Global Stereolithography (SLA) Technology 3D Printing Market Size, Share, Growth Analysis Printer Type (Desktop SLA Printers, Industrial SLA Printers), Material Type (Engineering Resins, Dental & Medical Resins, Others), Application (Prototyping, Manufacturing & End-Use Parts, Tooling & Molding, Education & Research, Others), End-Use Industry (Automotive, Aerospace, Healthcare, Consumer Goods, Manufacturing, Education, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176843

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

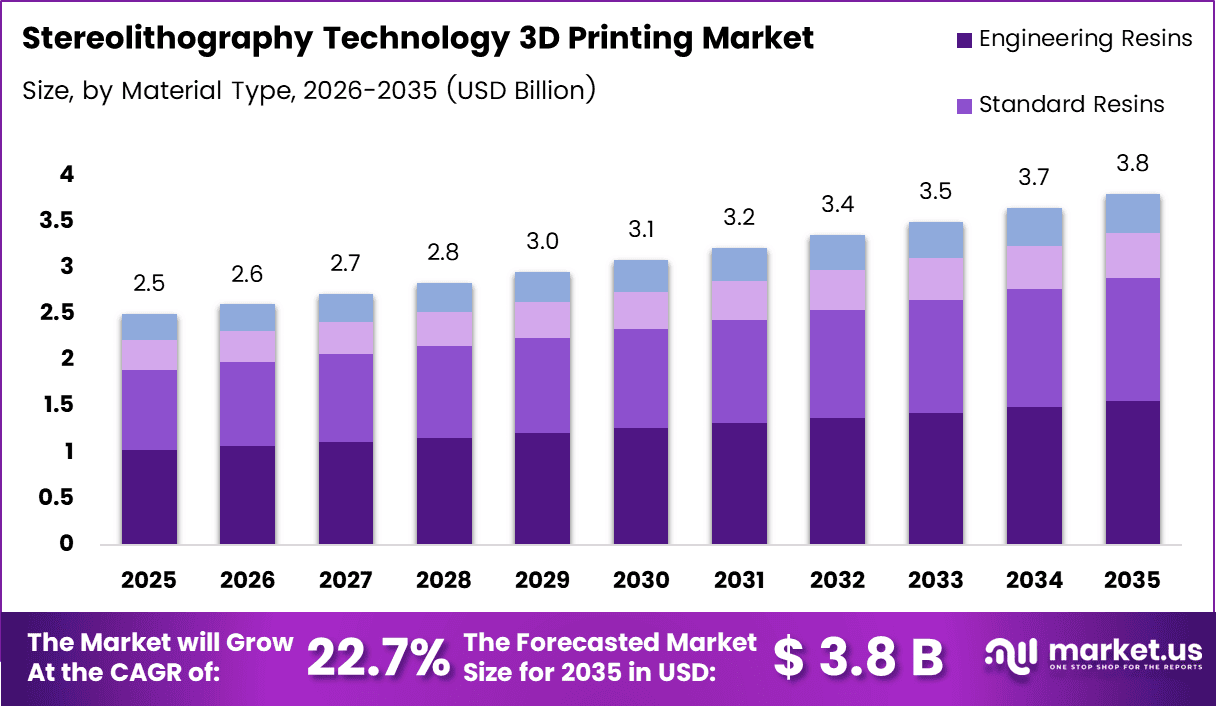

Global Stereolithography (SLA) Technology 3D Printing Market size is expected to be worth around USD 3.8 Billion by 2035 from USD 2.5 Billion in 2025, growing at a CAGR of 22.7% during the forecast period 2026 to 2035.

Stereolithography 3D printing represents an advanced additive manufacturing technology that uses ultraviolet lasers to cure liquid photopolymer resins layer by layer. This process creates highly detailed three-dimensional objects with exceptional surface quality and dimensional accuracy. SLA technology has become essential for applications requiring intricate geometries and smooth finishes.

The market experiences robust growth driven by increasing demand for rapid prototyping across multiple industries. Moreover, technological advancements in resin formulations and printing systems enhance manufacturing capabilities. Additionally, the growing need for customized production solutions accelerates market expansion globally.

Healthcare and dental sectors significantly contribute to market development through specialized applications. Consequently, manufacturers focus on developing biocompatible materials for medical devices and orthodontic products. Furthermore, automotive and aerospace industries leverage SLA technology for functional prototyping and tooling applications, expanding the addressable market substantially.

Digital transformation across manufacturing industries creates substantial opportunities for SLA technology adoption. However, companies invest in automation and workflow integration to improve production efficiency. Therefore, the shift toward Industry 4.0 practices drives demand for advanced 3D printing solutions with enhanced connectivity and data management capabilities.

Government initiatives supporting advanced manufacturing and innovation foster market growth in developed economies. Additionally, educational institutions increasingly adopt desktop SLA printers for research and training purposes. This trend cultivates skilled workforce development while expanding the technology’s accessibility to smaller enterprises and individual users.

According to Hubs, industrial SLA printers achieve dimensional accuracy of ±0.15% with lower limits of ±0.01 mm. Desktop models typically deliver ±0.5% accuracy with ±0.10 mm lower limits. Layer thickness ranges from 25 to 100 µm for standard applications.According to Hubs, build sizes vary significantly across printer categories. Desktop systems accommodate up to 145 x 145 x 175 mm, while industrial machines handle volumes up to 1500 x 750 x 500 mm. Post-cured parts demonstrate heat resistance up to 58°C compared to 42°C before curing.

Key Takeaways

- Global Stereolithography (SLA) Technology 3D Printing Market is projected to grow from USD 2.5 Billion in 2025 to USD 3.8 Billion by 2035 at a CAGR of 22.7%

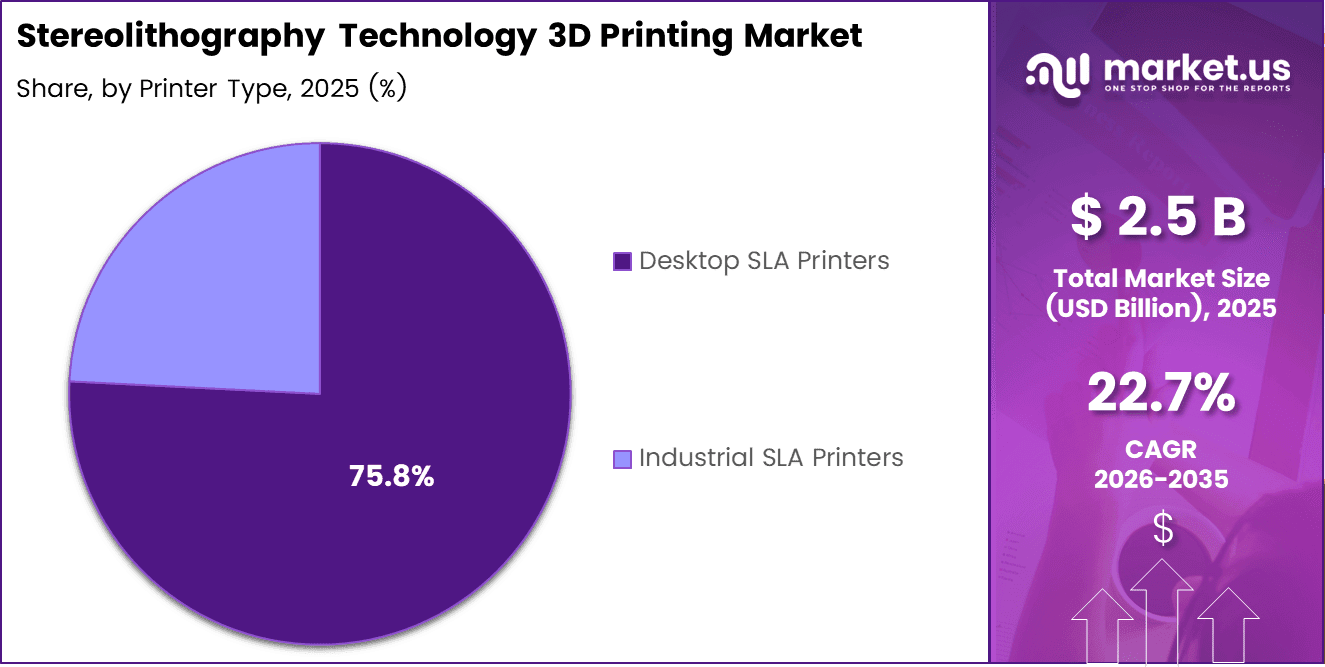

- Desktop SLA Printers dominate the Printer Type segment with 75.8% market share in 2025

- Engineering Resins lead the Material Type segment accounting for 40.9% of the market

- Prototyping represents the largest Application segment with 55.1% market share

- Healthcare sector dominates End-Use Industry segment holding 30.9% market share

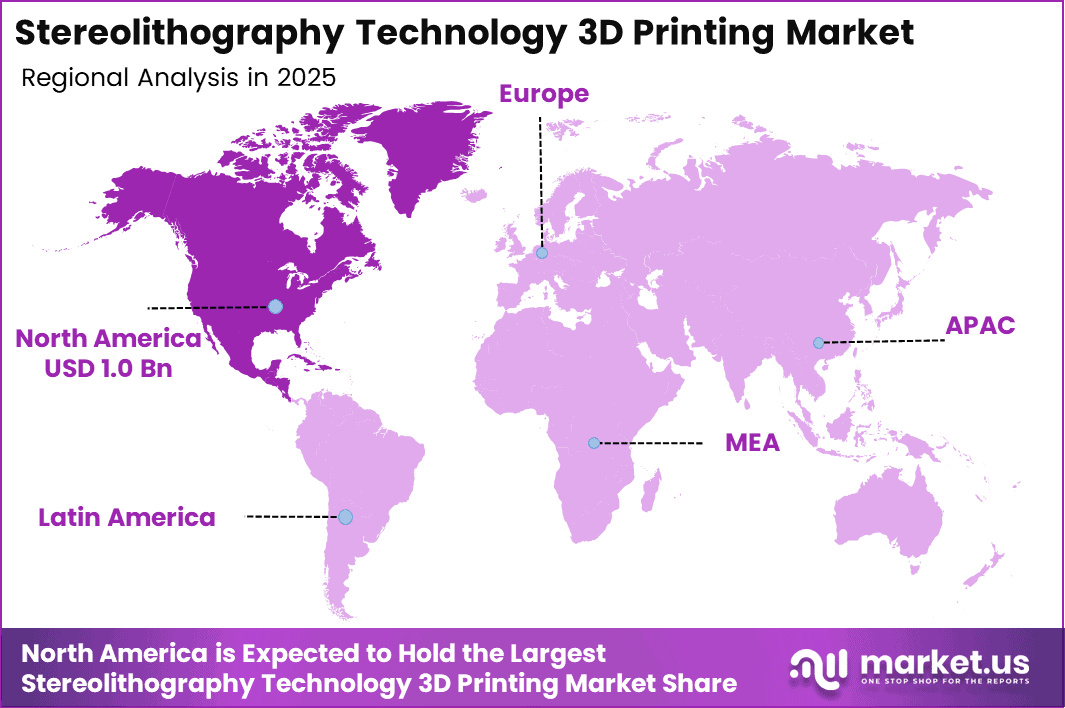

- North America leads regional market with 38.1% share valued at USD 1.0 Billion in 2025

Printer Type Analysis

Desktop SLA Printers dominate with 75.8% due to affordability, compact design, and accessibility for small businesses and educational institutions.

In 2025, Desktop SLA Printers held a dominant market position in the Printer Type segment of Stereolithography (SLA) Technology 3D Printing Market, with a 75.8% share. These compact systems offer exceptional resolution and surface finish at accessible price points for small manufacturers, designers, and educational users. Moreover, continuous improvements in user-friendly interfaces and automated workflows enhance adoption across diverse applications.

Industrial SLA Printers serve high-volume manufacturing environments requiring larger build volumes and enhanced production capabilities. These advanced systems deliver superior speed, precision, and material versatility for aerospace, automotive, and medical device manufacturing. Furthermore, industrial platforms integrate automated material handling and post-processing systems, reducing manual intervention while improving operational efficiency and throughput significantly.

Material Type Analysis

Engineering Resins dominate with 40.9% due to superior mechanical properties, temperature resistance, and versatility across prototyping and functional applications.

In 2025, Engineering Resins held a dominant market position in the Material Type segment of Stereolithography (SLA) Technology 3D Printing Market, with a 40.9% share. These advanced photopolymers offer excellent strength, durability, and thermal stability for demanding applications. Additionally, engineering resins enable production of functional prototypes and end-use parts across automotive, aerospace, and consumer goods industries.

Dental & Medical Resins represent specialized materials designed for healthcare applications requiring biocompatibility and regulatory compliance. These formulations support production of surgical guides, orthodontic appliances, dental crowns, and anatomical models. Consequently, stringent certification requirements and material innovation drive continuous development in this high-value segment.

Others category encompasses standard resins, flexible materials, and specialty formulations for specific applications. These materials serve general prototyping, artistic creation, jewelry manufacturing, and educational purposes. Moreover, emerging bio-based and sustainable resin alternatives attract environmentally conscious users seeking reduced environmental impact without compromising print quality.

Application Analysis

Prototyping dominates with 55.1% due to widespread need for rapid design iteration, validation, and product development across industries.

In 2025, Prototyping held a dominant market position in the Application segment of Stereolithography (SLA) Technology 3D Printing Market, with a 55.1% share. SLA technology excels at creating highly detailed models for design verification and functional testing. Furthermore, rapid turnaround times and exceptional surface quality reduce development cycles while enabling cost-effective iteration.

Manufacturing & End-Use Parts applications involve production of functional components for direct use in final products. This segment benefits from advances in durable resin materials and improved mechanical properties. Additionally, low-volume manufacturing and mass customization opportunities drive adoption across consumer goods, medical devices, and specialized industrial applications.

Tooling & Molding applications utilize SLA for creating patterns, molds, and manufacturing aids with complex geometries. These tools support injection molding, vacuum casting, and composite layup processes. Moreover, cost savings compared to traditional machined tooling accelerate product launches while maintaining precision.

Education & Research applications focus on academic institutions and research laboratories exploring advanced manufacturing techniques. These users develop new materials, processes, and applications while training future engineers and designers. Consequently, accessible desktop systems democratize 3D printing education and innovation.

Others category includes artistic creation, jewelry manufacturing, architectural modeling, and specialized niche applications. These diverse uses demonstrate SLA technology’s versatility beyond traditional industrial applications. Therefore, creative professionals leverage exceptional detail capabilities for unique production requirements.

End-Use Industry Analysis

Healthcare dominates with 30.9% due to growing demand for personalized medical devices, dental applications, and surgical planning models.

In 2025, Healthcare held a dominant market position in the End-Use Industry segment of Stereolithography (SLA) Technology 3D Printing Market, with a 30.9% share. Medical and dental professionals utilize SLA for creating patient-specific surgical guides, orthodontic aligners, and anatomical models. Moreover, biocompatible resin development enables direct production of medical devices and implantable components.

Automotive industry leverages SLA technology for functional prototyping, design validation, and custom tooling applications. Manufacturers create detailed interior components, lighting fixtures, and aerodynamic models with exceptional surface quality. Furthermore, rapid iteration capabilities accelerate vehicle development cycles while reducing costs.

Aerospace sector demands high-precision components and lightweight structures achievable through advanced SLA systems. Applications include ducting, brackets, tooling, and complex geometries impossible with traditional manufacturing. Additionally, material certifications and quality standards drive investment in industrial-grade printing platforms.

Consumer Goods manufacturers utilize SLA for product design, packaging prototypes, and limited production runs. This sector values rapid time-to-market and customization capabilities for competitive advantage. Consequently, brands leverage 3D printing for personalized products and market testing.

Manufacturing industry adopts SLA for jigs, fixtures, and production aids improving operational efficiency. These tools enhance assembly processes and quality control while reducing lead times. Moreover, on-demand production eliminates inventory costs associated with traditional tooling.

Education institutions integrate SLA technology into curricula developing next-generation engineers and designers. Students gain hands-on experience with advanced manufacturing processes and digital design workflows. Therefore, accessible desktop systems facilitate widespread adoption across universities and technical schools.

Others category encompasses jewellry, architecture, entertainment, and specialized industries requiring detailed models. These diverse applications demonstrate SLA technology’s broad applicability across creative and technical fields. Additionally, material innovations continue expanding addressable market opportunities.

Drivers

Rising Demand for Ultra-High Resolution Prototypes and Expanding Healthcare Applications Drive Market Growth

Product designers and engineers require exceptional surface finish and dimensional accuracy for design validation and functional testing. SLA technology delivers superior resolution compared to alternative 3D printing methods, enabling detailed feature reproduction. Moreover, rapid prototyping capabilities reduce development timelines while minimizing costs associated with traditional manufacturing processes.

Healthcare sector experiences substantial growth in dental, medical, and orthodontic applications utilizing biocompatible SLA materials. Customized surgical guides, dental aligners, and anatomical models improve patient outcomes through personalized treatment approaches. Furthermore, regulatory approvals for medical-grade resins expand clinical applications, driving significant investment in specialized printing systems.

Complex geometries and smooth surface finishes essential for tooling, molds, and pattern making applications favor SLA technology adoption. Manufacturers leverage these capabilities for injection mold patterns, vacuum casting masters, and composite layup tools. Additionally, cost savings and lead time reductions compared to CNC machining accelerate adoption across automotive, aerospace, and consumer goods industries.

Restraints

High Photopolymer Costs and Material Limitations Constrain Market Expansion

Photopolymer resins represent significant ongoing operational expenses compared to alternative 3D printing materials like thermoplastics. Additionally, post-processing requirements including washing, curing, and support removal increase labor costs and production time. These factors elevate total cost of ownership, particularly for high-volume manufacturing applications where material consumption becomes substantial.

Material durability and mechanical properties of photopolymer resins typically lag behind injection-molded thermoplastics and metal components. Consequently, SLA parts may exhibit lower impact resistance, heat tolerance, and long-term stability for demanding end-use applications. This limitation restricts market penetration in sectors requiring robust functional components.

Post-processing complexity involving multiple steps for achieving final part specifications creates workflow challenges for manufacturers. Moreover, chemical handling requirements for resin management and waste disposal necessitate specialized equipment and safety protocols. Therefore, operational complexity can deter adoption among smaller enterprises lacking dedicated technical resources.

Growth Factors

Mass Customization Trends and Material Innovation Accelerate Market Expansion

Integration of SLA technology in mass customization and low-volume manufacturing enables economically viable personalized products. Industries from consumer goods to medical devices leverage on-demand production capabilities reducing inventory costs. Moreover, digital workflows connecting design software directly to printers streamline production processes significantly.

Advancements in biocompatible and functional resin materials expand application possibilities across healthcare, electronics, and industrial sectors. New formulations deliver enhanced mechanical properties, thermal resistance, and specialized characteristics like flexibility or transparency. Furthermore, material certifications for medical and aerospace applications open high-value market segments.

Jewelry, fashion, and luxury product manufacturers increasingly adopt SLA for intricate designs and limited production runs. Exceptional detail reproduction and surface quality meet demanding aesthetic requirements while enabling rapid design iteration. Additionally, desktop SLA printer proliferation democratizes access for small businesses, educational institutions, and individual creators, broadening the technology’s addressable market substantially.

Emerging Trends

Technological Innovation and Sustainability Initiatives Reshape Market Landscape

Development of faster SLA systems with improved build speeds addresses productivity limitations hindering mass production applications. Manufacturers introduce advanced light sources, optimized resin chemistries, and parallel processing techniques reducing print times significantly. Consequently, throughput improvements enhance economic viability for higher-volume manufacturing scenarios.

Adoption of automated post-processing and resin handling solutions minimizes manual intervention while improving consistency and safety. Integrated washing, curing, and support removal systems streamline workflows reducing labor requirements. Moreover, automated material dispensing and recycling systems enhance operational efficiency.

Growing focus on sustainable and low-waste photopolymer materials responds to environmental concerns and regulatory pressures. Bio-based resins, recyclable formulations, and reduced VOC emissions attract environmentally conscious users. Furthermore, hybrid manufacturing approaches combining SLA with CNC machining and injection molding leverage complementary strengths, creating optimized production workflows for complex components requiring both additive and subtractive processes.

Regional Analysis

North America Dominates the Stereolithography (SLA) Technology 3D Printing Market with a Market Share of 38.1%, Valued at USD 1.0 Billion

North America leads the global market driven by strong aerospace, automotive, and healthcare sectors adopting advanced manufacturing technologies. The region benefits from substantial R&D investment, established 3D printing infrastructure, and favorable regulatory environments. Moreover, presence of major technology providers and material suppliers supports ecosystem development. The region held 38.1% market share valued at USD 1.0 Billion in 2025.

Europe Stereolithography (SLA) Technology 3D Printing Market Trends

Europe demonstrates significant adoption across automotive, aerospace, and medical device manufacturing sectors requiring precision engineering solutions. Germany, France, and the UK lead regional growth through Industry 4.0 initiatives and manufacturing innovation programs. Additionally, stringent quality standards and regulatory frameworks drive demand for certified materials and validated processes enhancing market development.

Asia Pacific Stereolithography (SLA) Technology 3D Printing Market Trends

Asia Pacific experiences rapid growth fueled by expanding manufacturing capabilities, increasing R&D investment, and growing adoption across consumer electronics and automotive industries. China, Japan, and South Korea lead regional development through government support for advanced manufacturing technologies. Furthermore, rising disposable incomes and growing awareness of 3D printing benefits accelerate market penetration.

Latin America Stereolithography (SLA) Technology 3D Printing Market Trends

Latin America shows emerging opportunities driven by increasing industrialization and growing awareness of additive manufacturing benefits. Brazil and Mexico lead regional adoption through automotive, healthcare, and consumer goods sectors. However, economic constraints and limited infrastructure present challenges to widespread technology adoption across the region.

Middle East & Africa Stereolithography (SLA) Technology 3D Printing Market Trends

Middle East & Africa demonstrates growing interest in 3D printing technologies supported by economic diversification initiatives and infrastructure development programs. Healthcare and aerospace sectors drive early adoption in GCC countries and South Africa. Consequently, government investments in technology education and innovation hubs foster ecosystem development despite relatively small current market size.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

3D Systems Inc. pioneered stereolithography technology and maintains strong market position through comprehensive product portfolio spanning desktop to industrial systems. The company offers diverse resin materials, software solutions, and professional services supporting end-to-end additive manufacturing workflows. Moreover, strategic partnerships and continuous innovation in print speed and material development strengthen competitive advantages across healthcare, aerospace, and industrial sectors.

Formlabs revolutionized desktop SLA accessibility through affordable, high-performance printers targeting professionals, small businesses, and educational institutions. Their ecosystem integrates hardware, proprietary resins, and cloud-based software for streamlined workflows. Furthermore, extensive material library including dental, medical, and engineering-grade resins addresses diverse application requirements while maintaining exceptional print quality and reliability.

Stratasys delivers industrial-grade SLA solutions for demanding manufacturing applications requiring precision, repeatability, and material performance. The company leverages decades of additive manufacturing expertise providing integrated solutions including printers, materials, and professional services. Additionally, focus on production-oriented applications and certified materials supports adoption in highly regulated industries.

Peopoly offers innovative large-format SLA printers combining affordability with industrial-scale build volumes. Their open-platform approach provides material flexibility and customization options appealing to advanced users and research institutions. Consequently, competitive pricing and expanding product line attract cost-conscious customers seeking industrial capabilities without premium pricing typical of established manufacturers.

Key Players

- 3D Systems Inc.

- Formlabs

- Stratasys

- Peopoly

- XYZ Printing

- FlashForge

- Zortrax

- B9Creations

- Shining 3D

- Prusa Research a.s

- Anycubic

- Phrozen Technology

- Kudo3D

- Asiga

- Uniz Technology LLC

- Other Key Players

Recent Developments

- July 2024 – Formlabs acquired 3D printing startup Micronics during its active Kickstarter campaign, strategically expanding technology capabilities and market reach. This acquisition demonstrates aggressive growth strategy through complementary technology integration and talent acquisition in competitive desktop SLA segment.

- April 2025 – Stratasys unveiled the Neo®800+ high-speed large-format stereolithography printer, significantly expanding industrial production capabilities. This advanced system addresses growing demand for large-scale additive manufacturing with enhanced throughput and precision for automotive and aerospace applications.

Report Scope

Report Features Description Market Value (2025) USD 2.5 Billion Forecast Revenue (2035) USD 3.8 Billion CAGR (2026-2035) 22.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Printer Type (Desktop SLA Printers, Industrial SLA Printers), Material Type (Engineering Resins, Dental & Medical Resins, Others), Application (Prototyping, Manufacturing & End-Use Parts, Tooling & Molding, Education & Research, Others), End-Use Industry (Automotive, Aerospace, Healthcare, Consumer Goods, Manufacturing, Education, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3D Systems Inc., Formlabs, Stratasys, Peopoly, XYZ Printing, FlashForge, Zortrax, B9Creations, Shining 3D, Prusa Research a.s, Anycubic, Phrozen Technology, Kudo3D, Asiga, Uniz Technology LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stereolithography (SLA) Technology 3D Printing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Stereolithography (SLA) Technology 3D Printing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3D Systems Inc.

- Formlabs

- Stratasys

- Peopoly

- XYZ Printing

- FlashForge

- Zortrax

- B9Creations

- Shining 3D

- Prusa Research a.s

- Anycubic

- Phrozen Technology

- Kudo3D

- Asiga

- Uniz Technology LLC

- Other Key Players