Global Solid State LiDAR Sensor Market Size, Share, Industry Analysis Report By Component (Sensors/Magnetometers (Optically Pumped Magnetometers, Nuclear Precession Magnetometers, Fluxgate Magnetometers, Superconducting Quantum Interference Devices (SQUIDs), Others), Signal Processing Electronics & DAS, Compensation Systems, Others), By Platform (Airborne (Manned Aircraft, Unmanned Aerial Vehicles (UAVs)), Naval/Surface (Ships & Vessels, Unmanned Surface Vehicles (USVs)), Ground/Vehicle-Mounted, Space-Based), By Application (Military and Defense, Aerospace, Marine Exploration, Geophysical Surveying, Search and Rescue Operations), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168644

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Quick Market Facts

- US Market Size

- By Component: Sensors/Magnetometers

- By Platform: Airborne

- By Application: Military and Defense

- Role of Generative AI

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

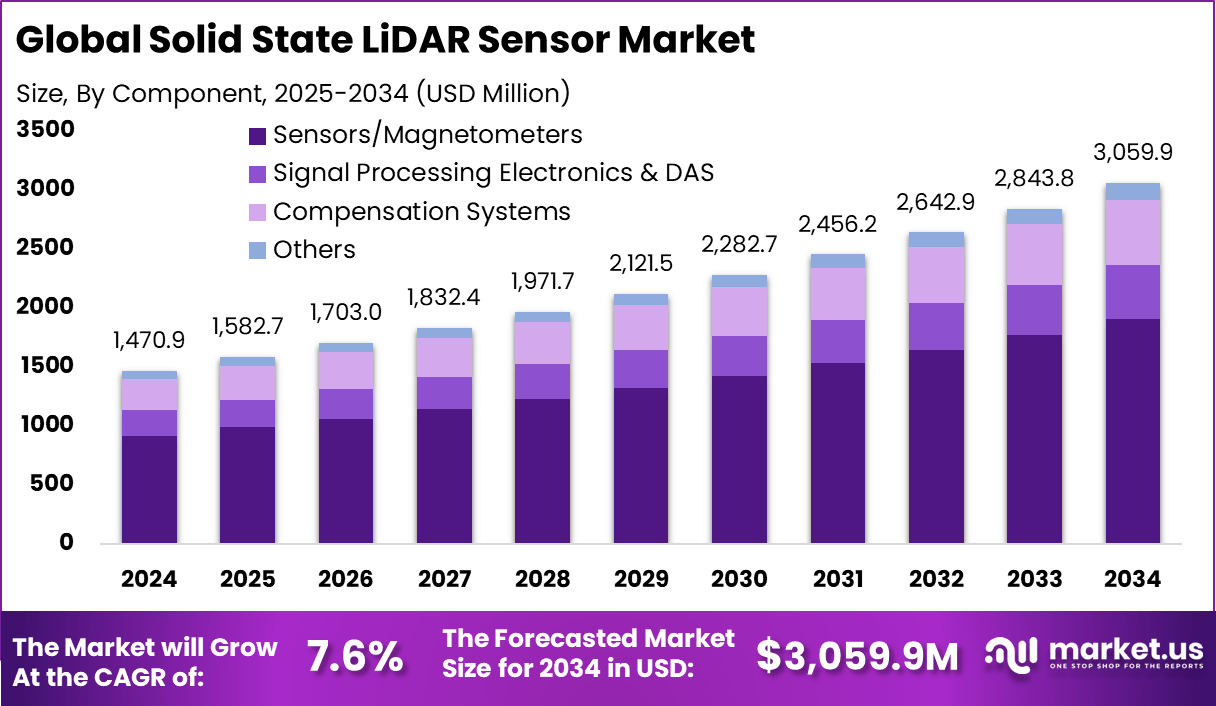

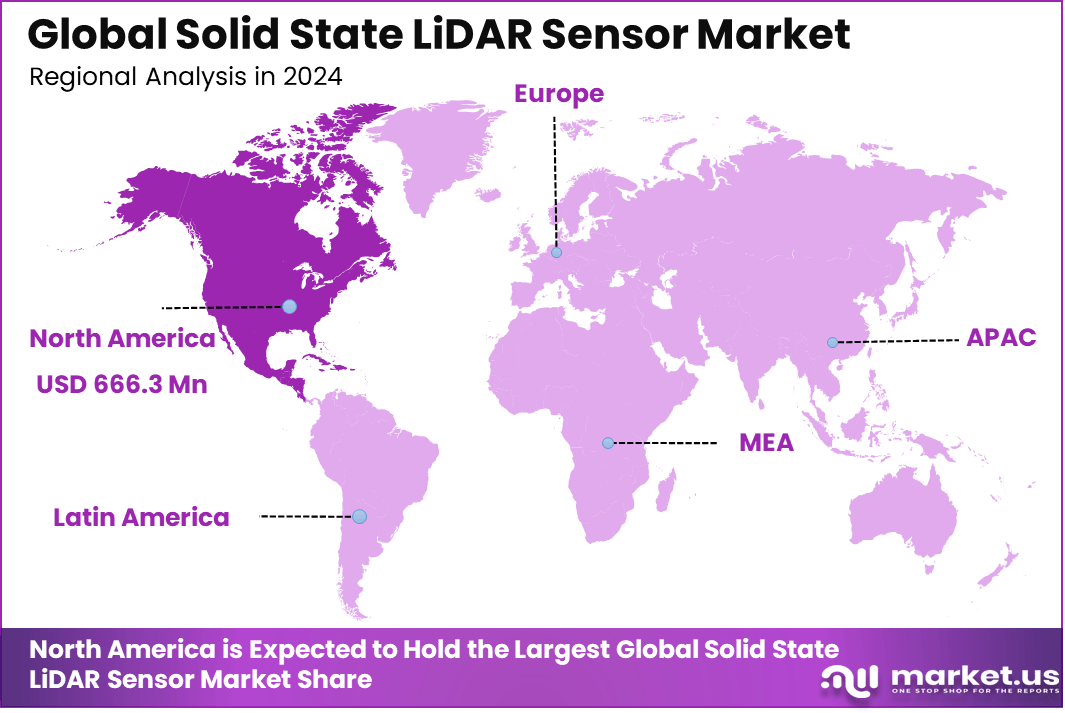

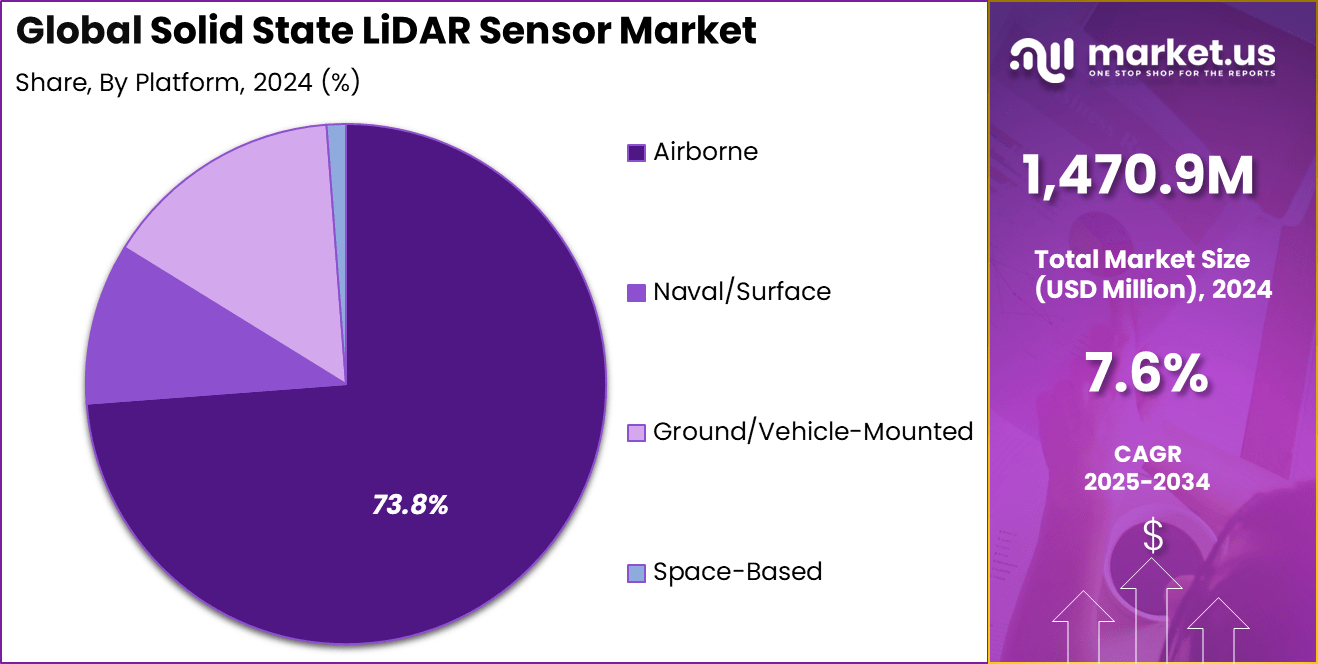

The Global Solid State LiDAR Sensor Market generated USD 1,470.9 Million in 2024 and is predicted to register growth from USD 1,582.7 Million in 2025 to about USD 3,059.9 Million by 2034, recording a CAGR of 7.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 45.3% share, holding USD 666.3 Million revenue.

The solid state LiDAR sensor market has expanded as automotive, industrial and robotics sectors adopt compact, durable and cost efficient sensing systems for accurate depth perception. Growth reflects the shift away from mechanical LiDAR toward solid state designs that offer higher reliability, lower maintenance and better integration into mass produced products. These sensors are now used in autonomous vehicles, smart infrastructure and advanced navigation systems.

The growth of the market can be attributed to rising demand for autonomous mobility, increasing need for precise environmental mapping and stronger adoption of driver assistance features. Solid state LiDAR enables high resolution perception at lower cost and supports safer operation in complex environments. Broader use of automation across transportation, logistics and industrial equipment further strengthens demand.

Quick Market Facts

- By component, sensors and magnetometers lead with 62.4%, supported by rising demand for compact and durable solid-state LiDAR units used in advanced detection and mapping applications.

- By platform, the airborne segment dominates with 73.8%, driven by strong use of LiDAR in drones, aircraft, and unmanned systems for surveillance and terrain analysis.

- By application, military and defense holds 70.2%, reflecting heavy investment in next-generation sensing technologies for reconnaissance, targeting, and situational awareness.

- North America accounts for 45.3%, supported by strong defense spending and rapid adoption of solid state LiDAR in aerospace programs.

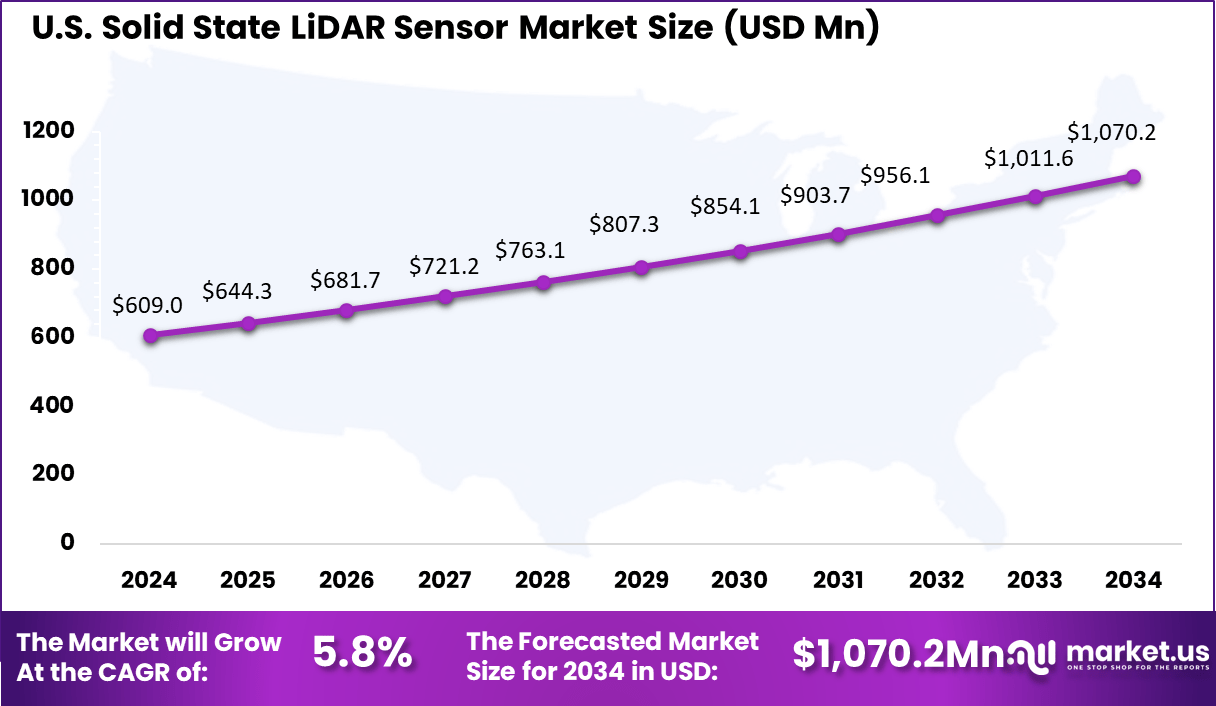

- The US market reached USD 609.02 million and is expanding at a steady CAGR of 5.8%, indicating consistent demand for LiDAR in defense, aviation, and security applications.

US Market Size

The United States specifically contributes a market value of about USD 609.02 million, growing at a steady 5.8% CAGR. Government initiatives and funding for autonomous systems, smart infrastructure, and defense upgrades enhance North America’s leadership position.

The expansion of R&D activities and partnerships among industry, academia, and government agencies ensures continued advancement in solid-state LiDAR technology and its applications across multiple sectors.

In 2024, North America leads the solid-state LiDAR sensor market with a significant 45.3% share, reflecting its strong aerospace, defense, and automotive technology ecosystems. The region benefits from substantial investments in autonomous vehicle technology, robotics, and defense modernization programs, which drive demand for reliable, cutting-edge sensor technologies. The presence of key industry players and a supportive regulatory framework further accelerate innovation and market growth in this region.

By Component: Sensors/Magnetometers

Sensors and magnetometers dominate the solid-state LiDAR sensor market, accounting for 62.4% of the share. These components are crucial for the precise detection and mapping capabilities that solid-state LiDAR systems provide. Their reliability and compact size make them ideal for integration into various platforms, especially where space and weight are critical constraints.

The advancement in sensor technology continues to improve accuracy while reducing power consumption, making these components central to the overall performance of LiDAR systems. With ongoing innovations, these sensors are becoming smaller, more cost-effective, and more resilient to environmental factors such as vibrations and temperature fluctuations.

This enhances their deployment in demanding applications like autonomous vehicles, drones, and robotics where precision and durability are essential. The push toward integrating these sensors with AI and IoT platforms is also expanding their functional capabilities, enabling more intelligent and real-time data processing in complex environments.

By Platform: Airborne

The airborne platform leads the solid-state LiDAR sensor market with a commanding 73.8% share. Airborne LiDAR systems are extensively used in applications such as aerial mapping, surveying, and military reconnaissance. Their ability to collect high-resolution spatial data over large areas quickly makes them indispensable for infrastructure monitoring, environmental research, and defense operations.

The technology’s compact size and reduced weight due to solid-state innovations enhance aircraft efficiency and operational flexibility. In addition to manned aircraft, unmanned aerial vehicles (UAVs) or drones also rely heavily on solid-state LiDAR sensors for obstacle avoidance and navigation.

The escalating demand for 3D topographic mapping in sectors like agriculture, forestry, and urban planning further drives growth in this platform segment. Advances in airborne LiDAR integration with GPS and inertial navigation systems are enhancing data accuracy and reliability for users globally.

By Application: Military and Defense

Military and defense applications dominate with 70.2% of the market share, reflecting the critical role solid-state LiDAR sensors play in surveillance, target acquisition, and autonomous navigation. Their precision, rapid data acquisition, and durability under extreme conditions make them highly suited for defense needs.

Increasing investments in modernizing military fleets and enhancing battlefield situational awareness are propelling the adoption of advanced LiDAR technologies in this sector. Besides traditional military aircraft, LiDAR sensors are being integrated into unmanned systems such as drones and ground vehicles for reconnaissance missions and threat detection.

The ability of solid-state LiDAR to operate silently and without moving parts offers tactical advantages. Moreover, governments are prioritizing funding for research and development to push enhancements in range, accuracy, and miniaturization of LiDAR systems to support evolving defense strategies.

Role of Generative AI

Generative AI plays an important role in enhancing the capabilities of solid-state LiDAR sensors by improving data processing and object recognition. By creating synthetic training data, generative AI helps train machine learning models to understand complex 3D environments with higher accuracy. This results in faster and more accurate interpretation of LiDAR point clouds, which is critical for applications like autonomous driving and industrial automation.

Studies show that generative AI integration can boost object recognition accuracy by over 20%, enabling more reliable environment mapping and obstacle detection. Besides data enhancement, generative AI automates the development of advanced algorithms that filter noise and compensate for poor weather conditions impacting LiDAR performance.

With AI-driven real-time analytics, solid-state LiDAR sensors can deliver better scene understanding and predictive maintenance insights. The adoption of generative AI in LiDAR systems is accelerating, with investments growing at a double-digit annual rate, reflecting its growing strategic importance in this field.

Emerging Trends

Miniaturization is a significant trend in solid-state LiDAR technology, driven by advances in photonics and semiconductor fabrication. This has resulted in sensors becoming smaller, lighter, and more power-efficient, making them easier to integrate into a broad range of platforms beyond automotive, such as drones, smart cities, and industrial robotics. The market reports a continuous 15% annual shrinkage in sensor size, fostering new application opportunities.

Another key trend is the fusion of LiDAR with other sensor types like cameras and radar to improve detection accuracy and reliability. Software innovations, particularly those incorporating AI and machine learning algorithms, enhance data processing efficiency and extend functionalities such as simultaneous localization and mapping. Around 40% of new solid-state LiDAR deployments now incorporate AI-based sensor fusion, highlighting its rapid adoption.

Growth Factors

Autonomous vehicles remain one of the main growth drivers for solid-state LiDAR due to the technology’s crucial role in enabling safe navigation and obstacle avoidance. The demand for advanced driver assistance systems is pushing continuous improvements in range, resolution, and cost-effectiveness of these sensors.

Approximately 65% of solid-state LiDAR applications in 2025 are linked to autonomous or semi-autonomous vehicle systems. In addition to automotive, industrial automation and security sectors are expanding their use of solid-state LiDAR for tasks such as 3D mapping, surveillance, and robotics.

Government regulations supporting autonomous driving and smart infrastructure development are also stimulating market growth. Investments in R&D aimed at boosting sensor performance and reducing manufacturing costs have increased over 25% year-over-year, further fueling adoption across different industries.

Key Market Segments

By Component

- Sensors/Magnetometers

- Optically Pumped Magnetometers

- Nuclear Precession Magnetometers

- Fluxgate Magnetometers

- Superconducting Quantum Interference Devices (SQUIDs)

- Others

- Signal Processing Electronics & DAS

- Compensation Systems

- Others

By Platform

- Airborne

- Manned Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Naval/Surface

- Ships & Vessels

- Unmanned Surface Vehicles (USVs)

- Ground/Vehicle-Mounted

- Space-Based

By Application

- Military and Defense

- Aerospace

- Marine Exploration

- Geophysical Surveying

- Search and Rescue Operations

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Demand in Autonomous Vehicles

One key driver for the solid-state LiDAR sensor market is the growing demand for autonomous vehicles and advanced driver-assistance systems (ADAS). These vehicles rely heavily on solid-state LiDAR sensors for safe navigation, obstacle detection, and precise environment mapping.

The technology’s capability to offer smaller, lighter, and more reliable sensors compared to mechanical LiDAR has made it essential for automotive innovation. Approximately 55% of global demand for these sensors in 2025 comes from autonomous driving applications, underlining the importance of this sector in driving market growth.

Furthermore, government regulations promoting road safety and autonomous vehicle adoption are encouraging investments in LiDAR technology. The automotive industry’s push to integrate sensors into Level 2+ and Level 3 autonomous driving platforms is accelerating the demand.

Restraint Analysis

Performance Limitations in Adverse Conditions

A significant restraint for the solid-state LiDAR sensor market is the limited performance under adverse weather conditions such as rain, fog, and snow. Despite advances, these environmental factors can degrade sensor accuracy and the quality of LiDAR data, affecting the reliability of object detection and mapping. This limitation restricts the broader adoption of solid-state LiDAR in outdoor environments where consistent performance is crucial.

Additionally, while solid-state LiDAR sensors offer benefits in size and reliability, many still lag behind mechanical LiDAR in terms of maximum range and resolution. These performance restraints hinder their adoption in applications requiring extensive long-range data collection, such as high-speed autonomous driving or large-scale industrial mapping. Addressing these issues is critical for broader market penetration.

Opportunity Analysis

Expansion into Industrial Automation and Smart Infrastructure

The solid-state LiDAR market has a promising opportunity in industrial automation and smart infrastructure sectors. Increasing demand for precision 3D sensing in robotics, warehousing automation, and production line optimization is driving adoption beyond automotive. Due to their ruggedness and maintenance-free design, solid-state LiDAR sensors fit well in these environments where reliability and continuous operation are essential.

Moreover, smart city initiatives requiring advanced surveillance, traffic management, and environmental monitoring are expanding the use cases for LiDAR sensors. Industrial automation is expected to continue growing steadily, fueled by the Industry 4.0 trend, which emphasizes efficiency, safety, and automation. These sectors represent significant new markets for solid-state LiDAR as technology matures and sensor costs decrease.

Challenge Analysis

High Initial Cost and Technological Maturity

A key challenge faced by the solid-state LiDAR sensor market is the high initial cost of advanced sensors. Despite cost reduction efforts, some systems remain expensive to produce at scale, which limits adoption, especially in cost-sensitive applications or emerging markets. The balance between affordability and high performance is not uniformly achieved, creating barriers for mass-market deployment.

Along with cost, the technology is still evolving to meet all performance requirements like enhanced resolution, longer range, and greater robustness. Continuous innovation and R&D investments are necessary to overcome these technical barriers. Meanwhile, competition among many players putting pressure on pricing and the need to develop more reliable sensor designs for harsh environments complicate the market landscape.

Competitive Analysis

Lockheed Martin, Honeywell, Raytheon, L3Harris, and Thales lead the solid-state LiDAR sensor market with advanced sensing systems designed for defense navigation, autonomous targeting, and high-precision situational awareness. Their solutions focus on enhanced range, rugged durability, and real-time detection in demanding environments. These companies continue to strengthen their position by integrating LiDAR into military platforms, unmanned systems, and next-generation surveillance technologies.

General Dynamics, BAE Systems, Kongsberg Gruppen, Fugro, Geometrics, Marine Magnetics, and Teledyne Technologies expand the competitive landscape with specialized solid-state LiDAR solutions for maritime, land, and airborne applications. Their platforms support terrain mapping, subsea inspection, and navigation in low-visibility conditions. These providers focus on improved signal processing, compact sensor design, and energy-efficient performance.

Bartington Instruments, Foerster, Metron, Raptor Photonics, Zonge International, Magnetic Technologies, Vista Clara, Gem Systems, and other participants add depth to the market with niche, high-sensitivity sensing technologies. Their offerings support scientific research, mineral exploration, infrastructure inspection, and precision positioning. These companies emphasize accuracy, robustness, and adaptability to diverse field environments.

Top Key Players in the Market

- Lockheed Martin Corporation

- Honeywell International Inc.

- Raytheon Technologies Corporation

- L3Harris Technologies, Inc.

- Thales Group

- General Dynamics Corporation

- BAE Systems plc

- Kongsberg Gruppen ASA

- Fugro N.V.

- Geometrics, Inc.

- Marine Magnetics Corp.

- Teledyne Technologies Incorporated

- Bartington Instruments Ltd.

- Foerster Holding GmbH

- Metron, Inc.

- Raptor Photonics Ltd.

- Zonge International, Inc.

- Magnetic Technologies Ltd.

- Vista Clara Inc.

- Gem Systems Inc.

- Others

Recent Developments

- May 2025: SolidVUE unveiled the SL-2.2, the world’s first 400×128 high-resolution single-chip solid-state LiDAR sensor IC at CES 2025. This compact sensor offers precise 3D point-cloud imaging up to 200 meters with lower cost and improved vibration reliability, targeting autonomous vehicles, robotics, and security applications.

- July 2025: XenomatiX launched its most advanced solid-state LiDAR, Xavia, representing next-generation technology with enhancements that likely improve range and resolution for automotive and industrial applications.

- August 2025: Raytheon Technologies completed a key flight test for its Lower Tier Air and Missile Defense Sensor integrating solid-state sensors. The test demonstrated 360-degree threat detection with enhanced power supply, supporting global deployment for advanced defense systems.

Report Scope

Report Features Description Market Value (2024) USD 1,470.9 Mn Forecast Revenue (2034) USD 3,059.9 Mn CAGR(2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Sensors/Magnetometers (Optically Pumped Magnetometers, Nuclear Precession Magnetometers, Fluxgate Magnetometers, Superconducting Quantum Interference Devices (SQUIDs), Others), Signal Processing Electronics & DAS, Compensation Systems, Others), By Platform (Airborne (Manned Aircraft, Unmanned Aerial Vehicles (UAVs)), Naval/Surface (Ships & Vessels, Unmanned Surface Vehicles (USVs)), Ground/Vehicle-Mounted, Space-Based), By Application (Military and Defense, Aerospace, Marine Exploration, Geophysical Surveying, Search and Rescue Operations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lockheed Martin Corporation, Honeywell International Inc., Raytheon Technologies Corporation, L3Harris Technologies, Inc., Thales Group, General Dynamics Corporation, BAE Systems plc, Kongsberg Gruppen ASA, Fugro N.V., Geometrics, Inc., Marine Magnetics Corp., Teledyne Technologies Incorporated, Bartington Instruments Ltd., Foerster Holding GmbH, Metron, Inc., Raptor Photonics Ltd., Zonge International, Inc., Magnetic Technologies Ltd., Vista Clara Inc., Gem Systems Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solid State LiDAR Sensor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Solid State LiDAR Sensor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lockheed Martin Corporation

- Honeywell International Inc.

- Raytheon Technologies Corporation

- L3Harris Technologies, Inc.

- Thales Group

- General Dynamics Corporation

- BAE Systems plc

- Kongsberg Gruppen ASA

- Fugro N.V.

- Geometrics, Inc.

- Marine Magnetics Corp.

- Teledyne Technologies Incorporated

- Bartington Instruments Ltd.

- Foerster Holding GmbH

- Metron, Inc.

- Raptor Photonics Ltd.

- Zonge International, Inc.

- Magnetic Technologies Ltd.

- Vista Clara Inc.

- Gem Systems Inc.

- Others