Global Solar Plant Insurance Market Size, Share, Industry Analysis Report By Coverage Type (Property Damage & Business Interruption, Construction All-Risk / Erection All-Risk, Liability (General, Environmental, Professional), Cyber & Technology Errors/Omissions, Others), By End-User (Utility-Scale IPPs & Owners, Commercial & Industrial Operators, Residential Aggregators & Community Solar), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162883

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- Leading Risks and Claim Statistics

- Emerging Insurance Solutions

- Emerging Trends

- Growth Factors

- Government Led Investments

- North America Market Size

- By Coverage Type

- By End-User

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

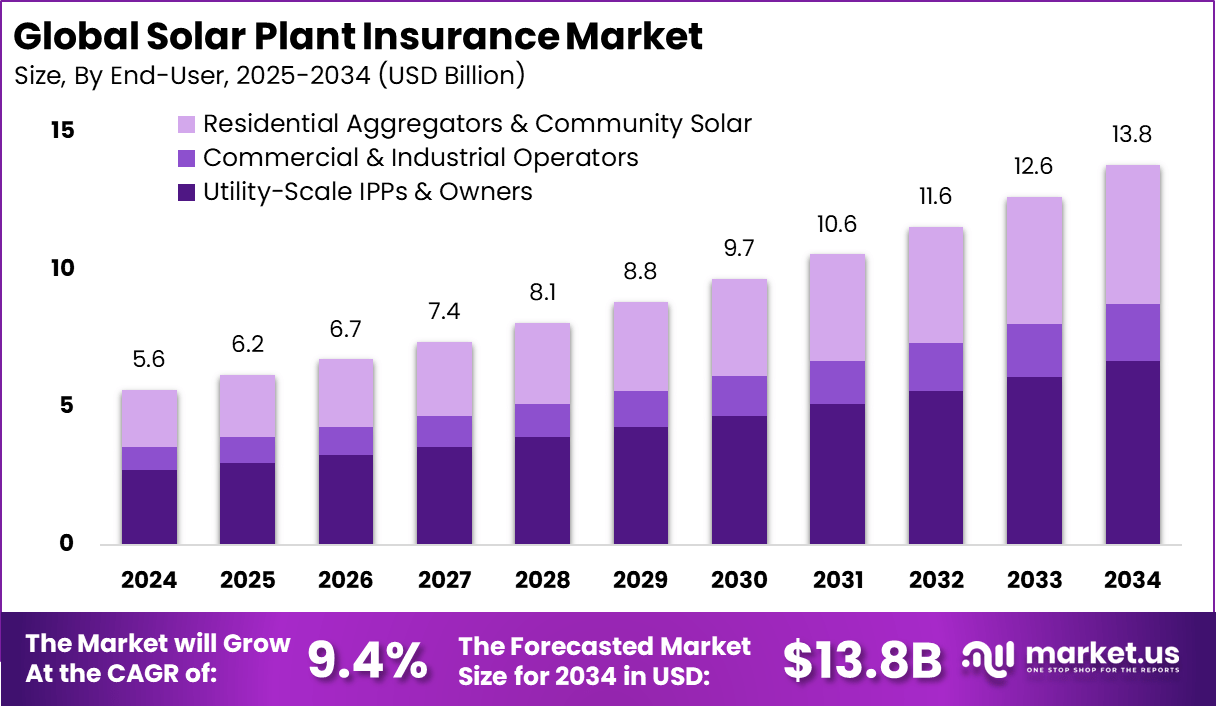

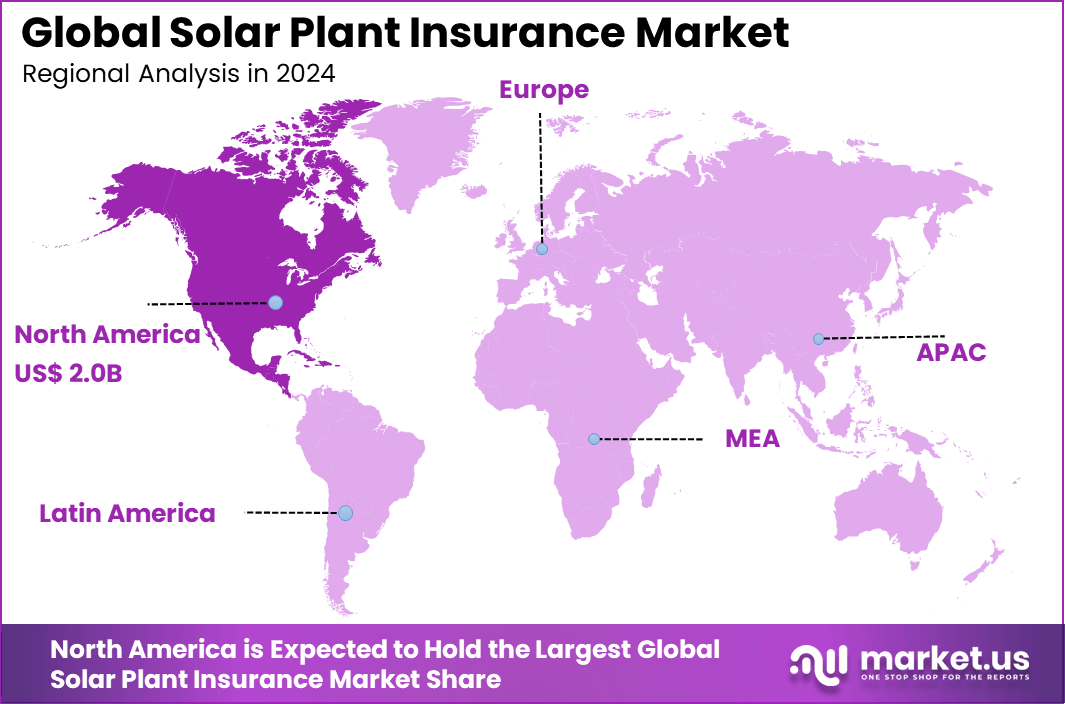

The Global Solar Plant Insurance Market generated USD 5.6 billion in 2024 and is predicted to register growth from USD 6.2 billion in 2025 to about USD 13.8 billion by 2034, recording a CAGR of 9.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36% share, holding USD 2.0 Billion revenue.

The solar plant insurance market covers insurance policies and risk-transfer solutions specifically designed for solar power generation assets. These assets include utility-scale solar farms, commercial rooftops, and distributed solar installations. The insurance encompasses coverage areas such as property damage, business interruption, equipment failure, performance shortfall, liability, and in some cases parametric triggers tied to weather or output.

Adoption rates for solar plant insurance are rising due to the need for risk management and protection from increasing weather-related events, manufacturing defects, and installation liabilities. Recent premium hikes for solar industry insurance have been significant, with property premiums up by 37% for catastrophic risk zones, and general liability premiums increasing between 5% and 15% depending on installation type. Such risks have made tailored insurance policies essential for developers and investors.

Rising installation of solar panels across residential, commercial, and utility sectors increases the demand for specialized insurance. Homeowners and businesses seek coverage for high installation costs, liability risks, and repairs caused by weather, fire, or operational failures. Studies show that properties with solar panels command higher resale values, had increased property limits, and generally require adjusted coverage to reflect their market worth.

Advances in solar panel efficiency and durability are changing the insurance landscape. Technologies such as bifacial panels, solar-plus-storage, and smart energy management introduce new risks but also make solar investments more attractive. Insurers now offer parametric insurance for rapid payouts based on measurable events and are developing policies to address cyber risk and technological obsolescence.

Top Market Takeaways

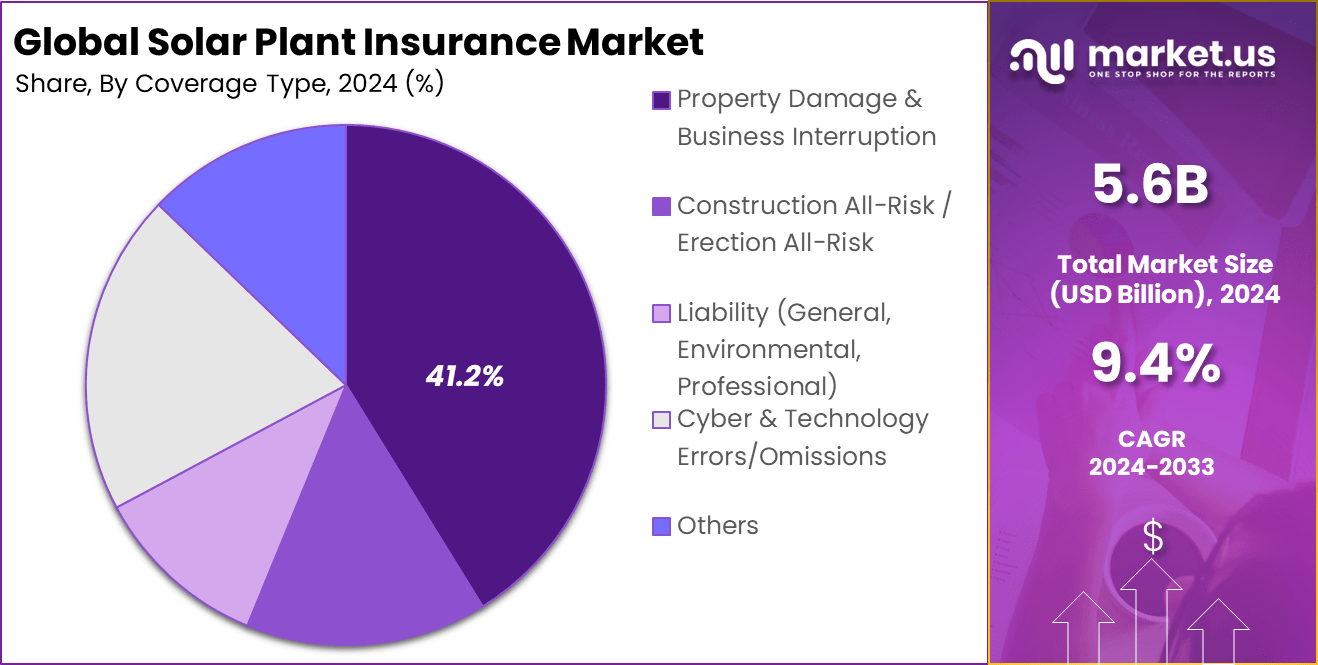

- Property Damage & Business Interruption coverage led with 41.2%, reflecting strong demand for comprehensive protection against natural disasters and operational losses.

- Utility-Scale IPPs & Owners accounted for 48.4%, driven by large-scale solar developers seeking risk-mitigation strategies for high-value assets.

- North America captured 36% of the global market, supported by expanding solar capacity and rising awareness of renewable energy insurance solutions.

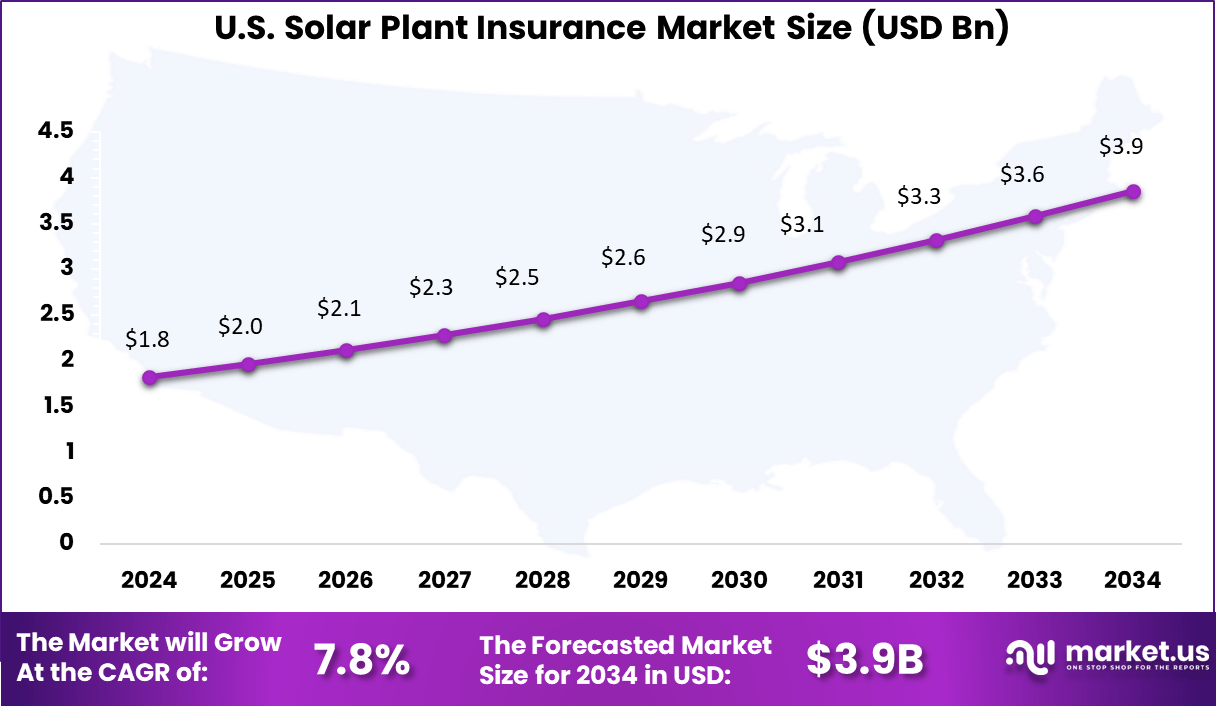

- The US market reached USD 1.82 Billion in 2024, recording a steady 7.8% CAGR, fueled by policy incentives, infrastructure investments, and increasing climate-related risk coverage needs.

Role of Generative AI

Generative AI is simplifying insurance modeling for solar plants, allowing underwriters to simulate multiple risk scenarios much faster. Nearly 38% of solar sector insurers now use AI-driven models to evaluate weather risk and equipment reliability in real time, which is speeding up claims processing and improving accuracy.

These advanced tools are helping insurance teams flag fraudulent claims more easily and predict issues before they happen, reducing losses for solar operators. AI-powered analytics has shifted how insurance policies are priced and managed, as insurers can now identify performance trends for solar installations using ongoing sensor data from the field.

About 41% of solar insurance companies said they plan to expand AI usage for underwriting and client advisory over the next year. This means more policies will offer custom coverage based directly on real-world site conditions- making risk protection fit better for solar companies.

Leading Risks and Claim Statistics

- Weather risks: Hail remains the costliest threat to solar projects, accounting for 73% of total loss amounts while representing just 6% of loss incidents. In recent years, hail claim costs have ranged from $5 million to $80 million. Notably, a 2022 hailstorm in Texas caused over $300 million in solar field damage, and another event in March 2024 led to an estimated $50 million in insured hail losses at a Texas solar farm.

- Rising storm frequency: Severe convective storms are intensifying. In the U.S., insured losses from these events surpassed $50 billion in both 2023 and 2024. With more solar farms being constructed in storm-prone areas, exposure to catastrophic weather-related claims continues to grow.

- Operational risks: Underperformance is another critical factor, with U.S. solar PV sites reporting an average 8.6% underperformance rate. Inverter malfunctions remain a leading cause of system downtime and reduced output.

- Cybersecurity threats: Cyberattacks on U.S. utility infrastructure increased by 70% in 2024, with attackers targeting solar facilities and connected energy storage systems. These risks highlight growing vulnerabilities as the grid becomes more digitized.

- Manufacturing flaws: Quality issues are emerging as well. The prevalence of module “hot spots” rose from 0.24% in 2023 to 0.81% in 2024 in North America, with half-cut modules particularly affected. Such flaws can cause long-term performance degradation.

- Insurance market dynamics: Property damage and business interruption claims made up 38.2% of the renewable energy insurance market in 2024, showing the high impact of asset loss and subsequent revenue disruption.

Emerging Insurance Solutions

- Parametric insurance: Designed to provide rapid payouts based on predefined indices, parametric insurance is expanding. The market for weather risk coverage in solar farms reached $1.43 billion in 2024, offering faster claims resolution compared to traditional models.

- Cyber insurance: Coverage is increasingly being developed to protect solar and energy storage operators from the financial impact of cyberattacks on their digital infrastructure.

- Performance and warranty products: Specialized insurance products, such as performance guarantee policies and PV warranty coverage, help safeguard investors against project underperformance. They also provide financial protection in cases where a manufacturer becomes insolvent and cannot honor warranty claims.

Emerging Trends

Usage-based solar plant insurance is gaining attention, with nearly 35% of insurers testing policies that adjust premiums according to actual production data and on-site weather readings. This approach is providing flexibility for plant owners in regions with seasonal output changes and supporting stronger grid reliability partnerships.

Digital twin technology is another new trend, as 29% of solar insurers are piloting virtual replicas to monitor asset health and predict damage events before they cause costly downtime. These models support faster inspections and remote recommendations, saving clients money while improving safety records for solar operators.

Growth Factors

Long-term solar insurance growth is being driven by stricter climate risk regulations in North America and Europe, with policy requirements for storm, hail, and fire coverage seeing a rise of nearly 24% since 2023. Insurers are providing more modular, scalable coverage packages to help plant owners meet these standards and reduce liability costs.

Technological improvement in solar panels and battery systems has reduced the frequency of equipment breakdown claims, leading to a 17% drop in technical risk payouts over the past two years. As solar systems get more efficient, insurance providers are shifting resources to adjust premiums based on emerging operational risks like cyber threats and grid connection issues.

Government Led Investments

Government-led investment in solar insurance has increased as national programs expand renewable energy targets. Public sector agencies in North America have contributed to a 33% increase in policy offerings and reinsurance pools designed to make coverage more accessible for new solar developers. These investments are stabilizing premium rates and supporting rapid grid integration for smaller solar sites.

Asia-Pacific governments have funded pilot projects for parametric insurance tied to solar plants, resulting in about 22% growth in coverage options for extreme weather events like typhoons. This government support is helping solar operators recover faster after disasters, minimizing business interruption risks and supporting regional clean-energy targets.

North America Market Size

In 2024, North America captures around 36% of the global solar plant insurance market, benefiting from steady deployment of utility-scale projects and advanced underwriting capacity. The region’s insurance market integrates renewable risk analytics, which strengthens resilience against natural disaster impacts. As grid modernization and energy transition policies advance, insurers are offering more flexible terms to accommodate diverse ownership models and technological upgrades in solar plants.

Within the region, the United States leads with an estimated value of USD 1.82 billion and a CAGR of 7.8%. The combination of expanding renewable incentives, risk diversification tools, and weather forecasting technologies has bolstered insurance adoption.

U.S. insurers are also partnering with clean energy investors to refine models that evaluate site-specific climate exposure and equipment life cycles. This evolution positions the country as a leader in integrating financial protection with sustainable infrastructure growth.

By Coverage Type

in 2024, Property damage and business interruption coverage dominates the solar plant insurance market, accounting for about 41.2%. This category is vital for safeguarding solar assets against risks such as fire, extreme weather, equipment breakdown, and grid failure. As solar farms expand in capacity and geographic reach, insurers are tailoring policies to address climate-driven losses and downtime from production halts.

Reliable compensation mechanisms are becoming a core need for solar developers seeking financial stability across long project lifecycles. The growth of this coverage type also reflects a shift in how renewable companies manage operational risk. More operators are demanding comprehensive protection that goes beyond basic asset replacement to include revenue interruption and repair delays.

Policies now often integrate performance-based clauses that account for power output losses. This evolution shows how insurance is adapting to the unique operational realities of large-scale solar production, ensuring investors remain protected from financial strain tied to unpredictable generation patterns.

By End-User

In 2024, Utility-scale independent power producers (IPPs) and plant owners hold around 48.4% of the market. Their large asset portfolios and long-term contracts increase exposure to financial and operational risks, making insurance coverage indispensable. As more IPPs expand into regions with variable weather patterns, the need for broad and adaptive insurance products rises sharply.

Such operators depend on strong insurance partnerships to protect revenue streams and maintain lender confidence in billion-dollar projects. The rising number of mega solar parks and hybrid renewable installations is further driving coverage demand among these end-users.

IPPs are increasingly negotiating custom insurance solutions linked to project performance metrics, grid connection reliability, and evolving environmental regulations. Their proactive approach reflects a maturing market where risk management forms part of standard financial planning. Continued investment in high-value projects will keep this segment central to the solar insurance ecosystem.

Key Market Segments

By Coverage Type

- Property Damage & Business Interruption

- Construction All-Risk / Erection All-Risk

- Liability (General, Environmental, Professional)

- Cyber & Technology Errors/Omissions

- Others

By End-User

- Utility-Scale IPPs & Owners

- Commercial & Industrial Operators

- Residential Aggregators & Community Solar

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Solar Installations Demand Insurance

The rapid expansion of solar energy installations globally drives the demand for solar plant insurance. As governments and private investors increasingly fund large solar farms and residential solar projects, the need to protect these valuable assets against risks such as natural disasters, equipment failure, and business interruptions grows significantly.

This expansion underpins a rising market value, with photovoltaic insurance expected to reach multi-billion-dollar levels, fueled by the critical necessity of managing new risks linked to solar technologies and their operational environments. Moreover, the push towards renewable energy for sustainability goals creates steady policyholder growth, making insurance essential for safeguarding investments.

Technological advances in solar panel efficiency and durability further boost confidence in solar projects, encouraging broader insurance adoption. This growth driver highlights the pivotal role insurance plays in de-risking renewable energy investments, supporting quicker project financing and deployment.

Restraint Analysis

Rising Premiums and Capacity Limits

A key restraint on the solar plant insurance market is the significant increase in insurance premiums paired with shrinking available coverage. Recently, premiums for solar property insurance have risen by 15% to 45%, reflecting the growing claim frequency and severity from weather events and manufacturing defects.

Insurers face capacity constraints, pulling back cover limits or exiting riskier regions or perils, which restricts market availability and affordability for many project developers, especially smaller ones. Additionally, premium hikes can delay or discourage new solar projects, slowing renewables adoption in certain regions.

The insurance market’s tightening is partly due to heightened natural catastrophe claims and supply chain disruptions driving underwriting caution. This premium hardening challenge pressures solar operators and insurers alike to innovate risk-sharing models or alternative coverage solutions.

Opportunity Analysis

Emerging Markets and Tailored Products

Emerging markets present a significant growth opportunity for solar plant insurance. Rapid industrialization, rising energy demand, and supportive governmental policies in Asia-Pacific, Latin America, and Middle East regions fuel the expansion of solar infrastructure, increasing the need for localized insurance products tailored to regional risks and project types.

Insurers can capitalize by customizing policies to fit diverse environmental and regulatory conditions, expanding market reach. Advanced technologies and digitalization also offer opportunities for innovative insurance offerings, including parametric products and enhanced risk assessment analytics.

These advancements can improve underwriting accuracy and claims efficiency, attracting more solar project investors. The steady transition to renewable energy combined with insurance education campaigns to raise awareness further strengthens growth potential in these markets.

Challenge Analysis

Climate Risks and Complex Underwriting

The solar plant insurance sector faces challenges from increasing climate-related risks and the complex nature of underwriting diverse solar technologies. Extreme weather events like hail, storms, and fires are leading causes of claims, intensifying loss severity and underwriting uncertainty.

Accurate risk modeling remains difficult due to limited historical loss data and evolving technology profiles such as floating solar and battery storage integration. This complexity demands specialized engineering and actuarial expertise, raising barriers for insurers and impacting pricing. Moreover, new risks like cyber threats and environmental liabilities add layers to coverage design.

Balancing adequate protection while maintaining competitive premiums requires continuous innovation and collaboration between insurers, solar developers, and analytics firms. This challenge underscores the need for agility in addressing dynamic risks to sustain market growth

Competitive Analysis

The Solar Plant Insurance Market is dominated by major global insurers and reinsurers such as Allianz, Munich Re, Zurich Insurance Group, and AXA XL. These companies provide comprehensive risk coverage solutions for solar energy projects, including property damage, business interruption, construction risk, and performance guarantees.

Prominent participants such as Chubb, AIG, Generali, and Liberty Mutual focus on offering tailored policies covering equipment breakdown, natural disaster risks, and liability exposures. Their global presence and deep technical capabilities enable them to support the growing adoption of solar power infrastructure across utility, commercial, and residential projects.

Additional market contributors including Swiss Re, Hannover Re, Tokio Marine, and Sompo International, along with other key players, play a crucial role in providing reinsurance and specialized risk transfer solutions. Their emphasis on parametric insurance models, predictive analytics, and satellite-based monitoring helps assess project vulnerabilities more accurately.

Top Key Players in the Market

- Allianz

- Munich Re

- Zurich Insurance Group

- Chubb

- AIG

- Liberty Mutual

- AXA XL

- Generali

- Swiss Re

- Hannover Re

- Tokio Marine

- Sompo International

- Others

Recent Developments

- April 2025, Allianz set ambitious 2030 goals focused on accelerating growth in renewable energy insurance. The company targets a 150% increase in profitable revenues from renewable energy and low-carbon technology insurance by 2030 compared to 2022. Allianz continues to insure large-scale solar photovoltaic and wind farms and is expanding coverage to emerging hydrogen technologies.

- June 2025, Zurich launched a new modular insurance product tailored for agrivoltaic systems in Germany. This product addresses risks unique to integrated agricultural and solar use, covering crop damage, livestock, farm machinery, and the photovoltaic components themselves from agricultural operational hazards.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Bn Forecast Revenue (2034) USD 13.8 Bn CAGR(2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Property Damage & Business Interruption, Construction All-Risk / Erection All-Risk, Liability (General, Environmental, Professional), Cyber & Technology Errors/Omissions, Others), By End-User (Utility-Scale IPPs & Owners, Commercial & Industrial Operators, Residential Aggregators & Community Solar) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz, Munich Re, Zurich Insurance Group, Chubb, AIG, Liberty Mutual, AXA XL, Generali, Swiss Re, Hannover Re, Tokio Marine, Sompo International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Plant Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Solar Plant Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-