Global SME Insurance Market Size, Share, Growth Analysis By Insurance Type (Property Insurance, General Liability Insurance, Cyber Insurance, Workers’ Compensation Insurance, Commercial Auto Insurance, Others), By Industry Vertical (Retail & E-commerce, Construction, Manufacturing, Healthcare, IT & Technology Services, Food & Beverage, Others), By Distribution Channel (Insurance Brokers & Agents, Direct Sales, Online Aggregators & Comparison Platforms, Bancassurance, Digital-Only InsurTech Platforms) - By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152489

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

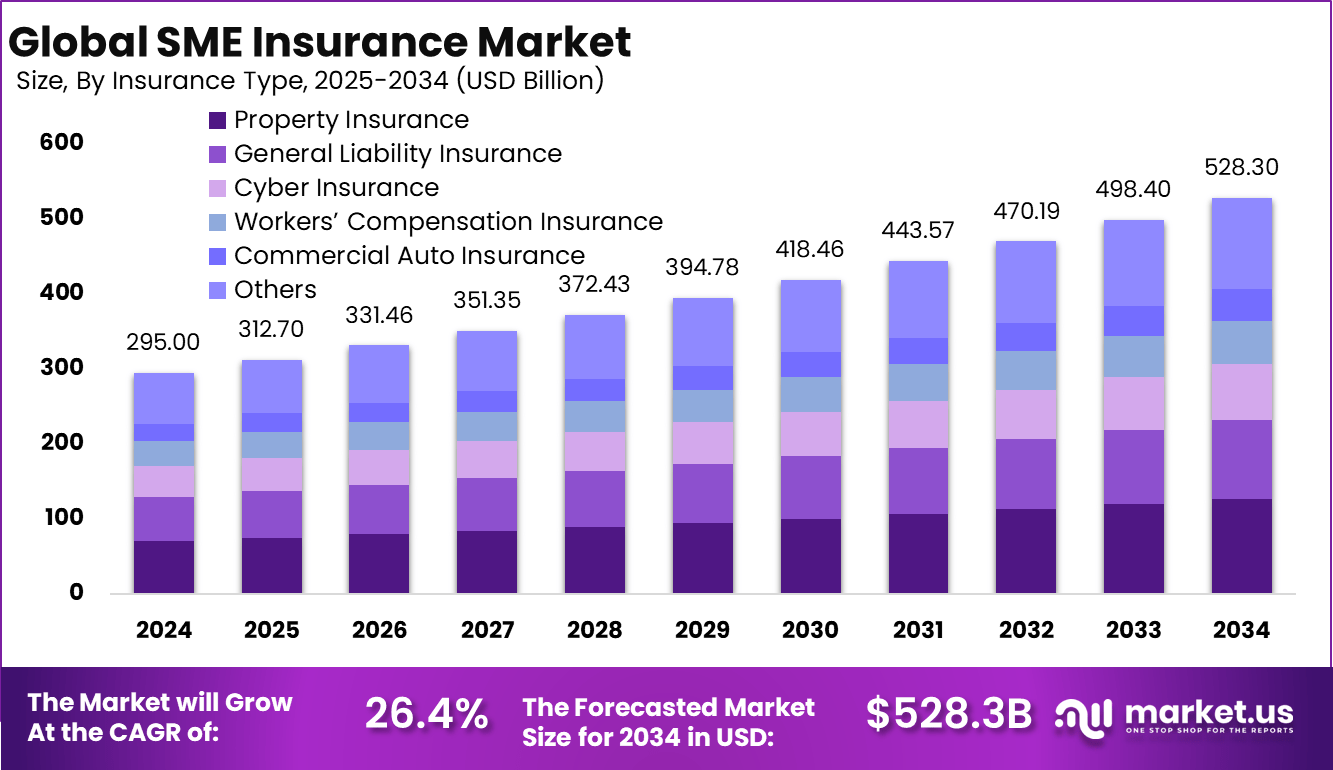

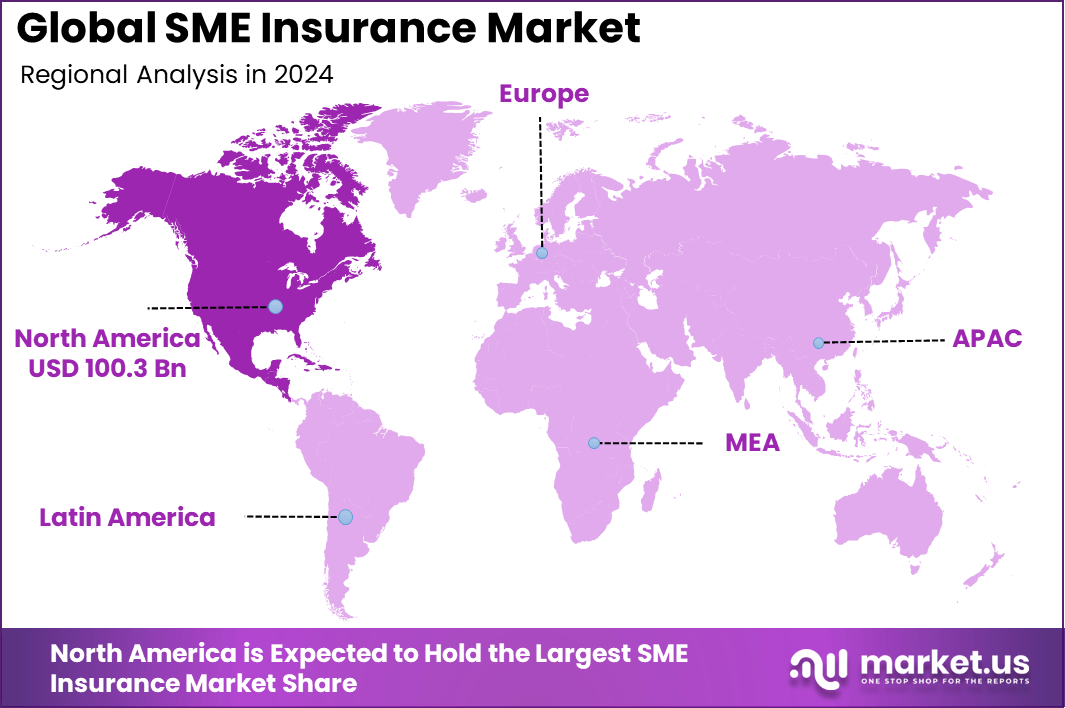

The Global SME Insurance Market size is expected to be worth around USD 528 billion by 2034, from USD 295 billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 100.3 billion in revenue.

The SME insurance market refers to the segment of the insurance industry dedicated to providing tailored risk coverage solutions to small and medium-sized enterprises (SMEs). This market addresses the unique operational, financial, and regulatory risks faced by SMEs, which are often underserved by traditional corporate insurance products. It encompasses a wide range of policies such as property, liability, business interruption, cyber risk, and employee-related coverage, designed to safeguard the continuity and resilience of SMEs.

For instance, in October 2024, Lockton launched a new digital insurance platform for SMEs in Australia, designed to simplify the insurance process for small and medium-sized businesses. The platform offers tailored coverage options, allowing businesses to easily access, compare, and purchase insurance products online. By leveraging digital tools, Lockton aims to improve the efficiency of policy management and enhance the overall customer experience.

Market Scope and Forecast

Report Features Description Market Value (2024) USD 295 Bn Forecast Revenue (2034) USD 528.3 Bn CAGR (2025-2034) 26.4% Largest market in 2024 North America [34% market share] The top driving factors influencing this market include the increasing awareness of risk management among SMEs and the rising regulatory pressures mandating certain types of coverage. Additionally, the growing complexity of business risks, particularly cyber threats and supply chain disruptions, has strengthened the demand for comprehensive and customized insurance solutions.

According to insuranceasia, around 80% of high-earning small and medium enterprises globally remain uninsured or underserved, with many lacking a Standard Industrial Classification code. Over 50% of SMEs also do not have protection against their top three risks. This gap is concerning as global natural disaster losses have exceeded $100 billion annually for four consecutive years, highlighting the need for stronger insurance adoption.

A robust demand analysis highlights that SMEs across manufacturing, services, and retail sectors exhibit growing interest in insurance products that combine affordability with relevance to their specific risks. Increased participation of SMEs in global supply chains and cross-border trade has amplified their exposure to external risks, thereby accelerating insurance uptake.

Key Insight Summary

- The market is projected to grow from USD 295 billion in 2024 to approximately USD 528 billion by 2034, registering a steady CAGR of 6.0%, driven by rising risk awareness, regulatory requirements, and tailored insurance offerings for small and medium-sized enterprises.

- North America led the global market in 2024, accounting for over 34% share and generating around USD 100.3 billion in revenue, supported by a mature insurance ecosystem and strong SME presence.

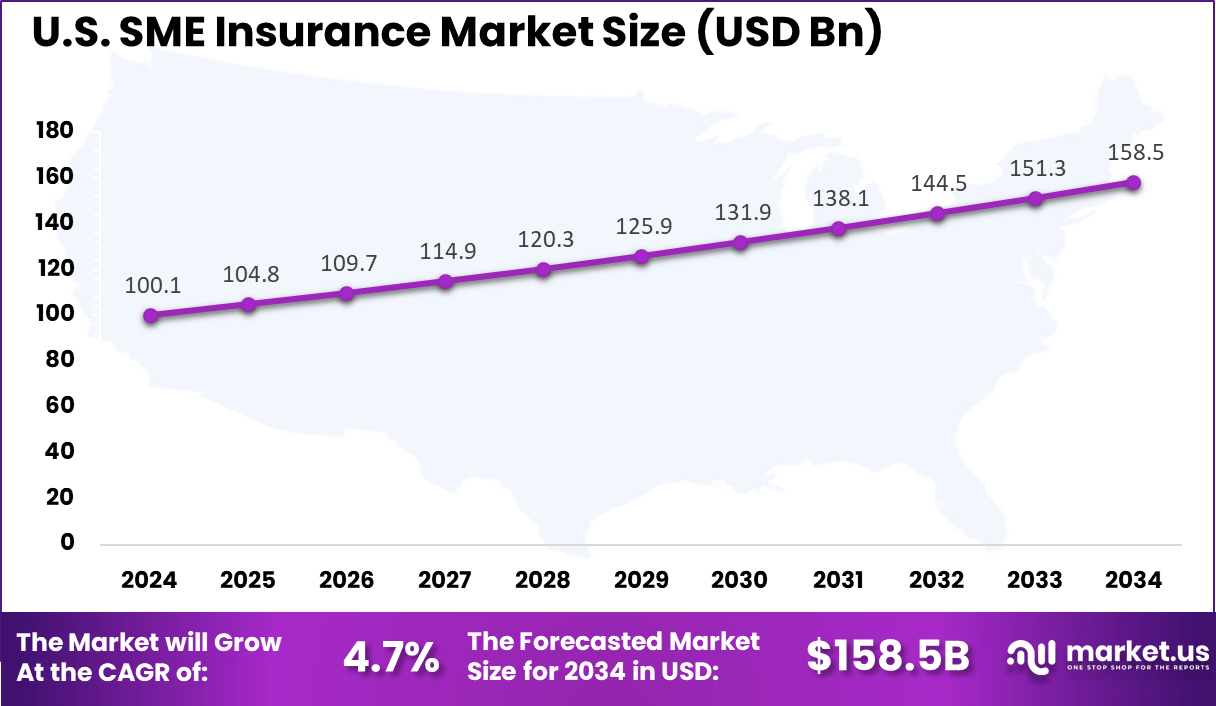

- The U.S. market alone contributed about USD 100.1 billion in 2024, with an expected CAGR of 4.7%, reflecting stable SME growth and continued demand for business protection solutions.

- By insurance type, Property Insurance dominated with a 24% share, as SMEs prioritize safeguarding their physical assets against damage, theft, or natural disasters.

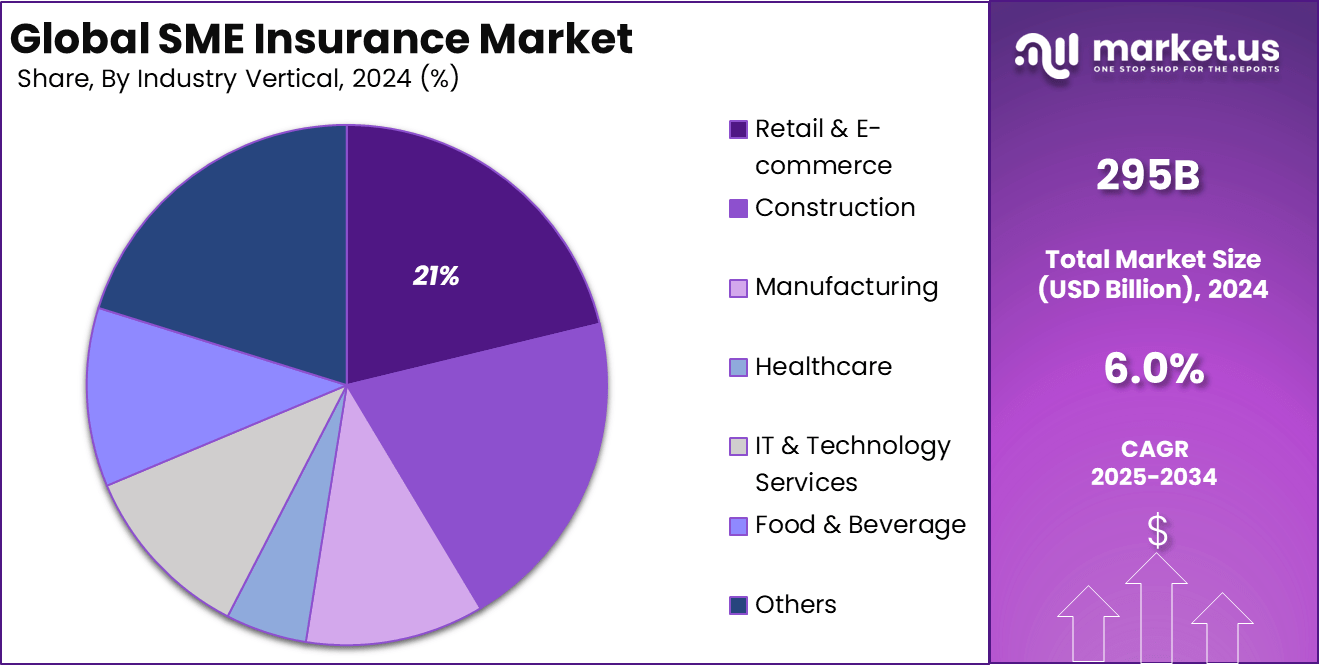

- Across industry verticals, Retail & E-commerce held the largest share at 21%, reflecting the high concentration of SMEs in this sector and their exposure to operational, supply chain, and liability risks.

- By distribution channel, Insurance Brokers & Agents led the market with 38% share, demonstrating their key role in advising SMEs and providing customized coverage options aligned with business needs.

US Market Size

The U.S. SME Insurance Market was valued at USD 100.1 Billion in 2024 and is anticipated to reach approximately USD 158.5 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

For instance, in June 2025, Zurich Insurance expanded its SME insurance offerings in the U.S. through a partnership with Cowbell, a leading InsurTech platform. This collaboration allows Zurich to provide more tailored and data-driven insurance solutions for SMEs, leveraging Cowbell’s advanced technology to offer proactive risk management and customized coverage.

In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 100.3 billion revenue. This leadership can be attributed to the region’s highly developed small and medium enterprise ecosystem and a mature insurance industry offering diverse, tailored products.

The strong regulatory framework encouraging SME participation in risk transfer mechanisms has also reinforced demand. In addition, widespread awareness of business continuity risks and high penetration of digital insurance channels have made it easier for SMEs to access and purchase appropriate coverage, strengthening the overall market presence in North America.

For instance, in June 2025, INTX Insurance Software launched its advanced platform in North America, offering innovative solutions designed to streamline the insurance process for SMEs. The platform aims to enhance the efficiency of insurance operations by providing insurers with real-time data analytics, automated underwriting, and improved claims management capabilities.

Analysts’ Viewpoint

The increasing adoption of technologies such as artificial intelligence, blockchain, and digital underwriting platforms has reshaped the SME insurance landscape. These technologies enable insurers to deliver faster policy issuance, more accurate risk assessment, and seamless claims settlement.

Digital channels have also expanded access to insurance for SMEs in remote and underserved regions, improving market penetration and operational efficiency for insurers while enhancing customer experience. Key reasons for adopting these technologies include the need for cost reduction in policy administration, improving underwriting precision, and providing personalized offerings at scale.

SMEs are increasingly attracted to insurers who can offer digital self-service portals, simplified application processes, and transparent pricing models, which are facilitated through technological integration. Significant investment opportunities can be observed in the development of niche insurance products targeted at emerging SME segments, such as gig economy businesses, green enterprises, and digital startups.

Insurance Type Analysis

In 2024, Property Insurance segment held a dominant market position, capturing a 24% share of the Global SME Insurance Market. This dominance is primarily driven by the growing need for SMEs to protect their physical assets against risks such as property damage, theft, and natural disasters.

With the growing recognition of the need to safeguard infrastructure and stock, property insurance has become an essential component of risk management. Additionally, the rise in climate-driven occurrences and financial instability has increased the demand for comprehensive property management.

For Instance, in June 2025, Black Opal Insurance launched a new property insurance platform specifically designed for real estate professionals and investors. The platform offers tailored coverage options for property investors, providing customizable policies that address the unique risks associated with real estate investments.

Industry Vertical Analysis

In 2024, the Retail & E-commerce segment held a dominant market position, capturing a 21% share of the Global SME Insurance Market. Retail and E-commerce demand has largely been driven by the rapid growth of online shopping, increasing awareness of cyber threats, and the need for robust protection against theft, inventory loss, and supply chain disruptions.

As more and more SMEs increase their online visibility, they are confronted with more complex risks, leading to the requirement for tailored insurance that encompasses both physical and digital aspects. This expansion is further supported by changing consumer preferences and more rigorous regulations on data security and operational continuity.

For instance, in November 2024, The Hartford was recognized for having the best small commercial digital capabilities in the insurance sector. According to the Keynova Group’s 2024 Small Commercial Insurance Scorecard, The Hartford’s digital solutions were rated as the most efficient and user-friendly, setting a benchmark for peers.

Distribution Channel Analysis

In 2024, The Insurance Brokers & Agents segment held a dominant market position, capturing a 38% share of the Global SME Insurance Market. This dominance is primarily due to the trusted relationships brokers and agents build with SMEs, offering personalized advice and tailored insurance solutions.

Their expertise in navigating complex insurance options and providing value-added services such as claims assistance and risk assessment makes them a preferred choice for many small and medium-sized businesses. Additionally, brokers and agents play a key role in simplifying the insurance purchasing process, ensuring SMEs obtain the most suitable coverage for their unique needs.

For Instance, in June 2025, PolicyBoss.com introduced Live Brokerage and Instapay for POSP (Point of Sales Person) agents, aiming to enhance the efficiency and flexibility of insurance distribution for SMEs. This initiative allows POSP agents to instantly track and earn commissions in real-time through the Live Brokerage feature, while Instapay enables immediate payout of their earned commissions.

Key Market Segments

By Insurance Type

- Property Insurance

- General Liability Insurance

- Cyber Insurance

- Workers’ Compensation Insurance

- Commercial Auto Insurance

- Others

By Industry Vertical

- Retail & E-commerce

- Construction

- Manufacturing

- Healthcare

- IT & Technology Services

- Food & Beverage

- Others

By Distribution Channel

- Insurance Brokers & Agents

- Direct Sales

- Online Aggregators & Comparison Platforms

- Bancassurance

- Digital-Only InsurTech Platforms

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Digital Transformation and InsurTech

The rapid adoption of digital tools by small and medium-sized enterprises has transformed the insurance sector, leading to a surge in InsurTech innovations. With these advancements, insurers can offer efficient, personalized insurance solutions that are also cost-effective and tailored to the specific needs of small businesses.

InsurTech streamlines administrative tasks, improves risk assessment, and enhances the customer experience, making insurance more accessible and appealing to small and medium-sized enterprises. In June 2025, Cork-based InsurTech firm Kayna made significant strides in its global expansion by leveraging an embedded insurance model.

The company announced its plans to accelerate growth by offering seamless, integrated insurance products within digital platforms. This model allows businesses to provide customers with tailored insurance options at the point of sale, enhancing accessibility and convenience.

Restraint

Cost Sensitivity

Cost sensitivity remains a significant barrier for SMEs in purchasing insurance. Insurance premiums are often considered a secondary expense by business owners who have limited financial resources and low profit margins.

The reluctance to pledge insurance coverage can hinder the adoption of comprehensive policies, as SMEs might focus more on short-term cash flow than long-run risk management, which could lead to unexpected financial losses.

For instance, in February 2025, a survey by QBE revealed that rising costs and profit squeezes are major concerns for SMEs in Singapore. The survey found that many small and medium-sized enterprises are struggling with increasing operational costs, which are significantly impacting their profitability and ability to grow.

Opportunities

Expansion in Emerging Markets

The SME insurance sector presents considerable growth opportunities in developing regions, including Africa, Southeast Asia, and Latin America, where the adoption of insurance is still limited. Due to the growth of small and medium-sized enterprises (SMEs) in these regions, insurers can create products that are tailored to local businesses’ unique challenges and risks.

For instance, In December 2021, Ecobank partnered with multiple insurers to deliver bancassurance solutions for SMEs across Africa. This initiative aims to improve access to life, health, and property insurance by leveraging Ecobank’s wide banking network. The collaboration simplifies the insurance process for small businesses, making coverage more accessible and affordable.

Challenges

Claims Management Complexity

Due to the diverse and specialized nature of SMEs’ operations, managing claims can be a challenging task. SME activities are diverse, and it is essential for insurers to have a comprehensive understanding of these risks.

Mishandling claims can lead to customer dissatisfaction and operational inefficiencies, especially if insurers lack the infrastructure or expertise to manage complex claims quickly and accurately, threatening customer trust and long-term relationships.

For instance, in December 2024, the Australian and New Zealand Institute of Insurance and Finance (ANZIIF) launched a training program to improve the use of expert reports in insurance claims. The initiative focuses on boosting accuracy and efficiency in property insurance by equipping professionals with skills to better interpret and apply expert assessments.

Latest Trends

The growing frequency and severity of climate-related events are driving SMEs to seek more efficient insurance solutions. The reason for the increasing popularity of parametric insurance is that it can provide faster payouts based on certain predetermined triggers, such as natural disasters. This approach eliminates the complexity and delays associated with conventional claims procedures, giving SMEs a faster and more cost-effective means of responding to climate challenges.

For instance, in December 2024, Zurich Insurance entered a strategic partnership to help build climate-smart businesses across the Asia-Pacific region. The collaboration focuses on providing SMEs with innovative insurance solutions that promote sustainability and climate resilience. Zurich aims to support businesses in adapting to environmental challenges by offering products that cover risks related to climate change, natural disasters, and transitioning to greener business practices.

Key Player Analysis

AXA, Allianz SE, and Zurich Insurance Group lead the SME insurance market with strong global presence and diversified products. Their focus on tailored solutions, digital platforms, and financial stability has strengthened their ability to serve SMEs effectively. These players remain preferred partners for small businesses seeking comprehensive and reliable insurance coverage across property, liability, and specialty risks.

Chubb Ltd., The Hartford, and Hiscox Ltd. have gained prominence through niche offerings like professional liability and cyber insurance. Their customer-centric approach, underwriting expertise, and use of analytics support their expansion into both developed and emerging SME markets. These companies continue to differentiate through specialized, high-value solutions.

Liberty Mutual, Travelers Companies, and QBE Insurance Group compete through multi-channel distribution, partnerships, and innovative services. Emerging players such as MAPFRE S.A., Next Insurance, and Simply Business are reshaping the landscape with digital-first, affordable policies. Their rise reflects growing SME demand for flexible, technology-driven insurance solutions tailored to specific needs.

Top Key Players Covered

- AXA

- Allianz SE

- Zurich Insurance Group

- Chubb Ltd.

- The Hartford

- Hiscox Ltd.

- Liberty Mutual

- Travelers Companies

- QBE Insurance Group

- MAPFRE S.A.

- Next Insurance

- Simply Business

- Others

Recent Developments

- In January 2025, AXA introduced Global Health Adapt, a flexible and customizable health insurance solution designed for SMEs with international workforces. This product aims to provide scalable health benefits that grow with the business, allowing companies to adjust coverage based on workforce expansion and geographical needs.

- In August 2024, MSIG Insurance announced a groundbreaking initiative that allows small and medium-sized enterprises (SMEs) in Singapore to access insurance products directly through WhatsApp. This move highlights MSIG’s commitment to simplifying insurance access for SMEs by leveraging popular digital platforms.

- In May 2024, Acrisure expanded its footprint in Scotland by acquiring WH&R McCartney, a broker specializing in general commercial SME insurance. This acquisition strengthens Acrisure’s regional growth strategy, building on its earlier entry into the Scottish market through the purchase of Glasgow-based Affinity Brokers in 2023.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Insurance Type (Property Insurance, General Liability Insurance, Cyber Insurance, Workers’ Compensation Insurance, Commercial Auto Insurance, Others), By Industry Vertical (Retail & E-commerce, Construction, Manufacturing, Healthcare, IT & Technology Services, Food & Beverage, Others), By Distribution Channel (Insurance Brokers & Agents, Direct Sales, Online Aggregators & Comparison Platforms, Bancassurance, Digital-Only InsurTech Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA, Allianz SE, Zurich Insurance Group, Chubb Ltd., The Hartford, Hiscox Ltd., Liberty Mutual, Travelers Companies, QBE Insurance Group, MAPFRE S.A., Next Insurance, Simply Business, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AXA

- Allianz SE

- Zurich Insurance Group

- Chubb Ltd.

- The Hartford

- Hiscox Ltd.

- Liberty Mutual

- Travelers Companies

- QBE Insurance Group

- MAPFRE S.A.

- Next Insurance

- Simply Business

- Others