Global Smart Shopping Cart Market Size, Share, Growth Analysis By Offering (Hardware, [Camera Module, Payment System, Scanner, Touchscreen Display, Weight Sensors], Services, [Consulting Services, Installation & Maintenance Services], Software), By Technology Type (Bar Codes, RFID), By End-User (Grocery Stores, Shopping Malls, Supermarket/Hypermarket, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169499

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

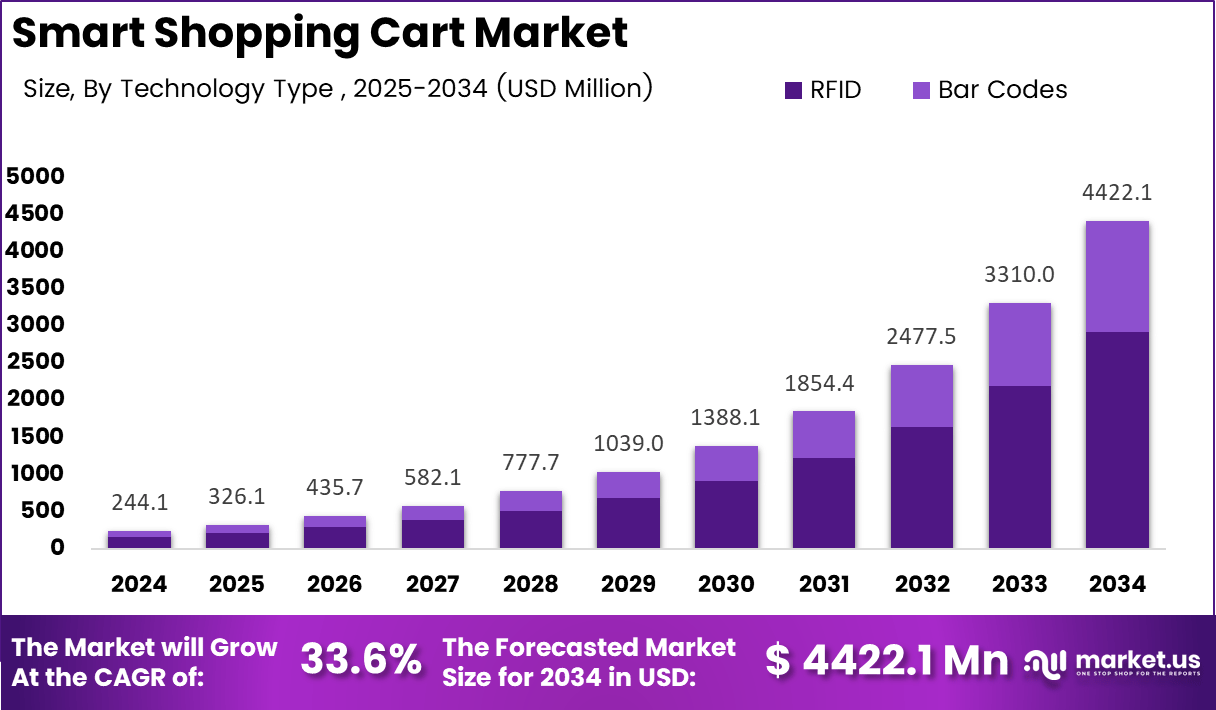

The Global Smart Shopping Cart Market size is expected to be worth around USD 4422.1 million by 2034, from USD 244.1 million in 2024, growing at a CAGR of 33.6% during the forecast period from 2025 to 2034.

The Smart Shopping Cart Market represents a shift toward autonomous retail, where sensor-based carts, RFID modules, touchscreen interfaces, and AI-enabled checkout systems improve shopping efficiency. It enhances customer convenience, reduces checkout friction, and supports retailers seeking real-time inventory monitoring, in-store analytics, and optimized customer journeys. This shift continues accelerating across digital retail ecosystems.

The market advances as retailers adopt embedded vision systems, barcode scanners, and IoT-enabled payment modules that support faster purchasing decisions. These systems integrate cloud processing, edge computing, and guided navigation features. Additionally, rising preference for automated in-store experiences reinforces long-term demand for smart shopping cart solutions across supermarkets, malls, and grocery formats.

Growth accelerates as governments promote digital retail transformation, cashless ecosystems, and AI adoption across supply chains. Public initiatives supporting smart retail infrastructure and data-driven commerce encourage the deployment of intelligent carts. Increasing regulatory attention toward data transparency and consumer safety pushes vendors to design compliant, secure, and privacy-aligned cart technologies used across modern retail networks.

Opportunities expand as retailers explore personalized recommendations, dynamic offers, and frictionless checkout experiences. Smart carts improve store throughput, customer engagement, and basket conversion, supporting operational improvements. Transitioning from manual carts to automated systems also reduces labor burden and improves real-time shelf visibility. These capabilities strengthen the overall value proposition for smart shopping cart adoption globally.

Analyst viewpoint on Smart Shopping Cart reflects a maturing technology ecosystem evolving around customer experience enhancement. Smart carts merge AI recognition, ergonomic design, and autonomous features to minimize purchase delays. They help retailers differentiate in competitive markets and optimize in-store micro-journeys. As retail digitalization accelerates, smart carts emerge as essential enablers of interactive commerce.

In vision AI, RFID tag, and machine-learning-based product identification. Retailers embrace embedded computing that supports SKU detection, smart navigation, and promotional targeting. These improvements reinforce market expansion as platforms integrate seamlessly with enterprise retail management systems and omnichannel environments supporting hybrid shopping behaviors.

According to a study, researchers used a questionnaire and survey method to determine ideal touchscreen placement and reader positioning. They reported customer preference for touchscreen screens located 250 mm from the cart handle while keeping the handle tilted at 45 degrees, supporting ergonomic smart cart design principles used in retail deployment.

A survey of 700 online shoppers found 71% were unaware they had used generative AI while shopping, although most recently interacted with retailers applying this technology. Despite low awareness, nearly half viewed AI as transformative, and 41% were comfortable using AI tools from trusted brands, indicating favorable adoption sentiment across digital retail ecosystems.

According to a data Survey, smart carts equipped with two cameras recognize thousands of SKUs with over 95% accuracy. In regions where its system operates, in-cart personalized promotions boosted conversion rates by up to 36.8%, reinforcing the measurable impact of AI-enabled smart cart technologies on retail performance and shopper engagement.

Key Takeaways

- The Smart Shopping Cart Market reached USD 244.1 Million in 2024 and is projected to reach USD 4422.1 Million by 2034.

- The market is expected to grow at a strong 33.6% CAGR from 2025–2034.

- By Offering, Hardware dominated with a 62.8% share.

- By Technology Type, Bar Codes led the segment with a 66.2% share.

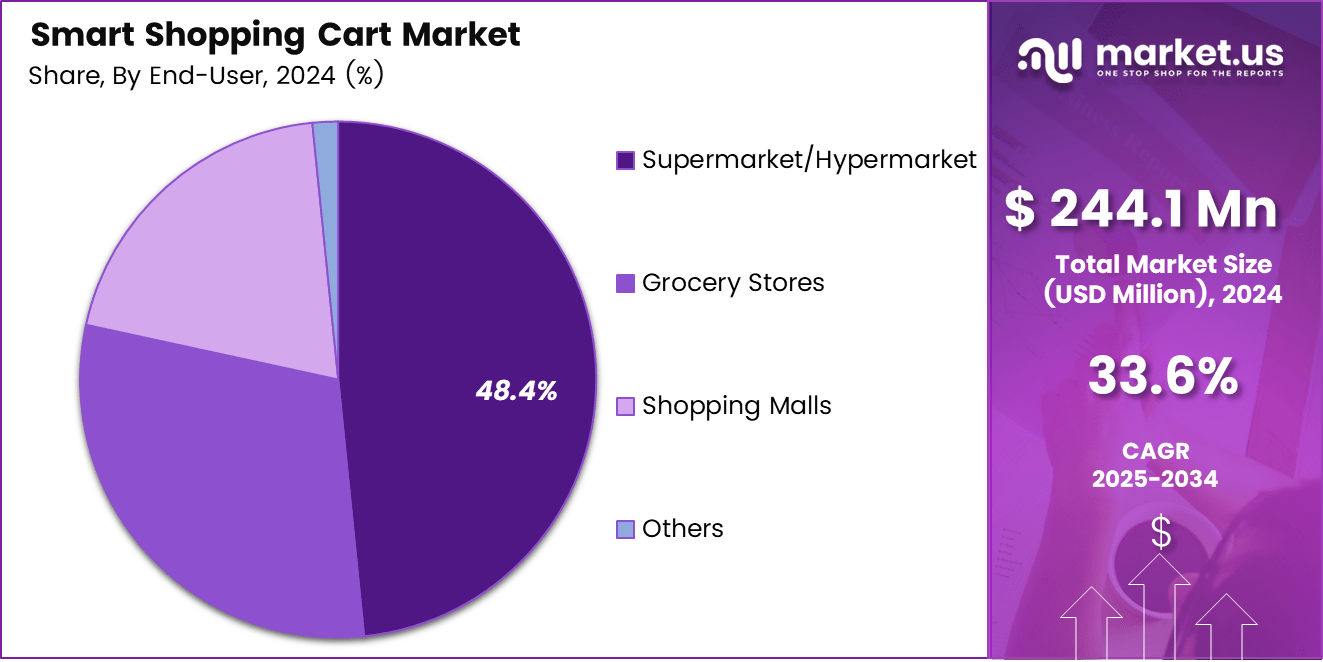

- By End-User, Supermarket/Hypermarket contributed the highest with 48.4%.

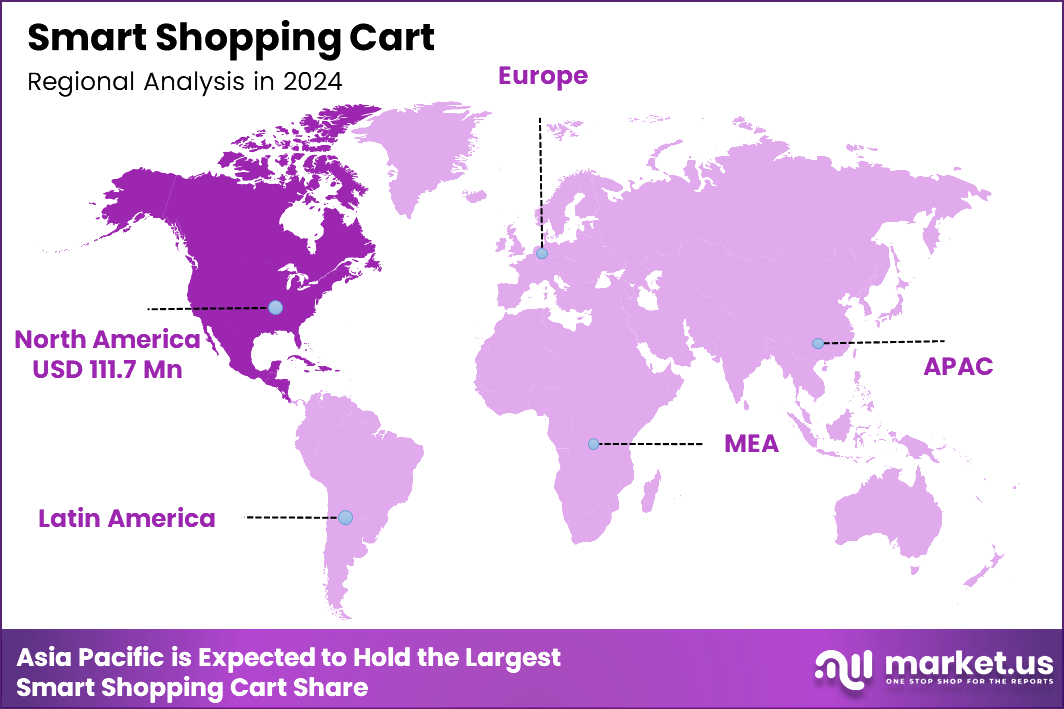

- Regionally, North America dominated with a 45.8% share valued at USD 111.7 Million.

By Offering Analysis

Hardware dominates with 62.8 percent due to strong adoption of advanced cart modules and sensor-based systems.

In 2024, Hardware held a dominant market position in the By Offering Analysis segment of the Smart Shopping Cart Market, with a 62.8% share. Its dominance is driven by touchscreen displays, barcode scanners, weight sensors, and IoT components supporting real-time inventory tracking. Retailers increasingly invest in durable hardware to enhance in-store automation.

Services advanced steadily as retailers adopted consulting, installation, and maintenance support to manage connected systems. This sub-segment enables smoother deployment and reduces operational downtime. Growing digital construction strategies encourage service outsourcing, helping stores maintain accuracy in cart performance. The rise in cloud integration further expands ongoing service engagements across large retail formats.

Software expanded consistently as smart carts integrate AI-based recommendation engines, billing algorithms, and interactive user interfaces. This sub-segment focuses on improving customer interaction and reducing checkout time. Retailers increasingly adopt analytics platforms that monitor cart usage patterns, enhancing efficiency. Software upgrades ensure seamless inventory visibility and enable predictive insights for stocking and aisle planning.

By Technology Type Analysis

Bar Codes dominate with 66.2 percent due to widespread compatibility and low deployment cost.

In 2024, Bar Codes held a dominant market position in the By Technology Type Analysis segment of the Smart Shopping Cart Market, with a 66.2% share. This technology remains popular because it is inexpensive, easy to integrate, and highly accurate. Stores rely on barcode systems to streamline scanning and reduce queue times.

RFID progressed as retailers explored faster item identification and reduced manual scanning. This sub-segment supports hands-free tracking and improves operational accuracy for high-volume stores. Smart carts equipped with RFID readers help detect multiple products instantly. Adoption grows where retailers prioritize automation, although cost considerations delay widespread implementation across mid-scale retail chains.

By End-User Analysis

Supermarket Hypermarket dominates with 48.4 percent due to high basket size and digital transformation spending.

In 2024, Supermarket Hypermarket held a dominant market position in the By End-User Analysis segment of the Smart Shopping Cart Market, with a 48.4% share. These large retail formats adopt smart carts to reduce checkout congestion, improve customer flow, and enhance in-store engagement. Their higher daily footfall strengthens demand for automated shopping experiences.

Grocery Stores expanded gradually as neighborhood formats implemented smart carts to optimize repeat-purchase journeys. These stores emphasize convenience, making automated billing highly valuable. Smart carts help customers locate products faster and reduce waiting time. Retailers integrate lightweight hardware modules to support faster deployment within smaller aisles and limited operating space.

Shopping Malls adopted smart carts primarily in large retail anchors and hypermarket sections. This sub-segment benefits from broader consumer footfall and rising expectations for digital services. Smart carts enhance navigation and product discovery in large retail floors. Their deployment supports premium experiences as malls shift toward technology-enabled retailing trends.

The other category includes specialty stores, home goods outlets, and retail chains adopting smart carts selectively. These formats use smart carts to differentiate customer experience, especially where high-touch engagement is essential. Adoption remains gradual but increasing as retailers test digital tools to expand convenience, optimize store layouts, and support data-driven planning.

Key Market Segments

By Offering

- Hardware

- Camera Module

- Payment System

- Scanner

- Touchscreen Display

- Weight Sensors

- Services

- Consulting Services

- Installation & Maintenance Services

- Software

By Technology Type

- Bar Codes

- RFID

By End-User

- Grocery Stores

- Shopping Malls

- Supermarket/Hypermarket

- Others

Drivers

Rising Transition Toward Lightweight Alloy Parts Enhances Market Growth

Smart Shopping Cart Market growth strengthens as retailers seek lightweight and durable components that improve movement and energy efficiency. Rising demand for better wheel durability mirrors the global push for long-lasting materials, helping stores manage heavier product loads while ensuring smoother in-store navigation. These needs drive continuous improvement in cart engineering.

Adoption of telematics-enabled monitoring encourages smarter lifecycle management. Retailers increasingly rely on sensors to track usage patterns, identify wear, and plan timely servicing. This shift supports better cost control and reduces cart downtime. As stores digitize operations, real-time monitoring becomes essential for maintaining a high-performing smart cart fleet.

Government-driven modernization programs indirectly support smart cart deployment as public investments expand digital retail infrastructure. Initiatives that encourage automation, sustainability, and smarter logistics positively influence in-store innovation. Retailers leverage these environments to integrate AI, RFID, and ergonomic systems into carts, improving operational efficiency and customer experience.

Demand continues rising as smart carts incorporate lightweight alloy parts that improve handling and payload efficiency. These innovations support faster store navigation, reduce strain on hardware components, and extend overall lifecycle value. The transition toward energy-efficient cart designs reinforces long-term adoption across supermarkets and retail chains.

Restraints

Persistent Material Shortages Slow Market Momentum

Smart Shopping Cart Market restraints emerge as forged steel and specialty material shortages disrupt component manufacturing. These constraints delay production schedules and increase procurement complexity. Retailers adopting smart carts face longer lead times, pushing many to reconsider upgrade frequency or explore alternative material combinations.

Standard harmonization progresses slowly across regions, complicating global deployment strategies. Varying safety, design, and digital compliance rules force retailers to adjust technical specifications for different markets. This slows cross-border adoption and creates additional engineering considerations for manufacturers attempting to scale consistently.

Limited digital readiness among smaller retailers restricts the adoption of sensor-driven maintenance tools. Many lack the IT infrastructure required to support real-time monitoring, cloud dashboards, or predictive servicing. This digital gap creates unequal adoption patterns, especially in cost-sensitive regions. As a result, modernization remains slower across fragmented retail networks.

The overall restraint landscape highlights foundational challenges that must be addressed through capacity expansion, regulatory alignment, and retailer education. Strengthening supply chains and increasing digital literacy remain essential for unlocking the full potential of advanced smart cart systems across evolving retail environments.

Growth Factors

Increasing Deployment of Automated Supply Chain Platforms Creates Growth Potential

Smart Shopping Cart Market opportunities expand as automated supply chain orchestration systems gain adoption. Retailers integrate procurement dashboards that streamline ordering for cart components, accessories, and digital modules. Automated workflows reduce operational friction and improve inventory visibility, enabling faster upgrades and replacements across large store networks.

Sustainability commitments drive refurbishment and remanufacturing services. Retailers increasingly prefer upgrading existing carts with new sensors, screens, and alloy components instead of purchasing entirely new units. This trend extends lifecycle value while minimizing environmental impact. It also opens new service-based revenue opportunities for maintenance providers.

Growth accelerates as smart cart ecosystems shift from hardware-only models to hybrid platforms combining software, AI analytics, and ergonomic design. As retailers modernize store operations, demand strengthens for carts capable of supporting navigation guidance, self-checkout, and personalized promotions. These advancements reinforce long-term market scalability.

The opportunity landscape signals strong potential for ecosystem expansion, driven by smarter supply chains and sustainability initiatives. The alignment of cost-efficiency and environmental responsibility further enhances adoption prospects across global retail environments.

Emerging Trends

Shift Toward Eco-Certified Materials Shapes Market Trends

Smart Shopping Cart Market trends emphasize the adoption of eco-certified materials that reduce environmental impact. Retailers increasingly request recyclable alloys, low-emission plastics, and greener manufacturing processes. This shift aligns with global sustainability goals and strengthens consumer perception of environmentally responsible retail operations.

Sensor-embedded systems emerge as a critical trend, enabling real-time stress, usage, and performance analytics. Draft gear and coupler-style components integrated with sensors improve maintenance accuracy and support optimized servicing cycles. These upgrades help retailers reduce downtime and maintain cart quality over longer operational periods.

Digital twin technology gains momentum as retailers simulate cart performance and validate design improvements before production. These virtual environments support predictive maintenance planning, ergonomic testing, and operational modeling. Digital twins reduce trial-and-error risks and accelerate smarter cart development cycles.

Overall, trending factors showcase a strong push toward material sustainability, smart sensing, and simulation-driven optimization. These advancements reinforce the industry’s transition toward intelligent, energy-efficient, and long-lasting smart shopping cart solutions.

Regional Analysis

North America Dominates the Smart Shopping Cart Market with a Market Share of 45.8%, Valued at USD 111.7 Million

North America accounted for the leading position in the Smart Shopping Cart Market with a strong 45.8% share, supported by advanced retail digitalization and widespread adoption of AI-enabled in-store automation. The region’s valuation of USD 111.7 million reflects growing demand for frictionless checkout, RFID-enabled cart systems, and enhanced customer experience tools across supermarkets. Retailers continue to integrate IoT networks and data analytics, strengthening the use of connected carts across the US and Canada.

Europe Smart Shopping Cart Market Trends

Europe observes steady expansion driven by smart retail transformation initiatives, increasing adoption of cashierless formats, and rising labor optimization needs across hypermarkets. The region benefits from strong regulatory support for digital commerce innovation and sustainability-focused retail technologies. Growing usage of real-time inventory carts in Germany, France, and the UK further strengthens market traction.

Asia Pacific Smart Shopping Cart Market Trends

Asia Pacific emerges as a rapidly evolving market fueled by high supermarket footfall, strong penetration of mobile payments, and rising adoption of AI-powered retail automation. Countries including China, Japan, and South Korea focus heavily on autonomous shopping ecosystems, creating favorable conditions for smart cart deployment. Urban digital retail infrastructure expansion continues to accelerate adoption.

Middle East and Africa Smart Shopping Cart Market Trends

The Middle East and Africa experience gradual growth in smart retail technologies, supported by rising investments in premium shopping environments and digital transformation programs across the Gulf countries. Smart carts gain traction in modern retail chains, emphasizing seamless checkout and customer analytics. Increasing mall-based retail development further strengthens long-term adoption potential.

Latin America Smart Shopping Cart Market Trends

Latin America shows improving market momentum as supermarkets adopt digital tools to enhance operational efficiency and reduce long checkout lines. Brazil, Mexico, and Chile are key adopters driven by growing consumer demand for streamlined shopping experiences. Expanding retail modernization initiatives and IoT integration continue to support regional growth.

United States Smart Shopping Cart Market Trends

The United States remains a core growth hub due to strong technology innovation, rapid expansion of contactless retail solutions, and rising consumer preference for automated in-store navigation. High deployment of AI-supported shopping carts across national supermarket chains enhances operational accuracy and shopper convenience. Continuous investments in digital retail ecosystems sustain steady market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Smart Shopping Cart Company Insights

The global Smart Shopping Cart Market in 2024 continues advancing as retailers prioritize automation, AI-enabled in-store navigation, and frictionless checkout systems. Companies are focusing on embedded vision, sensor intelligence, and ergonomic cart design to improve customer experience and operational efficiency. The first four players demonstrate strong strategic momentum through innovation-driven approaches.

Caper Inc. strengthens its position through advanced computer-vision carts that reduce checkout friction and enhance product recognition accuracy. The company focuses on building intuitive cart-based ecosystems that support faster shopping experiences, enabling retailers to adopt digital-first store formats that meet evolving customer expectations for convenience.

Cust2mate Ltd. accelerates the adoption of autonomous retail technologies by developing carts equipped with real-time scanning, payment modules, and guided interfaces. Its solutions help retailers streamline store workflows, reduce waiting time, and capture richer customer behavior insights, supporting operational improvements across high-traffic retail environments.

Focal Systems Inc. expands influence through AI-powered automation that transforms retail inventory management and shelf monitoring. By integrating smart cart compatibility with its vision platform, the company enables more accurate SKU tracking and enhances data-driven store decision-making, strengthening digital transformation for large retail chains.

HiCart Corporation focuses on intelligent cart systems designed for seamless product identification and user-friendly navigation. The company emphasizes modular hardware upgrades and adaptive software layers that improve cart performance and personalization features. This helps retailers enhance shopping speed, product visibility, and in-store engagement.

These companies collectively drive innovation in AI commerce, real-time recognition, and autonomous shopping technologies, reinforcing the Smart Shopping Cart Market’s growth trajectory as retailers transition toward connected and frictionless store ecosystems.

Top Key Players in the Market

- Caper Inc.

- Cust2mate Ltd.

- Focal Systems Inc.

- HiCart Corporation

- International Business Machines Corporation

- MetroClick, Inc.

- Microsoft Corporation

- Mitsui & Co., Ltd.

- Pentland Firth Software GmbH

- Retail AI, Inc.

Recent Development

- In Nov 2025, the company announced the launch of Caper Carts at Coles Supermarkets in Australia and at a Morrisons store in the U.K.. During 2025, ShopRite and Schnucks also expanded smart cart deployments across additional store locations, accelerating checkout automation.

- In Apr 2025, organizers announced EuroShop 2026, highlighting how technology innovations are reshaping retail from back office operations to customer checkout experiences. The EuroCIS Retail Technology dimension will take place from Feb 22–26, 2026, offering industry expertise and solutions across the retail technology ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 244.1 Million Forecast Revenue (2034) USD 4422.1 Million CAGR (2025-2034) 33.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, [Camera Module, Payment System, Scanner, Touchscreen Display, Weight Sensors], Services, [Consulting Services, Installation & Maintenance Services], Software), By Technology Type (Bar Codes, RFID), By End-User (Grocery Stores, Shopping Malls, Supermarket/Hypermarket, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caper Inc., Cust2mate Ltd., Focal Systems Inc., HiCart Corporation, International Business Machines Corporation, MetroClick, Inc., Microsoft Corporation, Mitsui & Co., Ltd., Pentland Firth Software GmbH, Retail AI, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Caper Inc.

- Cust2mate Ltd.

- Focal Systems Inc.

- HiCart Corporation

- International Business Machines Corporation

- MetroClick, Inc.

- Microsoft Corporation

- Mitsui & Co., Ltd.

- Pentland Firth Software GmbH

- Retail AI, Inc.