South Africa Faith-Based Tourism Market Size, Share, Growth Analysis By Tourism Type (Pilgrimages, Day Trips & Local Gateways, Museums, Religious and Heritage Tours, Others), By Tour Type (Independent Traveler, Package Traveler, Tour Group), By Booking Channel (Online Booking, Phone Booking, In Person Booking) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168114

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

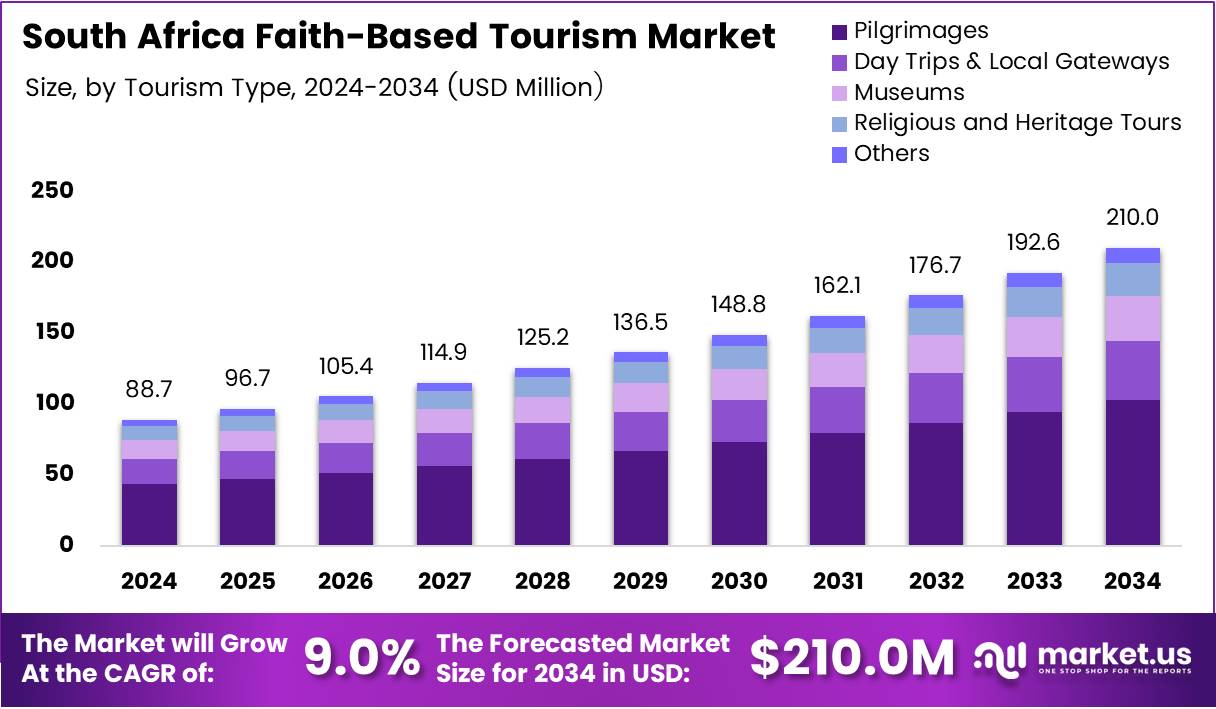

The South Africa Faith-Based Tourism Market is projected to reach USD 210.0 Million by 2034, up from USD 88.7 Million in 2024, expanding at a CAGR of 9.0% during the forecast period from 2025 to 2034. This sector represents a dynamic fusion of spiritual devotion and travel infrastructure, serving millions seeking meaningful religious experiences.

Faith-based tourism encompasses journeys undertaken primarily for spiritual enrichment, religious obligations, or heritage exploration. Consequently, this market includes pilgrimages, heritage tours, worship retreats, and interfaith cultural experiences. South Africa’s diverse religious landscape creates unique opportunities for domestic and international travelers alike.

The market demonstrates robust growth driven by increasing pilgrimage activities within Pentecostal and Zionist movements. Moreover, church-led travel packages are gaining popularity by bundling worship services with cultural immersion. Infrastructure development around sacred sites further supports market expansion across urban and rural destinations.

Rising domestic demand fuels significant market momentum as religious communities organize structured group travels. Additionally, international visitors seek authentic African spiritual experiences, particularly through interfaith heritage routes. Liberation-era sacred sites now integrate seamlessly with contemporary worship destinations, creating comprehensive pilgrimage experiences.

Government initiatives supporting tourism infrastructure benefit faith-based travel operators substantially. Furthermore, digital transformation enables personalized pilgrimage planning through AI-driven platforms. Social media amplification of gospel festivals and church events drives group travel conversion rates higher than traditional marketing methods.

According to World Wide Magazine, 85.3% of South Africa’s population professed Christianity in 2022, establishing a strong foundation for faith tourism. Meanwhile, research published on Academia highlights that approximately 240 million people travel globally for religious purposes annually, demonstrating substantial growth potential. Township ministry tours and mega-event hosting present lucrative expansion opportunities for operators.

Hybrid wellness-spiritual retreats incorporating prayer and counseling services represent emerging market segments. Similarly, indigenous sacred ecology experiences combining ritual practices with nature stewardship attract environmentally conscious travelers. Faith-aligned volunteer tourism programs linked to extended-stay travel further diversify revenue streams for industry stakeholders.

Key Takeaways

- South Africa Faith-Based Tourism Market projected to reach USD 210.0 Million by 2034 from USD 88.7 Million in 2024 at 9.0% CAGR

- Pilgrimages segment dominates tourism type category with 38.8% market share in 2024

- Independent Traveler segment leads tour type category holding 49.6% market share

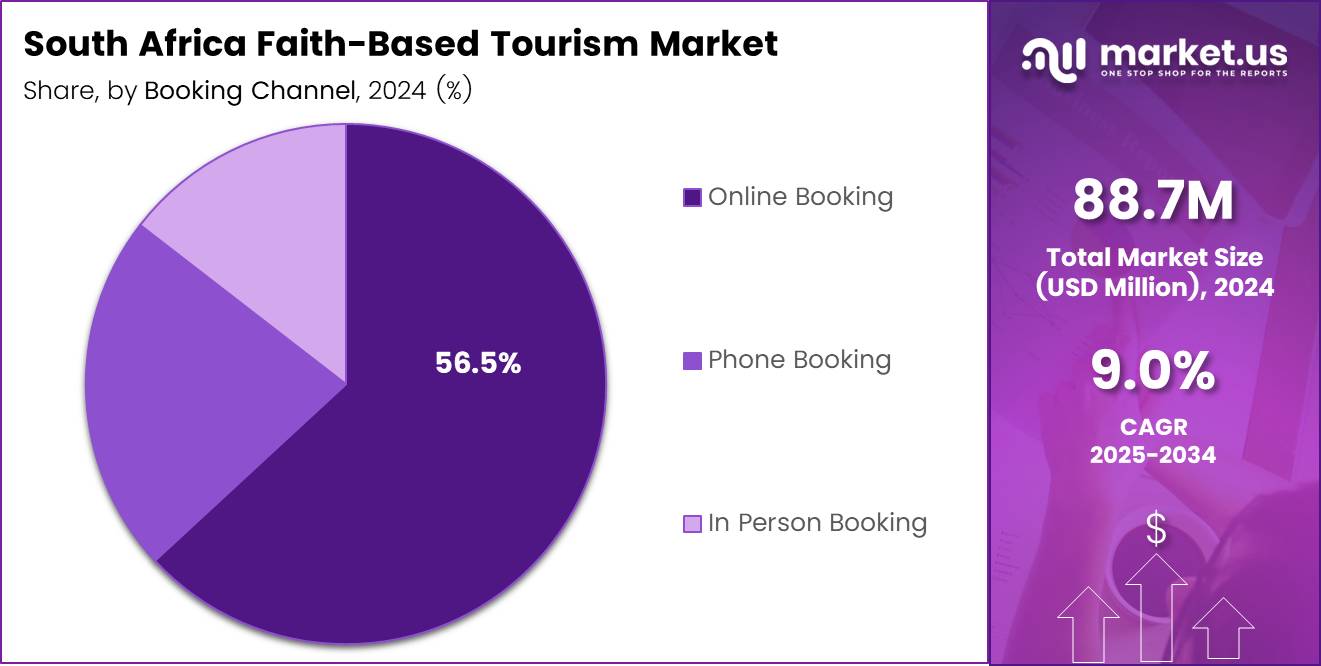

- Online Booking channel commands 56.5% share, reflecting digital transformation trends

Segments Overview

By Tourism Type Analysis

Pilgrimages dominates with 38.8% due to strong religious devotion and organized faith community travel.

In 2024, Pilgrimages held a dominant market position in the By Tourism Type Analysis segment of South Africa Faith-Based Tourism Market, with a 38.8% share. This segment thrives because religious communities organize structured journeys to sacred sites regularly. Pentecostal and Zionist movements particularly drive pilgrimage activities across provinces. Consequently, tour operators design specialized packages catering to group pilgrimage requirements effectively.

Day Trips and Local Gateways attract visitors seeking shorter spiritual experiences without overnight stays. These quick visits serve local congregations exploring nearby religious landmarks conveniently. Urban churches frequently organize same-day excursions to heritage sites, supporting steady demand. Moreover, affordability makes this option accessible to broader demographic segments consistently.

Museums focusing on religious history and heritage education draw culturally curious travelers. These institutions preserve artifacts, documents, and narratives of faith traditions across generations. Educational tours combine spiritual learning with historical context, appealing to schools and study groups. Furthermore, interactive exhibits enhance visitor engagement, creating memorable experiences beyond traditional worship settings.

Religious and Heritage Tours combine worship activities with cultural immersion experiences comprehensively. These journeys explore liberation-era sacred sites alongside contemporary religious landmarks. Interfaith routes showcase South Africa’s diverse spiritual landscape, attracting international visitors increasingly. Additionally, heritage tours connect past struggles with present-day faith communities, offering profound emotional resonance.

Others include niche segments such as retreat centers, faith-based conferences, and specialized spiritual programs. These offerings cater to specific denominational needs or unique spiritual practices. Wellness-spiritual hybrid experiences and indigenous sacred ecology tours fall within this category. Innovation within this segment continues expanding as operators identify emerging traveler preferences strategically.

By Tour Type Analysis

Independent Traveler dominates with 49.6% driven by personalized spiritual journey preferences and flexible itineraries.

In 2024, Independent Traveler held a dominant market position in the By Tour Type Analysis segment of South Africa Faith-Based Tourism Market, with a 49.6% share. This segment reflects growing desire for customized spiritual experiences tailored to individual needs. Travelers prefer controlling their schedules, choosing destinations, and pacing their pilgrimages independently. Digital tools and AI-driven planning platforms further facilitate self-guided religious journeys efficiently.

Package Traveler segment serves those seeking convenience through pre-arranged faith-based tourism bundles. These packages typically include transportation, accommodation, guided tours, and worship activities comprehensively. Church groups and first-time pilgrims particularly favor this hassle-free approach. Moreover, package deals often provide cost advantages through bulk bookings and negotiated rates.

Tour Group segment comprises organized faith communities traveling collectively for shared spiritual experiences. Churches, denominations, and religious organizations coordinate these group journeys regularly throughout the year. Shared costs make group travel economically attractive for members with limited budgets. Additionally, collective worship and fellowship during tours strengthen community bonds and enhance spiritual fulfillment significantly.

By Booking Channel Analysis

Online Booking dominates with 56.5% reflecting digital transformation and convenience-driven consumer behavior.

In 2024, Online Booking held a dominant market position in the By Booking Channel Analysis segment of South Africa Faith-Based Tourism Market, with a 56.5% share. Digital platforms provide travelers with instant access to faith tourism options, reviews, and pricing comparisons. Mobile-friendly booking interfaces cater to younger demographics increasingly participating in religious travel. Furthermore, online channels enable operators to reach broader audiences beyond traditional geographic limitations effectively.

Phone Booking remains relevant for segments preferring personal interaction during reservation processes. Older demographics and rural communities often favor speaking directly with booking agents. This channel allows travelers to ask specific questions about religious accommodation or dietary requirements. Moreover, phone support provides reassurance for complex multi-destination pilgrimage planning requiring detailed coordination.

In Person Booking serves travelers desiring face-to-face consultation before committing to faith journeys. Travel agencies specializing in religious tourism offer personalized guidance through in-person meetings. Church offices and community centers also facilitate bookings for congregation members collectively. Additionally, in-person interactions build trust, particularly for first-time pilgrims unfamiliar with destination options.

Key Market Segments

By Tourism Type

- Pilgrimages

- Day Trips & Local Gateways

- Museums

- Religious and Heritage Tours

- Others

By Tour Type

- Independent Traveler

- Package Traveler

- Tour Group

By Booking Channel

- Online Booking

- Phone Booking

- In Person Booking

Drivers

Rising Domestic Pilgrimage Demand and Church-Led Travel Packages Drive Market Expansion

Domestic pilgrimage activities within Pentecostal and Zionist movements generate consistent demand for faith-based tourism services. These religious communities organize regular journeys to sacred sites, creating predictable revenue streams for operators. Consequently, infrastructure development around pilgrimage destinations receives increased investment from both public and private sectors.

Church-led travel packages effectively bundle worship services with cultural experiences, appealing to congregations seeking meaningful travel. These offerings combine spiritual fulfillment with educational components, enhancing overall value propositions. Moreover, churches leverage their existing community networks to promote trips, ensuring strong participation rates consistently.

Integration of interfaith heritage routes with liberation-era sacred sites creates compelling narratives for domestic and international visitors. These journeys connect historical struggles with contemporary faith practices, offering profound emotional experiences. Additionally, global interest in authentic African spiritual experiences continues rising, driving international visitor arrivals steadily upward.

Restraints

Limited Standardized Accreditation and Infrastructure Gaps Constrain Market Development

Absence of standardized accreditation systems for faith-based tour operators creates quality inconsistencies across the industry. Travelers struggle to identify reliable service providers, potentially leading to unsatisfactory experiences. Consequently, reputation risks discourage some potential visitors from booking faith tourism packages with unfamiliar operators.

Infrastructure gaps at rural sacred sites and community ministry destinations limit accessibility for larger tourist groups. Many significant religious locations lack adequate facilities such as restrooms, parking, or visitor centers. Moreover, transportation networks connecting remote pilgrimage sites often remain underdeveloped, complicating logistics for tour operators significantly.

These challenges particularly affect operators attempting to expand offerings beyond urban areas into rural regions. Investment requirements for infrastructure improvements often exceed financial capabilities of small faith-based tourism businesses. Additionally, government support for rural tourism infrastructure develops slowly compared to commercial tourism priorities.

Growth Factors

Curated Township Ministry Tours and Religious Mega-Events Create Expansion Opportunities

Development of curated multi-day township ministry and worship immersion tours addresses growing demand for authentic community engagement. These experiences allow visitors to participate directly in local faith communities, fostering meaningful connections. Consequently, operators can charge premium pricing for exclusive access to genuine spiritual and cultural interactions.

Expansion of religious mega-event hosting with year-round tourism extensions transforms one-time gatherings into sustained revenue generators. Major conferences, gospel festivals, and denominational conventions attract thousands of attendees periodically. Moreover, operators develop complementary programming before and after events, encouraging extended stays and additional spending significantly.

Creation of indigenous sacred ecology experiences combining ritual practices with nature stewardship appeals to environmentally conscious travelers. Faith-aligned volunteer tourism programs linked to extended-stay travel offer purposeful engagement opportunities. Additionally, these innovative offerings differentiate South African faith tourism from competing destinations internationally.

Emerging Trends

Digital Sermon Tourism and AI-Driven Personalization Transform Faith Travel Experiences

Digital sermon tourism influence drives impressive group travel conversion rates as virtual content inspires physical pilgrimages. Popular preachers and worship leaders leverage social media to promote destination events, mobilizing followers effectively. Consequently, operators partner with influential religious figures to develop exclusive travel experiences for their audiences.

Hybrid wellness-spiritual retreats incorporating prayer and counseling services attract health-conscious faith travelers seeking holistic experiences. These programs combine traditional worship with modern wellness practices like meditation and nutrition guidance. Moreover, social media-amplified church choir and gospel festival travel trends generate viral marketing effects organically.

AI-driven personalized pilgrimage planning enables travelers to create customized itineraries matching their specific spiritual goals. Advanced algorithms consider denominational preferences, physical capabilities, and budget constraints when suggesting destinations. Additionally, chatbots provide instant responses to booking inquiries, improving customer service efficiency while reducing operational costs substantially.

Key South Africa Faith-Based Tourism Company Insights

The South Africa Faith-Based Tourism Market features diverse operators ranging from specialized religious travel agencies to comprehensive tour companies. XL Turners Travel based in Cape Town provides tailored faith tourism packages combining spiritual sites with cultural experiences. Summer Place offers curated religious heritage tours emphasizing historical context and contemporary worship opportunities effectively.

Wanderer Cape Town Tours & Travel specializes in private faith-based excursions, delivering personalized spiritual journeys for individuals and small groups. ILIOS Travel (Pty) Ltd develops comprehensive pilgrimage packages integrating multiple sacred destinations across provinces efficiently.

Hotspots2c focuses on accessible faith tourism experiences for diverse demographic segments, including family-friendly religious trips. The Cape Town Tour Guide Company employs knowledgeable guides who provide deep insights into religious history and spiritual significance of destinations.

Nomad Africa Adventure Tours combines faith-based experiences with adventure tourism, attracting younger religious travelers seeking dynamic journeys. Springbok Atlas leverages extensive transportation networks to offer reliable group pilgrimage services nationwide consistently.

Giltedge Travel Group provides luxury faith tourism options catering to affluent pilgrims desiring premium accommodations and exclusive access. Earthstompers Adventures develops eco-conscious religious tours emphasizing indigenous sacred ecology and environmental stewardship principles.

Key Companies

- XL Turners Travel- Cape Town

- Summer Place

- Wanderer Cape Town Tours & Travel- Private Capes Town Tours

- ILIOS Travel (Pty) Ltd

- Hotspots2c

- The Cape Town Tour Guide Company

- Nomad Africa Adventure Tours

- Springbok Atlas

- Giltedge Travel Group

- Earthstompers Adventures

Recent Developments

- In February 2024, Romanian tour operator Christian Tour acquired a majority stake in AnimaWings, expanding its capacity to serve European pilgrims traveling to diverse faith destinations globally. This strategic acquisition enhances operational capabilities for long-distance religious travel coordination significantly.

- In March 2025, the group unveiled plans for Caminos Lebanon, an innovative project designed to revitalize Christian religious tourism through unique pilgrimage experiences. This initiative draws inspiration from the renowned Camino de Santiago in Spain, creating similar spiritual walking routes.

Report Scope

Report Features Description Market Value (2024) USD 88.7 Million Forecast Revenue (2034) USD 210.0 Million CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tourism Type (Pilgrimages, Day Trips & Local Gateways, Museums, Religious and Heritage Tours, Others), By Tour Type (Independent Traveler, Package Traveler, Tour Group), By Booking Channel (Online Booking, Phone Booking, In Person Booking) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape XL Turners Travel – Cape Town, Summer Place, Wanderer Cape Town Tours & Travel – Private Cape Town Tours, ILIOS Travel (Pty) Ltd, Hotspots2c, The Cape Town Tour Guide Company, Nomad Africa Adventure Tours, Springbok Atlas, Giltedge Travel Group, Earthstompers Adventures Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  South Africa Faith-Based Tourism MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

South Africa Faith-Based Tourism MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- XL Turners Travel- Cape Town

- Summer Place

- Wanderer Cape Town Tours & Travel- Private Capes Town Tours

- ILIOS Travel (Pty) Ltd

- Hotspots2c

- The Cape Town Tour Guide Company

- Nomad Africa Adventure Tours

- Springbok Atlas

- Giltedge Travel Group

- Earthstompers Adventures