Global Smart Waste Routing AI Market Size, Share, Industry Analysis Report By Component (Software, Hardware, Services), By Application (Municipal Waste Management, Industrial Waste Management, Commercial Waste Management, Residential Waste Management, Others), By Deployment Mode (Cloud-Based, On-Premises), By End-User (Municipalities, Waste Management Companies, Industrial Facilities, Commercial Establishments, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168138

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Application Analysis

- Deployment Mode Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

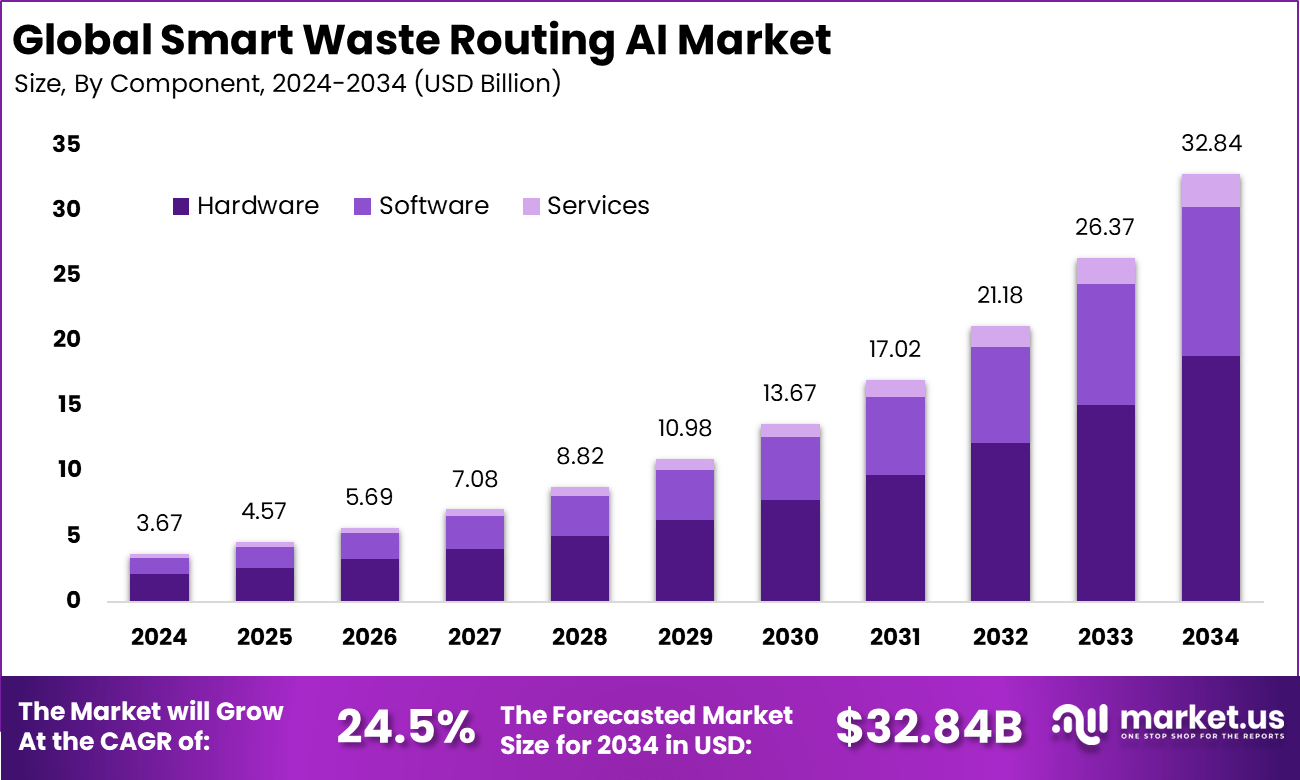

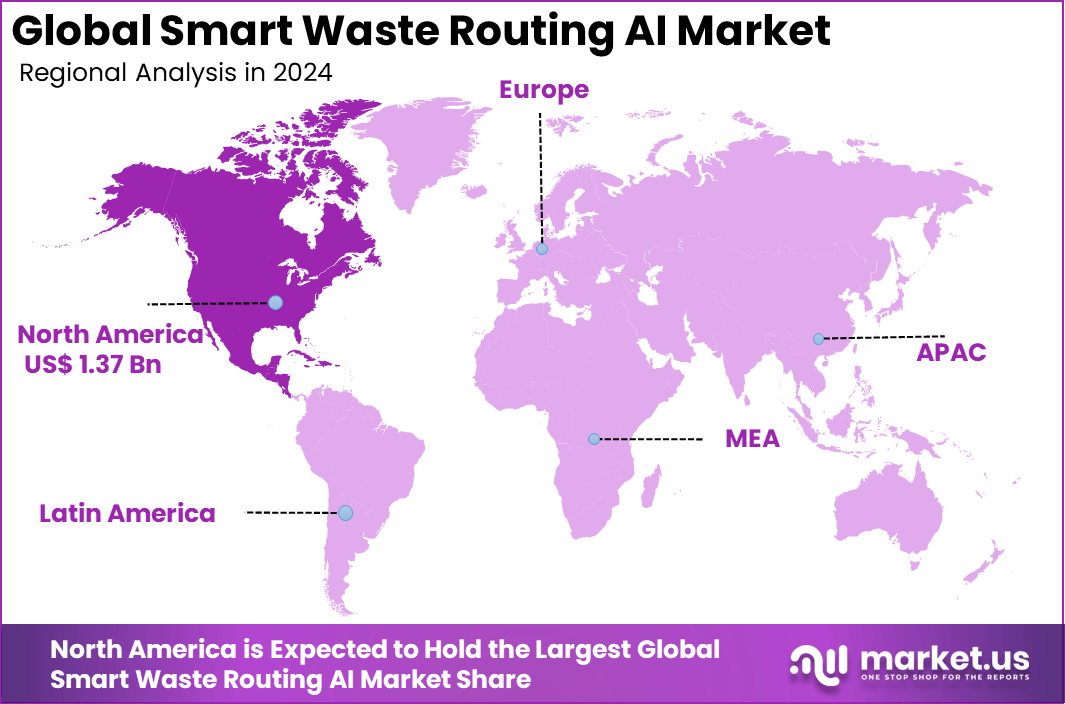

The Global Smart Waste Routing AI Market size is expected to be worth around USD 32.84 billion by 2034, from USD 3.67 billion in 2024, growing at a CAGR of 24.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.5% share, holding USD 1.37 billion in revenue.

The smart waste routing AI market has expanded as municipalities, waste management companies and commercial facilities adopt intelligent systems to optimise collection routes. Growth reflects rising operational costs, increasing urban waste volumes and the need for more efficient fleet management. AI driven routing tools use real time data to reduce fuel consumption, shorten travel distance and improve waste service reliability.

Top driving factors for Smart Waste Routing AI stem from the rising costs of waste collection and mounting pressure to reduce carbon emissions from fleet operations. Waste management providers face shrinking budgets and growing waste volumes, so achieving cost efficiencies is critical. Using AI to optimize routes can reduce fuel consumption by around 30 to 37% and collection time by nearly 28%, substantially lowering expenses.

The market for Smart Waste Routing AI is driven by the need to enhance waste collection efficiency and reduce operational costs. AI-powered route optimization helps waste management companies and municipalities cut fuel consumption, lower emissions, and minimize vehicle travel time. This technology allows dynamic routing based on real-time data, improving service reliability and sustainability.

For instance, in February 2025, the Building Research Establishment (BRE) launched SmartWaste Scan, an AI upgrade for their waste management platform. It reduces manual data entry time by 24% and improves operational efficiency using image recognition and machine learning.

Demand for smart waste routing AI is rising as cities grow and waste volumes increase. IoT-enabled bins and sensors provide real-time data that help predict waste levels, reduce unnecessary pickups, and improve fleet efficiency. This demand-driven routing supports cost control and helps meet environmental compliance requirements.

Key Takeaway

- In 2024, the Hardware segment held the leading position with a 57.4% share, driven by demand for IoT sensors, smart bins, GPS devices, and on-ground routing hardware.

- The Municipal Waste Management segment dominated with 45.5%, reflecting strong adoption of AI-driven routing systems to optimize collection frequency, reduce fuel usage, and enhance operational efficiency.

- The On-Premises segment led with 64.5%, indicating municipalities’ preference for locally managed systems to maintain data security and uninterrupted operations.

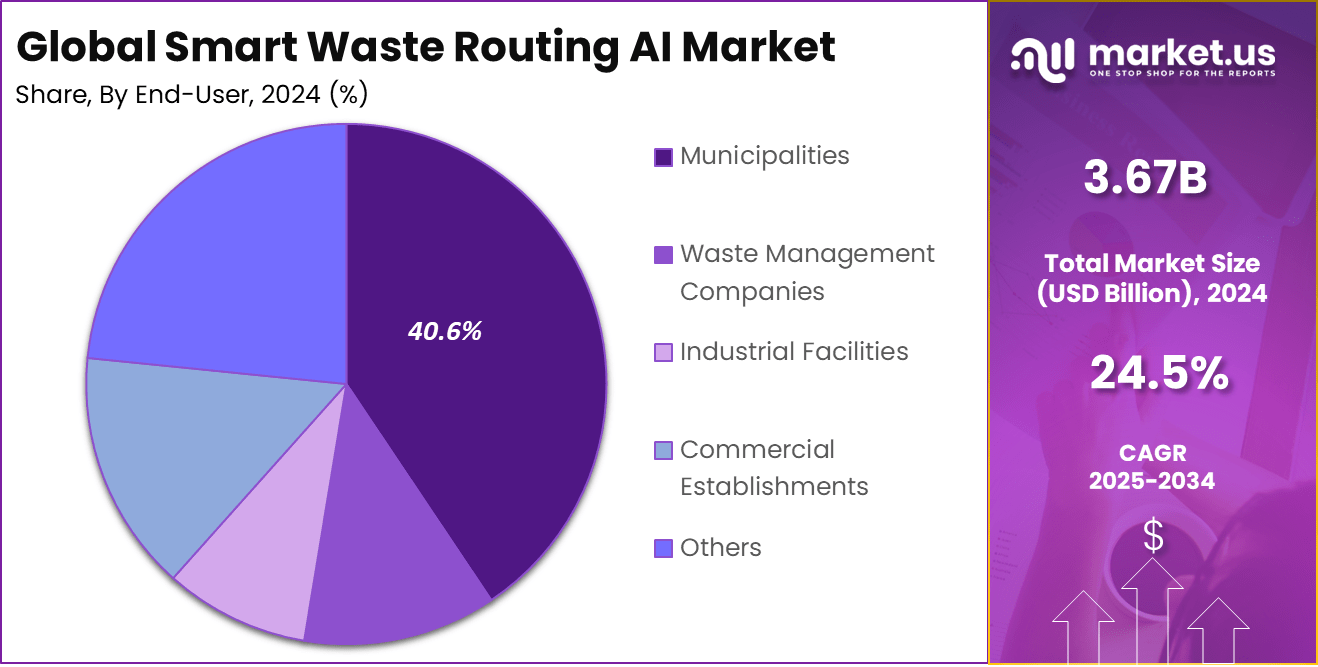

- The Municipalities segment accounted for 40.6%, showing extensive use of AI-based routing platforms across city-level waste management authorities.

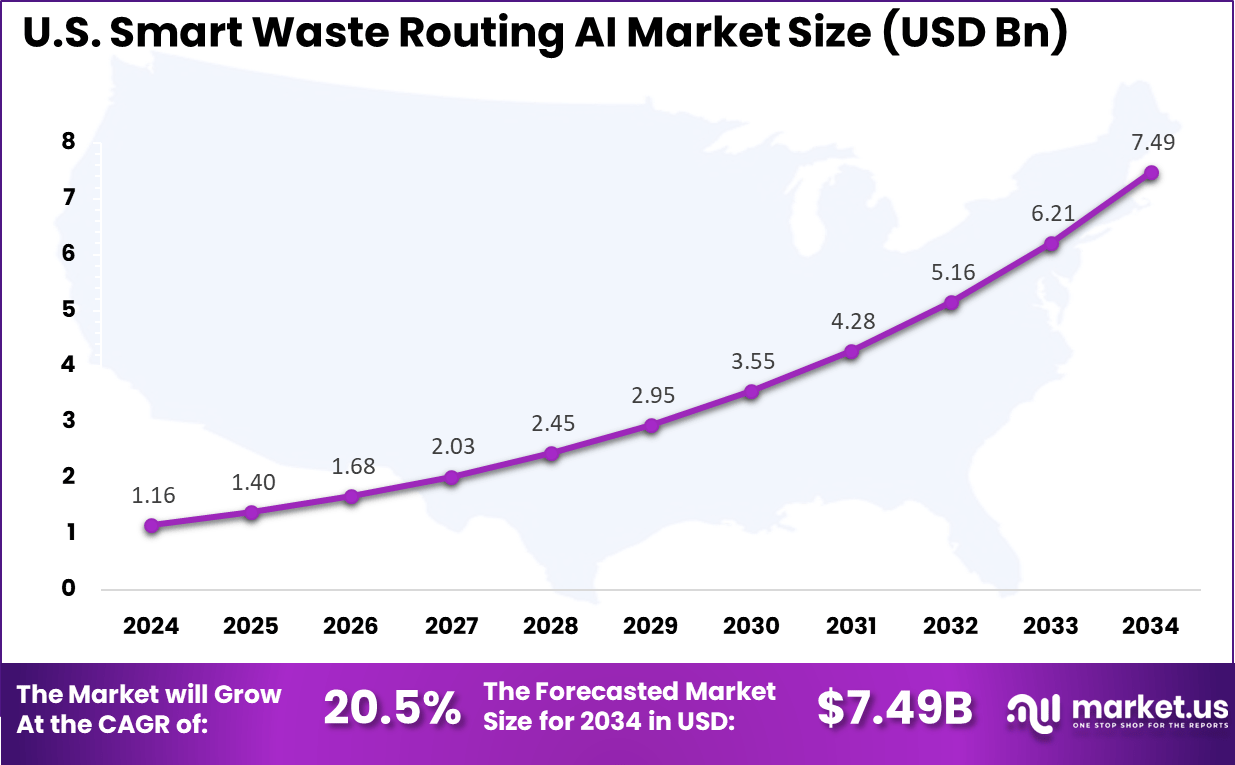

- The US market reached USD 1.16 billion in 2024 and is expanding at a robust CAGR of 20.5%, supported by sustainability goals and investment in smart city infrastructure.

- North America remained dominant with over 37.5% share, backed by advanced digital infrastructure, strong environmental mandates, and early adoption of AI-enabled waste optimization technologies.

Key Statistics

- AI based route optimization can reduce the transportation distance of waste collection vehicles by up to 36.8% through real time data analysis.

- Municipalities and private operators have reported up to 30% savings in waste collection costs, and one case study recorded a 7.4% reduction in total costs compared to traditional routing.

- Fuel consumption decreases by 15.5% to 32% as a result of shorter and more efficient routes, producing a direct reduction in greenhouse gas emissions.

- AI supported scheduling can save up to 28.22% in operational time by reducing the total hours spent on collection routes.

- Smart bins and predictive analytics help achieve an 80% reduction in bin overflow incidents and a 60% drop in public complaints.

- Predictive models identify overflow risks with high accuracy, reaching up to 94.1% in performance.

- Decentralized smart waste systems have achieved 92.5% overall efficiency compared to traditional systems operating at 75.4%.

Role of Generative AI

Generative AI plays an important role in optimizing smart waste routing by creating dynamic, real-time route adjustments based on multiple data inputs. It analyzes historical waste generation patterns, traffic conditions, and sensor data from bins to generate the most fuel-efficient routes.

Studies show that AI-driven route optimization can reduce transportation distances by up to 36.8% and cut operational time by 28.22%, leading to lower fuel consumption and emissions. This makes waste collection more sustainable and cost-effective while improving service efficiency. Additionally, generative AI facilitates predictive waste generation modeling, which helps in proactive planning and deployment of waste collection resources.

By simulating different scenarios and continuously learning from new data, generative AI ensures that waste trucks operate on optimized routes that adapt to changing urban conditions. This approach has delivered improvements such as a 30% increase in collection efficiency in real-world implementations, significantly reducing fuel use and operational costs.

Investment and Business Benefits

Investment opportunities in this area include developing AI-powered route optimization platforms, sensor technologies, and integrated waste management solutions. These investments are driven by the potential for operational cost savings, improved public service efficiency, and the growing regulatory push for sustainable waste handling.

Businesses investing in Smart Waste Routing AI can capitalize on higher operational productivity and better resource management, which translates into long-term economic and environmental benefits. Business benefits of Smart Waste Routing AI are substantial. These include reduced fuel consumption by eliminating unnecessary trips, lowered labor demands through predictive scheduling, and higher recycling rates due to improved waste sorting precision.

Organizations also gain real-time visibility into their operations, enabling quicker responses to service issues while cutting carbon footprints. Property managers and municipalities see enhanced customer satisfaction due to more reliable waste collection services.

U.S. Market Size

The market for Smart Waste Routing AI within the U.S. is growing tremendously and is currently valued at USD 1.16 billion, the market has a projected CAGR of 20.5%. The market is growing due to increasing urbanization and the resultant rise in waste generation.

Municipalities are adopting AI-powered solutions to optimize waste collection routes, reducing fuel consumption and lowering operational costs. This shift towards technology-driven waste management is driven by environmental regulations, sustainability goals, and the need for more efficient public services.

Moreover, advancements in IoT sensors and AI analytics enable real-time monitoring of waste levels, allowing dynamic routing and timely pickups. Strategic partnerships between technology providers and local governments accelerate the deployment of these solutions. Together, these factors create a strong foundation for the market’s rapid expansion, reflected in its substantial value and high growth rate.

For instance, in July 2025, Rubicon Technologies deployed its smart city software to automate solid waste collection for the City and County of Denver, enhancing fleet management and route optimization for over 150 waste and recycling vehicles servicing 418,000 locations weekly. This digitization improves operational efficiency and sustainability in waste services.

In 2024, North America held a dominant market position in the Global Smart Waste Routing AI Market, capturing more than a 37.5% share, holding USD 1.37 billion in revenue. This leadership is driven by advanced technological infrastructure, including widespread adoption of IoT and AI-enabled waste monitoring systems. Strong regulatory frameworks and government initiatives promoting sustainability and smart city projects further support market growth.

The region benefits from high urbanization rates and growing environmental awareness, encouraging municipalities and enterprises to invest in data-driven waste management solutions. Public-private partnerships and advancements in sensor technology accelerate the integration of AI in waste processes, driving efficiency and reducing environmental impact across North American cities and municipalities.

For instance, in August 2025, IBM leveraged AI-powered waste reduction solutions that use machine learning to identify optimal waste collection routes, storage, packaging sizes, and recycling workflows. Their AI systems monitor fill levels, contamination rates, and equipment maintenance needs to minimize fuel consumption, emissions, and operating costs.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 57.4% share of the Global Smart Waste Routing AI Market. This category includes smart sensors, IoT devices, RFID tags, GPS units, and AI chips that gather critical data like waste bin fill levels and location. These components are crucial for enabling accurate real-time monitoring, which fuels AI algorithms to optimize waste collection routes and schedules.

Hardware’s role extends beyond data collection. It also provides the durability and connectivity required in outdoor environments where waste bins and trucks operate. Smart bins equipped with sensors communicate data to central management systems, enabling waste authorities to take proactive decisions. The steady demand for resilient and precise hardware solutions supports the overall growth of the smart waste routing AI market, especially in urban and municipal contexts.

For Instance, in October 2023, Enevo demonstrated the use of wireless IoT sensors installed inside waste containers that use ultrasonic sonar to monitor fill levels continuously. These sensors, compact and maintenance-free, enable dynamic collection scheduling optimized by AI, showing how hardware innovations drive smarter waste collection by reducing unnecessary pickups and cutting costs.

Application Analysis

In 2024, the Municipal Waste Management segment held a dominant market position, capturing a 45.5% share of the Global Smart Waste Routing AI Market. This segment focuses on improving city and town waste collection through AI-powered route optimization. By using real-time data from sensors and GPS devices, municipalities can cut operational costs by avoiding empty or partially filled bin pickups and reducing fuel consumption.

This application directly impacts environmental goals as efficient routing reduces vehicle emissions and traffic congestion. Cities today face increasing waste volumes alongside rising budgets and regulatory pressures. AI-enhanced municipal waste management offers a practical solution by enabling cleaner, smarter, and cost-effective waste collection services, thus benefiting residents and local governments.

For instance, in December 2024, Bigbelly deployed its solar-powered smart compactors equipped with sensors that report fullness levels electronically, reducing waste collection frequency and greenhouse gas emissions. This application of AI with hardware directly assists municipal authorities in managing urban waste efficiently by automating collection alerts and minimizing extra vehicle trips.

Deployment Mode Analysis

In 2024, The On-Premises segment held a dominant market position, capturing a 64.5% share of the Global Smart Waste Routing AI Market. Many public sector users and municipalities prefer on-premises systems for their control over data security and system reliability. With on-premises deployment, AI analytics and routing computations happen locally, reducing dependency on stable internet connections and lowering latency.

This deployment model aligns well with regulatory requirements in many regions where sensitive municipal data cannot be stored in public clouds. Additionally, on-premises systems allow for customization and integration with existing municipal infrastructure. These advantages maintain on-premises solutions as the preferred choice despite growth in cloud-based alternatives.

For Instance, in February 2025, Sensoneo emphasized its data-driven waste management solutions relying on robust software integrated with hardware sensors, designed primarily for secure on-premises deployment to ensure data privacy and operational reliability, especially favored by public sector users.

End-User Analysis

In 2024, The Municipalities segment held a dominant market position, capturing a 40.6% share of the Global Smart Waste Routing AI Market. Public sector agencies are key adopters of AI-enabled waste routing to enhance operational efficiency and environmental compliance. Using AI, municipalities achieve better route planning, lower fleet costs, and improved service outcomes for residents.

This segment benefits from growing urbanization, increased waste generation, and government initiatives targeting smart city development. Municipalities also focus on sustainable waste management practices that reduce environmental impact. Their investments in AI technologies help address these challenges by leveraging data-driven waste collection and monitoring solutions.

For Instance, in May 2024, Suez, in partnership with Taichu Environmental Resource Management, signed agreements to build and operate smart collection and sorting centers, leveraging AI and intelligent systems to support municipal waste management, focusing on sustainability and detailed waste tracking for city authorities.

Emerging Trends

A major trend in smart waste routing is the extensive use of IoT sensors integrated with AI algorithms in smart bins. These sensors provide real-time data on bin fill levels, enabling collection routes to be dynamically adjusted only when bins need servicing. This trend reduces unnecessary collection trips and saves fuel, resulting in both cost and environmental benefits.

Studies indicate that smart systems can lower missed pickups by more than 70% and reduce fuel use by 15.5%, showing clear gains in operations and environmental performance when AI and IoT are integrated. Another key trend is the rising adoption of AI-driven robotics with machine learning for automated waste sorting, which improves recycling efficiency and reduces reliance on landfills.

Predictive analytics are increasingly applied to forecast waste volumes and optimize schedules, making waste operations more responsive and scalable. These advances collectively support the transition to circular economy models where AI systems continuously enhance routing and sorting efficiency.

Growth Factors

One key driver for growth is the increasing demand for operational efficiency and reduced environmental impact in municipal waste management. AI-powered route optimization significantly lowers fuel consumption and carbon emissions, appealing to cities aiming to meet sustainability targets.

Research shows up to a 36% reduction in transportation distances and over 10% reduction in emissions when AI is applied to waste logistics. This efficiency gain results in cost savings and better compliance with environmental regulations, driving adoption. Another growth factor is the rapid urbanization and waste generation worldwide, which challenge traditional waste collection methods.

AI enables data-driven solutions that can handle complex urban dynamics, including traffic fluctuations, seasonal waste variations, and varying bin usage patterns. Adaptive and scalable AI systems capable of integrating live data enable waste management services to keep pace with growing urban demand. This creates a strong market pull for AI-based routing solutions that improve coverage and service quality efficiently.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Application

- Municipal Waste Management

- Industrial Waste Management

- Commercial Waste Management

- Residential Waste Management

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By End-User

- Municipalities

- Waste Management Companies

- Industrial Facilities

- Commercial Establishments

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Efficiency Through AI-Optimized Routing

The market is driven by strong improvements in operational efficiency through AI based route optimization. AI analyzes IoT sensor data and historical waste patterns to select the most efficient collection paths, which reduces fuel use, cuts emissions, and lowers overall operating costs. These gains appeal to municipalities and waste management firms seeking to manage expenses while meeting sustainability goals.

Efficiency also improves service reliability. AI supported routing shortens travel time, avoids unnecessary trips, and helps maintain consistent collection schedules. This is especially valuable in crowded urban areas where traffic delays are common, making waste collection faster and more predictable.

For instance, In February 2023, Rubicon Technologies used AI route optimization to lower mileage and fuel consumption for city fleets. Its real time dashboards and dynamic route assignment tools allowed supervisors to avoid overlaps and streamline daily operations, helping cities such as Houston and Glendale reduce costs and improve time management.

Restraint

High Initial Investment

A significant restraint for Smart Waste Routing AI adoption is the high upfront cost associated with implementing these advanced technologies. Costs include purchasing sensors, AI software licenses, and integrating these systems with existing waste management infrastructure. Smaller municipalities and companies, especially in developing regions, may find these investments prohibitive given their tighter financial constraints.

Additionally, the complexity of AI systems requires specialized skills for setup, operation, and maintenance, adding to the initial burden. This financial and technical barrier slows the pace of adoption since stakeholders may hesitate to commit to relatively new and costly technology without proven short-term returns. Such high initial costs limit widespread deployment, particularly outside large urban and developed markets.

For instance, in December 2024, Sensoneo, a smart waste management company, highlights how the complexity and cost of installing sensors and AI infrastructure can be a barrier for some municipalities and businesses. Although their software improves route efficiency and transparency, the initial hardware and software investment remains significant, potentially limiting adoption in budget-restrained regions.

Opportunities

Expansion into Untapped Regions

The Smart Waste Routing AI market holds a significant opportunity in expanding into untapped geographies and emerging markets. As urbanization continues worldwide, many growing cities face waste management challenges that AI can help address efficiently. These regions often lack optimized routing solutions and could benefit greatly from the cost savings and operational improvements that AI offers.

The integration of AI with IoT devices in such areas creates new market segments where governments and private firms are increasingly investing in smart city technologies. Additionally, the growing regulatory emphasis on environmental sustainability globally creates strong incentives for adopting AI-driven waste management solutions in regions where waste collection and recycling currently have room for improvement.

For instance, in August 2025, Veolia unveiled Australia’s first AI-powered robotic arm for recycling sorting, significantly increasing recycling rates by sorting plastics faster and more accurately. This development opens growth opportunities in automated resource recovery and expanding AI waste management solutions in underserved or labor-shortage markets.

Challenges

Complex Waste Composition and Data Variability

A key challenge in the Smart Waste Routing AI market is the complexity in handling diverse waste compositions and the variability of data across regions. Different types of waste require different treatments and routing priorities. Training AI models to accurately predict and adapt to such diverse and evolving conditions is a complicated task demanding extensive, region-specific data.

Moreover, waste generation patterns vary widely, influenced by socioeconomic factors and local habits, making it difficult for AI solutions to maintain high accuracy and efficiency universally. Ensuring adaptability while maintaining system performance requires continuous updates and sophisticated machine learning models. This complexity poses a substantial barrier for developers and operators to create scalable, reliable AI routing solutions that work well across different environments.

For instance, in November 2022, Rubicon’s AI uses visual and sensor data from trucks for route optimization, but managing diverse waste types and dynamic urban conditions remains a challenge for AI accuracy and adaptability. Training AI models to handle variable waste streams and regional data complexity requires ongoing refinement and data collection, which is a complex process.

Key Players Analysis

Rubicon Technologies, Enevo, Bigbelly, and Compology lead the smart waste routing AI market with advanced sensor networks, real-time fill-level monitoring, and predictive routing engines. Their platforms help cities and waste operators reduce fuel consumption, cut collection frequency, and improve bin-level visibility. These companies focus on optimized route planning, automated alerts, and data-driven waste management.

Sensoneo, Waste Management, Suez, Veolia, IBM, SAP, and Ecube Labs strengthen the competitive landscape with integrated waste analytics, IoT-enabled tracking, and scalable management platforms. Their solutions support municipalities, commercial facilities, and environmental agencies with centralized dashboards and operational insights. These providers enable better workforce planning, lower overflow risks, and improved recycling efficiency.

Urbiotica, SmartBin (OnePlus Systems), Evreka, WAVIoT, IoT Solutions Group, Bin-e, Recy Systems, Pepperl+Fuchs, GreenQ, and others expand the market with flexible, cost-effective smart waste routing tools. Their technologies include ultrasonic sensors, AI-based contamination detection, and cloud-connected routing apps. These companies prioritize easy deployment, energy-efficient hardware, and actionable insights for daily operations.

Top Key Players in the Market

- Rubicon Technologies

- Enevo

- Bigbelly

- Compology

- Sensoneo

- Waste Management, Inc.

- Suez

- Veolia

- IBM Corporation

- SAP SE

- Ecube Labs

- Urbiotica

- SmartBin (OnePlus Systems)

- Evreka

- WAVIoT

- IoT Solutions Group

- Bin-e

- Recy Systems

- Pepperl+Fuchs

- GreenQ

- Others

Recent Developments

- In February 2025, Rubicon Technologies is advancing its tech-enabled waste and recycling services with a focus on sustainable data-driven solutions, emphasizing autonomous routing and integration of new smart waste technologies. They continue to expand in national and local markets with comprehensive fleet management software.

- In June 2025, Veolia implemented an AI-driven robotic arm at its Southwark recycling facility to improve sorting efficiency, increasing processed materials and reducing contamination. It is part of their GreenUP sustainability plan, focusing on digital innovations for waste processing.

Report Scope

Report Features Description Market Value (2024) USD 3.67 Bn Forecast Revenue (2034) USD 32.8 Bn CAGR(2025-2034) 24.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Application (Municipal Waste Management, Industrial Waste Management, Commercial Waste Management, Residential Waste Management, Others), By Deployment Mode (Cloud-Based, On-Premises), By End-User (Municipalities, Waste Management Companies, Industrial Facilities, Commercial Establishments, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rubicon Technologies, Enevo, Bigbelly, Compology, Sensoneo, Waste Management, Inc., Suez, Veolia, IBM Corporation, SAP SE, Ecube Labs, Urbiotica, SmartBin (OnePlus Systems), Evreka, WAVIoT, IoT Solutions Group, Bin-e, Recy Systems, Pepperl+Fuchs, GreenQ, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Waste Routing AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Waste Routing AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rubicon Technologies

- Enevo

- Bigbelly

- Compology

- Sensoneo

- Waste Management, Inc.

- Suez

- Veolia

- IBM Corporation

- SAP SE

- Ecube Labs

- Urbiotica

- SmartBin (OnePlus Systems)

- Evreka

- WAVIoT

- IoT Solutions Group

- Bin-e

- Recy Systems

- Pepperl+Fuchs

- GreenQ

- Others