Global Space Economy Market Size, Share, Industry Analysis Report By Sector (Satellite Manufacturing, Launch Services, Space Tourism, Space Mining, Ground Infrastructure, Space-based Communications, Earth Observation & Remote Sensing, Others), By Application (Defense & Security, Telecommunications, Navigation, Scientific Research, Commercial Exploration, Space Tourism, Earth Observation, Others), By End User (Government, Private Companies, Research Institutes, Educational Institutions, Others), By Technology Type (Reusable Rockets, Propulsion Systems, Space Habitats, Satellites, Space Robotics, Others), By Price Range (Low, Medium, Premium), By Distribution Channel (Direct Contracts, Online Services & Platforms, Partnerships & Collaborations, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161168

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Space Economy Expansion

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- By Sector

- By Application

- By End User

- By Technology Type

- By Price Range

- By Distribution Channel

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Significant Developments

- Report Scope

Report Overview

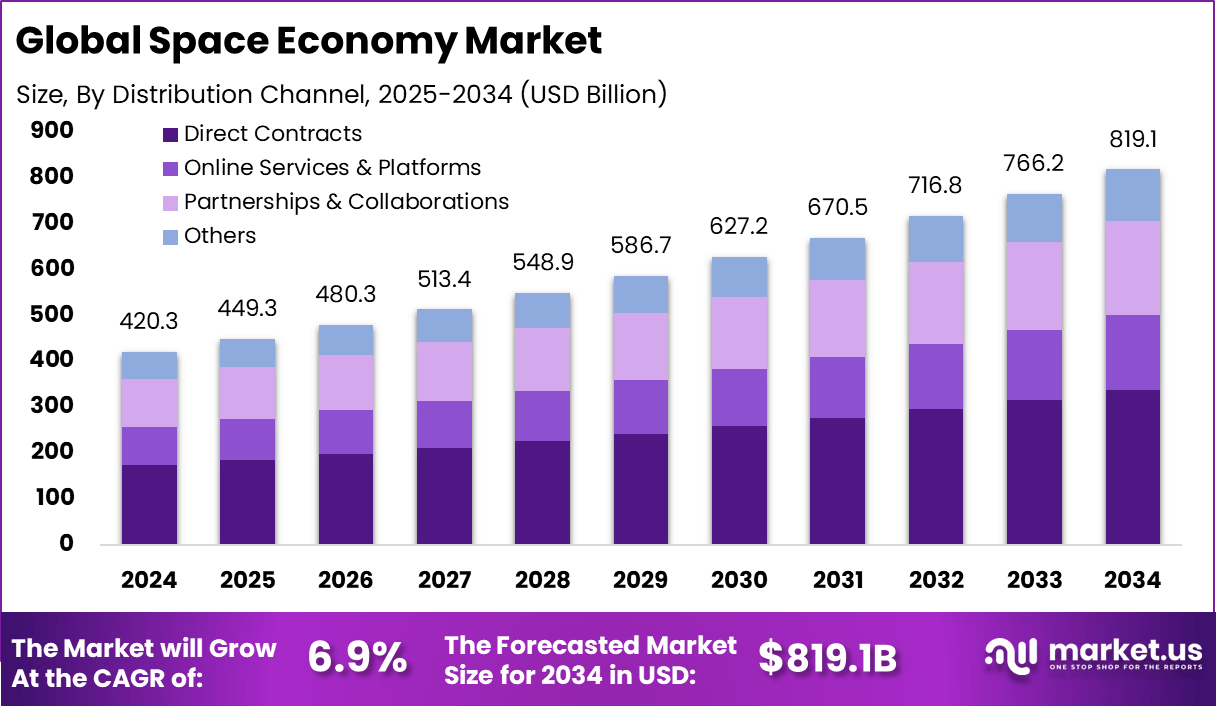

The Global Space Economy Market generated USD 420.3 billion in 2024 and is predicted to register growth from USD 449.3 billion in 2025 to about USD 819.1 billion by 2034, recording a CAGR of 6.9% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.5% share, holding USD 149.2 Billion revenue.

The space economy includes all industries and activities that create economic value from outer space, such as satellite services, launch operations, space manufacturing, and resource extraction. It is expanding quickly due to rising private investment, which is driving innovation in telecommunications, data services, and emerging technologies. Key trends include growing public–private funding, wider use of space-based applications across sectors, and interest in future opportunities like space mining and construction.

A key driver of the space economy’s growth is the significant decline in the cost of accessing space. Launch costs have fallen by roughly 90% over the last two decades, largely due to technological advances such as reusable rockets. This cost efficiency has spurred a rise in satellite mega-constellations and commercial space ventures.

The commercial sector now dominates the space economy, accounting for approximately 78% of its total value. Demand is driven by sectors requiring satellite communication, navigation, earth observation data, and emerging applications like space tourism, which are becoming financially viable with broader private investment. Satellite services have become essential in telecommunications, logistics, agriculture, and environmental monitoring, fueling demand across multiple global sectors.

Top Market Takeaways

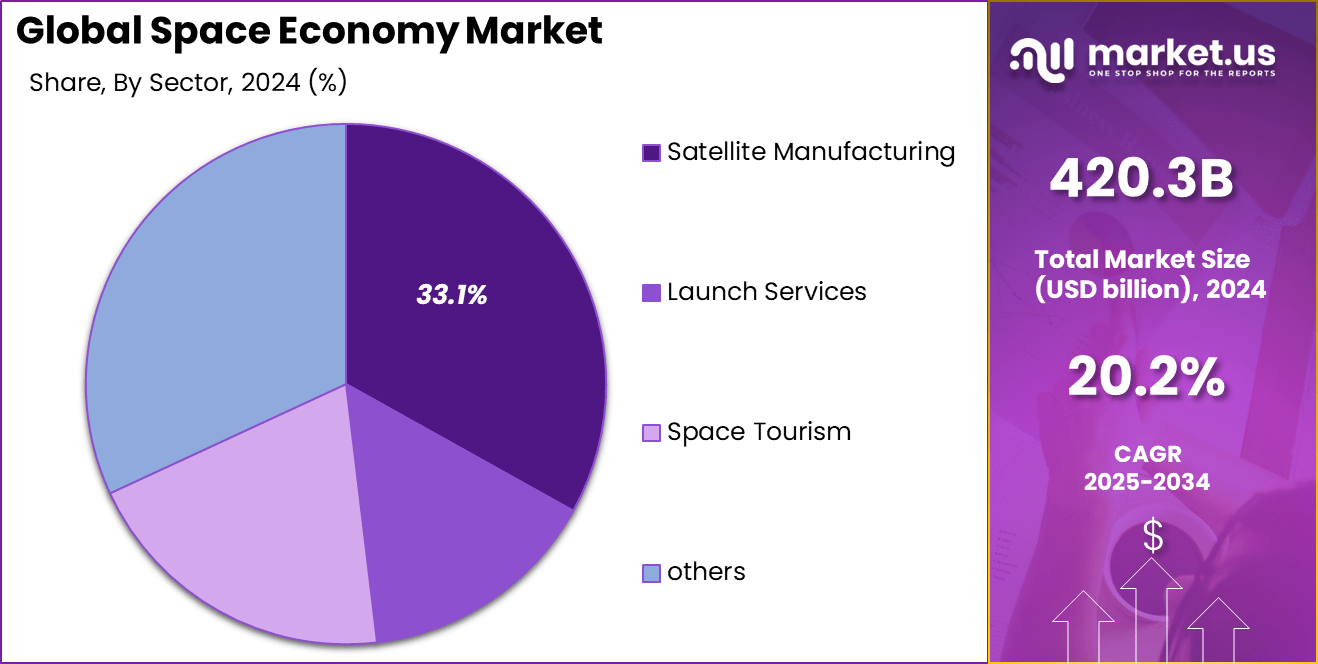

- By sector, satellite manufacturing leads with 33.1%, driven by rising demand for satellites in communication, navigation, and earth observation.

- By application, telecommunications holds 29%, reflecting the central role of satellites in global connectivity.

- By end user, governments account for 41.2%, supported by defense, national security, and space exploration programs.

- By technology type, reusable rockets capture 37.27%, showcasing their impact in lowering costs and enabling frequent launches.

- By price range, the medium segment leads with 39%, balancing affordability with advanced capabilities.

- By distribution channel, direct contracts dominate with 41.2%, reflecting strong ties between governments, space agencies, and contractors.

- North America contributes 35.5%, supported by large-scale investments and leading space exploration companies.

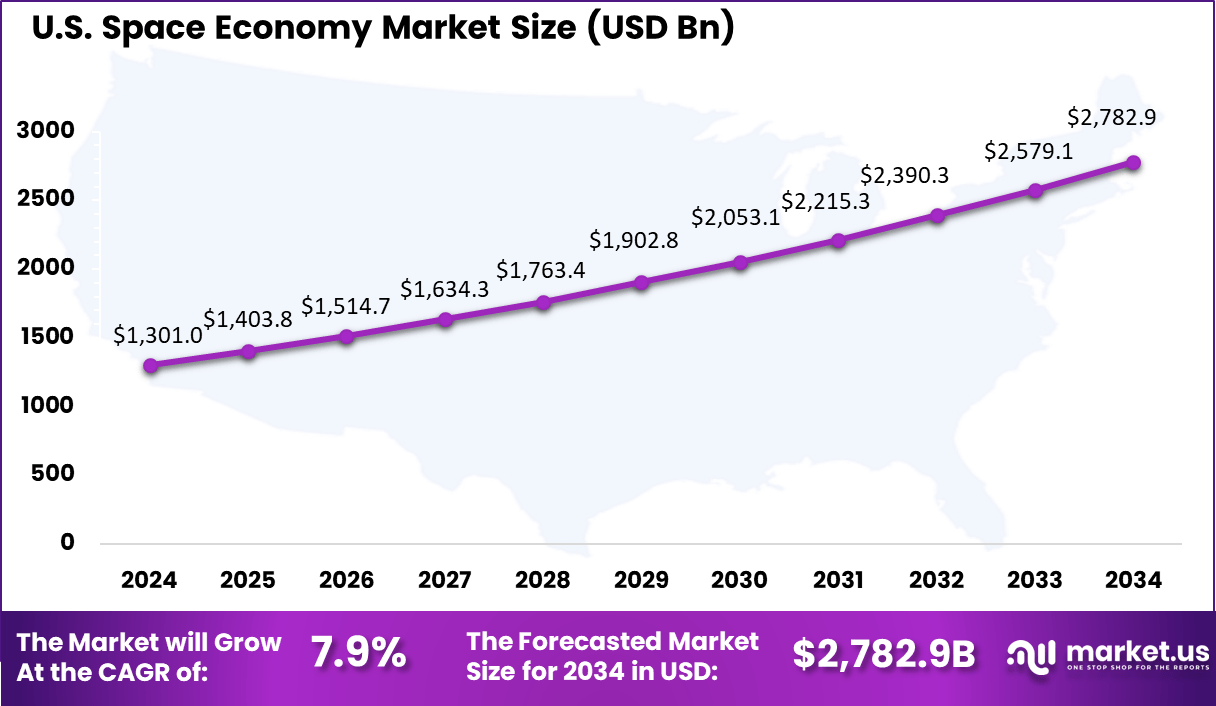

- The US market reached USD 130.1 billion and is expanding at a steady CAGR of 7.9%, reinforcing its leadership in the global space economy.

Space Economy Expansion

Government Spending and Trends

- Record expenditures: Global government spending on space programs reached $135 billion in 2024, reflecting a 10% increase over 2023.

- Top spenders (2024): The United States led with approximately $79.7 billion, followed by China ($19.9 billion) and Japan ($6.8 billion).

- Widespread increases: At least two-thirds of nations expanded their space budgets in 2024, partly driven by geopolitical tensions and strategic competition.

Investment and Innovation

- Investor confidence: Falling launch costs, enabled by reusable rocket technology, and profitability in the commercial sector continue to attract private and institutional investment.

- Private equity growth: Global funding into the space industry surpassed $5 billion in 2024, with a strong focus on launch services and satellite communications.

- Emerging technologies: Key innovation areas include artificial intelligence (AI), in-space manufacturing, and lunar resource extraction, signaling a shift toward long-term commercial opportunities.

- Launch frequency: The number of launches continues to climb. Since 2019, annual space launches have set records each year, with 149 launches in the first half of 2025 alone.

Analysts’ Viewpoint

The demand analysis reveals an increased integration of space-enabled technologies into various industries. Enterprises in telecommunications use satellite broadband for connectivity in remote areas, while logistics companies optimize supply chain operations with satellite tracking and weather data. Agriculture benefits from satellite imagery combined with AI for crop monitoring and pest control, enhancing productivity.

Energy sectors apply satellite data to detect pipeline leaks and monitor infrastructure. These use cases emphasize why businesses are adopting space technologies: they deliver operational efficiency, cost savings, risk reduction, and improved service delivery, making satellite data and space resources critical to modern industry workflows. Among the most rapidly adopted technologies are advanced satellite communication systems, reusable rocket launch vehicles, and miniaturized Earth observation satellites.

These innovations offer greater flexibility, reduced operational costs, and improved data accuracy. The rapid deployment of mega-constellations for global broadband internet is a prime example of how new tech adoption is transforming accessibility. Businesses adopt these technologies to enhance global connectivity, enable precise data-driven decisions, and open new commercial opportunities internationally, supporting digital transformation trends in diverse sectors.

Role of Generative AI

The space economy is increasingly benefiting from generative AI, which plays a crucial role in advancing design, operations, and autonomous systems. Generative AI algorithms enable the creation of optimized spacecraft components that reduce weight by up to 50% while improving durability. This capability allows for more efficient resource use in space missions.

Additionally, generative AI supports predictive maintenance by analyzing telemetry data to foresee equipment issues before failures happen, significantly reducing costly mission downtime. In 2025, the global active user base of generative AI technologies ranged between 115 million and 180 million, underscoring its widespread adoption across industries such as space.

Beyond design and maintenance, generative AI applications extend toward automating spacecraft navigation and improving data processing from satellite imagery. By autonomously charting courses and making decisions in real time, spacecraft equipped with AI can improve efficiency and reduce human error. These advances are helping the space industry unlock new potentials like resource extraction on asteroids and lunar base construction, with AI-powered robotics supporting these challenging tasks.

Investment and Business Benefits

Investment opportunities in the space economy are broad and robust, spanning satellite manufacturing, launch services, space tourism, and emerging fields like space mining and in-orbit servicing. Venture capital flows increasingly target startups innovating in satellite data analytics and platform-based applications.

The declining technical and financial barriers have widened the investor base, enabling participation through specialized funds and portfolios focused on space technologies. Business benefits from embracing the space economy include enhanced global communications infrastructure, improved data availability for decision-making, and new revenue streams from commercial space activities.

Companies integrating space data report increased efficiency, better risk management, and expansion into new markets. Additionally, the space economy stimulates high-skilled job creation and innovation spillovers that benefit terrestrial industries.

US Market Size

In 2024, The United States alone represents a significant portion of the space economy, valued at approximately USD 130.1 billion in 2025 with a compound annual growth rate of 7.9%. The U.S. advantage comes from combined government and private sector initiatives pushing advancements in satellite technology, reusable launch vehicles, and space exploration.

Public agencies like NASA and the Department of Defense support extensive space programs, while collaboration with commercial pioneers drives competitiveness. The U.S. market benefits from mature regulatory frameworks, substantial infrastructure, and ongoing investments aimed at maintaining technological superiority in space operations and supporting global space services.

In 2024, North America is the largest regional contributor, holding 35.5% of the space economy market. The region benefits from robust government funding, a strong presence of commercial aerospace companies, and advanced research institutions. Investments in satellite manufacturing, reusable rocket technologies, and space infrastructure have propelled North America’s leadership in the sector.

The region’s emphasis on public-private partnerships has accelerated technology commercialization and increased launch cadence. North America also leads in satellite communications and Earth observation programs, supporting both civilian and defense applications, and fostering a dynamic ecosystem for space startups and innovation.

By Sector

In 2024, Satellite manufacturing commands a significant portion of the space economy market, accounting for 33.1%. This segment benefits from the ongoing demand for new satellites used in telecommunications, Earth observation, navigation, and defense applications.

The introduction of miniaturized and more cost-effective satellite technologies has accelerated satellite production, with over 1,200 satellites expected to launch worldwide in 2025 alone. These advancements allow for rapid deployment and replacement, meeting the evolving needs of both commercial and government sectors.

This growth is supported by technological innovations such as reusable components and standard satellite platforms, which reduce costs and improve manufacturing efficiency. As satellite constellations expand to provide global broadband coverage and real-time data services, satellite manufacturing remains a critical pillar of the space economy, driving both innovation and investments globally.

By Application

in 2024, The telecommunications sector holds a 29% share in the space economy market. It remains the primary application for space assets due to the rising need for global connectivity through satellite broadband, mobile communication networks, and data relay services. More than 800 communication satellites were operational by 2025, supporting everything from internet access in remote areas to secure government communications.

As networks evolve towards 5G and beyond, reliance on satellite-based telecommunications infrastructure is set to grow. This helps bridge connectivity gaps and enhances network redundancy. Modern satellites are also engineered to support faster data transmission rates and lower latency, which are critical for meeting the stringent demands of next-generation communication services.

By End User

in 2024, Government agencies are the largest end users of space economy products and services, representing 41.2% of the market. National governments use space technologies for defense, scientific research, weather forecasting, and national security. Government investments often drive innovation, with funding allocated to satellite launches, space exploration missions, and infrastructure development.

This heavy involvement is also tied to strategic interests in space dominance and surveillance capabilities. Public-sector contracts frequently establish long-term partnerships with private aerospace firms, ensuring steady demand and fostering advancements in technology. Governments continue to heavily influence the space market’s development trajectory by setting regulatory frameworks and prioritizing strategic space programs.

By Technology Type

in 2024, Reusable rockets lead the technology segment with a 37.27% share. These rockets are transforming the economics of space access by significantly reducing launch costs and turnaround times. Key innovations in propulsion, modular design, and heat shielding allow rockets to be refurbished and reused multiple times, sometimes lowering costs by up to 65% compared to traditional expendable rockets.

This trend not only boosts commercial satellite deployments but also supports ambitious missions such as lunar exploration and space tourism. Reusable rockets have enabled more frequent launches, improving the sustainability and scalability of space operations. They are increasingly favored by both government agencies and private companies aiming for cost-effective and reliable space transport solutions.

By Price Range

in 2024, The medium price range segment holds a 39% share of the market. This segment typically includes mid-tier space technologies and services, which strike a balance between cost and performance. Many satellites, launch services, and space infrastructure projects fall into this category, offering reliable capabilities without the premium costs associated with cutting-edge or highly specialized systems.

Medium-priced solutions cater to a wide variety of commercial and governmental applications, offering versatility and accessibility. This price bracket supports the growing space economy by making space technology affordable for a broader range of entities, from emerging space nations to private sector startups. It enables steady market growth through expanding usage across satellite constellations and space infrastructure projects.

By Distribution Channel

in 2024, Direct contracts dominate the market with a 41.2% share. Governments and large organizations often rely on direct procurement contracts for satellite manufacturing, launch services, and ground systems. These contracts provide the assurance of reliability, quality control, and dedicated support essential for large-scale, complex space projects.

Such agreements help maintain supply chain stability and long-term partnerships between customers and aerospace providers. Direct contracts also facilitate strategic planning and risk management for both parties, supporting continuous innovation and infrastructure development within the space economy. This channel remains the backbone of most governmental and institutional space activity.

Emerging Trends

Emerging trends in the space economy reveal a sharp rise in commercial activities, especially in satellite constellations and reusable launch systems. In early 2025, over 85% of total launch tonnage originated from commercial constellations, marking a shift from government-led to scalable, private-led low-Earth orbit networks.

This transition drives innovation, lowers costs, and expands service offerings including broadband and earth observation. Satellite broadband is growing rapidly, with multiple constellations improving global connectivity and disaster response capabilities. Another significant trend is the increasing role of space robotics, which saw more than 150 deployments in recent years.

These advancements support autonomous servicing of satellites, planetary exploration, and construction of space habitats. Space tourism is also progressing from niche suborbital flights to developing orbital experiences, targeting high-net-worth individuals and evolving toward more regular market participation. These technological and business model shifts indicate a maturing and diversifying space sector.

Growth Factors

Growth in the space economy is fueled by demand for connectivity, navigational services, and enhanced insights powered by AI and machine learning. Increasing mobile device penetration drives positioning services, while applications in climate monitoring and logistics rely on satellite data. In 2024, the space economy grew 7.8% year-over-year, reflecting strong commercial sector growth which contributed 78% of the total expansion.

The commercial segment’s rapid pace of launch activity, including a record 149 launches in the first half of 2025, supports robust market momentum. Additionally, global spending on space programs rose by 10% year-over-year in 2024, with governments and private players expanding investments in space infrastructure, launch systems, and satellite production.

Pressure from geopolitical dynamics is motivating countries to enhance sovereign military space capabilities, which further stimulates industry growth. The continuous reductions in launch costs through reusable rockets have boosted accessibility, offering scalability for a broad range of space missions and commercial ventures.

Key Market Segments

By Sector

- Satellite Manufacturing

- Launch Services

- Space Tourism

- Space Mining

- Ground Infrastructure

- Space-based Communications

- Earth Observation & Remote Sensing

- Others

By Application

- Defense & Security

- Telecommunications

- Navigation

- Scientific Research

- Commercial Exploration

- Space Tourism

- Earth Observation

- Others

By End User

- Government

- Private Companies

- Research Institutes

- Educational Institutions

- Others

By Technology Type

- Reusable Rockets

- Propulsion Systems

- Space Habitats

- Satellites

- Space Robotics

- Others

By Price Range

- Low

- Medium

- Premium

By Distribution Channel

- Direct Contracts

- Online Services & Platforms

- Partnerships & Collaborations

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Technological Advancements Lowering Costs

Advancements in rocket technology and satellite design have drastically reduced the cost of accessing space. Reusable rockets developed by private companies have made launches more frequent and affordable, enabling increased participation from both commercial and government sectors. This trend is driving rapid expansion in satellite constellations and space services like broadband internet worldwide.

With lower barriers to entry, startups and established aerospace firms alike are launching new ventures into space-based communications, Earth observation, and exploration projects. This democratization of space access fuels innovation and investment, making technology improvements one of the strongest growth drivers in the space economy.

Restraint

High Costs and Complex Regulations.

Despite cost reductions, exploration and infrastructure development in space remain capital-intensive, requiring substantial investment and resources. The complexity of launching missions and maintaining satellites creates a high financial hurdle for many players, limiting participation to well-funded entities.

Additionally, the space economy faces a patchwork of regulations that can vary by country and region. Licensing requirements, international agreements, and rules governing orbital traffic management are still evolving, often causing delays and uncertainty. These regulatory challenges restrain the pace of growth and add operational complexities.

Opportunity

Expansion of Satellite Services and Data Applications

The growing demand for satellite-delivered services presents a significant opportunity for market expansion. Applications such as global broadband connectivity, precision agriculture, climate monitoring, and real-time Earth observation generate new revenue sources for space companies.

Emerging markets in space tourism, on-orbit manufacturing, and lunar resource extraction also offer promising frontiers. As commercial infrastructure and technology mature, these sectors are poised to transform the space economy, opening doors to novel industries and services.

Challenge

Space Debris and Sustainability Concerns

One of the foremost challenges facing the space economy is the increasing congestion in Earth’s orbits caused by space debris. Collisions between satellites or with debris can lead to damage or loss of assets, threatening operational safety in space.

Ensuring long-term sustainability requires coordinated international efforts to manage debris, implement debris removal technologies, and develop best practices for responsible space activities. Without effective solutions, the escalating problem of debris could significantly hamper growth and pose risks to future space ventures.

Competitive Analysis

The Space Economy Market is led by major aerospace and defense companies such as Northrop Grumman, Lockheed Martin, Boeing, and SpaceX. These players are central to satellite deployment, cargo transport, and deep-space missions. Their investments in reusable launch vehicles, propulsion systems, and space infrastructure enable cost reductions and rapid commercialization.

Commercial launch providers and satellite network developers including Blue Origin, Rocket Lab, Arianespace, and Relativity Space are expanding access to space through small-lift launch vehicles and reusable rocket technologies. Companies like OneWeb, Eutelsat, SES S.A., and Planet Labs focus on satellite internet, earth observation, and data services.

Emerging players such as Virgin Galactic, Maxar Technologies, and a range of other contributors are actively developing space tourism, in-orbit servicing, and satellite manufacturing capabilities. Their advancements in 3D printing, robotics, and space-based infrastructure are accelerating commercialization beyond traditional defense programs. Together, these players are shaping a diverse and fast-evolving global space economy.

Top Key Players in the Market

- Northrop Grumman

- SpaceX

- Blue Origin

- NASA

- Lockheed Martin

- Boeing

- ISRO (Indian Space Research Organisation)

- Arianespace

- OneWeb

- Rocket Lab

- Planet Labs

- Relativity Space

- Blue Origin

- Virgin Galactic

- Eutelsat

- SES S.A.

- Maxar Technologies

- Rocket Lab

- Others

Significant Developments

- October 2025: Northrop Grumman is developing a new 25mm semi-automatic grenade launcher with Colt, advancing beyond the canceled XM25 system to meet U.S. Army needs for the Precision Grenadier System with innovative fire control and ammunition types. The company is also testing longer-range anti-drone bullets for cost-effective drone defense following feedback from Ukraine’s military.

- October 2025: SpaceX has conducted 129 rocket launches in 2025, including 125 Falcon 9s and 4 Starships, maintaining a 100% launch success rate and aiming for 175-180 Falcon 9 launches by year end. The company plans to transition Starlink payloads to Starship, with FAA approval sought for 25 Starship launches annually, moving towards operational Starship flights.

- August 2025: NASA is actively strategizing to build a sustainable low Earth orbit economy focusing on safety, cost-effectiveness, and commercial viability by fostering partnerships and accelerating infrastructure development.

Report Scope

Report Features Description Market Value (2024) USD 420.3 Bn Forecast Revenue (2034) USD 819.1 Bn CAGR(2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Sector (Satellite Manufacturing, Launch Services, Space Tourism, Space Mining, Ground Infrastructure, Space-based Communications, Earth Observation & Remote Sensing, Others), By Application (Defense & Security, Telecommunications, Navigation, Scientific Research, Commercial Exploration, Space Tourism, Earth Observation, Others), By End User (Government, Private Companies, Research Institutes, Educational Institutions, Others), By Technology Type (Reusable Rockets, Propulsion Systems, Space Habitats, Satellites, Space Robotics, Others), By Price Range (Low, Medium, Premium), By Distribution Channel (Direct Contracts, Online Services & Platforms, Partnerships & Collaborations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Northrop Grumman, SpaceX, Blue Origin, NASA, Lockheed Martin, Boeing, ISRO (Indian Space Research Organisation), Arianespace, OneWeb, Rocket Lab, Planet Labs, Relativity Space, Virgin Galactic, Eutelsat, SES S.A., Maxar Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Northrop Grumman

- SpaceX

- Blue Origin

- NASA

- Lockheed Martin

- Boeing

- ISRO (Indian Space Research Organisation)

- Arianespace

- OneWeb

- Rocket Lab

- Planet Labs

- Relativity Space

- Blue Origin

- Virgin Galactic

- Eutelsat

- SES S.A.

- Maxar Technologies

- Rocket Lab

- Others