Global SMB Treasury Management App Market By Component (Software/Application, Services), By Deployment Mode (Cloud-based/SaaS, On-premises), By Application (Cash Flow Forecasting & Management, Payments & Transfers (ACH, Wires, etc.), Others), By End-User Business Type (Professional Services Firms, Retail & E-commerce Businesses, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177066

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Driver Impact Analysis

- Restraint Impact Analysis

- By Component Analysis

- By Deployment Mode Analysis

- By Application Analysis

- By End User Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Challenges

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

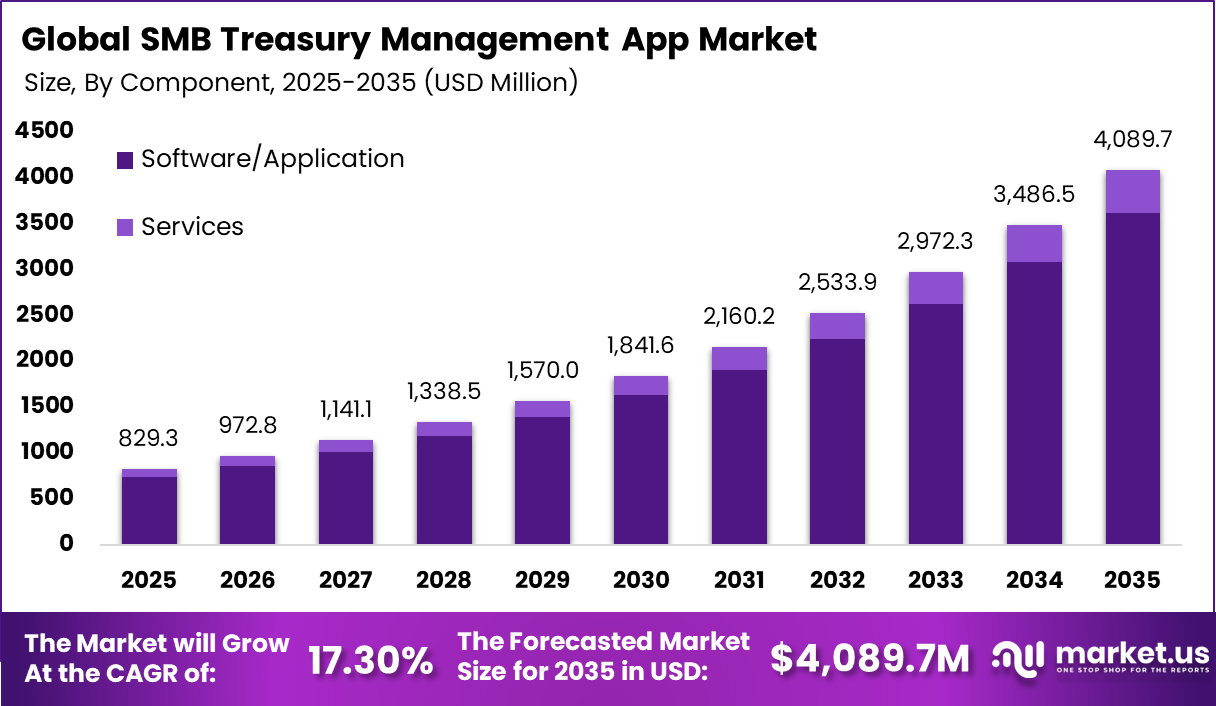

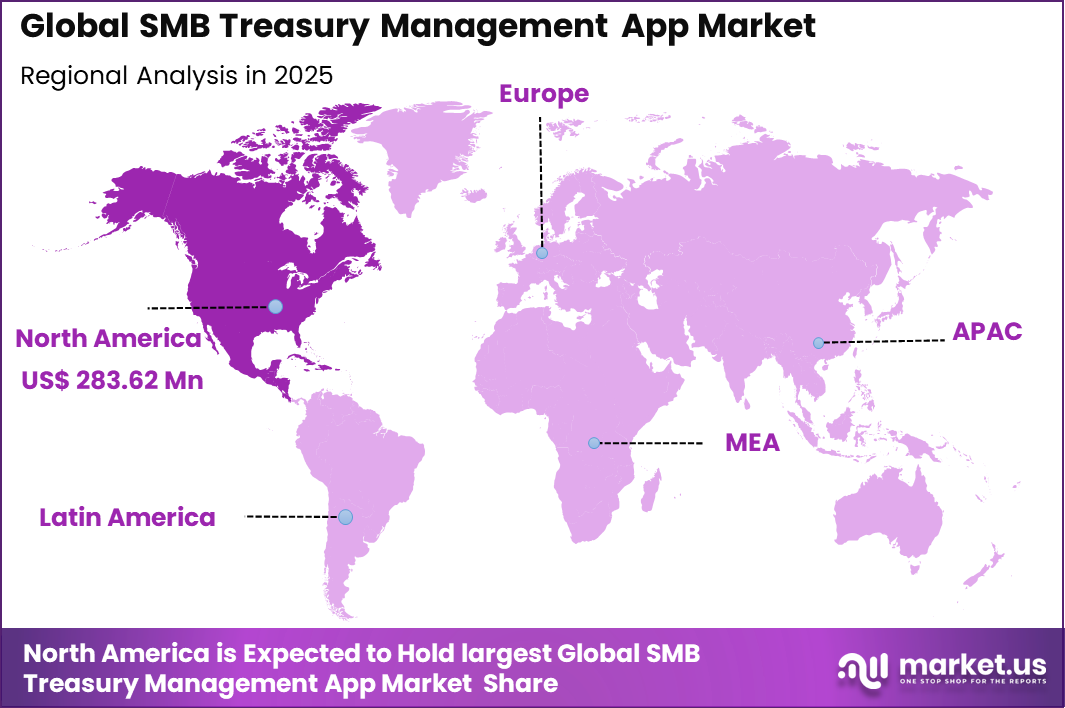

The Global SMB Treasury Management App Market generated USD 829.3 million in 2025 and is predicted to register growth from USD 927.8 million in 2026 to about USD 4,089.7 million by 2035, recording a CAGR of 17.30% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 34.2% share, holding USD 283.62 Million revenue.

The SMB Treasury Management App Market refers to digital applications designed to help small and medium sized businesses manage cash flow, liquidity, payments, and short term financial planning. These apps centralize daily treasury tasks such as balance monitoring, inflows and outflows tracking, and payment scheduling. For SMBs, treasury management apps act as simplified financial control systems that replace manual spreadsheets and fragmented tools.

The market has gained relevance as SMBs face tighter cash cycles and increasing financial complexity. One of the primary driving factors is cash flow volatility among SMBs. Delayed receivables, recurring expenses, and seasonal revenue patterns create liquidity pressure. Treasury management apps help businesses monitor positions daily and anticipate short term gaps. This visibility reduces reliance on reactive financing decisions.

Demand for SMB treasury management apps is rising as small businesses seek better financial discipline. Many SMBs operate with limited financial buffers. Internal surveys show that nearly 50% of SMB failures are linked to poor cash flow management rather than lack of demand. This risk awareness drives adoption of simple treasury tools.

Investment opportunities in this market exist in vertical specific treasury apps tailored to particular SMB segments. Retail, logistics, and professional services each have unique cash flow patterns. Specialized solutions deliver higher value and stronger retention. Investors favor platforms with clear segment focus.

Top Market Takeaways

- By component, software/application accounts for 88.5% of the market, delivering intuitive mobile/web apps for payments, reconciliation, and financial visibility tailored to small and medium businesses.

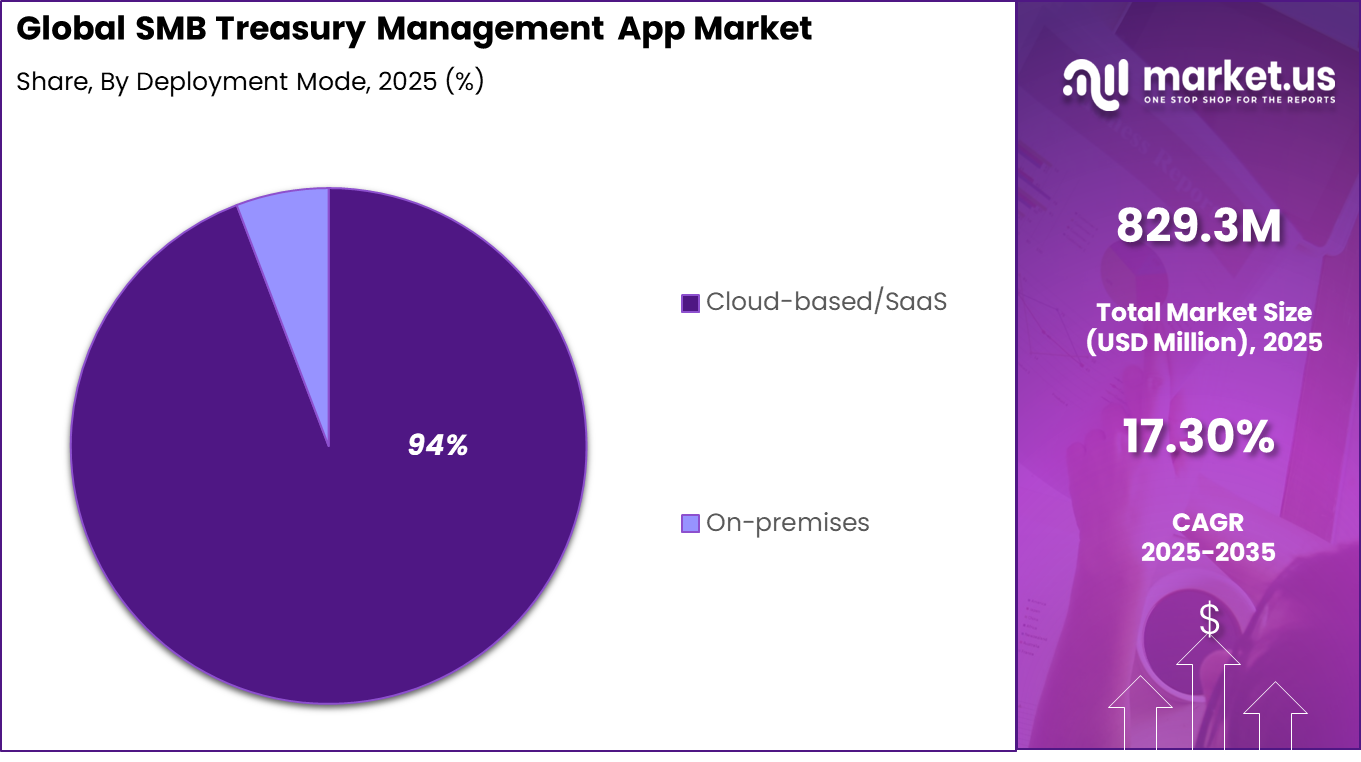

- By deployment mode, cloud-based/SaaS represents 94.2%, prized for low upfront costs, automatic updates, multi-device access, and integration with accounting tools like QuickBooks or Xero.

- By application, cash flow forecasting & management captures 38.7%, helping SMBs predict liquidity gaps, optimize working capital, and navigate economic volatility.

- By end-user business type, professional services firms hold 32.6% share, using these apps for client invoicing, expense tracking, and project-based cash management.

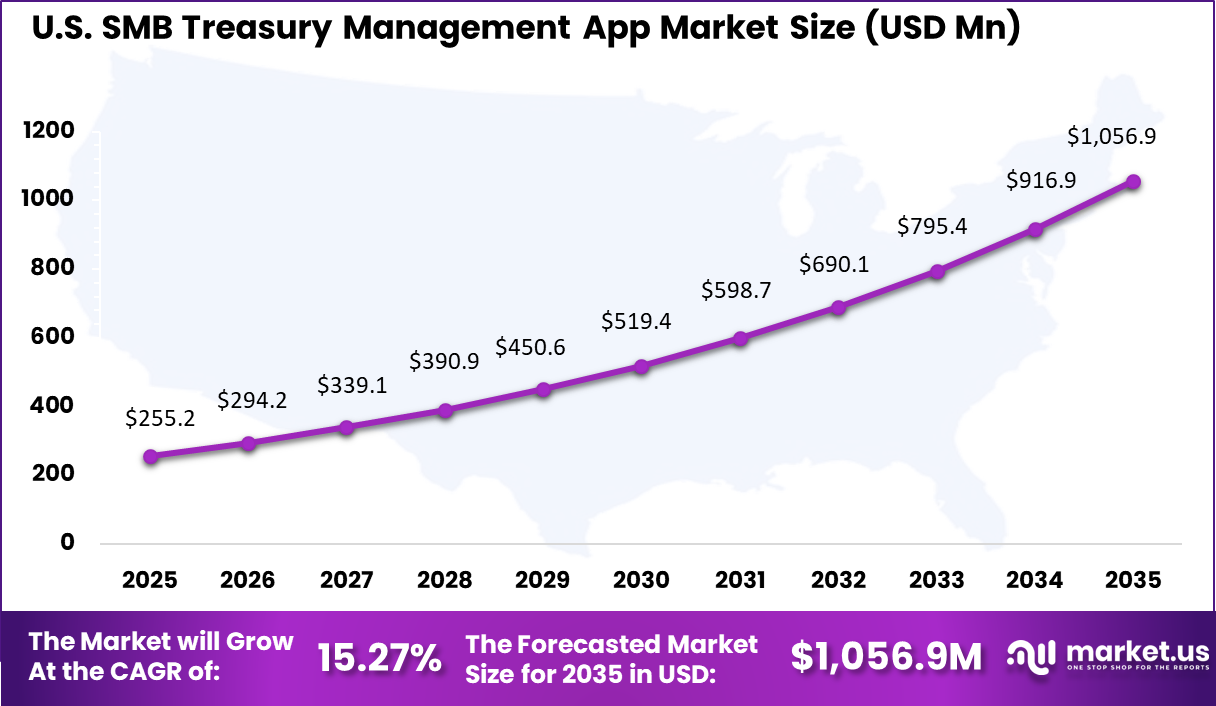

- By region, North America leads with 34.2% of the global market, where the U.S. is valued at USD 255.2 million with a projected CAGR of 15.27%, driven by SMB digitalization and FinTech accessibility.

Key Insights Summary

- In 2026, around 85% of SMB finance leaders expressed strong interest in using AI in finance, while 73% reported that AI is already delivering measurable business impact.

- Treasury automation is widely valued, with 93% of SMB finance leaders identifying moderate to high benefits from automating treasury operations.

- Despite growing interest in automation, nearly 80% of SMBs continue to rely on manual tools such as Excel for treasury workflows, increasing operational risk and limiting the effective use of dedicated Treasury Management Systems.

Driver Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising need for cash flow visibility and liquidity control among SMBs +4.1% North America, Europe Short to medium term Rapid digitization of SMB finance and accounting operations +3.6% Global Medium term Growing adoption of cloud-based financial management tools +3.1% North America, Asia Pacific Medium term Increased volatility in interest rates and operating costs +2.8% Global Medium term Expansion of digital payments and multi-bank connectivity +2.3% North America, Europe Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Budget constraints and price sensitivity among SMBs -3.2% Global Short to medium term Limited treasury management expertise within small businesses -2.6% Asia Pacific, Latin America Medium term Integration challenges with legacy accounting and ERP systems -2.1% Global Medium term Data security and compliance concerns -1.9% North America, Europe Medium term Long onboarding cycles for multi-bank integrations -1.6% Global Medium to long term By Component Analysis

By component, software and application solutions accounted for 88.5% of market adoption. SMBs favor ready to use applications that require minimal customization and internal IT resources. These solutions bundle forecasting, reporting, and payment oversight into a single interface. This simplifies treasury management for lean finance teams.

Application driven models reduce dependence on external consultants. Built in analytics support faster financial decisions without specialist knowledge. This has been particularly valuable for growing firms managing multiple client accounts or projects. Ease of use has remained a key adoption driver.

Continuous feature updates have strengthened software dominance. Vendors frequently enhance forecasting logic and reporting formats based on user behavior. This ensures relevance across changing economic conditions. As SMB needs evolve, application centric solutions continue to lead.

By Deployment Mode Analysis

By deployment mode, cloud based and SaaS platforms represented 94% of usage. Cloud delivery enables rapid onboarding without infrastructure investment. SMBs benefit from predictable subscription costs and flexible scaling. This aligns well with variable cash flows common in smaller businesses.

SaaS deployment also supports frequent updates and security improvements. Treasury functions require high data accuracy and uptime. Cloud platforms meet these requirements through automated maintenance. This has reduced operational risk for users.

Remote accessibility has further increased adoption. Finance teams can access treasury data from any location. This supports distributed work environments and faster decision making. As a result, cloud based deployment has become the standard model.

By Application Analysis

By application, cash flow forecasting and management held a share of 38.7%. Cash predictability is critical for SMB survival and growth. Treasury apps provide forward looking views of liquidity based on receivables, payables, and historical trends. This helps businesses anticipate funding gaps early.

Forecasting tools support scenario analysis and planning. SMBs can assess the impact of delayed payments or expense spikes. This improves resilience during uncertain demand cycles. Better forecasting also strengthens lender and investor confidence.

Automation has reduced manual forecasting effort. Real time updates replace static projections. This has improved forecast accuracy over time. As financial volatility persists, forecasting remains the most valued application area.

By End User Analysis

By end user, professional services firms accounted for 32.6% of adoption. These firms manage project based revenue with uneven cash inflows. Treasury apps help track billings, collections, and payroll timing more effectively. This improves short term liquidity control.

Professional services businesses often operate with limited finance staff. Simplified treasury tools reduce administrative burden. This allows partners and managers to focus on client delivery. Financial clarity supports pricing and staffing decisions.

As service firms scale, transaction complexity increases. Treasury applications provide structure without adding overhead. This has supported strong adoption within consulting, legal, and creative service segments.

Emerging Trends Analysis

An emerging trend in the SMB treasury management app market is increased use of artificial intelligence for cash forecasting and anomaly detection. Machine learning algorithms can identify spending patterns, forecast cash requirements, and highlight unusual transactions. These proactive insights improve financial planning and risk management.

Another trend is the growth of mobile enabled treasury tools. SMB owners and finance teams increasingly expect access to cash flow dashboards, payment approvals, and alerts on mobile devices. Mobile first interfaces enhance responsiveness and support distributed workflows.

Growth Factors Analysis

One of the key growth factors for the SMB treasury management app market is increasing digital adoption among small businesses. Cloud platforms, digital payments, and online sales channels are becoming standard. As finance operations digitise, treasury management apps naturally become part of the technology stack.

Another growth factor is rising emphasis on financial resilience. SMBs experienced pressure during economic disruptions and are investing in tools that improve visibility and control over liquidity. Treasury apps support resilience by providing real time insights and automated processes that reduce risk.

Opportunity Analysis

A significant opportunity in the SMB treasury management app market lies in integration with existing business systems. Connecting treasury apps with accounting software, payroll systems, and payment platforms streamlines data flow and reduces manual work. Seamless integration improves visibility and reduces friction for finance teams.

Another opportunity is expansion of predictive analytics and scenario planning features. These capabilities help SMBs anticipate cash shortfalls, plan for seasonal cycles, and optimise working capital. As advanced analytics becomes more accessible, treasury apps can differentiate by offering actionable insights rather than static reporting.

Challenge Analysis

A major challenge for the SMB treasury management app market is ensuring data security and compliance. Financial data is highly sensitive, and SMBs may be wary of cloud based storage. Treasury apps must demonstrate robust encryption, access controls, and compliance with data protection regulations. Any security incident can undermine trust and adoption.

Another challenge is balancing feature complexity with usability. SMBs often prefer intuitive, low maintenance applications. Overly complex interfaces or excessive configuration requirements can deter adoption. Treasury apps must provide powerful features without overwhelming users.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook SMB-focused fintech and SaaS providers Very High Medium North America, Europe Strong recurring subscription growth Banking and treasury software vendors High Medium Global Cross-sell and ecosystem expansion Banks and financial institutions Medium Low to Medium Global Strategic SMB value-added services Private equity firms Medium Medium North America, Europe Platform scaling and consolidation Venture capital investors High High North America Innovation-led treasury automation Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Cloud-native treasury and cash management platforms +4.2% Real-time cash visibility Global Short to medium term API-based bank connectivity and open banking integration +3.6% Automated data aggregation North America, Europe Medium term AI-driven cash flow forecasting and alerts +3.1% Predictive liquidity management North America Medium term Integration with accounting, ERP, and payment systems +2.7% Unified financial operations Global Medium to long term Embedded security and compliance automation +2.2% Data protection and trust Europe, North America Long term Key Challenges

- Limited financial and technical awareness among small business users

- Integration difficulties with existing accounting, banking, and payment systems

- Data security and privacy concerns related to cash flow and transaction information

- Price sensitivity among SMBs affecting long term subscription adoption

- Need for simple user interfaces to reduce reliance on financial expertise

Key Market Segments

By Component

- Software/Application

- Services

By Deployment Mode

- Cloud-based/SaaS

- On-premises

By Application

- Cash Flow Forecasting & Management

- Payments & Transfers (ACH, Wires, etc.)

- Bank Account Aggregation & Reconciliation

- Liquidity Management & Sweeping

- Others

By End-User Business Type

- Professional Services Firms

- Retail & E-commerce Businesses

- Manufacturing & Distribution

- Hospitality & Food Services

- Others

Regional Analysis

North America accounts for 34.2% of the SMB treasury management app market, supported by high adoption of digital financial tools among small and mid-sized businesses. SMBs in the region are increasingly using treasury apps to manage cash visibility, payments, and short-term liquidity more efficiently. Demand is driven by the need for real-time cash insights, reduced reliance on manual processes, and tighter financial control in a volatile operating environment.

The United States market is valued at USD 255.2 Mn and is expanding at a CAGR of 15.27%, reflecting strong uptake of mobile-first and cloud-based financial management solutions. Adoption is influenced by rising transaction volumes, faster payment cycles, and the need for integrated cash forecasting and bank connectivity. Growth is further supported by increasing awareness among SMBs of treasury automation benefits and the shift toward subscription-based financial software.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading treasury and payments automation providers such as MineralTree, Inc., Tipalti, Inc., and Bottomline Technologies, Inc. hold a strong position in the SMB treasury management app market. Their platforms focus on cash visibility, payment automation, and bank connectivity. These solutions help SMBs reduce manual processes and improve control over cash outflows.

Enterprise and mid-market finance software providers such as Kyriba Corp., Coupa Software Inc., and Sage Group plc extend treasury capabilities to SMBs through modular and cloud-based tools. Xero, Ltd. and Intuit, Inc. integrate basic treasury functions into accounting ecosystems. These players benefit from strong customer bases and ecosystem integrations. Demand is supported by SMB digital transformation and cloud adoption.

Specialized analytics and cash forecasting vendors such as TreasuryXpress, Inc., Cashforce, and CashAnalytics, Ltd. focus on scenario analysis and short-term liquidity planning. Trovata, Inc., Finagraph, LLC, and FinLync, Inc. support deeper insights for growing SMBs. Other vendors add regional depth and customization, strengthening competition across the market.

Top Key Players in the Market

- MineralTree, Inc.

- Tipalti, Inc.

- Bottomline Technologies, Inc.

- Kyriba Corp.

- Coupa Software Inc.

- Sage Group plc

- Xero, Ltd.

- Intuit, Inc.

- TreasuryXpress, Inc.

- Cashforce

- CashAnalytics, Ltd.

- Finagraph, LLC

- Trovata, Inc.

- AccountMate Software Corporation

- FinLync, Inc.

- Others

Future Outlook

The future outlook for the SMB Treasury Management App Market indicates steady growth as small and medium businesses increasingly seek tools to manage cash flow, payments, and financial risks. Demand for treasury management apps is expected to rise because these solutions offer automation, real-time visibility, and improved control over finances.

Adoption of cloud-based platforms, integration with banking systems, and mobile access will support broader use. Growth can be attributed to the need for operational efficiency, tighter cash management, and greater financial planning capabilities. Overall, the market is expected to expand as SMBs prioritize digital financial tools.

Recent Developments

- October, 2025 – Bottomline announced Bea, an embedded AI agent for its Treasury and Cash Management hub that delivers conversational insights, predictive cash forecasting and automated workflows tailored for SMBs to cut manual reconciliation and improve liquidity decisions.

- June, 2025 – MineralTree and Global Payments partnered with Sage Intacct to launch embedded vendor payments, streamlining B2B AP for SMBs with QR code invoicing, dynamic approvals and ERP-native reconciliation to reduce processing costs by over 75%.

- January, 2026 – Centime expanded AI cash forecasting and AR automation for SMBs, consolidating 70+ accounts and saving 48 hours monthly on liquidity planning, positioning as the only all-in-one treasury app for non-enterprise finance teams.

Report Scope

Report Features Description Market Value (2025) USD 829.3 Mn Forecast Revenue (2035) USD 4,089.4 Mn CAGR(2025-2035) 17.30% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Application, Services), By Deployment Mode (Cloud-based/SaaS, On-premises), By Application (Cash Flow Forecasting & Management, Payments & Transfers (ACH, Wires, etc.), Others), By End-User Business Type (Professional Services Firms, Retail & E-commerce Businesses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MineralTree, Inc., Tipalti, Inc., Bottomline Technologies, Inc., Kyriba Corp., Coupa Software Inc., Sage Group plc, Xero, Ltd., Intuit, Inc., TreasuryXpress, Inc., Cashforce, CashAnalytics, Ltd., Finagraph, LLC, Trovata, Inc., AccountMate Software Corporation, FinLync, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  SMB Treasury Management App MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

SMB Treasury Management App MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- MineralTree, Inc.

- Tipalti, Inc.

- Bottomline Technologies, Inc.

- Kyriba Corp.

- Coupa Software Inc.

- Sage Group plc

- Xero, Ltd.

- Intuit, Inc.

- TreasuryXpress, Inc.

- Cashforce

- CashAnalytics, Ltd.

- Finagraph, LLC

- Trovata, Inc.

- AccountMate Software Corporation

- FinLync, Inc.

- Others