this new approach, as it allows clinicians to provide highly personalized dietary and medical recommendations to reduce the risk of a stone coming back.

The financial and health benefits of this approach are substantial, which creates a strong incentive for adoption. The Urology Care Foundation reports that between 7% and 10% of Americans will have a kidney stone at some point in their lives, and without proper preventative care, stone recurrence rates are as high as 50% within five years. The ability of stone analysis software to directly combat this high recurrence rate by enabling a more informed and preventative approach is a major growth opportunity.

Impact of Macroeconomic / Geopolitical Factors

The stone analysis software market faces macroeconomic and geopolitical pressures. Rising global healthcare costs push urology clinics to adopt digital tools for accurate kidney stone diagnosis and cost-effective treatment planning. Economic slowdowns, however, limit budgets in smaller facilities, delaying software upgrades. US-China trade tensions disrupt supplies of imaging components, raising costs and slowing integrations.

Providers counter by forging European partnerships and boosting local innovation. This adaptability drives resilience and fuels market growth. US tariffs, with a 10% import duty since April 2025 and 25% on Chinese medical devices, increase hardware costs, squeezing margins and causing clinics to postpone software adoption.

Retaliatory EU tariffs at 15% hinder global collaborations and delay deliveries. Trade policy uncertainty prompts stockpiling, straining finances. Yet, these measures spur domestic manufacturing, enhancing local production and jobs. This shift stabilizes supply chains and sparks innovation, ensuring robust sector progress.

Latest Trends

The integration of artificial intelligence is a recent trend.

A defining recent trend in the stone analysis software market in 2024 is the integration of artificial intelligence (AI) and machine learning for automated analysis. Traditionally, the interpretation of stone analysis results from FTIR or XRD was a time-consuming process that required a skilled lab technician or a specialized physician.

AI algorithms are now being developed and trained to automatically analyze spectroscopic data and identify the chemical composition of stones with a high degree of accuracy and in a fraction of the time. This innovation promises to increase efficiency, reduce turnaround times, and make stone analysis more accessible. This trend is demonstrated by the rapid increase in related patent filings.

The US Patent and Trademark Office (USPTO)’s patent search database shows a steady increase in patent applications for AI-driven medical technologies between 2022 and 2024, particularly for image and data analysis in urology. This signals a strong and continuous investment in leveraging AI to create more intelligent, efficient, and precise software solutions for stone analysis.

Regional Analysis

North America is leading the Stone Analysis Software Market

In 2024, North America held a 35.9% share of the global stone analysis software market, driven by rising urolithiasis cases linked to dietary shifts and aging populations. Clinicians adopted advanced infrared spectroscopy and X-ray diffraction tools to pinpoint stone composition, enabling tailored prevention plans. AI-driven predictive analytics enhanced risk profiling, guiding personalized therapies for high-risk patients.

The FDA’s streamlined clearances for digital diagnostics boosted confidence in automated reporting systems. Cloud-based platforms facilitated real-time data sharing, optimizing multidisciplinary treatment planning. Reimbursement expansions for digital tools spurred smaller clinics to adopt sophisticated software. Venture funding in health informatics startups fueled mobile-compatible innovations for outpatient care. The National Institutes of Health awarded a US$7.37 million grant in 2024 to establish a comprehensive research resource for kidney stone disease across adults and children.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific stone analysis software sector to thrive during the 2024-2030 forecast period, fueled by urbanization-driven dietary imbalances. Governments invest heavily in urological surveillance, pushing hospitals to adopt compositional profiling tools. Tech firms collaborate with pharma to refine algorithms for region-specific stone variants, speeding up tailored treatments.

South Korea and Singapore advance AI-spectroscopy platforms, enabling rural clinics to perform on-site evaluations. India’s medical tourism surge anticipates multilingual software for seamless international case management. China prioritizes genomic analytics to tackle hereditary stone risks via national databases. Japan integrates robotics with digital tools to automate fragment analysis, boosting surgical precision. In 2022-23, Australia’s National Health and Medical Research Council allocated US$ 893.0 million for health research, including urology advancements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Top firms in the stone analysis software sector drive growth by integrating AI diagnostics and forging strategic partnerships to enhance urology outcomes. Thermo Fisher Scientific embeds AI-driven mineral analysis in its platforms, securing major hospital contracts. Beckman Coulter launches cloud-based data tools in 2025, boosting lab collaborations and North American market share.

Agilent Technologies invests in personalized recurrence algorithms, targeting Asia’s growing healthcare needs. Bruker Corporation upgrades Raman spectrometry for research, driving customized deployments. These leaders expand into Latin America with compliant solutions, ensuring sustained market momentum.

Top Key Players

- Siemens Healthineers

- Philips Healthcare

- Oracle Corporation

- Mindray Medical International Limited

- IBM Corporation

- Hitachi Ltd.

- GE Healthcare

- Fujifilm Holdings Corporation

- Cerner Corporation

- Agfa-Gevaert Group

Recent Developments

- In June 2025, Bruker Corporation announced the acquisition of biocrates, a leader in mass spectrometry-based quantitative metabolomics. This acquisition is a significant development because it expands Bruker’s portfolio of mass spectrometry platforms and software. While biocrates’ primary focus is on metabolomics, their technology can be applied to the analysis of various biological samples. This strategic acquisition is relevant to the stone analysis market as it demonstrates a major player’s strategy to enhance its technological capabilities and expand its software and analysis offerings through acquisition.

- In January 2023, Novartis acquired Chinook Therapeutics for over US$ 3.2 billion to expand its renal disease-focused portfolio. This acquisition indirectly boosts the Stone Analysis Software market by increasing demand for advanced diagnostic tools. As Novartis enhances its renal treatment offerings, there is a greater need for precise stone analysis software to support kidney stone management and treatment planning, thereby driving adoption of such technologies in nephrology.

Report Scope

Report Features Description Market Value (2024) US$ 56.8 Billion Forecast Revenue (2034) US$ 78.6 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standalone Software, and Integrated Software), By Application (Kidney Stone Analysis, Research & Laboratory, and Urolithiasis Diagnosis), By End User (Hospitals, Research & Academic Institutes, and Diagnostic Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Philips Healthcare, Oracle Corporation, Mindray Medical International Limited, IBM Corporation, Hitachi Ltd., GE Healthcare, Fujifilm Holdings Corporation, Cerner Corporation, Agfa-Gevaert Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stone Analysis Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Stone Analysis Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- Philips Healthcare

- Oracle Corporation

- Mindray Medical International Limited

- IBM Corporation

- Hitachi Ltd.

- GE Healthcare

- Fujifilm Holdings Corporation

- Cerner Corporation

- Agfa-Gevaert Group