Global Stock Trading and Investing Applications Market By Financial Instrument (Stocks, Cryptocurrencies, ETFs/Mutual Funds, Derivatives, and Other Financial Instruments ) By Platform (Mobile and Web-based) By Operating System (iOS, Android and Other Operating Systems) By End-user (Retail and Institutional), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 106116

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Stock Trading and Investing Applications Market is poised to reach USD 150 billion by 2032 from USD 39.8 billion in 2023. Between 2023 and 2032, this market is estimated to register a CAGR of 16.4%.

Stock trading and investing applications have gained immense popularity as user-friendly tools for managing investments and participating in financial markets. These apps offer convenience and real-time market data, support various order types, provide research tools and educational resources, and prioritize security. Popular options include Robinhood, E*TRADE, TD Ameritrade, Charles Schwab, and Fidelity, catering to diverse investor needs. Users should research these platforms and consider the associated risks. In essence, these apps democratize investing, making it accessible to all, regardless of experience.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- The global Stock Trading and Investing Applications Market is projected to achieve a CAGR of 16.4% from 2023 to 2032, with estimated sales surpassing USD 150.3 billion by 2032.

- User-friendly interfaces drive market growth, simplifying the complexity of financial markets, providing clear visual representations of data, and enhancing accessibility through responsive design and mobile apps.

- Infrastructure investment remains a significant restraining factor, with a constant battle against cyberattacks, emphasizing the need for robust cybersecurity measures and proactive threat detection strategies to safeguard financial systems.

- Derivatives emerged as the dominant market segment, capturing over 32.3% of the revenue share, owing to their flexibility and versatility as financial instruments for speculation, hedging, and risk management.

- Mobile platforms dominated the market in 2022, accounting for over 58.4% of the revenue share, while the Android segment held the major market share, exceeding 42.3% in 2022.

- The retail sector dominated the market, contributing over 70.3% of global revenue in 2022, showcasing increased accessibility to stock trading through online platforms and mobile apps, making it easier for individual and small investors to participate.

- North America holds the top position in the market, with a significant market share of 32.4%, driven by the presence of influential financial centers such as New York City and a deeply ingrained investment culture.

- Key players in the market include Morgan Stanley, FMR LLC, Charles Schwab & Co, Robinhood, Interactive Brokers LLC, eToro, Plus500, Zerodha, Angel One Limited, Ameriprise Financial, SoFi Invest, and E-Trade, among others.

- Rising mobile trading and apps have become popular among investors, offering convenient portfolio management on smartphones and tablets, thereby empowering informed decision-making.

- The surge in retail participation in stock trading is a significant trend, propelled by commission-free trading platforms and user-friendly, mobile-responsive trading apps, highlighting the increasing role of retail investors in the evolving financial landscape.

Driving Factors

User-Friendly Interfaces Drive the Market Growth

User-friendly interfaces in trading and investing applications have become more intuitive and appealing to both novice and experienced investors. These interfaces simplify the complexity of financial markets, provide clear visual representations of data, and enhance accessibility through responsive design and mobile apps. They offer educational resources, streamline trade execution, and include risk management tools. Overall, these interfaces democratize access to financial markets, making trading and investing more inclusive and comprehensible to a broader audience. Future advancements in technology are expected to further improve user experience design in this field.

Restraining Factors

Infrastructure Investment

The financial industry indeed faces an ongoing battle against cyberattacks, making the security of trading and investment platforms a top priority. These platforms are attractive targets for malicious actors due to the immense financial gains that can be achieved through successful breaches. These attacks pose not only financial risks but also significant threats to the reputation of service providers. The consequences of a security breach in this sector can be devastating, eroding trust among clients and stakeholders. Therefore, constant vigilance, robust cybersecurity measures, and proactive threat detection and mitigation strategies are imperative to safeguard the integrity and stability of financial systems.

By Financial Instrument Analysis

The Derivatives Segment is Dominant in the Market.

In 2022, derivatives emerged as the dominant market segment, capturing over 32.3% of the revenue share. This dominance can be attributed to the flexibility and versatility of derivatives as financial instruments. They allow investors to speculate on price movements and hedge against market risks, making them highly valuable for diversification and risk management. Additionally, derivatives enable leveraging positions, which can amplify potential gains and optimize capital allocation, making them appealing to a wide range of market participants.

By Platform Analysis

Mobile Segment Dominated in the Market in 2022.

In 2022, the mobile segment dominated the financial market with over 58.4% of the revenue share, driven by the widespread use of smartphones. Mobile platforms offer investors the convenience of trading on the go, accessing real-time market data, and managing portfolios from anywhere. This has made them the preferred choice for investors. Meanwhile, web-based platforms are expected to experience significant growth, offering accessibility and convenience to a wide range of investors, eliminating the need for specialized software, and allowing users to make informed decisions from any location with an internet connection.

By Operating System Analysis

The Android Segment Held a Major Market Share in 2022.

In 2022, the Android segment dominated the market with a revenue share of over 42.3%, thanks to its massive global user base and flexibility for developers. Android’s popularity attracted tailored stock trading and investment applications. On the other hand, the iOS segment is expected to see significant growth due to its strong security features, trustworthy App Store guidelines, and high-quality hardware. iOS devices, including iPhones and iPads, provide an ideal trading environment with their user-friendly interface and smooth performance.

By End-user Analysis

The Retail Segment Held a Major Market Share in 2022

In 2022, the retail sector dominated the market, contributing over 70.3% of global revenue, thanks to increased accessibility to stock trading through online platforms and mobile apps, making it easier for individual and small investors to participate. The institutional segment is expected to grow significantly, with a notable CAGR in the coming years.

Institutional investors, such as hedge funds and asset management firms, have substantial resources and expertise, which impact market liquidity and trading volumes. They are attracted to the stock market for diversification and risk management opportunities across various asset classes and investment strategies.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Based on Financial Instrument

- Stocks

- Cryptocurrencies

- ETFs/Mutual Funds

- Derivatives

- Other Financial Instruments

Based on Platform

- Mobile

- Web-based

Based on Operating System

- iOS

- Android

- Other Operating Systems

Based on End-user

- Retail

- Institutional

Growth Opportunities

Increasing Retail Participation

The surge in retail participation in stock trading and investing has been a significant trend in recent years, driven in part by commission-free trading platforms that have made stock market access easier for individual investors. User-friendly and mobile-responsive trading apps offered by companies have also contributed to this growth by simplifying the trading process and attracting more retail investors to the market. This trend highlights the increasing role of retail investors in the evolving financial landscape.

Latest Trends

Rising Mobile Trading and Apps

Mobile trading applications have experienced a significant surge in popularity due to investors’ preference for the convenience of managing their portfolios on smartphones and tablets. These user-friendly and feature-rich apps have become the top choice for many investors, providing seamless access to financial markets and empowering them to make informed decisions with ease.

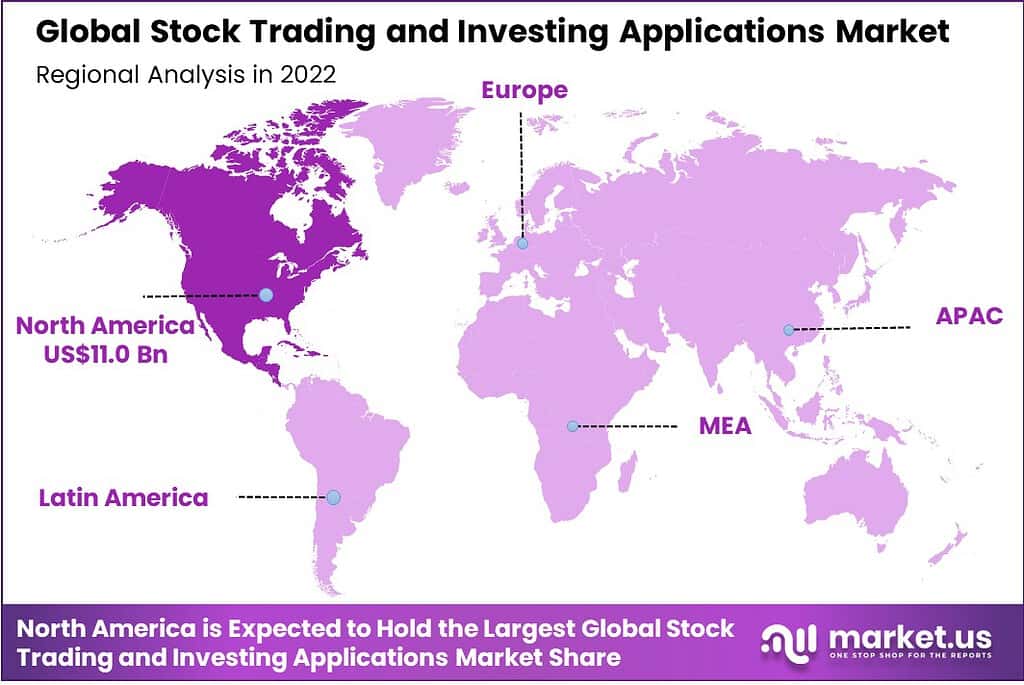

Regional Analysis

North America is the Dominant Region in the Global Stock Trading and Investing Applications Market

In 2022, North America will hold the top position in the market, with a significant market share of 32.4%, due to its concentration of influential financial centers, such as New York City, and a deeply ingrained investment culture. Key drivers of North America’s preeminence include the presence of a well-established, mature market for stock trading and investment applications buoyed by major stock exchanges like the NYSE and NASDAQ, which generate substantial trading activity.

Furthermore, the region’s tech innovation epicenters, typified by Silicon Valley, have consistently nurtured groundbreaking financial technology innovations, spawning numerous leading trading platforms and investment applications that have left a substantial mark on the industry landscape.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The stock trading and investing app market has some big players. Robinhood is known for not charging fees and is popular with younger people. E*TRADE, now with Morgan Stanley, offers many investment options. TD Ameritrade, which joined Charles Schwab, has strong tools. Charles Schwab has lots of services for different investors. Fidelity is trusted and has many investment choices. Interactive Brokers is for active traders. Webull is known for not charging fees and having long trading hours.

SoFi Invest offers many financial services. Merrill Edge is part of Bank of America, making it convenient for bank customers. Acorns makes investing easy by saving spare change. The market can change quickly, and different apps might be popular in different places. These companies will keep competing by improving technology and giving users better experiences.

Top Key Players

- Morgan Stanley

- FMR LLC

- Charles Schwab & Co

- Robinhood

- Interactive Brokers LLC

- eToro

- Plus500

- Zerodha

- Angel One Limited

- Ameriprise Financial

- SoFi Invest

- E-Trade

- Other Key Players.

Recent Developments

- On August 30, 2023, it was announced that Robinhood Markets, Inc. is slated to make a significant appearance at the highly anticipated Goldman Sachs Communacopia & Technology Conference, scheduled for September 7, 2023. This announcement marks a noteworthy development for the fintech company, as it offers a prime platform for Robinhood to showcase its strategies and vision within the financial technology sector.

Report Scope

Report Features Description Market Value (2023) US$ 39.8 Bn Forecast Revenue (2032) US$ 150.3 Bn CAGR (2023-2032) 16.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Financial Instrument (Stocks, Cryptocurrencies, ETFs/Mutual Funds, Derivatives, and Other Financial Instruments ) By Platform (Mobile and Web-based) By Operating System (iOS, Android, and Other Operating Systems) By End-user (Retail and Institutional) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Morgan Stanley, FMR LLC, Charles Schwab & Co, Robinhood, Interactive Brokers LLC, eToro, Plus500, Zerodha, Angel One Limited, Ameriprise Financial, SoFi Invest, E-Trade, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a stock trading and investing application?A stock trading and investing application is a software platform or mobile app that allows individuals and institutions to buy, sell, and manage investments in stocks, bonds, mutual funds, and other financial assets.

How do stock trading apps work?Stock trading apps provide access to stock exchanges and financial markets, allowing users to place orders, conduct research, and manage their portfolios. They connect users to brokerage accounts for executing trades.

What are the benefits of using stock trading and investing apps?Benefits include convenience, real-time market data, ease of trading, research tools, access to various investment products, and the ability to monitor and manage investments on-the-go.

Are stock trading apps safe?Most reputable stock trading apps use advanced security measures like encryption and two-factor authentication to protect user data and financial information. It's essential to choose a regulated and well-established platform.

What is the future outlook for the stock trading and investing applications market?The stock trading and investing applications market is expected to continue growing as more people turn to digital platforms for investing. Technological advancements, AI-driven tools, and the expansion of investment options may shape the industry's future.

Stock Trading and Investing Applications MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Stock Trading and Investing Applications MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Morgan Stanley

- FMR LLC

- Charles Schwab & Co

- Robinhood

- Interactive Brokers LLC

- eToro

- Plus500

- Zerodha

- Angel One Limited

- Ameriprise Financial

- SoFi Invest

- E-Trade