Global Sports Drug Testing Market By Product Type (Equipment, Urine Testing Devices, Rapid Testing Devices, Oral Fluid Testing Devices, Immunoassay Analyzers, Consumables, Chromatography Instruments, Assay Kits, Alcohol Breath Analyzers, and Others), By Sample Type (Urine, Oral Fluid, Hair, Breath, Blood, and Others), By End User (Drug Testing Laboratories, Pain Management Centers, Hospitals, Government Departments, Drug Rehabilitation Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163714

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

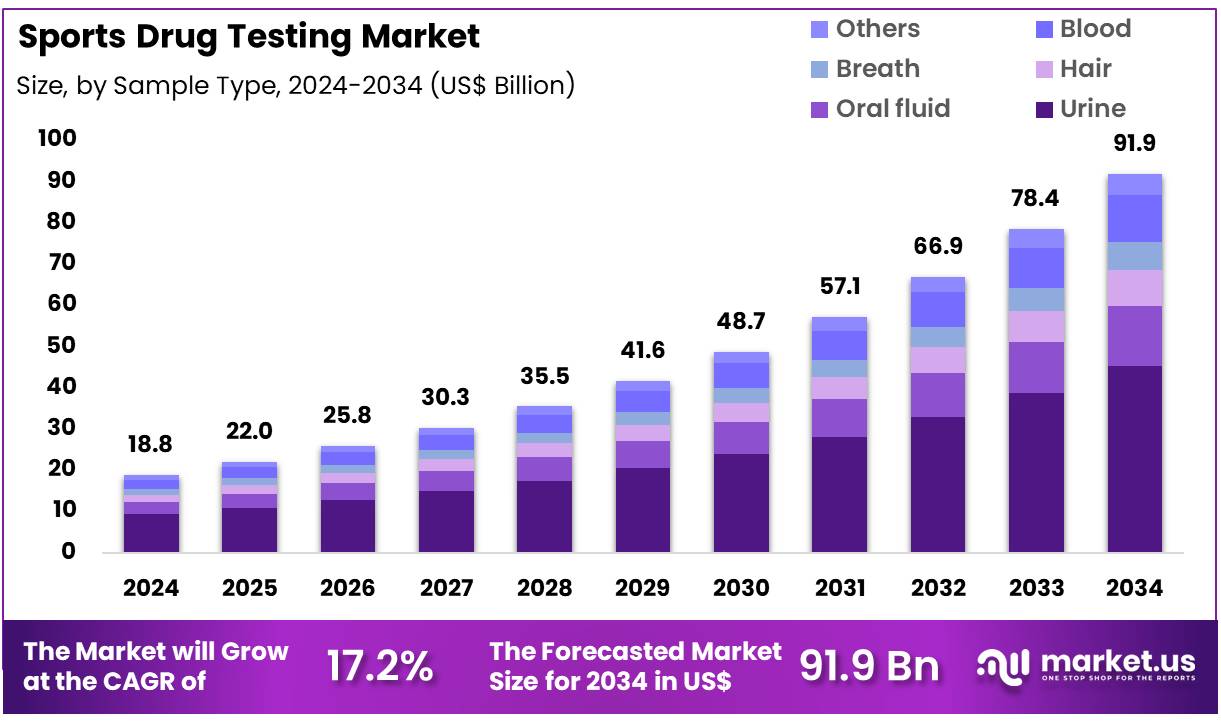

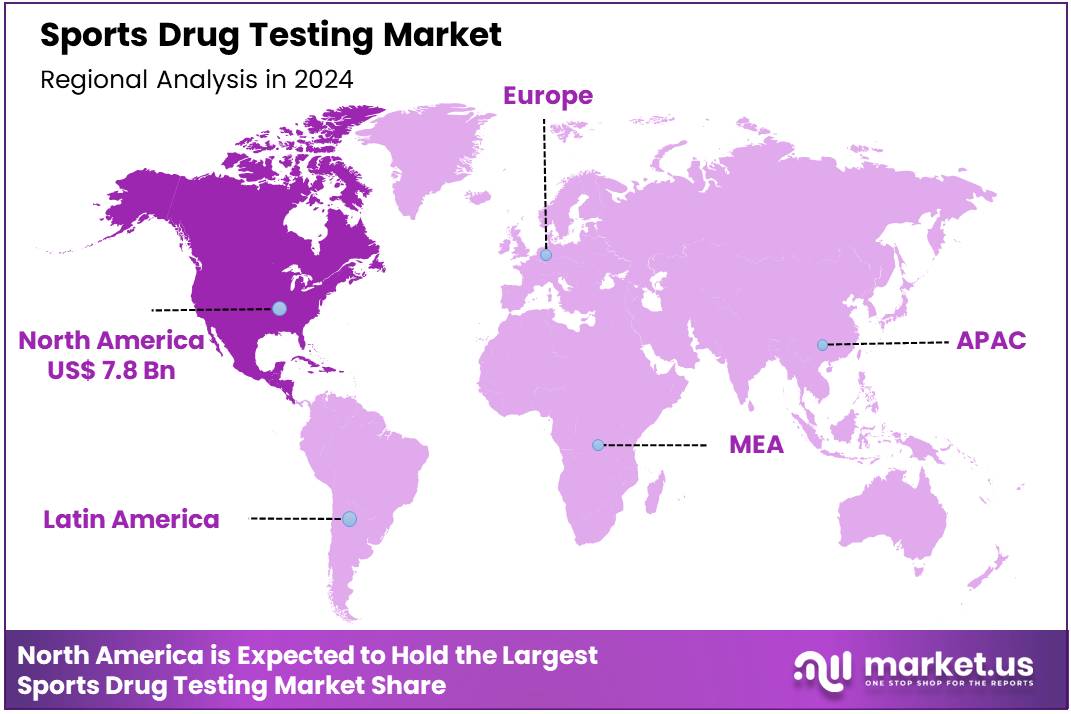

Global Sports Drug Testing Market size is expected to be worth around US$ 91.9 Billion by 2034 from US$ 18.8 Billion in 2024, growing at a CAGR of 17.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.3% share with a revenue of US$ 7.8 Billion.

Increasing investments in anti-doping research drive the Sports Drug Testing Market, as organizations commit substantial resources to advancing detection capabilities. Laboratories apply these tests in in-competition screening to identify performance-enhancing substances like anabolic steroids, ensuring fair play during events.

Researchers utilize advanced assays to detect emerging threats such as gene doping in preclinical studies, supporting regulatory compliance. These applications extend to out-of-competition monitoring, where athletes undergo random urine and blood sampling to deter misuse.

In 2024, WADA allocated a scientific research budget of US$ 4.5 million, with over US$1.4 million funding 14 projects focused on doping detection methods like EPO and AI integration. This strategic funding accelerates innovation in testing equipment and consumables, positioning the market for enhanced precision and reliability.

Growing volume of doping controls fuels the Sports Drug Testing Market, as governing bodies intensify surveillance across competitive platforms. Event organizers deploy comprehensive testing protocols during tournaments to screen for prohibited hormones and stimulants, safeguarding athlete health and integrity. These tests support national federations in routine athlete evaluations, identifying potential violations through biological passport monitoring.

High-throughput analyzers facilitate large-scale sample processing, optimizing workflows in accreditation labs. FIFA’s Anti-Doping Report for 1 January 2024 to 31 July 2025 highlighted nearly 2,000 doping control tests across major tournaments, involving players from 160 member associations. This extensive testing underscores sustained demand for scalable services, creating opportunities for expanded analytical solutions in global sports ecosystems.

Rising regulatory harmonization propels the Sports Drug Testing Market, as updated frameworks mandate standardized protocols worldwide. Anti-doping agencies implement these tests in therapeutic use exemption reviews, verifying legitimate medical needs against prohibited lists. Laboratories adapt methodologies to detect novel modulators, ensuring compliance with evolving standards.

On 23 July 2025, an amendment to India’s National Anti-Doping Bill ensured operational independence for its NADO, aligning with WADA code requirements. This legislative step reinforces uniform rule application, bolstering demand for consistent testing infrastructures. Such developments drive market growth by promoting interoperability and trust in international anti-doping efforts.

Emerging updates to prohibited substances create opportunities in the Sports Drug Testing Market, as laboratories procure cutting-edge tools for compliance. Testing experts apply mass spectrometry to identify non-approved compounds in athlete samples, mitigating risks of inadvertent violations. These assays support educational programs by simulating detection scenarios for coaches and support staff.

Trends toward integrated platforms combine multiple analyte screening, enhancing efficiency in forensic analysis. On 1 January 2025, WADA’s new Prohibited List came into force, adding examples of non-approved substances and specific hormone modulators. This revision necessitates rapid development of advanced reagents, securing steady procurement for high-tech solutions across the sector.

Key Takeaways

- In 2024, the market generated a revenue of US$ 81.8 Billion, with a CAGR of 17.2%, and is expected to reach US$ 91.9 Billion by the year 2034.

- The product type segment is divided into equipment, urine testing devices, rapid testing devices, oral fluid testing devices, immunoassay analyzers, consumables, chromatography instruments, assay kits, alcohol breath analyzers, and others, with equipment taking the lead in 2023 with a market share of 44.8%.

- Considering sample type, the market is divided into urine, oral fluid, hair, breath, blood, and others. Among these, urine held a significant share of 49.3%.

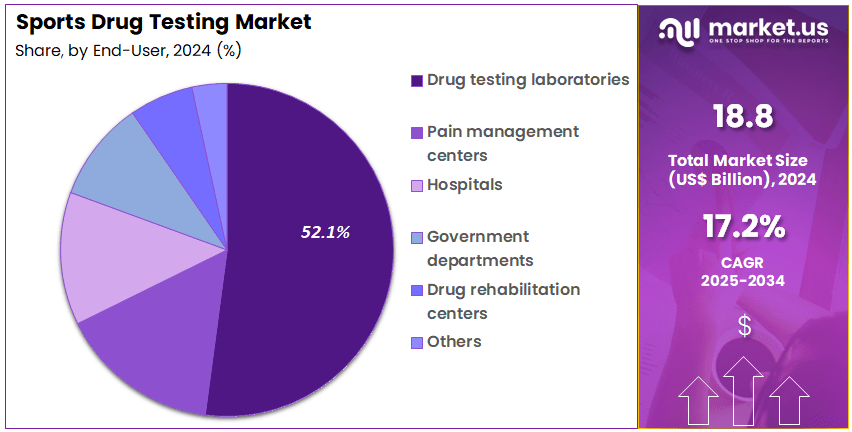

- Furthermore, concerning the end user segment, the market is segregated into drug testing laboratories, pain management centers, hospitals, government departments, drug rehabilitation centers, and others. The drug testing laboratories sector stands out as the dominant player, holding the largest revenue share of 52.1% in the market.

- North America led the market by securing a market share of 41.3% in 2023.

Product Type Analysis

Equipment accounts for 44.8% of the Sports Drug Testing market and is expected to dominate due to technological advancements in analytical and detection systems. Sophisticated instruments such as liquid chromatography–mass spectrometry (LC-MS) and gas chromatography–mass spectrometry (GC-MS) are becoming standard for identifying banned substances in athletes’ samples.

The increasing enforcement of anti-doping regulations by global bodies such as WADA and IOC is driving the demand for high-precision equipment in testing laboratories. Equipment upgrades that allow multi-analyte detection and improved sensitivity are enhancing testing accuracy. The growing prevalence of performance-enhancing drug use across competitive and amateur sports is projected to further accelerate adoption.

Laboratories increasingly prefer advanced automation-enabled systems to handle large sample volumes efficiently. Integration of AI-based analytics for pattern detection and result validation strengthens the reliability of test outcomes. Continuous innovations in portable and rapid testing devices enhance field-level screening capabilities.

Collaboration between sports authorities and diagnostic technology firms promotes the development of specialized anti-doping instruments. The rising emphasis on fair play and athlete safety ensures the sustained expansion of this segment globally.

Sample Type Analysis

Urine samples hold 49.3% of the sample type segment and are anticipated to continue leading due to their established reliability in detecting a wide range of banned substances and metabolites. Urine testing remains the gold standard in doping control as it provides a longer detection window for most drugs compared to other sample types.

Testing agencies and sports organizations rely on urine samples for both in-competition and out-of-competition testing. The use of advanced analytical platforms such as LC-MS/MS has improved the accuracy and sensitivity of urine-based testing, enabling detection of trace-level substances. Increased random and targeted testing in professional sports has elevated the number of urine tests conducted globally.

Urine collection is non-invasive and cost-effective, making it suitable for large-scale anti-doping programs. Continuous validation of new testing protocols ensures compliance with international anti-doping standards. Expansion of testing facilities and increased frequency of athlete monitoring further contribute to segment growth.

The development of specialized assays capable of detecting designer drugs and new performance enhancers enhances detection accuracy. As doping detection programs expand into amateur and collegiate levels, urine testing remains the primary diagnostic medium.

End-User Analysis

Drug testing laboratories represent 52.1% of the end-user segment and are projected to maintain dominance due to their essential role in anti-doping analysis, certification, and regulatory compliance. These laboratories serve as the operational backbone for global and regional sports organizations in maintaining integrity within competitive sports.

Increasing investment in laboratory infrastructure and equipment modernization supports higher throughput and more precise testing. Accredited laboratories follow rigorous international standards, enhancing trust among sports authorities and athletes. The growing complexity of banned substance profiles drives laboratories to adopt multi-technique testing approaches, integrating chromatographic, spectrometric, and immunoassay methods.

Collaborations between WADA-accredited facilities and regional testing centers promote data sharing and analytical consistency. Rising sports participation and expansion of anti-doping efforts in emerging economies are expected to increase laboratory testing volumes. Automation and digital data management systems improve workflow efficiency and result tracking.

Laboratories also engage in research to develop new biomarker-based detection methods, strengthening their strategic role in drug testing. As the global sports ecosystem continues to prioritize transparency and fairness, drug testing laboratories remain at the forefront of maintaining integrity and compliance across all levels of competition.

Key Market Segments

By Product Type

- Equipment

- Urine Testing Devices

- Rapid Testing Devices

- Oral Fluid Testing Devices

- Immunoassay Analyzers

- Consumables

- Chromatography Instruments

- Assay kits

- Alcohol Breath Analyzers

- Others

By Sample Type

- Urine

- Oral Fluid

- Hair

- Breath

- Blood

- Others

By End User

- Drug Testing Laboratories

- Pain Management Centers

- Hospitals

- Government Departments

- Drug Rehabilitation Centers

- Others

Drivers

Heightened Global Anti-Doping Efforts is Driving the Market

The intensification of international anti-doping initiatives has substantially advanced the sports drug testing market, as organizations implement more rigorous protocols to safeguard the integrity of competitions and protect athlete health. This driver is evident in the escalation of sample collections, reflecting a commitment to deterrence through comprehensive surveillance across elite and recreational levels.

Urinary and blood analyses, foundational to detecting anabolic agents and peptide hormones, are increasingly standardized under unified codes, ensuring equitable enforcement. The focus on intelligence-led testing targets high-risk disciplines, optimizing resource allocation amid rising participation in global events. Public scrutiny following high-profile violations further catalyzes investments in accredited laboratories, enhancing detection capabilities for emerging substances.

Regulatory harmonization facilitates cross-border collaborations, amplifying the scale of testing operations. The World Anti-Doping Agency reported a 12.5% increase in total samples analyzed, reaching 288,865 in 2023 compared to 256,770 in 2022, underscoring the expanding scope of global efforts. This uptick correlates with broader procurement of testing kits, as agencies prioritize volume to counter sophisticated evasion tactics.

Technological refinements, such as mass spectrometry upgrades, bolster sensitivity, accommodating diverse matrices from urine to dried blood spots. Economically, its proliferation mitigates reputational risks, justifying fiscal outlays for proactive programs. Stakeholder alliances, including national agencies and federations, disseminate best practices, fostering market resilience. This regulatory momentum not only sustains operational demands but also positions testing as a cornerstone of ethical sports governance.

Restraints

Detection of Designer Steroids and Novel Substances is Restraining the Market

The emergence of sophisticated designer steroids and novel psychoactive compounds poses formidable barriers to the sports drug testing market, as these evade conventional assays, necessitating costly methodological overhauls. These synthetic variants, chemically modified to bypass prohibited list criteria, challenge laboratories’ analytical bandwidth, extending validation timelines and inflating R&D expenditures.

This restraint manifests in false-negative rates, eroding stakeholder trust and prompting litigation over contested results. Resource-strapped agencies, particularly in developing nations, struggle with procurement of advanced instrumentation, perpetuating enforcement disparities. The rapid iteration of clandestine formulations outpaces regulatory updates, creating a cat-and-mouse dynamic that strains accreditation standards.

Privacy concerns, amplified by mandatory disclosures, further complicate consent frameworks, deterring voluntary participation. Efforts to integrate bioassays lag due to ethical hurdles in human validation. These analytical impediments not only constrain throughput but also undermine the market’s deterrent efficacy.

Opportunities

Expansion of Esports and Recreational Sports Testing is Creating Growth Opportunities

The burgeoning esports sector and surge in recreational athletics have unveiled vast prospects for the sports drug testing market, diversifying beyond elite domains to encompass digital and community-based competitions. Esports, with its cognitive enhancers and stimulants, requires tailored assays for non-traditional matrices like saliva, aligning with youth-driven demographics.

Opportunities arise in scalable, on-site solutions, subsidizing validations for amateur leagues amid rising wellness mandates. Public-private ventures underwrite protocol adaptations, bridging gaps in non-professional governance. This inclusivity counters doping normalization, positioning testing as a prophylactic for emerging modalities like virtual reality training. Fiscal incentives for broad-spectrum panels catalyze procurements, extending to corporate wellness integrations.

The U.S. Anti-Doping Agency tested 739 mixed martial artists a combined 4,231 times in 2023, highlighting scalable frameworks for recreational expansions amid low violation baselines. Such data validates economic rationales, as preventive testing averts escalation costs.

Innovations in user-centric devices, like breathalyzers for stimulants, enhance feasibility in grassroots settings. As metaverse platforms evolve, virtual biomarker tracking unlocks novel revenues. These participatory enlargements not only amplify volumes but also embed the market within holistic fitness ecosystems.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the sports drug testing market, leading them to delay mass spectrometry upgrades while focusing on essential urine screening kits amid reduced sponsorship budgets. U.S.-China export restrictions and Red Sea shipping disruptions are limiting supplies of chromatographic columns from Asian suppliers, extending method validation timelines and increasing certification costs for international athletic federations.

To address these constraints, some developers are partnering with Pennsylvania-based column manufacturers, implementing robustness protocols that accelerate WADA approvals and attract integrity-focused grants. Heightened doping scandals are driving IOC allocations into advanced biomarker assays, boosting adoptions in elite training camps.

U.S. tariffs of 10% on imported laboratory equipment effective April 5, 2025, are elevating costs for Asian-sourced analyzers and reagents, compressing margins for national testing agencies and occasionally stalling global harmonization initiatives. In response, developers are leveraging CHIPS Act incentives to build Virginia fabrication labs, introducing ion-trap enhancements and cultivating expertise in low-volume calibrations.

Latest Trends

Integration of AI-Driven Metabolomics for Enhanced Detection is a Recent Trend

The incorporation of artificial intelligence-driven metabolomics into sports drug testing workflows has marked a pivotal advancement in 2024, revolutionizing the detection of prohibited substances through comprehensive metabolic profiling. This trend leverages machine learning algorithms to analyze complex biomarker patterns in urine and blood, identifying subtle signatures of doping agents that evade traditional mass spectrometry.

AI systems process vast datasets from longitudinal athlete samples, enhancing specificity for novel compounds and their metabolites in real-time. This approach streamlines laboratory throughput, reducing manual interpretation errors and accelerating result turnaround for time-sensitive competitions. Regulatory bodies have embraced its validation, integrating AI outputs into compliance frameworks to support evidence-based sanctions.

The technology aligns with global anti-doping mandates, enabling predictive modeling of misuse trends across diverse sports. Its adaptability to emerging substances, such as gene-doping vectors, positions it as a proactive tool in evolving regulatory landscapes. Observers anticipate its assimilation into standard protocols, elevating precision in adjudications.

The shift fosters seamless data integration with cloud-based registries, enhancing traceability. Forward trajectories include federated learning to refine detection algorithms collaboratively. This AI-driven evolution not only optimizes analytical accuracy but also strengthens the market’s alignment with dynamic anti-doping imperatives.

Regional Analysis

North America is leading the Sports Drug Testing Market

In 2024, North America captured a 41.3% share of the global sports drug testing market, fueled by rigorous enforcement of the World Anti-Doping Code and expanded testing protocols amid high-profile events like the Paris Olympics, which necessitated advanced urine and blood analyses for performance-enhancing substances across amateur and professional levels.

Sports organizations, including the U.S. Olympic & Paralympic Committee, intensified no-notice out-of-competition sampling to deter anabolic steroid use in endurance athletes, incorporating stable isotope ratio mass spectrometry for precise detection of synthetic testosterone, thereby upholding integrity in collegiate and elite competitions.

The U.S. Anti-Doping Agency’s strategic focus on intelligence-led testing addressed rising concerns over erythropoietin misuse in cycling and track events, with modular kits enabling on-site preliminary screening to expedite results during major tournaments.

Demographic expansions in youth and Paralympic programs correlated with federal allocations for accessible testing infrastructure, mitigating equity issues in underrepresented regions through mobile units. Technological upgrades in dried blood spot sampling appealed to remote verification needs, aligning with national priorities for clean sport amid international scrutiny. These measures reinforced the region’s vanguard role in anti-doping vigilance.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National coordinators in Asia Pacific anticipate the sports drug testing sector to accelerate in the forecast period, as regional federations align with WADA standards to monitor emerging doping trends in rapidly expanding athletic programs. Authorities in China and South Korea deploy advanced profiling kits, equipping national teams to detect growth hormone variants in weightlifting cohorts vulnerable to synthetic manipulations.

Testing agencies collaborate with governmental labs to refine gas chromatography-mass spectrometry panels, projecting enhanced interception of selective androgen receptor modulators in martial arts competitions. Regulatory bodies in Japan and India subsidize biological passport implementations, positioning amateur leagues to track hematological parameters without invasive collections.

Administrative networks estimate integrating digital result chains with event management systems, streamlining verification for endurance runners in high-altitude trials. Regional pharmacologists pioneer saliva-based assays, synchronizing with continental databases to profile peptide hormones in aquatic sports. These developments forge a unified front for doping deterrence.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the anti-doping analytics sector drive expansion by engineering advanced mass spectrometry platforms that detect synthetic steroids and micro-dosing patterns, meeting the demands of elite competitions for undetectable enhancements. They pursue mergers with forensic labs to integrate AI-driven data interpretation, bolstering accuracy in post-competition reviews and reducing false positives.

Enterprises invest in mobile collection units equipped with chain-of-custody blockchain tracking, facilitating on-site testing at remote events and accelerating results delivery. Executives cultivate partnerships with international federations to co-design compliance protocols, embedding their solutions into global standards and unlocking endorsement contracts.

They advance into high-participation regions across Asia and South America, aligning with emerging anti-doping agencies to secure volume-based procurements. Additionally, they deploy subscription analytics services for ongoing athlete monitoring, enhancing program retention and generating predictable margins through value-added compliance consulting.

Quest Diagnostics Incorporated, founded in 1967 and headquartered in Secaucus, New Jersey, operates as a leading provider of diagnostic information services, with a dedicated focus on clinical testing and workplace wellness programs worldwide. The company leverages its Quest AD-Usmle platform to conduct comprehensive screening for performance-enhancing substances, supporting major leagues and Olympic committees with certified, tamper-evident processes.

Quest Diagnostics channels resources into laboratory automation and regulatory advocacy, ensuring adherence to WADA guidelines while innovating in genomic doping detection. CEO Sam Samad oversees a network of over 2,200 patient service centers across the U.S. and select international markets, emphasizing data security and rapid turnaround.

The firm collaborates with sports governing bodies to refine testing methodologies, promoting fair play initiatives. Quest Diagnostics reinforces its market dominance by combining extensive infrastructure with forward-thinking analytics to safeguard athletic integrity.

Top Key Players

- Thermo Fisher Scientific Inc.

- Siemens Healthcare GmbH

- Shimadzu Corporation

- Quest Diagnostics Incorporated

- PZ Cormay

- Lifeloc Technologies Inc.

- JMB Enterprises Inc.

- IDEXX Laboratories, Inc.

- Drägerwerk AG & Co. KGaA

- Abbott Laboratories

Recent Developments

- In February 2025, Tasso, Inc. launched its next-generation dried blood spot (DBS) collection technology, combining the new Tile-T20 cartridge with the Tasso Mini device. This innovation enhances sample accuracy and ease of use, which strengthens the Dried Blood Spot Testing Market by supporting broader applications in decentralized clinical trials and anti-doping programs where precise, low-volume sample collection is critical.

- In July 2025, Tasso, Inc. received additional regulatory clearances for its Tasso Mini device from Health Canada and European authorities, including approvals in Italy and Spain. These regulatory milestones expand the company’s global footprint and significantly drive the Dried Blood Spot Testing Market by improving access to self-administered, clinical-grade blood collection technologies that simplify logistics for diagnostics, monitoring, and public health programs across multiple regions.

Report Scope

Report Features Description Market Value (2024) US$ 18.8 Billion Forecast Revenue (2034) US$ 91.9 Billion CAGR (2025-2034) 17.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment, Urine Testing Devices, Rapid Testing Devices, Oral Fluid Testing Devices, Immunoassay Analyzers, Consumables, Chromatography Instruments, Assay Kits, Alcohol Breath Analyzers, and Others), By Sample Type (Urine, Oral Fluid, Hair, Breath, Blood, and Others), By End User (Drug Testing Laboratories, Pain Management Centers, Hospitals, Government Departments, Drug Rehabilitation Centers, and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Siemens Healthcare GmbH, Shimadzu Corporation, Quest Diagnostics Incorporated, PZ Cormay, Lifeloc Technologies Inc., JMB Enterprises Inc., IDEXX Laboratories, Inc., Drägerwerk AG & Co. KGaA, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Siemens Healthcare GmbH

- Shimadzu Corporation

- Quest Diagnostics Incorporated

- PZ Cormay

- Lifeloc Technologies Inc.

- JMB Enterprises Inc.

- IDEXX Laboratories, Inc.

- Drägerwerk AG & Co. KGaA

- Abbott Laboratories