Global Stolen Vehicle Recovery Market Size, Share, Growth Analysis By Vehicle (Passenger vehicles, Commercial vehicles), By Installation (OEM-installed systems, Aftermarket), By Technology (Cellular & Telematics Platforms, GPS-Based Tracking Systems, Radio Frequency (RF) Systems, Hybrid Systems (GPS + RF), Others), By Application (Active Stolen Vehicle Recovery, Fleet Management & Security, Insurance Telematics & UBI, Automotive Dealer Solutions, Asset & Equipment Tracking, Others), By Service Model (Hardware + Subscription, Integrated Service Plans, One-Time Purchase, Enterprise/Fleet Licensing), By End Use (Individual Vehicle Owners, Fleet Owners, Insurance Companies, Government & Law Enforcement, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176933

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Vehicle Type Analysis

- Installation Type Analysis

- Technology Analysis

- Application Analysis

- Service Model Analysis

- End Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Report Overview

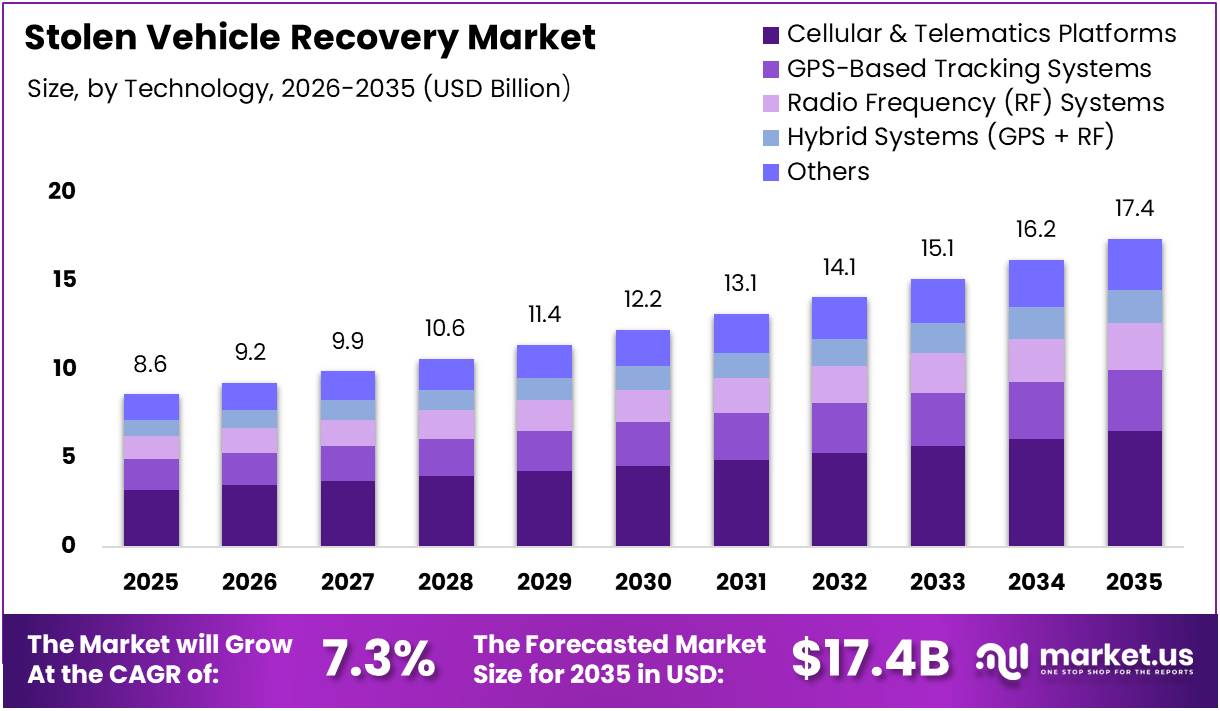

The Global Stolen Vehicle Recovery Market size is expected to be worth around USD 17.4 Billion by 2035 from USD 8.6 Billion in 2025, growing at a CAGR of 7.3% during the forecast period 2026 to 2035.

The Stolen Vehicle Recovery Market encompasses technologies and services designed to locate, track, and recover stolen vehicles using advanced tracking systems. These solutions include GPS-based tracking, cellular telematics, radio frequency systems, and hybrid platforms that enable real-time vehicle monitoring and theft prevention.

Moreover, this market serves individual vehicle owners, fleet operators, insurance companies, and law enforcement agencies. The systems combine hardware devices, software platforms, and subscription-based monitoring services to provide comprehensive vehicle security solutions. Additionally, integration with connected vehicle ecosystems enhances recovery capabilities and operational efficiency.

The market is experiencing robust growth driven by escalating vehicle theft rates globally and increasing consumer awareness about vehicle security. Furthermore, technological advancements in IoT, telematics, and artificial intelligence are transforming traditional recovery methods into predictive, proactive security platforms that prevent theft before occurrence.

However, government regulations mandating vehicle tracking systems for commercial fleets and high-value assets are accelerating market adoption. Consequently, automakers are increasingly integrating factory-installed recovery systems as standard features. Therefore, the shift toward connected mobility and smart transportation infrastructure creates substantial expansion opportunities.

According to Sequans, 91% of stolen vehicles equipped with next-gen trackers are successfully recovered within 48 hours. This demonstrates the effectiveness of advanced recovery technologies in minimizing vehicle loss and financial impact on owners and insurers.

Furthermore, practical deployments using dual GPS and VHF trackers have claimed approximately 91% recovery success rates. According to GRS Fleet Telematics, around 80% of stolen vehicles were found within 24 hours, demonstrating the superior performance of hybrid tracking technologies in urban theft scenarios.

Key Takeaways

- Global Stolen Vehicle Recovery Market projected to reach USD 17.4 Billion by 2035 from USD 8.6 Billion in 2025, growing at 7.3% CAGR.

- Passenger vehicles segment dominates by vehicle type with 72.3% market share in 2025.

- OEM-installed systems lead by installation type, capturing 62.8% of the market.

- Cellular and Telematics Platforms hold 37.5% share in technology segment.

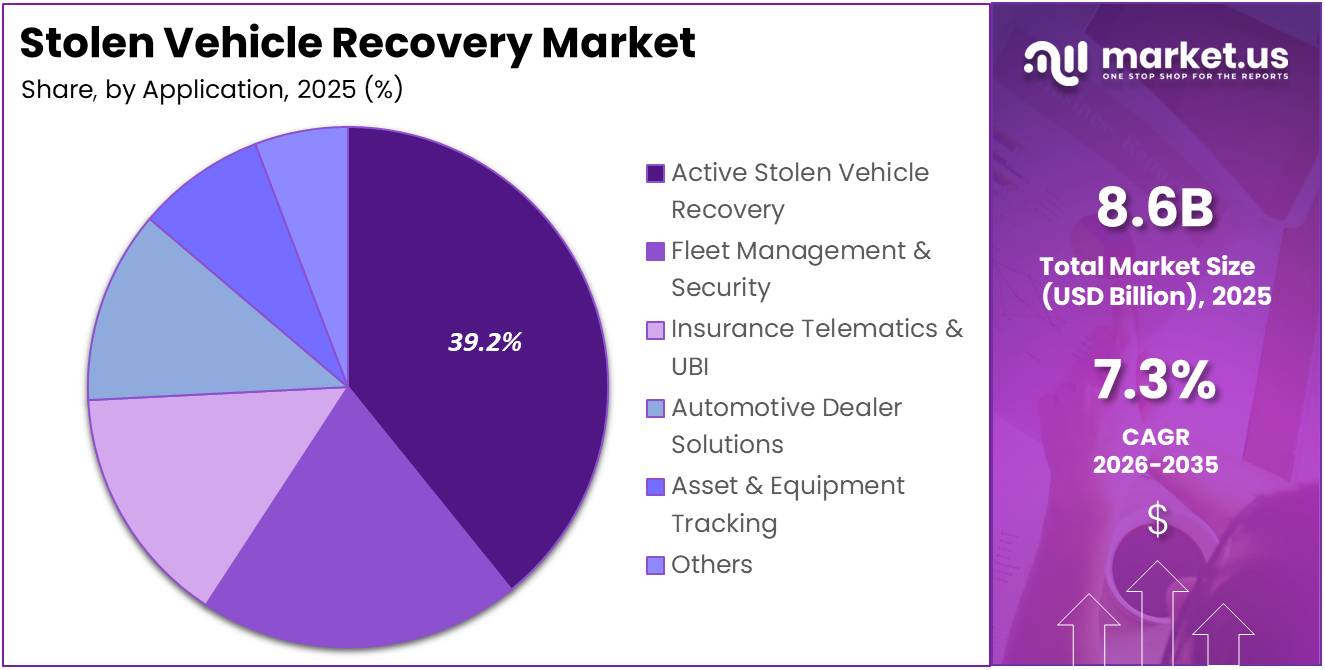

- Active Stolen Vehicle Recovery application accounts for 39.2% market share.

- Hardware plus Subscription service model dominates with 45.6% share.

- Individual Vehicle Owners represent 38.40% of end-use segment.

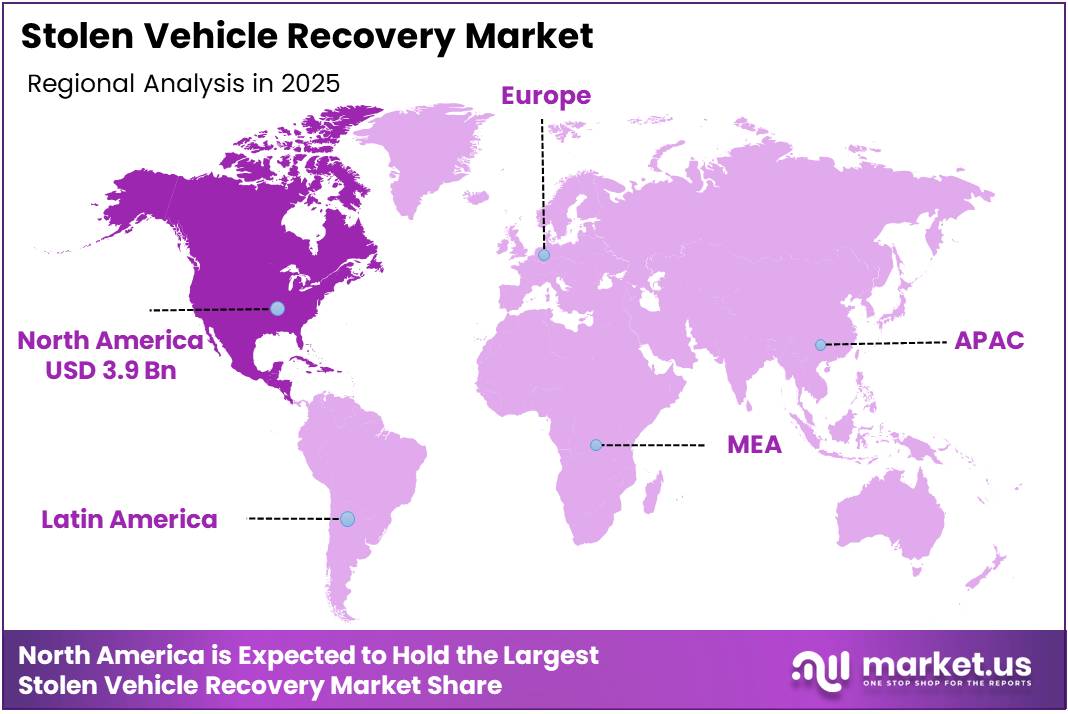

- North America leads regional market with 46.20% share, valued at USD 3.9 Billion.

Vehicle Type Analysis

Passenger vehicles dominates with 72.3% due to high ownership rates and increasing theft incidence globally.

In 2025, Passenger vehicles held a dominant market position in the By Vehicle segment of Stolen Vehicle Recovery Market, with a 72.3% share. This dominance stems from the vast global passenger vehicle fleet and rising consumer awareness about vehicle security. Moreover, manufacturers increasingly integrate factory-installed recovery systems in hatchbacks, sedans, and SUVs to meet safety standards and consumer expectations.

Commercial vehicles represent a growing segment driven by fleet management requirements and insurance mandates. Fleet operators prioritize theft prevention to minimize operational disruptions and asset losses. Additionally, light commercial vehicles, medium commercial vehicles, and heavy commercial vehicles require specialized tracking solutions that provide real-time location monitoring and geofencing capabilities for enhanced security.

Installation Type Analysis

OEM-installed systems dominates with 62.8% due to automaker integration and consumer preference for factory-fitted solutions.

In 2025, OEM-installed systems held a dominant market position in the By Installation segment of Stolen Vehicle Recovery Market, with a 62.8% share. Automakers increasingly embed recovery technologies during manufacturing to enhance vehicle value propositions and comply with safety regulations. Furthermore, factory-installed systems offer seamless integration with vehicle electronics, ensuring reliable performance and reduced installation complexity for consumers.

Aftermarket solutions cater to existing vehicle owners seeking retrofit security upgrades. These systems provide flexible installation options and customizable features for older vehicles without factory-fitted tracking capabilities. Moreover, aftermarket providers offer competitive pricing and advanced functionalities that appeal to cost-conscious consumers and fleet operators requiring scalable security solutions.

Technology Analysis

Cellular & Telematics Platforms dominates with 37.5% due to real-time connectivity and comprehensive data transmission capabilities.

In 2025, Cellular & Telematics Platforms held a dominant market position in the By Technology segment of Stolen Vehicle Recovery Market, with a 37.5% share. These platforms leverage mobile networks to provide continuous vehicle monitoring, instant theft alerts, and remote immobilization features. Additionally, integration with cloud-based analytics enables predictive maintenance and driver behavior monitoring beyond basic recovery functionalities.

GPS-Based Tracking Systems remain widely adopted for precise location determination and global coverage. These systems utilize satellite networks to pinpoint vehicle coordinates with high accuracy, enabling law enforcement to rapidly locate stolen assets. Moreover, GPS technology combines affordability with reliability, making it accessible to individual owners and small fleet operators.

Radio Frequency (RF) Systems excel in urban environments where GPS signals may be obstructed or jammed by thieves. RF technology operates independently of satellite networks, providing redundant tracking capabilities in challenging conditions. Furthermore, law enforcement agencies prefer RF systems for their proven effectiveness in quickly narrowing search areas during recovery operations.

Hybrid Systems (GPS + RF) combine multiple tracking technologies to maximize recovery success rates and overcome individual technology limitations. These integrated solutions leverage satellite positioning alongside radio frequency networks for comprehensive coverage. Consequently, hybrid systems deliver superior performance with recovery rates exceeding 90% and faster location identification in diverse operational environments.

Others encompass emerging technologies including Bluetooth Low Energy, Wi-Fi positioning, and IoT sensor networks for vehicle tracking applications. These alternative solutions address specific use cases such as indoor parking facilities or dense urban areas. Moreover, innovative tracking methods continue evolving to counter sophisticated theft techniques and enhance overall recovery ecosystem effectiveness.

Application Analysis

Active Stolen Vehicle Recovery dominates with 39.2% due to primary focus on theft prevention and rapid asset retrieval.

In 2025, Active Stolen Vehicle Recovery held a dominant market position in the By Application segment of Stolen Vehicle Recovery Market, with a 39.2% share. This application prioritizes immediate theft detection and law enforcement coordination to maximize recovery likelihood. Moreover, active systems provide real-time alerts, remote vehicle disabling, and continuous monitoring that significantly reduces financial losses from vehicle theft.

Fleet Management & Security applications address commercial operators needs for comprehensive asset protection and operational oversight. These solutions combine theft recovery with route optimization, driver performance monitoring, and maintenance scheduling. Additionally, fleet applications reduce insurance premiums while improving overall operational efficiency and vehicle utilization rates.

Insurance Telematics & UBI leverages recovery technologies to enable usage-based insurance models and risk assessment. Insurers utilize tracking data to calculate premiums based on actual driving behavior and vehicle usage patterns. Furthermore, integration with recovery systems reduces claim processing times and validates theft reports with location evidence.

Automotive Dealer Solutions protect dealership inventory from theft and facilitate vehicle financing management through integrated tracking capabilities. Dealers deploy recovery systems on lot vehicles and financed automobiles to minimize asset losses. Moreover, these solutions enable remote starter interrupt functionality for payment default situations and provide valuable inventory visibility across multiple dealership locations.

Asset & Equipment Tracking extends recovery technologies beyond automotive applications to construction machinery, agricultural equipment, and industrial assets. High-value mobile equipment faces significant theft risks in remote job sites and storage yards. Additionally, tracking systems provide utilization analytics and maintenance scheduling alongside security functionalities for comprehensive asset management.

Others include specialized applications such as rental vehicle tracking, ride-sharing fleet monitoring, and personal mobility device protection. These niche segments leverage recovery technologies for unique operational requirements. Furthermore, emerging use cases continue expanding as tracking hardware costs decline and connectivity infrastructure improves globally.

Service Model Analysis

Hardware + Subscription dominates with 45.6% due to recurring revenue model and comprehensive service offerings.

In 2025, Hardware + Subscription held a dominant market position in the By Service Model segment of Stolen Vehicle Recovery Market, with a 45.6% share. This model combines device installation with ongoing monitoring services, maintenance support, and software updates. Moreover, subscription plans ensure continuous system functionality and access to advanced features like predictive analytics and customer support services.

Integrated Service Plans bundle multiple functionalities including theft recovery, roadside assistance, and concierge services into comprehensive packages. These offerings appeal to premium vehicle owners seeking all-inclusive security solutions. Additionally, integrated plans simplify service management and provide enhanced value through consolidated billing and unified customer support channels.

One-Time Purchase models cater to customers preferring upfront payments without recurring subscription obligations or long-term commitments. This approach appeals to budget-conscious consumers and markets with limited payment infrastructure for ongoing billing. However, one-time purchase systems typically offer basic tracking functionality without continuous monitoring services or software enhancements available through subscription models.

Enterprise/Fleet Licensing provides large-scale deployment solutions tailored for commercial fleet operators and organizational buyers requiring extensive vehicle coverage. These licenses offer volume discounts, centralized administration platforms, and customizable service levels. Moreover, enterprise agreements enable scalable implementation across thousands of vehicles with dedicated account management and priority technical support capabilities.

End Use Analysis

Individual Vehicle Owners dominates with 38.40% due to large consumer base and rising personal vehicle security concerns.

In 2025, Individual Vehicle Owners held a dominant market position in the By End Use segment of Stolen Vehicle Recovery Market, with a 38.40% share. Growing vehicle theft rates in urban areas drive individual consumers to invest in recovery systems for personal asset protection. Furthermore, affordable subscription models and easy installation processes make these technologies accessible to mainstream vehicle owners seeking peace of mind.

Fleet Owners represent significant market share driven by commercial necessity and regulatory compliance requirements. Transportation, logistics, and rental companies deploy recovery systems to protect substantial vehicle investments and maintain operational continuity. Moreover, fleet applications deliver additional benefits including driver management, fuel efficiency monitoring, and maintenance optimization beyond theft prevention.

Insurance Companies utilize recovery technologies to reduce claim payouts and verify theft incidents. Insurers incentivize system adoption through premium discounts and preferential policy terms. Additionally, integration with telematics enables accurate risk assessment and fraud detection capabilities that improve underwriting accuracy.

Government & Law Enforcement agencies deploy recovery systems across public vehicle fleets including police cars, emergency response vehicles, and municipal transportation assets. These implementations ensure asset protection while enabling real-time fleet visibility for operational coordination. Moreover, law enforcement access to recovery networks facilitates cross-jurisdictional collaboration and accelerates stolen vehicle location identification during criminal investigations.

Others encompass diverse end-user segments including educational institutions, healthcare organizations, and non-profit entities operating vehicle fleets. These organizations require cost-effective security solutions to protect transportation assets while maintaining budget constraints. Additionally, specialized segments such as luxury vehicle collectors and exotic car owners deploy premium recovery systems for high-value asset protection.

Key Market Segments

By Vehicle

- Passenger vehicles

- Hatchbacks

- Sedans

- SUV

- Commercial vehicles

- Light commercial vehicles (LCV)

- Medium commercial vehicles (MCV)

- Heavy commercial vehicles (HCV)

By Installation

- OEM-installed systems

- Aftermarket

By Technology

- Cellular & Telematics Platforms

- GPS-Based Tracking Systems

- Radio Frequency (RF) Systems

- Hybrid Systems (GPS + RF)

- Others

By Application

- Active Stolen Vehicle Recovery

- Fleet Management & Security

- Insurance Telematics & UBI

- Automotive Dealer Solutions

- Asset & Equipment Tracking

- Others

By Service Model

- Hardware + Subscription

- Integrated Service Plans

- One-Time Purchase

- Enterprise/Fleet Licensing

By End Use

- Individual Vehicle Owners

- Fleet Owners

- Insurance Companies

- Government & Law Enforcement

- Others

Drivers

Rising Global Vehicle Theft Incidence Across Urban and Semi-Urban Regions

Vehicle theft rates continue escalating globally, particularly in densely populated urban centers and expanding semi-urban areas. Organized crime networks increasingly target high-value vehicles for parts resale and international trafficking. Consequently, vehicle owners and fleet operators seek advanced recovery technologies to protect assets and minimize financial losses from theft incidents.

Moreover, emerging markets experience rapid motorization without corresponding security infrastructure development. This gap creates opportunities for theft and necessitates adoption of sophisticated tracking systems. Additionally, insurance companies mandate recovery system installation for policy coverage, accelerating market penetration across demographic segments and geographic regions worldwide.

Furthermore, law enforcement agencies report growing sophistication in theft techniques including signal jamming and key cloning. Traditional security measures prove inadequate against modern criminal methods. Therefore, next-generation recovery systems incorporating multiple tracking technologies and anti-jamming capabilities become essential for effective vehicle protection and successful asset retrieval.

Restraints

Data Privacy and Cybersecurity Concerns Related to Vehicle Tracking

Consumer apprehension regarding continuous vehicle monitoring and location data collection limits market adoption. Privacy advocates raise concerns about potential misuse of tracking information by service providers or unauthorized third parties. Consequently, regulatory frameworks like GDPR impose strict data handling requirements that increase compliance costs and operational complexity for recovery system providers.

Moreover, cybersecurity vulnerabilities in connected tracking systems expose vehicles to hacking risks and remote exploitation. Malicious actors could potentially disable recovery systems, manipulate location data, or gain unauthorized vehicle control. Additionally, data breaches compromising customer information erode trust in tracking technologies and create legal liabilities for service providers.

Furthermore, lack of transparent data usage policies and customer consent mechanisms hinder consumer confidence. Vehicle owners demand clear assurances regarding data storage, sharing practices, and retention periods. Therefore, providers must invest substantially in cybersecurity infrastructure and privacy compliance measures, increasing system costs and potentially limiting affordability for price-sensitive market segments.

Growth Factors

Expansion of IoT-Enabled Recovery Solutions in Emerging Economies

Rapidly growing vehicle ownership in emerging markets creates substantial demand for affordable theft protection technologies. Countries across Asia Pacific, Latin America, and Africa experience significant motorization rates without adequate security infrastructure. Consequently, IoT-enabled recovery solutions offering cost-effective deployment and scalable architectures gain traction among budget-conscious consumers and commercial operators.

Moreover, improving telecommunications infrastructure and declining hardware costs enable widespread adoption of connected tracking systems. Mobile network expansion provides reliable connectivity even in remote areas, enhancing system effectiveness. Additionally, government initiatives promoting smart transportation and connected vehicle ecosystems accelerate technology integration and create favorable regulatory environments.

Furthermore, integration of recovery systems with smart city infrastructure unlocks synergies between public safety and private security initiatives. Collaborative platforms enable real-time information sharing between law enforcement, recovery providers, and vehicle owners. Therefore, comprehensive urban mobility solutions incorporating theft prevention capabilities drive market expansion and enhance overall ecosystem value propositions.

Emerging Trends

AI-Driven Predictive Theft Detection and Recovery Analytics

Artificial intelligence transforms stolen vehicle recovery from reactive response to proactive threat prevention. Machine learning algorithms analyze driving patterns, parking locations, and temporal data to identify theft risk indicators. Consequently, systems generate predictive alerts enabling preventive measures before actual theft occurs, significantly reducing incident rates and associated losses.

Moreover, AI-powered analytics optimize recovery operations through intelligent route prediction and criminal behavior profiling. These capabilities enable law enforcement to anticipate vehicle movement patterns and strategically position resources. Additionally, computer vision integration with surveillance infrastructure automates stolen vehicle identification in real-time, accelerating recovery timelines and improving success rates.

Furthermore, partnerships between automakers and technology service providers drive innovation in integrated security ecosystems. Collaborative development produces factory-embedded recovery systems with seamless connectivity to manufacturer platforms and third-party services. Therefore, standardized APIs and interoperable architectures emerge, enabling comprehensive solutions that combine theft prevention, recovery, and broader connected vehicle functionalities.

Regional Analysis

North America Dominates the Stolen Vehicle Recovery Market with a Market Share of 46.20%, Valued at USD 3.9 Billion

North America leads the global market driven by high vehicle theft rates, advanced technological infrastructure, and strong regulatory frameworks. The region benefits from established telematics ecosystems and widespread consumer adoption of connected vehicle technologies. Moreover, 46.20% market share reflects robust demand from individual owners, fleet operators, and insurance providers, with market value reaching USD 3.9 Billion in 2025.

Europe Stolen Vehicle Recovery Market Trends

Europe demonstrates strong market growth fueled by stringent automotive safety regulations and increasing theft incidents across major economies. Germany, France, and the UK lead regional adoption with mandatory tracking requirements for commercial fleets. Additionally, integration with EU-wide law enforcement networks enhances cross-border recovery capabilities and system effectiveness across member states.

Asia Pacific Stolen Vehicle Recovery Market Trends

Asia Pacific represents the fastest-growing regional market driven by rapid motorization and expanding middle-class populations. China, India, and Southeast Asian nations experience surging vehicle ownership alongside rising theft concerns. Furthermore, government initiatives promoting smart transportation infrastructure and affordable IoT technologies accelerate market penetration across diverse economic segments.

Latin America Stolen Vehicle Recovery Market Trends

Latin America shows significant growth potential despite economic challenges, with Brazil and Mexico leading regional adoption. High vehicle theft rates in urban centers drive demand for cost-effective recovery solutions. Moreover, improving telecommunications infrastructure and increasing insurance penetration create favorable conditions for market expansion across commercial and individual vehicle segments.

Middle East & Africa Stolen Vehicle Recovery Market Trends

Middle East and Africa exhibit emerging market characteristics with growth concentrated in GCC countries and South Africa. Government fleet management initiatives and luxury vehicle proliferation drive technology adoption. Additionally, expanding urban centers and improving connectivity infrastructure support gradual market development despite economic and regulatory challenges across diverse regional markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

CalAmp stands as a leading telematics provider delivering comprehensive stolen vehicle recovery solutions across global markets. The company leverages advanced cellular connectivity and cloud-based analytics to provide real-time tracking, geofencing, and remote vehicle management capabilities. Moreover, CalAmp’s integrated platforms serve diverse end-users including fleet operators, insurance companies, and individual vehicle owners with scalable subscription-based service models.

Geotab represents a dominant fleet telematics provider offering sophisticated vehicle tracking and recovery functionalities. The company’s open platform architecture enables seamless integration with third-party applications and enterprise systems. Additionally, Geotab’s recent acquisition of Verizon Connect’s commercial operations significantly expands its global footprint and strengthens market position in stolen vehicle recovery and comprehensive fleet management solutions.

Ituran Global operates as a specialized stolen vehicle recovery technology provider with proven track record across international markets. The company’s proprietary RF and GPS hybrid systems achieve exceptional recovery success rates exceeding industry benchmarks. Furthermore, Ituran’s dedicated recovery teams collaborate closely with law enforcement agencies, enabling rapid asset retrieval and minimizing customer losses from theft incidents.

Spireon delivers advanced GPS tracking and recovery solutions tailored for automotive dealers, fleet operators, and lenders. The company’s platforms combine real-time location monitoring with predictive analytics and automated alert systems. Moreover, Spireon’s comprehensive service offerings include starter interrupt capabilities, collateral protection, and detailed vehicle utilization reporting that extend beyond basic theft recovery functionalities.

Key players

- CalAmp

- Geotab

- Ituran Global

- Netstar (Altron)

- Samsara

- Spireon

- Teletrac Navman

- TomTom International

- Verizon Connect

Recent Developments

- October 2025 – Ituran SVR Tech successfully recovered USD 3 Billion worth of stolen vehicles globally, achieving an impressive 80% recovery success rate. This milestone demonstrates the effectiveness of the company’s advanced tracking technologies and coordinated law enforcement partnerships in protecting vehicle assets across international markets.

- October 2025 – Geotab completed the acquisition of Verizon Connect’s commercial operations, significantly expanding its global market presence and customer base. This strategic transaction strengthens Geotab’s position as a comprehensive fleet telematics provider and enhances its stolen vehicle recovery capabilities through expanded technological resources and geographic reach.

- February 2025 – Vodafone Automotive partnered with PlaxidityX to develop advanced vehicle protection solutions against modern theft methods. This collaboration combines Vodafone’s connectivity infrastructure with PlaxidityX’s security expertise to create next-generation anti-theft systems that address evolving criminal techniques including signal jamming and keyless entry exploitation.

Report Scope

Report Features Description Market Value (2025) USD 8.6 Billion Forecast Revenue (2035) USD 17.4 Billion CAGR (2026-2035) 7.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Passenger vehicles, Commercial vehicles), By Installation (OEM-installed systems, Aftermarket), By Technology (Cellular & Telematics Platforms, GPS-Based Tracking Systems, Radio Frequency (RF) Systems, Hybrid Systems (GPS + RF), Others), By Application (Active Stolen Vehicle Recovery, Fleet Management & Security, Insurance Telematics & UBI, Automotive Dealer Solutions, Asset & Equipment Tracking, Others), By Service Model (Hardware + Subscription, Integrated Service Plans, One-Time Purchase, Enterprise/Fleet Licensing), By End Use (Individual Vehicle Owners, Fleet Owners, Insurance Companies, Government & Law Enforcement, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CalAmp, Geotab, Ituran Global, Netstar (Altron), Samsara, Spireon, Teletrac Navman, TomTom International, Verizon Connect Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stolen Vehicle Recovery MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Stolen Vehicle Recovery MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- CalAmp

- Geotab

- Ituran Global

- Netstar (Altron)

- Samsara

- Spireon

- Teletrac Navman

- TomTom International

- Verizon Connect