Global Spices and Seasonings Market By Product Type (Spices, Herbs, Salt and Salt Substitutes, Others), By Application (Meat and Poultry Products, Snacks and Convenience Food, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Products, Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 18213

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

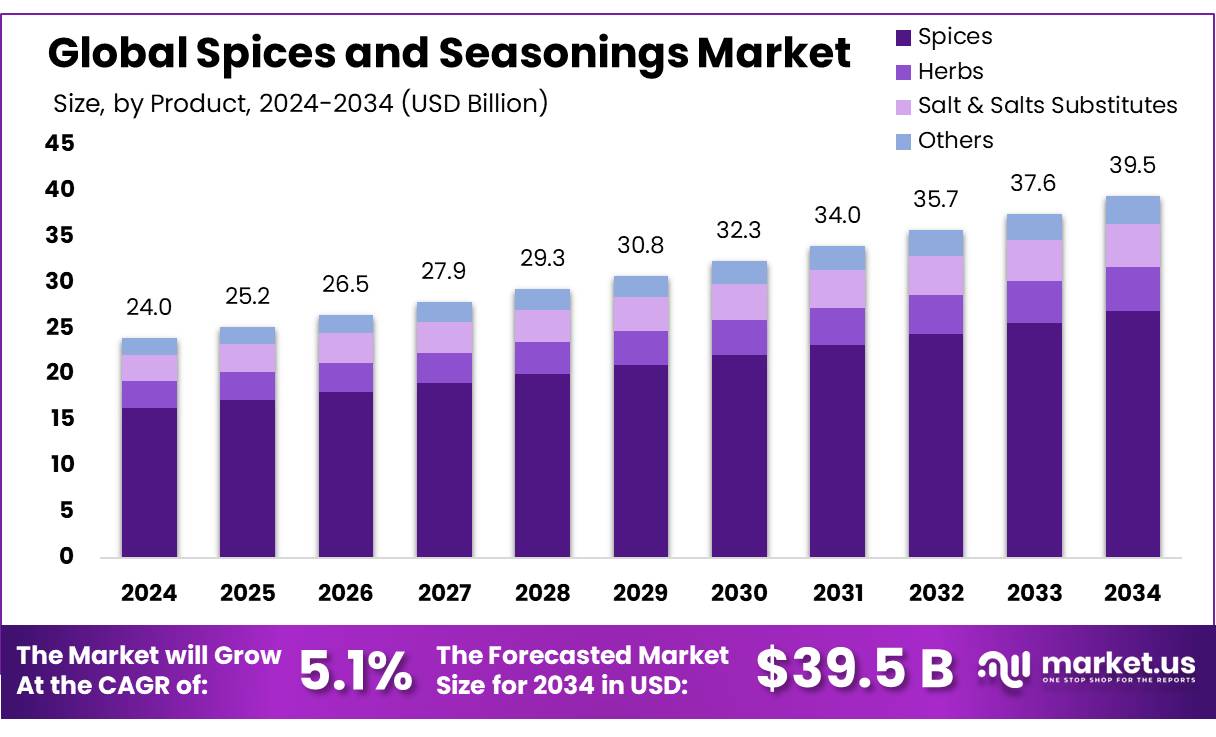

The global Spices and Seasonings market size is expected to be worth around USD 39.5 billion by 2034, from USD 24.0 billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The global spices and seasonings industry represents one of the most dynamic segments within the food and beverage sector, driven by centuries-old culinary traditions and evolving consumer preferences. Spices and seasonings refer to a wide array of dried seeds, fruits, roots, bark, or vegetables used to flavor, color, and preserve food. Increasing globalization of food cultures, along with growing awareness around health benefits associated with natural ingredients, has propelled sustained demand across both developed and emerging markets.

In 2023, according to the Food and Agriculture Organization (FAO), global spice production reached approximately 13.6 million metric tons, with leading contributors including India, Bangladesh, Turkey, and China. India alone accounted for nearly 75% of global spice production, with 10.2 million metric tons, reinforcing its position as the dominant producer and exporter. In the U.S., the United States Department of Agriculture (USDA) reported that the total consumption of spices surpassed 635 million pounds in 2022, reflecting a steady 2.8% annual growth.

The spices and seasonings is shaped by robust processing technologies, rising demand from foodservice industries, and expanding applications in ready-to-eat meals and snacks. Export-oriented economies, particularly India and Vietnam, continue to invest heavily in processing infrastructure to maintain product quality and meet stringent international standards. The Indian Spices Board, under the Ministry of Commerce and Industry, revealed that India’s spice exports were valued at USD 4.3 billion in FY 2023. New initiatives like India’s “Spice Parks” project are providing shared facilities for cleaning, grinding, packaging, and quality testing, enhancing the competitiveness of small and medium enterprises.

Several driving factors are accelerating the market’s growth trajectory. The health and wellness trend is crucial, as spices like turmeric, ginger, and cinnamon are increasingly linked with anti-inflammatory and immune-boosting properties. According to the World Health Organization (WHO), diets rich in natural spices have been associated with reduced risks of chronic diseases, including heart disease and diabetes. Furthermore, the rise in global tourism and multicultural cuisines has introduced spices to new consumer bases, expanding retail opportunities in Western countries.

Key Takeaways

- Spices and Seasonings market size is expected to be worth around USD 39.5 billion by 2034, from USD 24.0 billion in 2024, growing at a CAGR of 5.1%.

- Spices held a dominant market position, capturing more than a 68.3% share of the global spices and seasonings market.

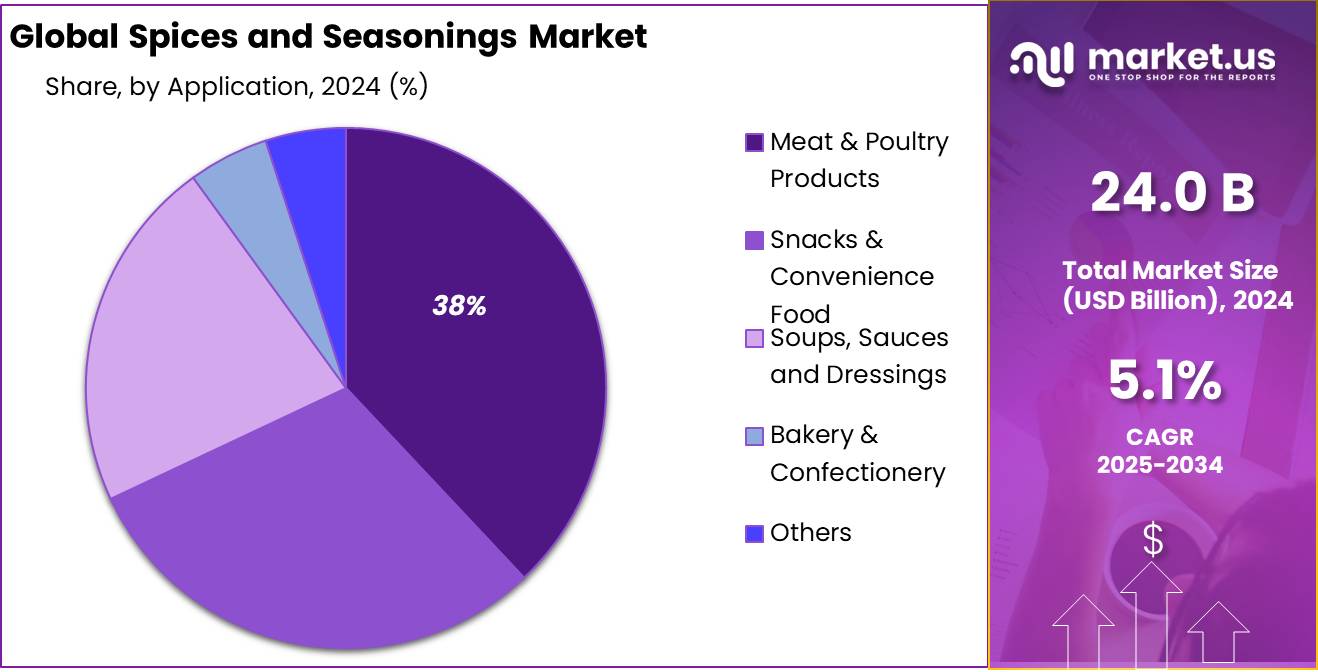

- Meat & Poultry Products held a dominant market position, capturing more than a 38.2% share.

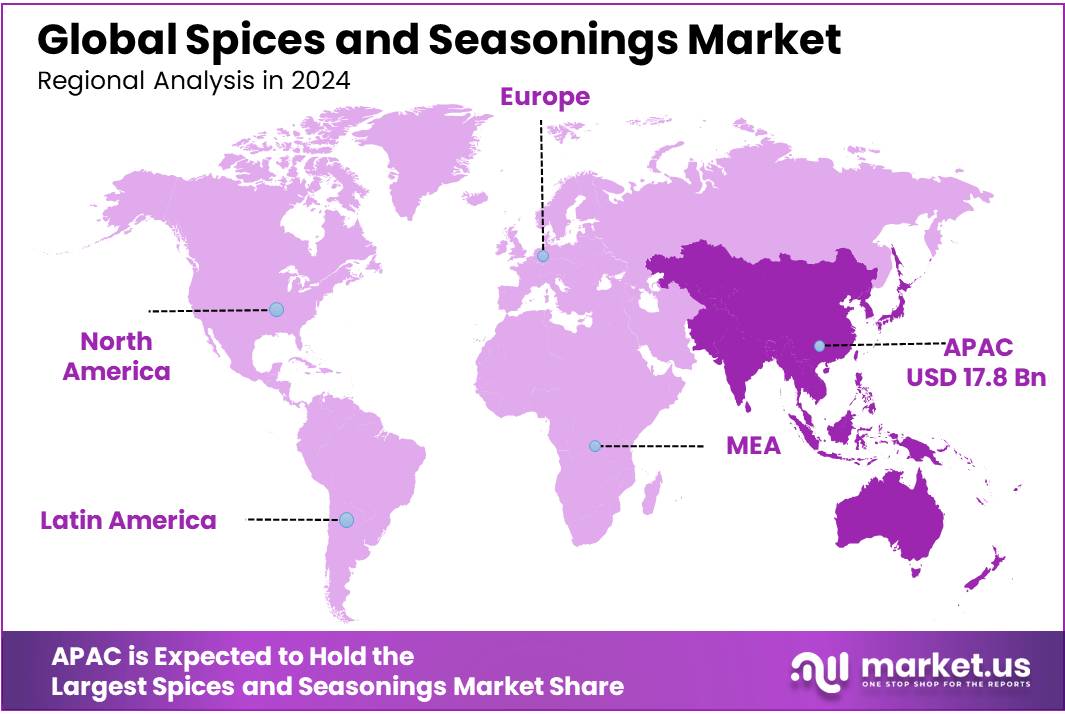

- Asia-Pacific (APAC) region holds a commanding position in the global spices and seasonings market, dominating with a substantial 74.20% market share, which translated to revenues of approximately USD 17.8 billion in 2024.

Analysts’ Viewpoint

From an investment perspective, the spices and seasonings market is poised for significant growth, presenting a range of opportunities and challenges that investors should consider. This growth is largely driven by an increasing demand for natural ingredients and a burgeoning interest in international and bold flavors, alongside a growing awareness of the health benefits associated with spices.

Investment opportunities are particularly vibrant in regions such as North America and Asia-Pacific, where the markets are expanding due to rising consumer interest in home cooking and diverse cuisines. North America alone is expected to see an annual growth rate of nearly 4.8%, with similar enthusiasm in Asia-Pacific as urbanization and increasing disposable incomes fuel spice consumption.

However, investors must also navigate potential risks. The spice market’s reliance on global supply chains makes it susceptible to geopolitical tensions and climate-related disruptions, which can lead to volatility in spice availability and prices. Additionally, with increasing regulatory scrutiny on food safety and quality, compliance becomes a crucial factor for companies in the sector.

Product Type Analysis

Spices dominate with 68.3% market share, driven by strong demand for authentic flavors.

In 2024, Spices held a dominant market position, capturing more than a 68.3% share of the global spices and seasonings market. This commanding share highlights the continued reliance on natural and traditional spices across food industries worldwide. Spices like turmeric, cumin, black pepper, and cardamom have remained essentials in home cooking, packaged food products, and the booming ready-to-eat meal sector.

The year 2024 saw a notable increase in consumer interest toward authentic ethnic cuisines, particularly Indian, Middle Eastern, and Southeast Asian foods, where spices play a central role. Furthermore, health trends around natural anti-inflammatory and antioxidant properties have boosted the use of turmeric and cinnamon in daily diets, encouraging higher consumption volumes. With lifestyle changes pushing demand for clean-label and organic ingredients, spices maintained their premium standing compared to synthetic seasonings and flavor enhancers.

By Application

Meat & Poultry Products dominate with 38.2% share, fueled by rising demand for seasoned meats.

In 2024, Meat & Poultry Products held a dominant market position, capturing more than a 38.2% share of the global spices and seasonings market by application. This leadership reflects the strong consumer preference for marinated and spiced meats, which have become staples across households, restaurants, and fast-food chains.

The surge in ready-to-cook and ready-to-eat meat products, especially in North America, Europe, and parts of Asia, has further increased the use of spice blends and seasoning mixes. In 2024, the growing popularity of ethnic cuisines such as Middle Eastern kebabs, Indian tandoori, and Latin American grilled meats contributed significantly to seasoning demand. Consumers are increasingly seeking richer, bolder flavors in their meat and poultry dishes, pushing food producers to innovate with diverse spice profiles.

Кеу Маrkеt Ѕеgmеnts

By Product Type

- Spices

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Coriander

- Cardamom

- Cloves

- Others

- Herbs

- Garlic

- Oregano

- Mint

- Parsley

- Rosemary

- Fennel

- Others

- Salt & Salt Substitutes

- Others

By Application

- Meat and Poultry Products

- Snacks and Convenience Food

- Soups, Sauces and Dressings

- Bakery and Confectionery

- Frozen Products

- Beverages

- Others

Drivers

Health Awareness Drives Spice and Seasoning Consumption

One major driving factor for the growth in the spices and seasonings market is the increasing consumer awareness regarding health benefits associated with natural spices. As more individuals seek healthier dietary options, the demand for natural and organic spices that offer nutritional benefits without compromising on flavor has surged.

According to the World Health Organization (WHO), incorporating natural spices into the diet can reduce the risk of chronic diseases such as heart disease and diabetes. This health-driven demand has seen a significant uptick, especially post-2020, as consumers became more health-conscious due to the global health crisis. For instance, the use of turmeric, known for its anti-inflammatory and antioxidant properties, has increased in household kitchens worldwide. The WHO highlights that in regions like Southeast Asia, daily turmeric consumption per capita is approximately 2 to 2.5 grams.

Furthermore, government initiatives aimed at promoting natural and traditional medicines have bolstered the market. In India, for example, the Ministry of AYUSH promotes the use of Ayurvedic spices as part of a holistic approach to health. In 2024, the Indian government allocated INR 2,970 crores to this ministry, aiming to boost research and global awareness about traditional remedies, including spices.

Market Restraints

Supply Chain Volatility Challenges Spice Market Stability

A major restraining factor impacting the growth of the spices and seasonings market is the volatility of supply chains. The global nature of spice production and distribution means that disruptions in one part of the world can have significant ripple effects across the market.

Countries like India, Vietnam, and Indonesia, which are among the top producers of key spices such as pepper, cardamom, and cinnamon, often face agricultural challenges that disrupt supply. These challenges range from climate change effects, such as unseasonal rains or prolonged droughts, to socio-economic issues like labor shortages and political instability. For example, in 2024, unexpected monsoon patterns in Southern India led to a decrease in cardamom yields by over 20% compared to the previous year, significantly affecting global supplies.

Furthermore, the stringent quality control standards required in major importing countries add another layer of complexity. For instance, the European Union’s regulations on pesticide residues have led to the rejection of several spice shipments from Asia due to non-compliance, causing supply bottlenecks and increased costs for producers.

Market Opportunities

Expanding Global Cuisine Popularity Opens Doors for Spice Market Growth

One significant growth opportunity in the spices and seasonings market is the expanding popularity of global cuisines. As people around the world become more adventurous with their food choices, driven by travel and cultural exchange, there is a marked increase in the demand for authentic, diverse flavors, which directly boosts the spice market.

The United Nations World Tourism Organization (UNWTO) reported that exposure to different cultures through travel is one of the primary drivers behind the exploration of new cuisines at home. This trend has led to a spike in spice imports in regions like North America and Europe, where the diversity of food preferences continues to widen (UNWTO Cultural Tourism Report). In 2024, the U.S. alone saw an increase in spice imports by over 15%, a clear indicator of the growing appetite for global flavors.

Governments are also recognizing the economic potential of this trend and are supporting the spice industry through initiatives aimed at improving spice production quality and marketing. For example, the Indian government has launched the “Spice Route” project, which not only promotes the country’s spices globally but also aims to strengthen the supply chain infrastructure, ensuring that the quality of exports meets international standards.

Market Trends

Sustainability and Traceability Becoming Key Trends in the Spice Market

A major trend shaping the future of the spices and seasonings market is the growing importance of sustainability and traceability within the industry. Consumers are increasingly aware of the environmental impact of their purchases and are demanding more ethically sourced and sustainably produced spices.

The trend towards sustainability is driven by concerns over environmental conservation and social responsibility. Consumers are showing a preference for spices that are certified organic, non-GMO, and responsibly harvested. According to the Food and Agriculture Organization (FAO), there has been a significant increase in the demand for organic spices, with the global market for organic spices projected to grow by over 5% annually through 2025.

Governments and international bodies are supporting these trends through various initiatives. For example, the Spice Board of India has launched the ‘Traceability and Quality Upgradation’ project for major spices like pepper and cardamom, which focuses on improving the quality of produce while ensuring that farming techniques are environmentally sustainable and socially beneficial.

Regional Analysis

The Asia-Pacific (APAC) region holds a commanding position in the global spices and seasonings market, dominating with a substantial 74.20% market share, which translated to revenues of approximately USD 17.8 billion in 2024. This dominance is rooted deeply in the region’s rich culinary traditions and the extensive agricultural landscapes dedicated to spice cultivation.

Countries such as India, China, Vietnam, and Indonesia are pivotal within the APAC spice market, not only as top producers but also as major consumers and exporters. India, for instance, leads globally both in production and export, with a significant portion of its economy relying on spices. The Indian spice industry benefits from an established agricultural framework and government support, such as subsidies for organic farming and export incentives provided by the Spices Board of India.

China and Indonesia follow, leveraging their biodiverse environments to produce a wide variety of spices, including star anise, cloves, and pepper. These countries have adapted to the growing international demand for authentic and exotic flavors, integrating advanced processing technologies to enhance quality and shelf life, thereby supporting their strong export markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Competitive Landscape

Ajinomoto Co. Inc., headquartered in Japan, is renowned for its comprehensive range of flavor-enhancing products, including spices and seasonings. The company’s commitment to innovation in food science has cemented its position as a leader in the global market. Ajinomoto’s strategic focus on health and wellness trends, along with its strong distribution networks in Asia, North America, and Europe, enables it to meet the growing demand for nutritious and flavorful food solutions.

Sensient Technologies Corporation specializes in developing advanced technologies for flavors and colors, which include a vast portfolio of spices and seasonings. The company’s commitment to high-quality ingredients and sustainable practices appeals to food manufacturers seeking natural and organic seasoning options. Sensient’s global presence and continual investment in R&D ensure its competitiveness in the dynamic food additives market.

Маrkеt Кеу Рlауеrѕ

- Ajinomoto Co, Inc.

- Sensient Technologies Corporation

- Associated British Food PLC

- Kerry Group plc

- McCormick & Company Inc.

- Baria Pepper

- Döhler GmbH

- DS Group

- Everest Spices

- Unilever Group

- The Watkins Company

- The Spice House

Recent Development

In 2024, Associated British Foods plc (ABF) demonstrated strong performance in the spices and seasonings market, primarily through its grocery division, which includes brands like Schwartz and British Pepper & Spice. The company’s overall group revenue reached £20.1 billion, marking a 4% increase from the previous year, while adjusted operating profit rose by 32% to £1.998 billion .

In 2024, Ajinomoto Co., Inc. showcased robust performance in the spices and seasonings sector, a key component of its global food business. The company’s total revenue for the fiscal year ending March 31, 2024, reached ¥1.44 trillion, reflecting a 5.89% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 24.0 Bn Forecast Revenue (2034) USD 39.5 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product Type (Spices, Herbs, Salt and Salt Substitutes, Others), By Application (Meat and Poultry Products, Snacks and Convenience Food, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Products, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co. Inc., Sensient Technologies Corporation, Associated British Food PLC, Kerry Group plc, McCormick & Company Inc., Baria Pepper, Döhler GmbH, DS Group, Everest Spices, Unilever Group, The Watkins Company, The Spice House, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF).  Spices and Seasonings MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Spices and Seasonings MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Co, Inc.

- Sensient Technologies Corporation

- Associated British Food PLC

- Kerry Group plc

- McCormick & Company Inc.

- Baria Pepper

- Döhler GmbH

- DS Group

- Everest Spices

- Unilever Group

- The Watkins Company

- The Spice House