Global Sports Events Market Size, Share, Growth Analysis By Type of Event (Professional Sports Events, Amateur & College Sports Events, E-Sports Events, Others), By Revenue Stream (Ticket Sales, Digital, Physical, Sponsorships & Advertising, Media Rights & Broadcasting, Merchandising & Licensing, Betting & Fantasy Sports), By Target Audience (Fans and Spectators, Stadium Attendees, Digital Audience, Athletes and Participants, Media and Broadcasters, Sponsors and Exhibitors, Event Organizers), By Event Scale (International, National, Regional), By Event Format (Live, Hybrid, Virtual), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175139

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type of Event Analysis

- By Revenue Stream Analysis

- By Target Audience Analysis

- By Event Scale Analysis

- By Event Format Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key sports events Company Insights

- Recent Developments

- Report Scope

Report Overview

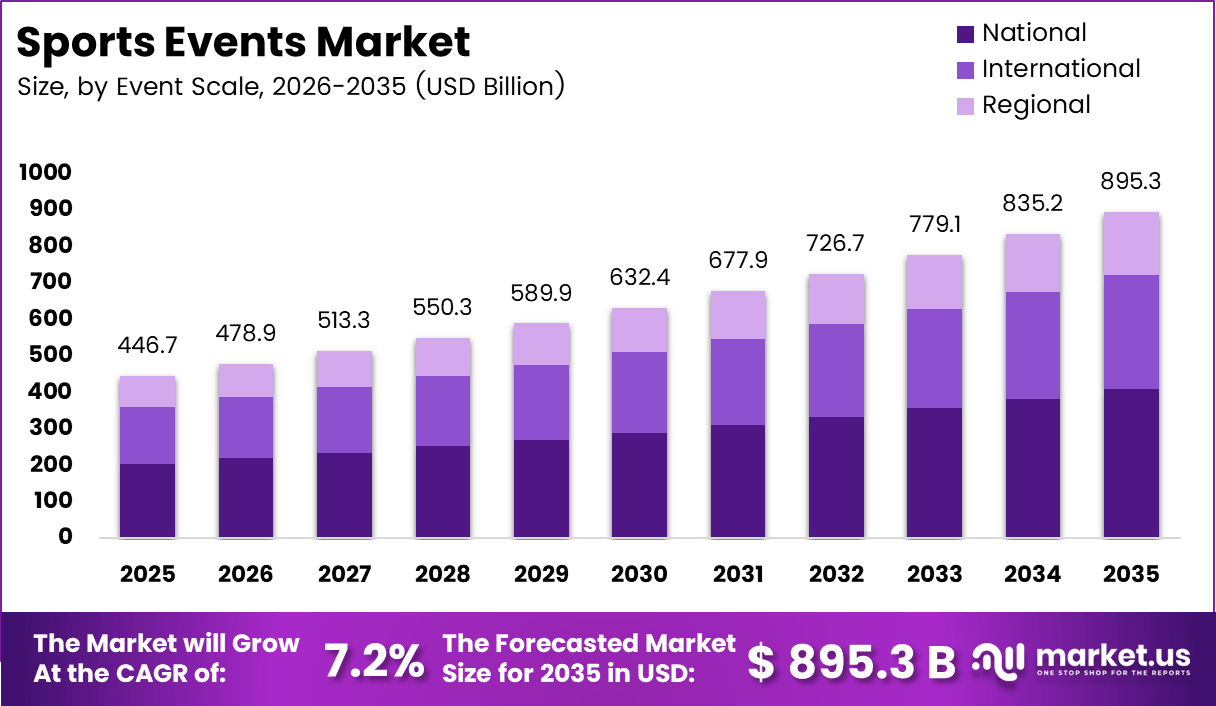

The Global sports events Market size is expected to be worth around USD 895.3 billion by 2035, from USD 446.7 Billion in 2025, growing at a CAGR of 7.2% during the forecast period from 2026 to 2035.

The sports events market represents the organized ecosystem of competitive, recreational, and commercial sporting activities delivered through live, hybrid, and digital formats. It integrates event management, broadcasting, ticketing, sponsorship, and fan engagement services, enabling structured participation and monetization across amateur and professional sports environments worldwide.

From a market perspective, sports events function as economic catalysts by stimulating tourism, media consumption, and local infrastructure development. Consequently, demand is supported by rising urbanization, expanding middle income populations, and increasing preference for experiential entertainment. Therefore, sports events increasingly align with wellness, lifestyle, and community engagement initiatives.

In terms of growth dynamics, the sports events market is expanding steadily due to rising participation and stronger institutional support. Moreover, digital ticketing, mobile engagement platforms, and data-driven scheduling improve operational efficiency. As a result, organizers achieve better audience reach, improved capacity utilization, and more predictable revenue streams.

Government investment continues to strengthen the sports events market through infrastructure funding and policy frameworks. Public spending on stadium upgrades, safety compliance, and grassroots programs enhances event quality. Additionally, regulations governing crowd control, licensing, and broadcasting rights improve transparency and long-term market sustainability.

From an opportunity standpoint, underserved demographics and emerging sports formats create new revenue pathways. Youth leagues, amateur tournaments, and endurance events are increasingly commercialized. Furthermore, integration of sports tourism, wellness travel, and destination branding enables host regions to maximize economic value from recurring sports events.

From a participation-driven lens, according to national sports participation surveys, gyms account for 29.3% of regular activity engagement, reflecting strong demand for fitness-based events. Cycling follows at 19.5%, while swimming represents 17.0%, supporting sustained interest in endurance-oriented sports formats.

Structurally, according to sports federation statistics, football accounts for 14.9% participation while maintaining the largest organized base with 1,063,090 registered players. This includes 997,106 men and 77,461 women, while female participation has increased by 55%, strengthening long-term market depth.

Key Takeaways

- The global sports events market is projected to reach USD 895.3 billion by 2035, expanding from USD 446.7 billion in 2025.

- The market is expected to grow at a CAGR of 7.2% during the forecast period from 2026 to 2035.

- Professional sports events dominate the market by type, accounting for a 67.3% share in 2025.

- Ticket sales represent the leading revenue stream, contributing 56.2% of total market revenue in 2025.

- Fans and spectators form the largest target audience segment, holding a 41.8% share of the market.

- National-level sports events lead by event scale, capturing a 45.9% market share.

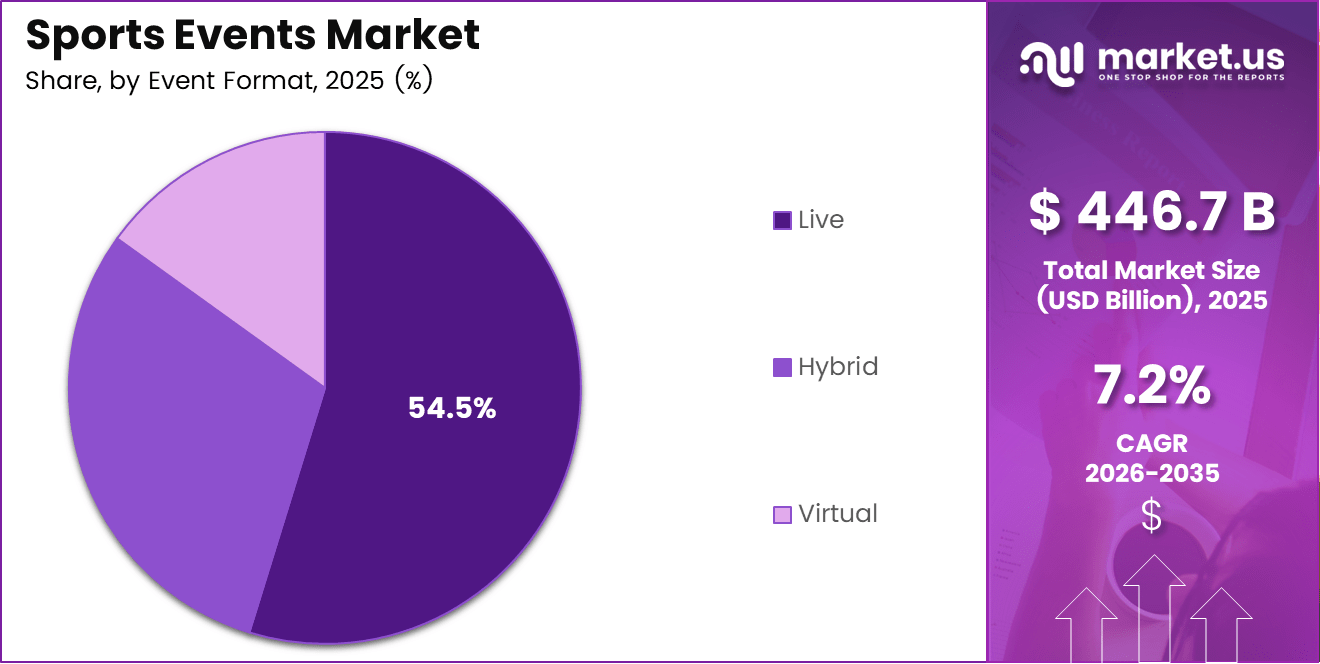

- Live sports events remain the dominant format, accounting for a 54.5% share of total events.

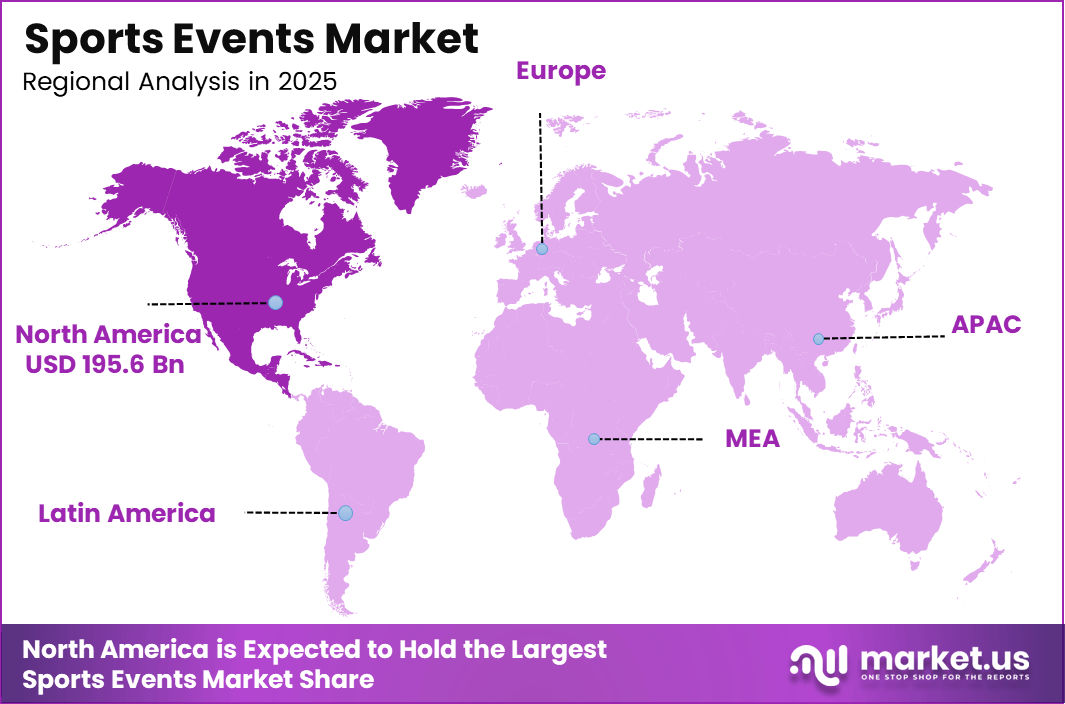

- North America dominates the regional landscape with a 43.8% share, valued at USD 195.6 billion.

By Type of Event Analysis

Professional Sports Events dominate with 67.3% due to their large-scale commercialization, global fan following, and strong media integration.

In 2025, Professional Sports Events held a dominant market position in the By Type of Event Analysis segment of sports events Market, with a 67.3% share. This dominance is driven by structured leagues, global tournaments, and consistent sponsorship inflows. Moreover, professional formats benefit from predictable scheduling and established broadcasting agreements.

Amateur & College Sports Events continue to expand steadily as grassroots participation increases. These events support talent development and regional engagement, while also attracting local sponsors. As institutional support improves, monetization opportunities through ticketing and digital streaming are gradually strengthening.

E-Sports Events are gaining momentum due to rising digital consumption and younger audience engagement. With low infrastructure requirements and global accessibility, e-sports are increasingly integrated into mainstream sports calendars, supported by streaming platforms and brand collaborations.

Others include community, exhibition, and niche sports events that contribute to market diversity. Although smaller in scale, these events play a role in regional tourism and cultural promotion, supporting incremental revenue generation.

By Revenue Stream Analysis

Ticket Sales dominate with 56.2% as live attendance remains central to sports event monetization.

In 2025, Ticket Sales held a dominant market position in the By Revenue Stream Analysis segment of sports events Market, with a 56.2% share. Strong demand for live experiences and premium seating continues to support this revenue stream, particularly for major professional events.

Digital revenue streams are expanding through streaming subscriptions, in-app purchases, and virtual access passes. This segment benefits from global reach and scalable distribution, especially for international and e-sports events.

Physical revenue includes on-site concessions and experiential offerings. These revenues complement ticket sales and enhance overall fan engagement during live events.

Sponsorships & Advertising, Media Rights & Broadcasting, Merchandising & Licensing, and Betting & Fantasy Sports collectively support diversified monetization. These streams benefit from brand partnerships, media exposure, and fan interaction, strengthening overall market resilience.

By Target Audience Analysis

Fans and Spectators dominate with 41.8% due to their direct contribution to ticketing and viewership demand.

In 2025, Fans and Spectators held a dominant market position in the By Target Audience Analysis segment of sports events Market, with a 41.8% share. Their spending on tickets, merchandise, and digital content remains the primary revenue driver.

Stadium Attendees represent a high value segment, supporting premium ticketing, hospitality services, and on site merchandise revenues. Their physical presence enables immersive fan engagement through live viewing, in venue technology, and experiential activations. Continuous investments in smart seating, connectivity, and safety infrastructure are enhancing overall event satisfaction and dwell time.

The Digital Audience segment is expanding rapidly due to wider broadband penetration, mobile streaming adoption, and social media driven sports consumption. This group strengthens advertising revenues through targeted digital campaigns, subscriptions, and pay per view models. Data driven fan insights further improve personalization and long term platform engagement.

Athletes and Participants, Media and Broadcasters, Sponsors and Exhibitors, and Event Organizers together form the operational backbone of the sports events ecosystem. Athletes drive competitive value, while media entities expand global reach and content monetization. Sponsors, exhibitors, and organizers provide funding, brand visibility, and execution capabilities that ensure event continuity and commercial scalability.

By Event Scale Analysis

National events dominate with 45.9% due to strong domestic fan bases and consistent scheduling.

In 2025, National events held a dominant market position in the By Event Scale Analysis segment of sports events Market, with a 45.9% share. These events benefit from national broadcasting deals and established sponsorship frameworks.

International events attract global audiences and large scale tourism inflows, positioning host destinations on the global sports calendar. Although less frequent in occurrence, these events generate high broadcast visibility and command premium sponsorship and media rights value.

Regional events support localized fan engagement by strengthening community level participation and recurring attendance. They play a critical role in talent identification and athlete development across semi professional and amateur sports ecosystems.

By Event Format Analysis

Live events dominate with 54.5% as in-person experiences remain central to sports culture.

In 2025, Live events held a dominant market position in the By Event Format Analysis segment of sports events Market, with a 54.5% share. Emotional engagement and atmosphere continue to drive attendance demand.

Hybrid events combine live and digital elements, enabling organizers to expand audience reach while maintaining the experiential value of physical attendance. This format supports real-time engagement across on-site and remote participants through integrated streaming and interaction tools. As a result, hybrid models enhance sponsorship visibility and data-driven audience targeting.

Virtual events rely entirely on digital participation, removing geographic and logistical barriers for both organizers and attendees. This format enables scalable global access at lower operational costs while supporting interactive features such as live chats and virtual exhibitions. Consequently, virtual events are increasingly relevant for e-sports, product launches, and experimental event formats.

Key Market Segments

By Type of Event

- Professional Sports Events

- Amateur & College Sports Events

- E-Sports Events

- Others

By Revenue Stream

- Ticket Sales

- Digital

- Physical

- Sponsorships & Advertising

- Media Rights & Broadcasting

- Merchandising & Licensing

- Betting & Fantasy Sports

By Target Audience

- Fans and Spectators

- Stadium Attendees

- Digital Audience

- Athletes and Participants

- Media and Broadcasters

- Sponsors and Exhibitors

- Event Organizers

By Event Scale

- International

- National

- Regional

By Event Format

- Live

- Hybrid

- Virtual

Drivers

Rising Global Viewership Fueled by Digital Broadcasting Drives Market Growth

Rising global viewership is a major driver for the sports events market, mainly supported by digital broadcasting and OTT sports platforms. From an analyst viewpoint, online streaming has made sports events more accessible to audiences across regions, age groups, and income levels. Fans can now follow live matches on smartphones, smart TVs, and connected devices, which expands reach beyond traditional stadium attendance.

Another key driver is increasing sponsorship and brand activation spending by multinational corporations. As viewership grows, brands see sports events as effective platforms to reach large and diverse audiences. Sponsorship deals, in-stadium branding, and digital campaigns around events continue to support revenue stability for organizers and leagues.

The expansion of international sports leagues and cross-border tournaments also strengthens market growth. Global competitions attract international audiences, media rights buyers, and sponsors, improving commercial returns. Analysts note that global leagues help standardize event formats and create year-round engagement.

Growth in disposable income further supports higher spending on live event experiences. Fans are more willing to spend on tickets, merchandise, hospitality, and travel, which enhances overall event revenue and supports long-term market expansion.

Restraints

High Operational and Security Costs Limit Market Scalability

High operational and security costs act as a key restraint for the sports events market. Large-scale sporting events require significant spending on venue management, crowd control, logistics, and staffing. From an analyst perspective, these costs increase financial risk, especially for organizers managing multi-day or international events.

Security requirements have also become more complex. Events must invest in surveillance systems, trained personnel, and emergency response planning. These measures are necessary to ensure safety but add pressure to operating budgets, particularly for emerging markets and smaller leagues.

Scheduling uncertainties present another challenge. Weather risks such as extreme heat, rain, or storms can disrupt outdoor events and reduce attendance. Analysts observe that climate-related disruptions are becoming more frequent, increasing planning complexity.

Geopolitical disruptions further affect scheduling and participation. Travel restrictions, regional conflicts, and policy changes can impact athlete availability and audience movement. Together, these factors create uncertainty in planning and can affect revenue predictability for sports event organizers.

Growth Factors

Immersive Fan Engagement Technologies Create New Growth Opportunities

Immersive technologies such as AR and VR present strong growth opportunities for the sports events market. Analysts highlight that these tools enhance fan engagement by offering virtual seat views, interactive replays, and behind-the-scenes access. This allows organizers to monetize digital audiences alongside physical attendees.

Sports tourism linked to mega sporting events is another major opportunity. Travel packages combining tickets, accommodation, and local experiences attract international fans. This trend supports collaboration between event organizers, tourism boards, and hospitality providers.

The increasing adoption of data analytics is also opening new opportunities. Event organizers use fan data to improve scheduling, pricing strategies, and on-site services. Better insights help optimize operations and increase fan satisfaction.

Expansion of women’s sports events is gaining strong momentum. Rising media coverage and commercial interest are attracting sponsors and broadcasters. Analysts expect this segment to contribute steadily to market growth and diversification.

Emerging Trends

Integration of Smart Stadium Infrastructure Shapes Market Trends

Integration of cashless payments and smart stadium infrastructure is a key trend in the sports events market. From an analyst viewpoint, digital ticketing, mobile payments, and connected services improve fan convenience and reduce operational friction during events.

AI-driven performance analytics and fan interaction tools are also becoming more common. Teams and organizers use AI to analyze player performance and personalize fan experiences through apps and digital platforms. This trend supports deeper engagement and data-driven decision-making.

Hybrid sports events that combine physical attendance with virtual participation are gaining popularity. Fans who cannot attend in person can still experience events through live streams and interactive features, expanding overall reach.

There is also a growing emphasis on sustainable and carbon-neutral sporting events. Organizers are adopting energy-efficient venues, waste reduction practices, and eco-friendly transport options. Analysts view sustainability as a long-term trend shaping future event planning and investment decisions.

Regional Analysis

North America Dominates the Sports Events Market with a Market Share of 43.8%, Valued at USD 195.6 Billion

North America holds a dominant position in the sports events market, accounting for 43.8% of global revenue and reaching a value of USD 195.6 billion. The region benefits from strong consumer spending on live sports, well-developed stadium infrastructure, and high media rights valuations. Advanced digital broadcasting and strong fan engagement further support consistent event attendance and monetization. In addition, established league structures and frequent international tournaments contribute to sustained market leadership.

Europe Sports Events Market Trends

Europe represents a mature and diversified sports events market, supported by deep-rooted sports culture and cross-border tournaments. The region sees stable demand driven by football, motorsports, and multi-sport championships. Strong public transport connectivity and compact geographies support high stadium utilization rates. Media partnerships and growing interest in women’s sports events continue to enhance long-term market stability.

Asia Pacific Sports Events Market Trends

Asia Pacific is experiencing rapid growth in the sports events market due to rising urban populations and increasing disposable income. Governments across the region actively support large-scale sporting events to boost tourism and global visibility. Growing adoption of digital platforms has expanded fan reach, especially among younger audiences. The region is also seeing increased investment in modern stadiums and event infrastructure.

Middle East and Africa Sports Events Market Trends

The Middle East and Africa region is emerging as a strategic market for international sports events. Investments in world-class venues and destination-driven sports tourism are strengthening regional visibility. Governments view sports events as tools for economic diversification and global branding. While the market size remains smaller, long-term growth prospects are supported by infrastructure expansion and policy support.

Latin America Sports Events Market Trends

Latin America maintains steady demand for sports events, driven by strong fan loyalty and high attendance for major tournaments. Sports play a central role in regional culture, supporting consistent ticket sales and broadcast interest. However, economic volatility can influence spending patterns. Despite this, international collaborations and regional competitions continue to support market resilience.

U.S. Sports Events Market Trends

The U.S. sports events market benefits from high per-capita spending on live entertainment and premium sports experiences. Advanced venue technologies and strong sponsorship ecosystems support higher event revenues. Media rights and digital engagement remain key growth enablers. The market continues to evolve through enhanced fan experiences and data-driven event management strategies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key sports events Company Insights

Nielsen Sports continues to strengthen its position through advanced analytics and audience measurement capabilities, helping rights holders and sponsors quantify engagement and ROI more effectively. The company’s data-driven approach is increasingly critical in an environment where commercial decisions hinge on real-time insights and fan behavior trends.

Sportfive remains a formidable intermediary in sports marketing and media rights, leveraging its strong relationships across major leagues and federations. Its ability to craft bespoke sponsorship packages and monetize media inventory is central to its growth trajectory, particularly in European and emerging markets where localized expertise drives value.

SponsorUnited has carved out a niche as a comprehensive sponsorship intelligence platform, offering unparalleled visibility into sponsorship deals and valuation benchmarks. By aggregating deal data and contractual insights, it empowers brands to benchmark opportunities and optimize partnership portfolios, a capability that resonates with marketers seeking precision in a crowded sponsorship landscape.

AEG Worldwide stands out for its vertically integrated model encompassing venue operations, event promotion, and asset management. Its diversified portfolio enables cross-leverage of properties and sponsorship assets, positioning AEG as a key driver of experiential engagement and long-term commercial partnerships. In 2025, AEG’s strategic focus on digital fan experiences and sustainable event practices underscores its leadership within the evolving global sports events ecosystem.

Top Key Players in the Market

- Nielsen Sports

- Sportfive

- SponsorUnited

- AEG Worldwide

- Wanda Sports Group Company Limited

- PGA TOUR, Inc.

- FIFA (Fédération Internationale de Football Association)

- Formula 1 (F1)

- IMG (International Management Group)

- Live Nation Entertainment

Recent Developments

- September 2025: In September 2025, Genius Sports Limited (NYSE: GENI) acquired Sports Innovation Lab to strengthen its fan intelligence and data analytics capabilities, enhancing its role across sports, betting, and media ecosystems through deeper audience insight and predictive engagement solutions.

- February 2025: In February 2025, TKO Group Holdings, Inc. (NYSE: TKO) completed the acquisition of IMG, On Location, and Professional Bull Riders (PBR) from Endeavor, significantly expanding its global sports rights, premium experiences, and live event portfolio.

Report Scope

Report Features Description Market Value (2025) USD 446.7 Billion Forecast Revenue (2035) USD 895.3 billion CAGR (2026-2035) 7.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Event (Professional Sports Events, Amateur & College Sports Events, E-Sports Events, Others), By Revenue Stream (Ticket Sales, Digital, Physical, Sponsorships & Advertising, Media Rights & Broadcasting, Merchandising & Licensing, Betting & Fantasy Sports), By Target Audience (Fans and Spectators, Stadium Attendees, Digital Audience, Athletes and Participants, Media and Broadcasters, Sponsors and Exhibitors, Event Organizers), By Event Scale (International, National, Regional), By Event Format (Live, Hybrid, Virtual) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nielsen Sports, Sportfive, SponsorUnited, AEG Worldwide, Wanda Sports Group Company Limited, PGA TOUR, Inc., FIFA (Fédération Internationale de Football Association), Formula 1 (F1), IMG (International Management Group), Live Nation Entertainment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nielsen Sports

- Sportfive

- SponsorUnited

- AEG Worldwide

- Wanda Sports Group Company Limited

- PGA TOUR, Inc.

- FIFA (Fédération Internationale de Football Association)

- Formula 1 (F1)

- IMG (International Management Group)

- Live Nation Entertainment