Global Specialty Vinegar Market Size, Share, Growth Analysis By Product (Balsamic Vinegar, Red Wine Vinegar, White Wine Vinegar, Rice Vinegar, Fruit Vinegar, Others), By Flavor (Plain/Unflavored, Flavored), By Type (Conventional, Organic), By End-use (Dressings And Condiments, Sauces, Pickled Items, Shelf-Stable Products, Prepared Foods, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158337

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

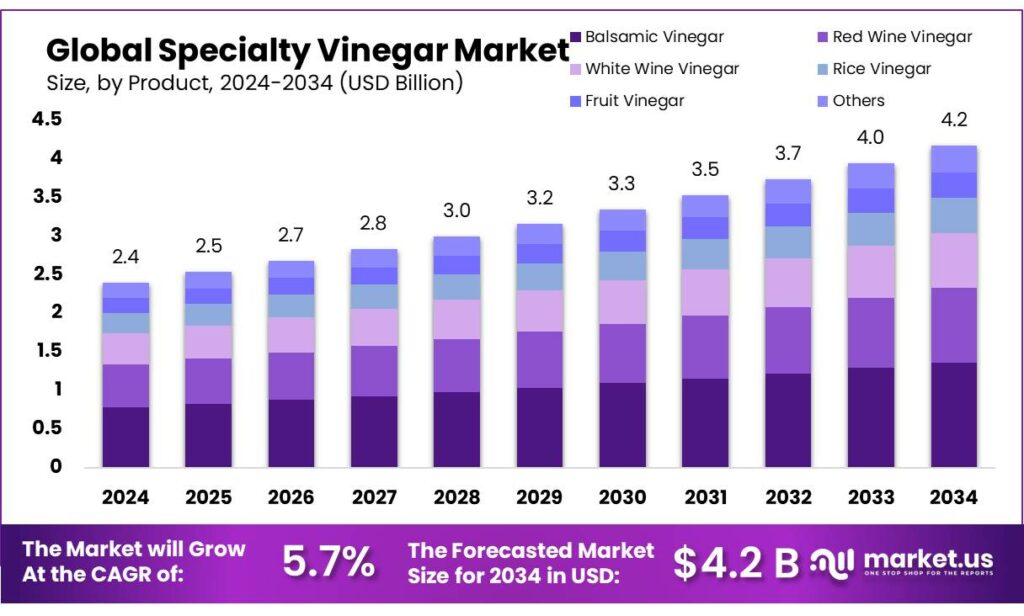

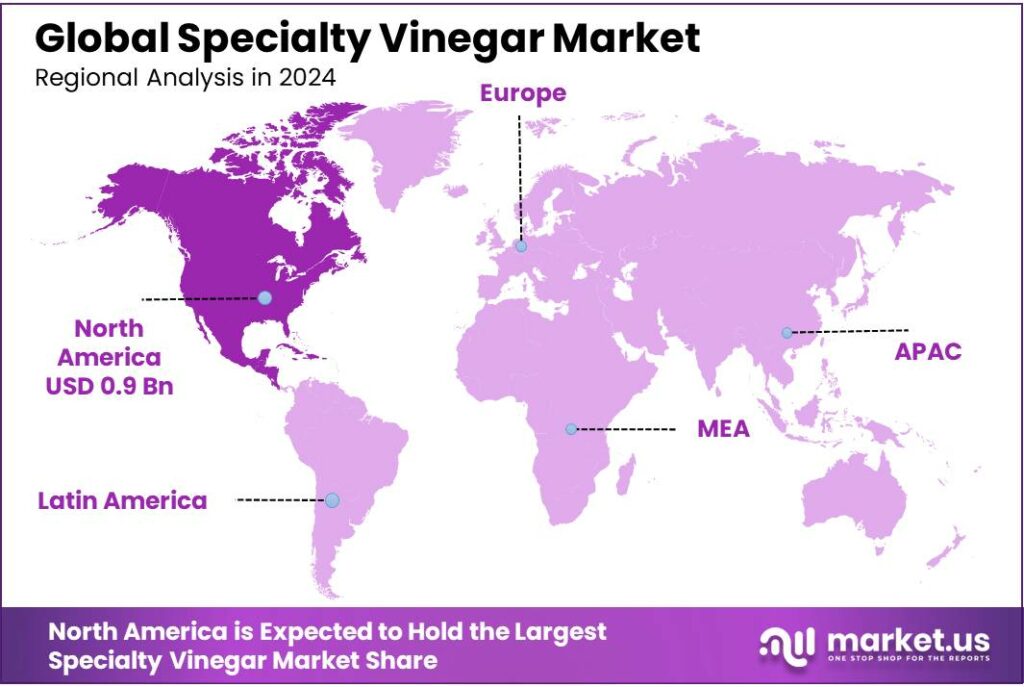

The Global Specialty Vinegar Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.3% share, holding USD 0.9 Billion in revenue.

The specialty vinegar industry in India is experiencing significant growth, driven by evolving consumer preferences, health consciousness, and supportive government initiatives. Specialty vinegars, including varieties like apple cider, rice, balsamic, and fruit-based vinegars, are gaining popularity due to their perceived health benefits and culinary versatility.

- In 2017, Hengshun allocated ¥120 million to implement a German-manufactured, fully automated bottling line capable of producing 24,000 bottles per hour, thereby becoming the sole condiment firm chosen for China’s national smart manufacturing demonstration initiative.

The Shanxi mature vinegar industry in China is another example of specialty vinegar production. In 2011, the output of Shanxi vinegar was about 600,000 tons, accounting for about 18% of the entire vinegar market in China, with aged vinegar accounting for about 70% of Shanxi vinegar. The government of Qingxu County, Shanxi Province, joined forces with 21 vinegar-making workshops to set up a public-private Qingxu Qu vinegar factory in Shanxi Province.

- Government initiatives and industry support have played a crucial role in the development of the specialty vinegar sector. For instance, the Zhenjiang Vinegar Industry Park in China serves as a model for integrating traditional vinegar production with modern industrial practices. Established in 1840, the park combines ancient brewing techniques with contemporary manufacturing processes, supporting a regional industrial cluster of over 40 vinegar firms with an annual output exceeding 300,000 tons.

Key Takeaways

- Specialty Vinegar Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 5.7%.

- Balsamic vinegar held a dominant position in the global vinegar market, capturing a 34.2% share.

- Plain/unflavored vinegar maintained a dominant position in the global specialty vinegar market, capturing a 68.2% share.

- Conventional vinegar maintained a dominant position in the global specialty vinegar market, capturing a 78.9% share.

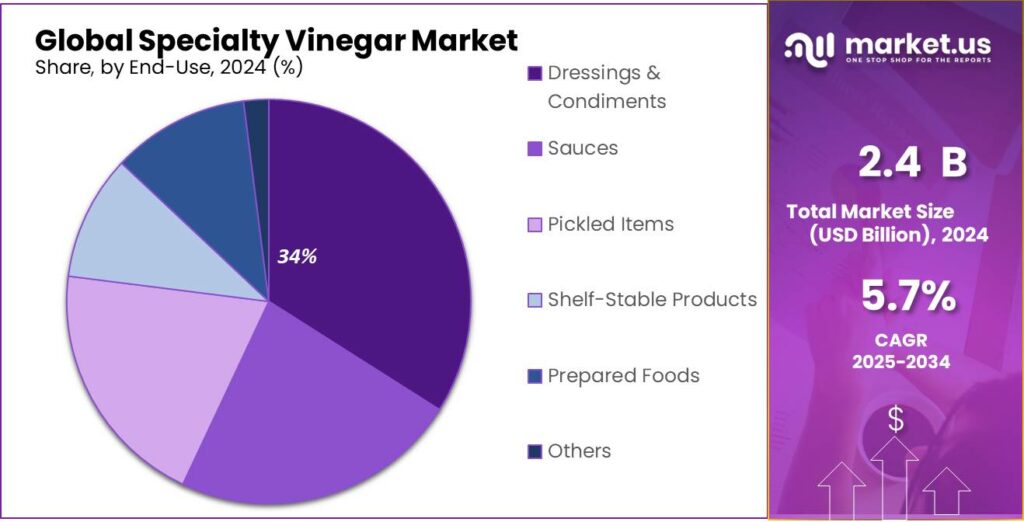

- Dressings and condiments sector held a dominant position in the specialty vinegar market, capturing more than a 34.5% share.

- Supermarkets and hypermarkets led the specialty vinegar market, holding a dominant share of 44.8%.

- North America emerged as the leading region in the global specialty vinegar market, capturing a 38.3% share, valued at approximately USD 0.9 billion.

By Product Analysis

Balsamic Vinegar Leads with 34.2% Market Share in 2024

In 2024, balsamic vinegar held a dominant position in the global vinegar market, capturing a 34.2% share. This significant market presence underscores its widespread popularity and preference among consumers worldwide. The rich, complex flavor profile of balsamic vinegar, coupled with its versatility in culinary applications, has contributed to its leading status. Its use in salad dressings, marinades, and gourmet dishes has made it a staple in both household kitchens and professional culinary settings.

The preference for balsamic vinegar is also reflected in its production and consumption patterns. Italy remains the largest producer, particularly in the Modena and Reggio Emilia regions, where traditional balsamic vinegar is crafted using time-honored methods. This artisanal approach, involving aging grape must for extended periods, imparts a unique depth of flavor that distinguishes traditional balsamic vinegar from its commercial counterparts.

By Flavor Analysis

Plain/Unflavored Vinegar Maintains 68.2% Market Share in 2024

In 2024, plain/unflavored vinegar maintained a dominant position in the global specialty vinegar market, capturing a 68.2% share. This substantial market presence underscores its widespread acceptance and preference among consumers worldwide. The neutral flavor profile of plain vinegar makes it a versatile ingredient in various culinary applications, including dressings, marinades, and pickling, contributing to its leading status in the market.

The preference for plain vinegar is also reflected in its production and consumption patterns. The United States, a significant player in the global vinegar market, has witnessed a steady increase in the production and consumption of plain vinegar, driven by its essential role in both household kitchens and the foodservice industry. This trend highlights the enduring popularity of plain vinegar as a staple ingredient in diverse culinary traditions.

By Type Analysis

Conventional Vinegar Dominates with 78.9% Market Share in 2024

In 2024, conventional vinegar maintained a dominant position in the global specialty vinegar market, capturing a 78.9% share. This substantial market presence underscores its widespread acceptance and preference among consumers worldwide. The affordability and established production infrastructure of conventional vinegar make it a staple in both household kitchens and the foodservice industry.

The preference for conventional vinegar is also reflected in its production and consumption patterns. The United States, a significant player in the global vinegar market, has witnessed a steady increase in the production and consumption of conventional vinegar, driven by its essential role in various culinary applications. This trend highlights the enduring popularity of conventional vinegar as a staple ingredient in diverse culinary traditions.

By End-use Analysis

Dressings & Condiments Lead with 34.5% Market Share in 2024

In 2024, the dressings and condiments sector held a dominant position in the specialty vinegar market, capturing more than a 34.5% share. This significant market presence underscores the widespread use of specialty vinegars in enhancing the flavor profiles of various culinary applications. Vinegars such as balsamic, apple cider, and rice vinegar are increasingly incorporated into salad dressings, marinades, sauces, and dips, driven by consumer preferences for natural and health-conscious ingredients.

The growth in this segment is further supported by the rising consumer demand for clean-label products, which are perceived as healthier alternatives to traditional condiments. Specialty vinegars, often produced through natural fermentation processes without artificial additives, align with these consumer trends, contributing to their popularity in dressings and condiments. Additionally, the versatility of specialty vinegars in culinary applications enhances their appeal among both home cooks and professional chefs.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Capture 44.8% of Specialty Vinegar Market in 2024

In 2024, supermarkets and hypermarkets led the specialty vinegar market, holding a dominant share of 44.8%. This significant market presence is attributed to their extensive reach, diverse product offerings, and the convenience they provide to consumers. These retail giants offer a wide variety of specialty vinegars, including balsamic, apple cider, and rice vinegars, catering to the growing demand for gourmet and health-conscious products.

The dominance of supermarkets and hypermarkets in the specialty vinegar market is further supported by their strategic location in urban and suburban areas, making them easily accessible to a broad customer base. Their ability to stock a wide range of products, from premium organic vinegars to more affordable options, ensures they meet the diverse preferences of consumers.

Key Market Segments

By Product

- Balsamic Vinegar

- Red Wine Vinegar

- White Wine Vinegar

- Rice Vinegar

- Fruit Vinegar

- Others

By Flavor

- Plain/Unflavored

- Flavored

- Apple

- Garlic

- Herbs

- Raspberry

- Fig

- Others

By Type

- Conventional

- Organic

By End-use

- Dressings & Condiments

- Sauces

- Pickled Items

- Shelf-Stable Products

- Prepared Foods

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

Emerging Trends

Premiumization and Artisanal Appeal in Specialty Vinegar

In recent years, the specialty vinegar market has experienced a significant shift towards premiumization, with consumers increasingly seeking high-quality, artisanal products. This trend is driven by a growing interest in gourmet cooking, health-conscious eating, and a desire for unique culinary experiences. Specialty vinegars, such as aged balsamic, apple cider, and fruit-infused varieties, are gaining popularity for their complex flavors and perceived health benefits.

Government initiatives have further supported this trend by promoting the production and consumption of high-quality, artisanal products. In China, the Zhenjiang Vinegar Industry Park serves as a pivotal location for vinegar production, integrating traditional brewing methods with modern industrial frameworks. Established in 1840, Hengshun Vinegar, a key producer in the region, has been recognized for its “solid-state layered fermentation” method, designated as a national intangible cultural asset in 2006.

The premiumization trend is also evident in the product offerings of leading specialty vinegar producers. For example, Carandini, a historic producer of Balsamic Vinegars from Modena, Italy, launched its Organic Silver Leaf Balsamic Vinegar of Modena PGI in the U.S. market in August 2022. This medium-density vinegar, made with 31% organic grape must and organic wine vinegar, is now available nationwide, including at Walmart, highlighting the shift towards more eco-friendly and health-conscious options.

Drivers

Government Support and Policy Initiatives

A significant driving factor for the growth of specialty vinegars lies in the robust support provided by governments worldwide through various initiatives and policies aimed at promoting sustainable agriculture, preserving traditional food practices, and enhancing food safety.

- For instance, the Zhenjiang Vinegar Industry Park, recognized as a National Productive Protection Demonstration Base for Intangible Cultural Heritage, integrates ancient brewing artistry with contemporary industrial frameworks, fostering both cultural heritage and industrial development. This initiative has contributed to a regional industrial cluster of 43 vinegar firms, with an annual output surpassing 300,000 tons, accounting for over 10% of the national production. In 2019, the park’s primary business revenue amounted to ¥3.03 billion, highlighting the economic impact of such government-supported endeavors.

Similarly, in Japan, the government has supported the vinegar industry through various measures, including subsidies for traditional brewing methods and promotional activities to enhance the global presence of Japanese vinegars. These efforts have led to increased exports and recognition of Japanese vinegars in international markets.

In Italy, the government has implemented policies to protect and promote traditional balsamic vinegar production, including the establishment of the Protected Designation of Origin (PDO) status for authentic balsamic vinegar. This designation ensures quality standards and helps preserve traditional production methods, contributing to the growth of the specialty vinegar market in the region.

Restraints

Regulatory Challenges and Compliance Costs

One of the most significant barriers to the growth of the specialty vinegar industry is the complex and stringent regulatory landscape that producers must navigate. These regulations, while essential for ensuring food safety and quality, can impose substantial compliance costs and operational hurdles, particularly for small and medium-sized enterprises (SMEs).

In the United States, the production of vinegar is subject to various federal and state regulations. For instance, the Alcohol and Tobacco Tax and Trade Bureau (TTB) requires producers to obtain formula approval for nonbeverage wines used in vinegar production. This process involves detailed documentation and adherence to specific production methods, which can be resource-intensive for smaller producers.

- Additionally, the U.S. Food and Drug Administration (FDA) enforces current Good Manufacturing Practices (cGMPs) under Title 21, Part 110 of the Code of Federal Regulations. These guidelines mandate rigorous standards for sanitation, equipment maintenance, and quality control, necessitating significant investment in facilities and training.

State-level regulations further complicate the compliance landscape. For example, in Michigan, the production of fermented foods, including vinegar, requires a license under the Michigan Food Law. This regulation ensures that such products are produced in facilities that meet specific safety and quality standards.

Opportunity

Surge in Health-Conscious Consumer Demand

This upward trajectory is fueled by increasing consumer awareness of the health benefits associated with specialty vinegars. Products like apple cider vinegar, balsamic vinegar, and rice vinegar are gaining popularity due to their perceived advantages in digestion, weight management, and antioxidant properties. The growing inclination towards natural and minimally processed foods further propels this demand.

Retailers are responding to this trend by expanding their offerings of specialty vinegars. Supermarkets, hypermarkets, and online platforms are introducing a diverse range of products, including organic and flavored variants, to cater to the evolving preferences of health-conscious consumers. This accessibility is enhancing consumer engagement and driving market growth.

Government initiatives also play a pivotal role in supporting the specialty vinegar market. For instance, in China, the Zhenjiang Vinegar Industry Park serves as a model for integrating traditional vinegar production with modern industry and tourism. Established in 1840, it combines ancient brewing techniques with contemporary industrial frameworks, promoting the region’s vinegar culture and contributing to its economic development.

Similarly, in Shanxi Province, the Shanxi Mature Vinegar industry has received governmental support through regulations protecting its unique production methods and designations as a national intangible cultural heritage. This recognition helps preserve traditional practices while fostering industry growth.

Regional Insights

North America Dominates the Specialty Vinegar Market with 38.3% Share in 2024

In 2024, North America emerged as the leading region in the global specialty vinegar market, capturing a 38.3% share, valued at approximately USD 0.9 billion. This dominance is primarily driven by the United States, which accounted for a significant portion of the market share. This trend is particularly evident in the increasing adoption of apple cider vinegar by nutraceutical brands and wellness cafés, reshaping sourcing channels and boosting demand for organic, unfiltered vinegar with health-forward positioning.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Acetum S.p.A., headquartered in Cavezzo, Italy, stands as the world’s largest producer of Balsamic Vinegar of Modena PGI. With a robust export presence in over 100 countries, Acetum specializes in premium vinegars, including traditional and organic varieties, catering to both retail and foodservice sectors. The company emphasizes sustainability and transparency across its supply chain, ensuring high-quality products that honor Italian culinary traditions.

Founded in 1912 by Paul Bragg, Bragg Live Food Products is a U.S.-based company specializing in organic apple cider vinegar and wellness-focused food products. Known for its raw, unfiltered vinegars containing “the mother,” Bragg has expanded its product line to include supplements, dressings, and seasonings. The brand has gained popularity among health-conscious consumers seeking natural wellness solutions.

Colavita S.p.A., founded in 1938 in Italy, is a family-owned company recognized for its olive oil and vinegar products. The company offers a variety of vinegars, including balsamic, red and white wine, and specialty vinegars, produced using traditional methods in the Molise region. Colavita emphasizes quality and authenticity, promoting Italian culinary heritage worldwide.

Top Key Players Outlook

- Acetum S.p.A.

- Aspall Cyder Ltd.

- Bragg Live Food Products

- Colavita S.p.A.

- Fini Group

- García de la Cruz

- Kühne Group

- Mizkan Holdings Co., Ltd.

- Oro Bailen

- Sonoma Vinegar

Recent Industry Developments

In 2024 Acetum S.p.A., continued to solidify its position as a market leader by producing and aging over 20 million liters of PGI-certified balsamic vinegar across its four state-of-the-art facilities in Modena.

In 2024, Bragg continued to innovate and expand its product offerings, introducing new formats such as the 10 oz ACV bottle to increase accessibility and meet consumer demand for convenient wellness solutions.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 4.2 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Balsamic Vinegar, Red Wine Vinegar, White Wine Vinegar, Rice Vinegar, Fruit Vinegar, Others), By Flavor (Plain/Unflavored, Flavored), By Type (Conventional, Organic), By End-use (Dressings And Condiments, Sauces, Pickled Items, Shelf-Stable Products, Prepared Foods, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Acetum S.p.A., Aspall Cyder Ltd., Bragg Live Food Products, Colavita S.p.A., Fini Group, García de la Cruz, Kühne Group, Mizkan Holdings Co., Ltd., Oro Bailen, Sonoma Vinegar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acetum S.p.A.

- Aspall Cyder Ltd.

- Bragg Live Food Products

- Colavita S.p.A.

- Fini Group

- García de la Cruz

- Kühne Group

- Mizkan Holdings Co., Ltd.

- Oro Bailen

- Sonoma Vinegar