Global Social Audit Services Market By Audit Type (Corporate Social Responsibility, Social and Quality Management, Occupational Health and Fire Safety, Ethical Trading, Social Impact Assessment, Climatic Change Assessment, Others), By End Users (Healthcare and Pharmaceuticals, Food and Beverage, Oil and Gas, Apparels and Footwear Industry, Telecom, Media and Entertainment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132197

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

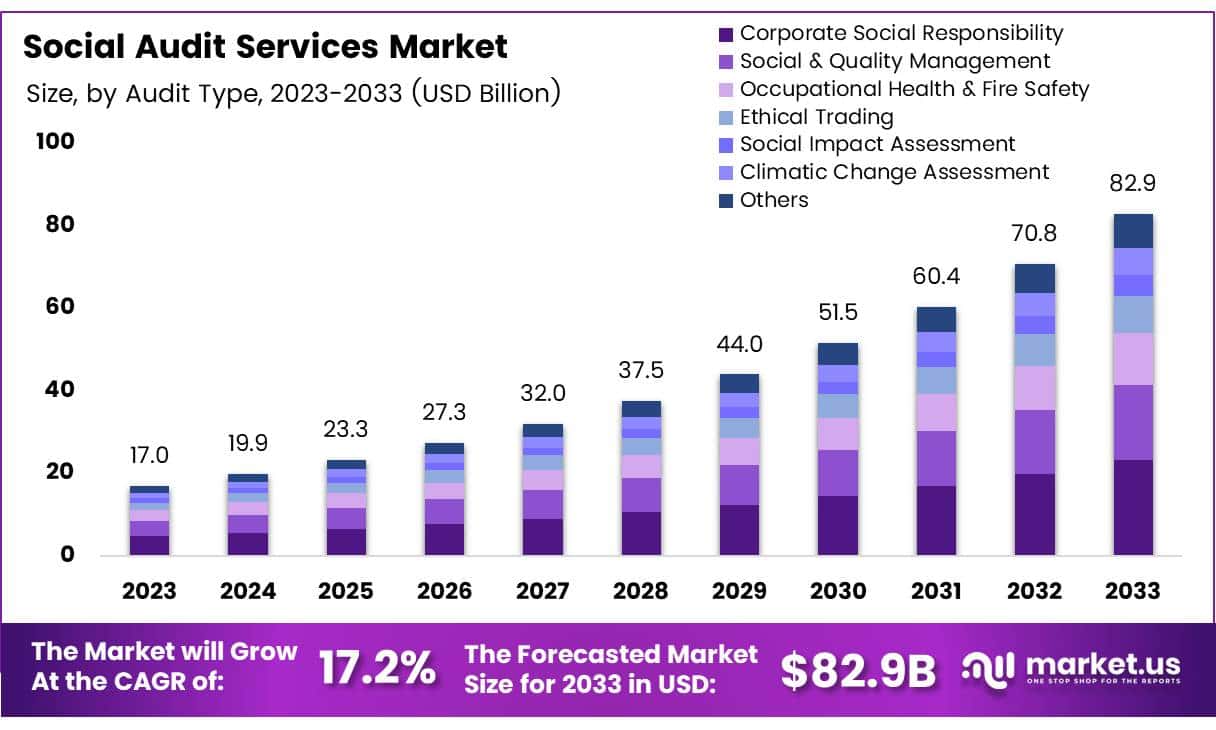

The Global Social Audit Services Market size is expected to be worth around USD 82.9 Billion by 2033, from USD 17 Billion in 2023, growing at a CAGR of 17.2% during the forecast period from 2024 to 2033.

Social audit services assess an organization’s social impact, regulatory compliance, and the effectiveness of its social responsibility initiatives. Conducted by independent entities, these audits are crucial for companies aiming to be transparent about their community and environmental impact.

They evaluate aspects such as labor practices, environmental impact, human rights, and community development. The findings from these audits help organizations improve their corporate social responsibility (CSR) strategies and build stakeholder trust by showing commitment to social values.

The market for social audit services has grown significantly as more businesses strive to meet societal expectations and regulatory demands regarding social responsibility. This market includes firms that offer auditing services, supported by stakeholders like corporations, non-profits, and government bodies, all aiming to boost their transparency and accountability.

The growth of the social audit services market can be attributed to several factors. Increasing governmental investments and regulatory frameworks around the world have mandated companies to be more transparent about their social impact, driving demand for comprehensive social audits.

For example, the United States’ welfare budget of $1.101 trillion in fiscal year 2023 underscores a significant government focus on social welfare and related services, indirectly influencing corporations to align with these priorities through social auditing.

Additionally, initiatives such as the Biden-Harris Administration’s allocation of $7.8 million in grants to connect people to healthcare and other critical services highlight a growing government role in facilitating and enhancing social services, which in turn promotes higher standards for corporate involvement in social issues.

The market for social audit services also presents numerous opportunities for expansion. Government actions, such as Governor Hochul’s announcement of $17.2 million to strengthen social services that help vulnerable families achieve financial stability, create a ripple effect in the private sector, encouraging businesses to participate in and invest in similar social initiatives.

Furthermore, Mayor Adams’ celebration of a historic $2 billion investment in affordable housing, with a total 10-year capital commitment reaching a record $26 billion by fiscal year 2025, projects an increasing trend of governmental and private investments into socially beneficial projects.

Key Takeaways

- The Global Social Audit Services Market is projected to grow from USD 17 Billion in 2023 to USD 82.9 Billion by 2033, achieving a CAGR of 17.2%.

- In 2023, CSR audits commanded a 57.5% share of the Social Audit Services Market, reflecting a strong emphasis on sustainable and ethical business practices.

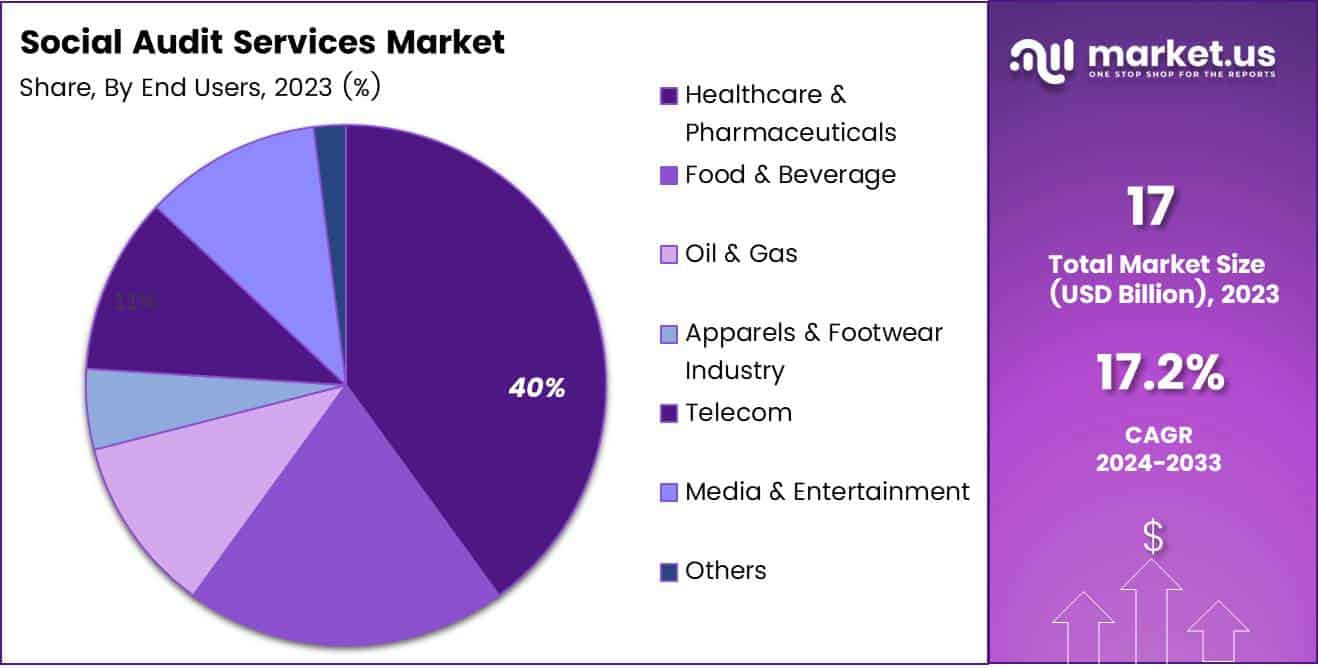

- Healthcare & Pharmaceuticals dominated end-user segments in social audit services in 2023 with a 44.2% share, driven by stringent regulatory compliance and demand for transparency.

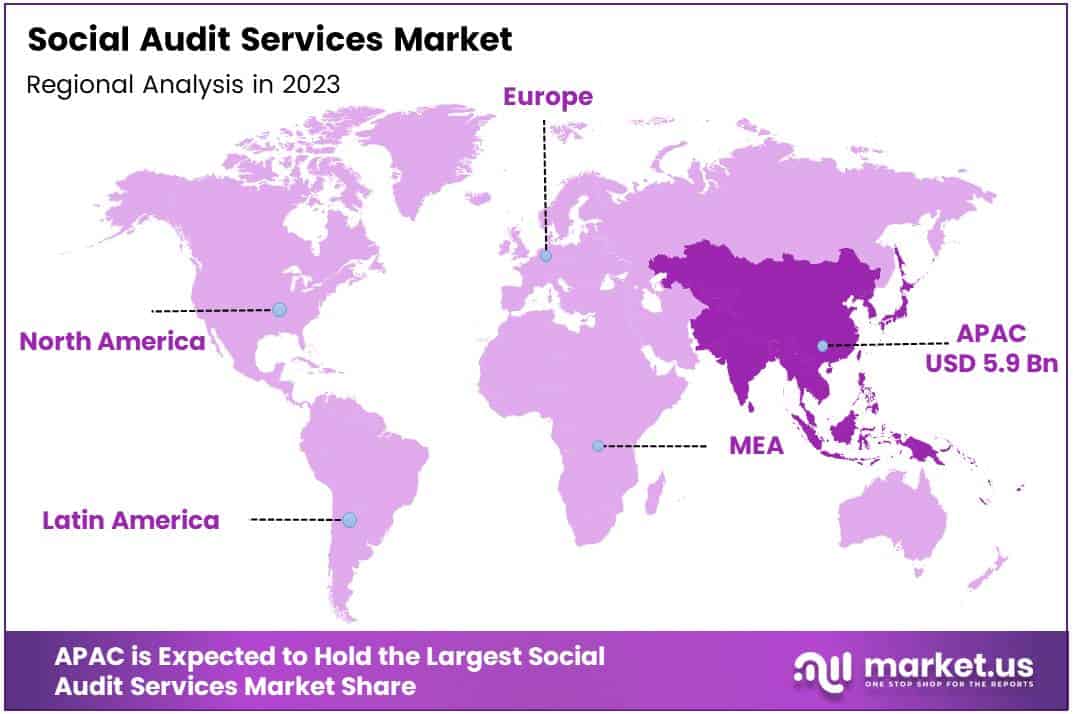

- The Asia Pacific region led with a 35% market share, driven by strict regulations and a focus on transparency, with China and India fueling growth due to rapid industrialization.

- Heightened awareness of mental health issues is driving audits of related organizational support programs to ensure compliance and effectiveness.

- Expansion in telehealth services offers growth potential for social audits, improving access to care in remote and underserved areas.

Audit Type Analysis

Corporate Social Responsibility Leads in Social Audit Services with a 57.5% Market Share

In 2023, Corporate Social Responsibility (CSR) held a dominant market position in the By Audit Type Analysis segment of the Social Audit Services Market, with a 57.5% share. This significant portion underscores the heightened corporate emphasis on sustainable and ethical business practices, reflecting a broader consumer and stakeholder demand for transparency and accountability.

Social & Quality Management, which integrates principles of corporate ethics with quality assurance protocols, also plays a crucial role in social auditing. This area focuses on the adherence to social, ethical, and quality standards across the supply chain, ensuring that products and services meet consumer expectations while adhering to regulatory requirements.

Occupational Health & Fire Safety audits remain critical, driven by increasing regulations and the intrinsic corporate responsibility to safeguard employee wellbeing. These audits are designed to evaluate the effectiveness of workplace safety measures, compliance with health standards, and fire safety protocols, contributing to reduced workplace incidents and enhanced employee morale.

The segment of Ethical Trading is gaining traction, emphasizing fair labor practices and equitable trade terms. This type of audit assesses compliance with international labor standards and ethical business practices, promoting corporate integrity and fostering trust among consumers and trade partners.

Social Impact Assessment and Climatic Change Assessment address the growing concerns around the environmental and social impacts of corporate operations. These assessments evaluate the direct and indirect effects of business activities on local communities and ecosystems, aligning business strategies with global sustainability goals.

The Others category includes niche audits tailored to specific industry needs or emerging market trends, such as digital security and supply chain resilience, reflecting the dynamic nature of the social auditing landscape.

End Users Analysis

Healthcare and Pharmaceuticals Segment Dominates at 44.2% Market Share

In 2023, Healthcare & Pharmaceuticals held a dominant market position in the By End Users Analysis segment of the Social Audit Services Market, with a commanding 44.2% share. This sector’s substantial lead reflects its critical focus on compliance and ethical standards, driven by increasing regulatory scrutiny and consumer demand for transparency in healthcare products and services.

Following closely, the Food & Beverage sector accounted for a significant portion of the market. Companies in this segment are increasingly investing in social audit services to ensure adherence to safety standards and to bolster their sustainability credentials. This is particularly important as consumers and regulators alike demand more information on the sourcing and production of what they consume.

The Oil & Gas industry also represented a noteworthy share, focusing on compliance and environmental sustainability. Social audits in this sector are crucial for maintaining license to operate and for managing reputational risks associated with environmental concerns and ethical practices in extraction and production processes.

In the Apparels & Footwear industry, social audits are leveraged to monitor complex supply chains and to certify labor practices and working conditions. This industry’s commitment to ethical practices is often directly linked to consumer loyalty and brand reputation, making social audits a key strategic tool.

The Telecom sector, while smaller in market share, utilizes social audit services to oversee infrastructural developments and to ensure compliance with international standards in a highly competitive and fast-evolving market landscape.

Media & Entertainment, though holding a modest slice of the market, focuses on intellectual property rights, data protection, and ethical advertising, reflecting the unique challenges of this dynamic industry.

Lastly, the Others category, which includes various industries not classified elsewhere, indicates the widespread adoption and versatility of social audit services across different sectors, highlighting their universal relevance in promoting accountability and sustainability in business practices.

Key Market Segments

By Audit Type

- Corporate Social Responsibility

- Social & Quality Management

- Occupational Health & Fire Safety

- Ethical Trading

- Social Impact Assessment

- Climatic Change Assessment

- Others

By End Users

- Healthcare & Pharmaceuticals

- Food & Beverage

- Oil & Gas

- Apparels & Footwear Industry

- Telecom

- Media & Entertainment

- Others

Drivers

Growing Demand for Mental Health Services Boosts Social Audit Services Market

The social audit services market is experiencing significant growth, driven by three primary factors. Firstly, heightened awareness of mental health issues is amplifying the demand for dedicated counseling, therapy, and psychiatric services. This surge is compelling organizations to ensure compliance with mental health guidelines and the effectiveness of support programs through social audits.

Secondly, the aging global population is creating a pressing need for comprehensive elder care and health management services. Social audit services are critical in verifying the quality and adequacy of these offerings to meet regulatory standards and societal expectations.

Lastly, government initiatives aimed at bolstering social support programs are further catalyzing market expansion. Enhanced funding and strategic support not only increase the availability of social services but also necessitate rigorous audits to maintain transparency, efficiency, and accountability in their delivery. These drivers collectively underscore the burgeoning reliance on social audit services to uphold and enhance service quality across various sectors.

Restraints

Budget Constraints Limit Social Audit Service Availability

In the market for social audit services, a significant restraint arises from budget constraints. The allocation of financial resources, whether from government bodies or private entities, plays a critical role in shaping the availability and expansiveness of these services. Limited funding can lead to a narrowed scope of audit activities, affecting the depth and breadth of the audits conducted.

Furthermore, staffing shortages exacerbate this issue, as the field of social audit services frequently faces a dearth of adequately trained professionals. This shortage can impede the efficiency and effectiveness of service delivery, challenging the industry’s capacity to meet growing demands.

Consequently, these financial and human resource constraints collectively hinder the market’s ability to fully implement comprehensive social audit programs, affecting both the quality and reach of the services provided.

Growth Factors

Growth Opportunities in the Social Audit Services Market

Expansion of telehealth services provides a significant growth opportunity in the social audit services market. By leveraging telehealth advancements, social services can extend their reach to underserved and remote areas, thereby enhancing accessibility and inclusivity. This expansion is particularly pertinent as communities increase their reliance on digital solutions for health and social care, a trend accelerated by the global pandemic.

Furthermore, innovative funding models like social impact bonds offer novel avenues for investment, enabling agencies to secure necessary resources while focusing on outcome-based accountability. These bonds not only attract private investment into public services but also encourage a performance-oriented approach that can lead to more sustainable community benefits.

Additionally, there is a growing emphasis on preventative services within the sector. By shifting focus from reactive to proactive measures, social audit services can contribute to significant reductions in long-term societal costs and markedly improve outcomes for communities.

This preventative approach aligns with broader health and social care strategies that aim to mitigate risks before they manifest into more complex and costly challenges. Together, these opportunities can transform the landscape of social audit services, creating more resilient and responsive social support systems.

Emerging Trends

Embracing Digital Platforms Enhances Social Audit Services

The social audit services market is witnessing significant growth driven by several pivotal factors. A prominent trend is the rise of digital services, which marks a shift towards using mobile applications and online platforms to enhance service delivery and accessibility. This digital transformation allows for more efficient data collection, analysis, and reporting, streamlining processes and improving transparency in social audits.

Furthermore, there is a notable increase in public engagement, with more individuals actively participating in advocacy and community organizing. This shift not only amplifies the impact of social audits but also fosters greater accountability and community trust in the outcomes.

Additionally, the sector’s emphasis on diversity, equity, and inclusion (DEI) initiatives is reshaping how services are delivered, ensuring they cater to the needs of diverse populations and promote greater equity within communities. Collectively, these factors are sculpting the landscape of social audit services, highlighting a move towards more inclusive, effective, and technologically integrated approaches.

Regional Analysis

Asia Pacific Leading the Market with 35% Share and USD 5.9 Billion in Value

Asia Pacific emerges as the dominant region, accounting for 35% of the global market share, valued at USD 5.9 billion. The robust growth in this region can be attributed to stringent regulatory requirements and a heightened focus on corporate transparency.

Emerging economies such as China and India are pivotal, with their rapid industrial growth driving demand for social audit services to ensure compliance and enhance brand reputation.

Regional Mentions:

North America, characterized by sophisticated corporate sectors and stringent compliance norms, also represents a significant portion of the market. The region’s focus on sustainability and ethical business practices fuels the demand for social audits, particularly in industries such as manufacturing and retail.

Europe follows closely, where the emphasis on sustainability and human rights has intensified the need for social audit services. The European market is driven by regulatory bodies and frameworks that mandate social responsibility across all business operations, thereby influencing substantial market engagement.

Latin America and the Middle East & Africa are experiencing gradual growth in this sector. In Latin America, increasing awareness about social and environmental responsibility among businesses contributes to the market expansion. Meanwhile, in the Middle East & Africa, although the market is nascent, it is poised for growth due to rising international investments and a budding recognition of governance, risk, and compliance (GRC) frameworks.

Collectively, these regions contribute to a dynamic global social audit services market. The Asia Pacific, however, remains the clear leader, not just in size but also in potential growth, driven by an amalgamation of regulatory pressure, market entry of multinational companies, and a burgeoning awareness of social responsibility standards.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Social Audit Services Market is significantly shaped by the activities and strategic developments of key players such as Intertek, SGS Group, and TÜV Rheinland, among others. These firms are pivotal in providing essential audit services that assess the compliance of companies with socially responsible practices across various industries.

Intertek, renowned for its comprehensive safety and sustainability solutions, continues to lead with robust social audit programs designed to ensure ethical operations and supply chain transparency. The company’s proactive approach in adopting new technologies for audit processes underscores its commitment to enhancing accuracy and efficiency in social compliance evaluations.

SGS Group maintains its stature with a global reach and a strong portfolio of audit and certification services that address a wide array of industry standards. SGS’s emphasis on continuous improvement and stakeholder engagement positions it as a crucial facilitator of corporate responsibility and sustainability practices worldwide.

TÜV Rheinland also stands out with its tailored solutions that cater to diverse industry needs, enhancing its reputation in risk management and compliance services. Its strategic focus on integrating digital tools has fortified its audit capabilities, thereby facilitating more dynamic and responsive social audit services.

These leading firms are instrumental in driving the evolution of the Social Audit Services Market, ensuring that corporate practices align with global standards for social responsibility. Their efforts not only aid businesses in mitigating risks and safeguarding reputations but also enhance the overall credibility of industries in meeting ethical obligations.

Top Key Players in the Market

- Intertek

- SGS Group

- HQTS Group Ltd.

- CSR Company International

- Bureau

- SCS Global Services

- DQS Cfs

- QIMA

- TUV Nord

- TUV Rheinland

Recent Developments

- In August 2024, Governor Kathy Hochul announced a $500 million investment in the new Social Care Networks Program. This initiative aims to strengthen social services across New York, focusing on improving health outcomes for millions of low-income residents by enhancing access to essential resources.

- In July 2023, New Jersey’s Fiscal Year 2024 State budget, signed by Governor Phil Murphy, allocated $112 million to increase reimbursement rates for child care providers. This funding continues critical support initially provided during the pandemic, benefiting both families and childcare providers.

- In May 2024, Robin Hood awarded $35 million in grants during the first half of the year to combat poverty in New York City. These funds were directed toward impactful programs focused on improving economic mobility and addressing urgent needs within low-income communities.

- In June 2023, California allocated $1.49 billion in grants for behavioral health and community housing initiatives. This funding aims to expand access to mental health services and provide housing support, addressing critical gaps in the state’s social safety net.

Report Scope

Report Features Description Market Value (2023) USD 17 Billion Forecast Revenue (2033) USD 82.9 Billion CAGR (2024-2033) 17.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Audit Type (Corporate Social Responsibility, Social & Quality Management, Occupational Health & Fire Safety, Ethical Trading, Social Impact Assessment, Climatic Change Assessment, Others), By End Users (Healthcare & Pharmaceuticals, Food & Beverage, Oil & Gas, Apparels & Footwear Industry, Telecom, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intertek, SGS Group, HQTS Group Ltd., CSR Company International, Bureau, SCS Global Services, DQS Cfs, QIMA, TUV Nord, TUV Rheinland Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Social Audit Services MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Social Audit Services MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Intertek

- SGS Group

- HQTS Group Ltd.

- CSR Company International

- Bureau

- SCS Global Services

- DQS Cfs

- QIMA

- TUV Nord

- TUV Rheinland