Global Smart Pulse Oximeters Market By Product Type (Finger Pulse Oximeter, Wrist Pulse Oximeter, Paediatric Pulse Oximeter and Handheld Pulse Oximeter), By End User (Hospital, Home Care Setting, Ambulatory surgical centres and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177339

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

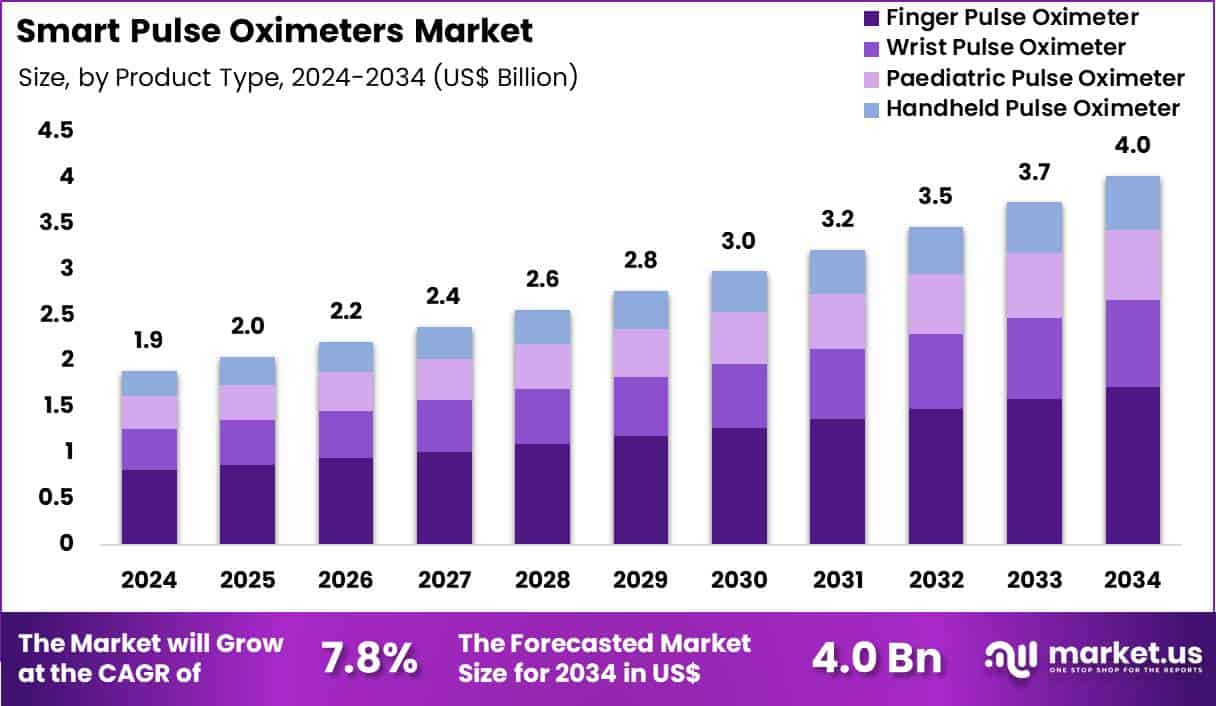

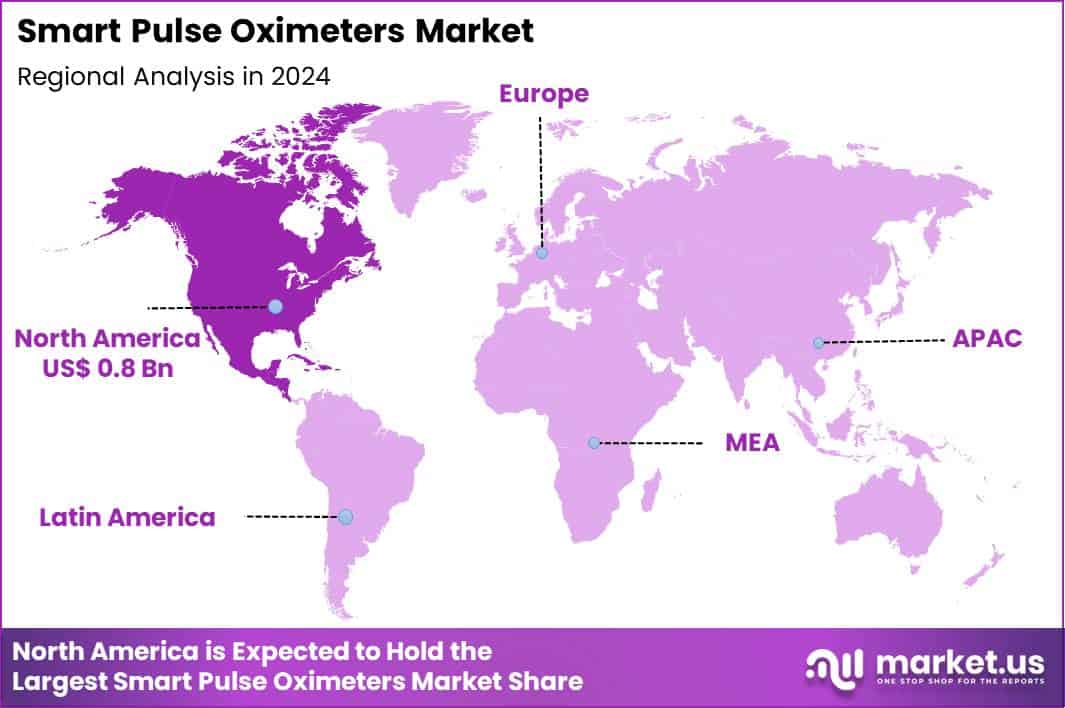

Global Smart Pulse Oximeters Market size is expected to be worth around US$ 4.0 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.6% share with a revenue of US$ 0.8 Billion.

Increasing prevalence of chronic respiratory and cardiovascular conditions drives the smart pulse oximeters market as healthcare providers and consumers seek continuous, non-invasive monitoring tools that deliver real-time oxygen saturation and heart rate data.

Clinicians increasingly utilize these devices in hospital settings to track postoperative recovery, where integrated alerts notify staff of desaturation events in patients undergoing general anesthesia or sedation. Home-based applications include monitoring sleep apnea sufferers, enabling users to record nocturnal oxygen levels and share trends with physicians for tailored continuous positive airway pressure adjustments.

Athletes and fitness enthusiasts apply smart oximeters during high-altitude training or endurance exercises, optimizing performance by detecting early signs of hypoxia. These tools support telemedicine consultations for chronic obstructive pulmonary disease management, allowing remote assessment of oxygenation status to prevent exacerbations.

Pediatric care benefits from wearable models that monitor infants with congenital heart defects, providing parents and caregivers with immediate notifications for irregular readings. Manufacturers pursue opportunities to embed artificial intelligence algorithms that predict respiratory distress, expanding applications in elderly care where devices integrate with fall detection systems for comprehensive health oversight.

Developers advance Bluetooth-enabled oximeters with extended battery life, broadening utility in remote patient monitoring programs for heart failure patients requiring daily oxygen trend analysis. These innovations facilitate hybrid models combining oximetry with electrocardiogram capabilities, supporting arrhythmia detection in outpatient cardiology follow-ups.

Opportunities emerge in consumer wellness apps that sync oximeter data for personalized breathing exercises, appealing to users managing anxiety-related hyperventilation. Companies invest in durable, waterproof designs suitable for aquatic therapy sessions in rehabilitation.

Recent trends emphasize seamless integration with electronic health records and voice-activated assistants, positioning smart pulse oximeters as essential components in proactive, data-driven healthcare ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.9 Billion, with a CAGR of 7.8%, and is expected to reach US$ 4.0 billion by the year 2034.

- The product type segment is divided into finger pulse oximeter, wrist pulse oximeter, paediatric pulse oximeter and handheld pulse oximeter, with finger pulse oximeter taking the lead with a market share of 42.7%.

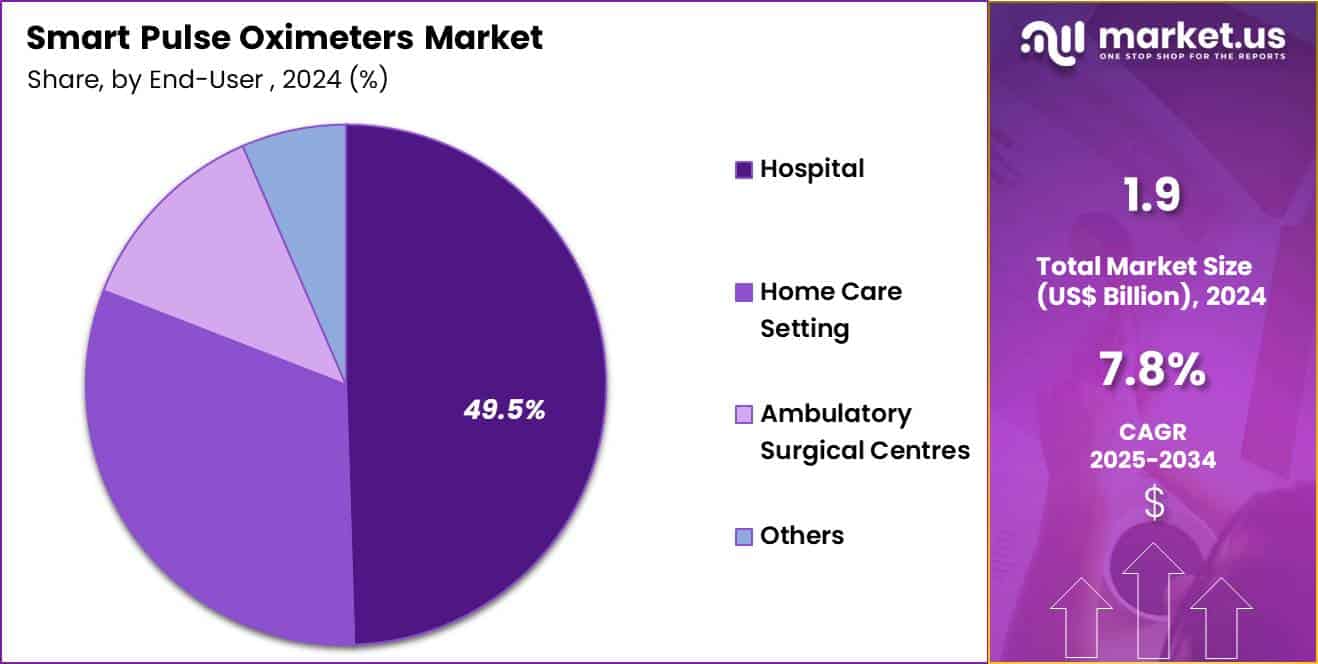

- Considering end user, the market is divided into hospital, home care setting, ambulatory surgical centres and others. Among these, hospital held a significant share of 49.5%.

- North America led the market by securing a market share of 40.6%.

Product Type Analysis

Finger pulse oximeters contributed 42.7% of growth within product type and led the smart pulse oximeters market due to their compact design, ease of use, and suitability for rapid spot-check monitoring. Clinicians and caregivers prefer finger-based devices because they provide quick readings without complex setup, which supports routine vital sign assessment.

Hospitals deploy these devices extensively across emergency rooms, wards, and outpatient departments to enable fast triage and continuous patient flow. High affordability compared to advanced monitoring systems further strengthens adoption across resource-diverse settings.

Growth strengthens as smart features such as Bluetooth connectivity, mobile app integration, and data storage enhance clinical value. Finger pulse oximeters support remote patient monitoring programs by enabling easy data sharing.

Rising prevalence of respiratory and cardiovascular conditions increases routine oxygen saturation checks. Infection control protocols also favor non-invasive and portable devices. The segment is expected to remain dominant as demand continues for reliable, easy-to-deploy oxygen monitoring solutions.

End-User Analysis

Hospitals accounted for 49.5% of growth within end-user and dominated the smart pulse oximeters market due to high patient volumes and continuous monitoring requirements. Emergency care, critical care, and postoperative recovery units rely heavily on pulse oximetry to track oxygen saturation in real time.

Hospitals prioritize smart oximeters to improve workflow efficiency and integrate patient data into electronic health records. Centralized procurement and standardized monitoring protocols reinforce consistent device usage.

Growth continues as hospitals expand digital health infrastructure and adopt connected monitoring systems. Rising admissions for respiratory illnesses increase dependence on accurate oxygen monitoring. Training familiarity and clinical guidelines reinforce routine use across departments.

Hospitals also act as early adopters for smart monitoring technologies. The segment is anticipated to remain the primary growth driver as hospitals continue to anchor acute and continuous patient monitoring practices.

Key Market Segments

By Product Type

- Finger Pulse Oximeter

- Wrist Pulse Oximeter

- Paediatric Pulse Oximeter

- Handheld Pulse Oximeter

By End User

- Hospital

- Home Care Setting

- Ambulatory surgical centres

- Others

Drivers

Increasing prevalence of chronic respiratory diseases is driving the market.

The rising incidence of chronic respiratory diseases globally has heightened the demand for smart pulse oximeters, which provide continuous monitoring of oxygen saturation levels in affected patients. Improved diagnostic capabilities and population aging contribute to more cases requiring home-based oxygen tracking tools.

Healthcare systems are increasingly integrating these devices to manage conditions like chronic obstructive pulmonary disease effectively. According to the Centers for Disease Control and Prevention, the age-adjusted prevalence of diagnosed chronic obstructive pulmonary disease among adults aged 18 and older was 3.8% in 2023.

This statistic illustrates the substantial patient base driving the adoption of advanced monitoring technologies. Smart pulse oximeters offer wireless connectivity and data analytics, supporting proactive disease management in clinical and home settings. The correlation between respiratory disorders and hospitalization risks further emphasizes the need for reliable oximetry solutions.

Government organizations advocate for early detection strategies to reduce healthcare burdens associated with these diseases. Key manufacturers are enhancing product features to align with this expanding clinical requirement. This driver continues to foster investments in respiratory care infrastructure worldwide.

Restraints

Accuracy concerns in diverse populations is restraining the market.

The ongoing issues with pulse oximeter accuracy across varying skin pigmentation levels have limited confidence in smart devices for equitable monitoring. Regulatory scrutiny highlights the risks of overestimation in oxygen saturation readings for individuals with darker skin tones. Healthcare providers must consider these limitations when relying on oximetry data for critical decisions.

The U.S. Food and Drug Administration convened a virtual public meeting of the Anesthesiology and Respiratory Therapy Devices Panel on February 2, 2024, to discuss performance evaluation of pulse oximeters considering skin pigmentation. This meeting underscores persistent concerns affecting market adoption in diverse patient groups.

Manufacturers face challenges in validating device performance for all demographics during premarket assessments. Government agencies recommend additional clinical testing to address these disparities in accuracy. Providers may prefer alternative monitoring methods in cases where reliability is questionable. This restraint impacts widespread implementation in multicultural healthcare environments. Industry efforts to refine sensor technologies aim to mitigate these accuracy issues over time.

Opportunities

Expansion in hospital procurement channels is creating growth opportunities.

The growth in procurement through group purchasing organizations presents avenues for smart pulse oximeters to penetrate large hospital networks efficiently. Enhanced contracting mechanisms facilitate bulk purchases of advanced monitoring equipment for critical care units. Healthcare facilities benefit from cost-effective access to connected oximeters for improved patient outcomes.

In 2024 and 2023, Masimo Corporation’s healthcare revenues from the sale of pulse oximetry products to hospitals associated with group purchasing organizations amounted to $794.0 million and $678.1 million, respectively. This revenue increase demonstrates the expanding role of organized purchasing in device distribution.

Partnerships with group purchasing organizations enable manufacturers to meet standardized requirements for hospital adoption. The large volume of procedures in institutional settings amplifies demand for reliable oximetry solutions.

Policy reforms in healthcare reimbursement support infrastructure upgrades in networked facilities. Primary corporations are leveraging these channels to diversify beyond retail markets. Overall, procurement expansions align with efforts to enhance monitoring standards in high-acuity environments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the smart pulse oximeters market through consumer spending power, hospital budgets, and digital health investment priorities. Inflation and higher interest rates raise component, logistics, and financing costs, which slows device refresh cycles for clinics and price sensitive consumers.

Geopolitical tensions disrupt supplies of sensors, chips, displays, and batteries, creating lead time uncertainty and inventory risk. Current US tariffs on imported electronics and finished devices increase landed costs for brands and distributors, which narrows margins and pressures retail pricing. These challenges weigh more heavily on smaller manufacturers and limit adoption in cost conscious channels.

On the positive side, trade pressure encourages local assembly, supplier diversification, and tighter quality control. Growing demand for remote monitoring, home care, and connected wellness keeps utilization and awareness high. With focused cost management, software differentiation, and channel expansion, the market remains positioned for steady and confident growth.

Latest Trends

Launch of over-the-counter smart pulse oximeters is a recent trend in the market.

In 2024, the introduction of consumer-accessible smart pulse oximeters has broadened home monitoring options for respiratory health management. These devices feature enhanced accuracy algorithms to address traditional limitations in fingertip readings. Manufacturers prioritize FDA clearance to ensure reliability for non-medical use.

Clinical validations focus on performance across diverse user profiles, including varying activity levels. Nonin Medical secured FDA clearance in December 2024 for its TruO2 OTC wireless fingertip pulse oximeter, designed to deliver accurate readings for patients of all skin colors. This launch facilitates over-the-counter availability for personal health tracking.

Enterprises emphasize Bluetooth connectivity for seamless data integration with mobile applications. The trend caters to growing consumer interest in proactive wellness monitoring. Regulatory pathways have adapted to support direct-to-consumer models in oximetry. Sector synergies refine features for user-friendly interfaces in everyday settings. These innovations aim to empower individuals in managing chronic conditions independently.

Regional Analysis

North America is leading the Smart Pulse Oximeters Market

North America captured a 40.6% share of the Smart Pulse Oximeters market in 2024, reflecting rapid adoption of connected oxygen monitoring across clinical and home settings. Health systems expanded remote patient monitoring programs to manage respiratory and cardiac conditions more efficiently outside hospitals.

Providers favored app-enabled oximetry devices that sync with telehealth platforms and electronic records for real-time clinical oversight. Clearer reimbursement pathways for home monitoring strengthened physician confidence and patient compliance.

An aging population and a high prevalence of chronic respiratory disorders sustained demand throughout the year. Retail availability and clinician recommendations normalized routine use beyond acute care. A strong supporting indicator comes from the Centers for Disease Control and Prevention, which reported in 2023 that 6 in 10 US adults live with at least one chronic disease, reinforcing the need for continuous oxygen monitoring technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Smart Pulse Oximeters market in Asia Pacific is expected to grow steadily during the forecast period as healthcare systems scale digital and home-based care models. Governments encourage early detection and continuous monitoring to ease pressure on overcrowded hospitals. Rising smartphone penetration supports wider use of app-linked health devices among consumers and caregivers.

Local manufacturers introduce cost-effective connected models, accelerating adoption across emerging economies. Hospitals integrate connected oximetry into post-discharge and chronic care pathways to improve outcomes. Telemedicine expansion strengthens demand for real-time vital sign tracking outside clinical facilities.

A verifiable signal of this momentum appears in India’s official data showing more than 500 million Ayushman Bharat Health Account IDs created by 2023 under the Ministry of Health and Family Welfare, highlighting the digital health foundation supporting connected patient monitoring growth across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the smart pulse oximeters market grow by enhancing sensor accuracy, adding Bluetooth connectivity, and integrating advanced health metrics such as respiratory rate and perfusion index that support more comprehensive remote monitoring. They also broaden their reach through partnerships with telehealth platforms, wearable tech brands, and consumer electronics retailers to tap both clinical and at-home care demand.

Firms differentiate offerings by streamlining mobile app interfaces, enabling real-time alerts, and supporting data sharing with healthcare providers to deepen user engagement and boost recurring usage. Strategic expansion into Europe, North America, and fast-growing Asia Pacific complements core market presence and captures rising adoption driven by chronic respiratory conditions and preventive health trends.

Masimo Corporation exemplifies a leading global technology company with expertise in innovative monitoring solutions, a strong portfolio of noninvasive sensors and devices, and a coordinated commercialization strategy that aligns product advancements with clinician and consumer needs.

The company strengthens its market position through disciplined R&D investment, targeted collaborations, and sustained customer support that translate innovation into differentiated performance.

Top Key Players

- Masimo

- Philips Healthcare

- Medtronic

- Nonin Medical

- Omron Healthcare

- Contec Medical Systems

- ChoiceMMed

- Wellue

- iHealth Labs

- Zacurate

Recent Developments

- In July 2025, Medtronic formed a strategic partnership with Philips to incorporate Nellcor pulse oximetry into Philips’ monitoring platforms. The integration is designed to support smoother information flow and more consistent oxygen saturation data throughout peri-operative care settings.

- In May 2025, Zynex submitted a 510(k) premarket notification for its NiCO laser-based pulse oximeter. The filing focuses on improving oxygen measurement reliability, particularly for patients with darker skin pigmentation, addressing long-standing accuracy challenges in pulse oximetry.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 4.0 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Finger Pulse Oximeter, Wrist Pulse Oximeter, Paediatric Pulse Oximeter and Handheld Pulse Oximeter), By End User (Hospital, Home Care Setting, Ambulatory surgical centres and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Masimo, Philips Healthcare, Medtronic, Nonin Medical, Omron Healthcare, Contec Medical Systems, ChoiceMMed, Wellue, iHealth Labs, Zacurate Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Pulse Oximeters MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Smart Pulse Oximeters MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Masimo

- Philips Healthcare

- Medtronic

- Nonin Medical

- Omron Healthcare

- Contec Medical Systems

- ChoiceMMed

- Wellue

- iHealth Labs

- Zacurate