Global Sodium Metasilicate Anhydrous Market Size, Share Analysis Report By Product (Powder, Fine, Medium), By End-Use (Detergents, Metal Cleaner, Ceramic, Textile, Paper Production, Water Treatment, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161620

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

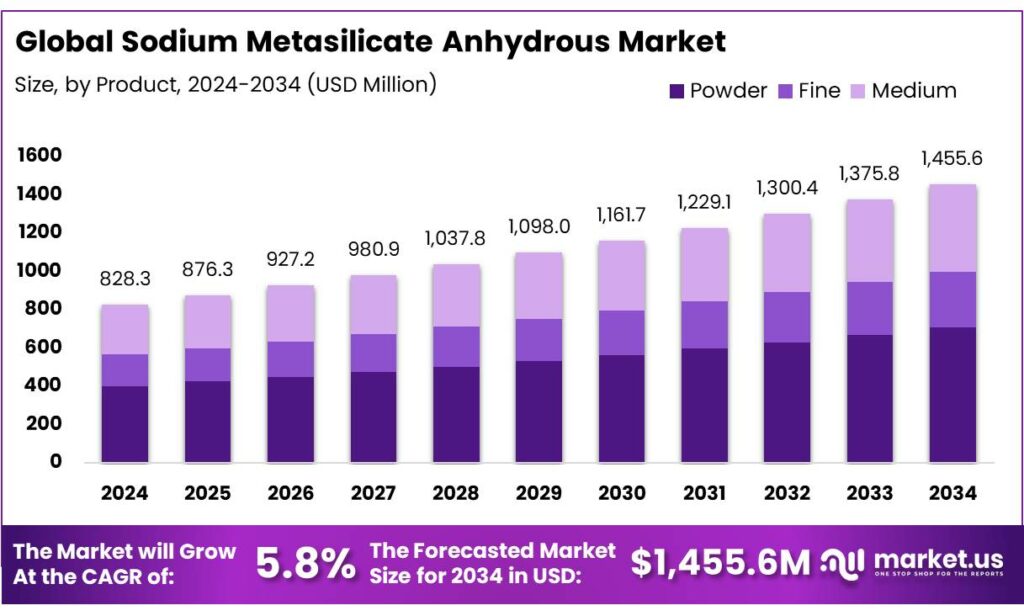

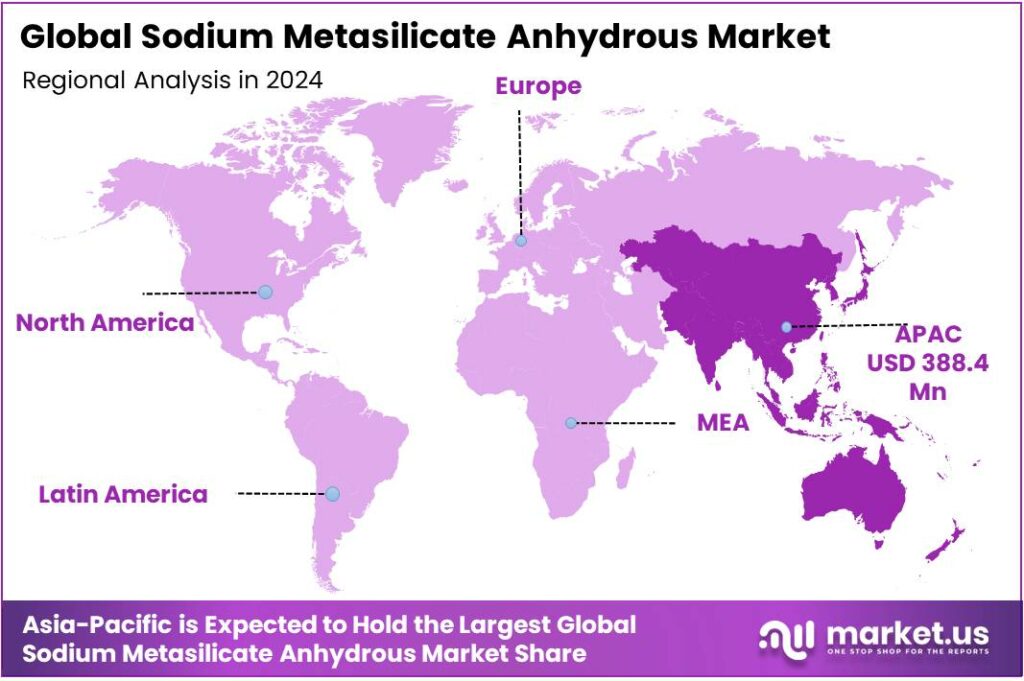

The Global Sodium Metasilicate Anhydrous Market size is expected to be worth around USD 1355.6 Million by 2034, from USD 828.3 Million in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 46.9% share, holding USD 388.4 Million in revenue.

Sodium metasilicate anhydrous is a strongly alkaline builder, dispersant, and corrosion inhibitor used across heavy-duty detergents, pulp and paper processing, ceramics, metal cleaning, and water treatment. Its appeal is technical and economic: high alkalinity and buffering capacity support lower-temperature cleaning and caustic replacement in plant hygiene and CIP regimes, while silicate films help protect steel and aluminum in wash and rinse cycles—important as energy-intensive industries seek both performance and efficiency gains.

The industrial backdrop is decisive. Industry accounted for 37% (166 EJ) of global final energy use in 2022, underscoring why process-side efficiency levers—including lower-temperature, high-alkalinity cleaning—are strategic for plant utilities and OPEX control. In the United States, the EIA projects 1,042 billion kWh of electricity sales to industrial customers in 2024, reflecting robust electrified loads in manufacturing and processing environments where cleaning and surface prep chemicals are specified.

Policy and corporate programs amplify adoption. The U.S. DOE’s Better Buildings Initiative reports cumulative partner savings of nearly $22 billion in energy costs and >220 million metric tons of avoided CO₂ since 2011, validating the business case for operational efficiency programs that often include optimized cleaning cycles and chemical selection. Within DOE Better Plants, participating manufacturers commit to reducing energy intensity by 25% over 10 years, aligning procurement toward process aids that enable shorter cycles and cooler wash temperatures without sacrificing cleanliness.

- The IEA’s Energy Efficiency 2023 underscores a push to double energy-efficiency progress to ~4%/year by 2030, supported by ~USD 700 billion in government efficiency-related spending since 2020 and the EU’s binding 11.7% 2030 energy-efficiency target plus a 1.49%/year savings obligation in 2024–2030. Such programs raise standards for hygiene, asset uptime, and heat-exchanger cleanliness—areas where alkaline builders like sodium metasilicate are routinely specified.

Key Takeaways

- Sodium Metasilicate Anhydrous Market size is expected to be worth around USD 1355.6 Million by 2034, from USD 828.3 Million in 2024, growing at a CAGR of 5.8%.

- Powder held a dominant market position, capturing more than a 48.6% share in the sodium metasilicate anhydrous market.

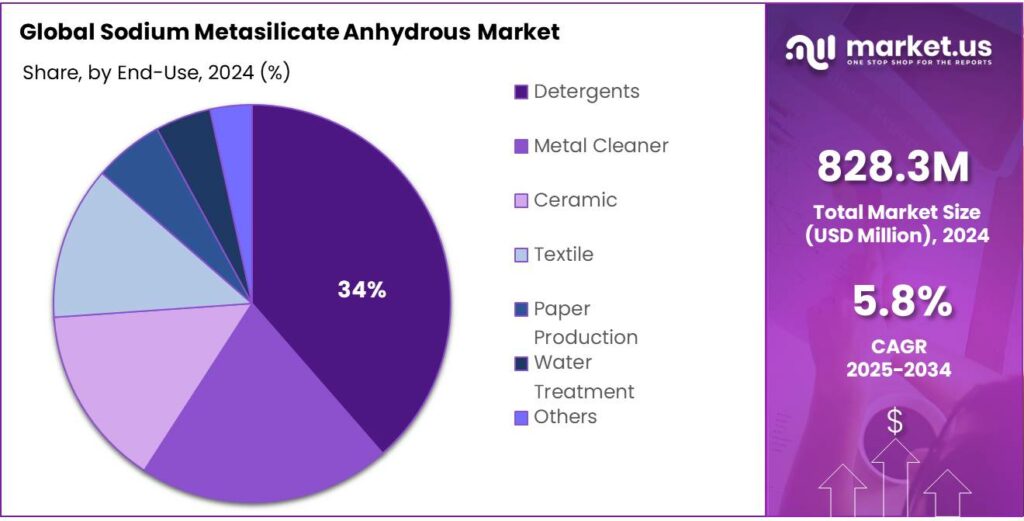

- Detergents held a dominant market position, capturing more than a 34.5% share in the sodium metasilicate anhydrous market.

- Asia Pacific region held a leading position in the sodium metasilicate anhydrous market, capturing 46.9% share, equivalent to USD 388.4 million.

By Product Analysis

Powder dominates with 48.6% share in 2024 due to its versatile industrial applications

In 2024, Powder held a dominant market position, capturing more than a 48.6% share in the sodium metasilicate anhydrous market. This strong performance can be attributed to its widespread use across multiple industries such as detergents, water treatment, ceramics, and textiles, where its stability and ease of handling make it highly preferred. The powder form allows for precise dosing and efficient storage, which enhances its appeal to manufacturers seeking cost-effective and reliable chemical inputs.

Its adoption has been particularly notable in detergent formulation, where it serves as an effective builder, and in water treatment processes, functioning as a flocculant to remove impurities. Looking ahead to 2025, the powder segment is expected to maintain its leading position, driven by continued industrial demand and growing awareness of efficient and environmentally friendly chemical solutions.

By End-Use Analysis

Detergents lead with 34.5% share in 2024 due to high demand in cleaning applications

In 2024, Detergents held a dominant market position, capturing more than a 34.5% share in the sodium metasilicate anhydrous market. This growth is driven by its essential role as a builder in detergent formulations, enhancing cleaning efficiency, stain removal, and water softening. Industrial and household cleaning sectors have increasingly relied on sodium metasilicate anhydrous for its effectiveness and stability, which ensures consistent performance across varied applications.

The rising awareness of hygiene standards and the expansion of commercial laundry services have further supported its widespread adoption. Moving into 2025, the detergent segment is expected to continue its strong presence, supported by steady growth in both domestic and industrial cleaning sectors, where efficiency, cost-effectiveness, and product reliability remain key priorities.

Key Market Segments

By Product

- Powder

- Fine

- Medium

By End-Use

- Detergents

- Metal Cleaner

- Ceramic

- Textile

- Paper Production

- Water Treatment

- Others

Emerging Trends

Sustainability & Green Cleaning in Food Processing

One of the most visible shifts in the sodium metasilicate anhydrous space is the rising demand for sustainable and green cleaning in food processing. Food manufacturers and regulators alike are pushing toward reduced chemical residues, lower wastewater impact, and safer worker handling. That means cleaning chemistries are evolving from “just strong enough” toward “strong and safe / green.” Sodium metasilicate, with its relatively simple chemistry and good performance under alkaline conditions, is being revisited in greener formulations as formulators seek to balance power with eco-friendliness.

Across the food and beverage world, pressures from consumers, brands, and policy are driving this. For example, in foodservice, over 90 % of surveyed facilities report that sustainability initiatives are expanding in their operations—and green cleaning is a top area of focus. Many buyers now expect their cleaning suppliers to offer lower-residue, lower environmental impact alternatives without compromising microbial safety.

On the regulatory and public health side, foodborne disease remains a serious concern that demands strong sanitation. In the U.S. alone, the FDA and CDC estimate that 48 million Americans fall ill yearly from contaminated food, leading to 128,000 hospitalizations and 3,000 deaths. That level of risk means food processors cannot sacrifice efficacy in pursuit of green branding. But the opportunity is in delivering formulations that deliver strong alkaline cleaning yet degrade into benign species, minimize corrosive load, and rinse cleanly.

To meet this, formulators are combining sodium metasilicate with biodegradable co-builders, enzymes, chelating agents with improved eco profiles, or even adjunct oxidants that can enhance microbial kill while softening residue load. The trend is also to lower the overall dose of strong alkalies by combining multiple modes of action—e.g. enzymatic + alkaline synergy—so that the burden of sodium metasilicate in the mix is optimized, not excessive.

Drivers

Tougher hygiene rules in food & beverage plants

A single, powerful force is lifting demand for sodium metasilicate anhydrous: stricter hygiene and sanitation across food and beverage processing. Foodborne illness is a stubborn, global problem, and regulators now expect plants to prove that cleaning works every shift, every line, every surface. The World Health Organization estimates unsafe food causes 600 million illnesses and 420,000 deaths each year, costing 33 million healthy life years—numbers that keep hygiene at the top of every plant manager’s agenda.

Those global risks cascade into local action. In the United States, the CDC estimates 48 million people get sick annually from foodborne illness, with 128,000 hospitalizations and 3,000 deaths. These figures have become shorthand for why validated cleaning-in-place (CIP), bottle-wash, crate-wash, and open-plant cleaning must be both effective and auditable.

Sodium metasilicate anhydrous fits that job. It’s a strong alkaline builder and detergent booster that lifts protein and fat soils, disperses mineral films, and helps prevent re-deposition. In bottle and returnable-crate lines, its alkalinity accelerates saponification of fats, while the silicate content helps inhibit corrosion on ferrous surfaces. In CIP blends, it pairs well with surfactants and chelants to punch through baked-on residues—especially in dairies, breweries, and prepared-food kitchens—without adding phosphates.

In the European Union, Regulation (EC) No 852/2004 obliges food businesses to maintain hygienic conditions using Good Hygiene Practices and HACCP principles. This pushes standardized cleaning chemicals and procedures that can be monitored, trended, and audited—again favoring robust, high-alkaline builders that perform reliably in hard water and heavy-soil environments.

Restraints

Regulatory Safety Concerns & Handling Risks

One significant brake on the broader adoption of sodium metasilicate anhydrous lies in safety, regulatory scrutiny, and handling hazards. Because sodium metasilicate is strongly alkaline and corrosive, it creates risks for workers, equipment, and the environment. These safety challenges increase compliance costs, slow adoption of higher concentrations, or limit its use in sensitive food or beverage contexts.

From a health and safety standpoint, the material is classified as “causes severe skin burns and eye damage” (Skin Corr. 1B, H314) and “May be corrosive to metals” (Met Corr. 1, H290) under EU’s chemical classification rules. Its corrosive properties demand rigorous handling protocols, specialized storage, protective gear, and staff training. In practice, that pushes up capital and operational costs for food processors compared to milder alkaline options or enzyme-based cleaners.

Additionally, in the U.S., the Environmental Protection Agency (EPA) limits several uses of sodium metasilicate by establishing “exemptions from the requirement of a tolerance” only if the aqueous solutions remain below specific percentages: 4% by weight when used as a plant desiccant, and 2.41% by weight when used as an insecticide or fungicide. Outside those bounds, regulatory approval becomes more complex, adding a barrier to innovation or higher-strength formulations in adjacent sectors.

Opportunity

CIP Modernization in Dairy & Beverage Plants

Food and beverage plants are under sustained pressure to clean equipment faster, more thoroughly, and with fewer residues. That pressure—driven by public-health burden and stricter compliance—creates a clear opening for sodium metasilicate anhydrous as a high-alkalinity builder in modern clean-in-place (CIP) systems. The public-health stakes are large: the World Health Organization estimates 600 million people fall ill and 420,000 die every year from unsafe food, underscoring why processors invest in more robust sanitation chemistries and validation.

The scale of dairy alone makes CIP efficiency a board-level topic. FAO reports world milk output reached ~930 million tonnes in 2022 and ~966 million tonnes in 2023. Each tonne flowing through pasteurizers, evaporators, and fillers adds sticky protein and fat soils that require strong, buffered alkalinity to remove. Sodium metasilicate’s alkalinity, dispersion, and buffering let formulators attack tenacious soils while holding them in suspension, reducing redeposition across stainless networks. As dairy lines expand and cycle more frequently, demand grows for builders that keep cleaning windows short, water/energy use controlled, and surfaces audit-ready.

Regulation amplifies this opportunity. In the United States, the FDA’s Food Safety Modernization Act requires hazard analysis and risk-based preventive controls, pushing plants to prove cleaning effectiveness as part of formal food-safety plans. CIP steps that reliably remove proteins/fats and minimize residues are favorable in these validations; sodium metasilicate-based alkalinity packages are often used to achieve the required outcomes at practical concentrations and temperatures. The rule’s compliance architecture—covering most registered food facilities—keeps sanitation performance on the critical path of operations.

Regional Insights

Asia Pacific dominates with 46.9% share, valued at USD 388.4 million in 2024

In 2024, the Asia Pacific region held a leading position in the sodium metasilicate anhydrous market, capturing 46.9% share, equivalent to USD 388.4 million. This dominance can be attributed to the rapid industrialization and urbanization across countries such as China, India, Japan, and South Korea, which has significantly increased demand for detergents, water treatment chemicals, ceramics, and textile processing.

China remains the largest contributor within the region, driven by its expansive manufacturing base and rising consumer awareness regarding hygiene and water purification standards. India has also shown substantial growth, fueled by increased investments in infrastructure, rising construction activities, and a growing household chemicals market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Qingdao Haiwan Group Co., Ltd. is a prominent state-owned chemical enterprise in China, established in 1947. The company specializes in the production of various chemical products, including sodium metasilicate anhydrous. Their sodium metasilicate is characterized by its high melting point of 1089°C and its ability to dissolve easily in water. The product exhibits properties such as decontamination, decentralization, wetness, penetrability, and pH value buffer capacity, making it suitable for diverse industrial applications.

Silmaco is a manufacturer of sodium metasilicate anhydrous, offering products with a molar ratio of 1:1 between silica and sodium oxide. This composition imparts corrosion-inhibiting properties to the product, protecting both metal and non-metal surfaces. The sodium oxide content provides powerful alkalinity, ensuring excellent solubility and efficient cleaning performance. Silmaco’s metasilicate anhydrous is available in various grain sizes and is utilized in applications requiring high alkalinity and effective cleaning.

Nippon Chemical Industrial Co., Ltd. is a Japanese company specializing in inorganic chemical products, including sodium metasilicate pentahydrate. Their sodium metasilicate pentahydrate is soluble in water and insoluble in alcohol, appearing as white crystals. The product contains 27.5–29.0% SiO₂ and 28.5–30.0% Na₂O, with a molar ratio of 0.9–1.1. It is primarily used in heavy-duty cleaning applications, such as cleaning metals, glass, porcelain, and laundries, and is available in 20 kg and 25 kg paper bags.

Top Key Players Outlook

- PQ CorporationSo

- Qingdao Haiwan Group Co.,Ltd.

- Silmaco

- Nippon Chemical Industrial Co., Ltd

- Glentham

- Aqua Bond Inc

- Oakwood Products, Inc

- Nama Group

- JAY DINESH CHEMICALS.

- Henan Sinowin Chemica lndustry Co. Ltd

- Taixing Yueda Industrial

Recent Industry Developments

In 2024 Glentham Life Sciences Ltd, continued to serve the laboratory and industrial sectors by providing high-purity sodium metasilicate anhydrous under product code GK6589. This product is characterized by its white granular powder form, with an assay of 45.0–47.5% SiO₂ and 49.5–51.0% Na₂O.

In 2024 Nippon Chemical Industrial, reported a revenue of ¥1.1 billion (approximately USD 7.5 million) and continued to expand its sodium silicate production to meet the growing demand for green chemicals in the Asia Pacific region.

Report Scope

Report Features Description Market Value (2024) USD 828.3 Mn Forecast Revenue (2034) USD 1455.6 Mn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Powder, Fine, Medium), By End-Use (Detergents, Metal Cleaner, Ceramic, Textile, Paper Production, Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape PQ CorporationSo, Qingdao Haiwan Group Co.,Ltd., Silmaco, Nippon Chemical Industrial Co., Ltd, Glentham, Aqua Bond Inc, Oakwood Products, Inc, Nama Group, JAY DINESH CHEMICALS., Henan Sinowin Chemica lndustry Co. Ltd, Taixing Yueda Industrial Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sodium Metasilicate Anhydrous MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Metasilicate Anhydrous MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PQ CorporationSo

- Qingdao Haiwan Group Co.,Ltd.

- Silmaco

- Nippon Chemical Industrial Co., Ltd

- Glentham

- Aqua Bond Inc

- Oakwood Products, Inc

- Nama Group

- JAY DINESH CHEMICALS.

- Henan Sinowin Chemica lndustry Co. Ltd

- Taixing Yueda Industrial