Global Space Weather Insurance Market Size, Share and Analysis Report By Coverage Type (Satellite Insurance, Power Grid Insurance, Aviation Insurance, Communication & Navigation Insurance, Others), By End-User (Aerospace & Defense, Energy & Utilities, Telecommunications, Aviation, Others), By Distribution Channel (Direct, Brokers, Others), By Provider Type (Private, Government, Consortium), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176873

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Current Adoption and Penetration Insights

- By Coverage Type

- By End User

- By Distribution Channel

- By Provider Type

- Regional Perspective

- Customer Impact: Trends and Disruptors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

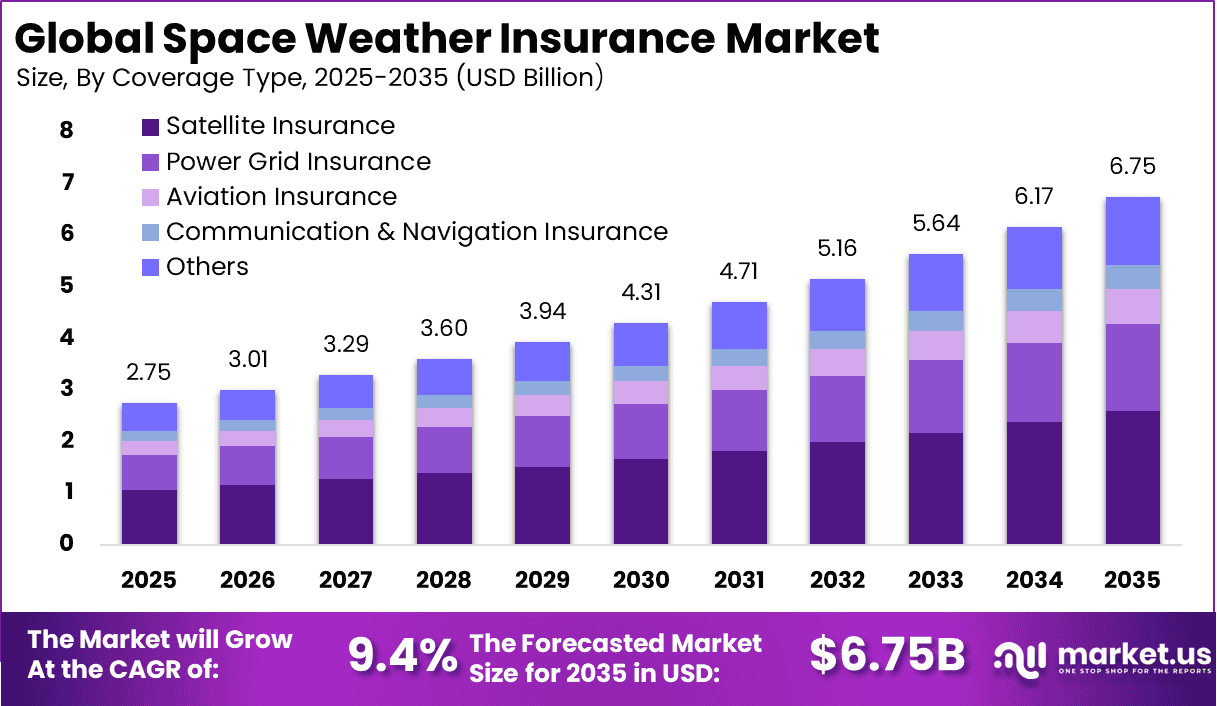

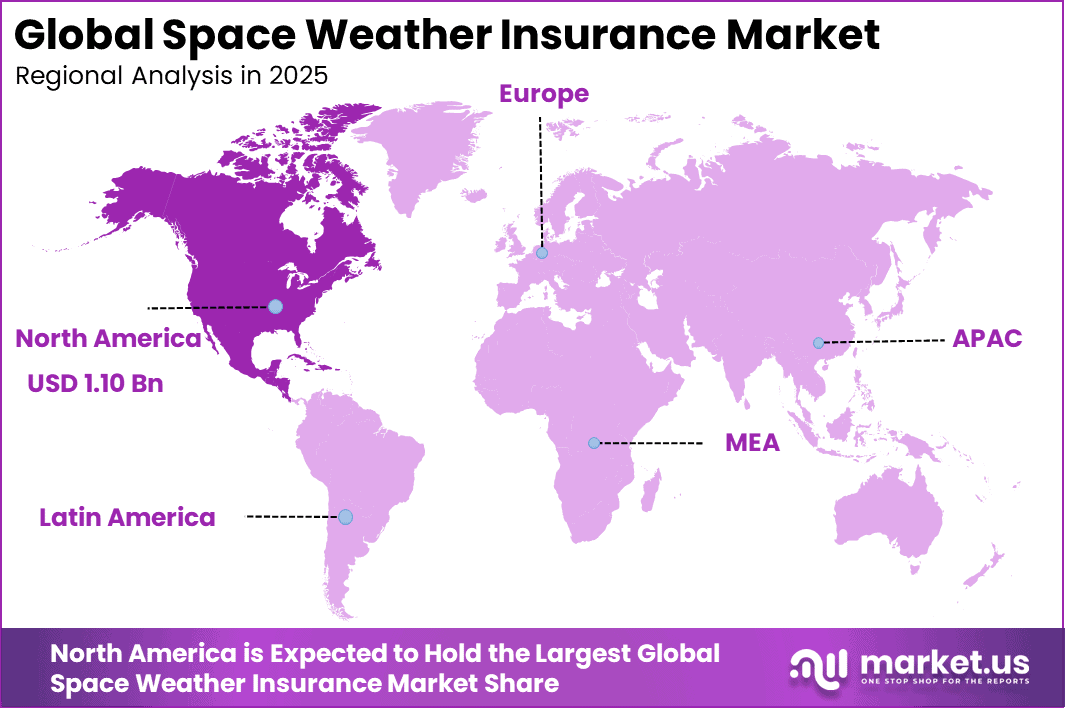

The Global Space Weather Insurance Market size is expected to be worth around USD 6.75 billion by 2035, from USD 2.75 billion in 2025, growing at a CAGR of 9.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 40.2% share, holding USD 1.10 billion in revenue.

The space weather insurance market addresses financial risk protection related to disruptions caused by solar activity such as geomagnetic storms, solar flares, and coronal mass ejections. These events can interfere with satellite operations, navigation systems, power grids, aviation communications, and other technology dependent infrastructure. Space weather insurance is increasingly viewed as a niche but critical component of catastrophe and specialty insurance portfolios.

Key driver factors shaping this market include growing dependence on satellite based services, rising exposure of critical infrastructure to electromagnetic disturbances, and improved scientific understanding of space weather risks. As economic activity becomes more reliant on uninterrupted digital and space enabled systems, demand for insurance solutions that address low frequency but high impact space weather events continues to strengthen.

Key Takeaway

- In 2025, the Satellite Insurance segment led the global space weather insurance market with a 38.5% share, driven by growing exposure of satellites to solar storms, geomagnetic disturbances, and radiation risks.

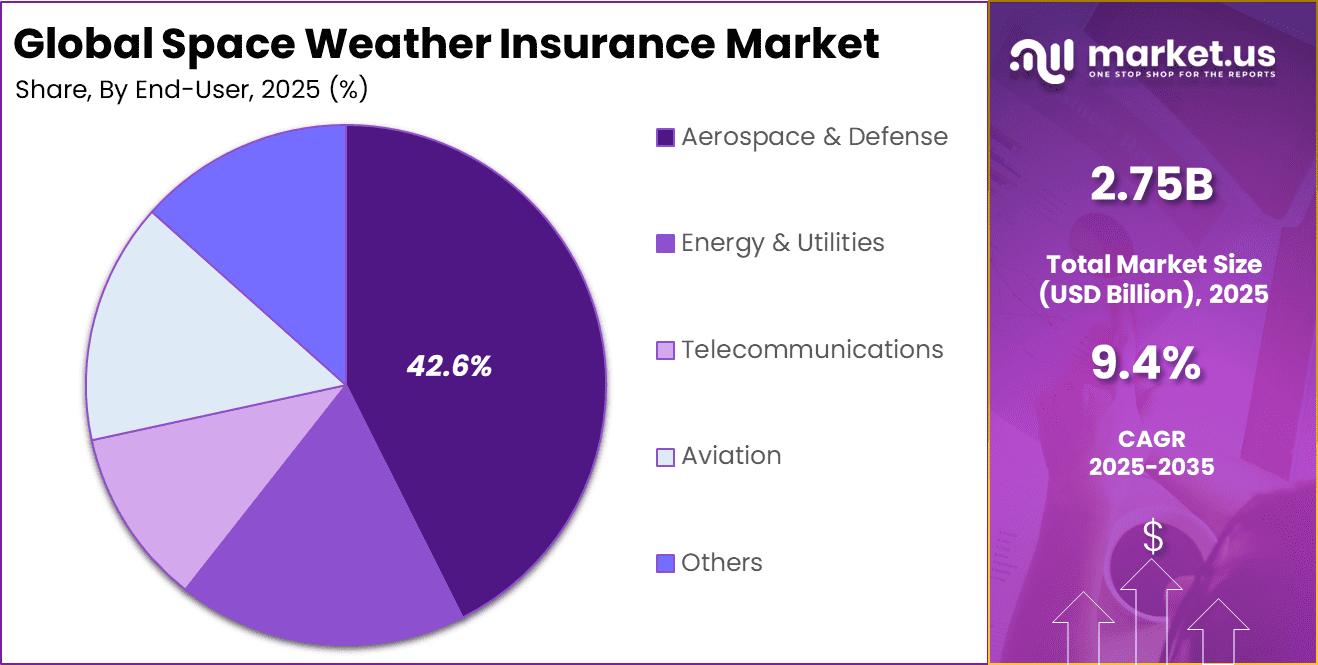

- The Aerospace & Defense segment accounted for 42.6%, reflecting high insurance demand from government agencies and defense operators relying on space-based assets for communication, navigation, and surveillance.

- The Direct distribution segment dominated with 58.4%, indicating a strong preference among large operators for direct insurer engagement to secure customized coverage and faster risk assessment.

- The Private sector segment captured 54.5%, supported by rising private investment in satellite launches, commercial space missions, and space-based services.

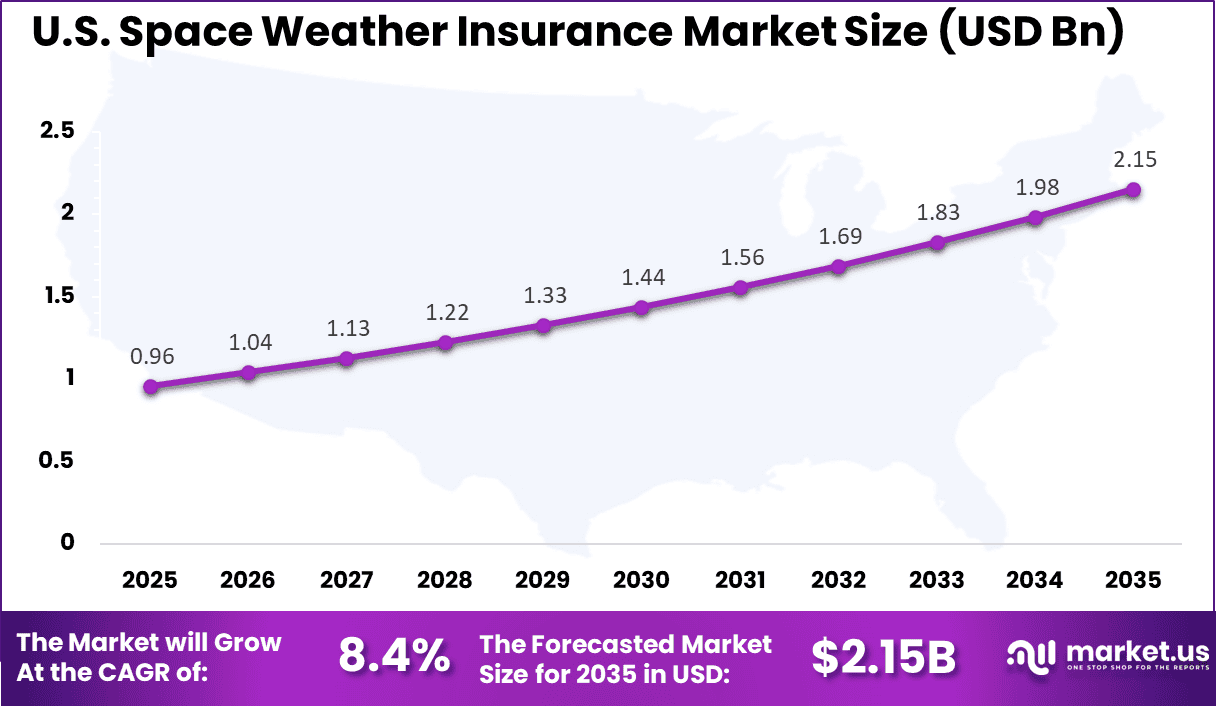

- The U.S. space weather insurance market was valued at USD 0.96 billion in 2025 and is expanding at a CAGR of 8.4%, driven by high satellite density and advanced space infrastructure.

- North America held a leading 40.2% global share in 2025, supported by strong space industry presence, mature insurance frameworks, and increasing awareness of space weather-related financial risks.

Current Adoption and Penetration Insights

- Total insured satellites: Of an estimated 10,000-13,000 active satellites in orbit during 2024-2025, only around 300 are fully insured for in-orbit operations, indicating low overall penetration.

- Geostationary orbit (GEO): Insurance adoption remains relatively strong, with about 43%-50% of commercial GEO satellites carrying in-orbit coverage due to high asset value and long operational lifespans.

- Low-Earth orbit (LEO): Coverage is extremely limited, with fewer than 50-63 satellites, representing less than 1%, insured for in-orbit risks. This reflects shorter mission durations, constellation scale, and higher cost sensitivity.

- Commercial demand: Private enterprises contribute roughly 52% of total space insurance demand, driven by the need to protect capital-intensive assets and ensure service continuity for commercial missions.

By Coverage Type

Satellite insurance represents 38.5% of overall adoption in the Space Weather Insurance Market. This dominance reflects the high exposure of satellites to solar storms, geomagnetic disturbances, and radiation events that can disrupt operations or damage onboard systems. Satellite operators prioritize coverage that protects against signal loss, payload malfunction, and shortened mission life.

The importance of satellite insurance is reinforced by the rising dependence on space based infrastructure for communication, navigation, and earth observation. Even short service interruptions can lead to significant financial and operational impact. As a result, satellite focused coverage remains the core segment within the market.

For Instance, in January 2026, Munich Re launched a new satellite insurance cover tailored for space projects. This product shields satellites from pre-launch tests through in-orbit operations, tackling risks like solar flares. With over 40 years in space risks, they use expert teams of engineers and underwriters to offer full protection.

By End User

Aerospace and defense organizations account for 42.6% of total end user demand. These entities operate mission critical space assets that must remain functional under extreme environmental conditions. Space weather events pose strategic and operational risks, making insurance coverage an essential component of risk management.

Insurance adoption among aerospace and defense users is driven by national security considerations and long term asset protection. Space systems often involve high capital investment and extended deployment timelines. This sustains strong demand from this end user segment.

For instance, in July 2025, Chubb ramped up aerospace hires to boost space insurance for defense clients. New experts target satellite protection against geomagnetic disruptions. As tensions rise, their tailored covers help military ops stay online. This strengthens Chubb’s role in shielding high-stakes aerospace missions from space hazards.

By Distribution Channel

Direct distribution represents 58.4% of policy placement across the market. This channel is preferred due to the technical complexity of space weather risk and the need for tailored policy structures. Direct engagement allows insurers and clients to define precise coverage triggers and exclusions.

The dominance of direct distribution is also supported by long term contractual relationships. Customized underwriting improves clarity and confidence for both parties. This strengthens the role of direct channels in policy procurement.

For Instance, in April 2025, AXA XL’s space head shared a Q1 update on direct placements for satellite risks. Clients in telecom bypass brokers for fast quotes on space weather covers via digital tools. This direct channel speeds approvals for urgent launches, cutting delays from solar alerts. AXA XL notes growing preference among operators for streamlined access.

By Provider Type

Private providers hold 54.5% of total market participation by provider type. Their leadership is supported by specialized underwriting expertise and flexible product design. Private insurers are better positioned to assess emerging space weather risks and structure customized coverage.

The strong presence of private providers is also linked to innovation in risk modeling and analytics. These capabilities improve pricing accuracy and coverage relevance. As space activities expand, private providers continue to play a central role.

For Instance, in December 2025, Swiss Re deepened private satellite data use for space insurance underwriting. Partnering on radar imagery, they refine risks for private providers. This tech aids quick, accurate policies against space weather. Private firms like Swiss Re lead by innovating faster than publics, attracting more space clients.

Regional Perspective

North America holds a leading position in the Space Weather Insurance Market, accounting for 40.2% of total activity. The region benefits from advanced space infrastructure, high satellite deployment rates, and strong insurance ecosystems. Risk awareness related to space weather events is well established.

Government and commercial investment in space systems further supports insurance adoption. Operational continuity and asset protection remain key priorities. These factors reinforce North America’s dominant regional position.

For instance, in October 2025, Chubb partnered with Monarch Weather for advanced weather intelligence services, including real-time monitoring and hazard alerts across the U.S. This collaboration from White Plains strengthens Chubb’s ability to manage extreme weather risks, supporting North America’s leadership in weather-related insurance products that mitigate space weather impacts on infrastructure.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 0.96 Bn and a growth rate of 8.4% CAGR. Expansion is supported by increased satellite launches and growing reliance on space enabled services. Insurance coverage is increasingly integrated into mission planning.

Adoption in the U.S. is influenced by regulatory frameworks and national security considerations. Aerospace and defense organizations prioritize protection against space environment risks. These dynamics collectively support steady growth in the U.S. market segment.

In January 2026, AXA XL expanded its space insurance offerings to cover pre launch, launch, in orbit, and liability risks, including tailored solutions for small satellites and specialized missions. Based in Stamford, Connecticut, the company is addressing growing space related risks and supporting satellite operators and launch providers as orbital activity increases.

Customer Impact: Trends and Disruptors

Customers exposed to space weather risk are becoming more proactive in risk assessment and mitigation. Satellite operators, airlines, and utilities increasingly evaluate space weather exposure during capital planning and contract negotiations. Insurance is being used alongside technical mitigation such as shielding and redundancy to stabilize financial outcomes.

Customers are also seeking faster claim resolution and clearer coverage terms. Given the operational urgency associated with disruptions, buyers value policies that offer rapid liquidity. This preference supports demand for parametric and simplified coverage structures.

One major disruptor is improved space weather forecasting accuracy. Enhanced early warning capabilities reduce uncertainty and enable preventive actions, potentially lowering insured losses. This disruptor shifts insurance demand toward complementary coverage rather than pure loss compensation.

Another disruptor is the increasing resilience of space and ground systems. Improved satellite hardening and grid protection technologies may reduce damage severity over time. While this lowers risk, it also changes insurance product design and pricing dynamics.

Driver Analysis

A primary driver of the space weather insurance market is the expanding use of satellites across communication, navigation, weather forecasting, and defense applications. Solar storms can damage satellite electronics, degrade signal quality, or shorten operational lifespan. These risks translate into substantial financial exposure for operators and service users. Insurance coverage provides a mechanism to transfer part of this exposure and protect long term investment value.

Another important driver is increased awareness of systemic infrastructure vulnerability. Power transmission networks, aviation systems, and maritime navigation can all be affected by geomagnetic disturbances. Governments and enterprises now recognize space weather as a credible threat to operational continuity. This recognition encourages inclusion of space weather risk within broader enterprise risk management and insurance planning frameworks.

Restraint Analysis

A key restraint in the space weather insurance market is limited historical loss data. Space weather events are rare and highly variable, making actuarial modeling complex. Uncertainty around event frequency, severity, and loss magnitude constrains underwriting confidence. This uncertainty can limit coverage availability or result in conservative policy terms.

Another restraint is the concentration of risk. A single severe solar event can affect multiple insured assets simultaneously, creating correlated losses. This aggregation challenge reduces insurers’ appetite to offer standalone coverage without reinsurance or risk sharing mechanisms. These structural limitations slow market expansion.

Opportunity Analysis

A major opportunity in the space weather insurance market lies in parametric insurance structures. Policies triggered by predefined physical indicators such as solar storm intensity or geomagnetic indices reduce claims ambiguity and accelerate payouts. Parametric designs improve transparency and operational efficiency, making coverage more attractive to technology dependent industries.

Another opportunity is collaboration with scientific and monitoring institutions. Improved forecasting, early warning systems, and real time solar monitoring enhance risk assessment. Insurers that integrate scientific data into underwriting and policy design can improve pricing accuracy and broaden coverage offerings. This data driven approach supports innovation and market confidence.

Challenge Analysis

A significant challenge for the space weather insurance market is defining clear coverage triggers and loss attribution. Differentiating space weather related damage from normal equipment failure or cyber incidents can be difficult. Ambiguity in causation may lead to disputes and delayed settlements. Clear definitions and documentation requirements are essential for trust.

Another challenge involves aligning policy coverage with evolving technology. As satellite design, shielding, and redundancy improve, risk profiles change. Insurance products must adapt to these technical advancements without becoming obsolete or mispriced. Continuous alignment with technological evolution remains a challenge.

Emerging Trends Analysis

An emerging trend in the space weather insurance market is increased use of advanced modeling and simulation tools. Scenario analysis based on historical solar events and simulated extreme conditions helps insurers estimate potential losses. These tools support more informed underwriting decisions and stress testing of portfolios.

Another trend is growing interest from non traditional buyers. Beyond satellite operators, industries such as aviation, energy, and telecommunications are exploring space weather coverage extensions. This broadening customer base reflects recognition of indirect exposure and supports gradual market diversification.

Growth Factors Analysis

One of the key growth factors for the space weather insurance market is rising global dependence on uninterrupted connectivity. Navigation, timing, and communication services rely heavily on satellite infrastructure. As reliance increases, tolerance for disruption declines. Insurance becomes a logical component of resilience planning.

Another growth factor is increasing policy level focus on infrastructure resilience. Governments and regulators emphasize preparedness for systemic risks. Space weather is increasingly included in national risk assessments. This policy recognition indirectly supports insurance market development.

Key Market Segments

By Coverage Type

- Satellite Insurance

- Power Grid Insurance

- Aviation Insurance

- Communication & Navigation Insurance

- Others

By End-User

- Aerospace & Defense

- Energy & Utilities

- Telecommunications

- Aviation

- Others

By Distribution Channel

- Direct

- Brokers

- Others

By Provider Type

- Private

- Government

- Consortium

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global specialty insurers such as AXA XL, Allianz Global Corporate & Specialty, and Chubb are among the primary providers of space weather insurance coverage. Their offerings typically protect satellites, power grids, aviation systems, and critical infrastructure against solar storms and geomagnetic disturbances. These insurers rely on advanced risk modeling and engineering assessments. Strong underwriting expertise supports coverage for high-value, technology-intensive assets.

Reinsurers and high-capacity risk carriers such as Munich Re, Swiss Re, SCOR SE, and Everest Re Group play a critical role in absorbing low-frequency but high-impact space weather losses. Lloyd’s of London provides flexible capacity through specialist syndicates. These players support innovative policy structures, including parametric and excess-loss covers. Their involvement improves market stability and risk-sharing for insurers underwriting complex space-related exposures.

Brokerage firms and specialty insurers such as Willis Towers Watson and Marsh & McLennan assist clients with risk assessment and policy placement. Tokio Marine HCC, Sompo International, QBE Insurance Group, and Zurich Insurance Group expand global coverage options. Other insurers enhance regional access and customization. This landscape supports growing adoption of space weather insurance across aerospace, energy, and defense sectors.

Top Key Players in the Market

- AXA XL

- Munich Re

- Swiss Re

- Lloyds of London

- Allianz Global Corporate & Specialty

- Chubb

- AIG (American International Group)

- Willis Towers Watson

- Marsh & McLennan

- Tokio Marine HCC

- Sompo International

- QBE Insurance Group

- Berkshire Hathaway Specialty Insurance

- HDI Global SE

- Mapfre

- Liberty Mutual Insurance

- Zurich Insurance Group

- SCOR SE

- RSA Insurance Group

- Everest Re Group

- Others

Company Evaluation Matrix

Company Quadrant Market Presence Key Capabilities / Notes Lloyd’s of London Leader High Strong expertise in satellite and aviation risks, accounts for a large share of global space insurance, active in parametric innovation Munich Re Leader High Deep reinsurance capabilities for satellites and space infrastructure, advanced analytics and predictive risk models, decades of space experience Swiss Re Leader High Parametric insurance solutions, collaboration with space agencies, diversified global risk portfolio Zurich Insurance Group Leader High Advanced catastrophe modeling, integrated business interruption coverage for large enterprises AXA XL Challenger High Expanding space insurance portfolio, coverage across launch and in-orbit risk phases Allianz SE Challenger Medium-High Strong corporate specialty insurance base, gradual expansion into space-related products Chubb Limited Emerging Medium Focus on high-value specialty risks, increasing participation in aviation and adjacent space coverage AIG Emerging Medium Broad business interruption coverage, adapting space risk exposure through partnerships Others (Beazley, QBE) Niche Low-Medium Specialized parametric offerings, region-focused underwriting strategies Recent Developments

- In November 2025, Willis Towers Watson (WTW) launched satellite-powered parametric farm insurance using geospatial analytics, directly addressing space weather impacts like solar-induced droughts. Deployed in Australia and Ethiopia, it provides instant payouts based on hyperlocal data, expanding WTW’s space risk portfolio.

- In December 2025, Tokio Marine HCC launched parametric weather insurance enhancements, including space weather triggers for event cancellation. Houston operations strengthen U.S. specialty coverage for solar activity disruptions.

Report Scope

Report Features Description Market Value (2025) USD 2.7 Billion Forecast Revenue (2035) USD 6.7 Billion CAGR(2025-2035) 9.4% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Satellite Insurance, Power Grid Insurance, Aviation Insurance, Communication & Navigation Insurance, Others), By End-User (Aerospace & Defense, Energy & Utilities, Telecommunications, Aviation, Others), By Distribution Channel (Direct, Brokers, Others), By Provider Type (Private, Government, Consortium) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA XL, Munich Re, Swiss Re, Lloyd’s of London, Allianz Global Corporate & Specialty, Chubb, AIG (American International Group), Willis Towers Watson, Marsh & McLennan, Tokio Marine HCC, Sompo International, QBE Insurance Group, Berkshire Hathaway Specialty Insurance, HDI Global SE, Mapfre, Liberty Mutual Insurance, Zurich Insurance Group, SCOR SE, RSA Insurance Group, Everest Re Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Space Weather Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Space Weather Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AXA XL

- Munich Re

- Swiss Re

- Lloyds of London

- Allianz Global Corporate & Specialty

- Chubb

- AIG (American International Group)

- Willis Towers Watson

- Marsh & McLennan

- Tokio Marine HCC

- Sompo International

- QBE Insurance Group

- Berkshire Hathaway Specialty Insurance

- HDI Global SE

- Mapfre

- Liberty Mutual Insurance

- Zurich Insurance Group

- SCOR SE

- RSA Insurance Group

- Everest Re Group

- Others