Global Smart Packaging Market By Type(Active Packaging, Intelligent packaging, Modified Atmosphere Packaging), By End-User(Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Electronics, E-commerce, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 99081

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Smart Packaging Market size is expected to be worth around USD 54.8 Million by 2033, from USD 29.2 Million in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033. North America dominated a 43.6% market share in 2023 and held USD 12.73 Million in revenue from the Smart Packaging Market.

Smart packaging refers to packaging systems that incorporate advanced technologies to provide functions beyond conventional containment and protection. It encompasses active packaging, which interacts chemically or biologically with its contents, and intelligent packaging, which incorporates features such as sensors, indicators, or RFID tags to track environmental conditions or improve product safety, quality, and information.

The Smart Packaging market is driven by the escalating demand for durable and advanced packaging technology in sectors like food, healthcare, and consumer electronics. These technologies enhance product lifespan, maintain quality, and ensure the safety of perishable goods. The increasing consumer awareness regarding health and the environmental impacts of packaging solutions are spurring innovations in this market.

The growth of the Smart Packaging market can be attributed to the rising demand for perishable food products and pharmaceuticals requiring stringent safety and quality measures. Additionally, the trend toward sustainable packaging solutions that reduce waste and environmental impact continues to propel the market forward.

Demand for Smart Packaging is fueled by consumer preference for fresh and authentic products, regulatory requirements for product safety, and industries’ needs for logistics efficiency and brand differentiation. This demand is robust in sectors requiring high barrier protection against moisture, oxygen, and microbial contamination.

Opportunities in the Smart Packaging market include developing more cost-effective and environmentally friendly materials and integrating IoT technologies to enhance connectivity across the supply chain. This integration promises real-time data tracking and management, opening new avenues for market growth and consumer engagement.

The Smart Packaging market is positioned at the intersection of technological innovation and sustainability, driven by escalating demands for food safety, pharmaceutical integrity, and consumer product authenticity. This sector is experiencing significant investment and regulatory attention, particularly in initiatives aimed at enhancing packaging sustainability and functionality.

For instance, the Indian government, with £250,000 backing from the UK’s Smart Sustainable Plastic Packaging Challenge, has launched the India Plastics Pact. This initiative underscores a global movement toward developing sustainable packaging solutions, bolstered by governmental and international collaboration.

Similarly, the UK government’s investment of £60 million in sustainable packaging projects, focusing on smart labels and eco-friendly materials, reflects a robust commitment to advancing the market. These investments not only highlight the industry’s potential for growth but also align with broader environmental objectives, offering substantial opportunities for innovation and market expansion.

Key Takeaways

- The Global Smart Packaging Market size is expected to be worth around USD 54.8 Million by 2033, from USD 29.2 Million in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

- In 2023, Active Packaging held a dominant market position in the By Type segment of the Smart Packaging Market, with a 71.2% share.

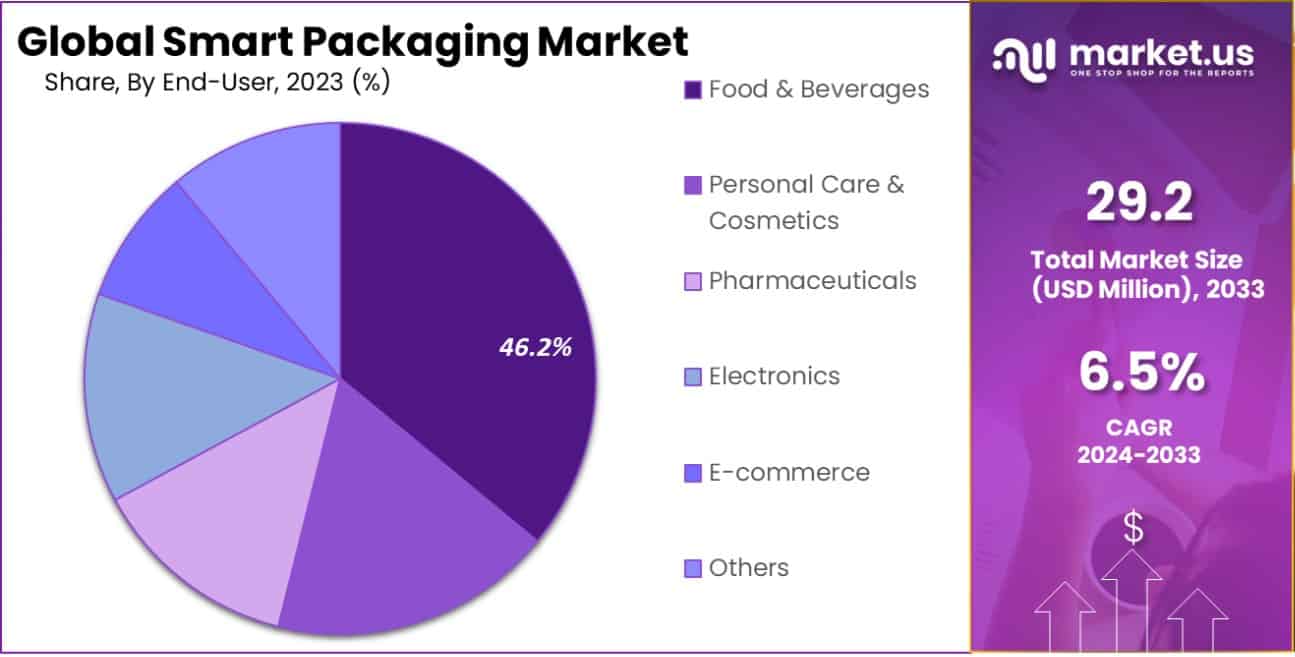

- In 2023, Food & Beverages held a dominant market position in the end-user segment of the Smart Packaging Market, with a 46.2% share.

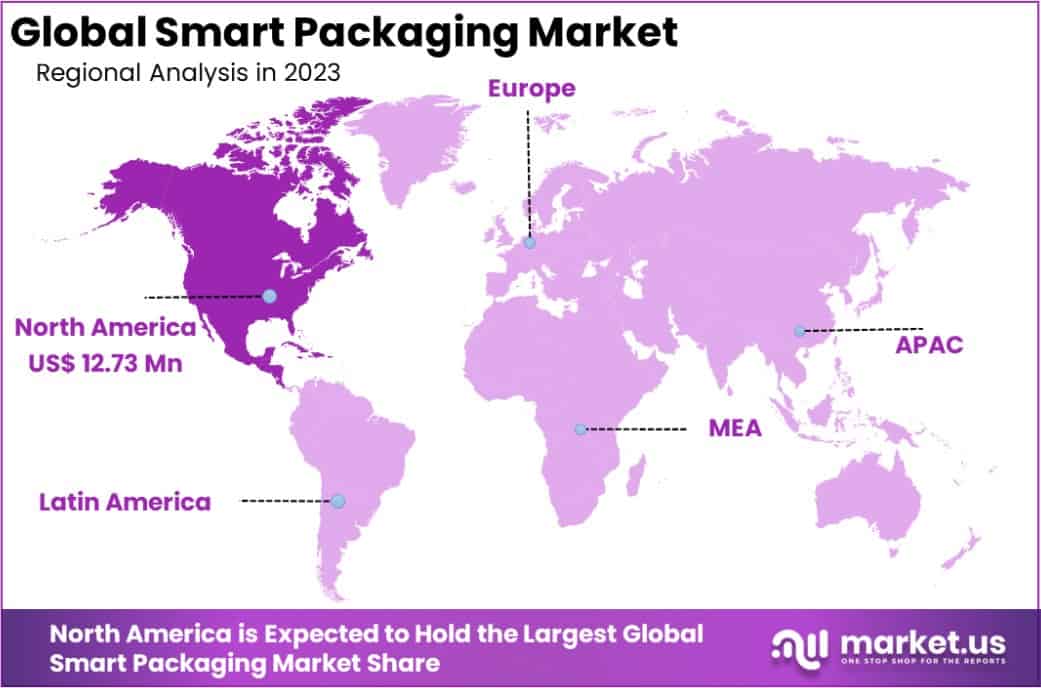

- North America dominated a 43.6% market share in 2023 and held USD 12.73 Million in revenue from the Smart Packaging Market.

By Type Analysis

In 2023, Active Packaging held a dominant market position in the “By Type” segment of the Smart Packaging Market, commanding a 71.2% share. This segment significantly outperformed others due to its crucial role in extending product shelf life and maintaining quality, especially in the food and pharmaceutical sectors.

Intelligent Packaging and Modified Atmosphere Packaging also contributed to the market dynamics, holding smaller but impactful shares. Intelligent Packaging, which integrates technologies like sensors and RFID tags, accounted for a notable segment, driven by the growing demand for traceability and consumer engagement through packaging.

On the other hand, Modified Atmosphere Packaging, which alters the atmosphere inside packages to extend freshness without the use of preservatives, is increasingly preferred in the food sector for its ability to maintain texture and nutritional quality.

The prominence of Active Packaging can be attributed to its direct impact on reducing spoilage and enhancing logistical efficiency, making it a preferred choice for industries looking to meet stringent safety standards while minimizing environmental impact through reduced waste.

As market trends toward sustainability and efficiency continue to evolve, these segments are expected to witness varying degrees of growth and innovation, reflecting changing consumer preferences and regulatory landscapes.

By End-User Analysis

In 2023, Food & Beverages held a dominant market position in the “By End-User” segment of the Smart Packaging Market, with a 46.2% share. This sector’s prominence is largely due to the critical need for packaging solutions that ensure food safety, extend shelf life, and provide convenient, tamper-evident features, which are highly valued in the food industry.

Other segments, such as Personal Care & Cosmetics, Pharmaceuticals, Electronics, E-commerce, and Others, also contribute to the market landscape but to a lesser extent. Personal Care & Cosmetics and Pharmaceuticals, with their stringent requirements for preservation and consumer safety, increasingly incorporate smart packaging technologies to maintain product integrity and facilitate compliance with regulatory standards.

The Electronics segment benefits from smart packaging through enhanced protection against static and moisture, while E-commerce utilizes smart packaging to improve logistics efficiency and product authentication. The varied needs and growth trajectories within these segments underline the adaptability and potential of smart packaging technologies to cater to diverse industry requirements.

The continuous innovation within these segments, especially in Food & Beverages, drives forward the market’s expansion, propelled by consumer demands for freshness and quality, alongside regulatory pressures for sustainable packaging practices.

Key Market Segments

By Type

- Active Packaging

- Intelligent packaging

- Modified Atmosphere Packaging

By End-User

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Electronics

- E-commerce

- Others

Drivers

Key Drivers of Smart Packaging Growth

The growth of the Smart Packaging market can be attributed to several key factors. Firstly, there’s a rising demand for packaging that ensures longer shelf life and maintains product quality, particularly in the food and pharmaceutical sectors.

Smart packaging technologies such as time-temperature indicators and freshness sensors help in monitoring the condition of products throughout the supply chain, enhancing consumer safety and reducing waste.

Additionally, the increasing adoption of the Internet of Things (IoT) and the integration of connected devices in packaging enable real-time tracking and data collection, providing valuable insights for businesses about consumer behavior and inventory management.

These innovations are driving the market forward as companies seek more efficient, informative, and interactive packaging solutions to meet consumer expectations and regulatory compliance.

Restraint

Challenges Limiting Smart Packaging Adoption

The expansion of the Smart Packaging market faces significant restraints, primarily the high cost associated with developing and implementing these advanced technologies. Smart packaging solutions often involve sophisticated components like sensors, data processing capabilities, and connectivity features, which can significantly increase the cost of packaging materials.

This makes it less accessible for smaller companies and startups with limited budgets. Additionally, there are concerns about the environmental impact of adding electronic components to disposable packages, which may not be easily recyclable.

This poses a challenge as consumers and regulatory bodies increasingly demand more sustainable packaging options. Together, these factors can hinder the widespread adoption of smart packaging technologies, especially in markets sensitive to cost and environmental impact.

Opportunities

Expanding Opportunities in Smart Packaging

The Smart Packaging market presents numerous opportunities, driven by growing consumer interest in safety, convenience, and sustainability. Innovations such as packaging that changes color to indicate freshness or spoilage offer manufacturers the chance to enhance product safety and reduce food waste, meeting consumer demands for transparency and environmental responsibility.

Additionally, the rise of e-commerce has accelerated the need for packaging that can monitor and report the condition of products during shipping, ensuring that consumers receive items in optimal condition. Smart packaging also supports personalized marketing strategies, as interactive labels and QR codes can provide consumers with detailed product information, promotions, and brand storytelling directly through their smartphones.

These opportunities suggest a bright future for the smart packaging industry, as technological advancements continue to align with evolving consumer preferences and industry regulations.

Challenges

Obstacles Facing Smart Packaging

The Smart Packaging market encounters several challenges that could impede its growth. A primary concern is the complexity of integrating advanced technologies into packaging at a cost-effective price. Many businesses, especially smaller ones, find the initial investment and ongoing costs for high-tech packaging prohibitive.

Additionally, regulatory hurdles present another significant challenge. As smart packaging often incorporates electronic and chemical components, securing approval from regulatory bodies can be a lengthy and uncertain process, varying widely by region and affecting market entry and expansion.

Furthermore, the environmental impact of disposing of smart packaging, which may contain non-biodegradable and electronic waste, raises sustainability concerns among environmentally conscious consumers and organizations. These challenges require innovative solutions and industry collaboration to ensure the broader adoption and success of smart packaging technologies in the marketplace.

Growth Factors

Driving Growth in Smart Packaging

Smart Packaging is rapidly gaining traction, fueled by several growth factors that address current consumer and industry needs. The increasing consumer demand for product safety and quality assurance plays a crucial role, as smart packaging technologies like freshness indicators and spoilage sensors enhance consumer confidence and reduce health risks.

The integration of smart technologies also caters to the growing trend of smart homes and connected devices, allowing consumers to interact with packaging in innovative ways, such as checking product contents or receiving usage tips via smartphone connectivity.

Additionally, the global expansion of e-commerce necessitates packaging that can endure shipping conditions while providing real-time tracking and condition monitoring, ensuring product integrity upon delivery. These factors collectively drive the adoption of smart packaging solutions across various industries, promising enhanced functionality and consumer engagement.

Emerging Trends

Emerging Trends in Smart Packaging

Emerging trends in the Smart Packaging market are reshaping how products are packaged and experienced. Notably, the integration of augmented reality (AR) features is gaining momentum.

These features allow consumers to interact with packaging through their smartphones, accessing detailed product information, brand stories, and engaging digital content, which enhances the consumer experience and boosts brand loyalty.

Another significant trend is the use of biodegradable sensors and circuits, which address environmental concerns by ensuring that smart packaging components are sustainable and reduce waste. Furthermore, advancements in nanotechnology are leading to the development of even smaller, more efficient smart sensors that can monitor product conditions more accurately and at lower costs.

These trends are not only enhancing the functionality of packaging but are also opening new avenues for creativity and sustainability in packaging design, driving further interest and investment in the sector.

Regional Analysis

The Smart Packaging market is experiencing varied growth across global regions, with North America leading the charge, holding a dominant market share of 43.6% and a value of USD 12.73 million. This prominence is largely due to the region’s robust technological infrastructure, high consumer spending on packaged goods, and stringent food safety regulations that drive demand for advanced packaging solutions.

In Europe, environmental concerns and strict EU regulations on packaging waste management are accelerating the adoption of sustainable smart packaging technologies, contributing significantly to market expansion.

Meanwhile, the Asia Pacific region is witnessing rapid growth due to increasing urbanization, rising middle-class incomes, and growing e-commerce activities, which demand innovative packaging solutions for product safety and quality.

However, the Middle East & Africa, and Latin America are still emerging in this market, with growth driven by gradual technological adoption and increasing awareness about the benefits of smart packaging in enhancing product integrity and consumer engagement. These regions present untapped opportunities for market players willing to navigate the challenges of economic variability and regulatory landscapes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Smart Packaging market in 2023, Sealed Air Corporation, Multisorb Technologies, and Amcor PLC stand out as key players, each contributing uniquely to market innovation and growth.

Sealed Air Corporation has consistently been at the forefront of the smart packaging industry, leveraging its expertise in protective packaging solutions. The company’s focus on sustainability through eco-friendly packaging materials that integrate smart technologies for food safety and waste reduction resonates well with current market demands.

Their development of smart indicators that provide real-time information on food freshness has positioned them as a leader in enhancing consumer trust and product integrity.

Multisorb Technologies specializes in active packaging solutions, such as moisture and oxygen absorbers that extend shelf life. Their success in 2023 can be attributed to their ability to integrate these solutions into consumer packaging effectively, reducing spoilage and maintaining product quality.

Multisorb’s focus on sectors with stringent packaging requirements, like pharmaceuticals and electronics, has allowed them to tailor innovative solutions that meet specific industry needs, thus broadening their market reach and influence.

Amcor PLC has made significant strides by incorporating advanced technologies into flexible packaging. Their investment in recyclable and reusable smart packaging formats has addressed the pressing need for sustainability in the packaging industry.

Amcor’s approach to innovation, particularly in integrating digital features such as QR codes and NFC technology, allows consumers to engage with packaging in ways that enhance user experience and foster brand loyalty.

These companies, through their distinctive strategies and innovations, are not only leading the market but also shaping the future direction of smart packaging. Their efforts in adapting to consumer preferences and regulatory standards are pivotal in driving the global smart packaging market forward.

Top Key Players in the Market

- Sealed Air Corporation

- Multisorb Technologies

- Amcor PLC

- Ball Corporation

- Huhtamaki OYJ

- Stora Enso

- Avery Dennison Corporation

- Zebra TechnologiesCorporation

- 3M Company

- International Paper Company

- Timestrip PLC

- Sysco Corporation

- Paksense Incorporated

- M & G USA Corporation

- BASF SE

Recent Developments

- In October 2023, Ball Corporation acquired a technology firm specializing in AI-driven packaging solutions to enhance product sustainability and tracking capabilities.

- In September 2023, Stora Enso invested €15 million in a startup developing NFC-enabled packaging to enable smarter recycling practices.

- In August 2023, Huhtamaki OYJ launched a new line of biodegradable smart packaging designed to improve food safety and extend shelf life.

Report Scope

Report Features Description Market Value (2023) USD 29.2 Billion Forecast Revenue (2033) USD 54.8 Billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Active Packaging, Intelligent packaging, Modified Atmosphere Packaging), By End-User(Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Electronics, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sealed Air Corporation, Multisorb Technologies, Amcor PLC, Ball Corporation, Huhtamaki OYJ, Stora Enso, Avery Dennison Corporation, Zebra TechnologiesCorporation, 3M Company, International Paper Company, Timestrip PLC, Sysco Corporation, Paksense Incorporated, M & G USA Corporation, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sealed Air Corporation

- Multisorb Technologies

- Amcor PLC

- Ball Corporation

- Huhtamaki OYJ

- Stora Enso

- Avery Dennison Corporation

- Zebra TechnologiesCorporation

- 3M Company

- International Paper Company

- Timestrip PLC

- Sysco Corporation

- Paksense Incorporated

- M & G USA Corporation

- BASF SE