Global Sodium Silicate Market By Form(Sodium, Liquid), By Application(Detergents, Catalysts, Pulp & Paper, Elastomers, Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 15821

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

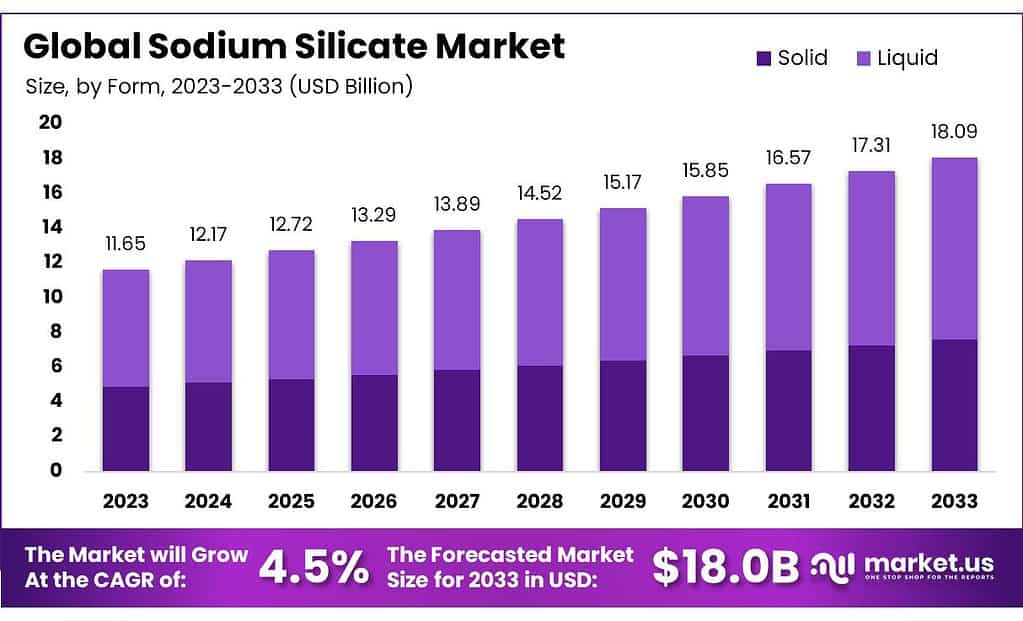

The Sodium Silicate Market size is expected to be worth around USD 18.9 billion by 2033, from USD 11.65 billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2033.

Product demand is expected to rise over the forecast period due to rising demand for sodium derivatives like zeolites, precipitated silica, and catalysts in chemical and biochemical processes. Sodium silicate, a key source of reactive silica, is in high demand across many industries, including paper, pulp, food and drink, detergent, rubber, and food and beverage. The market will see a rise in demand for silica gels or silica sols as well as paints, coatings, plastics, and ink.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Sodium Silicate market is anticipated to grow substantially, reaching a projected value of around USD 18.9 billion by 2033 from USD 11.65 billion in 2023, at a CAGR of 4.5% during 2023-2033.

- Form Dominance: The liquid form of Sodium Silicate claimed a significant market share, accounting for over 58% in 2023. Its adaptability, versatility, and application across various industries contribute to this dominance.

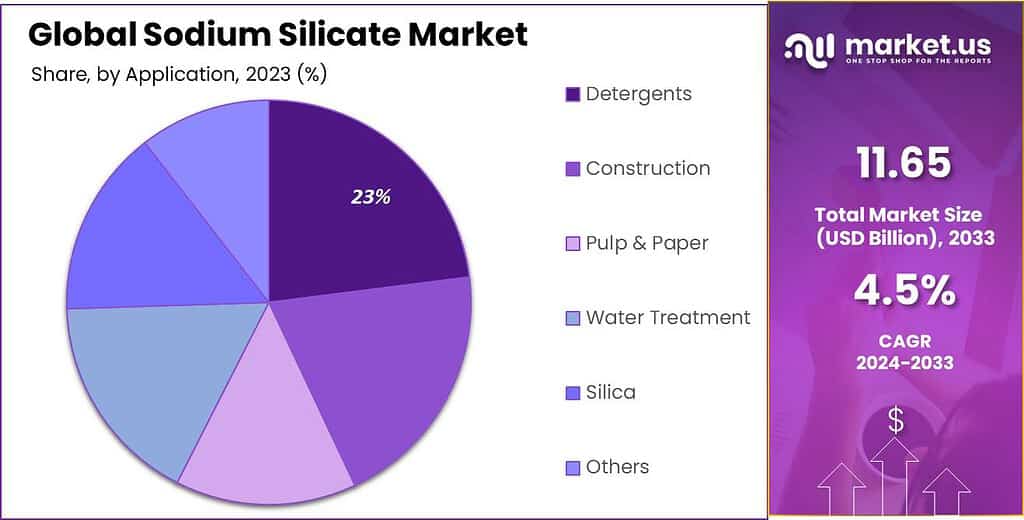

- Applications Driving Demand: Detergents led the market applications with over 23% share in 2023. Sodium Silicate plays a crucial role in enhancing cleaning efficiency and stabilization of detergent formulations. Other notable applications include construction, pulp & paper, elastomers, and water treatment.

- Market Drivers: The market growth is propelled by the rising demand for safer alternatives to phosphate additives in detergents. Additionally, its applications in wastewater treatment, construction, and urbanization initiatives significantly contribute to its expanding market.

- Constraints: Challenges faced by the Sodium Silicate market include its toxicity, potential harm to the environment, and the increasing demand for eco-friendly products. Balancing effectiveness with reduced environmental impact remains a significant challenge.

- Opportunities for Growth: Innovations focusing on safer formulations, eco-friendly products, and addressing environmental concerns offer promising opportunities. Expanding applications within the construction industry and meeting the demand for eco-friendly alternatives are key growth areas.

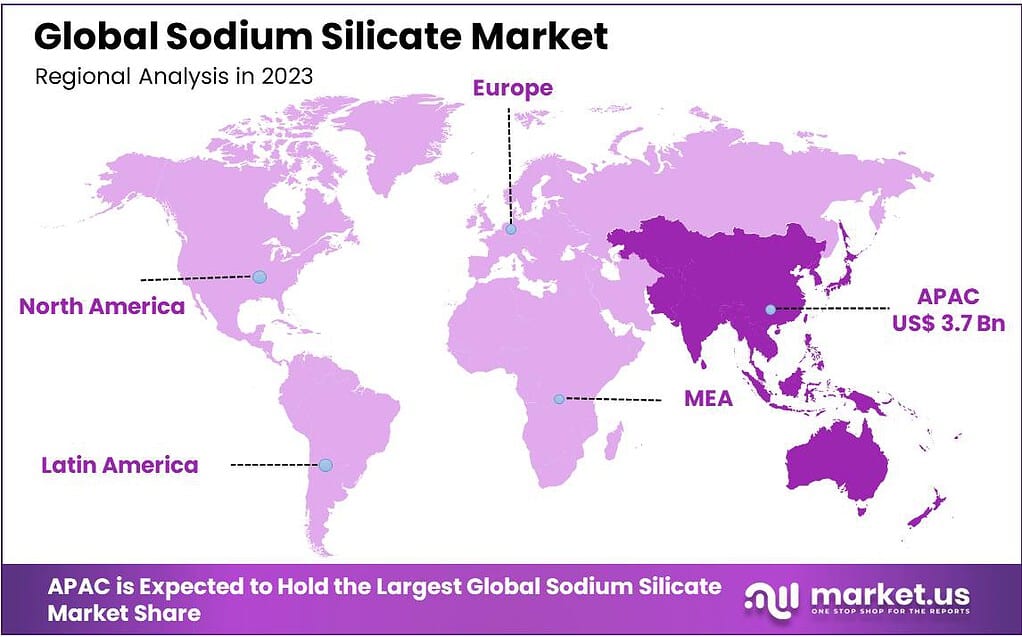

- Regional Insights: The Asia Pacific region held the highest revenue share in 2023, followed by Europe. Factors driving growth in these regions include increased demand in the pulp and paper industry and infrastructural development.

- Key Players: Major players in the Sodium Silicate market include PQ Corporation, Evonik Industries AG, BASF SE, and W.R. Grace & Company, among others. Companies are focusing on expanding their product range and market share through strategies like mergers, acquisitions, and capacity expansions

Form Analysis

In 2023, the Sodium Silicate market witnessed the dominance of the Liquid form, commanding a substantial share of more than 58%. Liquid Sodium Silicate emerged as a frontrunner due to its versatility and broad applicability across diverse industries. Its prominent usage in the detergent industry, where it serves as a key ingredient in laundry and dishwashing detergents for its cleaning and binding properties, significantly contributed to its market leadership.

Liquid Sodium Silicate has long been used in construction applications like concrete treatment and cement binding, with its use as a binder/sealant reinforcing its market position. Furthermore, water treatment applications found Liquid Sodium Silicate particularly helpful in controlling pH levels and precipitating impurities – further solidifying its market standing.

The Liquid form’s dominance stemmed from its adaptability and ease of integration into various formulations, ensuring its widespread utilization across multiple industries. Its fluidity, facilitating easier mixing and application, made it the preferred choice in numerous industrial processes, solidifying its significant market share.

Application Analysis

In 2023, the Sodium Silicate market was notably led by the Detergents application, securing over 23% of the market share. This dominance can be attributed to the indispensable role of Sodium Silicate in the detergent industry, where it acts as a key builder and stabilizer. Its ability to enhance the cleaning efficiency of detergents and contribute to the stabilization of formulations contributed significantly to its leading market position.

The Construction sector also played a substantial role, with Sodium Silicate finding extensive use in concrete treatment and cement binding applications. Its effectiveness as a binder and sealant in construction materials contributed to its market presence.

Furthermore, Sodium Silicate showcased significance in the Pulp and paper industry, where it serves as a binding agent in the production of paper and as a component in de-inking processes. Water Treatment applications also contributed to Sodium Silicate’s market share, with its role in controlling pH levels and precipitating impurities in water treatment processes.

The Silica segment, encompassing various industrial applications beyond the specified categories, further demonstrated the versatility of Sodium Silicate. Its adaptability across a range of industries underscored its relevance and contributed to its overall market share.

In essence, the segmentation of Sodium Silicate by application highlighted its diverse utility, with Detergents, Construction, Pulp and paper, and Water Treatment standing out as key drivers of its market dominance in 2023.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Form

- Sodium

- Liquid

By Application

- Detergents

- Catalysts

- Pulp & Paper

- Elastomers

- Other Applications

Drivers

The Sodium Silicate market is experiencing a surge in demand across diverse applications, propelling its growth trajectory. In the realm of detergents, Sodium silicates and metasilicates are proving highly effective in cleaning formulations, showcasing exceptional soil and dirt removal capabilities due to their alkalinity and cleaning prowess. Their role as binders in heavy-duty detergents and dishwash tablets further amplifies their significance in the cleaning industry.

One notable trend driving this demand surge is the growing awareness among consumers about the hazards posed by phosphate additives in detergents. This heightened awareness is steering consumers toward phosphate-free detergents, thereby bolstering the demand for Sodium Silicate-based alternatives.

Moreover, Sodium Silicates’ applications in wastewater treatment, particularly in the liquid form serving as iron deflocculants, are gaining traction. With increasing concerns and stringent regulations regarding wastewater treatment, the demand for silicate-based deflocculants is on the rise, further fueling market growth.

The construction industry is also a key contributor to the market’s growth, with Sodium Silicate witnessing high demand due to infrastructural development fueled by rapid urbanization. This demand surge from multiple sectors, including detergents, wastewater treatment, and construction, underpins the market’s expansion, driven by the product’s versatility and efficacy across various applications.

Restraints

The Sodium Silicate market faces constraints primarily due to the product’s toxic nature, presenting challenges to its market growth. Diluted solutions of Sodium Silicate are potent alkaline irritants, while the solid form exhibits corrosive properties.Corrosives or alkaline solutions may cause severe burns depending on their concentration and duration of exposure, making Sodium Silicate one of the more dangerous household cleaning and laundry products to use due to its potentially hazardous properties on human health. As part of many household products like cleaning detergents or laundry products, proper handling should be observed given its potentially corrosive qualities that could wreak havoc with one’s body.

Direct contact with skin can result in itching, pain and redness; while eye contact may trigger a burning sensation. Furthermore, Sodium Silicates have demonstrated moderate toxicity to aquatic organisms and pose minor risks to terrestrial life. When released into water bodies, they can moderately impact aquatic ecosystems and lifecycles. These factors concerning the compound’s harmful effects on both human health and the environment are expected to impose limitations on market growth.

Opportunities

Sodium Silicate market offers many opportunities despite its constraints, with safer and eco-friendly formulations offering particular promise. Innovations designed to decrease product toxicity while still offering its efficacy can open up new avenues, particularly within detergent and cleaning product formulations. Furthermore, safer alternatives that retain cleaning and binding properties present promising opportunities for market expansion.

Additionally, increasing demand for eco-friendly products and sustainable solutions provides opportunities for Sodium Silicate’s market expansion. Eco-friendly detergents and cleaning agents that utilize its cleaning properties without jeopardizing environmental safety is in line with this growing trend and is likely to create niche market segments within this trend.

Research and development efforts focused on mitigating Sodium Silicate’s effects on aquatic and terrestrial ecosystems could pave the way to safer formulations. Finding ways to lessen its environmental footprint while still meeting specific applications could open doors to new markets and foster increased adoption.

Construction industry expansion offers an ideal setting for the application of Sodium Silicate’s expanded applications. As infrastructure development and urbanization take place across various regions, its role as a cement binder and sealant could become even more sought-after – leading to further market growth in construction sectors worldwide.

Overall, exploring innovations in safer formulations, capitalizing on demand for eco-friendly products, addressing environmental concerns and expanding applications within construction are promising avenues for expanding Sodium Silicate’s market presence and continued growth.

Challenges

The Sodium Silicate market faces some big challenges. One is that it can be harmful and corrosive. Handling it, especially in strong forms, needs strict safety rules because it can hurt people. This limits where it can be used, especially in certain industries.

Its impact on the environment is another problem. When it gets into water, it can harm aquatic life. Making sure it follows rules and doesn’t harm nature is tough for industries using it.

Making Sodium Silicate safer while keeping it effective is a tough task. Finding the balance between making something less harmful while maintaining what makes it useful can be tricky.

There’s an increasing demand for eco-friendly products. Since Sodium Silicate isn’t very friendly to the environment, companies face challenges in making it more eco-friendly while still working well.

So, Sodium Silicate’s challenges include its harmfulness, its effect on nature, making it safer, and meeting the demand for eco-friendly products. Companies need to find smart solutions and follow strict rules to tackle these challenges.

Regional Analysis

Asia Pacific (APAC) held the highest revenue share at over 32% % in 2023. The growth of Mexico’s pulp and paper industry, in conjunction with increased foreign investment, will have a positive effect on regional market growth. Major pulp and paper manufacturers in the region, such as Copamex and International Paper, CMPC, and Smurfit Kappa, are expected to increase demand for the compound when it comes to manufacturing bleaching agents and binding agents.

Europe will account for 18.4% of the total revenue by 2025. The industry is expected to grow over the forecast period due to the growing demand for the compound in paper and healthcare. Glass-grade sodium silicate can be produced in the region at a rate of over 1,400 kilos annually. The manufacturers do not sell sodium silicates on the market because they are consuming the glass-grade sodium silicate in captivity.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The listed companies represent a diverse array of entities within the chemical and petrochemical industries. PQ Corporation operates as a global provider of specialty chemicals, catalysts, and services. Occidental Petroleum Corporation is a prominent energy company engaged in oil and gas exploration, production, and marketing. Evonik Industries AG specializes in specialty chemicals, particularly in the areas of nutrition and care, resource efficiency, and performance materials.

BASF SE is a multinational chemical company known for its wide-ranging portfolio encompassing chemicals, plastics, performance products, agricultural solutions, and oil and gas. Nippon Chemical Industrial Co., Ltd is involved in the manufacturing and distribution of chemical products, including fine chemicals and functional materials. Industrias Químicas del Ebro, S.A. focuses on chemical manufacturing, particularly in the field of agricultural solutions.

Tokuyama Corporation operates across various sectors, including chemicals, specialty products, and solar materials. Sinchem Silica Gel Co Ltd is dedicated to the production and supply of silica gel products. W.R. Grace & Company is known for its specialty chemicals and materials across industries such as refining, petrochemicals, and construction. CIECH Group operates in the chemical industry, primarily producing soda ash, plant protection products, and other chemicals. These companies contribute significantly to the chemical landscape, providing essential products and solutions across multiple sectors globally.

Market Key Players

- PQ Corporation

- Occidental Petroleum Corporation

- Evonik Industries AG

- BASF SE

- Nippon Chemical Industrial Co., Ltd

- Industrias Químicas del Ebro, S.A.

- Tokuyama Corporation

- Sinchem Silica Gel Co Ltd

- W.R. Grace & Company

- CIECH Group

- Others

Recent Development

September 2022: Evonik, one of the world’s leading silica producers, has entered a strategic cooperation with the Porner Group, Austria and Phichit Bio Power Co., Ltd., Thailand, to supply sustainable ULTRASIL precipitated silica to tire manufacturers.

Report Scope

Report Features Description Market Value (2023) USD 11.65 Billion Forecast Revenue (2033) USD 18.9 Billion CAGR (2023-2032) 4.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form(Sodium, Liquid), By Application(Detergents, Catalysts, Pulp & Paper, Elastomers, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PQ Corporation, Occidental Petroleum Corporation, Evonik Industries AG, BASF SE, Nippon Chemical Industrial Co., Ltd, Industrias Químicas del Ebro, S.A., Tokuyama Corporation, Sinchem Silica Gel Co Ltd, W.R. Grace & Company, CIECH Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is sodium silicate?Sodium silicate, also known as water glass, is a compound derived from sodium oxide and silica. It's available in various forms and has a wide range of industrial applications due to its adhesive, binding, and protective properties.

Where is sodium silicate sourced or produced?Sodium silicate is produced by melting sand (silica) with sodium carbonate at high temperatures. It's manufactured globally in various chemical plants.

What are the different forms or grades of sodium silicate?Sodium silicate is available in liquid and solid (powder or granular) forms. Grades can vary based on the ratio of sodium oxide to silica, which affects its properties like viscosity, pH, and solid content.

-

-

- РQ Соrроrаtіоn

- W. R. Grасе & Со

- Тоkuуаmа

- РРG Іnduѕtrіеѕ

- Nірроn Сhеmісаl

- Нubеr

- Аlbеmаrlе

- Other Key Players