Global Specialty Gas Market By Product(Ultra-high Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, Others), By End-use(Electronics and Semiconductors, Healthcare, Automotive, Manufacturing, Food and Beverage, Chemicals, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129188

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

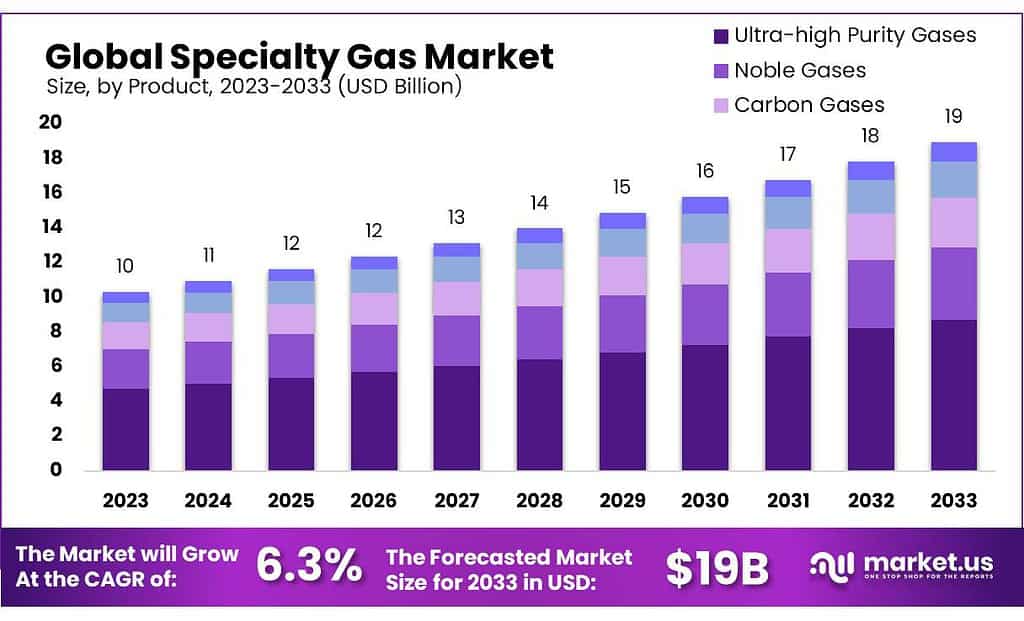

The global Specialty Gas Market size is expected to be worth around USD 19 billion by 2033, from USD 10 billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2033.

The specialty gas market is a dynamic segment within the gas industry, distinguished by its production and distribution of high-purity gases designed for specific applications across diverse sectors. These gases, including nitrogen, oxygen, argon, helium, hydrogen, and various gas mixtures, are pivotal in several critical areas ranging from healthcare to electronics and manufacturing.

For example, in healthcare, these gases are essential for respiratory therapies and anesthesia, while in the electronics industry, they are indispensable for semiconductor manufacturing processes such as etching and deposition.

This market is on a trajectory of significant growth, with projections indicating a potential reach of approximately USD 35 billion by 2026. This expansion is largely driven by escalating demands for advanced materials and sophisticated technologies across various industries.

Regulatory frameworks, particularly those aimed at curtailing emissions and enhancing safety standards, also play a crucial role in shaping market dynamics. These regulations encourage the adoption of environmentally friendly and efficient gases, influencing the development and uptake of alternative options like hydrofluorocarbon (HFCs) replacements, which are seeing substantial growth.

Moreover, the international trade landscape for specialty gases has been evolving, marked by a 12% increase in U.S. exports from 2020 to 2022, with significant demand noted in Europe and Asia. These regions are expanding their industrial bases and require high-purity gases for advanced manufacturing processes, further stimulating market growth.

Government initiatives such as the European Union’s Green Deal underscore a commitment to reducing emissions and fostering cleaner technologies. This policy not only supports environmental goals but also catalyzes the specialty gas industry by funding research and enhancing gas production methods.

Concurrently, private sector investments are surging, with major companies like Air Products and Linde channeling substantial resources into expanding production capacities and developing new gas technologies. For instance, Air Products’ investment of USD 2 billion into a hydrogen production facility showcases the integration of specialty gases in producing cleaner energy solutions, highlighting ongoing innovations within the sector.

Key Takeaways

- The global specialty gas market is expected to expand from USD 10 billion in 2023 to USD 19 billion by 2033, growing at a CAGR of 6.3%.

- In 2023, ultra-high purity gases captured 46.4% of the market, crucial for sectors like semiconductors and pharmaceuticals due to their contamination-free properties.

- The electronics and semiconductor sector accounted for 38.5% of the market in 2023, driven by high demand for precision gases in manufacturing processes like etching and deposition.

- Asia-Pacific (APAC) led the market in 2023, holding 39% of the global share, with significant growth driven by China, Japan, and South Korea’s industrial sectors.

By Product

In 2023, ultra-high purity gases held a dominant market position, capturing more than a 46.4% share of the specialty gas market. These gases are primarily utilized in sectors where exceptional purity is crucial, such as the semiconductor and pharmaceutical industries. Their extensive use is driven by the critical need for contamination-free environments in the manufacturing processes of electronics and precise pharmaceutical applications.

Noble gases also represent a significant segment of the market. These include gases like argon, helium, and neon, which are essential in lighting, welding, and in cooling processes in nuclear reactors. The unique properties of noble gases, such as non-reactivity and high stability, make them invaluable across various applications.

Carbon gases, comprising carbon dioxide, carbon monoxide, and others, are utilized in the food and beverage industry for carbonation and packaging, as well as in metal fabrication and medical applications. Their versatility supports steady demand within the specialty gas market.

Halogen gases, which include fluorine, chlorine, and bromine gases, are critical in chemical synthesis and refrigeration applications. Their reactive nature and effectiveness in various industrial processes ensure their continued relevance in the specialty gases market.

By End-use

In 2023, the electronics and semiconductors sector held a dominant market position in the specialty gas industry, capturing more than a 38.5% share. This sector relies heavily on ultra-high purity gases for various critical processes, including etching, deposition, and lithography in semiconductor manufacturing. The precision required in these applications underscores the necessity for high-quality specialty gases.

Healthcare follows closely, utilizing specialty gases for a range of applications such as medical imaging, clinical diagnostics, and patient care. Gases like nitrous oxide and oxygen are vital for anesthesia and respiratory therapies, reflecting their indispensable role in modern medicine.

The automotive industry also integrates specialty gases in significant ways, particularly in air conditioning systems and during the manufacturing process of components where inert atmospheres are necessary. This usage underscores the sector’s reliance on gases like argon and helium.

Manufacturing sectors leverage specialty gases for various applications, including metal fabrication and precision cutting. Gases such as nitrogen and carbon dioxide are utilized for their properties that enhance safety and efficiency in manufacturing processes.

The food and beverage industry uses specialty gases primarily for packaging and preservation. Carbon dioxide, for instance, is essential for the carbonation of beverages and for creating inert atmospheres in packaging, which extends the shelf life of products.

In the chemicals industry, specialty gases are used as raw materials and catalysts in chemical synthesis processes. The precise and controlled reactions necessitated by this sector make specialty gases crucial for ensuring product quality and process efficiency.

Market Key Segments

By Product

- Ultra-high Purity Gases

- Noble Gases

- Carbon Gases

- Halogen Gases

- Others

By End-use

- Electronics and Semiconductors

- Healthcare

- Automotive

- Manufacturing

- Food and Beverage

- Chemicals

- Others

Drivers

Rapid Growth in the Semiconductor Industry

One of the primary driving factors for the specialty gas market is the rapid growth of the semiconductor industry. As the demand for consumer electronics, including smartphones, tablets, and other digital devices, continues to rise, so too does the need for semiconductors, which are essential components in these products. Specialty gases play a critical role in the manufacturing of semiconductors, particularly in processes such as etching and deposition, where high-purity gases are indispensable for ensuring product quality and efficiency.

The global semiconductor market is projected to reach approximately USD 1 trillion by 2030, growing at a compound annual growth rate (CAGR) of around 8.6%. This expansion is primarily driven by advancements in technology and increasing consumer demand for electronic devices.

Specialty gases required in the semiconductor manufacturing process, such as ultra-high purity ammonia, nitrogen, and argon, have seen a surge in demand paralleling the growth of the semiconductor industry.

Governments worldwide are investing in the semiconductor industry to bolster their technological infrastructure and reduce dependency on international suppliers. For example, the U.S. CHIPS Act represents a significant government effort, allocating over USD 52 billion to stimulate domestic semiconductor production, which indirectly benefits the specialty gas market by increasing demand for the gases used in chip manufacturing.

Similarly, the European Union has launched initiatives aimed at doubling its share of the global semiconductor market by 2030, further driving the demand for specialty gases used in manufacturing processes.

Innovations in semiconductor technology, such as the development of smaller and more powerful microchips, require increasingly sophisticated manufacturing processes, including the use of specialty gases. The shift towards more advanced chip technology, such as 5G chips and AI-driven components, underlines the growing need for specialty gases that can meet stringent purity and performance standards.

The rise of the Internet of Things (IoT) and smart devices continues to drive the semiconductor market and, by extension, the specialty gas market. As devices become more interconnected, the complexity and quantity of semiconductors required grow, further pushing the demand for the precision provided by specialty gases in the manufacturing process.

The environmental impact of semiconductor manufacturing, which involves the use of potent greenhouse gases, has led to regulatory and industry-led initiatives aimed at reducing emissions. This environmental focus is prompting the development of new, more sustainable specialty gas solutions that reduce the ecological footprint of semiconductor production.

Restraints

Stringent Environmental Regulations and High Production Costs

One of the most significant restraining factors for the specialty gas market is the stringent environmental regulations coupled with the high production costs associated with these gases. As governments globally intensify their focus on environmental protection, the specialty gas industry faces increasing challenges due to the potential environmental impacts of gas production and usage.

Specialty gases, particularly those used in the electronics and semiconductor industries, such as perfluorocarbons (PFCs) and sulfur hexafluoride (SF6), are potent greenhouse gases. Regulatory bodies worldwide, including the Environmental Protection Agency (EPA) in the U.S. and the European Environment Agency (EEA) in the EU, have implemented strict regulations to curb emissions from these gases. The EPA, for example, mandates comprehensive reporting and direct regulation of emissions, which significantly impacts the operational flexibility of companies in the specialty gas sector.

The Kyoto Protocol and subsequent agreements under the United Nations Framework Convention on Climate Change have set specific targets for reducing greenhouse gas emissions, directly affecting industries reliant on high-global-warming-potential (GWP) gases. Compliance with these international standards requires substantial investment in control technologies and can lead to increased operational costs.

The production of specialty gases demands high purity and exacting standards, which involve complex and costly production processes. For instance, the purification processes necessary to achieve the required purity levels for electronics applications can be energy-intensive and require advanced technology, significantly driving up costs.

The investment in research and development (R&D) needed to innovate and develop less environmentally impactful alternatives or more efficient production methods also adds to the financial burden for companies in the specialty gas market. This is particularly impactful for smaller players who might not have the capital to invest heavily in R&D or to adapt quickly to regulatory changes.

The combination of high production costs and stringent regulatory compliance demands can limit market entry for new players and restrict the expansion of existing ones. This is especially true in regions with particularly harsh regulatory environments or where the infrastructure for environmentally friendly technologies is lacking.

Opportunities

Expansion in the Healthcare Sector

One of the most promising growth opportunities for the specialty gas market lies in the expanding healthcare sector. As the global population ages and healthcare standards rise worldwide, there is an increasing demand for medical gases used in various applications, from respiratory therapies to diagnostic procedures. This trend presents a significant opportunity for growth within the specialty gas industry.

Medical gases such as oxygen, nitrous oxide, and carbon dioxide are crucial in hospitals and healthcare facilities for patient care, anesthesia, and sterilization processes. This growth is driven by the worldwide increase in surgical procedures, emergency care, and a heightened focus on home healthcare, where specialty gases are increasingly used.

The demand for ultra-high purity gases in medical applications is particularly notable. These gases must meet stringent purity standards because they are directly administered to patients or used in sensitive medical devices.

Many governments are recognizing the critical role of healthcare in ensuring public health and are increasing their healthcare spending accordingly. For instance, the European Union has allocated substantial funds for healthcare development under its various health programs, with significant portions directed towards enhancing hospital infrastructure and capabilities, including medical gas provisions.

In the United States, the CARES Act and other healthcare-related funding initiatives have included provisions to bolster the medical gas supply chain, ensuring that hospitals and healthcare providers have the necessary resources to manage both routine medical needs and emergent health crises.

The integration of technology in healthcare, such as the rise of telemedicine and home healthcare equipment, also supports the growing demand for medical gases. These technologies often rely on specialty gases for their operation and maintenance, creating new avenues for specialty gas providers.

Innovations in gas application equipment and systems, such as more efficient and safer gas delivery methods, are opening up new markets for specialty gases within the healthcare sector.

Regulatory bodies are also updating and tightening standards around medical gas purity and delivery systems, which prompts ongoing innovation and upgrades in the specialty gas industry to meet these new standards. Compliance with these regulations ensures high standards of patient safety and care quality, driving trust and reliability in specialty gas products.

Despite the opportunities, the market faces challenges such as regulatory complexities and the need for continuous investment in technology to meet healthcare standards. Companies aiming to capitalize on this growth potential must navigate these challenges by investing in R&D, adhering to stringent regulatory standards, and forming strategic partnerships with healthcare providers and equipment manufacturers.

Latest Trends

Integration of Digital Technologies in Specialty Gas Management

One of the major trends reshaping the specialty gas market is the integration of digital technologies into gas management and distribution systems. As industries seek greater efficiency and precision in their operations, the adoption of advanced digital solutions is becoming increasingly prevalent. This trend is significantly driven by the need to enhance safety, improve tracking, and optimize the use of specialty gases in various applications.

The integration of Internet of Things (IoT) technology in specialty gas containers and cylinders is allowing for real-time tracking of gas levels, usage, and location. This capability not only enhances operational efficiency but also improves safety by providing exact data on gas conditions and potential leaks. For example, major gas companies are implementing IoT sensors that can detect changes in pressure and temperature, alerting managers to any irregularities that could indicate safety issues.

Automation technologies are being increasingly deployed to handle specialty gases, reducing human error and increasing efficiency in processes such as gas filling, mixing, and distribution. Automated systems ensure that gases are handled in precisely controlled environments, which is crucial for maintaining purity and preventing contamination.

Advanced data analytics are being used to better predict gas usage patterns and optimize supply chains. By analyzing historical data and current usage trends, companies can forecast future demand more accurately, reducing wastage and ensuring adequate supply. This trend is particularly important in industries like electronics and pharmaceuticals, where the precise management of specialty gases directly impacts production quality and yield.

With increasing environmental regulations, companies are using digital tools to ensure compliance with local and global standards. Technologies that monitor and report on emissions and environmental impact are critical for companies to maintain their operational licenses and avoid penalties. For instance, digital systems that integrate with regulatory reporting mechanisms can streamline the compliance process, making it easier for companies to adhere to stringent environmental standards.

Digital technologies are playing a crucial role in enhancing safety measures within the specialty gases sector. Systems equipped with AI and machine learning can predict potential failures or safety risks by analyzing data trends, enabling preventive maintenance and reducing the likelihood of accidents.

Regional Analysis

The global specialty gas market displays distinct regional trends, with Asia Pacific (APAC) leading the market. APAC dominates the specialty gas sector, holding 39% of the total market share, which translates to approximately USD 4.1 billion in 2023. This dominance is attributed to the region’s robust industrialization and expanding electronics, healthcare, and semiconductor industries, particularly in China, Japan, and South Korea. Increasing investments in manufacturing, coupled with the rising demand for specialty gases in electronics manufacturing, position APAC as the primary growth driver.

North America follows as a significant market player, driven by advancements in industries such as healthcare, automotive, and aerospace. The United States, in particular, leads the region, benefiting from its established semiconductor and pharmaceutical sectors, which rely heavily on high-purity specialty gases. The region’s strong R&D initiatives also contribute to the growing demand.

In Europe, specialty gases find substantial demand in the automotive and chemical sectors, especially in Germany, France, and the UK. The European market is further supported by stringent environmental regulations that drive the adoption of clean energy and advanced manufacturing processes, fueling demand for specialty gases.

The Middle East & Africa market is emerging, spurred by growing industrial activities and the increasing importance of specialty gases in the oil and gas sector. Countries like Saudi Arabia and the UAE are seeing rising demand for specialty gases in refining and petrochemical applications.

Latin America, although a smaller market, is witnessing growth in sectors like healthcare and metal fabrication, particularly in Brazil and Mexico, signaling the potential for future expansion across the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The specialty gas market is highly competitive, with key global players driving innovation and market expansion. Air Liquide and Linde plc are prominent leaders, leveraging their extensive product portfolios and strong global presence.

These companies are heavily invested in research and development to meet the growing demand for high-purity gases, particularly in sectors like healthcare, electronics, and chemicals. Air Products and Chemicals, Inc. also plays a critical role, focusing on specialty gas solutions for the semiconductor and manufacturing industries, while expanding its capabilities through technological advancements and strategic partnerships.

Other notable companies include Messer Group GmbH, which is known for its regional dominance in Europe and its focus on sustainable gas solutions. Taiyo Nippon Sanso Corporation and Iwatani Corporation of America are key players in the Asia Pacific market, catering to the growing demand for specialty gases in the electronics and automotive sectors.

Regional players like Coregas in Australia and ILMO Products Company in the U.S. maintain a strong presence in niche markets, offering customized gas solutions. Additionally, companies like SHOWA DENKO K.K. and Mitsui Chemicals, Inc. contribute to the specialty gas market with their expertise in industrial and chemical applications, further diversifying the competitive landscape.

Market Key Players

- Air Liquide

- Air Products and Chemicals, Inc.

- Coregas

- ILMO Products Company

- Iwatani Corporation of America

- Linde plc

- MESA Specialty Gases & Equipment

- Messer Group GmbH

- Mitsui Chemicals, Inc.

- Norco Inc.

- SHOWA DENKO K.K.

- Taiyo Nippon Sanso Corporation

- Weldstar

- YUEYANG KAIMEITE ELECTRONIC AND SPECIALTY RARE GASES CO.

Recent Developments

ILMO continues to focus on innovation and expanding its specialty gas offerings. The company operates out of multiple locations, including its ISO-accredited lab, which distributes gases across North America and internationally to regions like South America and Europe.

in 2023, Iwatani strengthened its U.S. industrial gas operations by acquiring Aspen Air US, further expanding its gas production and distribution capabilities.

Report Scope

Report Features Description Market Value (2023) US$ 10 Bn Forecast Revenue (2033) US$ 19 Bn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Ultra-high Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, Others), By End-use(Electronics and Semiconductors, Healthcare, Automotive, Manufacturing, Food and Beverage, Chemicals, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Air Liquide, Air Products and Chemicals, Inc., Coregas, ILMO Products Company, Iwatani Corporation of America, Linde plc, MESA Specialty Gases & Equipment, Messer Group GmbH, Mitsui Chemicals, Inc., Norco Inc., SHOWA DENKO K.K., Taiyo Nippon Sanso Corporation, Weldstar, YUEYANG KAIMEITE ELECTRONIC AND SPECIALTY RARE GASES CO. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Liquide

- Air Products and Chemicals, Inc.

- Coregas

- ILMO Products Company

- Iwatani Corporation of America

- Linde plc

- MESA Specialty Gases & Equipment

- Messer Group GmbH

- Mitsui Chemicals, Inc.

- Norco Inc.

- SHOWA DENKO K.K.

- Taiyo Nippon Sanso Corporation

- Weldstar

- YUEYANG KAIMEITE ELECTRONIC AND SPECIALTY RARE GASES CO.