Global Solar Pump Market Size, Share, And Business Benefits By Type (Up to 3HP, 3HP to 10 HP, Above 10 HP), By Motor Type (AC Pump, DC Pump), By Product (Surface Suction, Submersible, Floating, Others), By Application (Agricultural, Drinking Water, Municipal Engineering, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154981

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

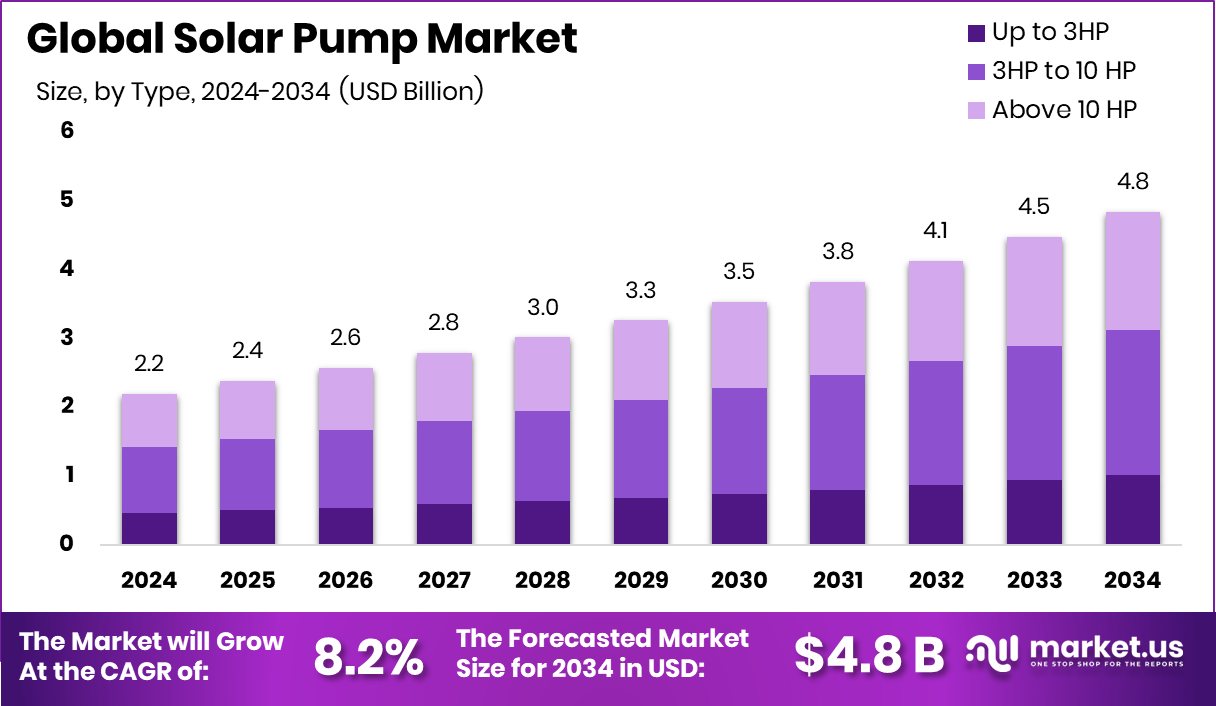

The Global Solar Pump Market is expected to be worth around USD 4.8 billion by 2034, up from USD 2.2 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. High agricultural demand and government support fueled the Asia Pacific’s 56.3% strong solar pump growth.

A solar pump is a water pumping system powered by solar energy through photovoltaic (PV) panels. These pumps are used to lift water for irrigation, livestock watering, and even community water supply systems. They are especially effective in remote and off-grid areas where electricity is unavailable or diesel-based systems are expensive to operate.

The pump system includes a solar panel array, a controller, and the actual pump—either submersible or surface-based—depending on the depth of the water source. Haryana farmers can now install 3 HP solar pumps at ₹53,926 with subsidy support, which is making such systems more affordable for rural communities.

The solar pump market is witnessing strong growth due to the rising adoption of renewable energy in agriculture and rural infrastructure. As countries push for sustainable irrigation and reduced reliance on fossil fuels, solar pumps are becoming a cost-effective and eco-friendly alternative.

Government subsidies and clean energy missions in developing nations have significantly boosted installations across rural farming communities, where affordability and energy access remain key challenges. Amrut Energy has secured ₹1 billion in funding to expand its solar pump manufacturing capacity, further supporting market expansion and the availability of advanced pumping solutions.

One of the major growth drivers is the increasing need for energy-efficient water pumping solutions in agriculture. With the global agricultural sector under pressure due to water scarcity and rising input costs, solar pumps provide an affordable, long-term solution for irrigation. They help reduce operational costs as they eliminate the dependency on grid electricity or diesel fuel. Shakti Pumps has raised funds to set up a 2.2 GW solar module factory in India, which is expected to strengthen domestic production capabilities and lower costs for end users.

Demand is also growing due to the global push toward a clean energy transition. Solar pumps are gaining attention in climate-resilient farming strategies, especially in regions affected by erratic weather and unreliable grid power. This shift is encouraging both public and private sector investment in solar-powered water infrastructure, ensuring that solar pump technology continues to play a vital role in sustainable water management and rural development.

Key Takeaways

- The Global Solar Pump Market is expected to be worth around USD 4.8 billion by 2034, up from USD 2.2 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- In the Solar Pump Market, 3HP to 10HP pumps account for 43.6% of the market share.

- AC motor-based pumps dominate the Solar Pump Market, capturing a strong 72.5% market presence.

- Submersible pumps lead the Solar Pump Market by product type, holding a 58.2% market share.

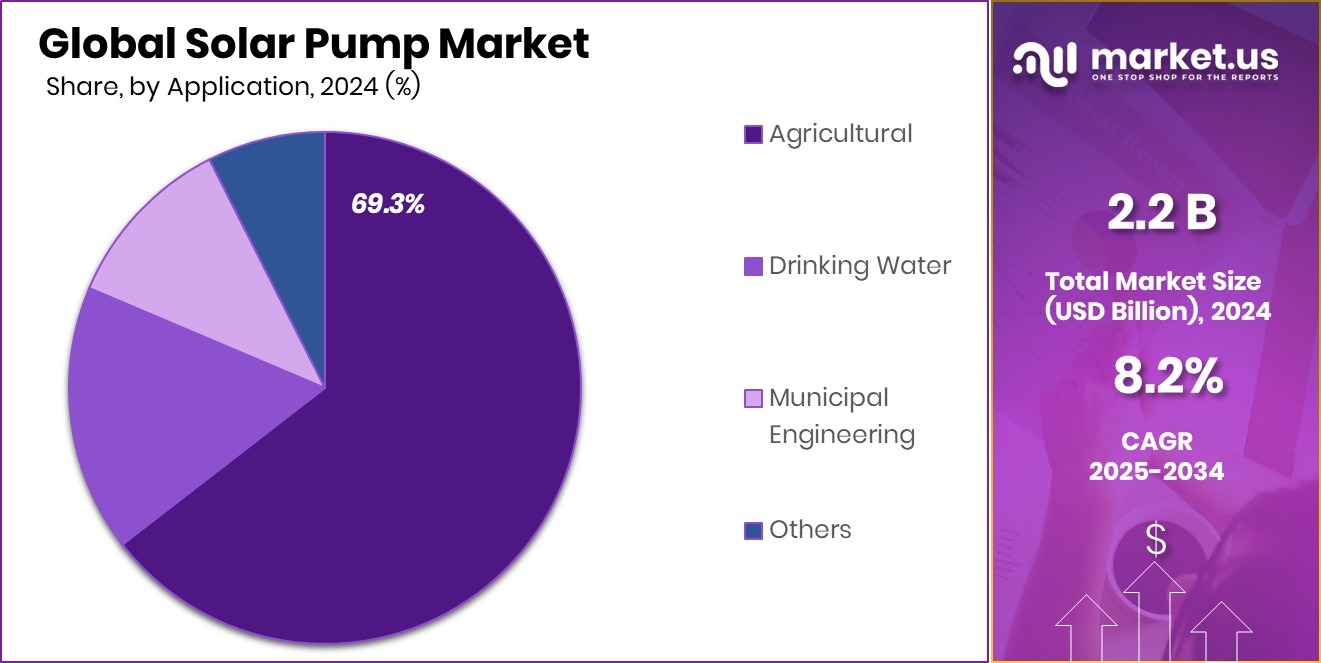

- Agriculture remains the top application in the Solar Pump Market, contributing 69.3% to overall demand.

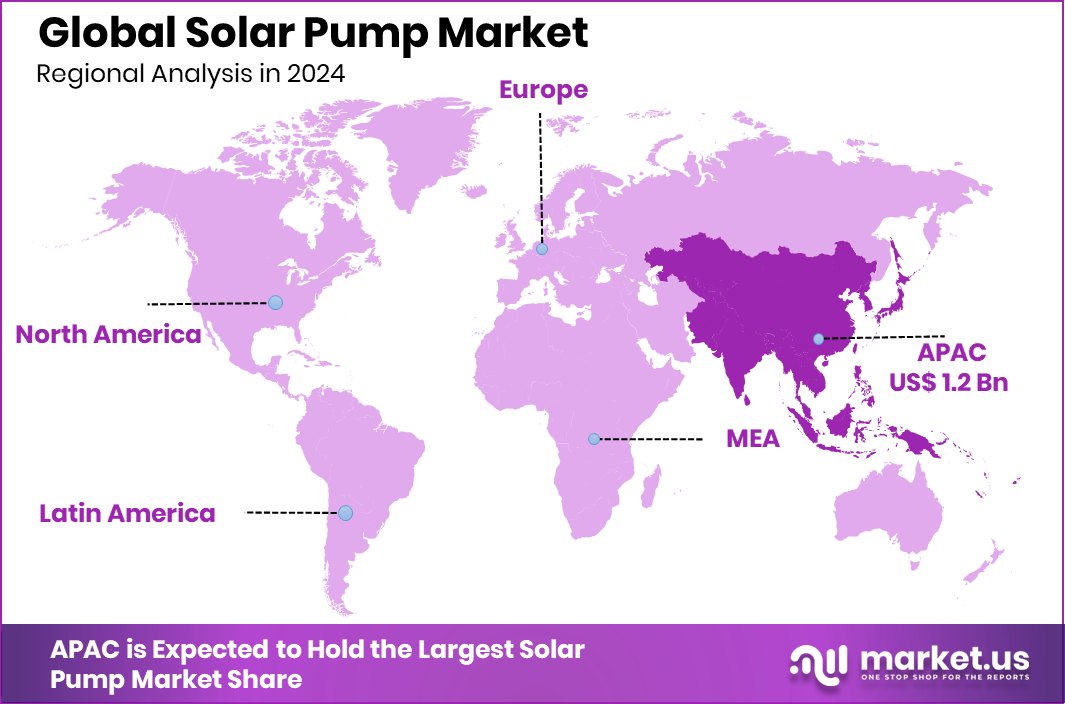

- The Asia Pacific market value reached USD 1.2 billion, leading global adoption trends.

By Type Analysis

In the Solar Pump Market, 3HP to 10HP holds 43.6%.

In 2024, 3HP to 10 HP held a dominant market position in the “By Type” segment of the Solar Pump Market, with a 43.6% share. This segment’s leadership can be attributed to its suitability across medium-scale agricultural and irrigation applications, particularly in regions where access to electricity remains limited. The 3HP to 10HP range strikes a balance between power output and cost-effectiveness, making it highly attractive for smallholder and mid-sized farmers who require a consistent and reliable water supply without incurring high operational costs.

The growing need for sustainable and decentralized irrigation systems has driven the demand for this horsepower range. As agricultural practices continue to shift toward energy-efficient and environment-friendly solutions, the 3HP to 10HP solar pumps have emerged as a preferred choice. These systems are capable of lifting water from moderate depths while ensuring adequate discharge rates, aligning well with the irrigation demands of crops across diverse geographies.

Additionally, the integration of government incentives and rural solar programs has further supported the adoption of this segment. Its dominance reflects a clear trend toward mid-range solar pump systems that offer scalability, reliability, and economic viability in both emerging and developing markets.

By Motor Type Analysis

AC pump dominates the motor-type segment with a 72.5% share.

In 2024, AC Pump held a dominant market position in the “By Motor Type” segment of the Solar Pump Market, with a 72.5% share. This commanding share reflects the widespread use and reliability of AC motor-based solar pumping systems in agricultural and rural water supply applications. AC pumps are known for their compatibility with high-power output needs, which aligns with the irrigation requirements of larger fields and deeper water sources. Their ability to handle heavy-duty operations efficiently has made them the preferred choice in regions with higher water table depths.

The availability of well-established infrastructure and technical expertise for AC motor systems also supports the strong presence of AC pumps. These pumps offer ease of maintenance and are often more cost-effective for end-users when integrated with existing power setups. In many government-supported rural electrification and solar irrigation schemes, AC pumps are deployed due to their proven performance in varied climatic and operational conditions.

Furthermore, the high market share of 72.5% is indicative of continued preference for robust and high-capacity systems in solar-powered water pumping. The segment’s dominance underscores its role as a reliable and scalable solution for high-demand water applications, making it the primary driver within the motor type classification of the solar pump market.

By Product Analysis

Submersible pumps lead the product segment with a 58.2% share.

In 2024, Submersible held a dominant market position in the “By Product” segment of the Solar Pump Market, with a 58.2% share. This substantial market share reflects the widespread deployment of submersible solar pumps, particularly in areas where groundwater extraction is necessary for irrigation and drinking water supply. These pumps are designed to operate while fully submerged in water, making them highly effective for deep well and borehole applications.

The strong performance of the submersible segment is also supported by its durability and low maintenance requirements, which are critical factors for users in remote and off-grid locations. These pumps are less exposed to environmental wear and offer longer operational lifespans compared to surface alternatives. The 58.2% share illustrates a clear market inclination toward dependable, long-term water pumping solutions that align with the increasing demand for sustainable and autonomous energy systems.

The dominance of the submersible category signifies its pivotal role in supporting agricultural productivity and rural water access, further reinforcing its relevance within the overall product segmentation of the solar pump market.

By Application Analysis

Agriculture drives demand, accounting for 69.3 of % application market share.

In 2024, Agricultural held a dominant market position in the “By Application” segment of the Solar Pump Market, with a 69.3% share. This significant share highlights the critical role solar pumps are playing in meeting the irrigation needs of the global farming sector. The agricultural segment’s dominance is largely driven by the growing necessity for a reliable and cost-efficient water supply in rural and semi-rural regions, where traditional energy infrastructure is often lacking or inconsistent.

The adoption of solar pumps in agriculture has been further supported by national-level initiatives promoting sustainable farming practices and renewable energy adoption. Farmers benefit from reduced dependency on fossil fuels or unreliable electricity grids, enabling timely irrigation and better water resource management. The 69.3% market share not only reflects the volume of installations in farmlands but also indicates the growing trust in solar pumping systems as long-term investments in agricultural infrastructure.

This dominant position underscores the segment’s importance in driving the overall solar pump market forward, as agriculture continues to account for the majority of global freshwater usage, making efficient water delivery systems like solar pumps essential for future food security and rural development.

Key Market Segments

By Type

- Up to 3HP

- 3HP to 10 HP

- Above 10 HP

By Motor Type

- AC Pump

- DC Pump

By Product

- Surface Suction

- Submersible

- Floating

- Others

By Application

- Agricultural

- Drinking Water

- Municipal Engineering

- Others

Driving Factors

Rising Demand for Irrigation in Remote Areas

One of the key driving factors for the solar pump market is the growing demand for reliable irrigation in rural and off-grid farming areas. In many developing regions, farmers face challenges with inconsistent electricity and high diesel costs for operating traditional water pumps. Solar pumps offer a practical and cost-effective solution by using sunlight to draw water for crops, reducing dependence on fossil fuels and lowering operational costs.

These pumps are especially helpful in areas with abundant sunlight but limited power infrastructure. Governments and non-profit organizations are also supporting rural farmers by offering subsidies and financial assistance for solar pump installations, further increasing their adoption and driving market growth in the agricultural sector.

Restraining Factors

High Initial Cost Limits Widespread Solar Adoption

One of the main restraining factors in the solar pump market is the high upfront cost of installation. While solar pumps reduce long-term operational expenses, the initial investment required for solar panels, pump systems, and controllers is still expensive for many small and marginal farmers. In areas where financial support or government subsidies are limited, the cost becomes a major barrier.

Additionally, a lack of access to financing options and awareness about long-term savings discourages adoption. For farmers in low-income regions, even basic solar equipment can be unaffordable without assistance. This financial barrier slows down market growth, especially in rural areas where the need for affordable and reliable irrigation systems is the highest.

Growth Opportunity

Government Subsidies Creating Strong Market Push

A major growth opportunity in the solar pump market lies in expanding government support through subsidies and incentive programs. Many countries are encouraging the use of solar energy in agriculture to reduce dependence on fossil fuels and promote sustainable farming. By offering financial assistance, tax benefits, and low-interest loans, governments are helping farmers afford the initial cost of solar pump systems.

These schemes are especially useful in rural and underserved areas, where traditional power supply is unreliable. As more governments increase their focus on clean energy and rural development, the reach of solar pump installations is expected to grow rapidly. These policy-level efforts are creating favorable conditions for wider adoption and long-term market expansion.

Latest Trends

Smart Solar Pumps With Remote Monitoring Technology

One of the latest trends in the solar pump market is the use of smart technology, especially remote monitoring systems. These advanced solar pumps can be controlled and tracked using mobile apps or cloud platforms. Farmers can check real-time data on water levels, pump performance, and energy usage without being physically present at the site.

This helps save time, reduce maintenance needs, and avoid unexpected breakdowns. Smart solar pumps also allow better water management, especially during dry seasons. With the rising use of smartphones and digital tools in agriculture, these smart systems are becoming more popular. The combination of solar power and smart features is making irrigation easier, more efficient, and more sustainable for farmers everywhere.

Regional Analysis

In 2024, the Asia Pacific held a 56.3% share of the solar pump market.

In 2024, Asia Pacific emerged as the dominant region in the global solar pump market, accounting for a significant 56.3% share with a market value of USD 1.2 billion. This dominance was primarily driven by the region’s large agricultural base, high solar irradiance, and growing efforts to promote off-grid renewable energy solutions. Countries across South and Southeast Asia have actively supported solar pump adoption through national subsidy programs and clean energy missions, particularly targeting rural irrigation.

In contrast, North America and Europe are experiencing steady growth, primarily due to increased interest in sustainable farming and technological innovations. However, their market shares remain lower compared to the Asia Pacific. The Middle East & Africa region is gradually expanding as solar energy becomes a practical solution for water scarcity and power shortages in agricultural areas.

Similarly, Latin America is adopting solar pumps in remote farming zones, though market penetration is still at a developing stage. While all regions contribute to the market’s expansion, Asia Pacific’s strong agricultural dependence and favorable government policies have firmly positioned it as the global leader in solar pump installations and revenue. This regional trend underlines the importance of supportive policies and rural electrification in driving solar pump market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alpex Solar Ltd has strengthened its market presence by prioritizing solar pump reliability and ease of installation. The company’s focus on durable designs has facilitated deployment in remote and electrification-challenged regions, supporting a consistent water supply even under challenging conditions.

AQUA Groups has advanced its market role by delivering modular pump systems tailored for varying depths and discharge volumes. Its adaptable solutions have enabled uptake across smallholder to mid-sized agricultural applications, reinforcing the firm’s reputation for flexibility and consistent performance.

Bright Solar Limited has distinguished itself by emphasizing affordability and low-maintenance operation. This approach has resonated strongly in price-sensitive rural markets, allowing sustained adoption without compromising long-term return on investment or functionality.

C.R.I. Pumps Private Limited has leveraged its expertise in pump technology to integrate enhanced energy conversion and hydraulic efficiency into its solar pump units. The resulting systems have provided superior operational performance, particularly in terms of flow rate and energy utilization, reinforcing the brand’s position as a technologically advanced provider.

Top Key Players in the Market

- Alpex Solar Ltd

- AQUA Groups.

- Bright Solar Limited

- C.R.I. Pumps Private Limited

- Crompton Greaves Consumer Electricals Limited.

- LORENTZ.

- DANKOFF SOLAR.

- Duke Plasto Technique Pvt Ltd.

- Franklin Electric

- Grundfos Pumps India Private Ltd.

- Jakson

- KSB SE & Co. KGaA

- waaree

Recent Developments

- In June 2025, C.R.I. Solar, the renewable energy division of C.R.I. Pumps secured major orders worth ₹210 crore. These orders, from MEDA (Maharashtra), HAREDA (Haryana), and PEDA (Punjab), involve the supply, installation, and commissioning of 6,894 solar pumping systems under state renewable energy programs.

- In September 2024, Aqua Group introduced a new range of durable stainless steel (SS) solar pumps. These pumps are specially designed to perform reliably even in harsh environmental conditions, enhancing their suitability for rural and off-grid water applications. The launch reflects the company’s ongoing emphasis on resilience and sustainability in solar pump solutions.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 4.8 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Up to 3HP, 3HP to 10 HP, Above 10 HP), By Motor Type (AC Pump, DC Pump), By Product (Surface Suction, Submersible, Floating, Others), By Application (Agricultural, Drinking Water, Municipal Engineering, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpex Solar Ltd, AQUA Groups., Bright Solar Limited, C.R.I. Pumps Private Limited, Crompton Greaves Consumer Electricals Limited., LORENTZ., DANKOFF SOLAR., Duke Plasto Technique Pvt Ltd., Franklin Electric, Grundfos Pumps India Private Ltd., Jakson, KSB SE & Co. KGaA, waaree Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpex Solar Ltd

- AQUA Groups.

- Bright Solar Limited

- C.R.I. Pumps Private Limited

- Crompton Greaves Consumer Electricals Limited.

- LORENTZ.

- DANKOFF SOLAR.

- Duke Plasto Technique Pvt Ltd.

- Franklin Electric

- Grundfos Pumps India Private Ltd.

- Jakson

- KSB SE & Co. KGaA

- waaree