Global Sponge and Scouring Pad Market Size, Share, Growth Analysis By Product (Heavy Duty, Light Duty, Medium Duty, Extra Heavy Duty), By Material (Steel, Polymer), By Application (Kitchen Utensils, Slabs & Sinks, Others), By End Use (Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166988

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

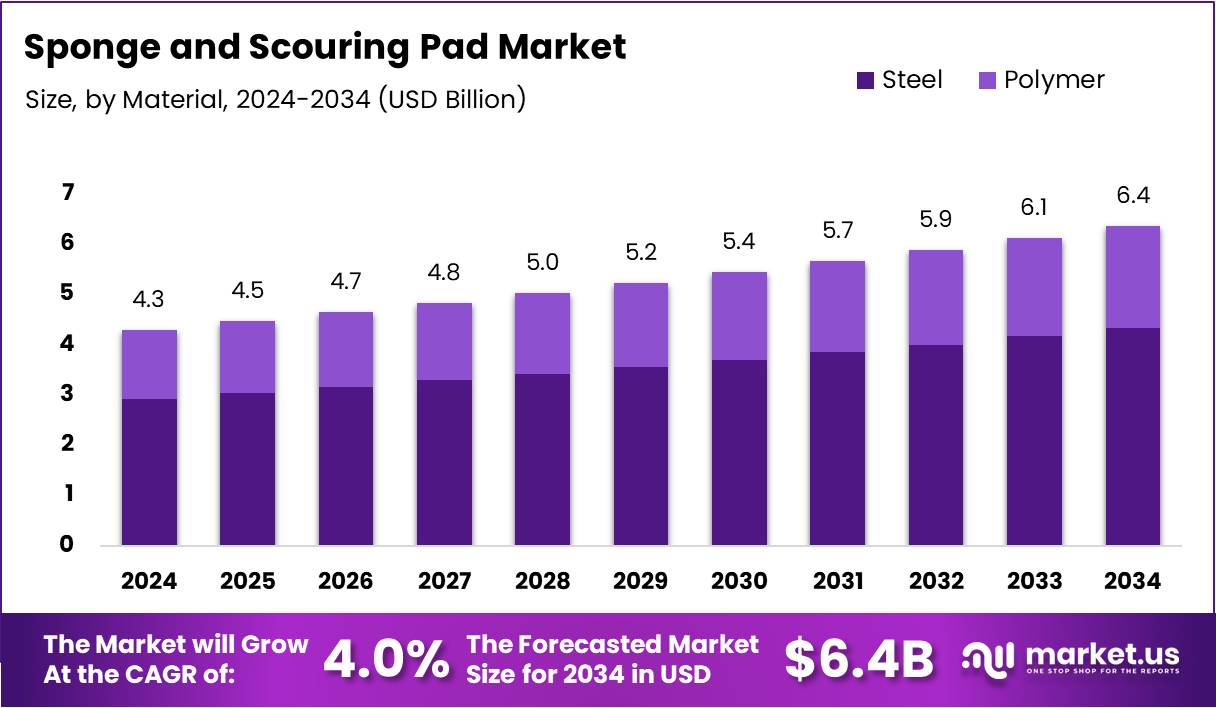

The Global Sponge and Scouring Pad Market size is expected to be worth around USD 6.4 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 4% during the forecast period from 2025 to 2034.

The sponge and scouring pad market includes essential cleaning tools used for dishwashing, kitchen care, and industrial surface scrubbing. It covers cellulose sponges, synthetic pads, and steel wool varieties. As hygiene awareness rises globally, these products continue gaining relevance across household, commercial, and industrial cleaning applications.

Moreover, the market is expanding steadily as consumers prioritize convenience, cleanliness, and fast surface-cleaning solutions. Growing urban populations and higher kitchen hygiene standards support consistent product demand. Manufacturers benefit from rising replacement cycles and recurring household usage, which naturally sustain long-term market momentum across regions.

Furthermore, eco-friendly alternatives are unlocking new opportunities. Biodegradable cellulose sponges, reusable scouring pads, and reduced-plastic formats appeal to environmentally conscious buyers. As sustainability becomes a core purchasing factor, businesses offering greener cleaning tools gain stronger market positioning and improved consumer trust.

Additionally, governments are promoting safer cleaning materials and better hygiene practices. Policies encouraging recyclable packaging, reduced chemical content, and improved product safety drive innovation. At the same time, public-health guidelines emphasize hygienic kitchen cleaning habits, helping increase awareness of proper sponge usage and replacement.

In fact, according to a survey, 58% of respondents used the same sponge for less than one month, 32% kept it for about two months, and 10% used it for longer. These insights reveal fast replacement habits, supporting recurring sales and stable household consumption levels.

Similarly, hygiene recommendations indicate that a sponge sanitized after every use can last 30 to 45 days. This suggests strong potential for promoting longer-lasting and antimicrobial sponge solutions that meet growing consumer interest in hygiene-driven cleaning products.

Meanwhile, the demand for durable scrubbing tools continues to rise. According to global usage estimates, annual steel wool consumption exceeds 3 billion units, reflecting consistent domestic and industrial reliance. This substantial demand highlights growth potential in high-performance scouring pads and durable scrubbers.

Overall, the sponge and scouring pad market is positioned for continued expansion due to rising hygiene focus, sustainability trends, and supportive regulatory shifts. Companies investing in eco-friendly materials, efficient supply chains, and value-added cleaning innovations are well-placed to capture emerging opportunities and strengthen long-term market presence.

Key Takeaways

- Global market projected to reach USD 6.4 Billion by 2034, growing from USD 4.3 Billion in 2024 at a 4% CAGR.

- Heavy Duty segment leads the product category with a 36.2% share in 2024.

- Steel material dominates the market with a 67.3% share in 2024.

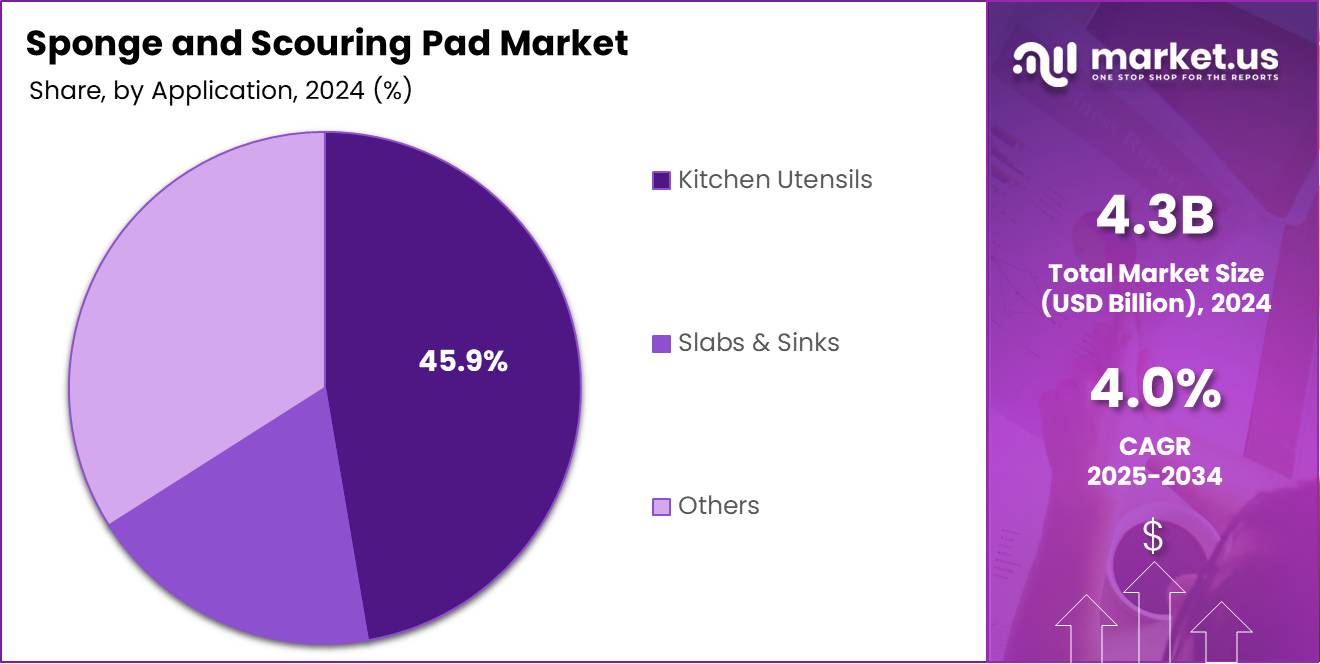

- Kitchen Utensils application segment holds the largest share at 45.9% in 2024.

- Commercial end-use segment accounts for 65.1% market share in 2024.

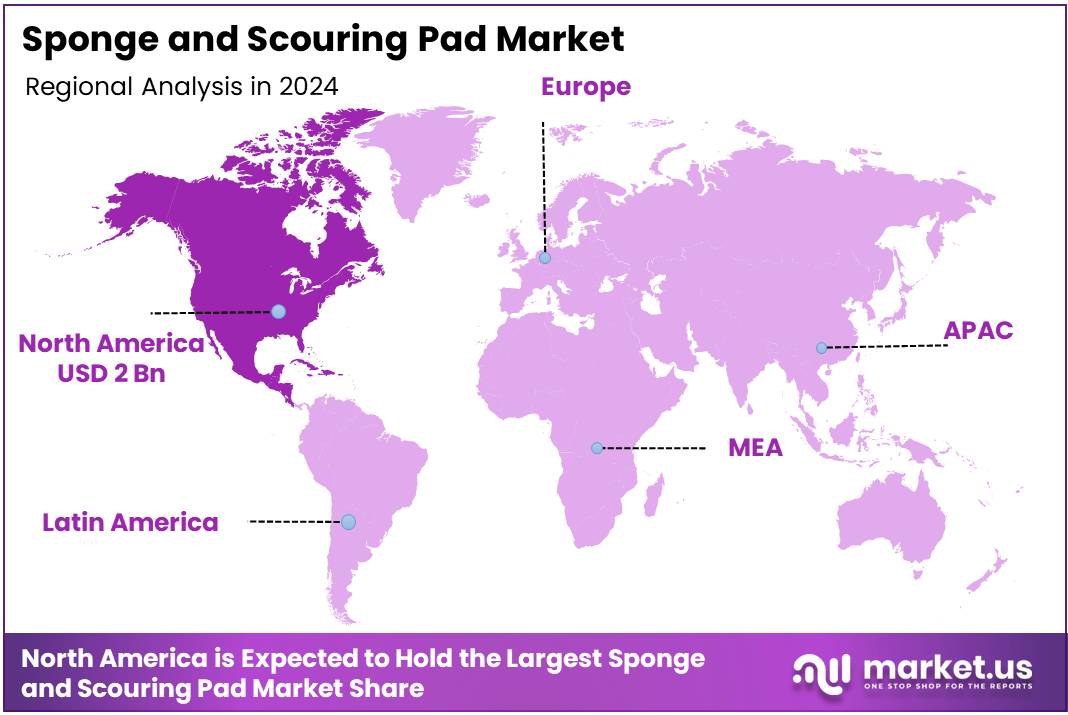

- North America leads regionally with 48.2% share, valued at USD 2 Billion in 2024.

By Product Analysis

Heavy Duty dominates with 36.2% owing to its higher durability and strong scrubbing capability.

In 2024, Heavy Duty held a dominant market position in the By Product segment of the Sponge and Scouring Pad Market, with a 36.2% share. This category leads because it offers strong abrasion strength, supports frequent cleaning cycles, and performs effectively on tough grime. As demand rises, adoption continues to grow.

The Light Duty segment serves consumers seeking gentle cleaning performance for sensitive surfaces. It grows steadily as households prefer softer pads for glassware and coated utensils. Additionally, manufacturers focus on lightweight designs to improve usage convenience and reduce surface scratches, supporting gradual market acceptance among home users.

The Medium Duty segment expands due to its balanced performance and versatility across daily cleaning tasks. It offers moderate abrasion suitable for kitchens, sinks, and appliances. As customers require multi-purpose solutions, this category gains traction. Continuous improvements in textures and ergonomics further enhance its suitability for routine applications.

The Extra Heavy Duty sub-segment targets demanding cleaning situations in industrial and commercial locations. It benefits from rising usage in high-grease environments such as restaurants and workshops. With manufacturers introducing stronger fibers and enhanced durability, the segment’s relevance improves, supporting usage in long and intensive scrubbing operations.

By Material Analysis

Steel dominates with 67.3% driven by its strong abrasion strength and long service life.

In 2024, Steel held a dominant market position in the By Material segment of the Sponge and Scouring Pad Market, with a 67.3% share. Its ability to remove stubborn stains and sustain heavy use makes it ideal for commercial and domestic cleaning tasks, strengthening its leadership across applications.

The Polymer sub-segment increases steadily as consumers seek lightweight, flexible, and scratch-free cleaning materials. Polymer-based pads also resist rust, improve handling comfort, and cater to modern kitchen needs. With rising demand for safe and surface-friendly alternatives, this category expands consistently across households and food-service environments.

By Application Analysis

Kitchen Utensils dominate with 45.9% due to frequent household cleaning requirements.

In 2024, Kitchen Utensils held a dominant market position in the By Application segment of the Sponge and Scouring Pad Market, with a 45.9% share. Increasing cooking frequency and regular utensil maintenance support its leading use. Manufacturers enhance durability and ergonomic comfort to meet routine cleaning needs.

The Slabs & Sinks segment grows as consumers seek efficient scrubbing solutions for larger kitchen surfaces. These pads remove stains, oil layers, and water marks effectively. With modern kitchens adopting smooth countertops, demand for surface-safe yet strong cleaning solutions rises steadily across residential and commercial environments.

The Others sub-segment includes general household surfaces, appliances, and bathroom fixtures. This category expands as multi-purpose cleaning becomes a priority. Pads designed for versatile use improve convenience and reduce household cleaning time. Additionally, product innovation supports broader adoption across varied maintenance activities.

By End Use Analysis

Commercial dominates with 65.1% because of high consumption frequency and bulk usage.

In 2024, Commercial held a dominant market position in the By End Use segment of the Sponge and Scouring Pad Market, with a 65.1% share. Heavy cleaning requirements in restaurants, hotels, and institutional kitchens boost consumption. Higher durability and frequent product replacement further strengthen this segment.

The Residential segment grows steadily as households adopt multiple cleaning tools for different surfaces. Increasing focus on hygiene and kitchen maintenance drives regular usage of sponges and pads. Manufacturers introduce ergonomic and long-lasting products to meet diverse home cleaning needs, supporting consistent market penetration.

Key Market Segments

By Product

- Heavy Duty

- Light Duty

- Medium Duty

- Extra Heavy Duty

By Material

- Steel

- Polymer

By Application

- Kitchen Utensils

- Slabs & Sinks

- Others

By End Use

- Commercial

- Residential

Drivers

Growing Household Spending on Premium Cleaning & Kitchen Care Products Drives Market Growth

Rising household spending on premium cleaning products is steadily boosting demand for sponges and scouring pads. Consumers now prefer long-lasting, high-quality pads that offer better hygiene and faster cleaning, especially in kitchens. This shift toward premium home-care solutions is expanding product adoption across urban and semi-urban homes.

At the same time, the foodservice and hospitality sectors continue to create strong demand for high-performance scouring pads. Restaurants, cafés, and hotels require durable, heat-resistant, and efficient pads to maintain daily cleaning standards. As these sectors expand with new outlets and rising customer footfall, bulk purchasing of cleaning tools becomes more frequent.

Moreover, increasing urbanization is shaping daily cleaning habits. Busy consumers seek convenient, easy-to-use, and time-saving cleaning solutions, making synthetic sponges and multipurpose scrubbing pads more popular. Urban homes with modular kitchens also drive higher usage of scratch-free and surface-specific pads.

Together, these factors strengthen overall market growth. Higher spending power, expanding commercial cleaning needs, and rapid urban lifestyle changes continue to support consistent and long-term demand for modern sponge and scouring pad products.

Restraints

Price Sensitivity Among Institutional Buyers Limiting Premium Product Adoption

The Sponge and Scouring Pad Market faces restraints as many consumers and businesses increasingly shift toward disposable, single-use cleaning wipes. These wipes offer quick convenience, reducing the need for traditional sponges and pads. As a result, long-lasting cleaning tools see slower demand growth, especially in urban markets where people prefer fast and ready-to-use options.

Additionally, the institutional sector such as restaurants, offices, and hospitality shows strong price sensitivity. These buyers often prioritize bulk, low-cost cleaning tools over premium, high-efficiency pads. This limits the adoption of advanced or specialized scouring pads that offer better performance but come at a higher price.

Furthermore, procurement teams in commercial facilities usually follow strict budget cycles. This leads them to choose economical products instead of investing in durable, long-life sponges, which affects premium brands and limits product upgrades within the segment.

Overall, the combination of rising use of disposable wipes and price-focused purchasing behavior creates pressure on manufacturers. These factors make it challenging for companies to push innovation and premiumization, slowing market expansion across both household and professional cleaning categories.

Growth Factors

Rising Demand for Eco-Friendly, Biodegradable Scouring Pads Creates New Growth Avenues

The market is witnessing strong opportunities as more consumers look for antibacterial and odor-controlled sponge variants. These products appeal to hygiene-focused households that prefer safer options for everyday cleaning. Brands can use this trend to introduce advanced hygiene features without raising product complexity too much.

Additionally, eco-friendly scouring pads made from natural fibers are becoming a major opportunity. With sustainability awareness increasing, many buyers now prefer biodegradable products over synthetic alternatives. This shift allows manufacturers to innovate using plant-based materials while positioning themselves as responsible and environmentally conscious.

There is also growing potential in heavy-duty, multi-surface pads designed for commercial and industrial settings. Foodservice, hospitality, and manufacturing facilities require durable cleaning tools that reduce labor time and enhance performance. By developing specialized pads for tough environments, companies can expand their presence in the premium and professional cleaning segment.

Overall, opportunities are rising across hygiene, sustainability, and industrial cleaning needs. Companies that invest in new materials, smarter product design, and targeted commercial solutions can capture stronger growth in the coming years.

Emerging Trends

Increased Popularity of Dual-Texture Pads Offering Multi-Purpose Cleaning Functions

The sponge and scouring pad market is witnessing strong momentum as consumers look for products that deliver better performance with less effort. Dual-texture pads have become a major trend because they allow users to scrub tough stains and wipe delicate surfaces with a single tool. This shift is increasing product visibility in both households and commercial spaces.

At the same time, the rise of colored and patterned sponges is shaping buying behavior. Many consumers now prefer cleaning tools that match modern kitchen décor and add visual appeal. This trend is especially strong among urban households seeking stylish yet functional cleaning accessories.

Manufacturers are also adopting plant-based foaming technologies to meet growing expectations for healthier and eco-friendly options. These materials provide soft lathering properties while reducing chemical use, making them attractive for sustainability-minded consumers. This trend is gaining traction across premium home-care brands.

Additionally, reusable and long-life scouring pads are becoming more popular as households work to reduce waste. Longer-lasting pads cut replacement frequency, lower disposal volumes, and support cost-conscious behavior. This trend aligns with the global push toward responsible consumption, making durable cleaning pads an important focus area for future product development.

Regional Analysis

North America Dominates the Sponge and Scouring Pad Market with a Market Share of 48.2%, Valued at USD 2 Billion

North America leads the global Sponge and Scouring Pad Market, holding a dominant 48.2% share and generating around USD 2 Billion in 2024. The region benefits from strong household spending, high adoption of premium cleaning tools, and rising demand for durable, multi-purpose pads. Growing emphasis on hygiene and expanding foodservice operations further reinforce its leadership.

Europe Sponge and Scouring Pad Market Trends

Europe shows steady growth driven by eco-friendly preferences and regulatory support for sustainable household products. Consumers increasingly choose biodegradable and long-life scouring pads, enhancing market penetration. The region maintains stable demand due to strong adoption from residential and commercial cleaning segments.

Asia Pacific Sponge and Scouring Pad Market Trends

Asia Pacific continues to expand rapidly, supported by rising urbanization, growing middle-income households, and increasing kitchen hygiene awareness. Strong manufacturing capabilities and a shift toward affordable yet efficient cleaning products fuel market momentum. The region is expected to emerge as a high-potential growth hub over the next decade.

Middle East & Africa Sponge and Scouring Pad Market Trends

The Middle East & Africa market grows moderately, influenced by expanding hospitality operations and increasing demand for high-efficiency pads. Rising construction of residential spaces also supports household cleaning product consumption. However, lower product standardization and limited awareness slow broader market penetration.

Latin America Sponge and Scouring Pad Market Trends

Latin America experiences stable progress, driven by increased household usage and gradual adoption of multi-surface scouring pads. Growing retail expansion and rising interest in cost-effective cleaning tools support market development. Economic fluctuations remain a key challenge, but long-term demand remains positive across major countries.

U.S. Sponge and Scouring Pad Market Trends

The U.S. remains a major contributor within North America, supported by strong consumer preference for premium and reusable pads. High cleanliness standards in homes and commercial kitchens sustain consistent demand. Product innovation and faster adoption of sustainable materials further enhance market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Sponge and Scouring Pad Company Insights

In 2024, the global Sponge and Scouring Pad Market continued to experience steady growth as consumers increasingly prioritized hygiene, durability, and convenience in household cleaning essentials. Market leaders strengthened their positioning through material innovation, ergonomic design upgrades, and portfolio diversification.

3M Company maintained strong global influence by investing in advanced scrubbing technologies and long-lasting synthetic materials. Its wide distribution and strong brand equity supported consistent demand across both household and commercial cleaning applications.

Procter & Gamble leveraged its consumer-centric product development and marketing capabilities to enhance reach in high-volume retail channels. The company expanded its cleaning accessories portfolio by emphasizing performance efficiency and comfort-focused designs for daily use.

Armaly Brands focused on sustainable sponge manufacturing and natural cellulose-based products, appealing to eco-aware consumers. Its ability to balance affordability with functional design helped the company maintain competitive placement across diverse retail environments.

O-Cedar strengthened its presence through ergonomically enhanced scouring pads and strong integration with its wider cleaning tools ecosystem. Its emphasis on durable, multipurpose products supported adoption among modern households seeking time-saving cleaning solutions.

Other established companies continued contributing to category growth through consistent product refreshes and channel expansion. Many brands increased attention toward antimicrobial treatments, biodegradable materials, and dual-texture pad designs to align with changing consumer expectations. Additionally, rising urban populations and higher kitchen maintenance needs across developing regions created favorable conditions for both premium and value-segment players. Overall, 2024 marked a year of balanced innovation and purposeful repositioning across the competitive landscape of sponge and scouring pad solutions.

Top Key Players in the Market

- 3M Company

- Procter & Gamble

- Armaly Brands

- O-Cedar

- Libman Company

- Quickie Manufacturing Corporation

- Freudenberg Household Products

- Vileda GmbH

Recent Developments

- In October 2025, the collaboration between Dremel and Scrub Daddy introduced the Dremel Cordless Versa Scrub Daddy Kits, combining precision power tools with scratch-free, odor-free sponge technology. This launch strengthened both brands’ presence in the high-efficiency home cleaning tools segment.

- In March 2023, Cif and Scrub Daddy announced and launched a co-branded product line to support Cif’s entry into the U.S. cleaning tools market, marking a strategic partnership focused on expanding market reach. The collaboration delivered new solutions blending Cif’s cleaning formulations with Scrub Daddy’s innovative sponge materials.

- In April 2024, Skura Style, co-owned by Eva Mendes, unveiled a new collection featuring her design-inspired versions of SKRUBBY Sponges and the VERY SKRUBBY dual-side scouring pad. This launch enhanced the brand’s premium lifestyle positioning with stylish, performance-driven cleaning essentials.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 6.4 Billion CAGR (2025-2034) 4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Heavy Duty, Light Duty, Medium Duty, Extra Heavy Duty), By Material (Steel, Polymer), By Application (Kitchen Utensils, Slabs & Sinks, Others), By End Use (Commercial, Residential) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M Company, Procter & Gamble, Armaly Brands, O-Cedar, Libman Company, Quickie Manufacturing Corporation, Freudenberg Household Products, Vileda GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sponge and Scouring Pad MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Sponge and Scouring Pad MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Procter & Gamble

- Armaly Brands

- O-Cedar

- Libman Company

- Quickie Manufacturing Corporation

- Freudenberg Household Products

- Vileda GmbH