Global Soy Dessert Market Size, Share, And Business Benefits By Product Type (Soy Yogurt, Soy Pudding, Soy Ice Cream, Soy Cheesecake),By Flavor (Vanilla, Chocolate, Strawberry, Mango, Others), By Distribution Channel (Online, Supermarkets, Health Food Stores, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158011

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

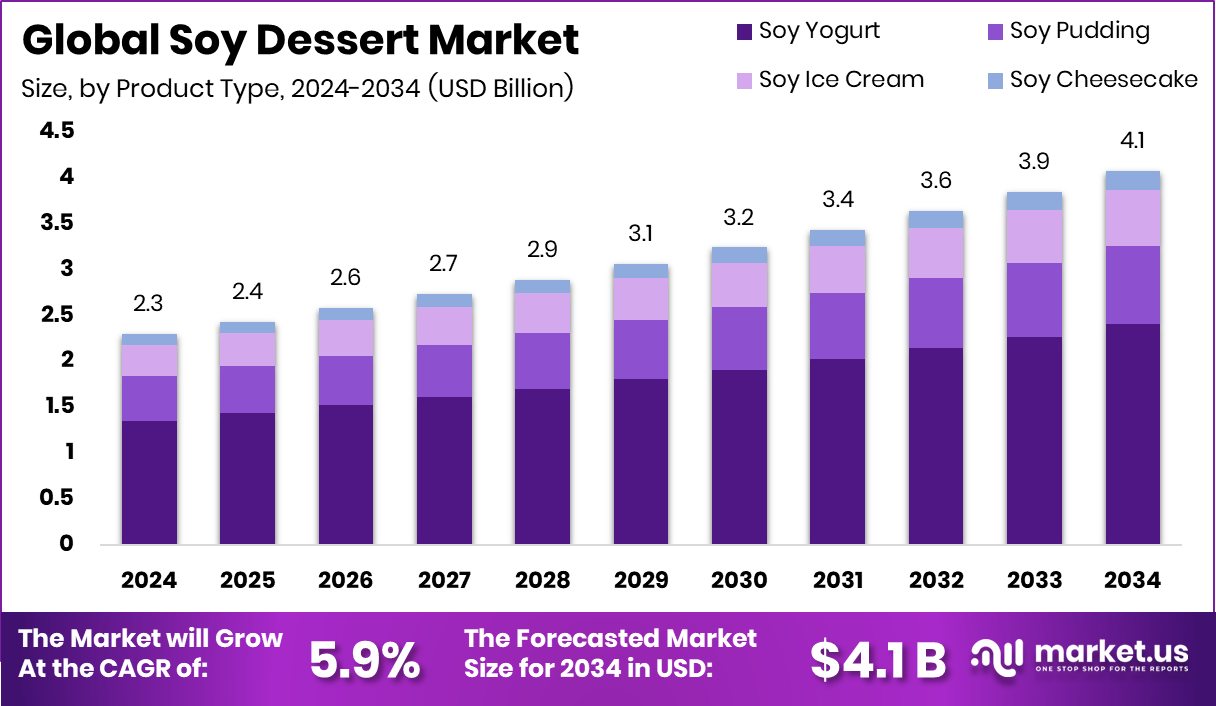

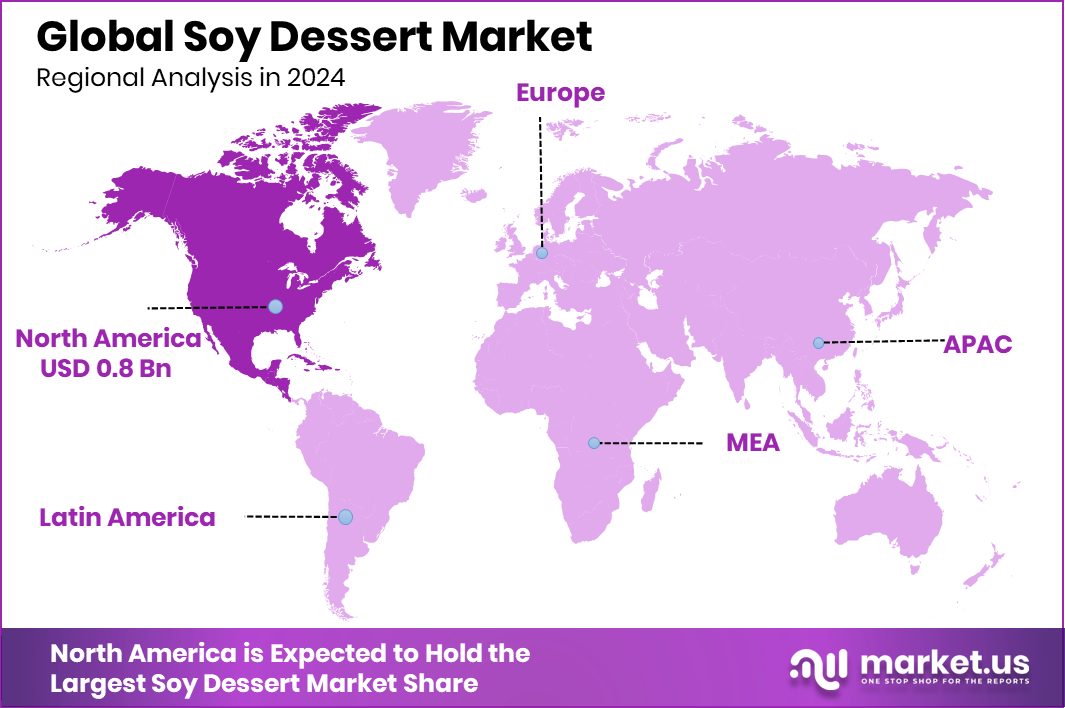

The Global Soy Dessert Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. With a 37.90% share, the North America Soy Dessert Market generated USD 0.8 Bn revenue in 2024.

A soy dessert is any dessert—sweet treat—where a key ingredient is derived from soybeans, such as soy milk, tofu, or soy protein. Instead of traditional dairy, soy components like silken tofu, soy custard, or soy-based puddings are used to build a creamy texture. These desserts appeal to consumers seeking plant-based, lactose-free, or vegan alternatives. They combine the nutritional benefits of soy—high in protein and low in saturated fat—with the sensory experience of desserts.

Several structural factors contribute to the growth of soy-based desserts. Globally, soy production has increased significantly: in 2022, total world soybean production reached approximately 350 million metric tons, according to the Food and Agriculture Organization. As production has scaled, raw materials like soy milk and tofu have become more affordable and available. In India specifically, total soybean production has climbed to around 12.5 million tonnes by 2024–25. This abundance supports more experimentation and production of soy desserts. Improvements in processing technology—like silk tofu or flavored soy gel—have added to diversity and appeal.

Demand for soy-based desserts grows as consumers become more health-conscious and aware of dietary restrictions. In India, soybean is a major oilseed and protein source: projected soybean production of 130.5 lakh tonnes in 2023–24 forms roughly one-third of total oilseed production (395.9 lakh tonnes). This underscores soy’s importance in diets, and as soy meal and soy oil become staples, related soy consumables—including desserts—gain legitimacy in kitchens. Also, growing concern over lactose intolerance, cholesterol, and saturated fats drives consumers to plant-based options.

The increasing volume of soy output creates opportunities to introduce soy dessert products into mainstream foodservice and retail channels. With such large production volumes, margins on soy-derived ingredients can become competitive, enabling manufacturers to offer affordable soy desserts. Furthermore, developing products tailored to local tastes—for instance, soy-based kheer or halwa in India—could help capture a wide base.

Since India consumed about 136 lakh tonnes of soybeans in 2021–22, leveraging part of that for value-added dessert products represents novel value extraction. There’s also room for innovation in fortifying these desserts with micronutrients or combining them with regional flavours to increase acceptance.

Key Takeaways

- The Global Soy Dessert Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Soy yogurt holds the largest share in the soy dessert market, accounting for 58.9%.

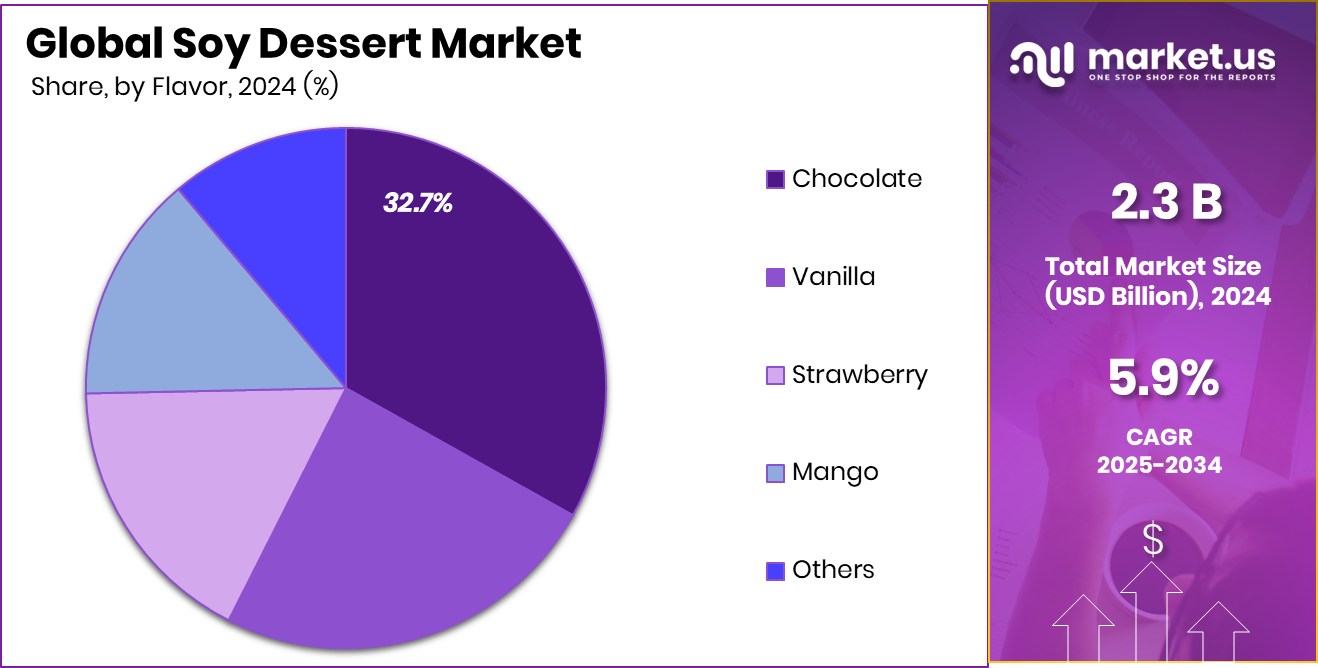

- Chocolate flavor is the most popular in soy desserts, capturing a 32.7% market share.

- Supermarkets dominate the distribution channel for soy desserts, holding a 36.5% market share.

- North America’s Soy Dessert Market at USD 0.8 Bn reflected 37.90% regional dominance in 2024.

By Product Type Analysis

Soy yogurt dominates the soy dessert market, capturing 58.9% of the share.

In 2024, Soy Yogurt held a dominant market position in the By Product Type segment of the Soy Dessert Market, with a 58.9% share. This strong presence is attributed to the increasing popularity of soy-based alternatives to dairy yogurt, driven by growing health-consciousness and demand for lactose-free, plant-based options.

Soy yogurt’s creamy texture and nutritional profile, including its high protein content and probiotics, make it a favorable choice among consumers seeking dairy-free, vegan, or lactose-free options. Furthermore, the ability to customize flavors and fortify the product with additional nutrients has helped drive its adoption. As consumer preferences shift toward healthier dessert alternatives, soy yogurt is expected to maintain its leadership position in the market.

By Flavor Analysis

Chocolate-flavored soy desserts hold a 32.7% share in the flavor category.

In 2024, Chocolate held a dominant market position in the By Flavor segment of the Soy Dessert Market, with a 32.7% share. This popularity is driven by chocolate’s widespread consumer appeal and its versatility in dessert products. The rich, indulgent taste of chocolate pairs well with the creamy texture of soy-based desserts, making it a top choice for consumers seeking plant-based alternatives to traditional dairy chocolate desserts.

Additionally, the increasing demand for healthier dessert options, such as those with reduced sugar or enhanced with functional ingredients, has supported chocolate-flavored soy desserts. As consumer interest in plant-based and dairy-free treats continues to rise, the chocolate flavor segment is expected to maintain its leading position in the market.

By Distribution Channel Analysis

Supermarkets are the leading distribution channel for soy desserts, with a 36.5% share.

In 2024, Supermarkets held a dominant market position in the By Distribution Channel segment of the Soy Dessert Market, with a 36.5% share. This is largely due to the widespread reach and convenience supermarkets offer to consumers, providing easy access to a variety of soy dessert products. Supermarkets also benefit from high foot traffic and their ability to stock a wide range of brands and flavors, catering to diverse consumer preferences.

Additionally, supermarkets often feature dedicated plant-based or health-conscious sections, which help attract shoppers looking for dairy-free or vegan dessert alternatives. As consumer demand for plant-based products continues to grow, supermarkets are expected to maintain a strong position as the primary distribution channel for soy desserts.

Key Market Segments

By Product Type

- Soy Yogurt

- Soy Pudding

- Soy Ice Cream

- Soy Cheesecake

By Flavor

- Vanilla

- Chocolate

- Strawberry

- Mango

- Others

By Distribution Channel

- Online

- Supermarkets

- Health Food Stores

- Convenience Stores

- Others

Driving Factors

Government Funding Drives Growth in Soy Dessert Market

The Indian soy dessert market is experiencing significant growth, driven in part by substantial government funding aimed at enhancing the food processing sector. The Ministry of Food Processing Industries (MoFPI) has implemented the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) with an outlay of ₹10,900 crores over six years (2021–2027). This initiative supports food manufacturing entities meeting minimum sales and investment criteria, fostering the creation of global food manufacturing champions and promoting Indian brands in international markets.

Additionally, the Pradhan Mantri Formalization of Micro Food Processing Enterprises (PMFME) scheme offers a 35% capital subsidy on project costs up to ₹10 lakh, seed capital support of ₹40,000 per member for Self-Help Groups (SHGs), and 50% … . These measures aim to modernize micro food processing units, enabling them to scale operations and access new markets.

Restraining Factors

High Production Costs Limit Growth of Soy Desserts

The Indian soy dessert market faces significant challenges due to high production costs, which hinder its growth potential. These elevated costs are primarily attributed to the high prices of raw materials and the need for specialized processing equipment. For instance, the soaring prices of soybean meal, a key ingredient in soy-based products, have been a concern for the industry. In 2021, domestic soybean meal prices surged to unprecedented highs, averaging INR 83,000 per metric ton, more than double the government’s minimum support price (MSP) of INR 39,500 per metric ton.

To address these issues, the Indian government has implemented various initiatives to support the food processing sector. The Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) offers financial incentives to food manufacturers meeting specific criteria, aiming to enhance domestic production capabilities and reduce dependency on imports. Additionally, the Pradhan Mantri Formalization of Micro Food Processing Enterprises (PMFME) scheme provides capital subsidies to micro food processing units, facilitating modernization and scaling of operations

Growth Opportunity

Expansion of Plant-Based Desserts in Asia

The growing demand for plant-based products presents a significant growth opportunity for the soy dessert market, particularly in Asia. As consumer preferences shift towards healthier and more sustainable food options, soy-based desserts have emerged as a popular alternative to dairy-based sweets. This trend is especially noticeable in countries like China, Japan, and India, where there is an increasing awareness of health benefits like lactose intolerance management and lower environmental impact.

Governments in these regions are supporting this shift through various funding initiatives aimed at promoting plant-based agriculture and sustainable food production. For example, Japan’s government has been providing subsidies to encourage the development of plant-based food alternatives. This support, coupled with growing health consciousness, is expected to drive significant growth in the soy dessert market in the coming years.

Latest Trends

Government Support Fuels Growth of Soy Desserts

The soy dessert market is experiencing significant growth, driven by increasing consumer demand for plant-based alternatives and strong government support. In India, the government’s recent decision to reduce the Goods and Services Tax (GST) on plant-based milk and meat alternatives to 5% has made these products more affordable and accessible to a broader population. This tax reform aligns plant-based options with traditional animal-based products, encouraging consumers to explore healthier and more sustainable choices.

Additionally, the Indian government has been actively promoting the plant-based food sector through various initiatives. The Ministry of Food Processing Industries (MoFPI) has recognized the potential of plant-based proteins and is working to enhance the food processing sector, including the development of plant-based foods and proteins. Furthermore, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) provides a framework for supporting the plant-based food industry, offering subsidies and incentives to encourage investment and innovation in this sector

These government actions not only make soy-based desserts more affordable but also create a conducive environment for businesses to invest in research and development, leading to the introduction of innovative products that cater to the evolving tastes and preferences of consumers. As a result, the soy dessert market is poised for sustained growth, benefiting from both consumer interest and supportive government policies.

Regional Analysis

In 2024, North America held a 37.90% share of the Soy Dessert Market, valued at USD 0.8 Bn.

In the global soy dessert market, North America emerges as the dominating region, holding approximately 37.90 % market share, with revenues around USD 0.8 billion. This leadership stems from strong consumer awareness around lactose intolerance, growing vegan and flexitarian populations, and robust retail and foodservice infrastructure supporting plant-based innovations.

North American manufacturers have accelerated product development, introducing premium soy puddings, yogurts, and frozen soy-based treats that cater to clean-label and high-protein demands. In contrast, Europe also shows steady adoption, driven by sustainability concerns and regulatory support for plant-based foods.

Asia-Pacific is witnessing rapid momentum, particularly in urbanized areas where dietary shifts and rising disposable incomes favour soy-based choices, though not yet overtaking North America in market share.

Latin America and the Middle East & Africa are emerging sectors: growing health consciousness, expanding distribution networks, and increased availability of soy desserts suggest solid growth potential, even if currently smaller than North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Hershey Company, traditionally recognized for its dominance in chocolates and confectionery, has been strategically diversifying into better-for-you segments. In 2024, the company continues leveraging its brand strength and retail penetration to experiment with plant-based alternatives, including soy-based desserts. With its wide distribution channels across North America, Hershey is well-positioned to capture consumers shifting toward dairy-free indulgence. By aligning with the growing demand for plant-based sweets, Hershey can bridge traditional chocolate lovers with soy-based innovation, giving the company a competitive edge in flavor-driven dessert launches.

Danone S.A. remains a global leader in the plant-based food space, with its Alpro and Silk brands already recognized in soy-based desserts, yogurts, and beverages. In 2024, the company continues to expand its soy dessert portfolio, emphasizing clean labels, nutritional fortification, and sustainable sourcing. With strong footprints in Europe and North America, Danone is shaping consumer expectations by investing in R&D to improve the taste and texture of soy alternatives. Its ability to scale innovations globally makes Danone a central driver of growth in the soy dessert category, especially as consumer interest in functional and fortified plant-based desserts accelerates.

The Hain Celestial Group, Inc. is an established player in natural and organic products, including soy-based categories. Through brands that emphasize health and wellness, Hain Celestial appeals strongly to niche but growing consumer bases that prioritize clean ingredients and dietary alternatives. In 2024, the company continues to strengthen its presence in North America by catering to flexitarians and health-focused consumers. Its soy dessert products align with the broader shift toward sustainable and plant-powered diets, giving Hain Celestial a distinct market advantage.

Top Key Players in the Market

- THE HERSHEY COMPANY

- Danone S.A.

- The Hain Celestial Group, Inc.

- AFC American Food Company

- ADM

- NOW Foods

- Kerry Group plc

- Gluten Intolerance Group

Recent Developments

- In May 2025, Danone announced an acquisition of a majority stake in Kate Farms, a U.S.-based company that specializes in plant-based, organic nutritional shakes and formulas—used both for everyday consumption and medical nutrition like tube feeding.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.1 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Soy Yogurt, Soy Pudding, Soy Ice Cream, Soy Cheesecake), By Flavor (Vanilla, Chocolate, Strawberry, Mango, Others), By Distribution Channel (Online, Supermarkets, Health Food Stores, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape THE HERSHEY COMPANY, Danone S.A., The Hain Celestial Group, Inc., AFC American Food Company, ADM, NOW Foods, Kerry Group plc, Gluten Intolerance Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- THE HERSHEY COMPANY

- Danone S.A.

- The Hain Celestial Group, Inc.

- AFC American Food Company

- ADM

- NOW Foods

- Kerry Group plc

- Gluten Intolerance Group